Bank of America PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank of America Bundle

Uncover the intricate web of political, economic, social, technological, legal, and environmental factors influencing Bank of America's strategic direction. This comprehensive PESTLE analysis provides actionable intelligence to anticipate market shifts and capitalize on emerging opportunities. Download the full report to gain a critical competitive advantage.

Political factors

Bank of America's operations are heavily shaped by government regulations concerning financial stability, consumer protection, and anti-money laundering efforts. For instance, the Dodd-Frank Act continues to influence capital requirements and risk management practices for large financial institutions like Bank of America.

Anticipated policy shifts, such as potential adjustments to trade agreements or increased oversight of major banks, directly affect Bank of America's operational strategies and the associated compliance expenses. The bank's 2023 annual report detailed significant investments in compliance and risk management infrastructure to navigate these evolving requirements.

The political climate, including election results and legislative agendas in key markets such as the United States, directly shapes the regulatory landscape. For example, changes in monetary policy, such as interest rate adjustments by the Federal Reserve, have a profound impact on Bank of America's net interest income, which was a significant contributor to its earnings in early 2024.

Escalating geopolitical tensions, including the ongoing Russia-Ukraine conflict and persistent U.S.-China relations, cast a long shadow of economic uncertainty globally. These situations can significantly disrupt international trade and the stability of financial markets, impacting institutions like Bank of America.

Bank of America's extensive global operations mean it's directly exposed to these risks. This exposure can manifest as disruptions to cross-border transactions, fluctuations in investment flows, and a general impact on the financial health of its international clientele.

Navigating a landscape of potential sanctions, evolving trade barriers, and shifting global alliances is crucial for the bank. These geopolitical shifts directly influence the performance and strategies within its global banking and markets segments, requiring constant adaptation.

For instance, the International Monetary Fund (IMF) projected in early 2024 that global growth would remain subdued, partly due to these geopolitical fragilities. This economic climate directly affects Bank of America's revenue streams from international operations and its ability to manage risk across diverse markets.

Bank of America's operations are significantly impacted by political stability in its key markets, such as the United States and the United Kingdom. In 2023, the US experienced a relatively stable political environment, which supported investor confidence. However, upcoming elections in 2024 could introduce some uncertainty.

Strong governance frameworks, like those in the US and UK, are crucial for financial institutions. These ensure a predictable legal and regulatory landscape, which is vital for managing assets and expanding services. Conversely, political instability, as seen in some emerging markets where the bank may have exposure, can trigger capital flight and currency depreciation, increasing operational risks and impacting profitability.

Lobbying and Public Policy Engagement

Bank of America actively participates in shaping financial regulation and economic policy through robust lobbying efforts. In 2023, the bank reported significant federal lobbying expenditures, reflecting its commitment to influencing legislative outcomes. This engagement is crucial for navigating the complex regulatory landscape and ensuring policies align with its strategic objectives.

The bank's public policy engagement extends to active membership in prominent financial industry trade associations. These memberships provide a platform to collectively advocate for industry interests and contribute to policy discussions. For instance, Bank of America is a member of organizations that focus on advocating for sound economic policies and regulatory frameworks beneficial to the financial sector.

- Federal Lobbying Expenditures: Bank of America consistently invests millions in federal lobbying annually, with reported figures often exceeding $5 million in recent years, demonstrating a substantial commitment to policy engagement.

- Trade Association Memberships: The bank maintains active participation in key financial industry groups, allowing it to amplify its voice on critical legislative and regulatory matters affecting the banking sector.

- Policy Influence: This proactive engagement aims to foster a regulatory environment that supports innovation, economic growth, and the bank's business model, while also mitigating potential adverse impacts from new legislation.

- Economic Policy Advocacy: Bank of America's lobbying efforts often center on advocating for policies that promote financial stability, capital markets development, and consumer protection, reflecting a broad interest in the overall economic health.

Government Scrutiny and 'Debanking' Concerns

Political scrutiny on large financial institutions, including Bank of America, is intensifying, particularly concerning practices like 'debanking.' This involves allegations of accounts being closed based on political or religious affiliations, a trend that has drawn significant attention from lawmakers and regulators.

Such scrutiny can translate into tangible risks for Bank of America. Investigations by government bodies could result in substantial fines, and negative publicity surrounding these practices can severely damage the bank's reputation. For instance, in early 2024, reports indicated that some U.S. banks were reviewing their policies in response to congressional inquiries about account closures. The potential for reputational damage is significant, as consumer trust is paramount in the banking sector.

To navigate these challenges, Bank of America must prioritize transparency and fairness in its account management policies. Ensuring that decisions regarding account closures are based on objective, non-discriminatory criteria is crucial. This proactive approach can help mitigate the risk of political backlash and costly legal battles, safeguarding the bank's operational stability and market standing.

- Increased Congressional Oversight: Lawmakers are actively investigating financial institutions for alleged discriminatory account closure practices.

