Bank of Lanzhou Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank of Lanzhou Bundle

The Bank of Lanzhou faces moderate competitive rivalry and a significant threat from substitute financial products. Buyer power is also a key consideration, as customers have choices in where they bank.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Bank of Lanzhou’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Depositors, both individuals and institutions, are crucial capital suppliers for the Bank of Lanzhou. Their ability to choose where to park their funds gives them considerable bargaining power. This power is amplified when alternative investment options offer more attractive returns or when competitors present more compelling interest rates, particularly in a market characterized by lower interest rates.

Suppliers of core banking software, digital platforms, and IT infrastructure hold moderate bargaining power over the Bank of Lanzhou. The increasing reliance on advanced technologies like artificial intelligence and sophisticated digital solutions for operational efficiency and competitive differentiation means these specialized providers are crucial partners. For instance, the global banking software market was valued at approximately $35 billion in 2023 and is projected to grow significantly, indicating a strong demand for these services.

The bargaining power of suppliers, particularly concerning skilled talent, is a significant factor for Bank of Lanzhou. A scarcity of professionals in crucial areas like fintech, risk management, and digital transformation directly impacts the bank's ability to innovate and maintain competitive operations. For instance, in 2024, the demand for AI and machine learning specialists in the financial sector outstripped supply, leading to salary increases of up to 20% for these roles, according to industry reports.

Interbank Funding Market

The bargaining power of suppliers in the interbank funding market for the Bank of Lanzhou is significant. Other financial institutions that provide this crucial short-term funding, essentially acting as suppliers of liquidity, can wield considerable influence, particularly if the Bank of Lanzhou experiences liquidity challenges or requires immediate capital infusion. This is especially true for smaller, regional banks that often rely on the interbank market for their own funding needs.

The Bank of Lanzhou's reliance on interbank funding means that the terms and availability of these loans directly impact its operational stability. If a significant portion of the interbank market is concentrated among a few large institutions, or if market-wide liquidity tightens, these suppliers gain leverage. For instance, in early 2024, reports indicated increased volatility in short-term funding markets globally, which could translate to higher borrowing costs for banks needing interbank loans.

- Interbank Funding Dependence: Banks like the Bank of Lanzhou often depend on the interbank market for managing daily liquidity needs and meeting reserve requirements.

- Supplier Concentration: The power of suppliers increases if the interbank market is dominated by a few large, stable financial institutions.

- Market Liquidity Conditions: During periods of general market stress or reduced liquidity, the cost and availability of interbank funds can become unfavorable for borrowers.

- Bank of Lanzhou's Financial Health: A bank facing financial difficulties or perceived as higher risk will find its suppliers have greater bargaining power.

Regulatory Bodies and Central Bank

Regulatory bodies, such as the National Financial Regulatory Administration (NFRA) and the People's Bank of China (PBOC), exert significant influence over banks like Bank of Lanzhou, acting as powerful, albeit non-traditional, suppliers of operational rules and capital mandates. These entities shape the bank's cost structure by setting capital adequacy ratios and reserve requirements, directly impacting profitability and strategic flexibility. For instance, in 2024, the PBOC continued its focus on maintaining financial stability, which could translate to tighter liquidity conditions or increased compliance costs for banks.

- NFRA and PBOC set capital requirements, influencing Bank of Lanzhou's lending capacity.

- Regulatory compliance costs are a significant factor in the bank's operational expenses.

- Monetary policy decisions by the PBOC can affect interest margins and funding costs.

- Changes in regulatory frameworks, such as those related to digital banking or risk management, necessitate costly adjustments.

