Bank of Cyprus Holdings PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank of Cyprus Holdings Bundle

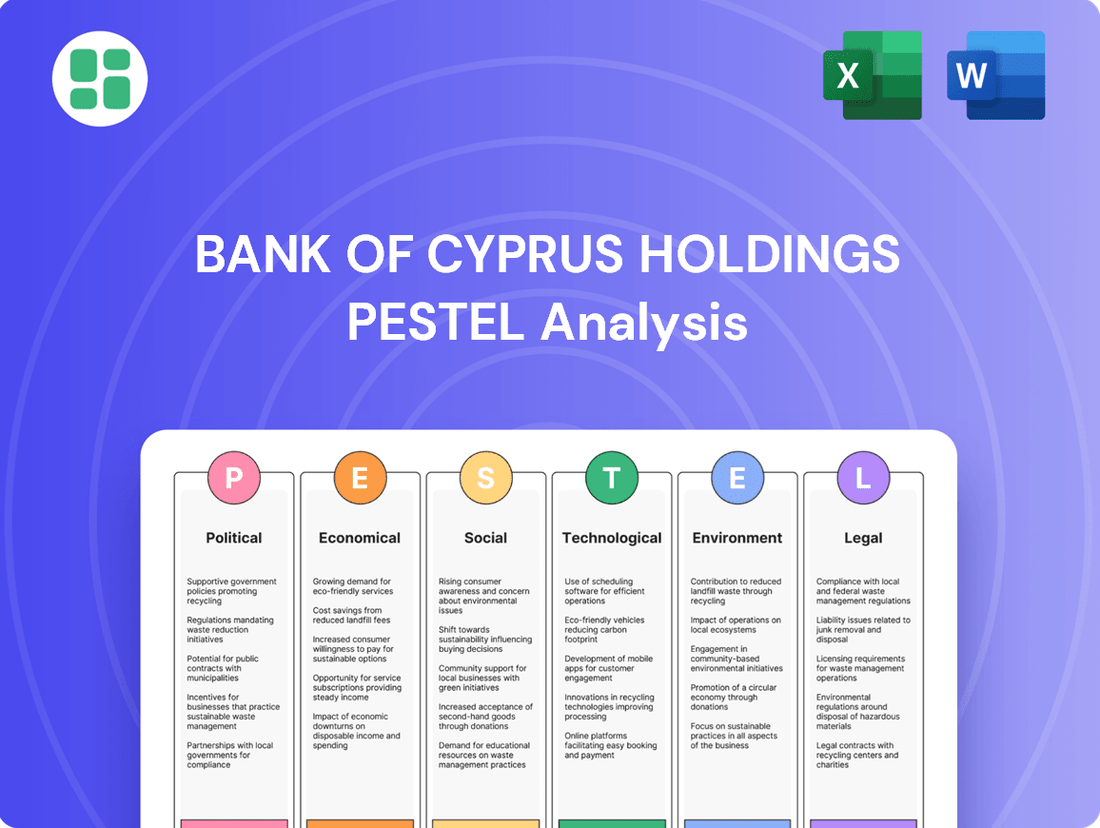

Uncover the critical political, economic, social, technological, legal, and environmental factors impacting Bank of Cyprus Holdings. Our PESTLE analysis provides a comprehensive overview, highlighting potential opportunities and threats. Gain a strategic advantage by understanding these external forces. Download the full report to unlock actionable insights for your business strategy.

Political factors

The stability of the Cypriot government and its economic policies are crucial for the banking sector. A consistent approach to fiscal policy and financial regulations creates a predictable environment for Bank of Cyprus, boosting investor confidence and aiding strategic decisions.

Cyprus has demonstrated a strong fiscal position, with government debt decreasing and projected surpluses, according to recent data. This positive political backdrop supports the banking industry by signaling a stable and well-managed economy.

As a member of the European Union and the Eurozone, Bank of Cyprus is deeply influenced by EU banking directives and the European Central Bank's (ECB) monetary policy. These regulations, such as capital requirements and supervisory priorities, shape the bank's operational framework and strategic decisions, directly impacting its profitability and risk management approaches.

The ECB's direct supervision of significant institutions within the Euro area, including Bank of Cyprus, means that changes in ECB policy, like interest rate adjustments or new prudential measures, have immediate and substantial effects. For instance, the ECB's key interest rates, which stood at 4.50% as of June 2024, influence lending margins and funding costs for the bank.

