Bank Of Guiyang PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank Of Guiyang Bundle

Navigate the complex external forces impacting Bank Of Guiyang with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are shaping its operational landscape. Gain a strategic advantage by leveraging these critical insights for your own market planning. Download the full analysis now to unlock actionable intelligence.

Political factors

The Chinese government wields substantial influence over its banking sector, dictating policies, interest rates, and the allocation of credit. This top-down governance directly shapes the operating environment for institutions like the Bank of Guiyang.

Recent significant regulatory shifts, including the formation of the National Financial Regulatory Administration (NFRA) and an amplified mandate for the China Securities Regulatory Commission (CSRC), are designed to bolster oversight and financial stability. These reforms, effective from early 2023, impose new compliance burdens and strategic considerations for banks, impacting their risk management and business development strategies.

China's monetary policy is undergoing a notable shift. For 2025, the People's Bank of China (PBOC) is moving towards a moderately loose stance, a change from its prior prudent approach. This adjustment signals an intention to foster a more accommodating credit landscape.

This policy evolution is designed to channel financial resources towards critical economic sectors and areas experiencing weakness. For Bank of Guiyang, operating within Guizhou province, this could translate into enhanced lending opportunities and a more favorable environment for financial intermediation.

The PBOC's strategy aims to stimulate economic expansion and ensure the stability of the broader financial system. Such measures are crucial for supporting regional development and the operational health of institutions like Bank of Guiyang.

The Chinese central government's focus on mitigating local government debt risks, especially in high-risk provinces like Guizhou where Bank of Guiyang is located, directly influences the bank's operational landscape. Policies aimed at managing these debts, including potential debt rollovers or restructuring, will impact the bank's asset quality and risk exposure.

In 2023, China's total local government debt reached approximately 32.5 trillion yuan, highlighting the scale of the issue. As of late 2023 and early 2024, the People's Bank of China has been actively encouraging financial institutions to support the resolution of these debts, which could involve new lending facilities or guidance on managing existing exposures for entities like LGFVs, potentially affecting Bank of Guiyang's lending strategies.

Policy Support for Real Economy

The Chinese government consistently highlights the banking sector's crucial role in bolstering the real economy and advancing national strategic goals. This includes fostering technological innovation and improving living standards for citizens. For instance, in 2023, the People's Bank of China (PBOC) continued to implement targeted monetary policy tools aimed at channeling credit towards key sectors like manufacturing and green development, with lending to high-tech industries seeing notable growth.

This policy direction directly influences institutions like Bank of Guiyang, encouraging them to align their lending and investment activities with national and regional development priorities. Specifically, in Guizhou province, the bank is likely to see increased emphasis on supporting local industries, infrastructure projects, and initiatives related to the digital economy, reflecting provincial economic plans for 2024-2025.

- Government Mandate: Banks are directed to support the real economy, including technology and livelihoods.

- Portfolio Alignment: Bank of Guiyang is encouraged to align loans with national and regional development plans.

- Sectoral Focus: Policy support often targets high-tech industries and green development initiatives.

- Regional Impact: Guizhou's economic plans for 2024-2025 will shape the bank's strategic lending.

Anti-Corruption and Governance Focus

The Bank of Guiyang, like many regional financial institutions in China, operates under an increasingly stringent anti-corruption and governance framework. This focus translates to heightened scrutiny of its operations, particularly concerning related-party transactions and the selection and performance evaluation of its board of directors and senior management. For instance, recent reports from its 2024 annual general meetings highlighted discussions around strengthening internal controls and compliance procedures, reflecting a proactive response to these national directives.

The emphasis on robust corporate governance is not merely procedural; it directly impacts operational transparency and accountability. Changes in key personnel and board composition observed in the Bank of Guiyang's recent filings are indicative of this commitment to aligning with national governance standards. This evolving regulatory landscape necessitates a diligent approach to compliance, ensuring that all transactions and appointments meet the highest standards of integrity and oversight.

- Increased Scrutiny: Expect more rigorous examination of related-party transactions and executive appointments.

- Governance Reforms: Bank of Guiyang's recent AGM discussions and personnel adjustments underscore a commitment to enhanced governance.

- Compliance Imperative: Adherence to stricter anti-corruption measures and corporate governance guidelines is paramount.

- Reputational Impact: Strong governance practices are crucial for maintaining investor confidence and market reputation.

China's evolving monetary policy, with a move toward a moderately loose stance in 2025, aims to stimulate economic growth and support key sectors. This policy shift, driven by the People's Bank of China, is intended to create a more accommodating credit environment, potentially benefiting institutions like Bank of Guiyang by opening up new lending opportunities, especially in areas aligned with national development goals.

