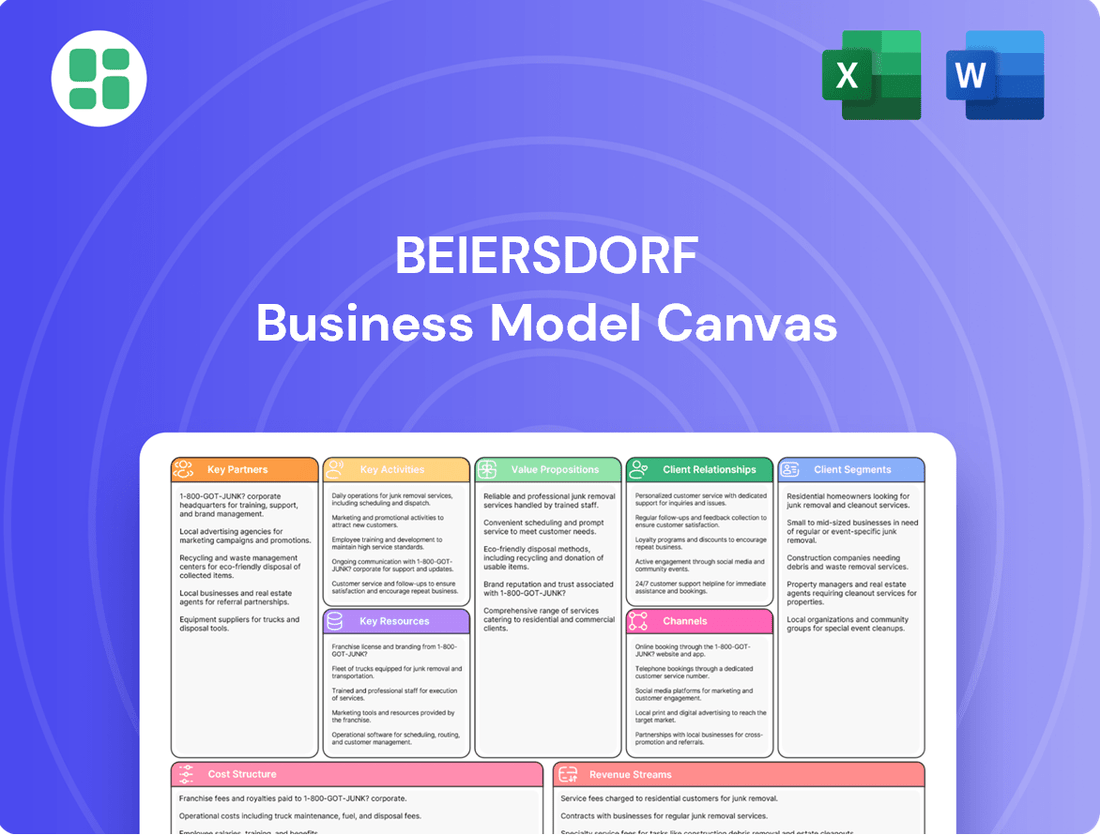

Beiersdorf Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Beiersdorf Bundle

Discover the strategic core of Beiersdorf's success with our comprehensive Business Model Canvas. This detailed analysis breaks down their customer relationships, key resources, and revenue streams, offering a clear roadmap to their market dominance. Ready to dissect a winning strategy?

Partnerships

Beiersdorf actively partners with esteemed research institutions and universities, including Columbia University, to push the boundaries of skin science, particularly in understanding aging and the nuances of skin of color. These collaborations are crucial for tapping into state-of-the-art research and specialized knowledge, which speeds up the creation of novel product offerings. For instance, Beiersdorf's commitment to open innovation, exemplified by these academic ties, significantly bolsters their internal R&D efforts, leading to breakthroughs in dermatology and cosmetic science.

Beiersdorf’s strategic alliances with suppliers are fundamental to securing a consistent and responsible flow of ingredients and packaging. These partnerships are geared towards advancing sustainability, such as encouraging recycled content and reducing emissions across the supply chain.

For example, Beiersdorf actively collaborates with its suppliers on initiatives like sustainable palm oil cultivation. In 2023, the company furthered its commitment to circular economy principles by increasing the use of recycled aluminum in its packaging, demonstrating a tangible step towards reducing virgin material reliance.

Beiersdorf actively collaborates with non-governmental organizations such as Ashoka, CARE, and Plan International. These partnerships are central to its 'Care Beyond Skin' sustainability strategy, aiming to create a positive impact beyond its core business.

Through these alliances, Beiersdorf supports critical social initiatives, with a particular focus on empowering girls and young women. These programs are implemented across diverse regions, including Africa, Asia, Europe, and Latin America, addressing local needs and fostering community development.

These collaborations are designed to significantly amplify Beiersdorf's societal contributions and align with global efforts. Specifically, the initiatives directly support the achievement of the United Nations Sustainable Development Goals, demonstrating a commitment to broader global progress.

Retail Partners and Distributors

Beiersdorf's success hinges on robust relationships with retail partners and distributors. These include major supermarket chains, drugstores, and pharmacies worldwide, ensuring broad consumer access to their extensive product range. In 2024, Beiersdorf continued to emphasize its e-commerce partnerships, recognizing their growing importance in reaching consumers.

These collaborations are crucial for both mass-market brands like Nivea and specialized offerings such as Eucerin and La Prairie. By leveraging these established networks, Beiersdorf effectively places its products in front of a vast customer base.

- Traditional Retail: Partnerships with global supermarket and drugstore chains remain foundational for Beiersdorf's market penetration.

- Pharmacies and Drugstores: These channels are vital for distributing dermocosmetic brands and building credibility.

- E-commerce Platforms: Beiersdorf actively strengthens its presence on online marketplaces and direct-to-consumer websites to enhance accessibility and sales.

- Global Reach: These diverse retail partnerships enable Beiersdorf to maintain a strong presence across various geographical markets.

Technology and Digital Solution Providers

Beiersdorf actively partners with technology and digital solution providers to accelerate its digital transformation. This collaboration is crucial for integrating advanced capabilities like artificial intelligence, which is used to streamline research and development, as well as to optimize marketing and sales operations. For instance, in 2024, Beiersdorf continued to invest in digital platforms to expand its e-commerce presence, aiming to capture a larger share of the growing online beauty market.