Cyprus's strategic location near the Middle East, a region often marked by geopolitical volatility, presents a significant risk factor for Bank of Cyprus. This proximity can trigger economic shocks, deter foreign capital inflows, and negatively impact vital sectors like tourism, directly affecting the bank's stability and the quality of its loan portfolio.

The Central Bank of Cyprus has explicitly identified escalating geopolitical instability as a primary concern, emphasizing the need for heightened monitoring and preparedness within the financial sector. For instance, ongoing regional conflicts can disrupt supply chains and increase operational costs for businesses operating in Cyprus, indirectly impacting their ability to service loans held by Bank of Cyprus.

Regulatory and Supervisory Framework

The political commitment to a strong regulatory environment is paramount for Bank of Cyprus. This involves strict adherence to international norms for combating money laundering and terrorist financing, alongside continuous oversight from the Central Bank of Cyprus and the European Central Bank (ECB). For instance, as of late 2024, the ECB's ongoing prudential supervision of significant institutions like Bank of Cyprus includes regular stress tests and capital adequacy assessments, reinforcing the framework.

This robust oversight is crucial for maintaining financial stability and bolstering the bank's international reputation, especially given its operations in a globalized market. The effectiveness of these regulations directly impacts investor confidence and the bank's ability to conduct cross-border transactions seamlessly, a key aspect of its business model.

- Adherence to EU AML/CFT Directives: Ensuring compliance with the latest iteration of EU Anti-Money Laundering and Counter-Terrorist Financing directives, which are regularly updated to address evolving threats.

- ECB Supervisory Expectations: Meeting the stringent capital requirements and risk management standards set by the European Central Bank, a critical factor for maintaining operational licenses.

- National Regulatory Compliance: Fulfilling all obligations mandated by the Central Bank of Cyprus, including reporting, capital buffers, and consumer protection measures.

- Impact on International Credibility: Demonstrating a commitment to regulatory compliance enhances the bank's standing with international correspondent banks and investors.

Government Support for Green Transition

Government initiatives and support for environmental sustainability, particularly the green transition, are increasingly shaping the financial landscape in Cyprus. These policies directly influence Bank of Cyprus's lending practices and investment opportunities, encouraging a pivot towards environmentally conscious financing. For instance, the Cypriot government has committed to ambitious renewable energy targets, which in turn create new avenues for the bank to align its portfolio with national and EU environmental objectives.

Policies promoting green finance, renewable energy projects, and sustainable development are creating new avenues for Bank of Cyprus. This aligns with broader European Union directives and national strategies aimed at fostering a more sustainable economy. As a result, Cypriot banks, including Bank of Cyprus, are actively implementing Environmental, Social, and Governance (ESG) criteria in their lending decisions, reflecting this significant shift in the market and regulatory environment.

- Renewable Energy Targets: Cyprus aims to significantly increase the share of renewable energy sources in its energy mix, creating demand for project financing.

- EU Green Deal Alignment: National policies are increasingly aligned with the EU Green Deal, promoting sustainable investments and green financial products.

- ESG Integration: Banks are embedding ESG factors into their risk management and lending frameworks, with a growing focus on green loan portfolios.

Political stability in Cyprus is a bedrock for Bank of Cyprus, with the government's commitment to fiscal discipline and regulatory consistency fostering a predictable environment. This stability is underscored by Cyprus's strong fiscal position, evidenced by decreasing government debt and projected surpluses, which bolsters investor confidence.

As an EU and Eurozone member, Bank of Cyprus operates under the stringent oversight of the European Central Bank (ECB) and EU banking directives. The ECB's monetary policy, including its key interest rates which stood at 4.50% in June 2024, directly influences the bank's lending margins and funding costs.

Geopolitical volatility in the Middle East poses a risk due to Cyprus's proximity, potentially disrupting capital flows and impacting sectors like tourism, which affects loan portfolios. The Central Bank of Cyprus has flagged escalating geopolitical instability as a key concern, necessitating enhanced monitoring within the financial sector.

The political emphasis on a robust regulatory framework, including strict adherence to anti-money laundering (AML) and counter-terrorist financing (CFT) norms, is vital for Bank of Cyprus. Ongoing ECB prudential supervision, including stress tests and capital adequacy assessments, reinforces this framework and the bank's international credibility.

