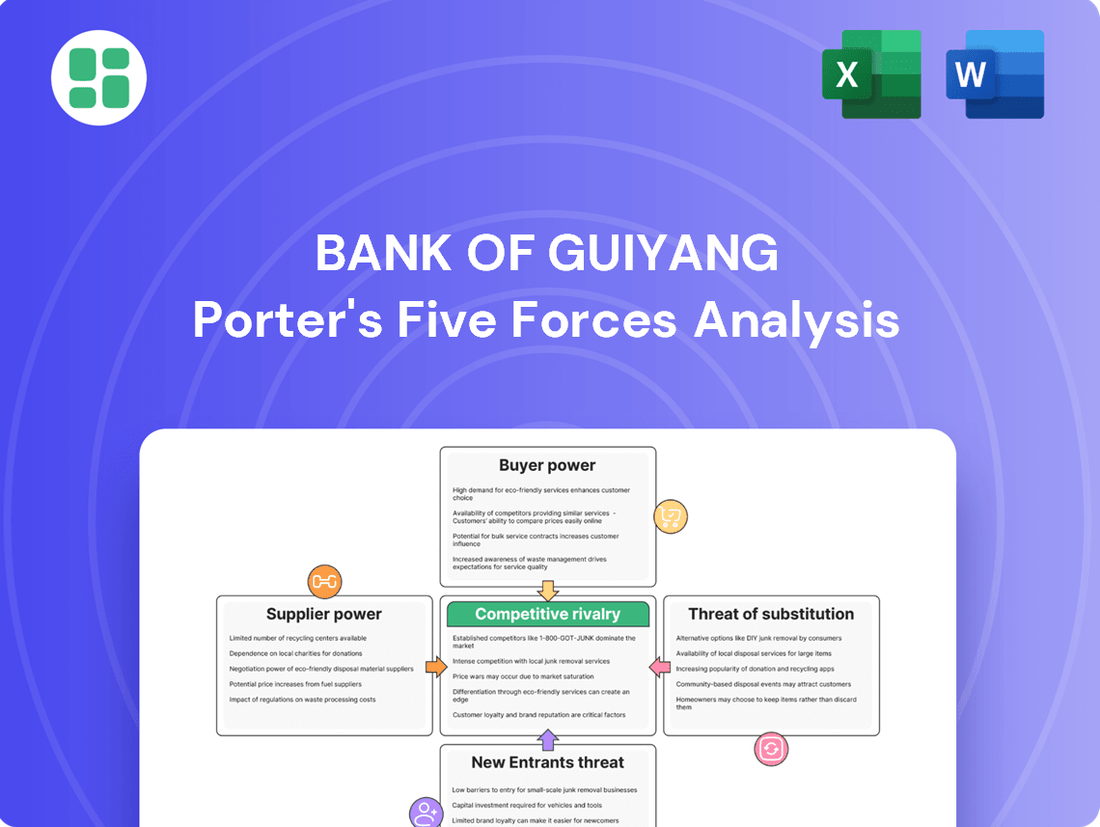

Bank Of Guiyang Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank Of Guiyang Bundle

Understanding the competitive landscape of Bank of Guiyang reveals significant pressures from rivals and the constant threat of new entrants. Buyer power, while present, is somewhat mitigated by established relationships and regulatory frameworks.

The complete report reveals the real forces shaping Bank Of Guiyang’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

For Bank of Guiyang, depositors are crucial capital providers, acting as suppliers of funds. Their bargaining power is typically moderate. While individual depositors have numerous banking options, a substantial and stable deposit base, particularly from government-linked entities and established corporations within Guizhou province, can temper their collective influence.

However, in a dynamic financial landscape, depositors can exert pressure for more favorable interest rates, especially if the bank's liquidity heavily depends on their deposits. As of the first quarter of 2024, Bank of Guiyang reported a deposit balance of approximately RMB 345.6 billion, highlighting the significant volume of funds entrusted to the institution.

Bank of Guiyang, like other financial institutions, relies on the interbank market and wholesale funding for liquidity. The bargaining power of these suppliers is directly influenced by market conditions. For instance, during periods of tight liquidity in 2024, banks that typically lend in the interbank market often commanded higher interest rates, increasing the cost of funds for borrowing institutions like Bank of Guiyang.

