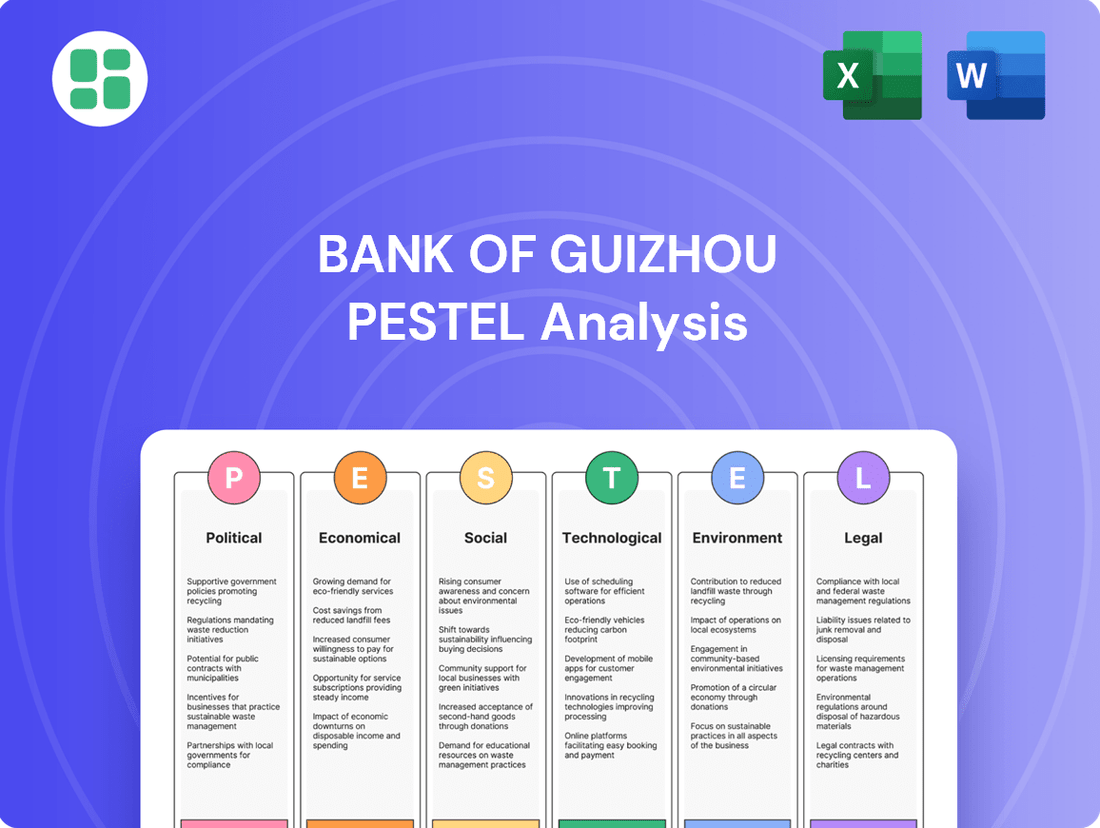

Bank of Guizhou PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank of Guizhou Bundle

Navigate the dynamic landscape surrounding Bank of Guizhou with our expert PESTLE analysis. Uncover how political shifts, economic fluctuations, and technological advancements are shaping its operational environment and future growth. Equip yourself with actionable intelligence to refine your market strategy and gain a competitive advantage. Download the full version now for immediate access to crucial insights.

Political factors

The Bank of Guizhou operates within a tightly regulated Chinese banking sector, heavily influenced by directives from the People's Bank of China (PBOC) and the National Financial Regulatory Administration (NFRA). These bodies set crucial parameters for lending, capital adequacy, and risk management, directly shaping the bank's operational landscape. For instance, the NFRA's ongoing efforts to strengthen risk management in the banking system, including requirements for loan loss provisioning, directly impact profitability and strategic lending decisions.

Guizhou province has seen significant government attention through policies aimed at boosting regional economic development. For instance, the central government's 2023 "Guizhou National Big Data Comprehensive Pilot Zone" initiative encourages technological advancement and data-driven industries, creating new lending avenues for the Bank of Guizhou in areas like IT infrastructure and digital transformation projects.

These regional development policies, including those focused on poverty alleviation and rural revitalization, directly align with the Bank of Guizhou's mission to support local growth. In 2024, the bank reported a notable increase in loans directed towards agricultural modernization and infrastructure improvements in underserved areas, reflecting its role in executing these national strategies.

China's political stability remains a key factor, with the government's focus on economic development and social harmony influencing the financial sector. Geopolitical tensions, particularly concerning trade relations with Western countries and regional security, could indirectly impact foreign investment flows into China and affect the Bank of Guizhou's international business dealings.

