Banco Bradesco Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Banco Bradesco Bundle

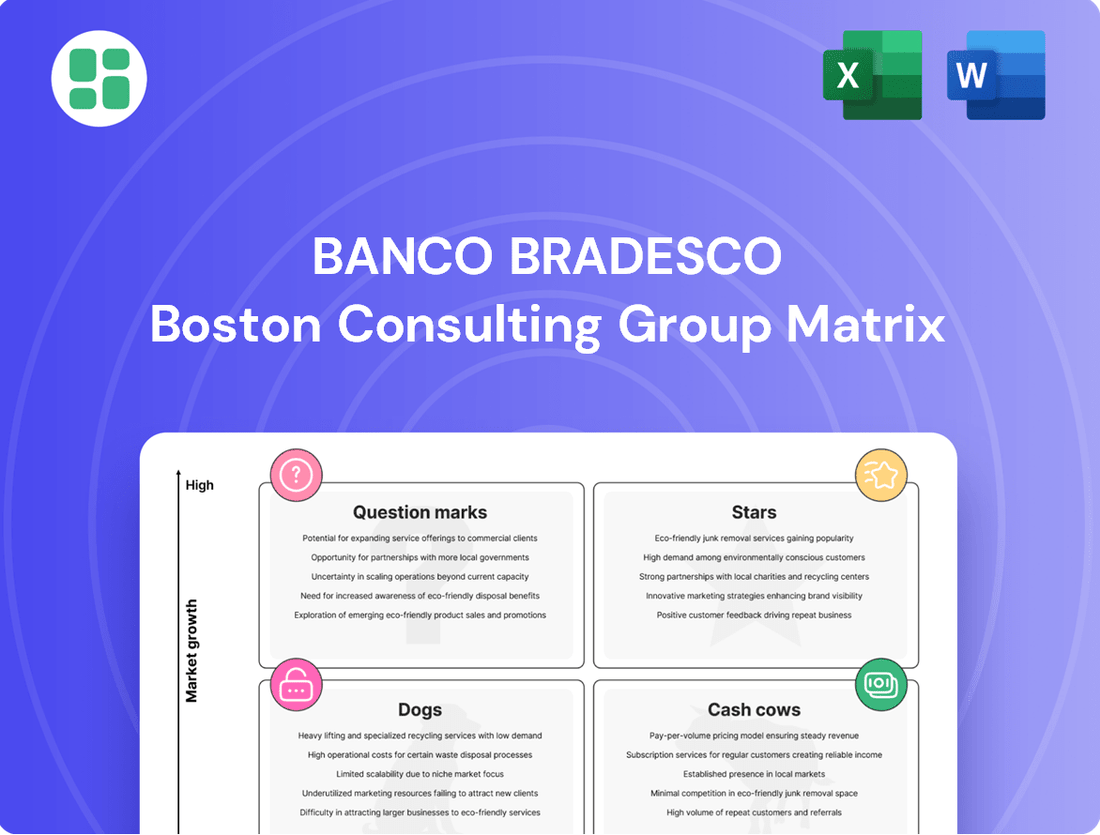

Explore the strategic positioning of Banco Bradesco's diverse product portfolio! This preview offers a glimpse into its market share and growth potential, hinting at its Stars, Cash Cows, Dogs, and Question Marks.

Ready to transform this understanding into actionable strategies? Purchase the full BCG Matrix report for a comprehensive breakdown of each product's quadrant placement, along with data-driven recommendations to optimize your investment and product development decisions.

Stars

Banco Bradesco's Next digital banking platform is a prime example of a Star in the BCG matrix, targeting Brazil's burgeoning digital-first consumer base. This initiative is crucial for future growth, aiming to capture a significant share of the younger, tech-savvy population.

Next has seen substantial user adoption, with Bradesco reporting over 16 million customers by the end of 2023, demonstrating its rapid expansion and market traction. The platform's success is driven by its user-friendly mobile interface and a comprehensive suite of digital services, including investments, loans, and insurance, all accessible through a smartphone.

Bradesco continues to invest heavily in Next's technological infrastructure and feature development, aiming to solidify its position as a market leader in digital banking. This focus ensures Next remains competitive against other digital challengers and traditional banks expanding their online offerings.

