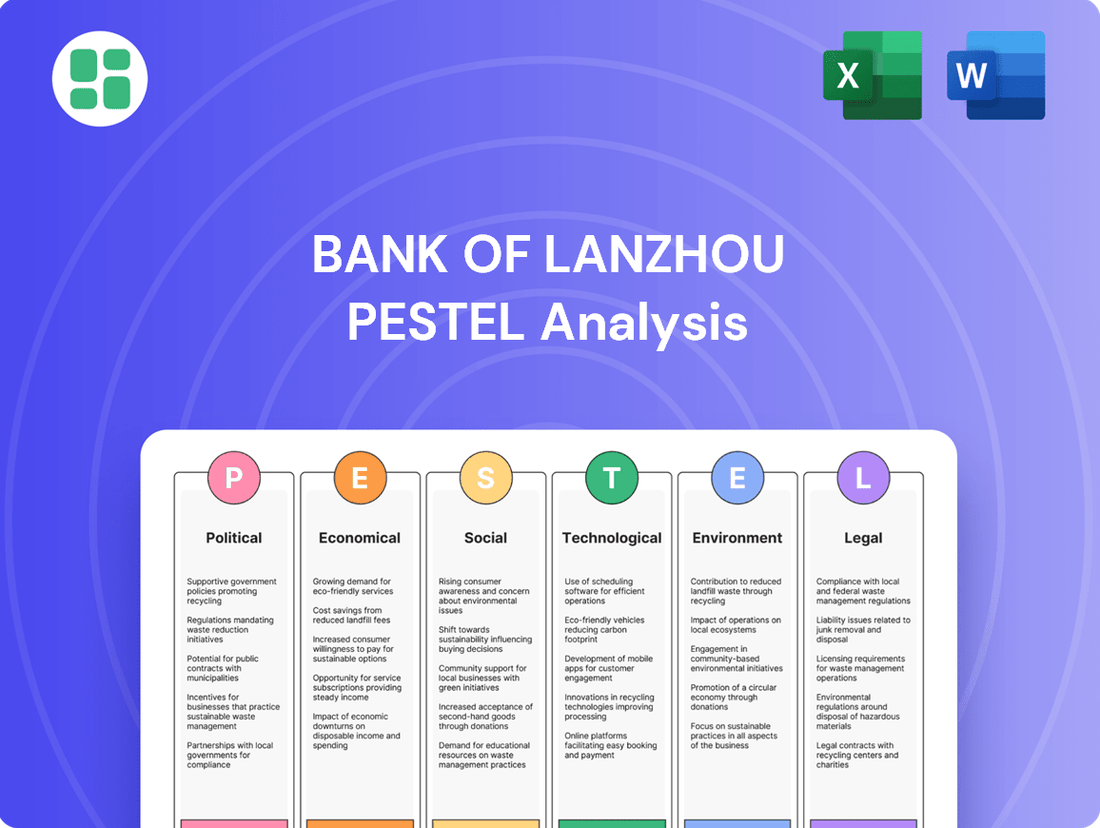

Bank of Lanzhou PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank of Lanzhou Bundle

Discover how political stability, economic growth, and technological advancements are shaping Bank of Lanzhou's operations. Our PESTLE analysis dives deep into these critical external factors, offering you a clear roadmap to navigate the evolving financial landscape. Secure your competitive advantage—download the full report now for actionable intelligence.

Political factors

The Bank of Lanzhou navigates a financial landscape in China heavily shaped by government regulation. This includes directives on lending priorities, interest rate management, and capital adequacy ratios, which are crucial for operational stability. For instance, the People's Bank of China's monetary policy adjustments, such as the Loan Prime Rate (LPR) changes, directly affect the bank's lending profitability and risk exposure.

Regional development policies significantly influence the Bank of Lanzhou's operational landscape as a commercial bank primarily serving Gansu province. Provincial and municipal government plans often prioritize infrastructure development, such as the continued expansion of the Lanzhou-Xinjiang high-speed railway, which directly impacts the demand for corporate loans in construction and logistics sectors. These policies also guide industrial growth, potentially increasing lending opportunities in manufacturing and technology, while agricultural support initiatives can boost demand for personal and SME loans in rural areas.

The People's Bank of China (PBOC) wields significant influence through its monetary policy. For instance, in late 2023 and early 2024, the PBOC maintained a relatively accommodative stance, with benchmark lending rates holding steady, which can support loan growth for banks like Lanzhou. However, any shifts in these rates or reserve requirements directly affect the Bank of Lanzhou's net interest margins and its ability to lend.

