Badger Meter Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Badger Meter Bundle

Badger Meter navigates a competitive landscape shaped by moderate buyer power and significant supplier influence, particularly concerning specialized components. The threat of new entrants is somewhat mitigated by high capital requirements and established brand loyalty, but the potential for disruptive technologies remains a key consideration.

The complete report reveals the real forces shaping Badger Meter’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Badger Meter depends on a select group of suppliers for specialized components essential to its smart water meters and flow instrumentation. When these suppliers are few and highly specialized, their ability to dictate terms, including pricing, significantly grows, potentially squeezing Badger Meter's profit margins or disrupting production.

The company has acknowledged facing cost pressures from tariffs, particularly on materials like bismuth used in brass ingots, which directly highlights the leverage suppliers can exert through raw material pricing. This reliance on a concentrated supplier base for critical inputs means Badger Meter has to carefully manage these relationships to mitigate risks and cost increases.

The cost and complexity for Badger Meter to switch suppliers can be substantial, especially when dealing with integrated technologies or proprietary components. This isn't just about the direct financial outlay but also encompasses potential production disruptions, the rigorous process of requalifying new parts, and the risk of impacting overall product performance. For instance, in 2024, Badger Meter's commitment to advanced metering infrastructure likely involves specialized components where supplier integration is deep.

These high switching costs significantly bolster the bargaining power of Badger Meter's suppliers. It creates a barrier, making it challenging and costly for Badger Meter to readily transition to alternative sources, thereby increasing supplier leverage in negotiations.

Badger Meter's position as a significant customer for its suppliers can influence the bargaining power of those suppliers. If Badger Meter accounts for a substantial portion of a supplier's total sales, the supplier may be more inclined to offer competitive pricing and maintain a strong relationship to secure that business. This interdependence can temper the supplier's ability to dictate terms.

Conversely, if Badger Meter represents a small fraction of a supplier's revenue, that supplier might possess greater leverage. While specific revenue breakdowns for Badger Meter's key suppliers are not publicly detailed, the company's market presence and operational scale suggest it is likely a considerable client for many of its component and material providers.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into manufacturing flow measurement and control solutions could significantly boost their bargaining power. This scenario, though less frequent for typical component suppliers, becomes a real concern if a crucial technology provider decides to enter the finished product market, directly competing with Badger Meter.

Such a move would diminish Badger Meter's dependence on that specific supplier and simultaneously intensify competition within the industry. For instance, if a specialized sensor manufacturer, vital for Badger Meter's product line, were to launch its own integrated meter, it would fundamentally alter the supply dynamic.

- Supplier Forward Integration: The possibility of suppliers entering Badger Meter's market creates a substantial threat.

- Increased Bargaining Power: If suppliers become competitors, their leverage over Badger Meter would rise.

- Reduced Dependence: Badger Meter would face less reliance on suppliers who also act as direct rivals.

- Market Competition: The entry of suppliers into the finished product space would heighten competitive pressures.

Availability of Substitute Inputs

The availability of substitute inputs significantly impacts Badger Meter's bargaining power with its suppliers. If Badger Meter can easily switch to alternative materials or components, the power of its current suppliers diminishes. For instance, if a key plastic resin used in meter casings has several comparable alternatives from different manufacturers, Badger Meter can negotiate more favorable terms or switch suppliers if prices rise excessively.

However, the situation changes for specialized components. For highly engineered parts or proprietary technologies crucial to Badger Meter's product performance, the availability of substitutes is often limited. In such cases, suppliers of these specialized items hold greater bargaining power. For example, if a particular sensor technology offers a unique advantage that competitors do not yet replicate, the supplier of that sensor can command higher prices and dictate terms, as Badger Meter has fewer viable alternatives.

In 2023, the global semiconductor shortage, a prime example of limited substitute availability for critical electronic components, demonstrated this dynamic. Many manufacturers, including those in the water metering industry, faced increased lead times and higher costs for essential chips, underscoring how a lack of substitutes can empower suppliers. Badger Meter, like many in the sector, likely navigated these challenges by securing long-term supply agreements or exploring alternative sourcing, though the underlying leverage remained with the component providers.

- Limited Substitutes for Advanced Components: Suppliers of specialized electronic sensors or high-precision machined parts often have strong bargaining power due to the scarcity of viable alternatives.

- Impact of Material Volatility: Fluctuations in the price of raw materials like brass or specialized polymers can be passed on to Badger Meter if substitute materials are not readily available at competitive prices.