The bargaining power of suppliers for Bank of Lanzhou is multifaceted, extending from depositors to technology providers and even regulatory bodies. Depositors can shift funds based on better returns, while specialized IT suppliers hold sway due to the critical nature of their services. Moreover, the scarcity of skilled talent in areas like fintech and AI in 2024 directly increased labor costs, highlighting supplier leverage in the human capital market.

| Supplier Type | Bargaining Power | Impact on Bank of Lanzhou |

|---|---|---|

| Depositors | Moderate to High | Affects funding costs and availability. Attractive alternatives can lead to deposit outflows. |

| Technology Providers (Software, IT) | Moderate | Crucial for operations and innovation; price increases or service disruptions can impact efficiency. |

| Skilled Talent (Fintech, AI Specialists) | High | Scarcity drives up wages and recruitment costs, impacting innovation and operational capacity. |

| Interbank Lenders | Moderate to High | Influences short-term funding costs and liquidity management, especially during market stress. |

| Regulatory Bodies (NFRA, PBOC) | Very High | Dictate capital requirements, operational standards, and compliance costs, shaping strategic direction. |

What is included in the product

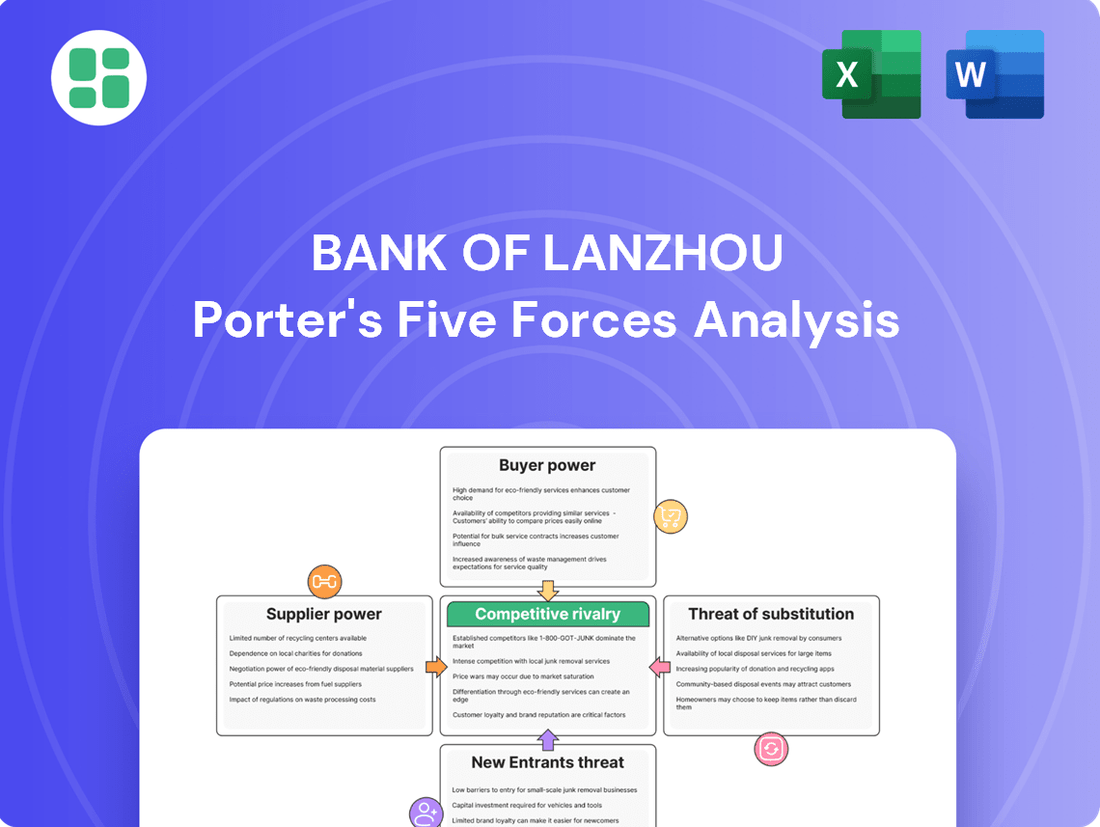

This Porter's Five Forces analysis specifically examines the competitive landscape of the Bank of Lanzhou, detailing the intensity of rivalry, the bargaining power of customers and suppliers, the threat of new entrants, and the impact of substitute products.