These policy adjustments are often tied to the government's broader economic objectives, such as managing inflation or stimulating growth. The Bank of Lanzhou must remain agile, adapting its financial strategies and product development in response to these evolving directives. For example, if the PBOC signals a tightening cycle, the bank might anticipate higher funding costs and adjust its lending strategies accordingly.

Furthermore, the central government's emphasis on financial stability imposes mandates that banks must adhere to. This includes capital adequacy ratios and risk management frameworks, which are critical for the Bank of Lanzhou's operational resilience and long-term viability. Adherence to these mandates, such as maintaining a robust capital adequacy ratio, is paramount, especially as regulatory scrutiny often intensifies during periods of economic uncertainty.

Anti-Corruption and Governance Initiatives

China's sustained focus on anti-corruption and governance reforms directly impacts the Bank of Lanzhou. These efforts, intensifying in recent years, mandate higher levels of transparency and accountability within financial institutions. For instance, the Central Commission for Discipline Inspection (CCDI) reported a significant increase in investigations into financial sector misconduct in 2023, underscoring the government's commitment.

These evolving regulatory landscapes necessitate that the Bank of Lanzhou reinforces its internal control frameworks and ethical standards. The objective is to mitigate financial risks associated with illicit activities and promote responsible financial stewardship. This includes stricter due diligence on borrowers and enhanced oversight of financial transactions.

- Increased Regulatory Scrutiny: The Bank of Lanzhou must adapt to stricter compliance requirements stemming from anti-corruption drives.

- Focus on Transparency: Mandates for greater financial transparency are crucial for building trust and reducing operational risks.

- Ethical Lending Practices: Adherence to responsible lending principles is paramount to avoid penalties and maintain a sound financial reputation.

Geopolitical Stability and Trade Relations

While the Bank of Lanzhou's operations are primarily domestic, shifts in China's broader geopolitical stance and international trade relations can create ripple effects. For instance, escalating trade disputes or global economic instability, potentially impacting China's export-oriented sectors, could indirectly weaken the financial standing of businesses within Gansu province. This, in turn, might affect the bank's loan portfolio and overall asset quality.

The stability of international relations is a key determinant of a predictable operating environment for financial institutions. China's trade surplus with the United States, for example, stood at approximately $29.2 billion in March 2024, a figure that could be subject to geopolitical pressures. Any significant disruption to these trade flows could have downstream effects on the economic health of Chinese enterprises, including those served by the Bank of Lanzhou.

- Impact of Trade Tensions: Geopolitical friction can lead to tariffs and trade barriers, potentially slowing economic growth in China and affecting businesses that rely on international trade, thereby influencing the Bank of Lanzhou's loan performance.

- Global Economic Outlook: Broader geopolitical instability can contribute to global economic slowdowns, impacting investor confidence and capital flows, which can indirectly affect the liquidity and profitability of regional banks like Lanzhou.

- China's Diplomatic Relations: China's relationships with major economic partners, such as those within the Belt and Road Initiative, influence regional development and investment opportunities, potentially creating or diminishing business prospects for the Bank of Lanzhou's clients.

Government policies are a primary driver for the Bank of Lanzhou, dictating everything from lending practices to capital requirements. The People's Bank of China's monetary policy, such as adjustments to the Loan Prime Rate, directly influences the bank's profitability. Regional development plans in Gansu province also shape lending opportunities, particularly in infrastructure and agriculture.

Increased regulatory scrutiny, especially concerning anti-corruption and transparency, necessitates robust internal controls. The bank must adhere to strict governance standards and ethical lending practices to avoid penalties. This focus on compliance is crucial for maintaining financial stability and trust.

China's geopolitical stance and international trade relations indirectly affect the Bank of Lanzhou. Trade tensions or global economic instability can impact businesses within Gansu, influencing the bank's loan portfolio. Maintaining strong diplomatic ties, like those within the Belt and Road Initiative, can foster regional development and create new business prospects for the bank's clients.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting the Bank of Lanzhou, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making, helping stakeholders identify opportunities and mitigate risks within the Bank of Lanzhou's operating landscape.

A PESTLE analysis for the Bank of Lanzhou provides a clear roadmap to navigate external challenges, acting as a pain point reliever by identifying opportunities and mitigating risks in political, economic, social, technological, environmental, and legal landscapes.

Economic factors

The Bank of Lanzhou's financial health is closely tied to Gansu province's economic expansion. For instance, Gansu's GDP grew by 4.7% in 2023, indicating a generally positive environment for the bank's services. This growth usually means more people and companies need loans, want to save money, and are looking for investment advice.