- Strategic Sourcing Importance: Badger Meter's ability to identify and qualify alternative suppliers for common components can mitigate supplier power and ensure cost stability.

- Technological Dependence: Reliance on unique technological inputs from a single supplier can create a significant power imbalance, potentially leading to higher costs for Badger Meter.

Badger Meter's suppliers hold significant bargaining power due to the specialized nature of many components required for its advanced metering technology. The limited availability of substitutes for these critical parts, coupled with the high costs Badger Meter incurs to switch suppliers, creates a strong leverage for these providers. This dynamic was evident in 2023 with global supply chain issues, particularly for semiconductors, which drove up costs and lead times for manufacturers across industries, including smart water meters.

For instance, if a supplier provides a unique sensor crucial for a meter's accuracy, Badger Meter has few alternatives, allowing the supplier to command higher prices. This reliance on specialized inputs means that suppliers of these niche technologies can significantly influence Badger Meter's cost structure and production schedules. The company's efforts in 2024 to enhance its smart water meter offerings likely involve even more sophisticated components, potentially increasing this supplier leverage.

| Factor | Impact on Badger Meter | 2023/2024 Relevance |

|---|---|---|

| Supplier Concentration | Few suppliers for specialized components increase their power. | Critical for advanced metering technology components. |

| Switching Costs | High costs to change suppliers limit Badger Meter's options. | Requalification of parts and potential production delays are key concerns. |

| Availability of Substitutes | Limited substitutes for unique technologies empower suppliers. | Semiconductor shortages in 2023 highlighted this issue for electronic components. |

| Supplier Forward Integration Threat | Suppliers entering Badger Meter's market would increase their leverage. | A potential risk for key technology providers. |

What is included in the product

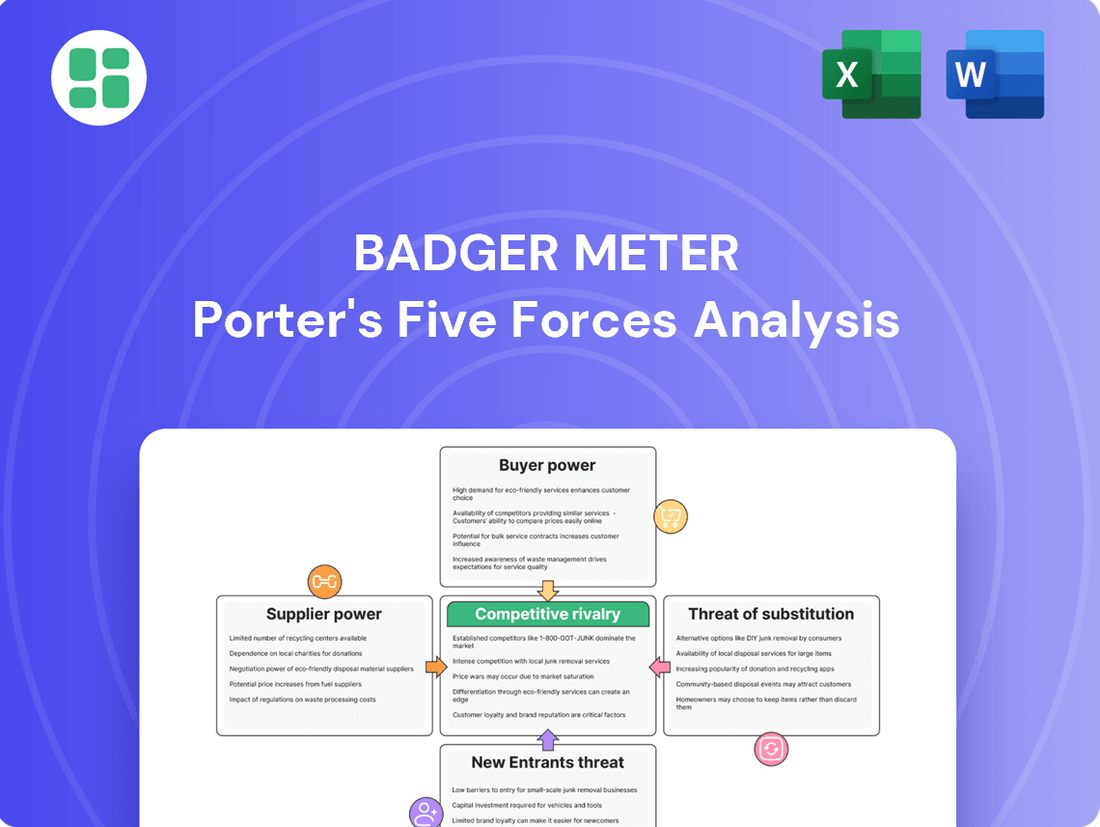

Tailored exclusively for Badger Meter, this analysis dissects the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the impact of substitutes on its market position.