Uncover the true competitive landscape of the Bank of Lanzhou with a clear, one-sheet summary of all five forces, perfect for quick strategic decision-making.

Customers Bargaining Power

Individual retail customers at Bank of Lanzhou possess moderate bargaining power. This is largely due to the competitive landscape offering many banking alternatives and the relatively low costs associated with switching basic accounts. For instance, in 2024, the proliferation of fintech solutions and neobanks has further increased customer choice, making it easier for individuals to compare and move their funds based on better rates or services.

The rise of digital banking significantly enhances this customer power. Online platforms and mobile apps provide greater convenience, allowing customers to easily access competitive interest rates and fee structures from various institutions. This ease of comparison and transaction means customers can readily shift their business if they find more favorable terms elsewhere, pressuring banks like Lanzhou to maintain attractive offerings.

Corporate and SME clients at Bank of Lanzhou can wield significant bargaining power, especially larger entities needing substantial financing or bespoke financial products. These clients often leverage their financial volume to negotiate more favorable interest rates, loan terms, and tailored service packages, directly impacting the bank's profitability on these relationships.

Local government entities and large institutions wield considerable bargaining power with Bank of Lanzhou. Their substantial deposit volumes and significant borrowing requirements give them leverage, as does their crucial role in fostering local economic development. For Bank of Lanzhou, a bank with a pronounced regional focus, these clients are not just customers but vital partners in its operational success and strategic growth.

Access to Alternative Financing

The bargaining power of customers for Bank of Lanzhou is significantly amplified by their access to alternative financing options. This means customers aren't solely reliant on traditional banks, as they can explore investment products and financing from non-bank financial institutions or directly tap into capital markets. This broadens their choices and gives them more leverage when negotiating terms or seeking specific financial solutions.

This increased customer choice compels banks like Bank of Lanzhou to remain highly competitive. To retain and attract customers, banks must continuously refine their product offerings, improve service quality, and ensure their pricing remains attractive. For instance, in 2024, the growth of fintech platforms offering specialized lending and investment services has put pressure on incumbent banks to innovate. Data from China's financial sector in late 2023 indicated a notable shift towards digital banking services, with a significant portion of new account openings occurring through non-traditional channels, underscoring the growing influence of alternative providers.

- Increased Customer Leverage: Customers can bypass traditional banking channels by accessing capital markets or non-bank financial institutions for their needs.

- Competitive Pressure on Banks: This forces banks to offer more attractive rates, better services, and innovative products to stay relevant.

- Fintech's Growing Role: The rise of fintech companies provides viable alternatives, enhancing customer bargaining power and pushing banks towards digital transformation.

Digital Sophistication and Expectations

Customers are becoming increasingly tech-savvy, particularly in major cities. This growing digital sophistication means they expect banking services to be seamless, secure, and cutting-edge.

For instance, by the end of 2023, over 80% of Bank of Lanzhou's transactions were conducted through digital channels, reflecting a strong customer preference for online and mobile banking. This trend forces the bank to continuously innovate and invest in its digital infrastructure to meet these elevated expectations.

- Digital Adoption: In 2024, it's estimated that over 85% of urban banking customers in China actively use mobile banking apps.

- Service Demands: Customers now demand features like instant transfers, personalized financial advice via AI, and robust cybersecurity measures.

- Competitive Pressure: Banks that fail to offer superior digital experiences risk losing customers to more agile competitors.

- Investment Needs: Significant investment in areas like cloud computing, AI, and data analytics is crucial for banks like Bank of Lanzhou to stay competitive.

The bargaining power of customers for Bank of Lanzhou is influenced by several factors. Individual retail customers have moderate power due to the availability of numerous banking alternatives and low switching costs for basic accounts. In 2024, the growth of fintech and neobanks amplified customer choice, making it easier to find better rates and services.