These partnerships are instrumental in unlocking new sales channels and enhancing customer engagement. By leveraging data analytics and AI, Beiersdorf can implement precision marketing strategies, ensuring that marketing spend is more effective and delivers a higher return on investment. This focus on data-driven approaches helps the company adapt swiftly to changing consumer behaviors and market trends, particularly among younger demographics.

- AI Integration: Beiersdorf utilizes AI to enhance product innovation and personalize customer experiences.

- E-commerce Growth: Partnerships support the expansion of online sales channels, a key growth area.

- Precision Marketing: Digital solutions enable targeted campaigns, improving marketing ROI.

- Consumer Engagement: Collaborations focus on reaching and engaging younger consumers through digital platforms.

Beiersdorf cultivates key partnerships with academic institutions, suppliers, NGOs, and technology providers to drive innovation and sustainability. These collaborations are vital for accessing cutting-edge research, ensuring responsible sourcing, amplifying social impact, and accelerating digital transformation. Strategic alliances with retailers and distributors, including an increased focus on e-commerce in 2024, are crucial for broad market access and consumer engagement.

What is included in the product

A detailed blueprint of Beiersdorf's operations, outlining its skincare and adhesive plaster value propositions, customer relationships with loyal consumers, and key partnerships with suppliers and retailers.

Beiersdorf's Business Model Canvas offers a structured approach to identify and address customer pain points by clearly defining value propositions and customer relationships.

It streamlines the process of understanding and solving customer needs by mapping out key resources and activities that deliver targeted solutions.

Activities

Beiersdorf's engine of innovation is its robust Research and Development (R&D) function, deeply invested in understanding the intricacies of skin. This commitment translates into creating groundbreaking skincare and personal care solutions. The company actively pursues novel active ingredients, such as the scientifically recognized Thiamidol and the recently discovered Epicelline, alongside developing environmentally conscious product formulations.

Demonstrating a strong belief in the power of innovation, Beiersdorf significantly boosted its R&D expenditure. In 2024, the company allocated €354 million to R&D, a clear signal of its dedication to pushing the boundaries of dermatological science and product development.

Beiersdorf's manufacturing and production activities are centered on transforming raw materials into high-quality skin and personal care products, as well as innovative adhesive solutions. This core function is crucial for delivering their diverse product portfolio to consumers worldwide.

The company is actively enhancing its global production capabilities. A significant example is the €300 million investment aimed at doubling the capacity of its Poznań plant. This expansion is strategically designed to serve more than 100 international markets, underscoring Beiersdorf's commitment to meeting growing global demand.

A key focus for Beiersdorf's production network is sustainability. They are working towards making all their production centers climate-neutral by 2030. Notably, their European plants are on track to achieve this ambitious goal by early 2025, demonstrating a proactive approach to environmental responsibility within their manufacturing operations.

Beiersdorf's marketing and brand management is crucial for nurturing its iconic brands like Nivea, Eucerin, and La Prairie, aiming for robust awareness and consumer loyalty. The company's strategic blueprint, 'Win with Care,' drives an aggressive expansion of its product footprint across all key markets, categories, and consumer segments.

This involves a deliberate cultivation of growth opportunities, with a significant emphasis on digital marketing initiatives and strategic influencer collaborations to enhance consumer engagement and reach. For instance, in 2023, Beiersdorf reported a 10.2% increase in sales, driven by strong brand performance and successful marketing campaigns, particularly in its consumer segment.

Supply Chain Management and Logistics

Beiersdorf's key activity in supply chain management and logistics is vital for getting its products from raw materials to consumers efficiently. This involves everything from sourcing ingredients to delivering finished goods across the globe. It's all about making sure products are available when and where customers want them, and doing so at a reasonable cost.

To strengthen this crucial area, Beiersdorf is actively investing in its global network. For instance, they are expanding production capacity in key growth regions like Mexico and Brazil. Simultaneously, the company is building new distribution centers in Germany, aiming to boost resilience and speed up delivery times to market. These strategic moves underscore the importance of a robust supply chain for reliable global product availability.

- Global Procurement and Production: Ensuring a steady flow of high-quality raw materials and efficient manufacturing processes worldwide.

- Distribution Network Optimization: Enhancing logistics through new distribution centers and capacity expansions in regions like Mexico and Brazil to improve delivery times and resilience.

- Inventory Management: Balancing stock levels to meet demand without incurring excessive holding costs, ensuring product availability.

- Logistics and Transportation: Managing the physical movement of goods from production facilities to retail partners and end consumers globally.

Global Sales and Distribution

Beiersdorf's global sales and distribution network is extensive, ensuring its products reach consumers in over 180 countries. This reach is achieved through a multi-channel approach, encompassing both traditional retail and burgeoning digital platforms. The company actively cultivates strong relationships with its retail partners to maintain product visibility and availability.

The strategic expansion into key markets like India and the United States is a testament to Beiersdorf's growth ambitions. Brands such as Eucerin are central to these market entries, aiming to capture significant market share. This geographical expansion is complemented by a robust focus on digital channels, recognizing the increasing importance of e-commerce in consumer purchasing habits.

In 2023, Beiersdorf reported a significant uplift in its e-commerce sales, which grew by 16.8% to €1.5 billion, demonstrating the success of its digital strategy. This growth underscores the company's objective to be omnipresent, meeting consumers wherever they shop, whether in physical stores or online.

- Global Reach Products available in over 180 countries.

- Channel Diversification Utilizes both traditional retail and e-commerce.

- Strategic Market Expansion Focus on growth in markets like India and the US.

- E-commerce Growth E-commerce sales reached €1.5 billion in 2023, a 16.8% increase.

