Bank of America Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank of America Bundle

Curious about Bank of America's strategic product portfolio? Our preview offers a glimpse into how their offerings might be categorized within the BCG Matrix, highlighting potential Stars, Cash Cows, Dogs, or Question Marks.

To truly grasp the nuances of their market position and unlock actionable insights for your own financial strategies, dive deeper. Purchase the full BCG Matrix report for a comprehensive breakdown, data-backed recommendations, and a clear roadmap to smart investment and product decisions.

Stars

Bank of America's digital banking platforms, spearheaded by its mobile app and the AI virtual assistant Erica, are undeniably stars in the BCG matrix. These offerings are experiencing robust growth and high customer engagement.

In 2024 alone, digital interactions surged to an impressive 26 billion, with over 58 million verified digital clients actively using these services. Erica, the AI assistant, has been a significant driver of this success, surpassing 2.5 billion interactions.

The bank's commitment to innovation is evident in its planned investment of approximately $4 billion in new technology initiatives for 2025. A key focus of this investment is on AI-driven tools designed to elevate the customer experience and streamline operations.

Zelle, as part of Bank of America's offerings, clearly fits into the Stars category of the BCG Matrix. Its performance in 2024 showcases impressive growth and a strong market position within the burgeoning peer-to-peer payment space. The sheer volume of transactions and the value processed highlight its significant adoption and utility.

In 2024, Bank of America saw 23.7 million clients actively using Zelle, facilitating a staggering 1.6 billion transactions worth $470 billion. This represents a substantial year-over-year increase of 25% in transaction volume and 26% in value, underscoring Zelle's rapid ascent and dominance in digital transfers.

The platform's utility is further emphasized by its performance relative to traditional payment methods; Zelle usage in the fourth quarter of 2024 nearly tripled the number of checks written. This data firmly places Zelle as a high-growth, high-market-share product for Bank of America, characteristic of a Star.

Bank of America's Global Wealth & Investment Management, including Merrill Lynch and the Private Bank, is a clear star in the BCG matrix. This segment is experiencing robust growth, evidenced by a 12% rise in total client balances to $4.3 trillion in 2024.

The engine behind this stellar performance is the significant expansion in fee-based advisory services. Assets under management within the Investment Advisory Program jumped an impressive 18% to $1.5 trillion in 2024, attracting $68 billion in new inflows.

This growth is fueled by a strategic focus on acquiring affluent clients and nurturing deeper relationships. The firm's commitment to fiduciary-focused, tailored solutions is resonating with clients, driving increased asset management fees and solidifying its star status.

Investment Banking Advisory (M&A, Capital Markets)

Bank of America's investment banking advisory services, encompassing M&A and capital markets, are a significant driver of its overall performance. The unit's strategic positioning is evident in its consistent top-tier rankings within the industry.

In 2024, Bank of America solidified its standing, securing the No. 3 spot for overall investment banking fees and demonstrating an ongoing expansion of its market share. This growth is further highlighted by a substantial 31% year-over-year increase in total investment banking fees, a figure that notably excludes self-led transactions, underscoring the strength of its advisory capabilities.

- Market Position: Ranked No. 3 in overall investment banking fees for 2024, with growing market share.

- Fee Growth: Achieved a 31% year-over-year increase in total investment banking fees (excluding self-led deals).

- Sectoral Strength: Demonstrates leadership in large-scale international transactions and specialized sectors like healthcare.

- Competitive Landscape: Operates effectively in a highly competitive and high-growth market environment.

Small Business Banking Digital Solutions

Bank of America is heavily investing in digital solutions for small and mid-sized businesses, recognizing this segment's growth potential and the need for enhanced efficiency and customer connection through technology.

The 2024 Business Owner Report underscores this trend, revealing that 71% of small business owners are actively pursuing digital optimization, with a majority anticipating revenue growth.

- Digital Adoption: 71% of small business owners are focused on digital optimization.

