Bank of Guizhou Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank of Guizhou Bundle

The Bank of Guizhou operates within a dynamic financial landscape, facing significant pressures from rivals and the evolving needs of its customers. Understanding the intensity of these forces is crucial for navigating its competitive environment effectively.

The complete report reveals the real forces shaping Bank of Guizhou’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of depositors for Bank of Guizhou is typically viewed as moderate to high. Large institutional depositors can exert significant influence, often negotiating for more favorable interest rates.

Retail depositors, particularly in a market characterized by low interest rates, also possess considerable power. They can readily switch to financial institutions offering superior yields or enhanced services, intensifying competition for funding.

Efforts by Chinese authorities to cap deposit rate ceilings in 2024 aimed to bolster bank profit margins. However, this regulatory move has not entirely diminished the competitive landscape for acquiring deposits.

The bargaining power of technology providers for banks like Bank of Guizhou is on the rise. As financial institutions increasingly depend on sophisticated IT infrastructure, robust cybersecurity, and advanced data analytics, these suppliers gain leverage. For instance, specialized fintech solutions and core banking systems can carry substantial switching costs, making it difficult and expensive for banks to change providers. This growing reliance is evident as banks continue to boost their technology investments; in 2023, global IT spending by banks was projected to reach over $200 billion, highlighting this dependence.

The bargaining power of skilled labor, especially in finance, tech, and data, is significant. Regional banks like Bank of Guizhou face intense competition from major national banks and agile fintech companies for these in-demand professionals.

This competition drives up wages and benefits, impacting operational costs for institutions like Bank of Guizhou. For instance, in 2024, the average salary for a data scientist in China's financial sector saw an estimated 15-20% increase year-over-year, reflecting this talent scarcity.

Retaining this specialized talent is paramount for Bank of Guizhou to foster innovation, enhance risk management capabilities, and maintain a competitive edge in the evolving financial landscape.

Interbank Market and Funding Sources

The interbank market is a critical source of liquidity and short-term funding for banks like the Bank of Guizhou. Financial institutions that lend to this market, effectively acting as suppliers of funds, wield significant bargaining power. The cost and availability of these essential funds are directly shaped by the People's Bank of China's monetary policy decisions, such as adjustments to benchmark interest rates and reserve requirements.

In 2024, the People's Bank of China continued to implement accommodative monetary policies to support economic growth. For instance, the central bank maintained relatively low benchmark lending rates, which generally translates to lower funding costs in the interbank market. However, the specific rates and conditions can fluctuate based on overall market liquidity and demand for funds.

Smaller banks, often having less stable deposit bases, tend to be more reliant on the interbank market for their funding needs. This increased dependence can amplify the bargaining power of larger, more liquid financial institutions that supply funds through this channel. The ability to access these funds at competitive rates is paramount for maintaining operational stability and profitability.

- Interbank Market as a Supplier The interbank market provides essential liquidity and short-term funding, making other financial institutions suppliers to banks like Bank of Guizhou.

- PBOC's Influence Monetary policies from the People's Bank of China, including interest rate adjustments and reserve ratio changes, directly impact the cost and availability of interbank funds, thereby influencing supplier bargaining power.

- Reliance of Smaller Banks Smaller financial institutions often exhibit a greater dependence on interbank funding, which can increase their vulnerability to the bargaining power of larger, more liquid market participants.

Regulators and Policy Makers

Regulators like the National Financial Regulatory Administration (NFRA) and the People's Bank of China (PBOC) significantly influence banks, including the Bank of Guizhou. These bodies set capital requirements and dictate permissible activities, directly affecting a bank's operational costs and strategic choices.

Policies on capital adequacy ratios, for instance, can force banks to retain more earnings or seek additional capital, impacting profitability and growth. In 2024, China's banking sector maintained robust capital adequacy, with the average capital adequacy ratio for commercial banks standing at 14.3% as of the end of the third quarter, according to the NFRA.

- Regulatory Influence: The NFRA and PBOC's directives on loan quality and risk management shape lending practices and provisioning needs.

- Cost Impact: Compliance with evolving regulations, such as those related to anti-money laundering and data security, adds to operational expenses.