Large corporate clients and SMEs possess significant leverage, especially when requiring substantial financing or specialized products. They can negotiate better interest rates and terms based on their transaction volume. Local government entities and major institutions also hold considerable sway due to their large deposit bases and borrowing needs, acting as vital partners for a regionally focused bank like Lanzhou.

The increasing accessibility of alternative financing options, such as capital markets and non-bank financial institutions, further empowers customers. This diversification of financial services compels banks to offer competitive pricing and superior service to retain business. By late 2023, digital banking transactions represented a significant portion of new account openings in China, highlighting the growing influence of alternative channels.

| Customer Segment | Bargaining Power Factor | Impact on Bank of Lanzhou |

|---|---|---|

| Individual Retail Customers | High availability of alternatives, low switching costs | Pressure on pricing and service quality; need for digital innovation |

| SMEs and Corporate Clients | Transaction volume, need for tailored products | Negotiation power on interest rates and loan terms; potential for higher profitability on large accounts |

| Government and Large Institutions | Deposit volume, borrowing requirements, regional economic importance | Significant influence on bank's funding and lending strategy; strategic partnership value |

What You See Is What You Get

Bank of Lanzhou Porter's Five Forces Analysis

This preview showcases the complete Bank of Lanzhou Porter's Five Forces Analysis, providing a thorough examination of its competitive landscape, including threats of new entrants, bargaining power of buyers and suppliers, threat of substitute products, and industry rivalry. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy. You can trust that the insights and formatting you see are precisely what you will receive, enabling immediate strategic decision-making.

Rivalry Among Competitors

The competitive landscape for Bank of Lanzhou is significantly shaped by the dominance of large state-owned commercial banks in China. These giants, such as the Industrial and Commercial Bank of China (ICBC), China Construction Bank (CCB), Agricultural Bank of China (ABC), and Bank of China (BOC), command vast market share and possess extensive branch networks across the nation. For instance, as of the end of 2023, these four banks collectively held over 40% of the total assets in China's banking sector, demonstrating their immense scale and reach.

These state-backed institutions leverage their substantial capital bases and government support to offer a wide array of financial products and services, often at competitive pricing. This allows them to attract a broad customer base, from large corporations to individual depositors, thereby intensifying pressure on regional players like Bank of Lanzhou. Their established brand recognition and deep pockets enable aggressive marketing campaigns and rapid adoption of new technologies, further widening the competitive gap.

Bank of Lanzhou encounters significant competition from other city commercial banks and rural commercial banks within Gansu province and its surrounding areas. This intense rivalry is particularly evident in the crucial markets for attracting local deposits and providing loans to small and medium-sized enterprises (SMEs).

In 2023, the banking sector in China, including regional players, saw continued efforts to consolidate and enhance competitiveness. For instance, many city commercial banks focused on digital transformation to improve customer experience and operational efficiency, directly impacting how they compete for the same customer base as Bank of Lanzhou.

The landscape is further shaped by the presence of larger national banks, which, while not strictly regional, exert considerable influence on local markets through their extensive branch networks and broader product offerings, adding another layer to the competitive pressures faced by Bank of Lanzhou.

Many core banking services, like savings accounts and basic loans, are nearly identical across institutions. This lack of differentiation forces banks, including Bank of Lanzhou, into competing primarily on price. This intense price competition directly impacts net interest margins, a critical profitability metric. For Chinese banks, this pressure is particularly acute, with analysts projecting net interest margins to remain under significant strain through 2024 and into 2025.

Market Saturation and Slowing Loan Growth

The Chinese banking sector is experiencing a noticeable slowdown in loan growth, which naturally ramps up the rivalry among institutions like the Bank of Lanzhou. As the overall pie of new lending opportunities shrinks, banks are compelled to compete more aggressively for the existing business. This intensified competition pressures margins and necessitates a sharp focus on operational efficiency and maintaining high asset quality to stand out.

- Slowing Loan Growth: China's banking sector saw aggregate loan growth decelerate. For instance, in 2023, new yuan loans amounted to 22.75 trillion yuan, a slight decrease from the previous year, indicating a cooling demand for credit.