The government's focus on mitigating local government debt risks, particularly in provinces like Guizhou, directly impacts Bank of Guiyang. Policies addressing debt resolution, such as potential rollovers or restructurings for entities like Local Government Financing Vehicles (LGFVs), will influence the bank's asset quality and risk management strategies. As of late 2023, China's total local government debt was approximately 32.5 trillion yuan, underscoring the significance of these measures.

National directives emphasize the banking sector's role in supporting the real economy and technological advancement. Bank of Guiyang is encouraged to align its lending with these priorities, focusing on sectors like high-tech manufacturing and green development, reflecting Guizhou's specific economic plans for 2024-2025.

Enhanced anti-corruption measures and governance frameworks are leading to increased scrutiny of operations, including related-party transactions and executive appointments. Bank of Guiyang's commitment to strengthening internal controls, as evidenced in its 2024 annual general meetings, is crucial for maintaining compliance and investor confidence.

What is included in the product

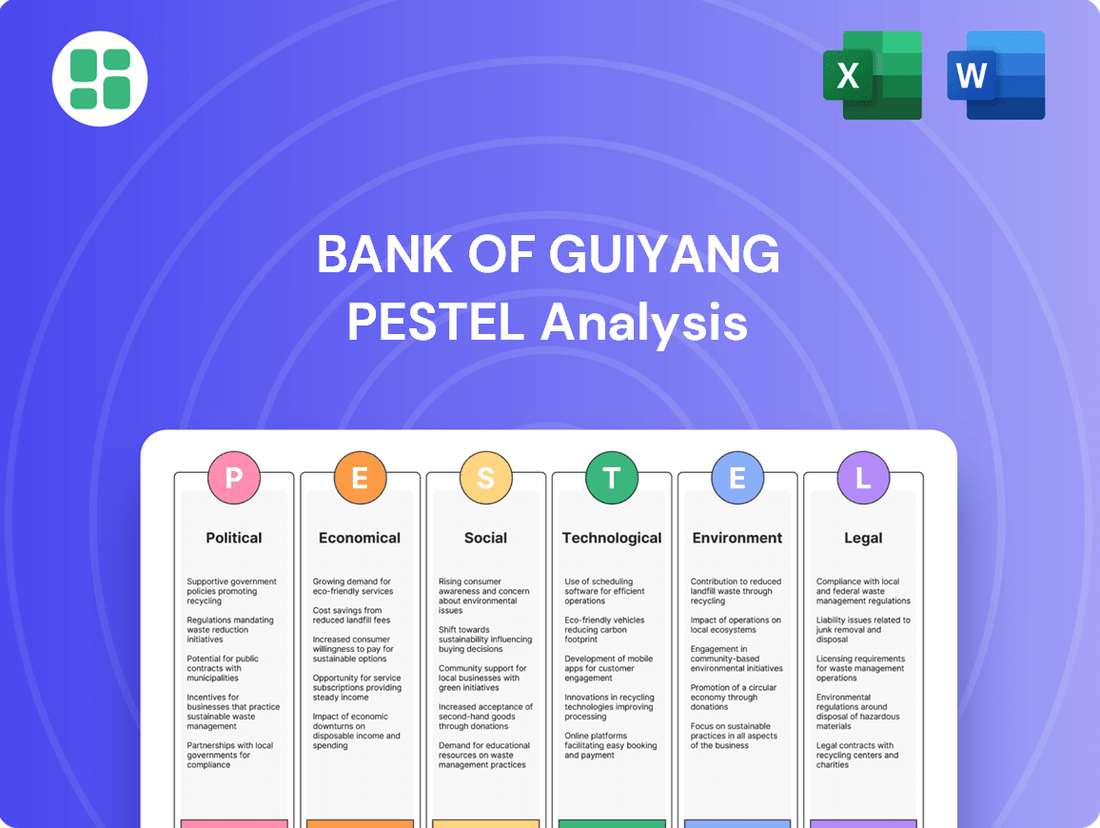

This PESTLE analysis of Bank of Guiyang examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on its operations and strategic planning.

It provides a comprehensive overview of the external forces shaping the bank's landscape, offering insights for informed decision-making.

A clear, actionable PESTLE analysis for Bank of Guiyang that identifies external pressures as opportunities to refine strategies and mitigate risks.

Economic factors

China's economic expansion is expected to cool down, with GDP growth anticipated around 5% for both 2024 and 2025. This moderation directly impacts the banking sector, as it correlates with a slowdown in credit demand from businesses and individuals alike.