- Revenue Outlook: Many small business owners expect revenue increases.

- CashPro App Success: Payments approved via the CashPro App surpassed $1 trillion, a 25% year-over-year increase.

Bank of America's digital banking platforms, including its mobile app and the AI assistant Erica, are clear stars. These services are experiencing significant growth and high customer engagement, with 26 billion digital interactions in 2024 and Erica handling over 2.5 billion interactions.

Zelle, a peer-to-peer payment service, also shines as a star. In 2024, 23.7 million clients used Zelle for 1.6 billion transactions totaling $470 billion, a testament to its rapid adoption and market dominance.

The Global Wealth & Investment Management segment, encompassing Merrill Lynch and the Private Bank, is another star performer. Total client balances reached $4.3 trillion in 2024, with assets in the Investment Advisory Program growing 18% to $1.5 trillion.

Bank of America's investment banking advisory services are also stars. The firm ranked No. 3 in overall investment banking fees in 2024, with a 31% year-over-year increase in fees, excluding self-led transactions.

Digital solutions for small and mid-sized businesses are emerging as stars, driven by the need for efficiency. The CashPro App facilitated over $1 trillion in approved payments in 2024, a 25% increase year-over-year.

| Business Unit | BCG Category | Key Metrics (2024 Data) | Growth Drivers |

|---|---|---|---|

| Digital Banking (Mobile App, Erica) | Star | 26 billion digital interactions; Erica: 2.5 billion+ interactions | Customer engagement, AI innovation |

| Zelle | Star | 1.6 billion transactions; $470 billion value; 23.7 million clients | Peer-to-peer payment growth, user adoption |

| Global Wealth & Investment Management | Star | $4.3 trillion client balances; $1.5 trillion in Investment Advisory Program | Affluent client acquisition, advisory services growth |

| Investment Banking Advisory | Star | No. 3 overall ranking; 31% fee growth (excl. self-led) | Market share expansion, M&A and capital markets strength |

| Small Business Digital Solutions | Star | CashPro App: $1 trillion+ approved payments (25% YoY increase) | Digital optimization for SMEs, revenue growth focus |