When Gansu's economy is strong, the demand for banking products like loans and deposits tends to rise, directly benefiting the Bank of Lanzhou. Conversely, a slowdown in provincial GDP, as seen in some periods of slower growth, can increase the risk of bad loans and shrink the bank's potential for new business.

The interest rate environment, primarily shaped by the People's Bank of China (PBOC), directly influences the Bank of Lanzhou's profitability through its net interest margin (NIM). For instance, as of early 2024, China's benchmark lending rates, like the Loan Prime Rate (LPR), have seen modest adjustments, impacting the cost of funds and lending yields for banks.

Navigating these fluctuations is crucial; lower rates, while potentially compressing NIMs, can incentivize greater borrowing activity and economic growth, which benefits the Bank of Lanzhou through increased loan volumes. Conversely, higher rates can widen NIMs by increasing the spread between lending and deposit rates, but they also carry the risk of slowing down credit demand and increasing the likelihood of non-performing loans.

The Bank of Lanzhou must therefore employ sophisticated asset-liability management strategies to effectively respond to interest rate shifts, ensuring its portfolio remains resilient and profitable amidst changing monetary policy. This involves careful consideration of deposit pricing, loan origination, and investment in interest-bearing securities to optimize its financial performance.

Inflation and deflation trends directly impact the Bank of Lanzhou's financial health. For instance, China's Consumer Price Index (CPI) saw a modest increase of 0.3% year-on-year in April 2024, indicating a generally stable, though low, inflationary environment. This can affect the real value of customer deposits and the repayment capacity of borrowers.

While low inflation might seem beneficial, prolonged periods could lead to deflationary pressures, which would increase the real burden of debt for corporate clients and potentially slow down loan demand. Conversely, a sudden surge in inflation, though not currently observed, would erode the purchasing power of individuals and increase operating costs for businesses, impacting the quality of the bank's loan portfolio.

The Bank of Lanzhou must closely monitor these price level shifts to effectively manage its risk exposure and adapt its strategies for deposit gathering and lending activities, ensuring its loan book remains robust amidst evolving economic conditions.

Credit Demand and Availability

The overall demand for credit from individuals, small and medium-sized enterprises (SMEs), and large corporations in Gansu significantly influences the Bank of Lanzhou's lending activities and financial performance. For instance, during 2024, a rebound in consumer spending and increased investment by local businesses, particularly in infrastructure and technology sectors, would likely boost credit demand. Conversely, tighter lending standards or a cautious economic outlook could dampen this demand.

Factors like consumer confidence, business investment intentions, and the effectiveness of government stimulus measures directly shape credit demand. In early 2025, continued government support for SMEs and potential interest rate adjustments by the People's Bank of China could further stimulate borrowing. The Bank of Lanzhou's own internal lending policies, its assessment of credit risk, and its willingness to extend loans are crucial determinants of credit availability.

Here are key considerations for credit demand and availability:

- Consumer Confidence: Higher consumer confidence in 2024 led to increased demand for personal loans and mortgages, benefiting the Bank of Lanzhou's retail lending portfolio.

- SME Investment: Government initiatives aimed at supporting SMEs in Gansu, such as tax breaks and subsidized loans, are expected to drive higher demand for business credit through 2025.

- Corporate Borrowing: Large corporations' investment plans in new projects or expansions, influenced by national economic policies and global market conditions, directly impact the bank's corporate lending volumes.

- Lending Policies: The Bank of Lanzhou's risk appetite and capital adequacy ratios will dictate its capacity and willingness to meet the evolving credit needs of its diverse customer base.

Real Estate Market Stability

The stability of the real estate market is a crucial economic consideration for the Bank of Lanzhou. Chinese banks, including the Bank of Lanzhou, have substantial exposure to property-related lending. Any downturn in Gansu's real estate sector, marked by falling property prices, reduced construction, or weakened housing demand, could directly affect the bank's mortgage book and the value of collateral backing corporate loans. This interconnectedness highlights the potential for systemic risk if market stability is not maintained.

Recent data underscores these concerns. For instance, in late 2024, property sales in some Chinese tier-2 and tier-3 cities experienced a noticeable slowdown, impacting developer financing and, by extension, bank loan performance. The Bank of Lanzhou's risk management strategies must account for these regional economic dynamics.

- Property Price Volatility: Fluctuations in Gansu’s property values directly influence the bank's mortgage portfolio and the collateral backing its loans.

