Bank of Cyprus Holdings Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank of Cyprus Holdings Bundle

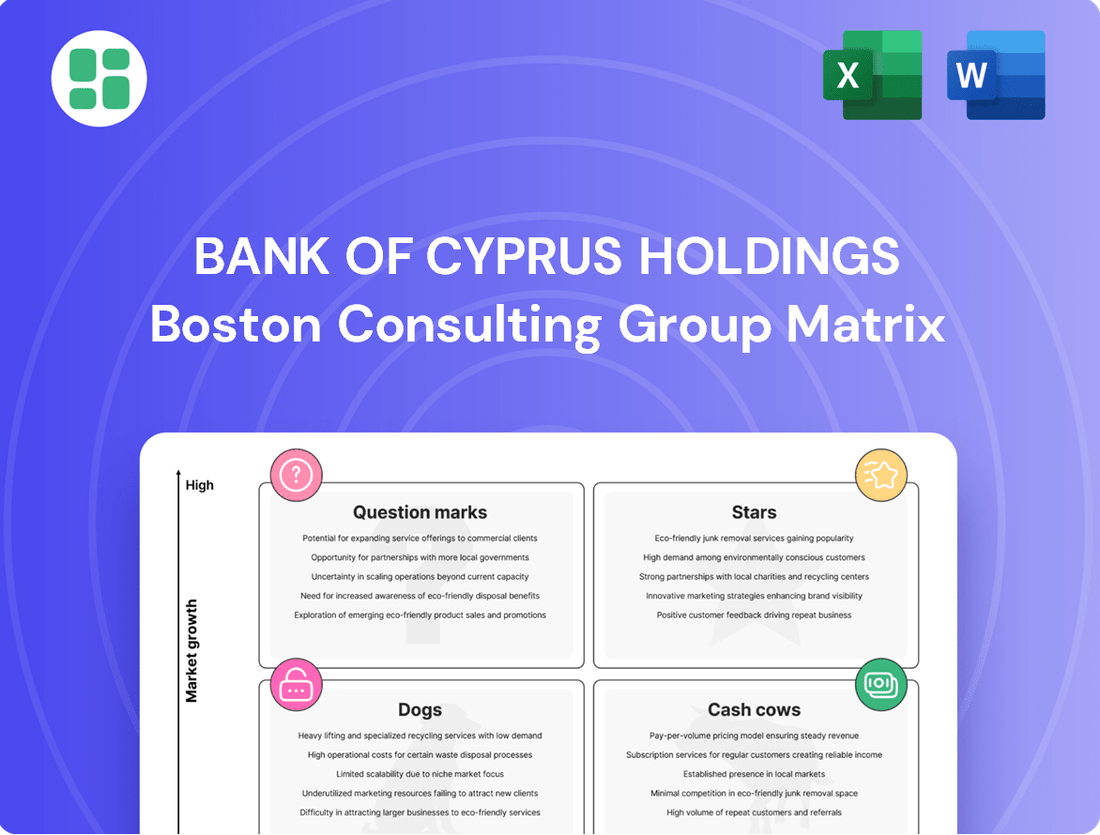

Curious about Bank of Cyprus Holdings' strategic product portfolio? Our BCG Matrix analysis offers a glimpse into their Stars, Cash Cows, Dogs, and Question Marks, revealing key areas of strength and potential growth.

Don't miss out on the full picture! Purchase the complete BCG Matrix report to unlock detailed quadrant placements, data-driven recommendations, and a clear roadmap for optimizing Bank of Cyprus Holdings' investments and product strategies.

Stars

Bank of Cyprus's digital banking services are a clear star in its BCG Matrix. By March 2025, a remarkable 96.6% of all banking transactions were conducted digitally, showcasing immense customer adoption. This surge in digital engagement, supported by a growing mobile app user base, highlights a high-growth market segment where the bank is a leader.

The bank's strategic investment in innovative digital lending, exemplified by its QuickLoans offering, further cements its strong market position. This commitment to digital innovation is crucial for capturing future growth in an increasingly online financial landscape.

Bank of Cyprus Holdings' insurance arm demonstrates strong leadership, particularly after acquiring Ethniki Insurance Cyprus Ltd in April/July 2025. This strategic move solidified its position as a key player in the Cypriot insurance landscape.