When market liquidity is scarce or interest rates are on an upward trend, the suppliers of these funds gain significant leverage. This means Bank of Guiyang could face higher borrowing costs, impacting its profitability. This wholesale funding is crucial for managing the bank's day-to-day liquidity needs and ensuring operational stability.

Core banking system providers, payment network operators, and IT infrastructure vendors hold significant sway. Their specialized services and the substantial costs associated with switching them can give them considerable bargaining power. For instance, a bank might incur millions in costs and operational disruption to migrate from one core banking system to another.

This leverage is amplified by the critical nature of these systems for a bank's daily functions and its digital transformation efforts. A disruption in payment networks or outdated IT infrastructure can directly impact customer service and revenue generation, making banks hesitant to antagonize these key suppliers.

Human Capital

The bargaining power of human capital as a supplier for Bank of Guiyang is significant, particularly concerning skilled employees. Talent in risk management, digital transformation, and investment banking is in high demand across the financial sector. For instance, in 2024, the average salary for a senior risk manager in China's banking industry saw an increase, reflecting this competitive landscape.

This elevated demand directly impacts the bank's ability to attract and retain top talent. When there's a scarcity of specialized skills, employees gain leverage, potentially driving up compensation packages and benefits. This can strain operational costs and affect the bank's capacity to implement new strategies or maintain existing services efficiently.

- High demand for specialized banking skills.

- Impact of talent shortages on labor costs.

- Employee compensation as a key bargaining factor.

Regulatory Bodies (Indirect Supplier)

Regulatory bodies, such as China's National Financial Regulatory Administration (NFRA), act as indirect suppliers to banks like Bank of Guiyang by providing the essential 'license to operate' and ensuring regulatory stability. Their pronouncements on capital adequacy, risk management, and compliance directly shape the bank's operational framework and strategic direction.

The NFRA's directives, including capital requirement ratios and stringent compliance mandates, significantly influence Bank of Guiyang's cost structure and decision-making processes. For instance, in 2024, the NFRA continued to emphasize robust risk management and consumer protection, potentially increasing compliance costs for financial institutions.

- Increased Compliance Burden: Adhering to evolving regulations, such as those concerning data privacy and anti-money laundering, adds to operational expenses.

- Capital Adequacy Requirements: Banks must maintain specific capital ratios, influencing their ability to lend and invest.

- Policy Uncertainty: Unpredictable regulatory shifts can disrupt business models and necessitate costly adjustments.

- Impact on Profitability: Non-compliance or unfavorable regulatory changes can lead to fines and a diminished ability to generate revenue.

The bargaining power of suppliers for Bank of Guiyang is multifaceted, encompassing depositors, wholesale funders, critical technology providers, and skilled human capital. While individual depositors have limited leverage, large institutional deposits and interbank market conditions significantly influence the cost of funds. Key technology vendors and in-demand financial talent can command higher prices due to switching costs and skill scarcity.

The regulatory environment, represented by bodies like the NFRA, also acts as a powerful supplier by setting operational rules and capital requirements. These regulations directly impact the bank's costs and strategic flexibility, with compliance demands often increasing operational expenses. For example, evolving data privacy and anti-money laundering regulations in 2024 necessitate ongoing investment in compliance measures.

| Supplier Type | Key Influence Factors | Impact on Bank of Guiyang |

|---|---|---|

| Depositors | Deposit volume, institutional relationships, interest rate sensitivity | Moderate; large stable deposits temper individual power, but market rates influence cost of funds. |

| Wholesale Funders | Interbank market liquidity, prevailing interest rates | Significant; tight liquidity in 2024 led to higher borrowing costs. |

| Technology Providers | Specialization, switching costs, system criticality | High; essential for operations and digital transformation, making banks hesitant to antagonize. |

| Skilled Employees | Demand for specialized skills (risk, digital), talent scarcity | Significant; drives up compensation and retention costs, impacting operational efficiency. |

| Regulatory Bodies (e.g., NFRA) | Capital requirements, compliance mandates, policy shifts | High; dictates operational framework, increases compliance costs, and influences strategic decisions. |

What is included in the product

This analysis unpacks the competitive intensity faced by Bank of Guiyang, examining the power of its buyers and suppliers, the threat of new entrants and substitutes, and the rivalry among existing players.