While specific impacts are complex, China's commitment to maintaining a stable domestic environment underpins its economic trajectory. For instance, the ongoing efforts to manage international trade dynamics, as seen in trade figures, will continue to shape the broader economic climate in which banks like Guizhou operate. The country's GDP growth, projected around 5% for 2024, signifies continued economic activity despite external pressures.

Anti-Corruption Campaigns

China's intensified anti-corruption campaigns, particularly those targeting the financial sector, directly impact the Bank of Guizhou. These initiatives mandate enhanced corporate governance and a more cautious risk appetite, pushing financial institutions towards greater transparency and stricter internal compliance. For instance, the Central Commission for Discipline Inspection (CCDI) has been a driving force, with reports in 2023 and early 2024 highlighting significant investigations and disciplinary actions within state-owned enterprises and financial bodies, underscoring the elevated scrutiny.

The implications for the Bank of Guizhou include the necessity for robust internal controls and adherence to increasingly stringent regulatory requirements. This focus on integrity and accountability can lead to a more stable operating environment by mitigating reputational and operational risks. The campaigns encourage a culture of compliance, potentially improving efficiency and long-term sustainability by reducing the likelihood of illicit activities and associated penalties.

- Increased Regulatory Scrutiny: Anti-corruption drives necessitate heightened compliance and reporting for financial institutions like Bank of Guizhou.

- Focus on Governance: Campaigns push for improved corporate governance structures and ethical conduct within the banking sector.

- Risk Appetite Adjustment: A more cautious approach to risk-taking is encouraged to prevent corruption-related losses.

- Enhanced Transparency: Financial institutions are expected to operate with greater openness, particularly in lending and investment decisions.

State Ownership and Influence

The Bank of Guizhou operates with significant state influence, a common characteristic of regional banks in China. This state ownership directly impacts its strategic direction and lending practices, often aligning them with provincial economic development goals rather than purely commercial imperatives. For instance, during 2024, the bank was instrumental in supporting key infrastructure projects within Guizhou province, channeling significant credit to sectors prioritized by the local government. This relationship offers a degree of stability and access to government-backed capital, but can also mean navigating directives that might not align with maximizing shareholder returns in the short term.

This state backing can be a double-edged sword. While it provides a safety net and facilitates access to funding for strategic initiatives, it also subjects the bank to potential policy shifts and regulatory oversight that are more pronounced than for private entities. In 2024, the Bank of Guizhou's lending portfolio reflected this, with a notable increase in loans to state-owned enterprises and projects deemed crucial for regional growth, even if some carried higher perceived risks. This strategic alignment is a key differentiator from purely market-driven financial institutions.

- State Ownership: The Guizhou Provincial State-owned Assets Supervision and Administration Commission (SASAC) holds a substantial stake in the Bank of Guizhou.

- Strategic Alignment: Lending priorities are often shaped by provincial five-year plans and economic development directives.

- Government Support: The bank benefits from implicit and explicit government support, particularly during periods of economic stress or for funding key provincial projects.

- Regulatory Environment: Operates under closer scrutiny from both national and provincial regulatory bodies compared to purely private banks.

China's political landscape, characterized by strong central government control and a focus on economic stability, directly influences the Bank of Guizhou's operational framework. The ongoing emphasis on deleveraging and risk mitigation within the financial sector, a key policy objective throughout 2024, necessitates rigorous compliance and capital management for the bank.

Provincial government directives play a significant role in shaping the Bank of Guizhou's lending strategies, particularly in supporting local economic development initiatives. For instance, in 2024, the bank actively participated in financing projects aligned with Guizhou's five-year plan for industrial upgrading and green development, reflecting the close integration between political objectives and financial support.

The political climate, including international relations and domestic reform agendas, creates both opportunities and challenges. While geopolitical stability generally supports economic growth, trade tensions could indirectly affect the bank's international business and access to foreign capital markets.

The anti-corruption drive within China's financial sector, intensified in 2023 and continuing into 2024, mandates greater transparency and stricter adherence to governance standards for institutions like the Bank of Guizhou, impacting internal controls and risk appetite.

What is included in the product

This PESTLE analysis comprehensively examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting the Bank of Guizhou, offering actionable insights for strategic decision-making.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying the Bank of Guizhou's complex external environment.

Helps support discussions on external risk and market positioning during planning sessions by clearly outlining the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the Bank of Guizhou.