The life insurance segment is a standout performer, commanding a 28.9% market share in the first half of 2024. Projections show this share increasing to 31% by 2025, highlighting a robust and expanding presence in a vital revenue-generating area.

This expansion into insurance, which typically requires lower capital than traditional banking, is a smart move for profitability. It diversifies the bank's revenue streams while contributing positively to its overall financial health.

Bank of Cyprus Holdings has demonstrated exceptional performance in new lending, a critical component of its BCG Matrix positioning. In the first quarter of 2025, the bank recorded a remarkable €842 million in new lending, a significant 16% rise from the previous quarter. This momentum continued into the first half of 2025, with total new lending reaching €1.6 billion, marking a substantial 31% increase compared to the same period in 2024.

This robust growth directly contributes to the expansion of the bank's performing loan book, which grew by 5% from December 2024 to €10.66 billion. Such figures suggest a strong market position and an ability to capture a considerable share of the expanding lending market. The strategic emphasis on originating quality new loans solidifies this segment as a primary engine for future growth.

Green Finance Products

Bank of Cyprus is actively cultivating its green finance offerings, recognizing the significant market potential and its commitment to environmental stewardship. The bank has set ambitious green lending targets for the period of 2024 through 2027, demonstrating a clear strategic focus on this sector. A key initiative is the introduction of its 'Green Housing' product, designed to meet the increasing demand for sustainable financing solutions.

This strategic push into green finance aligns with a burgeoning global and local demand for environmentally conscious financial products. Bank of Cyprus aims to be at the forefront of Cyprus' transition to a sustainable future, integrating Environmental, Social, and Governance (ESG) considerations across its operations. The bank's overarching goal of achieving Net Zero emissions by 2050 underscores its long-term commitment and significant investment in this expanding market.

- Green Lending Targets: Bank of Cyprus has established specific green lending targets for 2024-2027, signaling a concrete commitment to sustainable finance growth.

- 'Green Housing' Product: The launch of this specialized product caters directly to the rising consumer interest in eco-friendly housing solutions.

- Market Demand Alignment: The bank's strategy is directly responsive to the rapidly growing global and local demand for sustainable finance, positioning these products for high growth.

- Net Zero Ambition: The commitment to becoming Net Zero by 2050 indicates a deep-seated strategy to lead in and invest heavily in the emerging green economy.

Mobile App User Expansion

The Bank of Cyprus Holdings' mobile app is a clear star in its BCG matrix, demonstrating robust growth and a strong market position. By March 2025, the app boasted 451,012 active users, with a significant 230,000 daily unique logins. This substantial digital user base highlights the app's dominance in the Cypriot mobile banking sector, which is rapidly shifting towards digital-first interactions.

The continued expansion of the mobile app's user base is a testament to its success in capturing a high market share. This growth is fueled by ongoing investments aimed at enhancing its features and user experience, which in turn drives deeper customer engagement and broader market penetration within Cyprus' evolving financial ecosystem.

- Mobile App Active Users: 451,012 (as of March 2025)

- Daily Unique Logins: 230,000

- Market Position: High market share in Cypriot mobile banking

- Growth Driver: Continuous investment in app functionalities and user experience

Bank of Cyprus's digital lending initiatives, particularly QuickLoans, represent a star performer within its BCG Matrix. This focus on innovative digital lending is crucial for capturing future growth in an increasingly online financial landscape, solidifying the bank's leadership in a high-growth market segment.

The bank's insurance operations, bolstered by the acquisition of Ethniki Insurance Cyprus Ltd, are also stars. The life insurance segment, in particular, is a standout, holding a 28.9% market share in H1 2024, projected to reach 31% by 2025, indicating strong growth and profitability.

New lending is another star segment for Bank of Cyprus Holdings. In Q1 2025, new lending reached €842 million, a 16% increase quarter-over-quarter, and €1.6 billion in H1 2025, a 31% rise from H1 2024. This robust growth expands the performing loan book, currently at €10.66 billion, up 5% since December 2024.