- Construction Activity: A slowdown in construction can reduce demand for corporate loans from developers, impacting the bank's lending business.

- Housing Demand: Weakening consumer demand for housing can lead to increased non-performing loans in the mortgage sector.

- Systemic Risk: The interconnectedness of real estate with the broader financial system means that instability can pose wider economic threats.

Economic factors significantly shape the Bank of Lanzhou's operational landscape. Gansu province's GDP growth, projected to be around 4.5% for 2024, indicates a supportive economic climate for the bank's services. Fluctuations in China's benchmark lending rates, such as the Loan Prime Rate (LPR), directly influence the bank's net interest margin, with adjustments in early 2024 impacting funding costs and lending yields.

Inflationary pressures, evidenced by China's CPI remaining low at 0.3% year-on-year in April 2024, affect the real value of deposits and borrower repayment capacity. Credit demand, driven by consumer confidence and SME investment, is expected to remain robust through 2025, particularly with continued government support for small businesses.

The stability of the real estate market is a critical concern, as a slowdown in property sales, observed in late 2024 in some Chinese cities, can lead to increased non-performing loans for banks with significant property exposure.

| Economic Factor | 2023 Data | 2024 Projection/Early 2024 Data | Impact on Bank of Lanzhou |

|---|---|---|---|

| Gansu GDP Growth | 4.7% | ~4.5% | Supports loan demand and deposit growth |

| PBOC Benchmark Lending Rate (LPR) | Varied | Modest adjustments (early 2024) | Affects net interest margin and profitability |

| China CPI | Low | 0.3% (April 2024) | Impacts real value of deposits and borrower repayment |

| Real Estate Market Activity | Mixed | Slowdown in some cities (late 2024) | Risk of increased non-performing loans |

What You See Is What You Get

Bank of Lanzhou PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of the Bank of Lanzhou covers all key political, economic, social, technological, legal, and environmental factors impacting its operations. Understand the strategic landscape and make informed decisions with this detailed report.

Sociological factors

Gansu province is experiencing significant demographic shifts, with urbanization a key driver. As of 2023, China's urbanization rate reached 65.2%, and while specific Gansu figures fluctuate, the trend points towards increasing urban populations within the province, impacting demand for financial services.

This migration to cities, particularly Lanzhou, fuels a greater need for mortgages, car loans, and personal credit products. Younger, urban-dwelling populations also drive demand for digital banking solutions and investment products, requiring the Bank of Lanzhou to innovate its service delivery.

Chinese consumers, especially younger demographics, are rapidly shifting their financial habits. A significant trend is the increasing adoption of mobile banking and online payment systems; by the end of 2024, it's projected that over 85% of urban Chinese consumers will primarily use digital channels for banking transactions.

This evolving behavior presents a clear directive for the Bank of Lanzhou: invest heavily in user-friendly digital platforms and personalized wealth management tools. Data from early 2025 indicates that fintech adoption among Gen Z in China has surged by 30% year-over-year, highlighting the critical need for the bank to cater to these preferences to attract and retain this vital customer segment.

The financial literacy levels in Gansu province directly influence how readily people adopt more sophisticated banking products and impact the overall risk associated with individual borrowers. For instance, if a significant portion of the population struggles with basic financial concepts, the Bank of Lanzhou might find lower adoption rates for investment accounts or complex loan structures.

To counter this, the Bank of Lanzhou could implement targeted financial education programs, focusing on responsible debt management and prudent investment strategies. Such initiatives are crucial for fostering a more stable customer base and mitigating potential defaults.

Furthermore, extending financial services to rural and less-served communities in Gansu is not only a matter of social duty but also a significant avenue for growth. As of late 2024, rural penetration of digital banking services in China, while growing, still lags behind urban areas, presenting a clear opportunity for institutions like the Bank of Lanzhou to bridge this gap and capture new market share.

Income Levels and Wealth Distribution

Income levels and how wealth is spread across Gansu province directly shape the demand for different financial services. For instance, as more households move into the middle-income bracket, there's a greater need for investment vehicles and wealth management solutions. Conversely, lower-income populations often require access to micro-loans and fundamental savings accounts. The Bank of Lanzhou needs to carefully craft its product portfolio to effectively serve these varied economic groups within its service area.

Recent data highlights these disparities. In 2023, per capita disposable income in Gansu province was reported at approximately 26,000 RMB, which is below the national average. This suggests a significant portion of the population may still be focused on basic financial needs rather than complex investment strategies. However, urban areas within Gansu are seeing a rise in disposable income, potentially creating a growing segment interested in wealth management services.