Economic factors

Guizhou province's economic growth is a critical factor for the Bank of Guizhou. In 2023, Guizhou's GDP grew by 4.9%, demonstrating a steady upward trend that directly influences the demand for banking services. This local economic performance, particularly in sectors like big data, advanced manufacturing, and tourism, translates into increased opportunities for corporate lending and a stronger deposit base.

The province's focus on industrial upgrading and investment in infrastructure projects, such as the Guiyang-Nanning High-Speed Railway which opened in 2023, fuels demand for both construction financing and expanded personal banking services. Higher local incomes and business activity, evidenced by a 6.1% increase in retail sales in 2023, bolster the bank's retail loan portfolio and deposit growth.

The People's Bank of China's (PBOC) monetary policy significantly shapes the interest rate environment for institutions like the Bank of Guizhou. As of early 2024, the PBOC has maintained a relatively accommodative stance, with benchmark lending rates like the Loan Prime Rate (LPR) seeing modest adjustments. For instance, the one-year LPR was around 3.45% in early 2024, impacting the bank's lending income.

Fluctuations in these benchmark rates directly influence the Bank of Guizhou's net interest margin. When lending rates rise while deposit rates lag, profitability can expand. Conversely, a widening gap between deposit costs and lending yields, perhaps due to increased competition for deposits, can compress margins. The attractiveness of the bank's savings accounts and loan products is also directly tied to these prevailing rates, influencing customer acquisition and retention.

Inflationary pressures in China, while showing some moderation in late 2024, continue to influence the real value of the Bank of Guizhou's loan portfolio and deposit base. Higher inflation erodes the purchasing power of consumers and can impact corporate profitability, potentially leading to increased loan defaults if businesses struggle to pass on costs. For instance, China's Consumer Price Index (CPI) saw a modest increase in early 2024, which the bank must monitor closely for its effect on borrowers' repayment capacity.

Credit Demand and Supply

In Guizhou, credit demand from both businesses and individuals is influenced by the region's economic outlook and investment sentiment. For instance, during early 2024, reports indicated a moderate uptick in demand for business loans, particularly from sectors benefiting from provincial development initiatives. The Bank of Guizhou’s lending volumes are directly tied to this demand, alongside the supply of credit available through the banking system, which can be affected by monetary policy and capital adequacy ratios.

Regulatory lending quotas and guidelines also play a significant role in shaping the Bank of Guizhou's ability to expand its loan book. These directives can encourage or constrain lending in specific sectors or to certain borrower types. For example, in late 2023, provincial authorities emphasized increased lending to small and medium-sized enterprises (SMEs), a directive that would have directly impacted the Bank of Guizhou's lending strategy and volumes for that period.

- Credit Demand Drivers: Economic confidence and investment appetite among Guizhou's businesses and individuals are key drivers of credit demand.

- Credit Supply Factors: The overall credit supply within the banking system, influenced by monetary policy and interbank lending rates, dictates the Bank of Guizhou's capacity to lend.

- Regulatory Impact: Lending quotas and policy directives, such as those promoting lending to SMEs or key industries, directly shape the Bank of Guizhou's lending volumes and strategic focus.

- Loan Book Expansion: The Bank of Guizhou's ability to grow its loan book is a direct function of its success in meeting market demand while adhering to regulatory frameworks and managing its own risk appetite.

Disposable Income and Consumer Spending

Disposable income levels in Guizhou province directly shape consumer spending, impacting the Bank of Guizhou's retail banking operations. As residents' available funds increase, so does their capacity to engage with personal banking products.

Higher disposable income translates to greater demand for services such as consumer loans for larger purchases, mortgages for property acquisition, and wealth management solutions for investment and savings. This trend is crucial for the Bank of Guizhou's retail segment growth.

Recent data indicates a positive trend in Guizhou's economic development, contributing to rising disposable incomes. For instance, Guizhou's per capita disposable income for residents reached approximately 26,000 RMB in 2023, showing a steady increase. This growth fuels consumer confidence and spending.

- Rising Disposable Income: Guizhou's per capita disposable income has seen consistent growth, empowering residents to spend more.

- Increased Demand for Banking Products: Higher income levels directly correlate with greater uptake of consumer loans, mortgages, and wealth management services.

- Impact on Retail Banking: The Bank of Guizhou's retail segment performance is closely tied to these evolving consumer spending patterns.

- Economic Development Link: Provincial economic progress and improved living standards are key drivers behind these favorable consumer trends.

Guizhou's economic trajectory is vital for Bank of Guizhou, with the province's GDP expanding by 4.9% in 2023, signaling robust growth. This expansion, particularly in burgeoning sectors like big data and advanced manufacturing, directly translates into increased demand for the bank's lending and deposit services.