Pix, Brazil's instant payment system, has revolutionized transactions, and Banco Bradesco's strategic focus on this area, including advanced payment solutions, places it in a strong position within the BCG matrix. Bradesco's commitment to Pix integration and feature development is a key driver in capturing market share in this rapidly expanding sector.

These innovative Pix-based solutions are instrumental in attracting new clientele and deepening relationships with existing customers, thereby boosting transaction volumes for Bradesco. This increased engagement also opens doors for valuable cross-selling opportunities across the bank's product portfolio.

For instance, Bradesco reported a significant increase in Pix transactions, with millions of operations processed daily, underscoring the system's widespread adoption. Continued investment in Pix functionalities is crucial for Bradesco to maintain its competitive edge and fully leverage the dynamic Brazilian payment ecosystem.

Banco Bradesco's SME Credit and Solutions likely represent a Star in its BCG Matrix. The SME sector in Brazil is a significant engine of economic growth, and Bradesco's commitment to providing tailored credit lines and financial solutions positions it favorably. For instance, in 2024, Bradesco continued to emphasize digital platforms and specialized services to cater to the evolving needs of these businesses, aiming to capture a larger share of this dynamic market.

Investment Platforms (e.g., Ágora Investimentos)

Bradesco's investment platforms, exemplified by Ágora Investimentos, are strategically positioned within Brazil's burgeoning investment market. As an increasing number of Brazilians explore avenues beyond traditional savings accounts, Bradesco leverages Ágora to offer a wide array of investment products and expert guidance. This focus is crucial for expanding its footprint in the wealth management sector.

The growth in Brazil's investment market is significant. In 2023, the number of individual investors on the B3 stock exchange surpassed 5.4 million, a substantial increase from previous years. Ágora Investimentos, as a key player, aims to capitalize on this trend by providing accessible and diverse investment options.

To maintain competitiveness and attract a discerning investor base, Bradesco is committed to the ongoing refinement of Ágora's functionalities. This includes bolstering research resources, enhancing user experience, and delivering tailored investment advice.

- Market Growth: Brazil's individual investor base on B3 grew by over 20% in 2023, reaching 5.4 million.

- Product Diversification: Ágora Investimentos offers a broad spectrum of products, from fixed income to equities and funds.

- Customer Retention: Continuous platform upgrades and personalized advisory are vital for retaining and attracting high-net-worth clients.

- Digital Transformation: Bradesco continues to invest in digital tools and analytics to improve the Ágora user experience.

ESG-linked Financial Products

The increasing global and local emphasis on Environmental, Social, and Governance (ESG) criteria is fueling a significant expansion in the market for sustainable financial products. Bradesco's proactive approach includes developing and promoting ESG-linked loans, bonds, and investment funds, directly addressing this growing demand and establishing the bank as a frontrunner in responsible financial practices.

This segment, though still in its early stages, presents substantial growth opportunities. It is attracting a new wave of investors and businesses that prioritize sustainability. For instance, by the end of 2023, the global sustainable investment market had surpassed $37 trillion, demonstrating a clear trend toward ESG integration.

- Market Growth: The ESG investment market is experiencing robust expansion, with assets under management projected to reach $50 trillion by 2025.

- Bradesco's Offerings: Bradesco offers a range of ESG-linked financial products, including green bonds and sustainability-linked loans, to meet evolving investor and corporate needs.

- Investor Demand: A growing number of investors, particularly younger demographics, are seeking financial products that align with their personal values and contribute positively to society and the environment.

- Strategic Positioning: By focusing on ESG-linked products, Bradesco aims to capture market share in a rapidly developing sector and enhance its reputation as a socially responsible financial institution.

Banco Bradesco's Next digital banking platform is a prime example of a Star, targeting Brazil's burgeoning digital-first consumer base. This initiative is crucial for future growth, aiming to capture a significant share of the younger, tech-savvy population. Next has seen substantial user adoption, with Bradesco reporting over 16 million customers by the end of 2023, demonstrating its rapid expansion and market traction.

Bradesco's investment platforms, exemplified by Ágora Investimentos, are strategically positioned within Brazil's burgeoning investment market. As an increasing number of Brazilians explore avenues beyond traditional savings accounts, Bradesco leverages Ágora to offer a wide array of investment products and expert guidance. In 2023, the number of individual investors on the B3 stock exchange surpassed 5.4 million, a substantial increase from previous years.