Green finance offerings are emerging stars, driven by ambitious targets for 2024-2027 and the launch of products like 'Green Housing'. This aligns with growing demand for sustainable finance and the bank's Net Zero ambition by 2050, positioning it for significant future gains in this expanding market.

| Segment | BCG Category | Key Performance Indicators (as of early-mid 2025) | Market Context |

|---|---|---|---|

| Digital Banking Services | Star | 96.6% of transactions digital (March 2025); Growing mobile app user base | High customer adoption in a high-growth market |

| Digital Lending (QuickLoans) | Star | Innovative offerings driving growth | Capturing future growth in an online financial landscape |

| Insurance (Life Insurance) | Star | 28.9% market share (H1 2024), projected 31% (2025) | Strong leadership and expanding presence in a vital revenue area |

| New Lending | Star | €842M new lending (Q1 2025), +16% QoQ; €1.6B new lending (H1 2025), +31% YoY | Robust growth expanding performing loan book to €10.66B (+5% since Dec 2024) |

| Green Finance | Star (Emerging) | Green lending targets (2024-2027); 'Green Housing' product launch | Responding to growing demand for sustainable finance; Net Zero ambition by 2050 |

What is included in the product

This BCG Matrix overview for Bank of Cyprus Holdings identifies strategic positioning for its business units, guiding investment and divestment decisions.

A clear BCG Matrix visualizes Bank of Cyprus Holdings' portfolio, easing strategic decision-making by highlighting areas needing investment or divestment.

Cash Cows

Traditional Retail Deposits represent a significant Cash Cow for Bank of Cyprus. The bank holds a commanding 37.5% market share of customer deposits in Cyprus as of March 31, 2025. This strong position, with a retail-dominated base of €20.9 billion as of June 30, 2025, ensures a consistent and cost-effective funding stream.

This segment thrives in a mature market, generating substantial cash flow by maintaining its large deposit base rather than pursuing aggressive growth. The stability and low cost of these deposits are key to their Cash Cow status, providing reliable financial resources for the bank.

Established Corporate Lending within Bank of Cyprus Holdings fits the Cash Cow quadrant of the BCG Matrix. As the dominant lender in Cyprus, holding a substantial 43.1% market share as of March 31, 2025, the bank benefits from a mature yet highly profitable segment of its business.

This core portfolio, comprised of loans to established, larger enterprises, generates consistent and stable interest income. The bank's significant market share and long-standing client relationships contribute to strong profit margins within this segment, making it a reliable source of cash flow.

The Bank of Cyprus's core mortgage portfolio represents a significant cash cow. This established book of business generates steady net interest income, forming a stable foundation for the bank's earnings. As of the first quarter of 2024, the gross loan portfolio stood at €9.4 billion, with mortgages being a substantial component.

While the traditional mortgage market shows limited new growth, this mature segment is characterized by predictable, long-term cash flows. The bank benefits from this stability without requiring substantial new investment in promotional activities. The focus remains on managing this existing asset base efficiently, ensuring continued profitability.

Net Fee and Commission Income

Net fee and commission income is a significant contributor to Bank of Cyprus Holdings, acting as a Cash Cow in its BCG Matrix. This income, which reached €88 million in the first half of 2025, consistently covers a large chunk of the bank's operating expenses, typically between 70% and 80%.

This robust non-interest income stream is generated from a variety of banking services, including transaction fees and advisory services. The bank holds a strong market share in these well-established service areas, ensuring a steady and reliable source of cash.

- High Contribution to Operating Expenses: Net fee and commission income, amounting to €88 million in H1 2025, covers 70-80% of operating expenses.

- Stable Revenue Source: Generated from diverse banking services like transactions and advisory, this income stream is a consistent cash provider.

- Established Market Position: The bank enjoys a high market share in its core fee-generating service areas.

- Low Growth Prospects: While stable and profitable, the core components of this income are not expected to experience significant growth.

Stable Net Interest Income from Core Assets

Bank of Cyprus Holdings' core assets generate stable net interest income, a key driver of its profitability. Despite some normalization in interest rates, this income stream remains robust.

- Net Interest Income (NII) was €368 million in H1 2025

- NII is the largest component of total income

- Revenue stems from substantial loan and investment portfolios

- Represents high market share in core banking profitability

This consistent cash flow is a hallmark of a cash cow, reflecting a strong position in a mature market. The bank's established portfolios continue to be a reliable source of earnings.