The province's commitment to infrastructure development, exemplified by the 2023 opening of the Guiyang-Nanning High-Speed Railway, fuels demand for construction financing and broader banking services. Furthermore, a 6.1% rise in retail sales in 2023 indicates growing consumer spending, which bolsters the bank's retail loan portfolio and deposit base.

The People's Bank of China's monetary policy, maintaining an accommodative stance with the one-year Loan Prime Rate around 3.45% in early 2024, directly impacts Bank of Guizhou's net interest margins. Inflationary pressures, while moderating, continue to affect the real value of the bank's assets and borrowers' repayment capacities.

| Economic Indicator | Value | Period | Impact on Bank of Guizhou |

|---|---|---|---|

| Guizhou GDP Growth | 4.9% | 2023 | Increased demand for lending and deposit services |

| Retail Sales Growth | 6.1% | 2023 | Boosts retail loan portfolio and deposit growth |

| One-Year LPR | ~3.45% | Early 2024 | Influences net interest margin |

| Per Capita Disposable Income | ~26,000 RMB | 2023 | Drives demand for retail banking products |

Preview Before You Purchase

Bank of Guizhou PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis of the Bank of Guizhou. This detailed report covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the bank's operations and strategic decisions. You'll gain valuable insights into the external landscape shaping the Bank of Guizhou's future.

Sociological factors

Guizhou province continues to experience significant urbanization, with a considerable portion of its population transitioning from rural to urban centers. This internal migration reshapes the demographic landscape, directly impacting the Bank of Guizhou's customer base by increasing the concentration of potential clients in cities and towns.

As of the end of 2023, China's urbanization rate reached 66.16%, a figure that continues to climb and reflects broad trends applicable to Guizhou's development. This shift necessitates that the Bank of Guizhou adapt its service offerings and branch network to cater to the evolving needs of an urbanized population, which typically demands more sophisticated financial products and digital banking solutions.

The migration patterns within Guizhou also influence regional demand for financial services. Areas experiencing net out-migration may see a decline in demand for traditional banking services, while rapidly growing urban hubs will likely witness an increased demand for loans, investment products, and wealth management services, presenting both challenges and opportunities for the bank.

Consumer financial behavior in China is rapidly evolving, with a significant lean towards digital banking. By the end of 2024, mobile payment penetration in urban areas is projected to exceed 90%, driven by convenience and accessibility. This necessitates that the Bank of Guizhou enhances its digital platforms, including robust mobile banking applications and secure online payment gateways, to meet customer expectations for seamless transactions and personalized services.

Customer preferences are increasingly shaped by the demand for instant gratification and integrated financial solutions. In 2024, over 75% of younger consumers (18-35) in China prefer digital channels for most banking needs, from account management to loan applications. The Bank of Guizhou must therefore invest in user-friendly interfaces and innovative digital products, such as AI-powered financial advice and contactless payment options, to remain competitive and attract this crucial demographic.

The Bank of Guizhou must consider the prevailing financial literacy levels within its operating region. A significant portion of the population may require tailored educational programs to understand and utilize banking services effectively. For instance, initiatives focusing on basic savings, digital banking, and loan management could be crucial for expanding reach into underserved communities.

China's national push for financial inclusion, which aims to bring more citizens into the formal financial system, presents a key opportunity. By developing accessible products and providing clear guidance, the Bank of Guizhou can tap into a larger customer base. Data from the People's Bank of China's 2023 financial literacy survey indicated that while urban financial literacy is higher, rural areas still present challenges, suggesting a need for targeted outreach.

Aging Population Trends

China's demographic shift towards an aging population presents significant opportunities and challenges for the Bank of Guizhou. By 2023, China's population aged 65 and above reached approximately 216.76 million, representing 15.4% of the total population. This trend is particularly pronounced in regions like Guizhou, which historically has had a higher proportion of rural and elderly residents.

This aging demographic directly influences the demand for specific financial products. The Bank of Guizhou can anticipate increased demand for retirement planning services, wealth management solutions tailored for seniors, and financial products supporting elder care facilities and services. For instance, the growth in pension funds and the need for long-term care insurance are expected to rise substantially in the coming years.

- Increased Demand for Retirement Products: As more individuals enter retirement age, the market for pension plans, annuities, and investment products focused on capital preservation and steady income will expand.

- Growth in Wealth Management for Seniors: Financial institutions will need to offer specialized wealth management services catering to the unique needs of older clients, including estate planning and healthcare expense management.

- Elder Care Financing: The bank can explore opportunities in financing elder care homes, medical facilities, and related services, aligning its product development with the growing need for senior support.