The increasing global and local emphasis on Environmental, Social, and Governance (ESG) criteria is fueling a significant expansion in the market for sustainable financial products. Bradesco's proactive approach includes developing and promoting ESG-linked loans, bonds, and investment funds, directly addressing this growing demand and establishing the bank as a frontrunner in responsible financial practices. By the end of 2023, the global sustainable investment market had surpassed $37 trillion.

| Product/Service | BCG Category | Key Growth Drivers | 2023/2024 Data Highlight |

| Next Digital Banking | Star | Digital adoption, young demographic, comprehensive services | Over 16 million customers (end of 2023) |

| Ágora Investimentos | Star | Growing investor base, diverse product offerings, digital tools | B3 individual investors > 5.4 million (end of 2023) |

| ESG-Linked Products | Star | Demand for sustainable finance, responsible investing, ESG focus | Global sustainable investment market > $37 trillion (end of 2023) |

What is included in the product

This BCG Matrix overview for Banco Bradesco analyzes its business units, identifying Stars, Cash Cows, Question Marks, and Dogs.

It offers strategic recommendations on investment, holding, or divestment for each quadrant.

A clear BCG Matrix visual for Banco Bradesco simplifies strategic decisions, relieving the pain of complex portfolio analysis.

Cash Cows

Traditional retail banking services, encompassing checking accounts, savings accounts, and basic consumer loans, form the bedrock of Banco Bradesco's operations, serving a vast and loyal customer base. These mature offerings, operating in a highly penetrated market, generate consistent and reliable cash flows for the bank. As of the first quarter of 2024, Bradesco reported a substantial portion of its net interest income derived from its diversified loan portfolio, underscoring the ongoing strength of these foundational services.

Banco Bradesco's large corporate lending and debt financing arm functions as a robust cash cow. Its deep-rooted relationships with major corporations enable significant debt financing and syndicated loan origination, driving substantial revenue. This segment thrives in a mature, stable market, leveraging its strong capital base and established client trust for a distinct competitive edge.

The consistent, large-scale returns from these operations demand minimal aggressive marketing. In 2024, Bradesco continued to be a key player in Brazil's corporate debt market, facilitating major infrastructure and expansion projects for leading national companies, underscoring the segment's stable income generation.

Bradesco Seguros' established life and auto insurance portfolios are prime examples of Cash Cows within the company's BCG Matrix. These segments benefit from a dominant market share in Brazil's mature insurance landscape, ensuring a steady stream of premium income. In 2023, Bradesco reported significant contributions from its insurance operations, with the sector demonstrating robust profitability and a solid foundation for continued cash generation.

Asset Management for Institutional Clients

Banco Bradesco's asset management for institutional clients represents a significant Cash Cow. This segment, focusing on large pools of capital like pension funds and corporate treasuries, commands a substantial market share within a well-established industry. The stability of these long-term mandates translates into predictable fee income, offering a lower risk profile compared to the more dynamic retail investment sector.

The bank's established reputation and proven track record in handling substantial institutional assets are critical differentiators. This trust allows Bradesco to maintain its strong position and continue attracting significant mandates. For instance, as of the first quarter of 2024, Bradesco's asset management division reported R$1.7 trillion in assets under management, with a significant portion attributable to institutional clients.

- High Market Share: Bradesco benefits from a dominant position in the mature institutional asset management market.

- Stable Fee Income: Long-term institutional mandates provide consistent and predictable revenue streams.

- Lower Volatility: Compared to retail investments, institutional asset management generally exhibits less price fluctuation.

- Reputation and Expertise: The bank's strong brand and demonstrated skill in managing large assets are key competitive advantages.

Traditional Fee-Based Services (e.g., Account Maintenance)

Traditional fee-based services, like account maintenance and wire transfers, form a bedrock of Bradesco's revenue, contributing steadily to its non-interest income. These services, though individually modest, generate significant cumulative income from its extensive customer base in Brazil's established banking sector.

In 2024, Bradesco's commitment to these foundational services remained strong, reflecting their dependable revenue generation. The bank consistently leverages its large customer network to maximize income from these essential, low-investment offerings.

- Account Maintenance Fees: Bradesco collects recurring fees for basic account management, a stable income stream.