Effortlessly visualize competitive pressures on the Bank of Guiyang by instantly understanding the intensity of each Porter's Five Forces with a powerful spider/radar chart.

Customers Bargaining Power

Individual retail customers, while holding limited power individually due to small transaction volumes and standardized offerings, can exert significant collective influence. This is amplified by the ease of switching financial institutions, particularly with the growth of digital platforms and online comparison tools, which makes it simpler for customers to find better rates and services. For instance, in 2024, the digital banking adoption rate in China continued to climb, with a significant portion of retail banking transactions occurring online, highlighting the accessibility for customers to compare and switch.

Corporate clients, especially large enterprises and state-owned entities, wield considerable bargaining power over Bank of Guiyang. These clients are major players in lending and deposit markets, enabling them to negotiate more favorable terms for loans, treasury services, and various other banking products. For instance, in 2023, major corporate clients accounted for a significant portion of the bank's loan portfolio, giving them substantial leverage.

The ability of these corporate clients to explore alternative financing options or readily switch to competing banks offering superior pricing or enhanced services further amplifies their negotiating strength. This competitive landscape means Bank of Guiyang must remain responsive to client needs and competitive on pricing to retain these valuable relationships.

Government entities, including provincial and municipal agencies within Guizhou, represent significant clients for Bank of Guiyang. Their substantial deposit bases and demand for financing public infrastructure projects grant them considerable bargaining power. For instance, in 2023, government-backed entities accounted for a notable portion of the bank's loan portfolio, influencing pricing and service requirements.

Information Availability and Switching Costs

The growing availability of financial product information online significantly empowers Bank of Guiyang's customers. This transparency allows for easy comparison of offerings, effectively lowering switching costs, particularly for more standardized banking services. For instance, in 2024, a significant portion of retail banking customers reported using online comparison tools to evaluate deposit rates and loan offerings, indicating a heightened price sensitivity.

While more intricate financial products, such as bespoke corporate loans or wealth management packages, may still present higher barriers to switching due to complexity and relationship-based services, the overarching trend points towards increased customer knowledge and greater ease of movement between institutions. This dynamic places continuous pressure on Bank of Guiyang to maintain competitive pricing and elevate its service standards to retain its customer base.

- Increased Online Information: Customers can readily access and compare banking products and services across multiple providers.

- Reduced Switching Costs: For basic services like savings accounts or current accounts, the effort and expense to switch are minimal.

- Customer Price Sensitivity: In 2024, reports indicated a growing trend of customers actively seeking the best rates and lowest fees, driven by accessible online data.

- Pressure on Competitiveness: Bank of Guiyang must offer compelling value propositions to counter the ease with which customers can explore alternatives.

Demand for Digital Services

The increasing demand for digital services significantly bolsters customer bargaining power. As consumers across all segments expect seamless mobile banking, online payments, and instant service access, they can readily switch to banks offering superior digital platforms. This trend is evident globally, with a significant portion of banking transactions moving online. For instance, in 2024, it was reported that over 70% of retail banking customers preferred digital channels for their daily banking needs.

Bank of Guiyang's strategic investments in digital transformation are therefore paramount. By enhancing its digital offerings, the bank aims to meet these evolving customer expectations. Failing to do so risks customer attrition, as digitally savvy customers have a wider array of choices. The bank's commitment to innovation in this space directly impacts its ability to retain and attract customers in a competitive landscape.

- Digital Adoption: Over 70% of retail banking customers preferred digital channels in 2024.

- Customer Expectation: Demand for seamless mobile and online banking is a primary driver of customer choice.

- Competitive Advantage: Banks with superior digital platforms gain a distinct advantage in customer retention.

- Bank of Guiyang's Strategy: Investment in digital transformation is critical to meet market demands and prevent customer churn.