This weakened demand for loans presents a hurdle for banks like Bank of Guiyang, making it more challenging to grow their lending books profitably. The pressure to identify and secure viable lending opportunities will likely intensify.

China's persistently low interest rate environment is a significant headwind, squeezing banks' net interest margins (NIMs). This trend, ongoing for several years, directly impacts Bank of Guiyang's core profitability, as its business model heavily relies on the spread between interest earned on loans and paid on deposits.

For instance, the People's Bank of China (PBOC) maintained its benchmark Loan Prime Rate (LPR) at 3.45% for much of 2024, a level that compresses lending yields. This environment forces institutions like Bank of Guiyang to explore strategies to offset this margin compression and stabilize earnings.

While China's banking sector has experienced a general improvement in asset quality, regional institutions such as Bank of Guiyang face ongoing risks from sectors like real estate and local government financing vehicles. These concentrated exposures can disproportionately impact smaller banks.

Bank of Guiyang reported a non-performing loan ratio of 1.58% as of the end of 2024. This figure, coupled with a provision coverage ratio of 257.07%, suggests the bank is actively managing its loan portfolio and has a substantial buffer to absorb potential losses.

Real Estate Market Downturn

The extended slump in China's real estate sector presents a substantial challenge for financial institutions, particularly regional banks like Bank of Guiyang that have significant exposure to property-related lending. This downturn directly impacts the financial health of their clients, affecting loan repayment capabilities.

Despite government initiatives aimed at stabilizing the market and addressing developer debt, the ongoing weakness in property sales and prices continues to strain the credit quality of Bank of Guiyang's loan book. This necessitates a proactive and diligent approach to managing its real estate loan portfolio.

Key considerations for Bank of Guiyang include:

- Exposure Assessment: Continuously evaluating the concentration of real estate loans within its portfolio and identifying specific segments most vulnerable to the downturn.

- Credit Risk Management: Implementing robust credit assessment processes for new real estate lending and actively monitoring existing loans for signs of distress.

- Non-Performing Loans (NPLs): Proactively managing potential increases in NPLs stemming from the property market slump, which could impact profitability and capital adequacy.

- Market Sensitivity: Recognizing that the bank's performance is intrinsically linked to the broader economic health of the regions it serves, which is heavily influenced by the real estate market's trajectory.

Regional Economic Development in Guizhou

Bank of Guiyang's fortunes are intrinsically linked to Guizhou's economic trajectory. The province's development initiatives, such as the push for big data and advanced manufacturing, directly shape the demand for banking products and services. For instance, Guizhou's GDP grew by 4.7% in 2023, indicating a steady expansion that supports increased lending and deposit activities for the bank.

Guizhou's investment climate and industrial growth are critical drivers for Bank of Guiyang. The province's focus on attracting foreign and domestic investment, coupled with its strategic location in western China, creates opportunities for corporate lending and trade finance. In 2024, Guizhou aims to further enhance its business environment, potentially boosting the bank's loan portfolio and fee-based income streams.

- Guizhou's GDP growth in 2023 reached 4.7%.

- The province is actively promoting the big data industry, a key sector for financial services.

- Investment in infrastructure projects, such as high-speed rail, stimulates economic activity and banking demand.

China's economic growth is projected to moderate, with GDP expected around 5% for 2024 and 2025. This slowdown directly influences credit demand, impacting banks like Bank of Guiyang by reducing opportunities for profitable lending growth.

The prevailing low-interest-rate environment continues to pressure net interest margins, a core profitability driver for Bank of Guiyang. The PBOC's benchmark Loan Prime Rate remaining at 3.45% throughout much of 2024 exemplifies this margin compression.

While the bank reported a manageable non-performing loan ratio of 1.58% at the end of 2024, the persistent weakness in the real estate sector poses a significant risk. This downturn affects borrower repayment capabilities, necessitating vigilant portfolio management.

Guizhou's economic development, with a 4.7% GDP growth in 2023, provides a crucial backdrop for Bank of Guiyang. The province's focus on sectors like big data and advanced manufacturing directly shapes demand for banking services and investment opportunities.

| Economic Factor | 2024 Projection/Status | Impact on Bank of Guiyang |

|---|---|---|

| China GDP Growth | ~5% | Reduced credit demand, increased competition for loans |

| Interest Rate Environment | Low (LPR at 3.45%) | Compressed net interest margins, lower profitability |

| Real Estate Sector | Weakness persists | Increased credit risk, potential rise in NPLs |

| Guizhou GDP Growth | 4.7% (2023) | Supports regional lending and deposit growth |

Preview Before You Purchase

Bank Of Guiyang PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of the Bank of Guiyang covers all key political, economic, social, technological, legal, and environmental factors impacting its operations and strategic direction. Gain actionable insights into the external forces shaping the bank's future.