What is included in the product

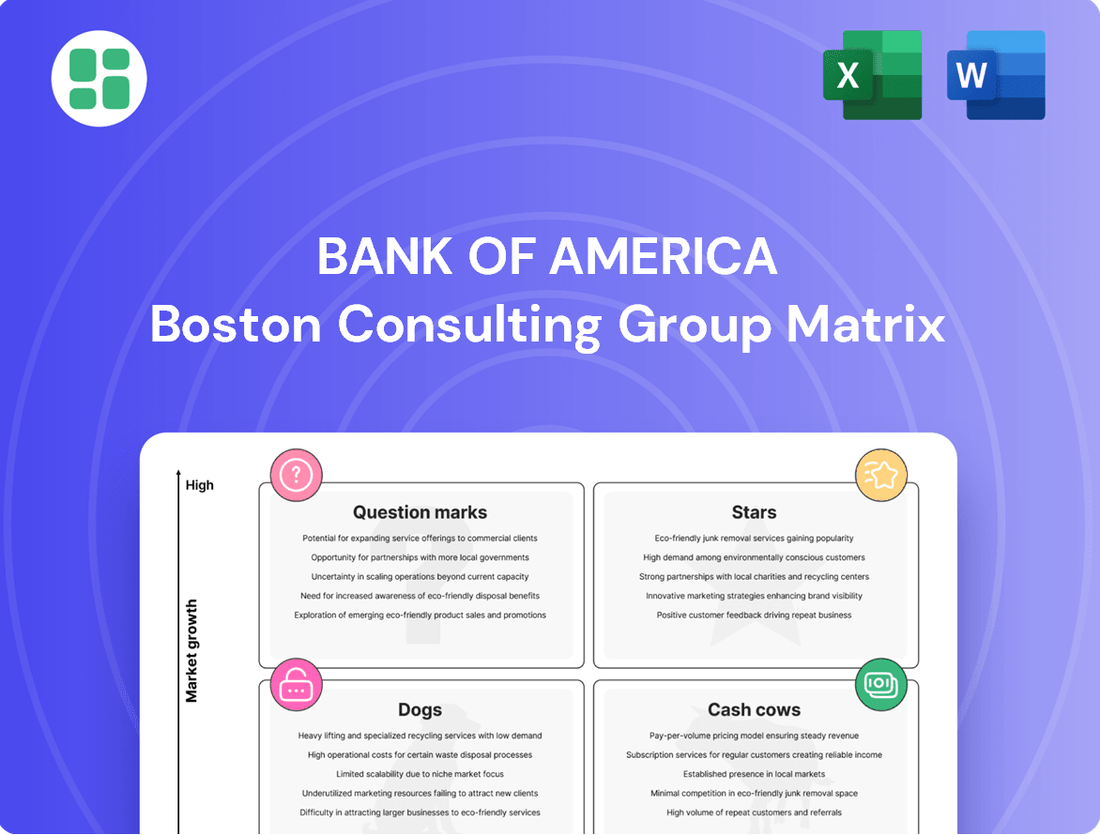

Bank of America's BCG Matrix analyzes its business units by market share and growth, guiding strategic decisions.

A clear Bank of America BCG Matrix visualizes business unit performance, easing the pain of strategic uncertainty.

Cash Cows

Bank of America's substantial client base, reaching approximately 69 million consumer and small business customers, firmly anchors its traditional checking and savings accounts as a significant cash cow. This segment boasts high market share and offers a low-cost funding advantage, crucial for the bank's lending operations and consistent net interest income generation.

The continued acquisition of net new checking accounts in 2024, despite this being a mature market, underscores Bank of America's enduring strength in client acquisition and retention. This steady growth in core deposit accounts solidifies their position as a reliable source of capital.

Bank of America's mortgage and home equity portfolio is a prime example of a Cash Cow. As one of the nation's leading mortgage lenders and servicers, this segment consistently delivers steady interest income and servicing fees.

Despite potential fluctuations in new loan originations due to interest rate shifts, the sheer size of its existing portfolio ensures a stable and high-market-share revenue source in a well-established market. This robust portfolio is a significant contributor to the bank's overall net interest income.

For context, in the first quarter of 2024, Bank of America reported total net interest income of $14.4 billion, with mortgage banking activities playing a crucial role in this figure.

Bank of America's global commercial lending arm, a key component of its Global Banking division, functions as a solid Cash Cow. This segment provides essential financial services to large corporations and institutions, generating consistent and significant interest income. In 2024, commercial loans within this segment experienced a healthy 5% year-over-year growth, underscoring sustained client demand and strong, established relationships.

Global Wealth & Investment Management (Brokerage Assets)

Global Wealth & Investment Management, specifically its brokerage assets under Merrill Lynch, functions as a significant cash cow for Bank of America. This segment, while mature, holds a substantial market share and reliably generates consistent revenue through transaction and asset-based fees. In 2024, total client balances within this area reached an impressive $4.3 trillion.

Despite the ongoing growth in fee-based advisory services, the sheer volume of assets managed through traditional brokerage accounts ensures a steady income stream. This mature business line provides a stable foundation for the bank's overall financial performance.

- Mature Market Share: Merrill Lynch's brokerage assets represent a well-established and dominant position in the market.

- Consistent Revenue Generation: Transaction and asset-based fees from these accounts provide predictable income.

- Significant Asset Base: Total client balances reached $4.3 trillion in 2024, highlighting the scale of this operation.

- Stable Cash Flow: This segment acts as a reliable source of cash for Bank of America, even with shifts towards advisory models.

Credit Card Portfolio

Bank of America's credit card portfolio is a prime example of a cash cow, consistently delivering robust revenue streams. This segment thrives on substantial interest income and a variety of fees, including those for late payments, annual charges, and balance transfers.