Cultural Attitudes Towards Debt and Savings

Cultural attitudes towards debt and savings in China, and specifically in Guizhou, significantly shape financial behaviors. While traditional values often emphasize thrift and saving, modern economic development has seen a rise in credit acceptance, particularly among younger generations. This evolving landscape directly impacts how consumers interact with financial institutions like the Bank of Guizhou.

For instance, a 2023 survey indicated that while a majority of Chinese households still prioritize savings, the proportion of those willing to take on consumer loans for significant purchases has increased. This trend suggests a growing comfort with leveraging debt, which can be beneficial for banks offering credit products.

- Growing Acceptance of Credit: Younger Chinese demographics, influenced by global trends, show a greater willingness to use credit for lifestyle upgrades and major purchases.

- Persistent Savings Culture: Despite increased credit use, a strong cultural emphasis on saving for future security and unexpected events remains prevalent, driving deposit growth for banks.

- Regional Variations: Attitudes can differ regionally, with urban centers often adopting new financial behaviors faster than more traditional, rural areas within Guizhou.

- Influence on Bank Engagement: These cultural nuances dictate consumer preferences for deposit accounts versus loan products and influence their overall trust and engagement with banking services.

China's demographic shifts, particularly the aging population and evolving consumer behaviors, present distinct opportunities for the Bank of Guizhou. With China's elderly population exceeding 216 million by the end of 2023, there's a growing demand for specialized financial products like retirement planning and wealth management for seniors. Furthermore, the increasing acceptance of credit, especially among younger consumers, alongside a persistent savings culture, shapes how the bank can tailor its offerings.

Technological factors

The Bank of Guizhou must prioritize investment in digital banking technologies to stay competitive. Online and mobile platforms are essential for enhancing customer experience and operational efficiency.

By adopting these digital solutions, the bank can extend its reach beyond physical branches, a critical move in a market where digital engagement is increasingly the norm. For instance, by mid-2024, over 80% of banking transactions in China were conducted digitally, highlighting the imperative for traditional institutions to adapt.

FinTech innovation is fundamentally reshaping the financial landscape, presenting both challenges and opportunities for the Bank of Guizhou. The rise of agile FinTech firms offering specialized services in areas like digital payments, peer-to-peer lending, and robo-advisory necessitates a strategic response. For instance, the global FinTech market was projected to reach $33.5 billion in 2024, highlighting the significant investment and growth in this sector.

To remain competitive, the Bank of Guizhou must actively engage with this evolving ecosystem. This could involve developing its own proprietary digital platforms for payments and wealth management, mirroring successful FinTech offerings. Alternatively, strategic partnerships or acquisitions of FinTech startups could accelerate innovation and broaden service portfolios, ensuring the bank can attract and retain customers in an increasingly digital-first environment.

The Bank of Guizhou must prioritize robust cybersecurity and stringent data privacy protocols. Protecting customer data and financial transactions from evolving cyber threats is paramount for maintaining customer trust and regulatory compliance.

In 2024, the global financial sector experienced a significant rise in sophisticated cyberattacks, with the average cost of a data breach reaching $4.45 million according to IBM's 2024 Cost of a Data Breach Report. This underscores the critical need for the Bank of Guizhou to invest heavily in advanced security measures to safeguard its digital infrastructure and sensitive customer information.

Big Data Analytics and AI

Big data analytics and AI are transforming the banking landscape, offering the Bank of Guizhou significant opportunities. Leveraging these technologies can lead to more accurate risk assessments, enabling better lending decisions. For instance, by analyzing vast datasets, the bank can identify subtle patterns indicative of potential defaults, a crucial capability in the evolving economic climate of 2024-2025. AI-powered tools can also personalize customer interactions, boosting satisfaction and loyalty. The Bank of Guizhou can use AI to offer tailored financial products and advice, differentiating itself in a competitive market.

Furthermore, the application of AI and big data is paramount for enhancing fraud detection and operational efficiency. Real-time transaction monitoring powered by AI can flag suspicious activities instantly, protecting both the bank and its customers. In 2024, financial institutions globally are investing heavily in these areas; for example, the global AI in banking market was projected to reach over $20 billion by 2025, indicating a strong trend towards AI adoption. The Bank of Guizhou can achieve a competitive edge by integrating these advanced analytical capabilities into its core operations.

- Enhanced Risk Assessment: AI algorithms can process complex financial data to predict creditworthiness and market volatility more effectively.

- Personalized Customer Service: Big data analytics allows for tailored product offerings and proactive customer support, increasing engagement.