- Strategic Constraints: Deposit rate ceilings or restrictions on certain financial products limit a bank's ability to compete and innovate, thereby affecting its revenue potential.

The bargaining power of suppliers to Bank of Guizhou, particularly those providing essential technology and data services, is notably strong. As digital transformation accelerates, banks are increasingly reliant on specialized fintech solutions and robust cybersecurity, leading to higher switching costs and greater supplier leverage. In 2023, global banks' IT spending exceeded $200 billion, underscoring this dependency.

Furthermore, the market for skilled financial and tech talent presents another significant supplier dynamic. Intense competition from larger financial institutions and agile fintech firms drives up compensation, impacting operational costs for regional banks like Bank of Guizhou. The average salary for data scientists in China's financial sector saw an estimated 15-20% year-over-year increase in 2024.

The interbank market also acts as a crucial supplier of liquidity, with larger, more liquid institutions wielding considerable power. The People's Bank of China's monetary policies, such as maintaining low benchmark lending rates in 2024, influence funding costs, though market liquidity and demand remain key determinants.

| Supplier Type | Bargaining Power Level | Key Factors Influencing Power | Example Data/Trend (2023-2024) |

|---|---|---|---|

| Technology Providers | High | High switching costs, increasing reliance on specialized solutions, cybersecurity needs | Global banks' IT spending > $200 billion (2023) |

| Skilled Labor (Finance/Tech) | Significant | Intense competition, talent scarcity, rising wage demands | Data scientist salaries in China's finance sector up 15-20% YoY (2024) |

| Interbank Market Lenders | Moderate to High | Liquidity provision, reliance of smaller banks, PBOC monetary policy | PBOC maintained accommodative policies, low benchmark lending rates (2024) |

What is included in the product

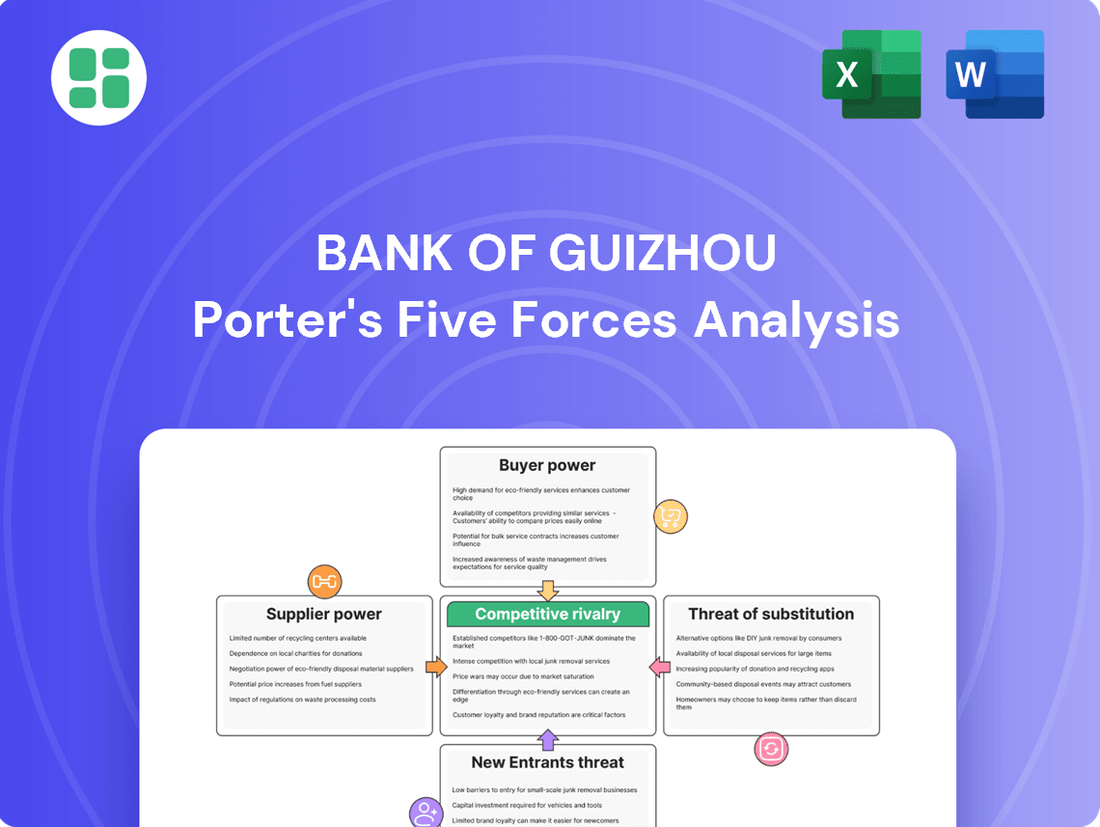

Tailored exclusively for Bank of Guizhou, analyzing its position within its competitive landscape by evaluating the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes.