What is included in the product

This PESTLE analysis provides a comprehensive overview of how political, economic, social, technological, environmental, and legal factors impact Bank of Cyprus Holdings.

It offers forward-looking insights to support strategic decision-making and identify potential threats and opportunities.

This PESTLE analysis for Bank of Cyprus Holdings provides a clear, summarized version of external factors, acting as a pain point reliever by simplifying complex market dynamics for easier referencing during meetings and presentations.

Economic factors

Cyprus's economic growth is a key driver for Bank of Cyprus. A strong GDP translates to more business for the bank, with higher demand for loans and better quality assets. The outlook for Cyprus remains positive, with GDP growth anticipated to be around 3% in 2025. This growth is primarily fueled by solid private consumption and increased investment, creating a favorable environment for the banking sector.

The interest rate environment, heavily influenced by the European Central Bank (ECB), directly impacts Bank of Cyprus's net interest income (NII) and overall profitability. Fluctuations in these rates can either bolster NII through higher lending margins or compress them when rates fall.

For instance, Bank of Cyprus's Q1 2025 financial results indicated a dip in net interest income. This was attributed to factors such as the revaluation of liquid assets and a prevailing environment of lower interest rates, which reduced the income generated from its loan portfolio.

Inflation significantly shapes consumer behavior and business decisions. As inflation moderates, it generally fosters a more stable economic environment, benefiting entities like Bank of Cyprus Holdings.

However, persistent or unpredictable inflation can diminish the real value of money, affecting how much consumers can buy and potentially impacting borrowers' ability to repay loans. This also influences the bank's deposit growth and the real return on its assets.

Projections suggest inflation in Cyprus is on a downward trend, with an anticipated stabilization around the 2% mark by 2026, which is generally considered a healthy rate for economic stability.

Unemployment and Labor Market Conditions

Low unemployment rates and a strong labor market typically translate to higher household incomes and reduced credit risk for banks. This scenario is favorable for Bank of Cyprus, as it can lead to better loan performance and a boost in consumer confidence, encouraging more borrowing and spending.

The Cypriot labor market has shown resilience. Projections indicate that unemployment is set to fall below 6% by 2025. This anticipated decline represents a significant improvement, potentially reaching the lowest unemployment figures seen in Cyprus for over a decade.

- Unemployment Rate Projection: Expected to fall below 6% by 2025.

- Labor Market Strength: Indicative of higher household disposable income.

- Credit Risk Reduction: Lower unemployment generally means fewer loan defaults.

- Consumer Confidence: A strong labor market often correlates with increased consumer spending.

Real Estate Market Trends

The real estate market's condition is paramount for Bank of Cyprus, largely due to its significant involvement in mortgage lending and its holdings of property-backed assets. Changes in property values and the pace of construction directly influence the bank's loan portfolio's health and the worth of its collateral.

Furthermore, Bank of Cyprus actively manages and divests properties it has acquired as a result of debt settlements, underscoring the direct impact of real estate market dynamics on its operations.

For instance, in Cyprus, the residential property price index saw a notable increase of 4.8% in the fourth quarter of 2024 compared to the same period in 2023, according to the Statistical Service of Cyprus. This trend suggests a generally positive environment for mortgage lending, though careful monitoring of specific regional performance remains essential for the bank.

- Mortgage Lending Exposure: Bank of Cyprus's profitability is tied to the volume and quality of its mortgage book, which is directly affected by property market activity.

- Collateral Valuation: Fluctuations in real estate values impact the security underlying the bank's loans, influencing risk management strategies.

- Non-Performing Loans (NPLs): A downturn in the property market can lead to an increase in NPLs as borrowers struggle to meet mortgage obligations, potentially increasing the bank's need to manage acquired properties.

- Property Management & Disposal: The bank's ability to recover value from properties taken in lieu of debt depends heavily on market conditions and buyer demand.

Cyprus's economic growth is a key driver for Bank of Cyprus, with GDP growth projected around 3% in 2025, fueled by consumption and investment.

Interest rates, set by the ECB, directly affect the bank's net interest income; for example, Q1 2025 saw a dip attributed to lower rates.

Inflation is trending downwards, expected to stabilize around 2% by 2026, creating a more predictable economic climate.