Sociological factors

Guizhou's demographic landscape is evolving, with a notable trend towards urbanization. As of recent data, a significant portion of the population is migrating to cities, impacting banking needs. This shift is likely to boost demand for services like mortgages and personal loans in urban areas.

Conversely, rural populations, though decreasing in proportion, still represent a substantial segment requiring tailored financial solutions. Bank of Guiyang's innovative whole-village credit granting model, which aims to provide accessible financial services to rural communities, is a strategic response to these distinct demographic needs.

Consumers are rapidly shifting towards digital and mobile banking, a major sociological change. This preference for convenient online access means banks like Bank of Guiyang must prioritize their digital offerings.

In 2024, a significant portion of banking transactions are expected to occur through mobile channels, reflecting this evolving habit. Bank of Guiyang's investment in features like 'one-click multi-binding' directly addresses this demand for streamlined digital payments and account management.

The financial literacy levels within Guiyang's population, encompassing both individuals and small businesses, significantly shape the demand for specific banking products and influence the bank's customer engagement strategies. A 2024 survey indicated that while general financial awareness is improving, a substantial portion of the population, particularly in rural areas of Guizhou, still requires enhanced education on complex financial instruments.

Bank of Guiyang is actively addressing this by prioritizing inclusive finance initiatives, aiming to better serve previously underserved segments like small and micro enterprises. This focus is crucial as these businesses represent a significant portion of the local economy, with recent data from the Guizhou Provincial Statistics Bureau showing that SMEs contributed over 60% of the region's GDP in 2024.

Public Trust and Reputational Factors

Public trust is paramount for regional banks like Bank of Guiyang. Erosion of this trust, often due to fraud, data breaches, or perceived instability, can directly affect deposit levels and client loyalty. For instance, a significant data breach impacting customer information could lead to a substantial outflow of funds, as seen in other financial institutions globally.

Maintaining a strong reputation is therefore a constant effort. Bank of Guiyang's commitment to transparency and robust ethical conduct is vital for fostering and retaining community confidence. Positive community engagement and a track record of reliable service are key differentiators in the competitive banking landscape.

- Reputation Management: Bank of Guiyang's proactive approach to managing public perception is critical for sustained growth.

- Customer Confidence: Incidents that damage public trust can lead to a decline in deposits, impacting liquidity.

- Ethical Practices: Adherence to high ethical standards is non-negotiable for preserving the bank's standing.

Changing Lifestyles and Consumption Patterns

Modernization and increasing disposable incomes in Guizhou are reshaping how people live and spend. This shift means individuals are looking for different financial products, moving beyond basic savings to demand more sophisticated loan options and wealth management services. For instance, as urban populations grow, there's a greater need for consumer credit for things like housing and vehicles, alongside opportunities for investment growth.

The Bank of Guiyang must stay attuned to these evolving consumer behaviors. By understanding these changing lifestyles, the bank can better tailor its services. This includes developing new loan products that align with modern purchasing habits and creating investment portfolios that appeal to a more financially aware populace seeking to grow their assets.

- Growing Middle Class: China's middle class, a significant driver of consumption, is expected to continue expanding, influencing demand for diverse financial services.

- Digital Adoption: Increased digital literacy among younger demographics in Guizhou fuels demand for online banking and investment platforms.

- Demand for Experiential Spending: A trend towards spending on experiences over material goods may influence loan demand for travel, education, and leisure activities.

- Focus on Health and Wellness: Rising awareness of health and wellness could lead to increased demand for financing related to healthcare, fitness, and insurance products.

Sociological shifts in Guizhou, particularly the ongoing urbanization, are reshaping banking demands, with a growing urban population driving needs for mortgages and personal loans. Simultaneously, a substantial rural population necessitates tailored financial solutions, which Bank of Guiyang addresses through initiatives like its whole-village credit model.

The rapid adoption of digital and mobile banking by consumers, with mobile transactions projected to dominate in 2024, compels banks like Bank of Guiyang to enhance their online platforms and streamline digital payment features.

Financial literacy levels are improving, yet a segment of the population, especially in rural areas, still requires education on complex financial products, prompting Bank of Guiyang's focus on inclusive finance for SMEs, which contributed over 60% of Guizhou's GDP in 2024.