The bargaining power of customers with Bank of Guiyang is a significant factor, driven by increasing transparency and ease of switching. Retail customers, while individually weak, gain strength collectively through readily available online information comparing rates and services, a trend that intensified in 2024 with widespread digital platform adoption. Corporate clients and government entities, however, hold substantial leverage due to their large transaction volumes and ability to negotiate favorable terms or switch to competitors, a reality underscored by their significant contribution to the bank's loan portfolios in 2023.

| Customer Segment | Bargaining Power Drivers | Impact on Bank of Guiyang | 2023/2024 Data Point |

|---|---|---|---|

| Retail Customers | Online information access, low switching costs for basic services | Increased price sensitivity, pressure on standard product margins | Over 70% of retail banking customers preferred digital channels in 2024. |

| Corporate Clients | Large transaction volumes, access to alternative financing, ability to switch | Ability to negotiate loan rates, fees, and service terms; retention critical | Major corporate clients accounted for a significant portion of the bank's loan portfolio in 2023. |

| Government Entities | Substantial deposit bases, demand for project financing | Influence on pricing and service requirements for public sector business | Government-backed entities accounted for a notable portion of the bank's loan portfolio in 2023. |

Full Version Awaits

Bank Of Guiyang Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for the Bank of Guiyang, detailing competitive rivalry, the threat of new entrants, the bargaining power of buyers, the threat of substitutes, and the bargaining power of suppliers. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy. You can be confident that the insights and strategic evaluations presented are exactly what you will receive, providing a thorough understanding of the bank's competitive landscape.

Rivalry Among Competitors

The banking landscape in China, and specifically within Guizhou province where Bank of Guiyang operates, is characterized by a high degree of competition. This includes major state-owned commercial banks like Industrial and Commercial Bank of China (ICBC) and China Construction Bank (CCB), alongside numerous national joint-stock commercial banks and other regional city and rural commercial banks.

Bank of Guiyang contends with this broad spectrum of financial institutions, all actively seeking to capture market share in crucial areas such as customer deposits, loan origination, and a wide array of other financial services. This diverse competitive environment significantly heightens the challenge of attracting and retaining customers within its core operating territory.

While Guizhou province, Bank of Guiyang's home, shows promise as a developing region, the broader Chinese banking sector is experiencing significant maturation. This maturity translates into intense competition for customers and market share.

This heightened rivalry can compress profit margins for all players, including Bank of Guiyang. In response, banks may resort to aggressive pricing tactics or ramp up marketing expenditures to attract and retain clients in this increasingly saturated landscape.

For instance, by the end of 2023, China's banking sector saw its asset growth rate slow to around 9.5%, a notable deceleration compared to previous years, indicating a market that is indeed becoming more crowded and competitive.

Many standard banking products are quite similar across the industry, making it hard for banks to stand out based on their offerings alone. This often pushes competition towards price, with banks vying for customers by offering slightly better interest rates on loans or deposits. For instance, in 2024, the average prime loan rate in China hovered around 4.35%, a figure that many banks closely match.

Bank of Guiyang is actively trying to differentiate itself. They focus on providing tailored services to local communities and specific sectors, like corporate and government entities. Additionally, they are investing in digital banking solutions to offer a more convenient experience. However, keeping this differentiation strong when competing with much larger banks that have greater financial resources is an ongoing effort.

Exit Barriers and Industry Overcapacity

The banking sector, including institutions like Bank of Guiyang, faces substantial exit barriers. These include massive capital commitments, stringent regulatory requirements for winding down operations, and the critical role banks play in the broader financial system. These factors make it very difficult for underperforming banks to simply close shop.

Consequently, these high exit barriers contribute to persistent industry overcapacity. Competitors are often compelled to remain active even when facing challenges, leading to sustained and often intense rivalry. For Bank of Guiyang, this means a market where rivals are unlikely to exit, ensuring ongoing competitive pressure.

- High Capital Investment: The banking industry requires significant investment in technology, infrastructure, and regulatory capital, making divestment costly.

- Regulatory Hurdles: Strict regulations govern bank closures, involving complex approvals and potential penalties, deterring quick exits.

- Systemic Importance: The interconnectedness of financial institutions means that the failure of one bank can have ripple effects, discouraging easy withdrawal by regulators and market participants.

- Overcapacity Impact: In 2023, the global banking sector continued to grapple with overcapacity in certain segments, particularly in retail banking, as digital transformation outpaced consolidation.

Regulatory Environment and Policy Influence

The regulatory landscape in China, overseen by the People's Bank of China (PBOC) and the National Financial Regulatory Administration (NFRA), profoundly influences competition among banks like Bank of Guiyang. Policies dictating interest rates, capital requirements, and who can enter the market directly impact how intense rivalry becomes.