- Gansu's per capita disposable income in 2023 was around 26,000 RMB.

- This income level is lower than the national average, indicating a focus on essential banking services for many residents.

- The growth of a middle-income demographic, particularly in urban centers, presents an opportunity for wealth management and investment product development.

- The Bank of Lanzhou must balance offerings for lower-income segments needing basic financial tools with the evolving needs of a growing middle class.

Cultural Trust in Traditional Banking

Despite the rapid growth of fintech solutions in China, a substantial segment of the population, particularly in less urbanized or more traditional areas, continues to exhibit a strong preference for established commercial banks. This enduring trust in institutions like the Bank of Lanzhou is a key sociological factor. For instance, a 2024 survey indicated that over 60% of respondents in Tier 3 and Tier 4 cities still preferred in-person banking interactions for significant transactions.

This cultural inclination towards physical branches and direct, face-to-face customer service presents a unique competitive advantage for the Bank of Lanzhou. It necessitates a strategic balance: maintaining and even enhancing its physical branch network to cater to this trust, while simultaneously investing in digital transformation to meet the evolving needs of all customer demographics.

- Enduring Trust: A significant portion of the Chinese population, especially in traditional regions, maintains high trust in established banks like Bank of Lanzhou.

- Preference for Physical Interaction: Cultural preference for face-to-face interactions and physical branches remains a strong driver for many customers.

- Competitive Advantage: This trust can be leveraged as a competitive edge, provided the bank supports its branch network alongside digital advancements.

- Digital Adaptation: The bank must integrate digital strategies to serve a broader customer base while respecting traditional banking preferences.

Sociological factors significantly influence the Bank of Lanzhou's operating environment, driven by demographic shifts and evolving consumer behaviors. Urbanization in Gansu, mirroring China's national trend where the urbanization rate hit 65.2% in 2023, is increasing demand for diverse financial products like mortgages and digital banking solutions. Younger, urban demographics, with fintech adoption surging by 30% year-over-year among Gen Z in early 2025, are pushing for innovative, user-friendly digital platforms.

Financial literacy levels and income disparities across Gansu also shape product demand. With a per capita disposable income of approximately 26,000 RMB in 2023, lower than the national average, many residents focus on basic banking needs. However, a growing middle class in urban areas presents opportunities for wealth management services, requiring the bank to cater to varied economic segments.

Furthermore, a strong cultural preference for established institutions and in-person banking, with over 60% of respondents in smaller cities favoring physical branches for major transactions in 2024, provides a competitive advantage for the Bank of Lanzhou. This necessitates a balanced strategy that supports its physical network while embracing digital transformation to meet the needs of all customer groups.

Technological factors

The surge in digital banking and mobile payments in China presents a significant technological shift. By early 2024, over 85% of Chinese consumers were actively using mobile payment services, a testament to this trend. This widespread adoption means Bank of Lanzhou must prioritize robust digital platforms and user-friendly mobile applications to remain competitive.

To counter this, the Bank of Lanzhou needs to invest heavily in its online banking infrastructure and mobile payment capabilities. Failing to keep pace with innovations, especially those from agile fintech competitors, could result in a loss of market share and customer base. For instance, in 2023, the digital transaction volume for leading Chinese banks saw double-digit growth, highlighting the demand for advanced digital services.

As financial services increasingly digitize, the Bank of Lanzhou faces escalating cybersecurity threats. Data breaches and sophisticated cyberattacks are significant risks, impacting customer trust and operational continuity. For instance, global financial institutions saw a 20% increase in cyberattacks in 2024, highlighting the pervasive nature of these threats.

To counter these risks, substantial investment in advanced cybersecurity infrastructure is crucial. This includes implementing state-of-the-art threat detection systems and robust data protection protocols. Ensuring compliance with evolving data privacy regulations, such as China's Personal Information Protection Law (PIPL), is also paramount for safeguarding sensitive customer information and maintaining regulatory adherence.

Artificial intelligence and big data analytics present significant avenues for the Bank of Lanzhou to refine credit scoring, bolster risk management, enhance fraud detection, and deliver tailored customer experiences. By harnessing these advanced technologies, the bank can achieve greater operational efficiency and cost reductions. For instance, in 2024, many financial institutions reported a 15-20% improvement in fraud detection rates through AI implementation.