The labor market remains strong, with unemployment anticipated to fall below 6% by 2025, bolstering household incomes and reducing credit risk.

| Economic Factor | 2025 Projection/Data | Impact on Bank of Cyprus |

|---|---|---|

| GDP Growth | ~3% | Increased demand for loans, improved asset quality |

| Inflation Rate | Stabilizing around 2% (by 2026) | More stable economic environment, better real returns |

| Unemployment Rate | Below 6% | Reduced credit risk, higher consumer confidence |

What You See Is What You Get

Bank of Cyprus Holdings PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Bank of Cyprus Holdings delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations. Understand the critical external forces shaping the bank's strategic landscape.

Sociological factors

Cyprus's demographic landscape is shifting, with an aging population and changing household structures directly impacting banking needs. As the proportion of older citizens grows, there's an increased demand for retirement planning, wealth management, and specialized loan products. For instance, by 2023, the percentage of individuals aged 65 and over in Cyprus reached approximately 18.5%, a trend that necessitates Bank of Cyprus adapting its service portfolio.

Migration patterns, including the influx of foreign workers, also present both challenges and opportunities for Bank of Cyprus. These new residents require accessible banking solutions for daily transactions, remittances, and potentially mortgages, influencing the bank's product development and customer service strategies. The need for multilingual support and digital onboarding processes becomes paramount to effectively serve this diverse customer base.

Consumers increasingly favor digital banking, with Bank of Cyprus seeing a substantial uptick in mobile app usage. This shift demands ongoing investment in robust technological infrastructure to support these evolving preferences.

The bank's digital transaction ratio and the growing number of active mobile app users underscore this pronounced trend. For instance, in the first half of 2024, digital channels accounted for a significant majority of transactions, reflecting a clear move away from traditional branch services.

The prevailing level of financial literacy in Cyprus directly influences how readily individuals engage with sophisticated financial instruments and investment opportunities. For Bank of Cyprus, this means that a higher general understanding of financial concepts can translate into increased demand for their advisory and wealth management services. Recent surveys indicate a growing emphasis on financial education, with initiatives aimed at improving this across the population.

Enhancing financial inclusion is a strategic imperative for Bank of Cyprus, as it broadens access to banking services for underserved segments of the population. This not only expands the bank's potential customer base but also contributes to a more robust and equitable economic landscape in Cyprus, fostering long-term growth and stability.

Social Attitudes Towards Debt and Saving

Societal attitudes toward debt and saving significantly shape the banking landscape. In Cyprus, there's a noticeable trend towards increased financial prudence, particularly following past economic challenges. This shift influences consumer behavior, impacting the demand for both credit and savings products offered by institutions like Bank of Cyprus Holdings.

Cultural norms around borrowing and investment play a crucial role. While some segments of society may be more inclined to leverage debt for consumption or investment, others prioritize saving and wealth accumulation. Understanding these evolving attitudes is key for banks to tailor their product offerings and risk management strategies effectively.

- Evolving Attitudes: Post-2013 financial crisis, Cypriot households demonstrated a heightened awareness of debt management, with a greater emphasis on savings.

- Deposit Growth: As of early 2024, total deposits in the Cypriot banking sector have shown steady growth, reflecting a cultural inclination towards saving.

- Credit Demand: While cautious, demand for credit, especially for productive investments and housing, remains present, influenced by economic confidence and interest rate environments.

Workforce Dynamics and Employee Expectations

Changing workforce expectations significantly shape how Bank of Cyprus manages its people. There's a growing demand for flexible work options, like remote or hybrid models, and a strong emphasis on achieving a healthy work-life balance. Employees also increasingly prioritize opportunities for professional development and career advancement.

To attract and keep skilled professionals in the competitive financial industry, Bank of Cyprus must adapt its human resource strategies. This includes offering competitive compensation, robust training programs, and fostering a supportive work environment that values employee well-being and growth.

- Increased demand for hybrid/remote work arrangements: A 2024 survey indicated that over 70% of financial sector employees prefer hybrid work models.

- Focus on work-life balance: Employee surveys from late 2023 and early 2024 show a significant rise in the importance placed on work-life integration.

- Emphasis on professional development: In 2024, companies investing in employee upskilling saw a 15% higher retention rate.