For instance, changes in capital adequacy ratios, such as the tiered approach introduced to manage systemic risk, can force banks to either raise capital or reduce riskier assets, altering their competitive positioning. In 2023, China's banking sector saw a capital adequacy ratio of 14.6% on average, a figure that regulators monitor closely.

- Interest Rate Liberalization: Gradual reforms in interest rate setting can lead to increased price competition.

- Capital Requirements: Stricter capital rules, like those aligned with Basel III standards, necessitate robust financial health, affecting lending capacity.

- Market Entry Barriers: While historically high, policies aimed at opening the financial sector to foreign competition could introduce new players and competitive pressures.

- Financial Inclusion Initiatives: Government pushes for financial inclusion may require banks to serve less profitable customer segments, impacting overall profitability and strategic focus.

Bank of Guiyang faces intense competition from large state-owned banks, national joint-stock banks, and other regional players, all vying for market share in deposits and loans. This crowded market, with average prime loan rates around 4.35% in 2024, forces banks to compete on price and service differentiation, impacting profit margins.

The banking sector's high exit barriers, including substantial capital requirements and regulatory oversight, mean that even struggling competitors remain active, ensuring persistent rivalry. This overcapacity, a global trend observed in 2023, means Bank of Guiyang must continually innovate to stand out.

Regulatory policies from bodies like the PBOC and NFRA significantly shape competition. For instance, capital adequacy ratios, which averaged 14.6% for China's banking sector in 2023, influence lending capacity and strategic choices, creating a dynamic competitive environment.

The similarity of many banking products compels competition towards price, with banks often matching benchmark rates like the 2024 average prime loan rate of 4.35%. Bank of Guiyang's strategy to differentiate through local focus and digital services is crucial but challenging against larger, resource-rich competitors.

SSubstitutes Threaten

Fintech and digital payment platforms, such as Alipay and WeChat Pay, pose a substantial threat of substitutes to Bank of Guiyang. These platforms offer a compelling alternative for everyday financial needs, including payments, lending, and wealth management, often with greater convenience and lower transaction costs than traditional banking services.

In 2023, digital payment transaction volumes in China continued their upward trajectory, with platforms like Alipay and WeChat Pay processing trillions of yuan in transactions. This widespread adoption means customers increasingly turn to these digital ecosystems, potentially reducing their reliance on traditional banks like Bank of Guiyang for daily financial activities and even small-scale credit needs.

The threat of substitutes for Bank of Guiyang is significant, particularly from direct financing channels like capital markets. For large corporate and government clients, issuing bonds or equity directly to investors offers an alternative to traditional bank loans. In 2024, global corporate bond issuance reached substantial figures, demonstrating the scale of this alternative funding source.

This direct access to capital allows these entities to potentially secure funds more efficiently or at a lower cost compared to borrowing from banks. For instance, a well-established corporation might find it more attractive to issue commercial paper rather than seek a syndicated loan from a bank. This bypasses the bank's intermediation role, directly impacting Bank of Guiyang's lending volumes and associated interest income.

Furthermore, the rise of sophisticated financial technology and platforms has made it easier for companies to tap into capital markets, increasing the attractiveness of these substitutes. This trend can erode the market share of banks in providing corporate financing, especially for larger, creditworthy clients who have multiple funding options available to them.

The rise of shadow banking and unregulated lending presents a significant threat of substitutes for Bank of Guiyang. These alternative financial channels, though facing greater oversight in China, continue to attract borrowers who find traditional banking too restrictive or inaccessible. This directly siphons off potential loan business, impacting the bank's market share.

Peer-to-Peer (P2P) Lending Platforms

Peer-to-peer (P2P) lending platforms in China, while significantly impacted by regulatory changes, previously offered a direct substitute for traditional bank loans, particularly for smaller personal and business needs. Although their market share has shrunk considerably, the core idea of bypassing banks for lending persists as a latent threat.

The Chinese P2P lending industry experienced a dramatic contraction; by the end of 2020, the number of licensed P2P platforms had fallen to just 15 from a peak of over 5,000. This regulatory tightening means that while P2P lending is no longer a widespread substitute, the underlying disintermediation model remains a competitive pressure for banks like Bank of Guiyang. Banks must ensure their small loan products are attractive and competitive to retain customers who might otherwise seek alternative funding sources, even if those sources are now more constrained.