Effortlessly identify and mitigate competitive threats by visualizing the Bank of Guizhou's Porter's Five Forces, providing actionable insights for strategic advantage.

Customers Bargaining Power

Retail customers, both depositors and borrowers, wield moderate bargaining power. This is largely due to the competitive landscape, which includes numerous regional banks, major state-owned institutions, and increasingly, digital financial service providers. For instance, as of early 2024, the People's Bank of China continues to guide benchmark lending rates, offering a basis for comparison across institutions.

The ease with which customers can compare interest rates on savings accounts and loans significantly influences their decisions. Furthermore, the proliferation of digital banking platforms has dramatically reduced the costs and effort associated with switching banks. This digital shift means customers are more attuned to competitive pricing and the overall quality of service offered by institutions like the Bank of Guizhou.

Corporate clients, particularly large enterprises and state-owned entities, wield significant bargaining power with the Bank of Guizhou. Their substantial transaction volumes allow them to negotiate more favorable terms on loans, treasury services, and other financial products, potentially impacting the bank's profitability on these relationships. For instance, in 2023, large corporate clients accounted for a significant portion of the bank's loan portfolio, giving them leverage in pricing and service agreements.

Government and public sector entities in Guizhou province represent a substantial customer base for the Bank of Guizhou. Their significant deposit volumes and borrowing requirements, particularly for local development initiatives, grant them considerable leverage. This influence can impact the bank's lending priorities and overall strategic planning.

Wealth Management and Investment Clients

Wealth management and investment clients at Bank of Guizhou wield considerable bargaining power. Their ability to allocate substantial assets means financial institutions must compete fiercely for their business. In 2024, the global wealth management market saw continued growth, with many clients actively seeking the best returns and personalized services, putting pressure on banks like Guizhou to offer competitive fee structures and innovative investment products.

These clients have a wide array of choices, from global private banks to specialized asset management firms. This broad accessibility forces Bank of Guizhou to differentiate itself through superior service, better investment performance, and attractive pricing. For instance, clients can easily compare offerings, and a perceived lack of value can lead to swift asset transfers, as evidenced by the increasing client mobility seen across the financial sector in recent years.

- High Asset Allocation Potential: Clients with significant investable assets can move large sums, increasing their leverage.

- Access to Alternatives: The availability of numerous financial providers means clients can easily switch for better terms or specialized products.

- Demand for Performance: Clients expect high returns, pushing banks to offer sophisticated and profitable investment strategies.

- Information Availability: Increased transparency and readily available market data empower clients to make informed comparisons and demands.

Digital-Savvy Customers

The growing number of digitally adept customers significantly amplifies their bargaining power. These customers, increasingly favoring online and mobile banking platforms, demand intuitive digital services, attractive interest rates, and tailored financial solutions. This trend compels institutions like the Bank of Guizhou to prioritize digital innovation to both retain its existing customer base and attract new clientele.

For instance, by mid-2024, it's projected that over 70% of banking transactions in China will be conducted digitally, a substantial increase from previous years. This shift means customers have more options and can easily compare offerings from various banks based on digital convenience and pricing.

- Digital Adoption: A rising percentage of customers, particularly younger demographics, prefer digital channels for banking.

- Service Expectations: Customers expect seamless, user-friendly online and mobile experiences.

- Price Sensitivity: Digital channels facilitate easier comparison of rates and fees, increasing price sensitivity.

- Competitive Landscape: The ease of switching banks digitally empowers customers to seek better value propositions.