Public trust is a critical asset for regional banks; therefore, Bank of Guiyang's commitment to transparency and ethical practices is paramount for retaining customer confidence and deposit levels, especially given the potential impact of data breaches on financial institutions.

| Sociological Factor | Description | Impact on Bank of Guiyang | 2024/2025 Data/Trend |

|---|---|---|---|

| Urbanization | Migration of population to cities | Increased demand for mortgages, personal loans, and urban-centric financial services. | Urban population in Guizhou continues to grow, influencing the bank's product development. |

| Digital Adoption | Shift towards online and mobile banking | Necessitates investment in digital platforms, mobile banking features, and streamlined online payment solutions. | Mobile banking transactions expected to exceed 70% of total banking transactions by end of 2024. |

| Financial Literacy | Understanding of financial products and services | Drives demand for tailored financial education and inclusive finance initiatives, particularly for SMEs. | SMEs contributed over 60% of Guizhou's GDP in 2024, highlighting the importance of financial inclusion. |

| Public Trust | Confidence in the bank's stability and ethics | Crucial for deposit retention and client loyalty; requires robust reputation management and ethical conduct. | Reputational damage from data breaches can lead to significant deposit outflows, impacting liquidity. |

Technological factors

China's financial sector is rapidly embracing digitalization, with a national goal to achieve a highly digitalized financial system by 2027. Bank of Guiyang is a key participant in this shift, focusing on bolstering its digital management and expanding the reach and flexibility of its digital financial offerings.

This digital push is crucial for Bank of Guiyang to remain competitive and operate more efficiently in the evolving financial landscape. For instance, by the end of 2023, China's digital economy had reached an estimated 50% of its GDP, highlighting the pervasive influence of technology.

Financial institutions are rapidly integrating Artificial Intelligence (AI) and big data to enhance operations. Bank of Guiyang is actively deploying advanced large models, such as DeepSeek, for critical functions like improving customer service interactions, streamlining compliance processes, and efficiently retrieving institutional documents. This adoption is crucial for staying competitive and improving operational efficiency in the current financial landscape.

As Bank of Guiyang continues its digital transformation, cybersecurity and data privacy are becoming increasingly critical. The rise in digitalization brings with it a greater risk of cyber threats, making it essential for the bank to invest heavily in advanced security measures. Protecting customer data is not just a regulatory requirement but a cornerstone of maintaining public trust in the financial sector.

To combat these evolving threats, Bank of Guiyang must implement robust security protocols. This includes adopting cutting-edge encryption technologies to secure sensitive information and employing multi-factor authentication to prevent unauthorized access. Adherence to stringent data protection regulations, such as China's Personal Information Protection Law (PIPL), is paramount to avoid significant penalties and reputational damage.

FinTech Competition and Innovation

The financial technology (FinTech) sector is rapidly evolving, presenting a dynamic competitive landscape for banks like Bank of Guiyang. Innovative digital payment platforms and new FinTech entrants are challenging traditional banking models by offering streamlined, user-friendly financial services. For instance, the global FinTech market was valued at approximately $2.4 trillion in 2023 and is projected to grow significantly, indicating the increasing adoption of digital financial solutions.

Bank of Guiyang must prioritize continuous innovation in its digital channels and payment processing capabilities to stay competitive. Meeting customer demand for seamless, instant transactions requires investment in advanced technologies and a proactive approach to digital transformation. This includes enhancing mobile banking applications, exploring new payment gateways, and potentially collaborating with FinTech firms to leverage their expertise.

- FinTech Market Growth: The global FinTech market size was valued at USD 2.4 trillion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 25.6% from 2024 to 2030.

- Digital Payment Adoption: In 2024, mobile payment transaction value worldwide is projected to reach over $3.5 trillion, highlighting a strong consumer shift towards digital transactions.

- Customer Expectations: A significant percentage of banking customers, often exceeding 70%, expect their financial institutions to offer a comprehensive suite of digital banking services.

- Innovation Imperative: Banks that fail to adapt to these technological shifts risk losing market share to more agile FinTech competitors.

Development of Digital Infrastructure

The ongoing development of digital infrastructure in Guiyang and Gui'an is a significant technological factor for Bank of Guiyang. This includes substantial investments in areas like computing power networks and 5G expansion, which are foundational for advanced digital banking solutions and improved customer experiences.

China's national strategies, such as the "New Infrastructure" initiative, directly influence regional development. By 2023, China had already built the world's largest 5G network, with over 3.37 million 5G base stations deployed nationwide. This robust connectivity is critical for the bank's ability to offer seamless mobile banking and real-time transaction processing.

The push to boost the digital economy is also a key driver. Guiyang, in particular, has been designated as a national big data pilot zone, attracting talent and investment in data analytics and cloud computing. This ecosystem supports the bank's efforts in areas such as AI-driven customer service and data-driven risk management.