The strategic application of AI and big data empowers the Bank of Lanzhou with deeper market trend and customer behavior insights, facilitating more astute business decisions. This analytical capability is crucial for staying competitive in a rapidly evolving financial landscape. By mid-2025, it's projected that AI-driven personalization in banking could increase customer retention by up to 10%.

Blockchain and Distributed Ledger Technology

Blockchain and distributed ledger technology (DLT) present significant opportunities for the Bank of Lanzhou to streamline operations. While still evolving, these technologies can transform areas like cross-border payments and trade finance. For instance, by 2024, the global blockchain in banking market was projected to reach over $2.5 billion, highlighting its growing adoption and potential impact.

Exploring DLT integration could enhance transparency, bolster security, and improve the overall efficiency of the Bank of Lanzhou's services. This could lead to reduced transaction costs and faster settlement times, crucial for competitive advantage in the financial sector.

- Enhanced Security: DLT's cryptographic nature can significantly reduce fraud and cyber threats.

- Improved Efficiency: Automation of processes like reconciliation and settlement can speed up transactions.

- Cost Reduction: Eliminating intermediaries and manual processes can lower operational expenses.

- Increased Transparency: Shared, immutable ledgers provide clear audit trails for transactions.

Fintech Competition and Collaboration

The financial technology (fintech) landscape is rapidly evolving, presenting the Bank of Lanzhou with a dynamic competitive and collaborative environment. Agile fintech companies and internet banks are increasingly challenging traditional banking models by offering innovative, customer-focused digital services, often with lower operational costs. For instance, by the end of 2024, the global fintech market was projected to reach over $33 trillion, highlighting the significant disruption and growth in this sector.

This competitive pressure necessitates strategic responses from the Bank of Lanzhou. The bank has two primary avenues: direct competition through developing its own cutting-edge digital banking solutions, or strategic collaboration. By partnering with or acquiring fintech firms, the Bank of Lanzhou can gain access to specialized technologies, expand its service offerings, and improve customer experience more rapidly. For example, many established banks in Asia have partnered with fintechs to offer specialized lending or wealth management services, seeing a significant uplift in digital customer engagement.

- Fintech Market Growth: Global fintech market expected to exceed $33 trillion by end of 2024.

- Customer-Centric Innovation: Fintechs often lead with user-friendly interfaces and personalized financial tools.

- Strategic Options: Bank of Lanzhou can either build its own digital capabilities or partner with existing fintech players.

- Partnership Benefits: Collaborations can accelerate innovation, reduce development costs, and enhance market reach.

The Bank of Lanzhou must embrace digital transformation, as over 85% of Chinese consumers used mobile payments by early 2024, demanding robust digital platforms. Investments in online banking and mobile capabilities are crucial to counter agile fintech competitors, whose digital transaction volumes saw double-digit growth in 2023.

Cybersecurity is a paramount concern, with global financial institutions experiencing a 20% rise in cyberattacks in 2024. Implementing advanced threat detection and adhering to data privacy laws like China's PIPL are essential for maintaining trust and compliance.

AI and big data analytics offer significant advantages for credit scoring, risk management, and fraud detection, with institutions reporting 15-20% improvements in fraud detection via AI in 2024. AI-driven personalization is also projected to boost customer retention by up to 10% by mid-2025.

Blockchain technology, with a projected market of over $2.5 billion in banking by 2024, can enhance security, efficiency, and transparency in operations like cross-border payments.

Legal factors

The Bank of Lanzhou's operations are governed by stringent regulations from the People's Bank of China (PBOC) and the National Administration of Financial Regulation (NAFR). These bodies enforce rules on capital adequacy, asset quality, and loan loss provisioning, crucial for maintaining the bank's license and stability.

The Bank of Lanzhou operates within a framework of robust Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) laws in China. These regulations are designed to curb illicit financial flows and are strictly enforced. For instance, in 2023, Chinese authorities continued to enhance their AML/CTF frameworks, with a particular focus on digital currencies and cross-border transactions, reflecting global trends and the increasing sophistication of financial crime.

To comply, the Bank of Lanzhou must maintain rigorous internal controls, including comprehensive customer due diligence (CDD) processes to verify identities and assess risks. Reporting suspicious activities promptly to authorities like the People's Bank of China is also a critical requirement, ensuring the bank contributes to national security and financial integrity.

Failure to adhere to these AML/CTF mandates carries significant consequences. These can range from substantial financial penalties, as seen in numerous cases across the global banking sector where non-compliance led to multi-million dollar fines, to severe reputational damage and operational restrictions that can disrupt business continuity.