- Talent acquisition challenges: The European banking sector faces ongoing challenges in attracting tech-savvy talent, requiring banks to offer attractive benefits beyond traditional salaries.

Societal attitudes towards financial prudence and debt are evolving in Cyprus, with a noticeable trend towards increased savings and cautious borrowing following past economic challenges. This shift directly influences consumer demand for various banking products, impacting the strategies of institutions like Bank of Cyprus Holdings.

Technological factors

Bank of Cyprus Holdings is heavily invested in digital transformation to boost efficiency and cut costs. This strategic focus includes creating new digital offerings and refining existing processes through advanced technologies. By March 2025, the bank reported a remarkable 96.6% of its transactions were conducted digitally, underscoring its successful adoption of new platforms.

The bank's commitment to innovation is evident in its development of digital lending solutions. This allows for faster, more convenient access to credit for customers, further solidifying its competitive edge in the evolving financial landscape.

As banking operations increasingly move online, strong cybersecurity and data protection are essential for Bank of Cyprus to protect customer data and maintain confidence. The growing threat of cyberattacks means significant investment in advanced security systems is crucial. For instance, the EU's Digital Operational Resilience Act (DORA), which came into full effect in January 2025, mandates stringent ICT risk management frameworks for financial entities, including banks, highlighting the critical need for robust defenses.

The burgeoning fintech sector presents a dual challenge and opportunity for Bank of Cyprus. Companies leveraging mobile payments, blockchain, and AI are reshaping customer expectations and operational efficiency. For instance, by the end of 2024, global fintech investment was projected to reach over $150 billion, highlighting the rapid innovation and competitive pressure banks face.

To stay ahead, Bank of Cyprus needs to actively track these technological advancements. Integrating solutions like AI-powered customer service or secure blockchain-based transactions could enhance its service delivery and operational resilience. This proactive approach is crucial as fintech adoption continues to accelerate, with projections indicating that by 2025, over 80% of banking customers will interact with their bank primarily through digital channels.

Artificial Intelligence and Machine Learning Adoption

The Bank of Cyprus is increasingly leveraging Artificial Intelligence (AI) and Machine Learning (ML) to sharpen its competitive edge. These technologies are instrumental in refining critical banking operations, from bolstering fraud detection systems to more accurately assessing credit risk. For instance, AI-powered tools can analyze vast datasets in real-time, identifying suspicious transaction patterns far more effectively than traditional methods. This proactive approach not only safeguards customer assets but also minimizes financial losses for the bank.

Investing in AI and ML is directly translating into tangible operational efficiencies and enhanced decision-making capabilities for Bank of Cyprus. By automating routine tasks, such as data entry and customer query handling through chatbots, the bank frees up human resources for more complex, value-added activities. Furthermore, ML algorithms provide deeper insights into customer behavior and market trends, enabling more informed strategic planning and product development. This technological integration is a key driver for improved profitability and customer satisfaction.

The impact of AI and ML adoption is evident across several key banking functions:

- Fraud Detection: AI models have demonstrated a significant reduction in false positives and an increase in the detection rate of fraudulent transactions, contributing to enhanced security.

- Credit Risk Assessment: ML algorithms are improving the accuracy of credit scoring models, leading to better loan portfolio management and reduced default rates.

- Customer Service: AI-driven chatbots and personalized recommendation engines are enhancing customer engagement and streamlining service delivery, with many banks reporting higher customer satisfaction scores.

- Operational Automation: The implementation of robotic process automation (RPA) powered by AI is reducing manual intervention in back-office processes, leading to cost savings and faster turnaround times.

Cloud Computing and IT Infrastructure

Bank of Cyprus is actively leveraging cloud computing to boost its IT infrastructure, aiming for greater scalability and cost efficiency. This modernization is crucial for enhancing operational agility and speeding up the delivery of digital services to customers. For instance, in 2024, many financial institutions, including those in Cyprus, reported significant cost savings, often in the range of 15-30%, by migrating core banking functions to the cloud.

Strategic alliances with leading IT infrastructure providers are a key part of this transformation. These partnerships are designed to optimize the bank's systems and accelerate the rollout of new digital offerings. By embracing these advanced technologies, Bank of Cyprus is positioning itself to better adapt to evolving market demands and customer expectations in the digital age.

- Scalability & Cost Reduction: Cloud adoption allows for flexible scaling of IT resources, directly translating to reduced operational expenses.