Customers' bargaining power with the Bank of Guizhou is generally moderate to high, influenced by market competition and digital advancements. Retail clients can easily compare rates and services, while large corporate clients leverage their transaction volumes to negotiate favorable terms, impacting the bank's profitability. Government entities also hold significant sway due to their substantial deposit and borrowing needs.

| Customer Segment | Bargaining Power Level | Key Influencing Factors |

|---|---|---|

| Retail Customers | Moderate | Ease of rate comparison, digital platform adoption, competitive landscape |

| Corporate Clients | High | Large transaction volumes, negotiation leverage on loan pricing and services |

| Government/Public Sector | High | Significant deposit volumes, borrowing requirements for development initiatives |

| Wealth Management Clients | Considerable | High asset allocation, access to alternative providers, demand for performance |

Same Document Delivered

Bank of Guizhou Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details the Bank of Guizhou's Porter's Five Forces Analysis, covering the bargaining power of buyers, the threat of new entrants, the threat of substitute products or services, the bargaining power of suppliers, and the intensity of rivalry among existing competitors.

Rivalry Among Competitors

Bank of Guizhou contends with significant rivalry from other regional and city commercial banks operating within Guizhou province and adjacent areas. These competitors frequently vie for the same customer bases, offering similar financial products and services. This overlap intensifies price-based competition, especially in crucial areas like attracting deposits and providing loans.

The six largest state-owned commercial banks in China, such as ICBC, CCB, ABC, and BoC, collectively command a substantial market share, leveraging their vast branch networks, robust capital bases, and comprehensive product portfolios. While Bank of Guizhou concentrates its efforts locally, these national giants present a formidable competitive challenge, particularly for larger corporate clients and high-net-worth individuals seeking a wider array of financial services and potentially more favorable terms.

Fintech companies and digital banks are significantly upping the ante in the financial services landscape, presenting a formidable challenge to established institutions like Bank of Guizhou. Their agility allows them to introduce cutting-edge, user-friendly, and frequently more affordable services. For instance, by mid-2024, the global fintech market was projected to reach over $1.5 trillion, demonstrating its substantial scale and influence.

These digital disruptors are particularly adept at carving out market share in areas such as payment processing, personal loans, and investment management. Their ability to bypass the overheads of traditional brick-and-mortar branches gives them a cost advantage. In China, digital payment platforms saw a surge in users, with mobile payment transaction volumes in 2024 expected to continue their upward trajectory, impacting traditional banking transaction revenues.

Consequently, Bank of Guizhou must prioritize and accelerate its own digital transformation initiatives to remain competitive. This includes enhancing its online and mobile banking platforms, exploring partnerships with fintech firms, and developing new digital-first products. Failure to adapt could lead to a gradual erosion of its customer base and market relevance.

Narrowing Net Interest Margins (NIM)

The Bank of Guizhou, like many Chinese regional banks, faces heightened competitive rivalry stemming from narrowing net interest margins (NIMs). This compression is largely driven by policy rate cuts and aggressive competition for both deposits and loans across the sector. Banks are thus compelled to compete more fiercely for market share and revenue in a low-interest-rate environment.

- Narrowing NIMs: In 2023, China's average NIM for commercial banks fell to approximately 1.73%, down from 1.91% in 2022, reflecting the impact of rate cuts and increased competition.

- Deposit Competition: Banks are increasingly offering higher deposit rates to attract and retain customers, which directly impacts their funding costs and NIMs.

- Loan Market Pressure: Intense competition for borrowers, coupled with a slowing economy, has led to lower lending rates, further squeezing profitability and intensifying rivalry among institutions like the Bank of Guizhou.

Economic Slowdown and Property Market Challenges

A subdued macroeconomic environment and the ongoing property market downturn in China are intensifying competitive rivalry among banks. This challenging backdrop means banks are fiercely competing for a shrinking pool of profitable business.

Slower credit expansion and weaker demand for loans force financial institutions to vie more aggressively for quality assets. This increased competition naturally elevates credit risks as banks may lower lending standards to secure business.

In 2023, China's property sector experienced significant headwinds, with a notable decline in new home sales and investment. For instance, property investment fell by 9.6% year-on-year in 2023, according to the National Bureau of Statistics. This contraction directly impacts banks' loan portfolios, particularly those heavily exposed to real estate developers and related industries.