Instantly assess competitive threats and opportunities with a visual representation of all five forces, streamlining strategic planning.

Customers Bargaining Power

Badger Meter's customer base is diverse, serving water utilities, commercial and industrial clients, and original equipment manufacturers (OEMs). Large water utilities, particularly those engaged in substantial infrastructure modernization projects, possess significant purchasing volume, which translates into considerable bargaining power. For instance, in 2023, the global smart water market was valued at approximately $11.5 billion and is projected to grow substantially, indicating increasing demand for Badger Meter's offerings.

For water utilities, the cost of switching metering or water management solutions is substantial. These expenses encompass not only the physical replacement of infrastructure but also the retraining of staff and the complex process of migrating existing data. This financial and operational barrier significantly raises switching costs for customers, thereby diminishing their leverage over providers like Badger Meter.

Badger Meter's strategic focus on its integrated 'BlueEdge' platform is designed to capitalize on this. By offering a comprehensive package of hardware, software, and ongoing services, the company aims to foster deeper customer integration. This integrated approach inherently increases the difficulty and expense for utilities to transition to a competitor, effectively locking them into Badger Meter's ecosystem and reinforcing the company's market position.

Badger Meter significantly reduces customer bargaining power by offering highly differentiated products and services. Their advanced metering infrastructure (AMI) solutions, including smart water metering and flow instrumentation, coupled with software like BEACON SaaS, create unique value propositions that are difficult for customers to replicate or substitute easily.

The company's emphasis on industry-leading cellular-based AMI and its comprehensive BlueEdge water management solutions further strengthens this differentiation. This focus on proprietary technology and integrated solutions makes customers less sensitive to price and less likely to switch to competitors, thereby limiting their bargaining leverage.

Threat of Backward Integration by Customers

The threat of backward integration by customers, particularly large water utilities, is generally low for companies like Badger Meter. Developing proprietary flow measurement and control solutions demands significant specialized expertise in engineering, manufacturing, and software development, along with substantial capital investment. This high barrier to entry means most customers lack the capability or desire to produce these technologies in-house.

Consequently, customers remain reliant on specialized suppliers, which inherently limits their bargaining power. For instance, in 2024, the global smart water meter market, valued at approximately $6.5 billion, is dominated by a few key players with established technological advantages. This concentration of expertise reinforces the supplier's position and reduces the likelihood of widespread customer backward integration.

- Low Likelihood of In-House Development: Water utilities typically focus on distribution and service, not high-tech manufacturing.

- High Technical Barriers: Creating advanced flow measurement technology requires deep R&D and specialized production capabilities.

- Capital Investment Constraints: The cost to develop and manufacture such solutions is often prohibitive for utility budgets.

- Supplier Dependence: Customers rely on suppliers like Badger Meter for innovation, quality, and cost-effectiveness in metering technology.

Customer Price Sensitivity

Customer price sensitivity for water management solutions, while present especially for budget-conscious municipalities, is often tempered by the significant long-term value proposition. For instance, in 2024, many municipalities faced ongoing budget pressures, making initial investment costs a consideration. Badger Meter's smart water technology, however, directly addresses this by offering substantial operational efficiencies and reduced water loss, which translate into tangible cost savings over time. The urgency for modern water infrastructure, driven by factors like aging systems and increasing demand for efficient resource management, further supports the adoption of these advanced solutions, reducing the impact of upfront pricing.

The bargaining power of customers in the water utility sector, while influenced by price sensitivity, is also shaped by the critical nature of the service and the long-term benefits of advanced metering. While municipalities may be budget-constrained, the payback period for smart water solutions, often measured in years rather than decades, demonstrates their economic viability. For example, studies in 2024 indicated that the reduction in non-revenue water achieved through smart metering can provide a return on investment within 5-7 years for many utilities. This long-term financial advantage, coupled with the imperative for regulatory compliance and improved customer service, lessens the customers' ability to exert downward pressure on prices based solely on initial cost.

- Price Sensitivity vs. Long-Term Value: Municipalities, though often budget-constrained in 2024, weigh initial costs against long-term savings from efficiency and reduced water loss.

- Mitigating Factors: Badger Meter's smart solutions offer efficiency gains and regulatory compliance benefits that lessen price sensitivity.