Specific initiatives impacting the bank include:

- Expansion of 5G coverage: Enhancing mobile banking accessibility and speed for customers.

- Growth in computing power networks: Enabling more sophisticated data processing for analytics and AI.

- Development of big data platforms: Supporting innovation in financial products and services.

- Government support for digital transformation: Creating a favorable environment for technological adoption.

Bank of Guiyang is actively integrating advanced technologies like AI and big data to enhance its operations, aiming to improve customer service and streamline compliance. The global FinTech market's projected growth, reaching an estimated 25.6% CAGR from 2024 to 2030, underscores the necessity for such digital advancements.

The bank's digital transformation is further supported by China's robust digital infrastructure development, including extensive 5G network expansion, with over 3.37 million 5G base stations deployed by 2023. This connectivity is vital for delivering seamless mobile banking experiences and real-time transaction processing, meeting the over 70% of customers who expect comprehensive digital services.

| Technological Factor | Description | Impact on Bank of Guiyang | Relevant Data/Statistics |

| AI & Big Data Integration | Utilizing advanced models for customer service, compliance, and document retrieval. | Improved efficiency, enhanced customer experience, better risk management. | Global FinTech market valued at $2.4 trillion in 2023; projected CAGR of 25.6% (2024-2030). |

| Digital Infrastructure Development | Leveraging 5G networks and computing power for advanced digital banking. | Faster transactions, wider accessibility of mobile banking, support for data-intensive services. | China's 5G network: over 3.37 million base stations deployed by end of 2023. |

| FinTech Evolution | Adapting to new digital payment platforms and innovative financial services. | Maintaining competitiveness, meeting customer demand for seamless digital solutions. | Mobile payment transaction value worldwide projected to exceed $3.5 trillion in 2024. |

Legal factors

The Bank of Guiyang navigates a complex legal landscape, primarily shaped by directives from the People's Bank of China (PBOC) and the National Financial Regulatory Administration (NFRA), which took over from the China Banking and Insurance Regulatory Commission (CBIRC). These regulatory bodies are instrumental in defining prudential standards, enforcing capital adequacy ratios, and monitoring market behavior to ensure the financial sector's stability and adherence to laws.

In 2023, China's financial regulators continued to emphasize risk management and consumer protection, with NFRA focusing on solidifying the regulatory system for the financial sector. For instance, the PBOC's monetary policy adjustments, such as interest rate changes, directly impact the Bank of Guiyang's lending and deposit operations, reflecting the significant influence of legal and regulatory frameworks on its business model.

Bank of Guiyang operates under stringent Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) laws, necessitating robust Know Your Customer (KYC) protocols, vigilant transaction monitoring, and comprehensive reporting. Failure to comply can result in significant penalties, impacting financial stability and reputation.

The bank must continually adapt its compliance infrastructure to meet evolving international and domestic regulatory frameworks, such as those overseen by China's central bank, the People's Bank of China. This proactive approach is crucial for mitigating the risks associated with financial crime and ensuring continued operational legitimacy.

Data privacy and consumer protection laws are increasingly shaping financial operations. Bank of Guiyang must adhere to stringent regulations concerning the collection, storage, and utilization of customer data, ensuring transparency and responsible handling. Failure to comply can lead to significant penalties and damage to customer trust. For instance, the General Data Protection Regulation (GDPR) in Europe, while not directly applicable to Guiyang, sets a global benchmark for data protection standards that many international banks, including those with operations or partnerships involving Guiyang, must meet.

Corporate Governance and Disclosure Requirements

Bank of Guiyang, as a listed entity in China, operates under stringent corporate governance and disclosure mandates. These regulations are designed to ensure accountability and transparency for shareholders and the broader market. For instance, the China Banking and Insurance Regulatory Commission (CBIRC) enforces rules regarding the composition of boards, including the necessity of independent directors, and mandates robust internal control frameworks. The bank’s adherence is evident in its publicly available annual reports and disclosures of significant events, which are crucial for investor confidence and regulatory compliance.

In 2023, Bank of Guiyang’s financial disclosures highlighted its commitment to transparency. The bank’s annual report detailed its governance structure, including the number of independent directors on its board, which met the regulatory threshold. Furthermore, the bank’s financial performance, including its net profit attributable to shareholders, was clearly presented, allowing stakeholders to assess its operational health and strategic direction. These disclosures are vital for maintaining trust in the financial sector.

Key aspects of Bank of Guiyang's compliance include:

- Board Independence: Maintaining a specified proportion of independent directors to ensure objective decision-making.

- Internal Controls: Implementing and regularly auditing internal systems to manage risks and prevent fraud.