- Fraud Detection: AI-driven anomaly detection systems can identify and prevent fraudulent transactions in real-time, safeguarding assets.

- Operational Efficiency: Automation of routine tasks and data analysis through AI can streamline processes and reduce operational costs.

Blockchain and Distributed Ledger Technology

Blockchain and Distributed Ledger Technology (DLT) are poised to significantly reshape the banking landscape. These technologies offer enhanced security and transparency, potentially revolutionizing areas like cross-border payments, which currently face inefficiencies and higher costs. In 2024, the global blockchain in banking market was valued at approximately $2.1 billion, with projections indicating substantial growth. The Bank of Guizhou could explore DLT for streamlining trade finance processes, reducing settlement times and counterparty risk.

The adoption of DLT presents opportunities for improved digital asset management and the creation of more efficient clearing and settlement systems. By preparing for these advancements, the Bank of Guizhou can position itself to leverage these technologies for greater operational efficiency and enhanced security. For instance, exploring pilot programs for DLT-based interbank settlements could be a strategic first step.

- Revolutionizing Payments: DLT can enable faster, cheaper, and more secure cross-border transactions, a key area for improvement in global finance.

- Transforming Trade Finance: Blockchain can digitize and automate trade finance documentation, reducing fraud and processing times.

- Digital Asset Management: DLT provides a secure framework for managing and trading digital assets, opening new revenue streams for banks.

The Bank of Guizhou must embrace digital transformation, investing in online and mobile platforms to enhance customer experience and operational efficiency, especially as digital transactions in China exceeded 80% by mid-2024.

FinTech innovation, with the global market projected to reach $33.5 billion in 2024, necessitates strategic adaptation, potentially through proprietary platforms or partnerships, to remain competitive.

Robust cybersecurity is critical, with global financial sector cyberattacks costing an average of $4.45 million per breach in 2024, highlighting the need for advanced security measures.

AI and big data analytics offer opportunities for improved risk assessment and personalized customer service, with the global AI in banking market expected to exceed $20 billion by 2025.

Legal factors

The Bank of Guizhou operates within China's stringent banking regulatory framework, primarily overseen by the National Financial Regulatory Administration (NFRA) and the People's Bank of China (PBOC). These bodies set critical prudential standards, including capital adequacy ratios, liquidity requirements, and loan-to-deposit limits, which directly shape the bank's risk management and operational strategies. For instance, China's banking sector maintained an average capital adequacy ratio of 14.0% as of the end of Q1 2024, well above the Basel III minimum of 10.5%, indicating a generally well-capitalized system that the Bank of Guizhou must adhere to.

Bank of Guizhou faces stringent legal mandates under Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) laws. These regulations require the bank to establish robust internal controls, including thorough customer due diligence and ongoing transaction monitoring, to detect and report suspicious activities. Failure to comply can result in severe penalties, impacting financial stability and reputation.

In 2024, China's financial regulators continued to emphasize AML/CTF compliance. Banks like Bank of Guizhou are expected to invest heavily in technology and training to meet these evolving standards. For instance, the People's Bank of China (PBOC) has been enhancing its oversight, with a focus on digital financial services where AML/CTF risks can be amplified.

Consumer protection laws in China significantly shape the Bank of Guizhou's operations by mandating transparency in product offerings and clear disclosure requirements. These regulations, such as those enforced by the China Banking and Insurance Regulatory Commission (CBIRC), aim to safeguard depositors and borrowers, influencing everything from loan terms to fee structures. For instance, the Personal Financial Information Protection Law, effective from November 1, 2021, imposes strict rules on data handling, requiring explicit consent for data usage and imposing penalties for breaches, which the Bank of Guizhou must meticulously adhere to. This legal framework directly impacts customer trust and the bank's ability to minimize potential legal disputes by ensuring fair lending practices and robust complaint resolution mechanisms.

Data Privacy and Cybersecurity Laws

China's legal framework for data privacy and cybersecurity is rapidly evolving, significantly influencing financial institutions like the Bank of Guizhou. Compliance with the Cybersecurity Law and the Personal Information Protection Law (PIPL) is paramount. These laws dictate how customer data can be collected, stored, processed, and transferred, directly impacting the bank's technological infrastructure and operational procedures.

The PIPL, effective from November 1, 2021, imposes stringent requirements on data handling, including obtaining explicit consent for data processing and implementing robust security measures. For instance, cross-border data transfers require specific assessments and approvals, adding complexity to international operations. The Cybersecurity Law, enacted in 2017, mandates network operators to implement security protections and report incidents, underscoring the critical need for the Bank of Guizhou to maintain high cybersecurity standards.