Beiersdorf's key activities revolve around innovation, production, marketing, supply chain, and sales. The company heavily invests in R&D, evidenced by a €354 million expenditure in 2024, to develop advanced skincare solutions. Its manufacturing operations are being scaled up, with a €300 million investment to double capacity at its Poznań plant, while also focusing on sustainability targets like climate-neutral production by 2030.

| Key Activity | Description | Recent Data/Focus |

| Research & Development | Developing innovative skincare and personal care solutions. | €354 million R&D investment in 2024. Focus on active ingredients like Thiamidol. |

| Production & Manufacturing | Transforming raw materials into finished goods. | €300 million investment to double Poznań plant capacity. Aiming for climate-neutral European plants by early 2025. |

| Marketing & Brand Management | Building brand awareness and consumer loyalty for brands like Nivea and Eucerin. | 'Win with Care' strategy for market expansion. 10.2% sales increase in 2023 driven by brand performance. |

| Supply Chain & Logistics | Efficiently managing raw material sourcing to product delivery. | Expanding production in Mexico and Brazil, building new distribution centers in Germany. |

| Sales & Distribution | Ensuring product availability across global markets through multiple channels. | Products in over 180 countries. E-commerce sales grew 16.8% to €1.5 billion in 2023. |

Delivered as Displayed

Business Model Canvas

The Beiersdorf Business Model Canvas preview you are viewing is an exact representation of the final document you will receive upon purchase. This means the structure, content, and formatting are identical to the complete file. You can be assured that what you see is precisely what you will get, allowing you to confidently assess its suitability for your needs before committing to a purchase.

Resources

Beiersdorf's intellectual property, including a robust portfolio of 1,638 active global patents as of the close of 2024, is fundamental to its business model. These patents are crucial for safeguarding its significant investments in research and development, particularly for groundbreaking active ingredients such as Thiamidol and Epicelline.

This extensive patent protection acts as a powerful competitive differentiator, shielding Beiersdorf's proprietary product formulations from imitation and ensuring its market leadership in skincare innovation.

Beiersdorf's strong global brands, including Nivea, Eucerin, La Prairie, Hansaplast, and tesa, are cornerstones of its business model, acting as powerful intangible assets. These brands cultivate high levels of consumer trust and awareness, which directly translates into robust sales and significant market share across diverse consumer segments, from mass-market skincare to premium luxury and essential adhesive solutions.

The sheer power of these brands is evident in their financial performance. For instance, Nivea, a flagship brand, achieved sales exceeding €5 billion in 2023, underscoring its immense market penetration and consumer loyalty. This brand equity allows Beiersdorf to command premium pricing and maintain a competitive edge in a crowded marketplace.

Beiersdorf's commitment to innovation is anchored by its extensive Research & Development expertise, boasting over 1,800 dedicated R&D employees globally. This vast pool of scientific talent fuels the company's ability to continuously explore and develop cutting-edge skincare solutions.

State-of-the-art facilities are crucial to this R&D prowess. Beiersdorf operates advanced laboratories worldwide, and its investment in a new Innovation Center in Hamburg underscores its dedication to fostering groundbreaking discoveries. These facilities are instrumental in developing novel active ingredients and pushing the boundaries of skincare science.

This robust R&D infrastructure directly translates into Beiersdorf's capacity to set new industry standards. By consistently developing scientifically advanced products and active ingredients, the company solidifies its position as a leader in the competitive skincare market, ensuring a pipeline of innovative offerings.

Global Production and Supply Chain Network

Beiersdorf operates a vast global production and supply chain network. This extensive infrastructure is crucial for efficiently manufacturing and distributing its diverse product portfolio to over 100 markets worldwide.

Recent strategic investments highlight Beiersdorf's commitment to strengthening its operational backbone. For instance, significant capacity expansions have been undertaken in key locations such as Poznań, Poland, as well as in Mexico and Brazil.

Furthermore, the establishment of new distribution centers plays a vital role in enhancing supply chain resilience and enabling more localized production capabilities. These developments are designed to ensure that Beiersdorf can effectively meet consumer demand across its global footprint.

- Global Reach: Serves over 100 markets worldwide.

- Strategic Investments: Capacity expansions in Poznań, Mexico, and Brazil.

- Infrastructure Development: New distribution centers to enhance efficiency and resilience.

Human Capital (Skilled Employees)

Beiersdorf’s more than 22,000 employees, a significant portion of whom are dedicated to research and development and specialized production, represent a cornerstone of its business model. This extensive workforce, characterized by its expertise and passion, is instrumental in driving the company's innovation pipeline and ensuring operational efficiency across its global activities. The entrepreneurial spirit embedded within its teams fuels continuous improvement and expansion.

The company actively invests in employee development, recognizing that continuous learning and skill enhancement are crucial for maintaining a competitive edge. This commitment extends to fostering a diverse and inclusive work environment, which Beiersdorf believes is essential for attracting top talent and nurturing a culture of creativity and collaboration. In 2023, Beiersdorf continued its focus on talent management, with initiatives aimed at upskilling employees in areas like digital transformation and sustainability.

- Skilled Workforce: Over 22,000 employees globally, with a strong concentration in R&D and specialized manufacturing.

- Innovation Drivers: Expertise and passion of employees are key to developing new products and improving processes.

- Employee Development: Ongoing investment in training and development programs to enhance skills and foster career growth.

- Diversity & Inclusion: Commitment to building a diverse workforce to drive creativity and attract global talent.

Beiersdorf's key resources are its intellectual property, strong global brands, extensive R&D expertise, robust production and supply chain, and a dedicated workforce. The company holds a significant patent portfolio, with 1,638 active global patents as of the end of 2024, protecting innovations like Thiamidol. Its brand portfolio, including Nivea, Eucerin, and La Prairie, is a major intangible asset, with Nivea alone generating over €5 billion in sales in 2023.

The company's commitment to innovation is supported by over 1,800 R&D employees and advanced facilities, including a new Innovation Center in Hamburg. Beiersdorf's operational strength is evident in its global production and supply chain, with recent capacity expansions in Poland, Mexico, and Brazil, serving over 100 markets. Finally, its over 22,000 employees are crucial, with ongoing investments in their development and a focus on diversity and inclusion.

| Key Resource | Description | 2023/2024 Data Point |

|---|---|---|

| Intellectual Property | Patented active ingredients and product formulations | 1,638 active global patents (end of 2024) |

| Global Brands | Consumer trust and market leadership | Nivea sales > €5 billion (2023) |

| R&D Expertise | Innovation pipeline and scientific advancement | 1,800+ R&D employees globally |

| Production & Supply Chain | Global manufacturing and distribution network | Operations in over 100 markets; capacity expansions in Poznań, Mexico, Brazil |

| Human Capital | Skilled workforce driving innovation and operations | 22,000+ employees globally; focus on talent development |

Value Propositions

Beiersdorf provides scientifically formulated, premium skincare and personal care items designed to meet a wide array of consumer requirements, ranging from everyday moisture to targeted dermatological treatments.