The competitive landscape is further strained by:

- Increased competition for deposits: As loan demand softens, banks focus on securing stable funding sources, driving up deposit rates and compressing net interest margins.

- Asset quality concerns: The property market slump raises the specter of non-performing loans, forcing banks to be more cautious and selective in their lending, thereby intensifying competition for sound borrowers.

- Regulatory pressures: While not directly a competitive force, regulatory guidance on risk management and capital adequacy can influence lending strategies, indirectly shaping competitive dynamics.

Competitive rivalry for Bank of Guizhou is intense, fueled by both established national players and agile fintech innovators. The pressure is amplified by narrowing net interest margins, a trend evident in the drop of China's average commercial bank NIM to approximately 1.73% in 2023. This forces institutions like Bank of Guizhou into fiercer competition for deposits and loans, impacting profitability.

The subdued macroeconomic climate, particularly the downturn in China's property sector, where investment fell 9.6% year-on-year in 2023, exacerbates this rivalry. Banks are aggressively competing for a smaller pool of quality borrowers, potentially leading to lower lending standards and increased credit risk.

| Competitor Type | Key Characteristics | Impact on Bank of Guizhou |

| Regional & City Banks | Similar product offerings, local focus | Direct competition for customer base, price wars on deposits/loans |

| Large State-Owned Banks (e.g., ICBC, CCB) | Vast networks, strong capital, broad services | Dominance in corporate and HNW segments, challenging for larger deals |

| Fintech & Digital Banks | Agile, user-friendly, cost-efficient digital services | Disruption in payments, personal loans; erosion of traditional transaction revenue |

SSubstitutes Threaten

Fintech payment platforms, such as Alipay and WeChat Pay, represent a substantial threat of substitution to traditional banking payment services. These digital wallets provide seamless, integrated experiences for everyday transactions, diminishing the necessity for individuals and small enterprises to rely solely on bank accounts and traditional transfer methods.

In 2024, the global digital payments market is projected to reach over $11.5 trillion, highlighting the significant adoption of these alternative payment solutions. This widespread use directly challenges banks’ traditional revenue streams from transaction fees and account maintenance.

Larger corporations often bypass traditional bank lending by issuing bonds or selling stock directly in capital markets. In 2024, global bond issuance reached significant figures, providing substantial alternative funding avenues. This trend directly diminishes the demand for corporate banking services, impacting institutions like Bank of Guizhou.

Shadow banking and unregulated lending pose a significant threat of substitution for traditional banks like Bank of Guizhou. These channels, often operating with less oversight, can attract borrowers seeking quicker approvals or more accommodating terms than regulated institutions offer. For instance, in 2023, the total assets of China's shadow banking sector were estimated to be substantial, though precise, up-to-the-minute figures are subject to regulatory definitions and data availability.

This informal financial ecosystem can siphon off a portion of the loan market, particularly from small and medium-sized enterprises or individuals with less-than-perfect credit histories. While these substitute avenues often carry higher risks, their flexibility can be a powerful draw, potentially impacting the Bank of Guizhou's market share and profitability.

Peer-to-Peer (P2P) Lending and Online Micro-Lending

Peer-to-peer (P2P) lending and online micro-lending platforms represent a significant threat of substitutes for traditional banking services, including those offered by the Bank of Guizhou. Despite regulatory challenges in China, these digital credit providers offer swift and convenient loan options, directly competing with banks for consumer and small business financing.

These platforms often boast faster approval times and more flexible eligibility criteria compared to conventional bank loans. For instance, in 2024, the digital lending market continued to expand, with platforms leveraging technology to streamline the application and disbursement processes, making them an attractive alternative for borrowers seeking immediate capital.

- Accessibility: Online platforms provide 24/7 access to loan applications, bypassing traditional banking hours and physical branch limitations.

- Speed: Many digital lenders can approve and disburse funds within hours or days, a stark contrast to the weeks often required for bank loan processing.

- Niche Markets: P2P and micro-lending often cater to underserved segments of the market, offering tailored financial products that traditional banks may overlook.

- Cost Competitiveness: While interest rates can vary, some digital lenders offer competitive pricing, especially for smaller loan amounts or specific borrower profiles.