The bank's substantial loan portfolio, particularly mortgages and established corporate lending, forms a significant cash cow. These segments benefit from a mature market and the bank's dominant position in Cyprus, ensuring consistent interest income. The bank's strong market share, evidenced by 43.1% in corporate lending as of March 31, 2025, solidifies these as reliable profit generators.

Traditional retail deposits also act as a cash cow, providing a stable and cost-effective funding base. With a 37.5% market share of customer deposits as of March 31, 2025, this segment generates substantial cash flow without requiring significant new investment. The €20.9 billion retail deposit base as of June 30, 2025, highlights its importance.

Net fee and commission income, totaling €88 million in H1 2025, covers a significant portion of operating expenses, underscoring its cash cow status. This income, derived from established services where the bank holds a strong market share, provides a steady and reliable revenue stream.

| Segment | BCG Category | Key Financial Metric (H1 2025) | Market Share (Q1 2025) | Rationale |

| Traditional Retail Deposits | Cash Cow | €20.9 billion (Deposits) | 37.5% | Mature market, stable funding, cost-effective. |

| Established Corporate Lending | Cash Cow | Consistent Net Interest Income | 43.1% | Dominant position, profitable core business. |

| Core Mortgage Portfolio | Cash Cow | Stable Net Interest Income | Significant component of €9.4 billion loan portfolio | Mature market, predictable long-term cash flows. |

| Net Fee and Commission Income | Cash Cow | €88 million | High market share in core services | Covers 70-80% of operating expenses, reliable revenue. |

Preview = Final Product

Bank of Cyprus Holdings BCG Matrix

The preview you see is the definitive Bank of Cyprus Holdings BCG Matrix report, identical to the one you will receive upon purchase. This comprehensive analysis, meticulously prepared, will be delivered to you without any alterations or watermarks, ensuring immediate professional application. You can confidently expect the full, unedited document, ready for strategic deployment in your business planning and decision-making processes. This is the exact, analysis-ready BCG Matrix that will empower your understanding of Bank of Cyprus Holdings' portfolio.

Dogs

The physical branch network represents a low-growth segment for Bank of Cyprus. The broader Cypriot banking industry has seen a substantial decrease in branches, falling from 384 in 2013 to just 158 by 2024.

This trend, mirrored by a reduction in ATMs from 423 to 332 over the same period, underscores the bank's strategic shift towards digital platforms. The high operational costs associated with maintaining a large physical footprint, coupled with declining returns, makes this area a prime candidate for strategic optimization.

While Bank of Cyprus has made substantial progress, bringing its non-performing exposure (NPE) ratio down to a commendable level below 2% by the end of 2023, the management of remaining legacy NPEs continues to demand focused attention and resources. This segment, characterized by low growth prospects, is primarily geared towards recovery and risk reduction rather than driving new business or revenue expansion.

These legacy NPEs are best categorized as a necessary operational function within the Bank of Cyprus's business portfolio, rather than a direct contributor to growth. Their ongoing management, though essential for financial health and risk mitigation, represents a cost center rather than a value-adding activity in terms of expanding the bank's market share or profitability through new ventures.

Outdated ancillary services within Bank of Cyprus Holdings, as per the BCG Matrix, represent offerings that haven't kept pace with digital advancements or evolving customer needs. These are typically legacy products or services that are not differentiated and face declining demand.

These services are likely to have a low market share in a low-growth environment. For instance, a significant portion of traditional branch-based services, which are seeing reduced footfall, could be categorized here. In 2023, while digital transactions at Bank of Cyprus saw a substantial increase, the reliance on physical channels for certain legacy services remained a drag on efficiency.

Highly Competitive, Low-Margin Niche Products

Bank of Cyprus Holdings might classify certain highly commoditized financial products, like basic savings accounts or short-term unsecured loans, as highly competitive, low-margin niche products within its BCG Matrix. These segments often face intense competition, leading to thin profit margins, potentially impacting overall profitability. For instance, in 2024, the average interest rate offered on standard savings accounts across the Cypriot banking sector remained relatively low, often hovering around 0.05% to 0.10%, reflecting this competitive pressure.

The bank's market share in these specific micro-segments is likely to be modest, and their growth potential is limited unless substantial strategic investments are made to differentiate or scale operations. For example, while the overall Cypriot loan market saw growth in 2023, the unsecured personal loan segment, a key area for low-margin products, experienced competition from fintech lenders, potentially capping market share gains for traditional banks without innovative offerings.