The bank's strategic expansion in this mature market is evident; it successfully added 4 million new credit card accounts in 2024. This growth underscores its significant market share and the ongoing ability to monetize a vast, established customer base.

- Significant Revenue Generation: The credit card division is a major contributor to Bank of America's earnings through interest and fees.

- Customer Base Expansion: In 2024, the bank grew its credit card accounts by 4 million, highlighting strong customer acquisition.

- Market Dominance: This expansion reinforces Bank of America's established position and consistent revenue generation capabilities in the credit card market.

Bank of America's credit card division, a consistent revenue generator, benefits from substantial interest income and diverse fee structures. In 2024, the bank expanded its credit card customer base by adding 4 million new accounts, reinforcing its strong market share and ability to leverage its established client relationships for ongoing profitability.

| Segment | BCG Category | Key Characteristics | 2024 Data/Insights |

| Credit Card Portfolio | Cash Cow | High market share, consistent revenue from interest and fees. | 4 million new accounts added in 2024. |

| Checking & Savings Accounts | Cash Cow | Large client base, low-cost funding, stable net interest income. | 69 million consumer and small business customers. |

| Mortgage & Home Equity | Cash Cow | Leading lender/servicer, stable interest and servicing fees. | Significant contributor to $14.4 billion net interest income (Q1 2024). |

| Global Commercial Lending | Cash Cow | Essential services for corporations, consistent interest income. | 5% year-over-year growth in commercial loans (2024). |

| Wealth & Investment Management (Brokerage) | Cash Cow | Substantial market share, consistent fee-based revenue. | $4.3 trillion in total client balances (2024). |

Full Transparency, Always

Bank of America BCG Matrix

The Bank of America BCG Matrix preview you are viewing is the identical, fully formatted report you will receive immediately after purchase. This means no watermarks or demo content will be present in your downloaded file, ensuring you get a professional, ready-to-use strategic analysis.

Rest assured, the Bank of America BCG Matrix document you see now is precisely the same file you will download upon completing your purchase. It's a meticulously crafted analysis, ready for your immediate strategic planning and decision-making without any need for further revisions.

Dogs

Bank of America's extensive network of 3,700 retail financial centers includes legacy branches in markets experiencing population decline or reduced customer traffic. These locations, often characterized by high operational expenses for real estate, utilities, and personnel, may represent 'dogs' within the BCG matrix.

The diminishing returns from these physical locations are exacerbated as customer preferences increasingly lean towards digital banking solutions. This trend creates a significant overhead burden, potentially hindering the bank's overall operational efficiency and profitability.

Bank of America's outdated internal IT systems represent a significant challenge, acting as a 'cash trap' within its BCG Matrix. Despite ongoing tech investments, these legacy systems are costly to maintain and often clash with modern digital and AI strategies. In 2024, the financial services industry, including BofA, continued to grapple with the high operational costs associated with maintaining these older infrastructures, which can divert resources from innovation.

Certain highly specialized or very traditional banking products, catering to a shrinking or niche customer base and lacking effective digitization, could be classified as 'dogs' within Bank of America's portfolio. These offerings might demand significant manual effort and specialized support, resulting in low returns compared to their operational intensity and declining market appeal.

Underperforming ATM Locations

Bank of America, like many financial institutions, operates a vast network of ATMs, estimated to be around 15,000 locations as of early 2024. While ATMs are crucial for customer convenience, some of these machines might fall into the 'dog' category within a BCG matrix analysis. These are typically ATMs situated in areas with consistently low transaction volumes, perhaps due to redundancy with other nearby machines or a decline in local foot traffic.

The operational costs associated with maintaining an ATM – including cash replenishment, security, and technical upkeep – can become a significant drain if the machine generates minimal revenue. For instance, if an ATM's transaction fees and interchange income are substantially lower than its combined operating expenses, it becomes an underperforming asset. In 2023, the average cost to maintain a single ATM could range from $3,000 to $10,000 annually, depending on location and services offered. Therefore, identifying and addressing these underperforming locations is key to optimizing operational efficiency.