- Reputational Risk: 'Debanking' allegations can lead to significant public backlash and erosion of customer trust.

- Potential Fines and Legal Challenges: Non-compliance with anti-discrimination laws can result in substantial financial penalties and litigation.

- Policy Review Necessity: Banks like Bank of America must ensure their account policies are demonstrably transparent and non-discriminatory to avoid regulatory action.

Political stability in key operating regions directly impacts Bank of America's strategic planning and risk assessment. For example, the U.S. political landscape in 2023 provided a relatively stable environment, bolstering investor confidence. However, the upcoming 2024 elections introduce a degree of uncertainty that the bank must actively monitor.

Government regulations remain a cornerstone of Bank of America's operational framework, influencing capital requirements and risk management practices, as reinforced by ongoing adherence to post-2008 financial crisis legislation. Anticipated policy shifts, whether concerning trade or banking oversight, necessitate continuous investment in compliance infrastructure, as evidenced by the bank's 2023 financial disclosures detailing substantial expenditures in this area.

Geopolitical tensions, such as those stemming from the Russia-Ukraine conflict and U.S.-China relations, create economic uncertainties that can disrupt global trade and financial markets, directly affecting Bank of America's international operations and revenue streams. The IMF's early 2024 projection of subdued global growth, partly due to these fragilities, underscores the impact on the bank's cross-border transactions and clientele.

| Factor | Impact on Bank of America | 2023/2024 Data/Context |

|---|---|---|

| Regulatory Environment | Shapes capital requirements, risk management, and compliance costs. | Continued adherence to Dodd-Frank Act provisions; significant compliance investments in 2023. |

| Political Stability | Influences investor confidence and operational predictability. | US political stability in 2023 supported confidence; 2024 elections introduce potential uncertainty. |

| Geopolitical Tensions | Disrupts international trade, financial markets, and global growth. | IMF projected subdued global growth in early 2024 due to geopolitical fragilities. |

| Lobbying Efforts | Aims to influence legislative outcomes and regulatory frameworks. | Reported federal lobbying expenditures often exceeding $5 million annually in recent years. |

What is included in the product

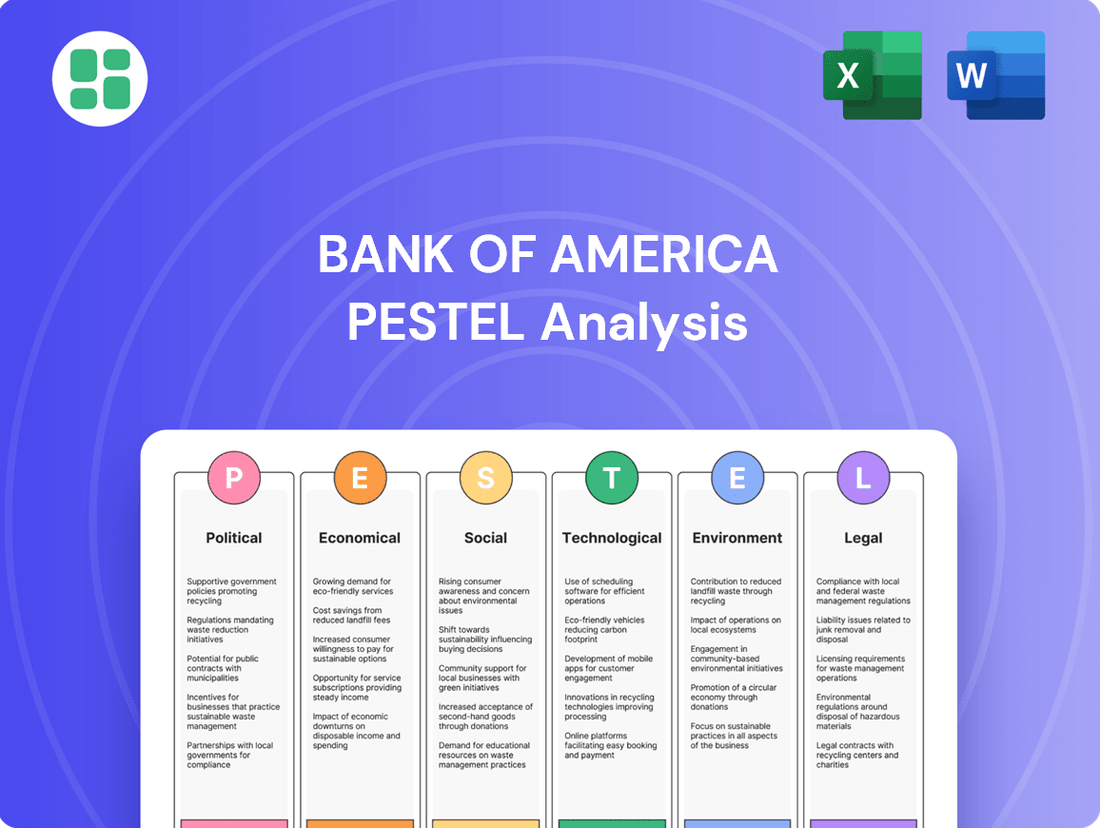

This PESTLE analysis examines the external macro-environmental factors impacting Bank of America, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Provides a concise version of the Bank of America PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors for strategic discussions.