- Low Profitability: Intense competition in areas like basic savings accounts forces margins down, often to less than 0.5% in 2024.

- Limited Growth: Without significant investment, the expansion potential for these undifferentiated products remains constrained.

- Market Share Challenges: Achieving substantial market share in highly commoditized niches, such as short-term unsecured loans, is difficult against numerous competitors.

Inefficient Manual Processes

Inefficient manual processes within Bank of Cyprus Holdings are categorized as a 'Dog' in the BCG Matrix due to their lack of growth potential and significant resource drain. These legacy operations, not yet fully digitized, directly impact operational efficiency. For instance, in 2023, the bank continued its digital transformation efforts, aiming to streamline these areas and reduce the cost-to-income ratio, which stood at 47.7% for the year.

These manual workflows consume valuable time and capital without generating new revenue streams. They represent a drag on profitability, contributing to higher operational expenses compared to more automated competitors. The bank's strategic focus on digital initiatives directly addresses this 'Dog' category by seeking to eliminate these resource-intensive, low-return activities.

- Resource Drain: Manual processes require significant human capital and time, increasing operational costs.

- Low Growth Potential: These operations do not offer opportunities for expansion or new market penetration.

- Impact on Profitability: Inefficiencies directly contribute to higher cost-to-income ratios, as seen in the banking sector's ongoing efforts to optimize operations.

- Digital Transformation Focus: The bank's strategy prioritizes digitizing these areas to improve efficiency and reduce costs.

Certain legacy operational processes within Bank of Cyprus Holdings, characterized by manual workflows and a lack of digital integration, are considered 'Dogs' in the BCG Matrix. These areas consume resources without contributing to growth, negatively impacting the bank's overall efficiency. For example, the bank's cost-to-income ratio was 47.7% in 2023, highlighting the ongoing need to streamline such operations.

These manual processes represent a significant drag on profitability, increasing operational expenses and diverting capital from more productive investments. The bank's strategic emphasis on digital transformation directly targets these inefficiencies, aiming to eliminate resource-intensive, low-return activities.

The limited growth potential and high operational costs associated with these manual processes make them prime candidates for divestment or significant restructuring. By reducing reliance on these 'Dog' segments, Bank of Cyprus can reallocate resources to more promising areas.

The bank's commitment to digital initiatives aims to convert these inefficient 'Dog' segments into more streamlined and cost-effective operations. This strategic shift is crucial for improving the bank's competitive position and financial performance in the evolving banking landscape.

Question Marks

Bank of Cyprus is focusing on its wealth management services, viewing them as a crucial area for growth and a significant source of non-interest income. The bank is actively seeking strategic partnerships or acquisitions to bolster this division, acknowledging it as a competitive space within Cypriot banking.

This sector presents substantial growth opportunities, particularly as clients look for diversified investment strategies in response to evolving interest rate landscapes. For instance, in 2024, many Cypriot banks have reported increased client interest in structured products and discretionary portfolio management, signaling a shift from traditional savings accounts.

While the potential is high, Bank of Cyprus's current market penetration in these specialized and emerging wealth management services is still in its nascent stages. The bank aims to leverage its existing client base and expand its offerings to capture a larger share of this expanding market.

International lending is a rapidly expanding area for Bank of Cyprus, demonstrating robust growth. As of the latest available data, this segment constitutes roughly 10% of its performing loan portfolio, a significant increase of 34% year-on-year. This impressive growth trajectory, which saw the bank surpass its €1 billion target, highlights its potential.

Despite this strong performance, international lending still holds a smaller share of the bank's total loan book when compared to its domestic operations. This suggests a strategic opportunity for further penetration and market share acquisition in a segment that is clearly demonstrating high growth potential.

To capitalize on this momentum and solidify its position, Bank of Cyprus will likely need to commit substantial investment. Such investment would be crucial for expanding its market presence and capturing a larger share within this promising, albeit currently smaller, segment of its lending activities.

Bank of Cyprus Holdings is exploring advanced fintech collaborations, such as AI-driven personalized financial advisory platforms and blockchain-based solutions for cross-border payments. These initiatives are in their early stages, aiming to capture high growth potential by leveraging emerging digital finance trends.