Innovations such as Eucerin Hyaluron-Filler Epigenetic Serum and NIVEA's Q10 Dual Action Serum with Glycostop exemplify Beiersdorf's dedication to cutting-edge skin rejuvenation and proven efficacy, reinforcing its value proposition.

In 2023, Beiersdorf's Consumer segment, which houses these product lines, saw a significant increase in sales, demonstrating strong market reception for its high-quality and innovative offerings.

Beiersdorf's value proposition is significantly bolstered by its portfolio of trusted and globally recognized brands, such as Nivea. For over a century, Nivea has cultivated a deep sense of reliability and familiarity among consumers worldwide, becoming a staple in millions of households. This enduring brand equity translates into a powerful consumer trust, assuring consistent quality and performance across Beiersdorf's diverse product lines.

Beiersdorf's value proposition is significantly enhanced by its specialized dermocosmetic and luxury skincare offerings. Under the Eucerin brand, the company addresses specific dermatological needs with scientifically backed formulations, catering to consumers with sensitive or problematic skin. This segment is crucial for building trust and loyalty among a health-conscious demographic.

In the premium segment, Beiersdorf leverages brands like La Prairie and Chantecaille to capture the luxury skincare market. These brands deliver high-performance products, often incorporating exclusive ingredients and sophisticated packaging, appealing to discerning consumers who prioritize efficacy and an elevated experience. This dual approach allows Beiersdorf to serve a broad spectrum of consumer needs and preferences.

Sustainable and Responsible Products

Beiersdorf champions sustainable and responsible products, a core value proposition resonating with a growing segment of environmentally aware consumers. The company actively pursues initiatives to shrink its ecological impact, evident in its development of eco-friendly formulations and the increased use of recycled packaging materials. For example, Beiersdorf aims for 100% recyclable, reusable, or compostable packaging by 2025. This commitment extends to climate-neutral production processes, underscoring a dedication to environmental stewardship across its operations.

This focus on sustainability directly addresses consumer demand for ethical and eco-conscious purchasing decisions. Products like tesa's solvent-free adhesive tapes exemplify this, offering performance without harmful chemical emissions. Similarly, NIVEA's adoption of recycled plastic bottles for many of its product lines demonstrates a tangible effort to reduce plastic waste. In 2023, Beiersdorf reported that 80% of its plastic packaging was already made from recycled or renewable sources, a significant step towards its ambitious goals.

- Eco-friendly Formulations: Development of products with reduced environmental impact.

- Recycled Packaging: Increased use of recycled materials in product packaging.

- Climate-Neutral Production: Commitment to reducing carbon emissions in manufacturing processes.

- Consumer Appeal: Attracting environmentally conscious consumers seeking responsible brands.

Adhesive Solutions for Industry and Consumers

Through its tesa segment, Beiersdorf provides advanced adhesive tapes and self-adhesive systems. These solutions are designed to enhance both products and manufacturing processes for industrial customers, while also offering convenient, practical applications for everyday consumers.

This dual focus highlights Beiersdorf's technical capabilities, extending far beyond its well-known personal care brands. The tesa offering addresses a wide array of functional requirements, demonstrating a commitment to innovation across diverse markets.

- Industrial Applications: tesa tapes are integral to automotive manufacturing, electronics assembly, and construction, improving efficiency and product quality.

- Consumer Products: For households, tesa offers solutions for mounting, repairing, and decorating, making everyday tasks simpler.

- Market Reach: In 2023, the tesa segment contributed significantly to Beiersdorf's overall revenue, underscoring its importance as a diversified business unit.

- Innovation Focus: Beiersdorf continues to invest in R&D for tesa, aiming to develop sustainable and high-performance adhesive technologies.

Beiersdorf's value proposition centers on scientifically advanced, premium skincare and personal care products, addressing diverse consumer needs from daily hydration to specialized dermatological solutions.

The company's commitment to innovation is evident in products like Eucerin Hyaluron-Filler Epigenetic Serum, reinforcing its dedication to effective skin rejuvenation.

Beiersdorf's portfolio includes highly trusted, globally recognized brands such as Nivea, which has built over a century of consumer familiarity and loyalty, ensuring consistent quality and performance.

The company also caters to specific dermatological needs with its Eucerin brand and targets the luxury market with premium brands like La Prairie, demonstrating a broad appeal across different consumer segments.

Sustainability is a key element, with Beiersdorf aiming for 100% recyclable, reusable, or compostable packaging by 2025 and increasing the use of recycled materials, as seen with NIVEA's recycled plastic bottles.

In 2023, 80% of Beiersdorf's plastic packaging was already made from recycled or renewable sources, highlighting its progress in environmental stewardship.

Beyond personal care, Beiersdorf's tesa segment offers advanced adhesive solutions for both industrial and consumer applications, showcasing its technical expertise and market diversification.

The tesa segment's contribution to Beiersdorf's overall revenue in 2023 underscores its importance as a diversified business unit.

Customer Relationships

Beiersdorf cultivates deep customer loyalty by consistently delivering on its brand promises of quality and efficacy, particularly evident with flagship brands like Nivea. They actively engage consumers through various digital channels and social media, fostering a strong sense of community. For instance, in 2023, Nivea's global social media presence reached hundreds of millions of followers, underscoring their community-building efforts.

Beiersdorf actively fosters digital engagement, leveraging e-commerce, social media, and influencer collaborations to connect directly with consumers. This approach allows for personalized communication and swift feedback, significantly improving the customer experience and deepening brand loyalty. For instance, in 2023, Beiersdorf saw a substantial rise in its digital sales, contributing significantly to its overall revenue growth, reflecting the success of these direct-to-consumer strategies.