- Enhanced Agility: Modernized infrastructure enables quicker deployment of new digital products and services.

- Strategic Partnerships: Collaborations with IT leaders ensure access to cutting-edge technology and expertise for system optimization.

- Digital Service Acceleration: The focus on cloud and infrastructure upgrades directly supports the bank's digital transformation goals.

Bank of Cyprus is aggressively pursuing digital transformation, with 96.6% of transactions digital by March 2025. This focus on technology, including AI for fraud detection and credit risk, alongside cloud adoption for scalability, is key to its strategy. The bank is also navigating the competitive fintech landscape, where global investment neared $150 billion in 2024, and adhering to regulations like DORA, effective January 2025.

Legal factors

Bank of Cyprus operates under the watchful eye of the European Central Bank (ECB) and the Central Bank of Cyprus (CBC), adhering to a robust regulatory framework. This includes strict capital adequacy rules, such as maintaining a high Common Equity Tier 1 (CET1) ratio, which for the Bank of Cyprus stood at a solid 15.6% as of the first quarter of 2024. These evolving regulations directly influence the bank's operational capacity and overall financial health.

Bank of Cyprus must rigorously comply with Anti-Money Laundering (AML) and Counter-Terrorist Financing (CFT) laws to safeguard its reputation and avoid substantial fines. These legal mandates necessitate strong internal control systems, the diligent reporting of suspicious activities, and thorough customer due diligence processes, all of which directly influence operational efficiency and increase compliance expenditures.

For instance, in 2023, the European Banking Authority reported that financial institutions across the EU faced significant investments in AML/CFT compliance, with many dedicating substantial budgets to technology and personnel to meet evolving regulatory demands.

Consumer protection laws significantly shape Bank of Cyprus's customer interactions. These regulations mandate transparency in financial products, fair lending, and robust complaint handling. For instance, the European Union's General Data Protection Regulation (GDPR) impacts how the bank manages customer data, requiring strict adherence to privacy principles and consent. Non-compliance can lead to substantial fines, as seen with GDPR violations across various sectors, underscoring the financial and reputational risks.

Data Protection Regulations (e.g., GDPR)

The General Data Protection Regulation (GDPR) and similar data privacy laws globally, including those enacted in Cyprus, profoundly shape Bank of Cyprus's operations. These regulations dictate how the bank must collect, store, and process sensitive customer information, necessitating robust data management and security protocols. Failure to adhere can result in substantial financial penalties and reputational damage, impacting customer trust and loyalty. For instance, under GDPR, breaches can lead to fines of up to 4% of annual global turnover or €20 million, whichever is higher. In 2024, ongoing scrutiny of data handling practices by regulators across the EU continues to emphasize the critical need for proactive compliance measures.

Bank of Cyprus must ensure its digital platforms and internal processes are fully compliant with evolving data protection standards. This involves continuous investment in cybersecurity infrastructure and employee training to safeguard customer data against breaches and unauthorized access. The bank's commitment to data privacy is not just a legal obligation but a strategic imperative for maintaining its competitive edge and customer relationships in an increasingly digital financial landscape.

- GDPR Fines: Potential penalties up to 4% of global annual turnover or €20 million.

- Customer Trust: Data protection is crucial for maintaining customer confidence and loyalty.

- Operational Impact: Regulations influence data collection, storage, and processing methods.

- Cybersecurity Investment: Ongoing need for robust security measures and employee training.

Digital Operational Resilience Act (DORA)

The EU's Digital Operational Resilience Act (DORA), taking effect in January 2025, will significantly impact Bank of Cyprus by mandating stricter management of information and communication technology (ICT) risks. This regulation requires financial entities to bolster their defenses against cyber threats and ICT disruptions, ensuring continued operations even when facing significant technical challenges. For Bank of Cyprus, this means a comprehensive review and upgrade of its ICT frameworks to meet these new EU-wide standards.

Compliance with DORA necessitates robust risk management processes, including thorough ICT third-party risk management and incident reporting. The European Banking Authority (EBA) has been actively developing regulatory technical standards (RTS) under DORA, with many expected to be finalized in 2024, providing detailed guidance for implementation. Bank of Cyprus will need to allocate resources to align its operations with these evolving requirements, potentially involving investments in new technologies and enhanced cybersecurity protocols to meet the 2025 deadline.