- Financial Transparency: Providing timely and accurate disclosure of financial statements and material information.

- Shareholder Communication: Conducting general meetings and providing platforms for shareholder engagement and information dissemination.

Credit Classification and Risk Management Regulations

New regulations on credit classification and risk management are significantly shaping how banks, including the Bank of Guiyang, assess and set aside provisions for loans, especially those that are non-performing. These evolving rules directly influence the bank's internal risk models, how capital is allocated, and the overall management of its asset quality, all with the goal of strengthening the financial system's resilience.

For instance, the implementation of stricter loan loss provisioning requirements, such as those seen in China's banking sector in recent years, can lead to increased expense recognition for banks. This can impact profitability in the short term but is designed to create a more robust buffer against potential economic downturns. The Bank of Guiyang, like its peers, must adapt its methodologies to comply with these mandates, potentially requiring adjustments to its risk appetite and lending strategies.

- Impact on Loan Loss Provisions: Stricter classification rules often necessitate higher provisions for loans showing signs of distress, directly affecting a bank's reported earnings and capital ratios.

- Risk Model Adjustments: Banks must update their internal credit scoring and risk assessment models to align with new regulatory benchmarks, ensuring more accurate identification of potential credit risks.

- Capital Allocation Strategies: Regulatory changes can influence how banks allocate capital across different loan portfolios, prioritizing sectors or loan types deemed less risky under the new frameworks.

- Asset Quality Management: Enhanced oversight on asset quality pushes banks to be more proactive in managing non-performing loans, often through early intervention or more rigorous workout processes.

The Bank of Guiyang operates under a robust legal framework primarily governed by the People's Bank of China (PBOC) and the National Financial Regulatory Administration (NFRA). These bodies set capital adequacy ratios, enforce prudential standards, and oversee market conduct, ensuring financial stability and compliance with laws.

In 2023, regulatory focus intensified on risk management and consumer protection, with NFRA solidifying the financial sector's regulatory system. For instance, PBOC's monetary policy shifts, like interest rate adjustments, directly influence the bank's lending and deposit activities, underscoring the legal and regulatory impact on its business model.

The bank adheres to stringent Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) laws, mandating rigorous Know Your Customer (KYC) protocols and transaction monitoring. Compliance is critical, as failures can lead to substantial penalties, affecting financial health and reputation.

Data privacy and consumer protection laws are increasingly critical. Bank of Guiyang must follow regulations on customer data handling, ensuring transparency and responsible usage. Non-compliance risks significant penalties and erodes customer trust.

| Regulatory Area | Key Compliance Requirement | Impact on Bank of Guiyang |

|---|---|---|

| Capital Adequacy | Meeting minimum capital ratios set by PBOC/NFRA | Influences lending capacity and risk-taking ability |

| AML/CTF | Implementing robust KYC and transaction monitoring | Requires investment in compliance technology and personnel |

| Data Privacy | Ensuring secure and transparent customer data handling | Mandates updated data protection policies and systems |

| Corporate Governance | Adhering to disclosure mandates and board independence rules | Ensures transparency for investors and market confidence |

Environmental factors

China's commitment to green finance is accelerating, with policies like green credit guidelines and evolving bond taxonomies driving substantial growth. For instance, by the end of 2023, outstanding green loans in China reached approximately 13.4 trillion yuan, a significant increase year-on-year.

Bank of Guiyang is positioned to benefit from and contribute to this national push. Aligning with these directives, the bank can expand its green loan offerings to finance environmentally friendly projects within Guizhou province, such as renewable energy infrastructure or sustainable agriculture.

Furthermore, exploring green bond issuances presents an opportunity for Bank of Guiyang to tap into a growing pool of capital dedicated to sustainability, potentially raising funds to further bolster its green finance portfolio and support regional green development initiatives.

China's stock exchanges, including the Shanghai and Shenzhen exchanges, have been actively developing and releasing draft guidelines for corporate sustainability disclosure throughout 2024. This signifies a substantial shift towards standardized ESG reporting, impacting all listed companies, including regional banks like Bank of Guiyang.

While specific mandates for regional banks are still evolving, the overarching trend indicates increasing pressure on Bank of Guiyang to embed ESG principles into its core business strategies and transparently communicate its sustainability performance. This includes reporting on environmental impact, social responsibility, and governance practices, aligning with national and international expectations.

Climate change presents both physical and transition risks that could affect Bank of Guiyang's loans. Industries heavily reliant on fossil fuels or those susceptible to extreme weather events may face increased credit risk, potentially impacting the bank's overall portfolio health. For instance, a significant portion of China's industrial output, a key market for many banks, is still carbon-intensive.