- Regulatory Impact: China's P2P lending sector saw a drastic reduction from over 5,000 platforms to a handful due to stringent regulations aimed at curbing financial risks.

- Historical Substitution: P2P platforms historically served as a viable alternative for individuals and small businesses seeking personal and business loans, directly competing with traditional banking services.

- Latent Threat: Despite the crackdown, the concept of direct lending outside traditional channels remains a potential substitute, compelling banks to offer competitive small loan products.

- Market Evolution: The consolidation and regulation of P2P lending highlight the dynamic nature of financial services and the need for banks to adapt to evolving customer preferences and technological advancements.

Emerging Financial Technologies (e.g., Blockchain, DeFi)

Emerging financial technologies like blockchain and decentralized finance (DeFi) pose a long-term threat by offering alternative ways to manage assets and conduct transactions, potentially bypassing traditional banks. These technologies could fundamentally change how financial services are delivered, impacting areas like payments, lending, and asset management.

While widespread adoption in China's regulated market is still developing, the potential for these fintech innovations to act as substitutes for conventional banking services is significant. For instance, by mid-2024, the global DeFi market capitalization had seen substantial growth, indicating increasing interest and development in these alternative financial systems.

- Blockchain and DeFi offer new avenues for asset management and payments.

- These technologies could disintermediate traditional banking infrastructure.

- The growth of the global DeFi market signifies increasing user adoption and innovation.

- Bank of Guiyang needs to monitor these evolving technologies as potential future substitutes.

Fintech platforms like Alipay and WeChat Pay offer convenient, low-cost alternatives for daily transactions, directly competing with Bank of Guiyang's core services. In 2023, China's digital payment market continued its robust growth, with these platforms processing trillions of yuan, indicating a significant shift in consumer behavior away from traditional banking for everyday financial needs.

Direct financing channels, such as capital markets, serve as a substantial substitute for corporate clients, allowing them to issue bonds or equity. Global corporate bond issuance in 2024 remained strong, providing a clear alternative to bank loans for larger entities seeking funding, thus impacting Bank of Guiyang's lending volumes.

Emerging technologies like blockchain and decentralized finance (DeFi) represent a long-term threat by offering alternative systems for payments and asset management. The global DeFi market capitalization saw notable expansion by mid-2024, signaling increasing innovation that could potentially disintermediate traditional banking models.

Entrants Threaten

The banking sector in China, including institutions like Bank of Guiyang, faces substantial regulatory hurdles. The National Financial Regulatory Administration (NFRA) enforces rigorous capital adequacy ratios, complex licensing processes, and continuous compliance mandates. For instance, in 2023, the NFRA continued to emphasize stringent risk management and capital preservation for all financial institutions, reflecting a commitment to stability that directly impacts new entrants.

These demanding regulations create a formidable barrier to entry. Aspiring banks must navigate extensive approval procedures and meet significant capital requirements, making it exceptionally difficult and expensive to establish a presence. This high cost of entry and the ongoing burden of compliance effectively deter potential new competitors from challenging established players like Bank of Guiyang.

Establishing a bank, like Bank of Guiyang, necessitates immense initial capital. For instance, in 2024, regulatory capital requirements for banks often run into the billions of dollars, covering everything from regulatory reserves to robust IT infrastructure and operational funding. This substantial financial hurdle significantly restricts the number of new players capable of entering the banking sector, thereby shielding incumbent institutions.

Existing banks, including Bank of Guiyang, enjoy significant economies of scale. This means they can spread the costs of operations, technology, and marketing across a vast customer base, leading to lower per-unit costs. For instance, in 2023, major Chinese banks reported substantial operating efficiencies driven by their scale.

New entrants face a steep challenge in matching these cost advantages. Without an established infrastructure and a large customer base, they would find it difficult to achieve similar cost efficiencies. This disparity makes it hard for newcomers to compete on price, directly impacting their initial profitability and creating a notable cost disadvantage.

Brand Loyalty and Trust

Building strong brand loyalty and trust in banking is a long, arduous process, often taking decades. Customers entrust banks with their savings and financial futures, naturally gravitating towards institutions with a proven track record and a solid reputation. This makes it incredibly challenging for new entrants to quickly establish credibility and attract a substantial, stable deposit base, which is the lifeblood of any bank's operations and liquidity management.