Beiersdorf prioritizes comprehensive customer service and support, addressing inquiries and resolving issues to foster customer satisfaction and trust. This dedication ensures consumers feel valued, reinforcing the positive perception of their brands like Nivea and Eucerin.

In 2024, Beiersdorf's commitment to customer engagement is evident through various channels, including digital platforms and direct consumer interactions. This approach is crucial for maintaining brand loyalty in a competitive skincare market, where personalized experiences are increasingly important.

Innovation-Driven Relationship

Beiersdorf fosters an innovation-driven relationship by consistently launching new, science-backed products designed to meet changing consumer demands and skin issues. This commitment to cutting-edge skincare research, including areas like epigenetics and microbiome science, positions Beiersdorf as a provider of advanced and effective solutions.

For instance, Beiersdorf’s Eucerin brand has been a leader in dermatological skincare, with significant investment in research and development. In 2023, Beiersdorf reported a sales increase of 10.7% to €9.0 billion, underscoring the market's positive reception to their innovative product pipeline.

- Focus on Scientific Advancement: Beiersdorf invests heavily in R&D, exploring fields like epigenetics and the skin microbiome to create next-generation skincare.

- Addressing Evolving Needs: The company's innovation strategy directly targets emerging consumer concerns and preferences in the beauty and skincare market.

- Building Trust Through Efficacy: By delivering scientifically validated and effective solutions, Beiersdorf cultivates long-term customer loyalty and trust.

- Market Validation: Beiersdorf’s consistent sales growth, such as the 10.7% increase in 2023, reflects consumer confidence in their innovative product offerings.

Educational Content and Expert Advice

Beiersdorf enhances customer relationships by providing valuable educational content. This includes detailed information on skincare routines, proper product application, and insights into dermatological science. Such content empowers consumers to make informed decisions about their skin health.

By positioning itself as a knowledgeable authority, Beiersdorf fosters trust and loyalty. This expert advice goes beyond simple sales, building a deeper connection with customers who see the company as a reliable resource for their skincare needs.

- Educational Content: Beiersdorf offers extensive guides on skin types, ingredient benefits, and product usage across its brands like Nivea and Eucerin.

- Expert Advice: Dermatologist-backed tips and articles are frequently featured on their websites and social media channels, reinforcing their credibility.

- Informed Choices: This approach helps consumers understand their skin better, leading to more effective product selection and usage.

- Trusted Authority: By sharing knowledge, Beiersdorf cultivates a reputation as a trusted partner in skincare, not just a product provider.

Beiersdorf actively nurtures customer relationships through a multi-faceted approach, blending digital engagement with a strong emphasis on scientific credibility and educational content. This strategy aims to build lasting loyalty by providing value beyond just product sales. The company's commitment to understanding and addressing evolving consumer needs, particularly in skincare, is a cornerstone of its customer relationship management.

| Customer Relationship Strategy | Key Activities | Impact/Metric |

|---|---|---|

| Digital Engagement | Social media interaction, influencer collaborations, e-commerce | Increased online sales, strong community following |

| Scientific Credibility & Innovation | R&D in epigenetics, microbiome science, new product launches | Market leadership in dermatological skincare (e.g., Eucerin), sales growth |

| Educational Content | Skincare guides, expert advice, ingredient information | Enhanced consumer understanding, trusted brand perception |

| Customer Service | Responsive support and issue resolution | Improved customer satisfaction and trust |

Channels

Mass market retailers, including supermarkets, hypermarkets, and drugstores, are fundamental to Beiersdorf's strategy for its mass-market brands like Nivea and Hansaplast. These channels provide unparalleled accessibility, allowing consumers to easily purchase everyday essentials. In 2024, Beiersdorf continued to leverage these extensive networks to ensure its products are readily available to a vast customer base worldwide.

The broad consumer reach offered by these retailers is a significant advantage, facilitating high sales volumes. Furthermore, these channels present prime opportunities for impactful in-store promotions and prominent shelf placement, driving brand visibility and purchase intent. For instance, Beiersdorf often participates in seasonal campaigns and offers multi-buy discounts within these retail environments to boost sales.

Pharmacies and dermocosmetic stores are crucial for Beiersdorf, particularly for brands like Eucerin. These specialized channels offer a platform where expert advice on dermatological solutions can be provided, directly addressing consumer needs for targeted skincare. This environment enhances brand credibility by aligning with healthcare professionals and a focus on efficacy.

In 2024, the global dermocosmetics market continued its robust growth, driven by increasing consumer awareness of skin health and the demand for scientifically backed products. Pharmacies, as trusted healthcare touchpoints, are instrumental in this segment. Beiersdorf leverages these channels to ensure Eucerin products are recommended by pharmacists and dermatologists, reinforcing their position as a leading dermocosmetic brand.

Luxury retailers and high-end department stores are critical channels for Beiersdorf's premium skincare brands, such as La Prairie. These outlets offer an environment that mirrors the exclusivity and sophistication of the brands themselves, ensuring a premium customer experience. For instance, in 2023, the global luxury goods market was valued at approximately $350 billion, with skincare and beauty segments showing robust growth, underscoring the importance of these high-touch channels.

E-commerce Platforms and Company Websites

Beiersdorf is actively expanding its e-commerce capabilities, utilizing both its proprietary brand websites and partnerships with major online retailers. This dual approach allows the company to directly engage consumers and tap into the vast reach of established online marketplaces, catering to an increasingly digital consumer base.

E-commerce represents a pivotal growth engine for Beiersdorf. It facilitates direct-to-consumer sales, enabling a wider and more comprehensive presentation of their product portfolio. Furthermore, these digital channels unlock significant opportunities for targeted digital marketing and data-driven customer engagement.

- Direct-to-Consumer (DTC) Growth: Beiersdorf's own brand websites are crucial for building direct relationships and capturing higher margins.

- Online Retailer Partnerships: Collaborations with platforms like Amazon and Douglas provide access to a broader customer base and leverage existing online infrastructure.

- Digital Marketing Integration: E-commerce channels are central to executing sophisticated digital marketing campaigns, driving brand awareness and sales.