- Increased Competition: This environment forces banks to fight harder for market share, potentially leading to more aggressive pricing or specialized product offerings to attract and retain customers.

- Focus on Efficiency: Banks must prioritize cost reduction strategies and robust risk management to safeguard asset quality amidst this heightened competitive landscape.

Aggressive Digital Transformation by Competitors

The banking sector in China is witnessing an aggressive digital transformation, with numerous institutions heavily investing in artificial intelligence and other advanced technologies. This push aims to significantly improve customer experience and streamline operations.

This intense digital innovation among competitors creates a formidable challenge for regional banks like Bank of Lanzhou. They must allocate substantial capital to keep pace with these advancements, or risk falling behind in service quality and market share.

For instance, by the end of 2023, major Chinese banks reported significant increases in their IT spending. ICBC, for example, allocated over 40 billion RMB to technology, a substantial portion of which was directed towards AI and digital platforms, illustrating the scale of investment required to compete.

- Increased investment in AI and cloud computing by major banks.

- Focus on enhancing customer-facing digital services and mobile banking.

- Competitors leveraging data analytics for personalized product offerings.

- The need for regional banks to match or exceed these digital capabilities.

The competitive rivalry for Bank of Lanzhou is fierce, primarily due to the overwhelming presence of large state-owned commercial banks. These giants, including ICBC and CCB, dominate the market with extensive networks and substantial capital, as evidenced by their collective over 40% share of China's banking assets by the end of 2023. This scale allows them to offer competitive pricing and invest heavily in technology, creating a significant challenge for regional banks.

Furthermore, Bank of Lanzhou faces intense competition from other city and rural commercial banks in its operating regions, particularly in attracting local deposits and serving SMEs. The overall banking sector in China, including regional players, is undergoing digital transformation, with many banks, like those in the city commercial bank sector, focusing on enhancing customer experience and operational efficiency in 2023 to stay competitive.

The lack of differentiation in core banking products forces many institutions, including Bank of Lanzhou, into price-based competition, which pressures net interest margins. This pressure is expected to continue through 2024 and 2025. The slowdown in loan growth in China, with new yuan loans in 2023 totaling 22.75 trillion yuan, a slight decrease from the previous year, further intensifies this rivalry as banks compete more aggressively for a smaller pool of new business.

| Competitor Type | Key Characteristics | Impact on Bank of Lanzhou |

|---|---|---|

| Large State-Owned Banks (e.g., ICBC, CCB) | Vast market share, extensive branch networks, strong capital, government backing, aggressive technology investment. | Dominant pricing power, broad product offerings, superior customer reach, significant technological advantage. |

| Other City/Rural Commercial Banks | Regional focus, competition for local deposits and SME loans, undergoing digital transformation. | Direct competition in core markets, pressure on pricing and service delivery, need to match digital advancements. |

| National Banks (with local presence) | Broader product portfolios, established national brands, extensive branch networks. | Indirect but significant competition, offering wider choices to customers, influencing local market standards. |

SSubstitutes Threaten

Fintech companies, with their innovative mobile payment solutions and online lending platforms, pose a significant threat to Bank of Lanzhou. These digital alternatives often boast lower transaction fees and a more streamlined user experience, directly competing with traditional banking services. For instance, by mid-2024, the global fintech market was projected to reach over $1.1 trillion, indicating a substantial and growing alternative for consumers and businesses seeking financial services.

Direct capital market financing presents a significant threat to traditional bank lending, particularly for larger, creditworthy corporations. Companies can bypass banks by issuing bonds or selling equity directly to investors, which can be more cost-effective and provide greater flexibility. In 2024, global bond issuance reached trillions of dollars, demonstrating the scale of this alternative funding channel.

The rise of shadow banking activities presents a significant threat of substitutes for traditional banking services. These entities, operating with less regulatory oversight, can offer more flexible and sometimes cheaper financing options, particularly for businesses and individuals who find it difficult to access credit through conventional banks. For instance, peer-to-peer lending platforms and other fintech innovators are increasingly providing alternative avenues for capital, potentially diverting business away from institutions like the Bank of Lanzhou.