For Bank of Guiyang, its established local presence and history are significant assets in fostering this customer trust. In 2023, Bank of Guiyang reported total assets of approximately RMB 475.2 billion, demonstrating its scale and established position within its operating region. This long-standing relationship with its community makes it harder for newcomers to sway customer allegiance, as the perceived risk associated with an unknown entity is considerably higher.

- Customer Inertia: Many customers are hesitant to switch banks due to the perceived hassle and risk, favoring the familiarity of their current institution.

- Reputation Capital: Decades of reliable service build a reservoir of trust that new banks must painstakingly replicate.

- Regulatory Hurdles: New financial institutions face stringent regulatory requirements that can delay market entry and increase initial operating costs.

- Funding Challenges: Attracting deposits, a primary funding source, is significantly more difficult for new entrants compared to established banks with existing customer relationships.

Access to Distribution Channels and Talent

New banks face significant hurdles in establishing a widespread branch network, even with digital banking options. Building this physical presence is a substantial capital investment and takes considerable time. For instance, in 2024, the cost of opening a new bank branch can range from $1 million to $5 million, depending on location and size.

Attracting and retaining skilled banking professionals is another major challenge for new entrants. The financial industry demands specialized expertise, and experienced talent is often drawn to established institutions with proven stability and growth opportunities. In 2024, the average salary for a bank manager in China was approximately ¥250,000 annually, a significant cost for a new operation.

Bank of Guiyang benefits from its established infrastructure and experienced workforce, creating a formidable barrier for new competitors. Its extensive branch network, which numbered over 300 locations across China by the end of 2023, and its seasoned management team are assets that new entrants would struggle to match quickly or affordably.

- High Capital Investment: Establishing a physical branch network is a significant financial undertaking for new banks.

- Talent Acquisition Costs: Recruiting and retaining experienced banking professionals is expensive and competitive.

- Bank of Guiyang's Advantage: Existing infrastructure and skilled personnel provide a strong competitive moat.

The threat of new entrants in China's banking sector, impacting institutions like Bank of Guiyang, is significantly mitigated by high regulatory barriers and substantial capital requirements. For instance, in 2024, new banks must meet stringent capital adequacy ratios, often requiring billions in initial investment, making entry exceptionally costly and difficult. This financial and regulatory landscape effectively deters most potential competitors.

Furthermore, established banks benefit from strong brand loyalty and customer inertia, as seen with Bank of Guiyang's extensive network and community trust built over years. In 2023, Bank of Guiyang reported total assets of approximately RMB 475.2 billion, reflecting its solid market position. New entrants struggle to replicate this trust and customer base, facing a significant disadvantage in attracting deposits, the lifeblood of banking operations.

The cost and complexity of building essential infrastructure, such as a nationwide branch network and acquiring skilled talent, also pose major challenges. In 2024, opening a single bank branch can cost millions, and attracting experienced staff like bank managers, who earned around ¥250,000 annually in 2024, adds substantial operational expenses for newcomers. Bank of Guiyang's existing infrastructure and experienced workforce, with over 300 branches by end-2023, create a formidable competitive moat.

| Barrier Type | Description | Example Data (2023-2024) |

|---|---|---|

| Regulatory Requirements | Stringent licensing, capital adequacy ratios, compliance mandates | NFRA's continued emphasis on risk management and capital preservation (2023) |

| Capital Requirements | High initial investment for licensing, operations, and infrastructure | Billions of dollars in regulatory capital for new banks (2024) |

| Economies of Scale | Cost advantages from large customer base and operational efficiency | Major Chinese banks' operating efficiencies driven by scale (2023) |

| Brand Loyalty & Trust | Customer preference for established, reputable institutions | Bank of Guiyang's RMB 475.2 billion in assets (2023) indicating established trust |

| Infrastructure Costs | Investment in branch networks and IT systems | $1 million to $5 million per new bank branch (2024 estimate) |

| Talent Acquisition | Cost of hiring and retaining experienced banking professionals | ~¥250,000 annual salary for a bank manager in China (2024) |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Bank of Guiyang is built upon a foundation of publicly available financial statements, annual reports, and regulatory filings from the bank itself and its competitors. We also incorporate data from reputable financial news outlets and industry-specific research reports to capture current market trends and competitive dynamics.