- Transaction Fees: Charges for services like wire transfers and other administrative tasks add to the fee-based revenue.

- Operational Efficiency: These services necessitate only ongoing operational upkeep, ensuring consistent profitability with minimal new capital outlay.

- Customer Base Leverage: The sheer volume of Bradesco's customers turns small individual fees into a substantial revenue contributor.

Banco Bradesco's established credit card operations, particularly its co-branded cards and loyalty programs, represent significant Cash Cows. These offerings benefit from a substantial, recurring customer base and mature market penetration in Brazil, generating consistent transaction fees and interest income. The bank's strong brand recognition and extensive distribution network further solidify its dominant position in this segment.

In 2024, Bradesco continued to leverage its vast customer base for credit card growth, with reported increases in credit card transaction volumes. The bank's focus on customer retention and tailored offers for its existing clientele ensures sustained revenue generation from these mature, high-volume products.

| Segment | Market Position | Revenue Driver | 2024 Data Point |

|---|---|---|---|

| Credit Card Operations | Dominant in Brazil | Transaction Fees, Interest Income | Increased transaction volumes |

| Retail Banking Services | Bedrock of Operations | Net Interest Income from Loans | Substantial portion of Q1 2024 net interest income |

| Corporate Lending | Key Player | Debt Financing, Syndicated Loans | Facilitated major national projects |

| Insurance Portfolios | Dominant Market Share | Premium Income | Significant contributions to profitability in 2023 |

| Institutional Asset Management | Substantial Market Share | Predictable Fee Income | R$1.7 trillion in assets under management (Q1 2024) |

Preview = Final Product

Banco Bradesco BCG Matrix

The Banco Bradesco BCG Matrix preview you are seeing is the definitive document you will receive upon purchase. This means the analysis, formatting, and strategic insights presented here are precisely what you'll download, ensuring no surprises and immediate usability for your business planning.

Dogs

Certain physical branch locations for Banco Bradesco, especially those in areas with declining populations or rapid digital banking uptake, might be classified as Dogs. These branches often show low transaction volumes and incur high operating expenses, making them less profitable. For instance, in 2024, some rural branches saw a 15% decrease in in-person transactions compared to 2023.

Banco Bradesco's legacy IT systems and infrastructure likely represent its 'Dogs' in a BCG Matrix analysis. These are older, less efficient platforms that are difficult to integrate with modern digital banking solutions, requiring substantial resources for maintenance. For example, in 2023, many traditional banks reported that a significant portion of their IT budget was allocated to maintaining these legacy systems, often exceeding 60%, which stifles innovation and agility.

These systems, while critical for ongoing operations, do not offer a competitive advantage or drive growth in the rapidly evolving digital financial landscape. They are primarily cost centers, demanding investment for upkeep rather than for developing new services or expanding market reach. This situation is common across the banking sector, where the cost of modernizing core banking systems can be substantial, often running into hundreds of millions of dollars for large institutions.

Niche, low-demand traditional products within Banco Bradesco's portfolio might include very specific, paper-based financial instruments or legacy advisory services that have been largely superseded by digital alternatives. For instance, certain types of physical bond certificates or highly specialized, outmoded investment advice packages could fit this description. These offerings likely contribute minimally to overall revenue and may necessitate ongoing, disproportionate operational costs for their continued existence.

Underperforming Regional Operations

Underperforming regional operations within Banco Bradesco would likely be categorized as Dogs in the BCG Matrix. These are business segments or branches that exhibit low market share and operate in low-growth regions. For instance, a Bradesco branch in a declining industrial town might struggle to attract new customers or grow its loan portfolio.

These units often require significant investment to even maintain their current, albeit low, performance. The decision to divest or liquidate such operations is often considered when the cost of revitalization outweighs the potential future returns. In 2024, financial institutions like Bradesco are constantly evaluating their branch networks and regional performance to optimize resource allocation.

- Low Market Share: These operations have not captured a significant portion of their local market.

- Low Growth Market: The economic environment in which they operate is not expanding rapidly.

- Profitability Concerns: They may be barely breaking even or consistently losing money.

- Resource Drain: They can consume management attention and capital that could be better used elsewhere.