Wealth Management Products from Non-Bank Institutions

The threat of substitutes for Bank of Guizhou's wealth management products is significant, coming from non-bank financial institutions. Insurance companies, asset management firms, and securities brokers offer a wide array of investment products and wealth management services that directly compete with traditional bank offerings. These alternatives provide customers with diversified options beyond simple bank deposits, attracting a substantial portion of savings and investment capital. For instance, by the end of 2023, the asset management industry in China, a key market for Bank of Guizhou, managed trillions of yuan in assets, highlighting the scale of competition.

These non-bank entities often provide specialized investment strategies and potentially higher returns, making them attractive substitutes. They can cater to specific investor needs, such as long-term growth, income generation, or risk mitigation, often with more flexible product structures than typical bank products. This diversification of financial services means customers are not solely reliant on banks for their wealth management needs.

- Insurance companies offer investment-linked insurance policies and annuities, providing both protection and wealth accumulation.

- Asset management firms specialize in mutual funds, exchange-traded funds (ETFs), and alternative investments, catering to diverse risk appetites.

- Securities brokers facilitate direct investment in stocks, bonds, and other capital market instruments, empowering self-directed investors.

The threat of substitutes for traditional banking services, particularly in payments and lending, is substantial. Fintech platforms and digital lenders offer faster, more accessible, and often more convenient alternatives. This shift is underscored by the massive growth in digital payments, projected to exceed $11.5 trillion globally in 2024, and the continued expansion of digital lending markets.

Furthermore, capital markets and shadow banking entities provide alternative funding channels for corporations and individuals, bypassing traditional bank intermediation. These substitutes, while sometimes carrying higher risks, often present greater flexibility and speed, directly impacting banks like Bank of Guizhou by siphoning off market share and revenue opportunities.

| Substitute Type | Key Characteristics | Impact on Banks | 2024 Market Indicator |

|---|---|---|---|

| Fintech Payment Platforms | Seamless, integrated, 24/7 access | Reduced transaction fees, account reliance | Global digital payments > $11.5 trillion |

| Capital Markets | Direct bond issuance, stock sales | Diminished demand for corporate banking | Significant global bond issuance |

| Shadow Banking/Unregulated Lending | Quicker approvals, flexible terms | Siphons loan market share, especially SMEs | Substantial total assets (2023 estimate) |

| P2P & Online Micro-lending | Fast approvals, flexible criteria | Direct competition for consumer/SME finance | Continued digital lending market expansion |

| Non-Bank Wealth Management | Specialized strategies, potentially higher returns | Diversifies savings/investment capital away from banks | Trillions of yuan managed by China's asset management industry (end of 2023) |

Entrants Threaten

The banking sector in China presents substantial hurdles for new players, primarily due to immense capital requirements. Commercial banks need significant financial backing to operate, and this is further amplified by rigorous approval processes overseen by authorities such as the National Financial Regulatory Administration.

These substantial financial and regulatory barriers effectively deter many potential entrants, safeguarding established institutions like the Bank of Guizhou from immediate new competition.

Established brand loyalty and trust represent a significant barrier for new entrants in the banking sector. Existing institutions, like the Bank of Guizhou, have cultivated deep customer relationships over years, fostering a sense of reliability that is difficult for newcomers to replicate. In 2023, for instance, the Bank of Guizhou reported a customer deposit base of over 1.5 trillion RMB, underscoring the substantial trust placed in it by its clientele.

Traditional banks, like the Bank of Guizhou, benefit from substantial economies of scale. This means they can spread their operational costs, like technology investment and regulatory compliance, over a much larger customer base. For instance, in 2023, major Chinese banks reported operating costs that were a fraction of their total assets, a feat difficult for newcomers to match.

Furthermore, established banks have built extensive distribution networks, both physical branches and robust digital platforms. These networks are crucial for customer acquisition and service delivery. A new entrant would need to invest billions to establish a comparable reach, making it challenging to compete on price or convenience against incumbents with decades of network development.

Government Influence and State Ownership

The threat of new entrants in China's banking sector, particularly for institutions like the Bank of Guizhou, is significantly shaped by government influence and the prevalence of state-owned enterprises. Major state-owned banks, backed by government policy and capital, already hold a dominant position, creating substantial barriers for new, purely private, or foreign competitors. This established state presence and the inherent policy direction can foster an uneven competitive environment, making it challenging for newcomers to establish a strong foothold.