Peer-to-Peer (P2P) Lending Platforms

Peer-to-peer (P2P) lending platforms, despite facing increased regulatory scrutiny, continue to present a viable alternative to traditional banking for borrowers. These platforms have historically offered a pathway for individuals and small businesses to secure funding outside of conventional bank channels. While their market share has fluctuated, the potential for these platforms to evolve or re-emerge as significant competitors means they remain a relevant substitute threat to Bank of Lanzhou.

The threat of substitutes from P2P lending is influenced by several factors:

- Regulatory Landscape: While regulations have tightened, impacting some platforms, a more stable and clear regulatory environment could foster renewed growth and attract more users.

- Technological Advancement: Ongoing innovation in fintech could lead to more efficient, user-friendly, and competitive P2P lending solutions.

- Interest Rate Environment: When traditional banks have higher lending rates, P2P platforms can become more attractive to borrowers seeking lower costs.

- Investor Demand: The willingness of individual and institutional investors to fund loans through P2P platforms directly impacts the availability of capital for this substitute.

Asset Management Products from Non-Bank Institutions

Wealth management products and investment instruments offered by securities firms, insurance companies, and other non-bank financial institutions are significant substitutes for traditional bank deposits and investment products. These alternatives, such as mutual funds, exchange-traded funds (ETFs), and structured products, compete directly for customer assets. In 2024, the global asset management industry continued its robust growth, with assets under management (AUM) projected to reach over $140 trillion, highlighting the substantial appeal of these non-bank offerings.

The increasing sophistication and accessibility of these substitute products mean customers have more choices beyond traditional banking. For instance, the rise of robo-advisors and online investment platforms has lowered barriers to entry for alternative investments. In the first half of 2024, retail investors increasingly turned to ETFs, with global net inflows into ETFs reaching record levels, demonstrating a clear shift in investment preferences away from solely bank-held assets.

- Competition from Securities Firms: Securities firms offer a wide array of investment products, including stocks, bonds, and managed portfolios, directly challenging banks' traditional roles.

- Insurance Company Offerings: Insurance companies provide investment-linked policies and annuities that serve as long-term savings and investment vehicles, attracting funds that might otherwise be deposited in banks.

- Growth of Alternative Investment Platforms: The proliferation of fintech platforms offering access to alternative assets like private equity, real estate, and digital assets provides further substitutes for bank-originated investments.

- Customer Preference for Higher Yields: In a competitive interest rate environment, customers are actively seeking higher returns, often found in non-bank investment products, which puts pressure on banks to innovate their deposit and investment offerings.

The threat of substitutes for Bank of Lanzhou is substantial, encompassing a range of financial services and products that bypass traditional banking channels. Fintech innovations, direct capital market access, shadow banking, peer-to-peer lending, and diverse wealth management products all present viable alternatives for customers seeking financial solutions. These substitutes often offer greater convenience, lower costs, or higher potential returns, directly challenging the Bank of Lanzhou's market share and profitability.

By mid-2024, the global fintech market's projected value exceeding $1.1 trillion underscored the scale of digital financial alternatives. Concurrently, trillions in global bond issuance in 2024 demonstrated the significant appeal of direct capital market financing for corporations. The asset management industry, with projected assets under management surpassing $140 trillion in 2024, further highlights the strong customer preference for non-bank investment vehicles.

| Substitute Category | Key Offerings | 2024 Market Indicator |

|---|---|---|

| Fintech Companies | Mobile Payments, Online Lending | Global Fintech Market > $1.1 Trillion (projected) |

| Capital Markets | Bonds, Equity Issuance | Global Bond Issuance in Trillions |

| Shadow Banking/P2P Lending | Alternative Financing, Peer Loans | Growing Market Share in Specific Niches |

| Wealth Management | ETFs, Mutual Funds, Structured Products | Global AUM > $140 Trillion (projected) |

Entrants Threaten

The threat of new entrants into China's banking sector, particularly for institutions like Bank of Lanzhou, is significantly dampened by exceptionally high regulatory barriers and demanding licensing requirements. The National Financial Regulatory Administration (NFRA) imposes stringent oversight, ensuring only well-capitalized and compliant entities can operate.