- DORA's January 2025 effective date sets a clear compliance timeline.

- The regulation targets enhanced management of ICT risks and operational resilience.

- Financial entities like Bank of Cyprus must adapt their ICT systems and processes.

- EBA's finalized RTS in 2024 will provide crucial implementation details.

Bank of Cyprus operates within a stringent legal and regulatory environment, heavily influenced by EU directives and national Cypriot law. Key legislation includes capital adequacy requirements, such as the Common Equity Tier 1 (CET1) ratio, which the bank maintained at 15.6% in Q1 2024, demonstrating a strong buffer against financial shocks.

The bank must also adhere to comprehensive Anti-Money Laundering (AML) and Counter-Terrorist Financing (CFT) regulations, necessitating robust internal controls and diligent reporting. Consumer protection laws, including GDPR, dictate data privacy practices, with non-compliance risking fines up to 4% of global annual turnover. Furthermore, the upcoming Digital Operational Resilience Act (DORA), effective January 2025, will mandate enhanced management of ICT risks and operational resilience, requiring significant investment in cybersecurity and system upgrades.

| Regulation | Effective Date/Status | Impact on Bank of Cyprus | Key Requirement |

|---|---|---|---|

| Capital Adequacy (CET1) | Ongoing (15.6% in Q1 2024) | Ensures financial stability and operational capacity. | Maintaining high capital ratios. |

| AML/CFT | Ongoing | Requires strict internal controls and reporting, increasing compliance costs. | Diligent customer due diligence and suspicious activity reporting. |

| GDPR | Effective 2018 | Dictates data handling, with potential fines up to 4% of global annual turnover. | Robust data management and security protocols. |

| DORA | January 2025 | Mandates enhanced ICT risk management and operational resilience. | Upgrading ICT frameworks and cybersecurity measures. |

Environmental factors

Bank of Cyprus Holdings, like all financial institutions, must navigate the dual threats of climate change. Physical risks, such as increased frequency of extreme weather events like heatwaves or floods, could directly impact the value of collateral held by the bank, potentially affecting loan portfolios. For instance, a severe drought in Cyprus could impact agricultural loans, a key sector for the island.

Transition risks are equally significant as the global economy shifts towards lower carbon emissions. This means that investments in carbon-intensive industries, such as fossil fuels, could become less valuable or even obsolete, creating ‘stranded assets’ on the bank’s balance sheet. As of late 2024, the European Central Bank has been emphasizing the need for banks to assess their exposure to these transition risks, with a focus on sectors like energy and transportation.

In response, Bank of Cyprus is actively incorporating climate-related risks into its overall risk management framework. This includes updating lending policies to better assess the climate resilience of borrowers and their assets, and considering the long-term environmental impact of its financing decisions. This proactive approach aims to safeguard the bank’s financial stability in an evolving regulatory and economic landscape.

Increasing regulatory pressure and stakeholder demand for Environmental, Social, and Governance (ESG) disclosures are compelling Bank of Cyprus to bolster its reporting and embed ESG criteria into its core business strategy. This aligns with a broader trend where financial institutions are increasingly scrutinized for their sustainability practices.

The bank actively publishes a Sustainability Report, demonstrating its commitment to transparency. For instance, its 2023 Sustainability Report highlighted a 15% reduction in its carbon footprint compared to 2022, showcasing tangible environmental progress.

Bank of Cyprus is also actively aligning with internationally recognized ESG frameworks, such as the Global Reporting Initiative (GRI) standards. This strategic alignment is crucial for meeting investor expectations and navigating the evolving landscape of sustainable finance, especially as ESG investments in Europe reached an estimated €7.4 trillion by the end of 2024.

Bank of Cyprus is capitalizing on the surge in green finance by expanding its sustainable lending offerings. This includes products like green mortgages and financing for renewable energy ventures, aligning with growing investor and customer demand for environmentally conscious financial solutions. The bank's commitment is underscored by its active promotion of green lending and its establishment of decarbonisation targets for its entire loan portfolio, demonstrating a strategic pivot towards sustainability.

Carbon Footprint and Operational Sustainability

Bank of Cyprus Holdings is actively pursuing carbon neutrality by 2030, focusing on reducing its operational carbon footprint. This commitment involves a strategic plan to decrease Scope 1 and 2 greenhouse gas emissions across its operations.