- Sales Performance: In 2023, Beiersdorf reported a substantial increase in its digital sales, underscoring the growing importance of its e-commerce channels in its overall revenue mix.

Direct Sales to Industrial Customers (for tesa)

The tesa business segment leverages direct sales to serve industrial clients, offering specialized adhesive solutions critical for sectors such as automotive, electronics, and construction. This direct engagement facilitates the development of highly customized products and fosters deep partnerships with business customers. In 2023, tesa's industrial segment played a significant role in Beiersdorf's overall performance, with the company reporting total sales of €9.06 billion, underscoring the importance of these direct industrial relationships.

This direct sales model is particularly effective for tesa as it allows for close collaboration with clients to engineer adhesive solutions that meet precise technical specifications. For instance, in the automotive industry, these adhesives are vital for lightweight construction and assembly processes. Beiersdorf's 2023 annual report highlighted the resilience and growth within its industrial segment, driven by innovation and strong customer ties.

- Direct Engagement: tesa's sales teams work directly with industrial clients, understanding their unique needs.

- Tailored Solutions: This approach enables the creation of bespoke adhesive products for specific applications.

- Key Industries: Major sectors served include automotive, electronics, and construction, where precision is paramount.

- Sales Contribution: The industrial segment is a vital contributor to Beiersdorf's overall revenue, which reached €9.06 billion in 2023.

Beiersdorf utilizes a multi-channel approach to reach its diverse customer base, from mass-market retailers and pharmacies to luxury outlets and e-commerce platforms. This strategy ensures broad accessibility for brands like Nivea and specialized reach for Eucerin, while premium brands benefit from high-end environments. The company's digital expansion is a key focus, driving direct consumer engagement and sales growth.

In 2023, Beiersdorf's digital sales saw a significant uptick, demonstrating the increasing importance of its online presence. This growth is supported by strategic partnerships with major online retailers and a focus on its own brand websites for direct customer interaction. The company's commitment to e-commerce reflects the evolving consumer landscape and its drive to capture a larger share of the digital market.

The tesa business segment, however, relies heavily on direct sales to industrial clients, providing bespoke adhesive solutions for critical sectors. This direct engagement fosters strong client relationships and allows for the development of highly specialized products. The industrial segment remains a vital contributor to Beiersdorf's overall revenue, underscoring the value of these direct business-to-business relationships.

| Channel Type | Key Brands/Segments | Strategic Importance | 2023/2024 Relevance |

|---|---|---|---|

| Mass Market Retailers | Nivea, Hansaplast | Broad accessibility, high volume sales | Continued leverage for everyday essentials |

| Pharmacies & Dermocosmetic Stores | Eucerin | Expert advice, trust, efficacy focus | Growth in dermocosmetics market, pharmacist recommendations |

| Luxury Retailers | La Prairie | Premium experience, exclusivity | Aligns with growth in the global luxury goods market |

| E-commerce (DTC & Online Retailers) | All brands | Direct engagement, digital marketing, data insights | Significant increase in digital sales, key growth engine |

| Direct Industrial Sales | tesa | Customized solutions, deep partnerships | Vital contributor to overall revenue, resilience in industrial segment |

Customer Segments

Mass market consumers are the backbone of Nivea's strategy, representing a vast group of individuals looking for dependable and accessible personal care items. This segment values products that offer good quality at an affordable price for everyday use.

Nivea's extensive product portfolio, covering everything from face creams and body lotions to sunscreens and deodorants, is designed to meet the varied needs of this broad demographic. Their widespread availability ensures that consumers can easily find Nivea products wherever they shop.

In 2023, the global skincare market, which Nivea heavily participates in, was valued at over $150 billion, demonstrating the sheer scale of this consumer base. Nivea's brand recognition and broad appeal allow it to capture a significant share of this market by consistently delivering on its promise of reliable and gentle skincare.

Dermocosmetic consumers are individuals actively seeking skincare products backed by scientific research and dermatological testing, often driven by specific skin issues like sensitivity, aging, or acne. Brands like Eucerin and Aquaphor cater to this segment by offering specialized formulations that promise efficacy and address these particular concerns. In 2023, the global dermocosmetics market was valued at approximately $50 billion, with a projected compound annual growth rate of over 6% through 2030, indicating a strong and growing demand for scientifically-driven skincare solutions.

This segment includes affluent individuals who seek out the best in skincare, valuing cutting-edge anti-aging science and rare, potent ingredients. They are willing to invest significantly in products that offer a noticeable difference and an elevated user experience, often associating premium pricing with superior efficacy and exclusivity. For example, La Prairie's Skin Caviar Luxe Cream, a flagship product, is priced at over $500, reflecting the high-value proposition and the luxury ingredients it contains.

Industrial Clients (tesa)

The tesa segment caters to a wide array of industrial sectors, notably automotive, electronics, and construction. These clients depend on tesa for specialized adhesive solutions crucial for manufacturing processes, assembly lines, and diverse industrial applications.

These industrial customers have specific demands, prioritizing adhesive products that offer high performance, unwavering reliability, and frequently require custom formulations to meet unique operational needs.

In 2024, tesa's industrial solutions played a vital role in key sectors. For instance, the automotive industry's reliance on advanced bonding technologies for lightweighting and structural integrity continued to grow, with tesa's products being integral to vehicle assembly. Similarly, the electronics sector saw increased demand for precision adhesives in the production of smartphones and other devices, highlighting tesa's contribution to miniaturization and durability. The construction industry also benefited from innovative adhesive tapes used in energy-efficient building solutions and facade bonding.

Key aspects of tesa's industrial client relationships include:

- Industry Specialization: Providing tailored adhesive solutions for sectors like automotive, electronics, and construction.

- Performance Demands: Meeting stringent requirements for high performance, durability, and reliability in demanding industrial environments.

- Customization Needs: Developing bespoke adhesive products to address specific manufacturing and assembly challenges faced by clients.

- Innovation Partnership: Collaborating with industrial clients to drive innovation in material science and application technologies.