Economic factors

Changes in interest rates by central banks, like the Federal Reserve, directly influence Bank of America's net interest income (NII), a key revenue driver. For instance, the Fed's aggressive rate hikes throughout 2022 and 2023 significantly boosted NII for large banks.

Higher rates generally allow banks to earn more on loans compared to the interest paid on deposits, widening lending margins. Bank of America's NII saw substantial growth during this period, reflecting this dynamic.

Conversely, a shift towards lower interest rates, as might be anticipated in late 2024 or 2025 depending on inflation trends, could compress these margins, impacting profitability. The bank's financial performance remains closely tied to the broader monetary policy landscape and the prevailing interest rate environment.

Inflationary pressures directly influence Bank of America's operations by impacting consumer spending and business investment. For instance, persistent inflation in 2024, hovering around 3-4% in many developed economies, can reduce the real value of savings and increase the cost of goods and services, potentially dampening loan demand.

While moderate inflation, typically between 2-3%, can signal a robust economy, elevated levels can erode purchasing power and prompt central banks to tighten monetary policy. This tightening, seen in the Federal Reserve's interest rate hikes throughout 2023 and into early 2024, increases borrowing costs for both consumers and businesses, potentially affecting loan origination volumes for Bank of America.

Looking ahead to 2025, global economic growth is projected by organizations like the IMF to moderate, with estimates suggesting a global GDP growth rate of around 2.7% to 3.0%. This slowdown could translate into reduced demand for loans and potentially impact the quality of Bank of America's loan portfolio as businesses and individuals face tighter economic conditions.

Consumer spending remains a critical driver for Bank of America's consumer banking operations. Despite inflationary pressures in early 2024, consumer spending showed surprising strength, with retail sales increasing by 0.2% in February 2024, according to the U.S. Census Bureau. This indicates continued demand for goods and services, which directly benefits Bank of America's transaction and lending volumes.

However, the overall health of consumer credit presents a more nuanced picture. While many consumers have managed their debt effectively, there's a noticeable uptick in delinquencies, particularly in credit card and auto loans. For instance, the Federal Reserve Bank of New York reported that credit card delinquencies rose to 3.14% in the fourth quarter of 2023, a notable increase from previous periods. This trend necessitates careful risk management and adaptive strategies from Bank of America.

Bank of America is actively monitoring these shifts in consumer financial health. The bank's approach involves refining its lending criteria and tailoring service offerings to meet evolving consumer needs and manage potential credit risks. This proactive stance is crucial for maintaining asset quality and supporting sustainable growth within its consumer segment amidst a dynamic economic landscape.

Global Economic Outlook and Trade

The global economic outlook significantly shapes Bank of America's performance, particularly in its global banking and markets segments. Projections for 2024 and 2025 indicate a mixed picture, with the IMF forecasting global GDP growth to remain steady at 3.2% in 2024 before a slight dip to 2.9% in 2025, reflecting ongoing geopolitical tensions and inflation concerns.

Trade dynamics are also crucial. Rising protectionism and trade disputes can directly impact cross-border transactions and investment banking deals, areas where Bank of America is heavily involved. For instance, the World Trade Organization (WTO) has noted a slowdown in trade volume growth compared to pre-pandemic levels, creating headwinds for international financial services.

- Global GDP Growth: Expected to hover around 3% for 2024-2025, with variations across regions.

- Trade Volume: Anticipated to see modest growth, potentially impacted by ongoing trade policy uncertainties.

- Inflationary Pressures: While moderating, persistent inflation in key economies could influence interest rate policies and investment appetite.

- Geopolitical Risks: Continued geopolitical instability remains a significant factor influencing global economic sentiment and financial market stability.

Capital Markets Performance

Bank of America's performance is closely tied to the health of global capital markets. In 2024, equity markets have shown resilience, with major indices like the S&P 500 reaching new highs, driven by strong corporate earnings and anticipation of potential interest rate cuts. Fixed income markets have also seen shifts, with bond yields fluctuating based on inflation data and central bank policy expectations.

This dynamic environment directly impacts Bank of America's key business areas. For instance, the Global Markets segment benefits from increased trading volumes and wider bid-ask spreads during periods of market activity. Similarly, the Global Wealth & Investment Management division thrives when clients' portfolios grow, leading to higher asset-based fees and increased demand for advisory services.