Government policies and regulations often favor existing state-backed institutions, which can translate into preferential treatment in areas like capital allocation, regulatory approvals, and access to certain markets. For instance, in 2023, the People's Bank of China continued to implement targeted monetary policies that often supported larger, state-controlled financial institutions. This regulatory landscape can act as a formidable deterrent, increasing the capital and operational hurdles for any new entrant aiming to compete directly with these established players.

- Dominant State-Owned Banks: Large state-owned commercial banks like ICBC, CCB, ABC, and BoC controlled approximately 65% of total banking assets in China as of late 2023, illustrating the concentrated market power.

- Regulatory Hurdles: Obtaining banking licenses and navigating the complex regulatory framework in China can be a lengthy and demanding process, particularly for entities not aligned with state objectives.

- Policy Guidance: Government directives on lending priorities, financial stability, and economic development often steer the market, creating an environment where alignment with state goals is crucial for success.

Emergence of Digital-Only Banks and Fintech Innovators

While traditional banking entry remains challenging due to capital requirements and regulatory hurdles, the threat of new entrants is primarily amplified by digital-only banks and fintech innovators. These agile players often bypass the need for extensive physical infrastructure, allowing them to target specific customer segments with specialized offerings. For instance, by mid-2024, fintech adoption in banking services continued its upward trajectory, with a significant portion of consumers in developed markets utilizing at least one fintech service.

These new entrants can operate with considerably lower overheads, enabling them to offer competitive pricing or more attractive features within their chosen niches. Their ability to innovate rapidly and adapt to evolving customer demands presents a potent challenge to incumbent institutions. By Q1 2024, venture capital funding into fintech companies globally remained robust, indicating continued investor confidence in disruptive business models within the financial sector.

- Digital-Only Banks: These entities, often referred to as neobanks, are built entirely on digital platforms, offering streamlined account opening, mobile-first interfaces, and often lower fees.

- Fintech Innovators: This broad category includes companies specializing in payments, lending, wealth management, and other financial services, often leveraging AI and blockchain technology.

- Niche Market Disruption: Fintechs can gain traction by focusing on underserved or overlooked market segments, such as small business lending or cross-border remittances, before potentially expanding their services.

- Lower Operational Costs: The absence of physical branches and legacy systems allows digital-first players to achieve cost efficiencies that can be passed on to customers or reinvested in growth.

The threat of new entrants for the Bank of Guizhou is considerably low due to significant capital requirements, stringent regulatory approvals from bodies like the National Financial Regulatory Administration, and the established trust and brand loyalty of incumbent banks. Economies of scale enjoyed by larger institutions, coupled with extensive distribution networks, further deter newcomers. Government policy and the dominance of state-owned banks also create substantial barriers.

| Barrier Type | Description | Impact on New Entrants | Example Data (as of late 2023/early 2024) |

|---|---|---|---|

| Capital Requirements | High initial investment needed to establish operations and meet regulatory capital adequacy ratios. | Significant financial hurdle, limiting the pool of potential entrants. | Minimum registered capital for commercial banks in China can be in the billions of RMB. |

| Regulatory Hurdles | Complex licensing, compliance, and ongoing supervision by authorities. | Lengthy and costly approval processes, favouring well-connected or state-backed entities. | Obtaining a banking license can take several years and involves extensive documentation and scrutiny. |

| Economies of Scale | Lower per-unit costs due to large operational volume. | New entrants struggle to match the cost efficiency of established banks. | Major Chinese banks reported operating costs as a small fraction of their asset base in 2023. |

| Brand Loyalty & Trust | Established customer relationships and reputation built over time. | Difficult for new players to attract and retain customers. | Bank of Guizhou's customer deposit base exceeded 1.5 trillion RMB in 2023. |

| Dominance of State-Owned Banks | Concentrated market share and government backing for large SOEs. | Creates an uneven playing field, making it hard for new, independent entities to compete. | State-owned banks held ~65% of total banking assets in China by late 2023. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for the Bank of Guizhou leverages data from official company disclosures, including annual reports and investor presentations, alongside insights from financial news outlets and industry-specific regulatory filings.