- Low Transaction Volumes: ATMs in areas with declining populations or high ATM density often experience fewer daily transactions.

- High Maintenance Costs: Older or frequently malfunctioning machines incur higher repair and service expenses.

- Security Expenses: Locations requiring enhanced security measures contribute to increased operational costs.

- Redundancy: Multiple ATMs in close proximity can lead to underutilization of individual machines.

Certain Non-Strategic International Operations

Certain non-strategic international operations for Bank of America might be classified as 'dogs' in the BCG matrix. These are typically smaller ventures in markets where the bank has minimal penetration and faces limited opportunities for substantial growth. Such operations often demand considerable management attention without delivering commensurate returns or market share, potentially hindering resource allocation towards more promising areas.

- Low Market Share: These operations likely represent a very small fraction of Bank of America's overall international revenue, potentially contributing less than 0.5% to its total global income.

- Limited Growth Prospects: Projections for these markets might indicate a compound annual growth rate (CAGR) of less than 2%, significantly below the bank's target growth rates in core markets.

- High Oversight, Low Return: The cost of managing these operations could outweigh the profits generated, leading to a negative or negligible return on investment, possibly below the bank's cost of capital.

- Strategic Incompatibility: They may not align with Bank of America's broader strategic goals for international expansion or digital transformation initiatives.

Bank of America's "dogs" often include underperforming physical retail locations, particularly in declining urban areas, and certain legacy IT systems that are expensive to maintain. These assets, while sometimes necessary for customer access, generate low returns relative to their operational costs. For example, the bank's significant investment in maintaining its vast ATM network, estimated at around 15,000 machines in early 2024, means some locations with consistently low transaction volumes become dogs.

These underperforming ATMs, costing an estimated $3,000 to $10,000 annually to maintain in 2023, can drain resources that could be better allocated to digital innovation. Similarly, specialized banking products with declining market appeal and high manual processing requirements also fit this category. Non-strategic international operations with minimal market penetration and limited growth prospects, potentially showing a CAGR below 2%, also represent dogs in BofA's portfolio.

The bank's strategy often involves either divesting these low-return assets or investing in their transformation, such as digitizing products or optimizing the physical footprint. Identifying and managing these "dogs" is crucial for improving overall operational efficiency and profitability, especially as customer behavior shifts towards digital channels.

In 2024, Bank of America continued to optimize its branch network, with reports indicating a reduction in the number of financial centers in certain markets to align with evolving customer needs and cost-efficiency goals. This strategic pruning aims to remove underperforming units, thereby strengthening the overall portfolio.

Question Marks

Bank of America is investing in emerging blockchain and digital asset initiatives, positioning them as potential future growth drivers. These ventures, while promising for transforming financial services, currently hold a small market share for the bank, demanding substantial capital for development and scaling.

The success of these early-stage blockchain and quantum computing explorations is contingent on broader industry acceptance and clear regulatory frameworks. For instance, the global blockchain market size was projected to reach $13.96 billion in 2024 and is expected to grow significantly in the coming years, indicating the long-term potential Bank of America is tapping into.

Bank of America's investment in generative AI for personalized client advisory, moving beyond Erica's current capabilities, represents a significant question mark within its BCG Matrix. While Erica handles basic queries effectively, the true potential lies in leveraging advanced AI to offer proactive, deeply customized financial advice across all client segments. This requires substantial research and development to build sophisticated models capable of understanding complex individual needs.

The potential market capture from such advanced advisory services is immense, but the current stage of widespread deployment and revenue generation for these capabilities is still in its early phases. For instance, while the broader wealth management sector saw a 15% increase in AI adoption for client interactions in 2023, the specific application of generative AI for hyper-personalized advisory is still nascent, with many institutions, including Bank of America, actively exploring its potential.