As digital banking expands, the Bank of Lanzhou faces heightened scrutiny under data privacy and consumer protection legislation. Compliance with regulations like China's Personal Information Protection Law (PIPL), which came into full effect in November 2021, is paramount, governing how customer data is collected, stored, and utilized, with a strong emphasis on transparency and explicit consent.

These legal frameworks also mandate fair practices in financial dealings, requiring the Bank of Lanzhou to implement robust mechanisms for dispute resolution and adhere to principles of responsible lending. For instance, the PIPL can impose significant penalties for data breaches, with fines potentially reaching up to 5% of annual turnover or 50 million yuan, underscoring the financial and reputational risks of non-compliance.

Contract Law and Debt Recovery

The Bank of Lanzhou's ability to conduct lending operations is heavily influenced by the legal framework governing contract enforcement and debt recovery. Effective contract law ensures that loan agreements are binding and that the bank has recourse in case of default, which is critical for managing credit risk. For instance, China's Civil Code, which came into effect in 2021, provides a comprehensive framework for contract law, including provisions on loan contracts and secured transactions, aiming to enhance legal certainty for financial institutions.

Efficient debt recovery mechanisms are paramount for maintaining the bank's asset quality and profitability. This includes clear procedures for seizing collateral and navigating bankruptcy proceedings. In 2023, China's Supreme People's Court continued to emphasize streamlined judicial processes for debt recovery, aiming to reduce the time and cost associated with resolving non-performing loans, a key concern for banks like Lanzhou.

Legal reforms, particularly those aimed at improving the efficiency of the judicial system in handling financial disputes, directly impact the Bank of Lanzhou's operational performance. A robust legal environment that facilitates swift and fair resolution of loan defaults can significantly reduce the bank's exposure to bad debts. For example, efforts to digitize court filings and hearings, accelerated by the pandemic, are contributing to faster case processing times for financial institutions across China.

- Contract Enforcement: China's Civil Code provides the legal basis for loan agreements, crucial for the Bank of Lanzhou's lending activities.

- Debt Recovery Efficiency: Streamlined judicial processes, as emphasized by the Supreme People's Court in 2023, are vital for the bank to recover defaulted loans.

- Legal Reforms Impact: Initiatives to digitize court processes aim to expedite financial dispute resolution, directly benefiting the bank's asset quality.

Securities and Investment Product Regulations

The Bank of Lanzhou, by offering investment and wealth management products, operates under strict securities and investment product regulations. These rules govern how products are issued, marketed, and sold, ensuring investor protection and market fairness. For instance, in 2024, China's Securities Regulatory Commission (CSRC) continued to emphasize enhanced disclosure requirements for new investment products, aiming to provide greater transparency to retail investors.

Key regulatory areas include:

- Investor Suitability: Banks must assess if investment products align with a client's financial situation, risk tolerance, and investment objectives.

- Disclosure Requirements: Comprehensive and accurate information about product risks, fees, and performance must be provided to investors before purchase.

- Prevention of Insider Trading: Strict measures are in place to prevent the misuse of non-public information for trading purposes, safeguarding market integrity.

Failure to comply with these regulations can lead to significant penalties, including fines and reputational damage, underscoring the critical importance of adherence for institutions like the Bank of Lanzhou.

The Bank of Lanzhou navigates a complex legal landscape, with China's Civil Code, effective from 2021, providing the bedrock for contract enforcement and debt recovery, crucial for managing credit risk. The Supreme People's Court's 2023 directives to streamline judicial processes for debt recovery directly impact the bank's ability to address non-performing loans and maintain asset quality. Furthermore, ongoing digitalization of court processes is expected to expedite financial dispute resolution, benefiting the bank's operational efficiency and risk management.

Environmental factors

China's commitment to environmental protection is driving significant growth in green finance. By mid-2024, the issuance of green bonds in China had already reached over ¥200 billion, a substantial increase from the previous year, demonstrating robust government support and market demand for sustainable investments.

The Bank of Lanzhou can capitalize on this trend by actively developing and promoting green financial products. Offering specialized green loans for renewable energy projects, energy efficiency upgrades, and pollution control initiatives aligns with national environmental goals and taps into a growing market segment. This strategic alignment can bolster the bank's image as a responsible financial institution.

By integrating green finance into its core business strategy, the Bank of Lanzhou can not only contribute to sustainable development but also unlock new revenue streams and enhance its competitive edge. This proactive approach to environmental, social, and governance (ESG) principles is becoming increasingly crucial for long-term financial success.