- Demand Drivers: The growing need for modern water technology, driven by efficient resource management, supports the value proposition of advanced metering.

Badger Meter's customer bargaining power is generally low due to high switching costs, proprietary technology, and the essential nature of their offerings. While large utilities have purchasing volume, the expense and complexity of replacing integrated metering and management systems limit their leverage. For example, the global smart water meter market, valued at approximately $6.5 billion in 2024, is characterized by technological specialization, making it difficult for utilities to develop solutions in-house.

The company's integrated BlueEdge platform and advanced AMI solutions create significant customer stickiness. These offerings provide unique value, reducing customer sensitivity to price and making it costly to switch. In 2023, the smart water market reached about $11.5 billion, highlighting the demand for sophisticated, integrated systems that Badger Meter provides.

Price sensitivity is also mitigated by the long-term operational efficiencies and reduced water loss that Badger Meter's technology delivers. Despite budget pressures faced by municipalities in 2024, the rapid payback periods for smart water solutions, often 5-7 years, underscore their economic advantage over initial costs. This focus on value and efficiency limits customers' ability to negotiate lower prices.

| Factor | Impact on Customer Bargaining Power | Supporting Data/Observation |

| Switching Costs | Lowers customer power | High costs for infrastructure replacement, data migration, and retraining staff. |

| Product Differentiation | Lowers customer power | Proprietary AMI and BlueEdge platform create unique value difficult to substitute. |

| Backward Integration Threat | Lowers customer power | High technical and capital barriers prevent utilities from in-house development. |

| Price Sensitivity | Moderately low customer power | Long-term value and rapid ROI (5-7 years) outweigh initial cost concerns. |

Full Version Awaits

Badger Meter Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This comprehensive Porter's Five Forces analysis of Badger Meter details the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the water metering industry. What you're previewing is what you get—professionally formatted and ready for your needs.

Rivalry Among Competitors

The flow measurement and control solutions market, especially in smart water metering, is quite competitive. Badger Meter faces several significant rivals, including established names like Itron, Watts Water Technologies, Sensus, Mueller Water Products, and Neptune Technology Group Inc. This diverse group of competitors means Badger Meter must continually innovate to maintain its market position.

The competitive landscape is further intensified by the emergence of new players focusing on niche technologies. For instance, companies specializing in advanced solutions like non-contact radar flow meters are entering the market. This technological diversity underscores the dynamic nature of the industry and the constant pressure on existing companies to adapt and improve their offerings.

The smart water metering market is a hotbed of innovation, with projections showing a significant expansion. This sector is expected to grow from $4.41 billion in 2024 to $5.02 billion in 2025, marking a robust compound annual growth rate of 13.9%. Such rapid expansion can temper competitive rivalry, as companies have ample room to grow their revenue and operations without necessarily encroaching on their rivals' existing market share.

This dynamic is further supported by the broader water utility services market, which is also exhibiting steady growth. When an industry is expanding, the pressure to aggressively compete for a finite customer base is lessened. This allows companies like Badger Meter to focus on innovation and capturing new opportunities rather than engaging in cutthroat price wars or aggressive market share grabs.

Badger Meter actively differentiates itself through innovative product offerings and integrated solutions. Key examples include their ORION Cellular Advanced Metering Infrastructure (AMI) and the BEACON Software-as-a-Service (SaaS) platform, which provide advanced data management and customer engagement capabilities.

Strategic acquisitions bolster this differentiation. The 2022 acquisition of SmartCover, for instance, expanded Badger Meter's reach into the crucial markets of sewer and lift station monitoring, adding valuable environmental sensing and data analytics to their portfolio.

In 2023, Badger Meter reported revenue growth of 17% to $674.7 million, underscoring the market's demand for their differentiated solutions. Continued investment in sensor technology, data analytics, and software is paramount to maintaining this competitive advantage and meeting evolving customer needs in the smart water utility sector.

Exit Barriers

High exit barriers can significantly influence competitive rivalry within an industry. For Badger Meter, the specialized nature of its flow measurement technologies, which often involve proprietary software and complex manufacturing processes, creates substantial sunk costs. Companies heavily invested in these unique assets find it difficult and costly to divest or repurpose them, leading to a reluctance to exit the market even when profitability declines.

This reluctance to leave can prolong periods of intense competition. For instance, if a competitor has invested heavily in R&D and manufacturing for advanced ultrasonic or electromagnetic meters, abandoning this investment would mean a significant financial loss. This situation forces existing players to continue competing, potentially driving down prices and margins for all involved, as they strive to recover their initial outlays.