Non-Strategic Investments with Poor Returns

Non-strategic investments with poor returns in Banco Bradesco's portfolio represent assets that have historically underperformed and offer limited potential for future growth. These could include minority stakes in companies outside of Bradesco's core banking and financial services operations. Such investments often drain valuable capital and management attention without contributing to the bank's overall strategic objectives or profitability.

For instance, consider a hypothetical past investment of R$500 million in a non-financial technology startup that, as of early 2024, has only appreciated by 5% since its acquisition. This minimal return, coupled with a lack of synergy with Bradesco's primary business lines, positions it as a classic "Dog" in the BCG Matrix. The opportunity cost of this capital could be significantly higher if deployed in more strategic areas or even in diversified market investments yielding average returns of 8-10% annually.

- Underperforming Assets: Investments that have consistently generated low returns, such as a 2% annual yield on a R$200 million stake in a retail chain, which lags behind inflation and benchmark interest rates.

- Lack of Strategic Fit: Holdings that do not align with Bradesco's core competencies in banking, insurance, or asset management, thereby offering no synergistic benefits.

- Capital Inefficiency: These assets tie up capital that could otherwise be reinvested in high-growth areas or returned to shareholders, impacting overall capital allocation efficiency.

- Divestment Consideration: Bradesco might explore divesting these non-core, low-return assets to free up capital, potentially realizing losses but improving the portfolio's overall financial health and strategic focus.

Banco Bradesco's legacy IT systems are prime examples of "Dogs" in the BCG Matrix. These older platforms require substantial maintenance, consuming over 60% of IT budgets in 2023 for many traditional banks, hindering innovation. They do not offer a competitive edge and are primarily cost centers, demanding investment for upkeep rather than growth.

Underperforming regional operations, such as a branch in a declining industrial town, also fall into the "Dog" category. These units have low market share in low-growth areas and may struggle to attract new customers or grow their loan portfolios. By early 2024, financial institutions like Bradesco are actively evaluating such underperforming assets to optimize resource allocation.

Non-strategic investments with poor returns, like a hypothetical R$500 million investment in a technology startup that saw only a 5% appreciation by early 2024, are also "Dogs." These assets tie up capital inefficiently and lack strategic fit, prompting consideration for divestment to improve overall financial health.

| Category | Description | Banco Bradesco Example | 2023/2024 Data Point | Strategic Implication |

|---|---|---|---|---|

| Legacy IT Systems | Outdated, inefficient platforms requiring high maintenance costs and hindering digital transformation. | Traditional core banking infrastructure. | Over 60% of IT budgets allocated to maintenance for legacy systems in the banking sector. | Drains resources, limits agility, and impacts competitive positioning. |

| Underperforming Branches | Physical locations with declining transaction volumes and high operating expenses in low-growth markets. | Rural or economically depressed area branches. | 15% decrease in in-person transactions in some rural branches (2024 vs. 2023). | Potential for divestment or restructuring to optimize the branch network. |

| Non-Strategic Investments | Assets with low returns and no synergy with core business operations. | Minority stakes in non-financial companies. | A hypothetical R$500 million tech startup investment appreciated only 5% by early 2024. | Represents capital inefficiency and opportunity cost, prompting divestment reviews. |

Question Marks

Banco Bradesco is actively exploring blockchain and distributed ledger technologies (DLT) through pilot projects focused on areas like trade finance and interbank settlements. These initiatives represent potential high-growth opportunities for the future of financial services.

Currently, blockchain and DLT applications have low market penetration, placing them in the experimental "Question Marks" category of the BCG Matrix. Bradesco's commitment to these nascent technologies signifies a strategic bet on future market shifts, requiring significant investment with uncertain short-term returns.

Banco Bradesco’s new international market entries are positioned as Stars or Question Marks in the BCG Matrix, depending on their current growth trajectory and market share. These ventures, often in emerging economies with high growth potential, demand significant capital for brand building and customer acquisition. For instance, Bradesco’s expansion into Latin American countries like Colombia or Peru would fit this category if they are still establishing their presence.

These new markets are characterized by intense competition from entrenched local banks and other international players. Bradesco’s strategy here involves aggressive marketing and tailored product offerings to gain traction. The success of these ventures is critical for future revenue diversification, though they currently represent a drain on resources as they build market share.