Climate change presents significant challenges and avenues for growth for the Bank of Lanzhou. Physical risks, like increased frequency of floods or droughts, could negatively affect its loan book, particularly in sectors heavily reliant on stable weather patterns, such as agriculture and property development. For instance, a severe drought in Gansu province could impact agricultural loan repayments.

Transition risks are also a concern, as industries heavily reliant on fossil fuels may face devaluation, potentially creating stranded assets within the bank's investment portfolio. China's commitment to carbon neutrality by 2060 means a gradual shift away from carbon-intensive sectors, which could affect the value of loans made to these industries.

However, these risks also unlock considerable opportunities. By financing green projects and supporting businesses transitioning to sustainable practices, the Bank of Lanzhou can tap into a growing market. China's renewable energy sector saw significant investment in 2023, with solar and wind power installations reaching new heights, offering a clear area for the bank to expand its green financing initiatives.

The Bank of Lanzhou must increasingly align its operations with Environmental, Social, and Governance (ESG) standards, driven by investor and regulatory pressures. This means integrating ESG criteria into lending and investment processes. For instance, by 2024, global sustainable investment assets reached an estimated $37.7 trillion, highlighting the significant capital flow towards ESG-conscious entities.

Implementing strong ESG policies offers tangible benefits for the Bank of Lanzhou. It can bolster risk management by identifying and mitigating environmental and social risks in its portfolio. Furthermore, it can attract socially responsible investors, a segment that saw a 10% growth in assets under management globally in 2024, and significantly enhance the bank's reputation.

Transparency in ESG reporting is paramount. Investors and stakeholders expect clear, verifiable data on the bank's environmental impact, social contributions, and governance practices. Leading financial institutions are now publishing detailed sustainability reports, often aligned with frameworks like the Global Reporting Initiative (GRI), to meet these evolving expectations and build trust.

Sustainable Lending Practices

The Bank of Lanzhou must embed sustainable lending practices, rigorously evaluating the environmental impact of financed projects. This necessitates a thorough screening process for borrowers, focusing on their environmental compliance, social responsibility, and governance (ESG) frameworks. Such responsible lending not only safeguards against reputational damage but also positions the bank advantageously within the accelerating global shift towards sustainability.

This strategic pivot is crucial as financial institutions worldwide increasingly prioritize ESG factors. For instance, by 2024, a significant portion of global sustainable finance was directed towards climate mitigation and adaptation projects, indicating a strong market demand for environmentally conscious financing. By implementing robust ESG screening, the Bank of Lanzhou can tap into this growing market and enhance its long-term financial resilience.

Key aspects of developing these practices include:

- Developing clear ESG assessment criteria for loan applications.

- Integrating environmental risk assessment into the credit analysis process.

- Offering preferential terms for projects with strong sustainability profiles.

- Enhancing transparency in reporting on financed projects' environmental performance.

Resource Scarcity and Pollution Concerns

Concerns about resource scarcity, particularly water and energy, in Gansu province directly impact the operational sustainability of various industries. For instance, the agricultural sector, a significant part of Gansu's economy, faces increasing pressure from water shortages, which could affect loan portfolios tied to farming enterprises.

Pollution concerns, especially related to industrial activities, also pose risks. The Bank of Lanzhou must evaluate how environmental regulations and remediation costs affect its clients' profitability and ability to repay loans. By encouraging sustainable practices, the bank can proactively manage these environmental risks, fostering long-term resilience for both its borrowers and the regional economy.

- Water Stress: Gansu province is classified as a water-scarce region, with per capita water resources significantly below the national average, impacting water-intensive industries.

- Energy Transition: China's national goal to peak carbon emissions before 2030 and achieve carbon neutrality by 2060 will necessitate shifts in energy-dependent industries, potentially affecting loan collateral and borrower viability.

- Environmental Regulations: Stricter enforcement of environmental protection laws can lead to increased compliance costs for businesses, influencing their financial health and the bank's credit risk assessment.

China's commitment to environmental protection is a major driver for green finance, with green bond issuance in China exceeding ¥200 billion by mid-2024. This trend presents an opportunity for the Bank of Lanzhou to develop green financial products, such as loans for renewable energy and energy efficiency projects, aligning with national environmental goals and tapping into a growing market. By integrating green finance, the bank can enhance its image and unlock new revenue streams.

PESTLE Analysis Data Sources

Our Bank of Lanzhou PESTLE Analysis is built on a robust foundation of data sourced from official Chinese government publications, reputable financial institutions, and leading economic research firms. This ensures that our insights into political, economic, social, technological, legal, and environmental factors are accurate and current.