However, volatility remains a significant factor. For example, the first half of 2024 saw periods of heightened uncertainty due to geopolitical tensions and persistent inflation concerns, which can dampen investor sentiment and reduce fee-generating activities. The bank's ability to navigate these market fluctuations is crucial for sustained revenue growth.

- Equity Market Performance: The S&P 500 saw a gain of approximately 10% in the first quarter of 2024, indicating robust investor confidence.

- Fixed Income Volatility: Treasury yields experienced significant swings in early 2024, with the 10-year Treasury yield trading in a range between 3.9% and 4.7%.

- Impact on Fees: Higher asset values in wealth management typically translate to increased fee revenue; for example, a 1% increase in assets under management can boost annual fees by billions for large institutions.

- Trading Revenue: Increased market volatility often leads to higher trading revenues for investment banks, as seen in the Q1 2024 results for many financial institutions.

Economic factors significantly shape Bank of America's operational landscape, with interest rates and inflation being paramount. Central bank policies, such as the Federal Reserve's actions, directly influence the bank's net interest income. For instance, the Fed's rate hikes in 2022-2023 boosted NII, but a potential easing in late 2024 or 2025 could compress margins.

Inflation impacts consumer spending and business investment, affecting loan demand. While moderate inflation is healthy, elevated levels can reduce purchasing power and prompt tighter monetary policy, increasing borrowing costs. Global economic growth is projected to moderate in 2025, potentially reducing loan demand and impacting portfolio quality.

Consumer spending has shown resilience, but rising delinquencies in credit cards and auto loans, noted by the Federal Reserve Bank of New York, require careful risk management. Bank of America is adapting its lending criteria and services to navigate these evolving consumer financial health trends.

| Economic Factor | 2024 Projection/Observation | 2025 Projection | Impact on Bank of America |

|---|---|---|---|

| Interest Rates | Fed hikes continued into early 2024; potential for easing later. | Continued moderation or stabilization expected. | Affects net interest income (NII) and loan margins. |

| Inflation | Hovering around 3-4% in developed economies. | Expected to moderate but remain a concern. | Influences consumer spending, borrowing costs, and monetary policy. |

| Global GDP Growth | Projected around 3.2% for 2024. | Slightly slower, around 2.9% projected for 2025. | Impacts loan demand and the quality of loan portfolios. |

| Consumer Spending | Showed strength in early 2024 (e.g., retail sales up 0.2% Feb 2024). | Expected to remain a key driver, though sensitive to economic conditions. | Drives transaction volumes and lending activity in consumer banking. |

| Consumer Credit Delinquencies | Uptick observed, especially in credit cards (3.14% Q4 2023). | Continued monitoring and risk management critical. | Requires adaptive strategies to maintain asset quality. |

Preview the Actual Deliverable

Bank of America PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Bank of America PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the financial giant. You'll gain a clear understanding of the external forces shaping its strategic landscape.

Sociological factors

Consumers are increasingly turning to digital channels for their banking needs, expecting intuitive and convenient mobile and online experiences. This trend is reshaping how financial institutions operate and interact with their customer base.

Bank of America has experienced significant growth in digital engagement, with over 56 million active users across its digital platforms as of the first quarter of 2024. Millions of these clients regularly utilize its digital tools for transactions, account management, and even investment activities, showcasing a clear preference for digital solutions.

This accelerated digital adoption means Bank of America must continue to prioritize investment in its digital infrastructure and the development of personalized, user-friendly services. Meeting these evolving customer expectations is crucial for retaining and attracting clients in the current financial landscape.

Demographic shifts are profoundly reshaping the financial landscape, with the emerging affluent segment showing a growing appetite for specific products like sustainable investments and tailored financial planning. This trend directly impacts how institutions like Bank of America approach wealth management.

Bank of America's wealth management arms, Merrill and Private Bank, are actively adjusting their strategies to meet these evolving client demands, aiming to attract new households by offering specialized services that resonate with changing preferences.

For instance, as of early 2024, U.S. households with investable assets between $200,000 and $1 million represent a significant growth opportunity, with many expressing increased interest in ESG (Environmental, Social, and Governance) investing, a key component of sustainable finance.

The financial sector, including Bank of America, grapples with attracting and keeping skilled professionals, especially in high-demand fields like AI and cybersecurity. Reports from 2024 indicate a significant talent gap, with many firms struggling to fill these critical roles.

Bank of America needs to align with evolving employee desires for flexible work options and robust compensation packages to remain competitive. The shift towards hybrid models, for instance, is a key consideration for talent acquisition and retention in the current market.

Prioritizing employee growth through training programs and fostering a positive workplace culture are essential for retaining top performers and boosting overall productivity, as evidenced by industry studies showing higher retention rates in companies with strong development initiatives.

Financial Inclusion and Community Engagement

Societies increasingly expect financial institutions to foster financial inclusion and actively support communities, particularly those historically underserved. Bank of America addresses this by investing in programs like its Community Homeownership Commitment, which aims to make homeownership more accessible. Furthermore, the bank actively provides capital to diverse developers, recognizing the importance of equitable development.