- Cybersecurity Law (2017): Requires network operators to implement security measures and report breaches.

- Personal Information Protection Law (PIPL) (2021): Sets strict rules for data collection, consent, and cross-border transfers.

- Impact on Operations: Mandates significant investment in data security technologies and compliance protocols.

- Customer Trust: Adherence to these laws is crucial for maintaining customer confidence and avoiding substantial penalties.

Contract Law and Dispute Resolution

Contract law in China, including the framework governing the Bank of Guizhou's operations, ensures that lending agreements, deposit contracts, and other financial transactions are legally enforceable. The legal system provides established mechanisms for resolving commercial disputes, offering recourse for contract breaches and ensuring the integrity of financial dealings.

The enforcement of contracts is crucial for financial institutions like the Bank of Guizhou. China's judicial system, including arbitration bodies, plays a key role in mediating and adjudicating disputes, providing a predictable environment for banking operations. For instance, in 2023, Chinese courts handled millions of commercial cases, demonstrating the active legal landscape for contract enforcement.

- Contractual Validity: All financial agreements entered into by the Bank of Guizhou are subject to China's Contract Law, ensuring they are legally binding and enforceable.

- Dispute Resolution Mechanisms: The bank can utilize formal legal proceedings or alternative dispute resolution methods like arbitration to resolve contractual disagreements.

- Enforcement Environment: China's commitment to strengthening its legal framework supports the reliable enforcement of financial contracts, vital for investor confidence.

Legal factors significantly shape the Bank of Guizhou's operational landscape, particularly concerning regulatory compliance and data protection. Adherence to China's stringent banking regulations, overseen by bodies like the NFRA and PBOC, is paramount, with requirements for capital adequacy and liquidity impacting financial strategies. For example, China's banking sector maintained an average capital adequacy ratio of 14.0% in Q1 2024, exceeding the Basel III minimum, a standard the Bank of Guizhou must meet.

The bank must also navigate robust Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) laws, necessitating significant investment in compliance technology and training. Furthermore, consumer protection laws, including the Personal Financial Information Protection Law (PIPL) effective since November 2021, mandate transparency and secure data handling, directly influencing customer interactions and operational procedures. The Cybersecurity Law of 2017 also imposes strict security protocols, underscoring the need for continuous investment in cybersecurity measures to maintain customer trust and avoid penalties.

| Legal Factor | Key Regulations | Impact on Bank of Guizhou | Example/Data (2024/2025) |

|---|---|---|---|

| Regulatory Compliance | Banking Law, NFRA/PBOC Directives | Adherence to capital adequacy, liquidity, and lending standards. | Average CAR in China's banking sector: 14.0% (Q1 2024). |

| AML/CTF | Anti-Money Laundering Law | Mandates robust internal controls, customer due diligence, and transaction monitoring. | Increased regulatory focus on digital financial services' AML/CTF risks. |

| Data Privacy & Cybersecurity | PIPL (2021), Cybersecurity Law (2017) | Strict data handling, consent requirements, and security protocols. | PIPL governs cross-border data transfers, requiring specific assessments. |

| Contract Law | Contract Law of the PRC | Ensures enforceability of financial agreements and provides dispute resolution mechanisms. | Millions of commercial cases handled by Chinese courts annually, ensuring contract enforcement. |

Environmental factors

China's commitment to environmental sustainability is driving significant growth in green finance. By the end of 2023, outstanding green loans in China reached approximately 31.45 trillion yuan, a 20.3% increase year-on-year, reflecting robust policy support. The Bank of Guizhou is therefore incentivized to align its lending practices with these national directives, actively supporting projects that contribute to carbon reduction and ecological preservation.

This focus translates into opportunities for the Bank of Guizhou to develop specialized green financial products, such as green bonds or loans for renewable energy and sustainable agriculture. Such initiatives not only support the government's environmental goals but also position the bank to tap into a rapidly expanding market segment, fostering a more sustainable economic development within Guizhou province.

The Bank of Guizhou faces growing expectations to integrate Environmental, Social, and Governance (ESG) principles into its operations and reporting. This means the bank will likely need to assess and disclose its environmental footprint, commitment to social responsibility, and governance structures to stakeholders and regulatory bodies.

For instance, China's financial sector, including regional banks like Bank of Guizhou, is increasingly aligning with national sustainability goals. By the end of 2023, green loans in China reached over 30 trillion yuan, indicating a significant push towards environmentally conscious financing that the Bank of Guizhou will need to navigate and potentially contribute to through its own ESG disclosures.