Key initiatives are underway to achieve these ambitious targets. The bank is increasing its reliance on renewable energy sources for its facilities and implementing energy efficiency measures within its buildings.

These efforts are crucial for operational sustainability and align with broader environmental, social, and governance (ESG) expectations. By 2023, the bank reported a 10% reduction in its Scope 1 and 2 emissions compared to its 2020 baseline, demonstrating tangible progress towards its 2030 goal.

- Carbon Neutrality Target: Aiming for carbon neutrality by 2030.

- Emission Reduction Focus: Targeting a decrease in Scope 1 and 2 GHG emissions.

- Key Initiatives: Increasing renewable energy usage and improving building energy efficiency.

- Progress Update: Achieved a 10% reduction in Scope 1 & 2 emissions by 2023 against a 2020 baseline.

Resource Scarcity and Environmental Stewardship

The Bank of Cyprus, like many financial institutions, is increasingly navigating the implications of resource scarcity, particularly concerning water and energy. This awareness directly shapes its operational strategies and its commitment to corporate social responsibility. For instance, in 2023, the bank continued its focus on reducing its carbon footprint, with a target to decrease energy consumption by 15% by 2025 compared to a 2020 baseline.

Promoting responsible consumption and effective waste management throughout its operations and supply chain are key components of the bank's sustainability agenda. These efforts are designed to align with broader environmental stewardship goals and contribute to a more resilient operational model.

Key initiatives include:

- Energy Efficiency Programs: Implementing upgrades to lighting and HVAC systems across its branches and offices to reduce energy usage.

- Waste Reduction Targets: Setting specific goals for reducing paper consumption and improving recycling rates within its facilities.

- Sustainable Procurement: Prioritizing suppliers who demonstrate strong environmental practices and commitment to resource management.

- Digital Transformation: Leveraging technology to reduce the need for physical resources and paper-based processes.

Environmental factors present both risks and opportunities for Bank of Cyprus Holdings. Physical risks from climate change, like extreme weather, could impact loan collateral, particularly in sectors like agriculture, a key part of Cyprus's economy. Transition risks arise from the shift to a low-carbon economy, potentially devaluing investments in carbon-intensive industries.

The bank is actively integrating ESG into its strategy, evidenced by its 2023 Sustainability Report showing a 15% carbon footprint reduction from 2022. By aligning with frameworks like GRI, the bank is meeting growing investor demand, as European ESG investments neared €7.4 trillion by the end of 2024.

Bank of Cyprus is expanding its green finance offerings, including green mortgages and renewable energy project financing, responding to market demand. Furthermore, the bank is committed to operational sustainability, aiming for carbon neutrality by 2030 and reporting a 10% reduction in Scope 1 and 2 emissions by 2023 against a 2020 baseline.

The bank's initiatives include energy efficiency programs, waste reduction targets, and sustainable procurement, all aimed at responsible resource management. These efforts support its broader environmental stewardship goals and contribute to a more resilient operational model.

| Environmental Factor | Impact on Bank of Cyprus | Key Initiatives/Progress |

|---|---|---|

| Climate Change (Physical Risks) | Potential impact on loan collateral value (e.g., agriculture) | Updating lending policies for climate resilience |

| Climate Change (Transition Risks) | Risk of 'stranded assets' from carbon-intensive investments | Assessing exposure to transition risks, focus on ECB guidance |

| ESG Reporting & Stakeholder Demand | Increased pressure for transparency and ESG integration | Published 2023 Sustainability Report (15% carbon footprint reduction), GRI alignment |

| Green Finance & Sustainable Lending | Opportunity to capitalize on growing demand for eco-friendly products | Expansion of green mortgages, financing for renewables, decarbonisation targets for loan portfolio |

| Operational Sustainability & Carbon Neutrality | Commitment to reducing operational footprint | Targeting carbon neutrality by 2030, 10% reduction in Scope 1 & 2 emissions by 2023 (vs. 2020 baseline) |

| Resource Scarcity & Responsible Consumption | Need for efficient operations and supply chain management | Energy efficiency programs, waste reduction targets, sustainable procurement |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Bank of Cyprus Holdings is grounded in data from official Cypriot government publications, European Union economic reports, and international financial institutions like the IMF and World Bank. We also incorporate insights from reputable industry analysis firms and financial news outlets.