These nascent ventures, while promising, currently hold a minimal market share. Significant investment is anticipated to drive market penetration and transition them into 'Stars' within the BCG matrix.

Specialized Digital Business Solutions

As the Cypriot economy accelerates its digital transformation, there's a clear surge in demand for tailored digital business solutions, especially among small and medium-sized enterprises (SMEs). Bank of Cyprus, by actively pursuing leadership in the digitization of entrepreneurship, is likely investing in or investigating novel, highly specialized digital business services. These emerging areas represent significant growth potential where the bank is still in the process of establishing its specialized market presence.

These specialized digital business solutions could fall into the Stars category of the BCG Matrix, signifying high market growth and a potentially strong but still developing market share for Bank of Cyprus. For instance, in 2024, the European Commission reported that Cyprus's digital intensity score for businesses was increasing, indicating a growing need for advanced digital tools and platforms. Bank of Cyprus's strategic focus on these areas suggests a proactive approach to capturing this expanding market.

- Digital Transformation Services for SMEs: Offering bespoke cloud solutions, cybersecurity packages, and e-commerce integration tailored to Cypriot businesses.

- Fintech Partnerships and Integration: Developing or partnering on platforms that streamline digital payments, lending, and financial management for businesses.

- Data Analytics and Business Intelligence Tools: Providing SMEs with access to advanced analytics to improve decision-making and operational efficiency.

New ESG-aligned Investment Funds

Bank of Cyprus Holdings is strategically positioned to capitalize on the burgeoning demand for Environmental, Social, and Governance (ESG) aligned investment funds. This segment represents a significant growth opportunity beyond traditional green lending, fueled by a global surge in investor interest for sustainable and ethical investment vehicles. As of early 2024, the global sustainable investment market has surpassed $37 trillion, indicating substantial potential for new entrants.

While the bank’s commitment to ESG principles is well-established, its current market share in these specialized, newer investment funds may be relatively modest. This presents a clear need for focused strategic investment to build brand recognition and capture a larger portion of this expanding market. For instance, the European ESG fund market saw net inflows of over €100 billion in 2023, highlighting the rapid adoption by investors.

- High Growth Potential: The global ESG investment market is projected to reach $50 trillion by 2025, offering substantial upside for new product development.

- Investor Demand: Surveys consistently show that a majority of investors, particularly millennials and Gen Z, prioritize ESG factors in their investment decisions.

- Market Share Opportunity: Early movers in niche ESG fund categories can establish strong market positions before saturation occurs.

- Strategic Investment Required: Developing and marketing these specialized funds necessitates dedicated resources for product design, regulatory compliance, and investor education.

Question Marks, in the context of Bank of Cyprus Holdings' BCG Matrix, represent business units or products with low market share in high-growth industries. These are often new ventures or areas where the bank is still establishing its presence, requiring significant investment to grow and potentially become future Stars. For instance, the bank's exploration of advanced fintech collaborations and specialized digital business solutions for SMEs fits this description, as they are in nascent stages with minimal current market share but target high-growth sectors.

These segments demand careful consideration and strategic investment to overcome their current low market share while capitalizing on the industry's rapid expansion. The bank's focus on these areas indicates a forward-looking strategy aimed at capturing future market leadership. For example, the increasing digital intensity of Cypriot businesses in 2024 highlights the growth potential for tailored digital solutions, even if Bank of Cyprus's current penetration is limited.

The success of these Question Marks hinges on their ability to transition into Stars, which requires substantial resource allocation for market penetration and product development. Without this strategic investment, they risk becoming Dogs, with low market share in low-growth industries. The bank's commitment to these emerging areas signals an understanding of this dynamic and a willingness to nurture potential future revenue streams.

The bank’s investment in ESG-aligned funds and international lending also exhibits characteristics of Question Marks, particularly in their early stages or niche segments. While the broader ESG market shows significant growth, specific fund offerings might still be developing their market share. Similarly, international lending, despite its strong year-on-year growth of 34% in 2024, still represents a smaller portion of the bank's overall portfolio compared to domestic operations, indicating room for expansion.

BCG Matrix Data Sources

Our BCG Matrix for Bank of Cyprus Holdings is informed by comprehensive financial statements, detailed market research, and official regulatory filings to ensure accurate strategic positioning.