Bank of America's robust community engagement and philanthropic activities are not just about social responsibility; they are crucial for maintaining its social license to operate. These efforts directly bolster its brand reputation, making it a more trusted and valued institution within the communities it serves. For instance, in 2023, Bank of America invested $250 million in communities across the U.S. through its philanthropic efforts.

- Financial Inclusion Initiatives: Bank of America's commitment to financial inclusion is demonstrated through programs designed to increase access to banking services and credit for low-to-moderate income individuals and communities.

- Community Development Investments: The bank actively supports community development through investments in affordable housing, small business growth, and job creation, particularly in underserved areas.

- Philanthropic Contributions: Significant philanthropic investments, totaling hundreds of millions annually, underscore Bank of America's dedication to addressing social needs and strengthening communities.

- Brand Reputation and Social License: These proactive social engagements enhance Bank of America's brand image, fostering goodwill and securing its social license to operate, which is vital for long-term business sustainability.

Ethical Banking and Trust

Public trust in banks is paramount, and recent years have seen heightened scrutiny following the 2008 financial crisis and ongoing concerns about corporate ethics. Bank of America, like its peers, must actively cultivate and maintain this trust. For instance, in 2023, a Gallup poll indicated that trust in banks had seen some recovery but remained below pre-2008 levels, with a significant portion of the public still wary of financial institutions' motives.

Bank of America's focus on responsible growth, transparent financial reporting, and a strong commitment to ethical business practices are key to solidifying customer and stakeholder confidence. These efforts are not merely about compliance; they directly influence brand perception and customer loyalty. A 2024 study by Edelman found that ethical considerations and corporate responsibility are increasingly important drivers of consumer choice, impacting brand value significantly.

The perception of fairness and integrity in banking operations directly correlates with client retention and the overall value of the Bank of America brand. When customers and investors believe a bank operates ethically and transparently, they are more likely to remain loyal and advocate for the institution. This sociological factor underscores the importance of robust corporate governance and community engagement initiatives in the financial sector.

Key aspects influencing ethical banking and trust include:

- Transparency in Fees and Services: Clear communication about all charges and product terms builds confidence.

- Commitment to Fair Lending Practices: Ensuring equitable access to credit and avoiding discriminatory policies is crucial.

- Data Privacy and Security: Protecting customer information is a fundamental trust-building measure.

- Corporate Social Responsibility (CSR) Initiatives: Demonstrating a commitment to societal well-being beyond profit enhances reputation.

Societal expectations are shifting towards greater financial inclusion and community support, particularly for underserved populations. Bank of America is actively investing in programs like its Community Homeownership Commitment to improve access to housing and provides capital to diverse developers, reflecting a commitment to equitable development.

The bank's extensive community engagement and philanthropic efforts, which included $250 million invested in communities in 2023, are vital for maintaining its social license to operate and bolstering its brand reputation as a trusted institution.

These initiatives directly contribute to a stronger brand image and foster goodwill, underscoring the importance of proactive social engagement for long-term business sustainability in the financial sector.

Technological factors

Bank of America is aggressively pursuing digital transformation, allocating substantial capital to technology, including a significant push into generative AI in 2024. This strategic investment aims to modernize operations and enhance customer experiences across the board.

The bank is integrating AI across its operations, from customer-facing services to internal processes. Its digital assistant, Erica, is being enhanced with AI to provide more personalized financial advice, while AI tools are also being deployed to boost employee productivity in areas like software development and client interaction, improving efficiency and service delivery.

The financial services sector, including giants like Bank of America, remains a high-value target for evolving cyber threats. Sophisticated attacks such as ransomware, phishing schemes, and vulnerabilities in API integrations are constant concerns, demanding continuous vigilance.

Bank of America's commitment to robust cybersecurity is paramount, involving substantial ongoing investment to safeguard sensitive customer information and the integrity of its financial operations. This proactive stance is crucial in an environment where digital assets are increasingly under siege.

The consequences of a data breach are severe, encompassing not only direct financial losses and hefty regulatory penalties but also significant damage to the bank's reputation and customer trust. For instance, in 2023, the financial services industry saw a notable increase in cyberattack frequency, with some reports indicating a 40% rise in ransomware attacks targeting financial institutions compared to the previous year.

Bank of America is actively investing in blockchain and Distributed Ledger Technology (DLT) to enhance operational efficiency. They are particularly focused on using DLT to speed up stock settlements and international payments, aiming to reduce transaction times and costs. This strategic focus is evidenced by their collaborations with DLT platforms such as Paxos.

The bank's significant investment in blockchain is further underscored by its substantial portfolio of blockchain-related patents. As of early 2024, Bank of America had filed over 50 blockchain patents, signaling a strong commitment to innovation and securing intellectual property in this rapidly evolving space.