Climate change presents significant risks to the Bank of Guizhou. Physical risks, such as increased frequency of extreme weather events like floods or droughts in Guizhou province, could directly impact borrowers' ability to repay loans, particularly in agriculture and tourism sectors. For instance, reports from 2023 indicated substantial economic losses in China due to natural disasters, a trend expected to continue.

Transition risks are also a concern. As China advances its carbon neutrality goals, industries heavily reliant on fossil fuels within Guizhou's economy may face stricter regulations, increased operational costs, or reduced demand. This could lead to a deterioration in the asset quality of loans extended to these sectors, potentially affecting the bank's overall financial stability.

Resource Scarcity and Pollution Concerns

Resource scarcity and pollution are significant environmental challenges impacting Guizhou province and China broadly. These issues directly affect the Bank of Guizhou's corporate clients, especially those in sectors like mining, manufacturing, and energy production, which are often resource-intensive and can contribute to pollution.

For instance, stricter environmental regulations aimed at curbing pollution could increase operational costs for these businesses, potentially weakening their financial health and their capacity to service existing loans. In 2023, China intensified its efforts to control industrial pollution, with significant investments in environmental protection technologies and stricter enforcement of emission standards.

- Increased operational costs: Companies in Guizhou's key industries, such as coal mining and heavy manufacturing, face higher expenses for compliance with new environmental standards, potentially impacting profitability and loan repayment ability.

- Supply chain disruptions: Scarcity of key resources, like water or certain minerals, could disrupt production cycles for clients, affecting their revenue streams and creditworthiness.

- Asset devaluation: Assets in heavily polluting industries may face devaluation or become stranded as environmental policies evolve, increasing the bank's exposure to non-performing loans.

- Shift to green finance: The bank may see increased demand for loans supporting environmentally friendly projects, requiring adaptation in its lending strategies and risk assessment frameworks.

Sustainable Development Goals (SDGs) Alignment

The Bank of Guizhou's strategies are increasingly influenced by the global and national commitment to the Sustainable Development Goals (SDGs). This alignment means prioritizing investments and business practices that support environmental protection and sustainable economic growth within Guizhou province. For instance, by channeling funds into green energy projects or sustainable agriculture, the bank directly contributes to SDG 7 (Affordable and Clean Energy) and SDG 2 (Zero Hunger).

This focus on SDGs enhances the bank's corporate social responsibility (CSR) image and can attract environmentally conscious investors. In 2024, China's commitment to carbon neutrality goals, aiming for peak emissions before 2030 and neutrality before 2060, provides a strong national framework for such alignment. The Bank of Guizhou's lending portfolio for green projects saw a significant increase in the first half of 2024, reaching approximately 15% of its total new loans, up from 10% in the same period of 2023.

- SDG Alignment: The bank is actively integrating SDGs into its lending and investment decisions, particularly those concerning environmental sustainability.

- Green Finance Growth: In early 2024, green finance constituted around 15% of new loans, demonstrating a clear shift towards sustainable projects.

- CSR Enhancement: This strategic direction bolsters the bank's reputation and appeal to stakeholders committed to environmental, social, and governance (ESG) principles.

- National Policy Support: China's ambitious carbon reduction targets provide a supportive policy environment for the bank's sustainable development initiatives.

China's robust push for environmental sustainability, evidenced by a 20.3% year-on-year increase in green loans to 31.45 trillion yuan by the end of 2023, directly influences the Bank of Guizhou.

The bank is increasingly expected to integrate ESG principles, with green finance comprising 15% of its new loans in early 2024, up from 10% in early 2023.

This strategic shift aligns with national carbon neutrality goals and presents opportunities for specialized green financial products, while also necessitating careful management of climate-related physical and transition risks.

| Environmental Factor | Impact on Bank of Guizhou | Data/Trend (2023-2024) |

|---|---|---|

| Green Finance Growth | Increased demand for green loans and products | Outstanding green loans in China reached 31.45 trillion yuan by end-2023 (+20.3% YoY). Bank of Guizhou's green loans were 15% of new loans in early 2024 (vs. 10% in early 2023). |

| Climate Change Risks | Potential for increased non-performing loans due to extreme weather and regulatory shifts | China experienced significant economic losses from natural disasters in 2023. Transition risks from carbon policies could impact fossil fuel-reliant sectors. |

| Resource Scarcity & Pollution | Higher operational costs and supply chain disruptions for corporate clients | Intensified pollution control efforts in China in 2023; stricter regulations increase compliance costs for industries like mining and manufacturing. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Bank of Guizhou is built on a comprehensive review of official government publications from China and Guizhou province, economic data from reputable financial institutions like the People's Bank of China, and industry-specific reports on the banking sector.