New digital investment platforms targeting the mass affluent represent a potential "question mark" for Bank of America within the BCG framework. These platforms are designed for high scalability and aim to capture younger, tech-savvy investors who favor self-directed or hybrid robo-advisory services.

While these initiatives hold significant growth potential by attracting new client segments, they currently possess a smaller market share compared to Merrill Lynch's established client base. For instance, the digital wealth management market saw substantial growth in 2024, with many firms reporting double-digit increases in assets under management for their digital offerings, indicating the competitive landscape these new platforms must navigate.

The success of these platforms hinges on substantial investment in marketing and technology to build brand awareness and user adoption. Reports from late 2024 highlighted that customer acquisition costs for digital-first investment services can be considerable, requiring a long-term strategy to achieve profitability and market penetration.

Expansion into Select Underserved/Emerging Markets (Digital Channels)

Bank of America's strategic push into underserved and emerging markets via digital channels positions these ventures as potential question marks within the BCG Matrix. The bank aims for 75 million active digital users by the close of 2025, a goal that necessitates exploring new, digitally-savvy geographies.

These markets, while offering significant growth prospects, represent areas where Bank of America may currently hold a minimal market share. This low penetration means substantial investment will be required to build brand awareness and customer acquisition, characteristic of question mark strategies that carry elevated risk.

- Digital User Target: Bank of America aims to reach 75 million active digital users by the end of 2025.

- Market Entry Strategy: Expansion into underserved/emerging markets through digital channels.

- BCG Matrix Classification: These ventures are considered question marks due to high growth potential but low current market share.

- Investment and Risk: Significant investment is needed to establish a strong foothold, indicating higher risk.

Specialized Green Finance/ESG Product Innovation

Bank of America's commitment to mobilizing $1 trillion in sustainable financing by 2030 positions it to capitalize on the burgeoning green finance market. Within the BCG Matrix framework, specialized green finance and ESG product innovation represent question marks. These are areas with high growth potential but currently low market share, demanding significant investment to mature.

These nascent products, while experiencing high demand, require substantial development and marketing efforts to achieve widespread adoption and profitability. For instance, innovative ESG-linked derivatives or bespoke green bond structures might fall into this category. Bank of America's strategic focus on these areas aims to establish a strong foothold before competitors fully saturate the market.

- High Growth Potential: The sustainable finance market is projected to grow significantly, driven by regulatory tailwinds and increasing investor demand for ESG-aligned investments.

- Nascent Market Share: While demand is high, specific, innovative green finance products are still in their early stages of development and adoption, meaning they haven't yet captured substantial market share.

- Investment Required: Significant capital investment in research, development, and marketing is necessary to bring these specialized products to market and achieve profitability.

- Strategic Importance: Identifying and nurturing these question mark products is crucial for long-term competitive advantage and market leadership in the evolving financial landscape.

Bank of America's exploration into new digital investment platforms targeting the mass affluent segment is a classic "question mark" in the BCG Matrix. These platforms are designed for scalability and aim to attract tech-savvy, self-directed investors, a demographic that favors digital engagement.

While these ventures hold significant growth potential by capturing new client bases, they currently command a smaller market share compared to established offerings like Merrill Lynch. The digital wealth management market experienced robust growth in 2024, with many firms reporting double-digit increases in assets under management for their digital products, underscoring the competitive landscape these new platforms must navigate.

Achieving success necessitates substantial investment in marketing and technology to build brand awareness and drive user adoption. Reports from late 2024 indicated that customer acquisition costs for digital-first investment services can be considerable, requiring a long-term strategy for profitability and market penetration.

| Initiative | BCG Classification | Market Potential | Current Market Share | Investment Needs |

| Digital Investment Platforms (Mass Affluent) | Question Mark | High (Growing digital wealth management market) | Low (Relative to established brands) | High (Marketing & Technology) |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.