Banco Bradesco's venture into hyper-personalized, AI-driven financial advisory for its mass-affluent customers is a classic Question Mark. While the global robo-advisory market was projected to reach $2.1 trillion in assets under management by 2025, Bradesco's specific market penetration for these advanced services in early 2024 might still be in its nascent stages, facing the challenge of customer adoption.

Significant investment in sophisticated AI algorithms and robust data analytics infrastructure is crucial for Bradesco to truly differentiate its offerings. For instance, the cost of developing and maintaining cutting-edge AI platforms can be substantial, impacting profitability in the short term as the bank works to build scale and prove the value proposition to its client base.

Strategic Fintech Partnerships/Acquisitions

Banco Bradesco's strategic fintech partnerships and acquisitions often begin as question marks in the BCG matrix. These ventures, focused on emerging areas like embedded finance or specialized lending, typically have low initial market share and uncertain scaling potential. For example, Bradesco's investment in the digital payments platform RecargaPay, which has seen significant user growth, represents a classic question mark. In 2024, such investments are crucial for staying competitive, though they demand substantial cash for development and market penetration.

These fintech collaborations are designed to explore high-growth segments, but their ability to capture significant market share and generate substantial returns remains a key question. Their success hinges on effective integration and the ability to scale rapidly. Bradesco's ongoing exploration of AI-driven credit scoring solutions for small businesses exemplifies this strategy, aiming to unlock new revenue streams but requiring considerable upfront investment.

- Focus on Emerging Technologies: Partnerships and acquisitions target areas like embedded finance, AI-driven advisory services, and blockchain-based solutions.

- Low Initial Market Share: These fintech entities typically start with a small customer base and limited revenue.

- High Investment Needs: Significant capital is allocated for research, development, integration, and market expansion.

- Uncertain Future Success: The long-term viability and market dominance of these ventures are yet to be determined, placing them in the question mark category.

Specialized Digital Credit Products for Underserved Segments

Developing specialized digital credit products for underserved segments, like small business owners or gig economy workers, presents a classic Question Mark scenario for Bradesco. While the potential for growth is substantial, given the significant unmet demand in these areas, the initial investment in technology and data analytics is considerable. For instance, in 2024, the digital lending market in Brazil was projected to grow by over 15%, with a significant portion of this growth expected from alternative credit solutions.

These products often rely on alternative data sources, such as utility payments or social media activity, for credit scoring, which requires sophisticated data science capabilities and robust risk management frameworks. Bradesco's ability to effectively underwrite and price these loans, while achieving profitability, is still being proven. The bank's market share in these nascent segments may be low initially, necessitating aggressive marketing and product refinement to capture a meaningful position.

- High Growth Potential: The demand for accessible credit among underserved populations in Brazil remains largely unmet, offering a significant opportunity for digital solutions.

- Investment Intensive: Significant capital expenditure is required for developing advanced data analytics, AI-powered credit scoring models, and secure digital platforms.

- Uncertain Profitability: Refining the business model to ensure consistent profitability from these niche segments, given potentially higher default rates and operational costs, is a key challenge.

- Low Initial Market Share: Entering these new markets means Bradesco will likely start with a small customer base, requiring substantial effort to build brand awareness and trust.

Banco Bradesco's foray into new digital banking platforms and specialized financial apps often falls into the Question Mark category. These initiatives aim to capture younger demographics or specific market niches, but their success is contingent on customer adoption and competitive differentiation. For instance, a new app focused on micro-investments or sustainable finance would require substantial marketing and feature development.

The bank is investing heavily in these digital ventures, anticipating future revenue streams, but the immediate return on investment is uncertain. In 2024, the fintech landscape continues to evolve rapidly, meaning these platforms face intense competition and the risk of obsolescence if they cannot scale effectively or adapt to changing user preferences. Bradesco's ability to gain significant market share in these emerging digital spaces is still unproven.

| Initiative | Market Growth Potential | Current Market Share | Investment Required | Projected ROI (Uncertain) |

|---|---|---|---|---|

| New Digital Banking Platform | High | Low | High | Medium |

| Specialized Financial Apps | Medium | Low | Medium | Low to Medium |

BCG Matrix Data Sources

Our Banco Bradesco BCG Matrix is constructed using comprehensive financial disclosures, detailed market share data, and expert industry analysis to provide a clear strategic overview.