Craftspeople and DIY Consumers (tesa Consumer)

The Craftspeople and DIY Consumers segment, often referred to as tesa Consumer, encompasses a broad range of individuals. This includes professional tradespeople who rely on dependable adhesive solutions for their work, as well as hobbyists and homeowners undertaking do-it-yourself projects. Their primary need is for tapes and related products that are both effective and user-friendly for everyday applications, from minor repairs to creative endeavors.

tesa addresses this market by offering a diverse portfolio designed for ease of use and practical problem-solving. These products are tailored for tasks such as hanging pictures, sealing packages, mending items, and various crafting activities. The brand's commitment is to provide reliable adhesion for a multitude of household and personal projects, ensuring satisfaction for both the novice and the experienced DIYer.

In 2024, the global DIY market continued to show robust growth, with consumers increasingly investing in home improvement and personal projects. For instance, the global adhesives and sealants market, which includes tapes, was projected to reach over $70 billion by 2024, indicating a significant demand for products like those offered by tesa to this segment.

- Target Audience: Professional craftspeople and general consumers undertaking DIY projects.

- Needs: Reliable, easy-to-use adhesive tapes and solutions for household and crafting purposes.

- Market Context (2024): Strong growth in the DIY sector, with the global adhesives and sealants market valued in the tens of billions of dollars.

- tesa's Offering: A wide array of consumer tapes designed for practical applications, from repairs to creative crafting.

Beiersdorf's Nivea brand primarily targets mass-market consumers who seek reliable and affordable personal care products for daily use. This extensive demographic values quality and accessibility, making Nivea's broad product range and widespread availability key to its success.

A distinct segment is dermocosmetic consumers who prioritize scientifically-backed skincare solutions for specific skin concerns. Brands like Eucerin and Aquaphor cater to this group with specialized, efficacy-driven formulations.

Furthermore, Beiersdorf serves affluent consumers willing to invest in premium, high-performance skincare featuring advanced anti-aging science and exclusive ingredients. This luxury segment seeks noticeable results and an elevated experience, often associating higher prices with superior product quality.

The tesa division targets industrial clients across automotive, electronics, and construction, requiring specialized, high-performance adhesives tailored to unique manufacturing needs. In 2024, tesa's solutions were critical for vehicle lightweighting and precision electronics assembly, underscoring the demand for reliable industrial bonding technologies.

Additionally, tesa serves craftspeople and DIY consumers with user-friendly tapes for household repairs, crafts, and home improvement projects. The robust DIY market in 2024, with the global adhesives and sealants market valued in the tens of billions, highlights the significant demand for tesa's practical consumer offerings.

Cost Structure

Beiersdorf dedicates substantial resources to Research and Development, a cornerstone of its innovation strategy. This includes significant expenditure on its workforce, with over 1,800 R&D employees, alongside essential laboratory operating costs and investments in external research partnerships.

In 2024, the company's commitment to advancing its product portfolio was evident in its R&D expenses, which totaled €354 million. This figure underscores Beiersdorf's ongoing focus on developing new and improved skincare and cosmetic solutions.

Manufacturing and production costs are a significant component, encompassing everything from the raw materials and packaging needed for products like Nivea and Eucerin to the labor involved in their creation. Energy consumption at Beiersdorf's global production facilities also falls under this umbrella.

These costs are directly influenced by Beiersdorf's strategic investments. For instance, a substantial €300 million investment in expanding and modernizing its Poznań production site in 2024 highlights the company's commitment to enhancing capacity and adopting more sustainable manufacturing technologies, which will impact the overall cost structure.

Beiersdorf invests heavily in marketing and selling expenses, a significant cost driver for its business model. This includes substantial allocations for advertising, brand building activities, and maintaining a global sales force to support its diverse product lines.

The company's strategy involves extensive digital marketing, engaging influencer collaborations, and point-of-sale promotions to boost consumer interest and capture market share. For instance, in 2023, Beiersdorf’s marketing and selling expenses amounted to €1.7 billion, reflecting a commitment to driving brand visibility and sales growth.

Distribution and Logistics Costs

Beiersdorf incurs significant costs in its distribution and logistics network, encompassing warehousing, transportation, and overall supply chain management. These expenses are critical for ensuring their diverse product portfolio reaches consumers across numerous global markets efficiently. For instance, in 2023, Beiersdorf’s cost of sales, which includes these distribution elements, amounted to €2.7 billion, reflecting the scale of their operations.

Managing a complex global supply chain involves substantial investment in operating distribution centers and maintaining a robust logistics infrastructure. This ensures timely delivery and product availability, a key factor in customer satisfaction and market competitiveness. The company’s commitment to efficient distribution is evident in its continuous efforts to optimize these processes.

Key components of these costs include:

- Warehousing: Costs associated with storing raw materials, components, and finished goods in strategically located distribution centers.

- Transportation: Expenses related to moving products via various modes of transport, including sea, air, and land freight, to reach different international markets.

- Supply Chain Management: Investments in technology, personnel, and processes to oversee and optimize the entire flow of goods from production to end-consumers.

- Inventory Management: Costs tied to holding inventory, including capital costs, storage, insurance, and potential obsolescence.

General and Administrative Costs

General and administrative (G&A) costs for Beiersdorf are the essential corporate overheads that keep the entire global operation running smoothly. These include everything from the salaries of administrative staff to the investments in IT infrastructure, legal counsel, finance departments, and human resources. These functions are crucial for ensuring efficient management and adherence to regulatory requirements across Beiersdorf's diverse markets.

In 2024, Beiersdorf's commitment to robust G&A is reflected in its operational efficiency. For instance, the company’s focus on digital transformation, a key component of its IT infrastructure, aims to streamline processes and reduce long-term administrative burdens. These investments are vital for maintaining a competitive edge and ensuring compliance with the complex web of international business regulations.

- Corporate Overheads: These cover the costs associated with running the central headquarters and regional administrative offices.

- Salaries and Benefits: Compensation for administrative, legal, finance, and HR personnel.

- IT Infrastructure: Investments in technology systems, software, and maintenance to support global operations.

- Legal and Compliance: Expenses related to legal services, regulatory filings, and ensuring adherence to laws and standards worldwide.