These hurdles include substantial capital adequacy ratios and rigorous operational standards, making it exceedingly difficult and costly for newcomers to gain a foothold. For instance, in 2024, the average capital requirement for new rural commercial banks in China remained substantial, often in the billions of Renminbi, effectively deterring smaller or less-resourced entities.

Establishing a new bank, particularly one with a comprehensive physical branch network and advanced digital banking capabilities, necessitates a massive upfront capital infusion. For instance, regulatory capital requirements alone can run into hundreds of millions, if not billions, of dollars, acting as a significant deterrent.

The banking sector inherently relies on trust, a significant hurdle for any new entrant aiming to compete with established institutions like Bank of Lanzhou. Building this trust and brand recognition requires substantial investment in marketing and a proven track record, often taking years to cultivate.

Established Customer Relationships and Networks

Established banks, including Bank of Lanzhou, benefit from deeply entrenched customer relationships and extensive branch networks, especially those serving local communities. These long-standing connections and physical presence make it difficult for new entrants to gain traction and build a comparable reach quickly.

For instance, in 2024, the banking sector continued to see a significant portion of customer loyalty tied to established institutions. While digital banking is growing, a substantial segment of the population still values in-person interactions and trust built over years. This loyalty acts as a significant barrier for any new bank attempting to enter the market and attract a meaningful customer base.

- Deeply Entrenched Relationships: Existing banks have cultivated trust and loyalty over decades.

- Extensive Branch Networks: Physical presence in communities remains a key differentiator.

- Customer Inertia: Switching banks often involves effort, discouraging customers from moving.

- Brand Recognition: Established banks enjoy higher brand awareness and perceived reliability.

Emergence of Digital-Only Banks or Specialized Licenses

While establishing a full-service traditional bank faces significant hurdles, the threat of new entrants for Bank of Lanzhou could materialize through specialized digital-only banks or fintech firms securing specific financial licenses. These new players often focus on underserved or niche markets, offering streamlined, low-cost digital services that bypass the overhead of brick-and-mortar branches.

For instance, in 2024, the global fintech market continued its robust expansion, with neobanks and digital payment providers gaining substantial traction. These agile competitors can attract customers with competitive pricing and user-friendly interfaces, directly challenging established players like Bank of Lanzhou by offering specialized services such as international money transfers or peer-to-peer lending with greater efficiency.

- Digital-only banks can operate with lower overhead costs compared to traditional institutions.

- Fintech companies often leverage advanced technology to offer innovative and targeted financial products.

- Specific financial licenses allow new entities to enter the market with a focused business model.

- These new entrants can quickly capture market share by appealing to customer demand for digital convenience and lower fees.

The threat of new entrants for Bank of Lanzhou is generally low due to substantial regulatory hurdles and high capital requirements in China's banking sector. For example, in 2024, new rural commercial banks often needed billions of RMB in capital. Established trust and extensive branch networks also present significant barriers, making it difficult for newcomers to gain market share and customer loyalty.

| Barrier Type | Impact on New Entrants | Example (2024 Data) |

|---|---|---|

| Regulatory Requirements | High | Substantial capital adequacy ratios, stringent licensing |

| Capital Investment | Very High | Billions of RMB for new rural commercial banks |

| Brand Loyalty & Trust | High | Deeply entrenched customer relationships |

| Economies of Scale | High | Established branch networks and operational efficiencies |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Bank of Lanzhou is built upon a foundation of publicly available financial statements, annual reports, and regulatory filings from the bank itself. We also incorporate data from industry-specific research reports and economic indicators relevant to the Chinese banking sector.