Cloud Computing and Infrastructure Modernization

Bank of America's strategic embrace of cloud computing is essential for enhancing operational efficiency and scalability in its financial services. However, this transition inherently broadens the potential attack surface for sophisticated cyber threats, necessitating robust security measures. For instance, in 2024, the financial services sector saw a significant increase in cloud-based attacks, highlighting the ongoing challenge.

Modernizing its IT infrastructure, including cloud environments, remains a top priority for Bank of America to guarantee resilience and security. This continuous upgrade cycle is crucial for handling increasing transaction volumes and adapting to evolving regulatory landscapes. The bank's commitment to technological advancement is reflected in its substantial IT spending, which is projected to remain high through 2025.

- Cloud Adoption Benefits: Enhanced agility and cost savings are key drivers for financial institutions like Bank of America adopting cloud solutions.

- Cybersecurity Risks: Increased reliance on cloud infrastructure presents new vulnerabilities that require constant vigilance and advanced threat detection.

- Infrastructure Modernization: Investments in upgrading IT systems, including cloud platforms, are critical for maintaining competitive advantage and operational integrity.

- Strategic Partnerships: Collaborations with leading cloud providers are vital for accessing cutting-edge technology and expertise to manage complex IT environments.

FinTech Partnerships and Open Banking

The accelerating growth of FinTech firms and the widespread adoption of open banking principles are compelling traditional banks like Bank of America to forge strategic alliances and ensure seamless system interoperability. This evolving landscape demands collaboration to remain competitive.

Bank of America is actively pursuing partnerships with technology innovators and integrating cutting-edge solutions to bolster its service portfolio. For instance, in 2024, the bank continued to invest in digital disbursement services, aiming to streamline customer access to funds and improve transaction efficiency.

- FinTech Collaboration: Bank of America actively collaborates with FinTech companies to integrate innovative solutions, enhancing customer experience and operational efficiency.

- Open Banking Integration: The bank is focused on adapting to open banking trends, allowing for secure data sharing and fostering new digital financial services.

- Digital Payment Solutions: Bank of America is a leader in adopting and developing new payment technologies, including real-time payment systems and digital wallets, to meet evolving consumer demands.

- Competitive Advantage: These technological integrations and partnerships are crucial for Bank of America to maintain its competitive edge in a rapidly digitizing financial services market.

Bank of America is heavily investing in AI and machine learning, aiming to enhance customer service and operational efficiency. For example, their digital assistant, Erica, is being upgraded with generative AI capabilities, projecting a significant increase in personalized financial advice interactions by late 2024.

The bank's commitment to blockchain technology is evident in its ongoing development of DLT solutions for faster settlements and international payments, with over 50 blockchain patents filed as of early 2024, underscoring its focus on innovation.

Cybersecurity remains a critical focus, with substantial investments to combat evolving threats like ransomware, which saw a reported 40% increase in attacks on financial institutions in 2023. This necessitates continuous upgrades to IT infrastructure, including cloud environments, to protect sensitive data and ensure operational resilience through 2025.

Strategic partnerships with FinTech firms and adoption of open banking principles are key to Bank of America's strategy for staying competitive in the digital financial landscape, driving the integration of new payment technologies and digital services.

Legal factors

Bank of America navigates a stringent regulatory landscape, adhering to rules set by the Federal Reserve, SEC, and international financial authorities. Staying compliant with measures like Dodd-Frank, Basel III, and anti-money laundering statutes demands substantial investment in operations and reporting, with non-compliance carrying risks of significant financial penalties.

Global data privacy regulations like GDPR in Europe and CCPA in California significantly impact how Bank of America handles customer information, demanding rigorous data collection, storage, and processing standards. Failure to comply can result in substantial fines; for instance, GDPR fines can reach up to 4% of annual global turnover or €20 million, whichever is higher.

Maintaining robust data governance and cybersecurity is paramount for Bank of America, especially with its extensive international operations, to meet these evolving legal requirements. A data breach not only incurs financial penalties but also severely erodes customer trust, a critical asset for any financial institution.

Bank of America operates under rigorous Anti-Money Laundering (AML) and sanctions compliance regulations worldwide, crucial for thwarting illegal financial transactions. The institution dedicates substantial resources to advanced technological solutions and comprehensive employee training programs designed to identify and report any suspicious activities.

Non-compliance with these critical regulations carries severe repercussions, including substantial financial penalties, significant damage to the bank's reputation, and potential criminal prosecution for the organization and its executives.

For instance, in 2023, major financial institutions collectively paid billions in AML-related fines, underscoring the high stakes involved. Bank of America, like its peers, continually updates its compliance infrastructure to meet evolving global standards and mitigate these risks.

Consumer Protection Laws

Consumer protection laws are a significant legal factor for Bank of America, particularly in its retail banking operations. These regulations govern everything from lending fairness and fee transparency to how customer information is handled. For instance, the Consumer Financial Protection Bureau (CFPB) actively enforces rules like the Truth in Lending Act, which mandates clear disclosure of loan terms and costs. Failure to comply can lead to substantial penalties and damage to the bank's reputation.