Beiersdorf's cost structure is heavily influenced by its significant investment in research and development, aiming for innovation in skincare and cosmetics. Manufacturing and production costs, including raw materials, packaging, and labor, are substantial, further impacted by strategic facility upgrades like the €300 million investment in Poznań in 2024.

Marketing and selling expenses represent a major cost driver, with €1.7 billion spent in 2023 on advertising and brand building. Distribution and logistics, including warehousing and transportation, are also critical, contributing to the €2.7 billion cost of sales in 2023.

General and administrative costs, encompassing IT infrastructure and personnel, ensure smooth global operations and compliance. These varied expenses collectively shape Beiersdorf's operational financial landscape.

| Cost Category | 2023 Data | Key Drivers |

|---|---|---|

| Research & Development | €354 million (2024 estimate) | Innovation, new product development, R&D staff, external partnerships |

| Manufacturing & Production | Included in Cost of Sales | Raw materials, packaging, labor, energy, facility investments |

| Marketing & Selling | €1.7 billion (2023) | Advertising, brand building, sales force, digital marketing |

| Distribution & Logistics | Included in Cost of Sales | Warehousing, transportation, supply chain management, inventory |

| General & Administrative | Operational Overheads | IT, legal, finance, HR, corporate functions |

Revenue Streams

Beiersdorf's core revenue generation stems from the direct sale of its extensive portfolio of consumer skincare and personal care items. This is the bedrock of their financial success, with well-known brands such as Nivea, Eucerin, La Prairie, and Hansaplast leading the charge.

In 2024, this crucial segment was the primary engine of sales, contributing a substantial €8.2 billion to the company's overall revenue. This highlights the significant consumer demand and brand loyalty Beiersdorf commands in the global market.

Revenue streams for Beiersdorf's tesa segment primarily stem from the sale of a wide array of innovative adhesive tapes and self-adhesive solutions. These products cater to diverse needs, serving both demanding industrial applications and everyday consumer use.

In 2024, the tesa segment demonstrated its significant market presence by generating €1.7 billion in sales. This figure, while smaller than the company's Consumer segment, highlights tesa's crucial role in Beiersdorf's overall financial performance and its strength in specialized adhesive markets.

E-commerce sales represent a significant and expanding avenue for Beiersdorf, driven by direct-to-consumer efforts via brand websites and partnerships with major online retailers. This digital channel is a key strategic pillar for increasing market penetration and fostering deeper consumer engagement.

In 2023, Beiersdorf reported a substantial uplift in its e-commerce business, with online sales growing by a notable percentage, reflecting a successful shift towards digital channels. This growth underscores the increasing importance of online platforms in reaching a wider customer base and adapting to evolving consumer purchasing habits.

Sales from New Market Entry and Product Launches

Beiersdorf's revenue streams are significantly boosted by strategic expansions into new geographic territories and the introduction of novel products. For instance, the successful rollout of Eucerin in India and the innovative Thiamidol range across the United States and China demonstrates this approach. These ventures are designed to tap into previously unreached customer bases, thereby generating substantial incremental sales and reinforcing market presence.

These market entries and product launches are critical for Beiersdorf's growth trajectory. In 2023, for example, the company saw strong performance driven by these very strategies. New product innovations are a cornerstone, with a particular focus on dermatological skincare, a segment experiencing robust global demand. This focus allows Beiersdorf to capture new customer segments and drive incremental sales.

- Geographic Expansion: Entry into markets like India with Eucerin and the US/China with Thiamidol.

- Product Innovation: Launch of new, scientifically-backed products to meet evolving consumer needs.

- Customer Acquisition: Capturing new customer segments through targeted market entry and product offerings.

- Sales Growth: Driving incremental revenue by successfully penetrating new markets and introducing successful product lines.

Royalties and Licensing Income

Beiersdorf can earn income through royalties and licensing. This involves allowing other companies or affiliated entities to use their patents, research findings, or well-known brands. It's a way to monetize their significant investment in research and development and the strong reputation of their brands.

For example, in 2023, Beiersdorf's royalty and licensing income contributed to its overall financial performance, though specific figures for this segment are often embedded within broader revenue reporting. The company's robust portfolio of brands like Nivea and Eucerin provides ample opportunity for such agreements.

- Brand Licensing: Allowing third parties to use Beiersdorf's brand names on non-core products.

- Patent Royalties: Earning revenue from the use of patented technologies or formulations by other manufacturers.

- Intellectual Property Sharing: Agreements with partners for the use of R&D outputs.

Beiersdorf's revenue streams are multifaceted, primarily driven by its two core segments: Consumer and tesa. The Consumer division, encompassing skincare and personal care brands like Nivea and Eucerin, is the larger contributor. The tesa segment focuses on adhesive solutions for industrial and consumer markets.

In 2024, the Consumer segment generated €8.2 billion, underscoring its dominance. The tesa segment followed with €1.7 billion in sales for the same year, demonstrating its significant, albeit smaller, contribution to the company's overall financial health.

Beyond direct product sales, Beiersdorf also leverages e-commerce, with online channels showing robust growth as a key strategy for market penetration and consumer engagement. Furthermore, the company capitalizes on geographic expansion and product innovation, exemplified by the successful introduction of Eucerin in India and Thiamidol in new markets, driving incremental sales.

| Revenue Stream | 2023 Revenue (EUR Billion) | 2024 Revenue (EUR Billion) | Key Brands/Products |

|---|---|---|---|

| Consumer Segment | 7.6 | 8.2 | Nivea, Eucerin, La Prairie, Hansaplast |

| tesa Segment | 1.5 | 1.7 | Adhesive tapes, self-adhesive solutions |

| E-commerce | N/A (Integrated within segment reporting) | Significant growth | Direct-to-consumer websites, online retailers |

| Royalties & Licensing | N/A (Embedded in overall revenue) | Contribution from brand/patent use | Brand licensing, patent utilization |

Business Model Canvas Data Sources

The Beiersdorf Business Model Canvas is constructed using a blend of internal financial data, comprehensive market research on consumer trends and competitor strategies, and insights from Beiersdorf's own strategic planning documents. This multi-faceted approach ensures each component of the canvas is grounded in actionable intelligence.