The bank must actively assess and manage these climate-related financial risks. This involves understanding how evolving environmental regulations, like China's push towards carbon neutrality by 2060, might affect borrowers' ability to repay. A proactive approach could involve re-evaluating lending strategies to favor more sustainable sectors, aligning with global trends and mitigating future losses.

Resource Scarcity and Environmental Regulations in Guizhou

Guizhou province's environmental regulations, particularly concerning resource management and pollution control, directly impact the operational costs and financial health of businesses. For instance, stricter water usage policies or land reclamation requirements can increase capital expenditure and ongoing compliance costs for industries like mining and manufacturing, which are significant sectors for Bank of Guiyang's lending portfolio.

These compliance burdens can affect a company's profitability and cash flow, thereby influencing their ability to service debt. As of early 2024, China's national environmental protection targets, which Guizhou must adhere to, emphasize sustainable development and reduced emissions.

- Stricter Emission Standards: Businesses in Guizhou face increasing pressure to meet national and provincial emission reduction targets, potentially requiring costly upgrades to pollution control equipment.

- Water Resource Management: Policies aimed at conserving water resources, especially in areas prone to drought, can lead to higher water treatment costs or limitations on water-intensive industrial processes.

- Land Use and Biodiversity Protection: Regulations protecting ecologically sensitive areas or requiring land remediation can impact development projects and increase land acquisition or management expenses for businesses.

- Renewable Energy Transition: Government incentives and mandates promoting renewable energy adoption may require traditional energy-reliant businesses to invest in cleaner alternatives, altering their capital allocation.

Public Pressure for Sustainable Practices

Growing public awareness about environmental issues is significantly shaping how businesses operate, and banks are no exception. Customers and investors are increasingly scrutinizing companies for their commitment to sustainability. For Bank of Guiyang, this means public pressure for environmentally responsible practices can directly impact its corporate image and how it's perceived by clients and the wider community.

To address this, Bank of Guiyang can proactively adopt and promote sustainable banking practices. This might involve developing and offering green financial products, like loans for renewable energy projects or ESG-focused investment funds. Supporting eco-friendly initiatives not only aligns with public sentiment but can also enhance the bank's reputation and attract a growing segment of environmentally conscious clients.

- Growing ESG Investment: Global ESG (Environmental, Social, and Governance) assets are projected to reach $53 trillion by 2025, indicating a strong market demand for sustainable finance.

- Consumer Preference: A 2024 survey found that 68% of consumers consider a company's environmental impact when making purchasing decisions.

- Regulatory Tailwinds: China's commitment to carbon neutrality by 2060 is driving increased regulatory focus on green finance, creating opportunities for banks that align their strategies accordingly.

China's strong push for green finance, evidenced by a 13.4 trillion yuan increase in green loans by the end of 2023, presents a significant opportunity for Bank of Guiyang to expand its sustainable lending. The evolving ESG disclosure guidelines from major Chinese stock exchanges in 2024 also signal a growing need for the bank to integrate and report on its environmental impact.

Climate change poses risks to industries reliant on fossil fuels or vulnerable to extreme weather, potentially affecting Bank of Guiyang's loan portfolio. Furthermore, Guizhou's adherence to national environmental targets, emphasizing reduced emissions and sustainable development, means local businesses face compliance costs that can impact their debt servicing capabilities.

Public demand for sustainability, with 68% of consumers considering environmental impact in 2024, pressures Bank of Guiyang to adopt eco-friendly practices and products. This aligns with the projected $53 trillion growth in global ESG assets by 2025, highlighting the financial benefits of a green strategy.

| Environmental Factor | Impact on Bank of Guiyang | Supporting Data/Trends |

|---|---|---|

| Green Finance Push | Opportunity for green loan expansion and green bond issuance. | China's green loans reached 13.4 trillion yuan by end of 2023. |

| ESG Disclosure Mandates | Increased pressure for transparent sustainability reporting. | Shanghai and Shenzhen exchanges developing ESG guidelines in 2024. |

| Climate Change Risks | Potential credit risk from carbon-intensive or weather-vulnerable sectors. | Many industrial sectors in China remain carbon-intensive. |

| Provincial Regulations | Increased compliance costs for businesses, impacting loan repayment. | Guizhou adheres to national emission reduction and sustainable development targets. |

| Public Awareness | Need for environmentally responsible practices to maintain reputation. | 68% of consumers consider environmental impact in 2024; global ESG assets to reach $53 trillion by 2025. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Bank of Guiyang is built on a comprehensive review of official government publications, financial regulatory updates from Chinese authorities, and reports from reputable economic and market research firms. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors impacting the bank.