Bank of America, like all major financial institutions, must navigate a complex web of consumer protection statutes. These laws are designed to ensure fair treatment and prevent predatory practices, impacting product development and customer service protocols. For example, in 2023, the CFPB continued its focus on areas such as overdraft fees and fair lending, issuing guidance and taking enforcement actions against various financial institutions.

- Fair Lending: Laws like the Equal Credit Opportunity Act (ECOA) prohibit discrimination in credit transactions, requiring banks to demonstrate fair lending practices.

- Disclosure Requirements: Regulations such as the Truth in Lending Act (TILA) and the Truth in Savings Act (TISA) mandate clear and accurate disclosures of loan terms, interest rates, and fees to consumers.

- Data Privacy: Consumer data protection laws, such as those related to the Gramm-Leach-Bliley Act (GLBA), require financial institutions to safeguard customer financial information.

- Enforcement Actions: Regulatory bodies like the CFPB can impose fines and other sanctions for non-compliance, as seen in various settlements reached with banks over consumer protection violations.

Litigation and Legal Risks

Bank of America, as a major financial institution, navigates a landscape fraught with litigation. These legal challenges often stem from its diverse operations, encompassing areas like mortgage-backed securities, consumer grievances, and employment-related conflicts. For instance, in the first quarter of 2024, the bank continued to address legacy legal matters, though specific new litigation provisions were not a dominant factor in its financial reporting for that period, indicating a degree of stability in managing existing cases.

The financial repercussions of these legal battles can be substantial. They often translate into significant settlement costs, escalating legal fees, and, crucially, damage to the bank's reputation. While specific figures for ongoing litigation provisions fluctuate, the sheer volume of transactions and customer interactions inherent in a bank of Bank of America's size means a constant exposure to potential legal claims. Managing these risks effectively is paramount.

- Ongoing Litigation: Bank of America faces persistent legal challenges across its business lines, including mortgage-backed securities, consumer complaints, and employment disputes.

- Financial Impact: Legal actions can lead to substantial financial settlements, considerable legal expenses, and negative impacts on the bank's public image.

- Risk Mitigation: The bank's proactive legal strategy and robust risk management frameworks are essential for minimizing the adverse effects of litigation.

- Regulatory Scrutiny: As a large bank, Bank of America is subject to intense regulatory oversight, which can also trigger investigations and potential legal actions.

Bank of America operates under a strict legal framework, requiring adherence to numerous financial regulations. These include compliance with directives from bodies like the Federal Reserve and SEC, as well as international standards such as Basel III. The bank invests heavily in operational compliance and reporting to avoid significant penalties for non-adherence.

Consumer protection laws are a critical area, with entities like the Consumer Financial Protection Bureau (CFPB) enforcing rules on fair lending and fee transparency. For instance, the CFPB's continued focus in 2023 on issues like overdraft fees highlights the ongoing scrutiny financial institutions face.

The bank also faces ongoing litigation across its operations, from mortgage-backed securities to consumer disputes. While specific litigation provisions fluctuate, the sheer scale of Bank of America's business exposes it to constant legal risk, necessitating robust risk management.

| Legal Area | Key Regulations/Focus | Potential Impact of Non-Compliance | 2023/2024 Data Point |

|---|---|---|---|

| Regulatory Compliance | Dodd-Frank, Basel III, AML | Financial penalties, reputational damage | Billions paid collectively by major banks in AML fines in 2023 |

| Consumer Protection | Truth in Lending Act, ECOA, CFPB enforcement | Fines, damage to customer trust, operational changes | CFPB continued focus on overdraft fees and fair lending in 2023 |

| Litigation | Mortgage-backed securities, consumer grievances | Settlement costs, legal fees, reputational harm | Bank of America addressing legacy legal matters in Q1 2024 |

Environmental factors

Bank of America acknowledges the tangible threats posed by climate change, including severe weather events like hurricanes and floods. These events can directly impact the bank's extensive loan portfolios, particularly in sectors like real estate and agriculture, and affect its physical infrastructure and operational continuity.

The institution actively assesses and quantifies these physical risks, especially in regions prone to climate-related disasters, to safeguard the stability of its financial assets and ensure operational resilience. For example, in 2023, the bank reported increased investments in climate resilience initiatives, though specific figures related to direct physical risk mitigation were not detailed in public statements.

The global shift towards a low-carbon economy poses significant transition risks for Bank of America, impacting its lending and investment portfolios. The bank is actively addressing these by committing to mobilize $1.5 trillion in sustainable finance by 2030. This ambitious goal underscores a strategic focus on financing environmentally sound projects and assisting clients in their own sustainability journeys, aiming to mitigate risks and capture emerging opportunities.

Investors and stakeholders are increasingly demanding detailed Environmental, Social, and Governance (ESG) reporting. Bank of America responded by publishing its 2023 ESG Report, highlighting a 49% reduction in financed emissions intensity for its corporate and commercial portfolio compared to a 2019 baseline. This commitment to transparency, including alignment with SASB and CDP frameworks, is vital for attracting capital from the growing pool of responsible investors.

Carbon Footprint and Operational Emissions

Bank of America is actively working to shrink its carbon footprint, focusing on both its own operations and those of its supply chain. The company has set an ambitious target to reach net-zero greenhouse gas emissions across its financing, operations, and supply chain before 2050.

Key initiatives include reducing energy and water usage, increasing the adoption of renewable energy sources, and implementing robust waste management strategies. For instance, by the end of 2023, Bank of America had reduced its absolute operational greenhouse gas emissions by 54% compared to a 2010 baseline.

These efforts are crucial for aligning with global climate goals and mitigating the financial risks associated with environmental changes. The company’s commitment extends to providing sustainable finance solutions to clients, further amplifying its impact.

- Net-Zero Goal: Aiming for net-zero emissions in financing, operations, and supply chain before 2050.

- Operational Efficiency: Reducing energy and water consumption, alongside waste management improvements.

- Renewable Energy: Increasing the procurement and use of renewable energy sources.

- Progress: Achieved a 54% reduction in absolute operational greenhouse gas emissions by end of 2023 (vs. 2010 baseline).

Reputational Risks from Environmental Impact

Bank of America's reputation is significantly tied to its perceived environmental responsibility. Public scrutiny over its financing of carbon-intensive sectors, such as fossil fuels, can lead to negative sentiment and calls for divestment. For instance, as of early 2024, Bank of America remained a significant financier of the oil and gas industry, drawing criticism from environmental groups advocating for a faster transition to renewable energy.

These environmental concerns can translate into tangible reputational risks. Protests and divestment campaigns, fueled by public perception, can impact customer loyalty and investor confidence. In 2023, several shareholder resolutions focused on the bank's climate policies, highlighting the growing pressure from stakeholders to align its lending practices with global climate goals.

To counter these risks, Bank of America is increasingly emphasizing its commitment to sustainable finance and transparently communicating its environmental initiatives. This includes investments in renewable energy projects and setting targets for reducing financed emissions. By proactively engaging in green financing and clearly articulating its strategy, the bank aims to bolster its brand image and mitigate potential backlash from its environmental footprint.

- Financing Focus: Bank of America continues to face scrutiny for its substantial financing of the oil and gas sector, a key area of concern for environmental advocates.

- Shareholder Activism: In 2023, shareholder resolutions highlighted a growing demand for stronger climate action and more transparent reporting on financed emissions.

- Reputational Impact: Negative public perception stemming from environmental impact can lead to customer attrition and reduced investor confidence, as seen in ongoing campaigns against banks financing fossil fuels.

- Mitigation Strategy: The bank is actively promoting its investments in renewable energy and setting financed emissions reduction targets to improve its environmental standing and mitigate reputational damage.

Bank of America faces significant risks from climate change, impacting its loan portfolios and infrastructure through events like floods and hurricanes. The transition to a low-carbon economy presents further challenges, prompting the bank to mobilize $1.5 trillion in sustainable finance by 2030 to mitigate these risks and capitalize on new opportunities.

The bank is actively reducing its operational carbon footprint, having achieved a 54% reduction in absolute operational greenhouse gas emissions by the end of 2023 against a 2010 baseline. This aligns with its net-zero goal for financing, operations, and supply chain before 2050.

Reputational risks are also a concern, particularly regarding its financing of the oil and gas industry, which drew shareholder attention in 2023. Bank of America is addressing this by highlighting its sustainable finance initiatives and setting targets for reducing financed emissions to enhance its environmental standing.

| Environmental Factor | Bank of America's Response/Data | Key Metrics/Targets |

|---|---|---|

| Physical Climate Risks | Assesses and quantifies physical risks, particularly in disaster-prone regions. | Increased investments in climate resilience initiatives (2023). |

| Transition to Low-Carbon Economy | Mobilizing sustainable finance to support clients' transitions. | $1.5 trillion in sustainable finance by 2030. |

| Operational Emissions Reduction | Focus on energy efficiency, renewable energy, and waste management. | 54% reduction in absolute operational GHG emissions by end of 2023 (vs. 2010 baseline). Net-zero by 2050. |

| Reputational Management | Emphasizing sustainable finance and transparent environmental reporting. | 49% reduction in financed emissions intensity (corporate/commercial) vs. 2019 baseline (2023 ESG Report). |

PESTLE Analysis Data Sources

Our PESTLE analysis for Bank of America is grounded in data from official U.S. government agencies, international financial institutions like the IMF and World Bank, and leading economic research firms. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting the bank.