- Specialized Assets: Badger Meter's manufacturing facilities are likely equipped with highly specialized machinery for producing precision flow measurement devices, making them difficult to repurpose for other industries.

- Long-Term Contracts: Many municipal and industrial clients enter into multi-year service and supply agreements, creating contractual obligations that are costly to break.

- Sunk Costs: Significant investments in research and development for patented technologies and extensive sales networks represent substantial sunk costs that deter market exit.

- Industry Trend: As of 2024, the smart water meter market, a key segment for Badger Meter, continues to see strong demand, but the high initial capital expenditure for advanced manufacturing and R&D keeps the barrier to entry and exit elevated.

Market Concentration

The North American water meter market exhibits significant concentration, with Badger Meter, Sensus, Neptune Technology Group Inc., and Mueller Water Products Inc. collectively capturing over 90% of sales. This consolidation among a few key players suggests a market where established relationships and brand recognition play a crucial role.

Despite this concentration, competitive rivalry remains intense. The ongoing shift towards electronic meters and advanced metering infrastructure (AMI) creates opportunities for innovation and differentiation, fueling competition among these dominant firms. For instance, the increasing demand for smart water solutions means companies are constantly vying to offer the most advanced and cost-effective technologies.

- Market Dominance: Badger Meter, Sensus, Neptune, and Mueller control over 90% of the North American water meter market.

- Intense Rivalry: High market concentration does not diminish the competitive drive, particularly with technological advancements.

- Technological Disruption: The adoption of electronic and smart metering technologies is a key battleground for market share.

Competitive rivalry within the flow measurement and control solutions market, particularly in smart water metering, is robust. Badger Meter faces formidable competition from established players like Itron and Sensus, alongside emerging niche technology providers, driving a constant need for innovation.

The market's projected growth, with the smart water metering sector expected to reach $5.02 billion by 2025, offers room for expansion, potentially tempering aggressive competition as companies focus on capturing new opportunities rather than solely market share.

Badger Meter differentiates itself through offerings like the ORION Cellular AMI and BEACON SaaS platform, further strengthened by strategic acquisitions such as SmartCover in 2022, which expanded its capabilities into sewer and lift station monitoring.

In 2023, Badger Meter achieved 17% revenue growth, reaching $674.7 million, highlighting the demand for its advanced solutions and the importance of continued investment in technology and data analytics to maintain its competitive edge.

| Competitor | Key Offerings | Market Focus |

|---|---|---|

| Itron | Smart grid solutions, smart meters | Water, gas, electricity utilities |

| Sensus (Xylem) | Smart water meters, communication networks | Water utilities |

| Mueller Water Products | Water infrastructure, fire hydrants, valves | Water and wastewater utilities |

| Neptune Technology Group Inc. | Meter reading systems, data management | Water, gas, electric utilities |

SSubstitutes Threaten

The threat of substitutes for Badger Meter's products primarily revolves around the price-performance trade-off. Traditional mechanical meters, though less sophisticated, present a lower-cost alternative, especially in markets with limited technological adoption or tighter budgets. For instance, in some developing regions, the upfront cost of advanced smart metering technology can be a significant barrier.

However, the tangible benefits of Badger Meter's smart meters, such as enhanced accuracy, real-time data transmission, and advanced leak detection, often justify the higher initial expenditure for many customers. These performance advantages translate into long-term savings through reduced water loss and more efficient resource management, making the upgrade economically sensible despite the higher initial price point.

Customers' willingness to switch to alternatives is significantly influenced by their understanding of water scarcity, environmental rules, and the financial benefits of efficient water use. As cities expand and environmental awareness rises, the inclination to adopt smart water technologies grows, lessening the appeal of simpler, less advanced options.

For instance, in 2024, cities facing critical water shortages, like parts of California and Texas, saw increased demand for smart metering solutions, with adoption rates in some municipalities climbing by over 15% compared to the previous year. This trend is driven by both regulatory pressure and the clear cost savings realized from reduced water waste.

The threat of substitutes for Badger Meter's offerings is amplified by the availability of alternative flow measurement technologies. Beyond traditional mechanical meters, advanced options like ultrasonic, electromagnetic, and Coriolis flowmeters provide different benefits and can serve as replacements in various scenarios. For instance, non-contact radar flow meters are increasingly competing, especially in demanding operational settings.

While Badger Meter itself offers a diverse technological portfolio, the wider market presents a broad spectrum of solutions. This means customers have choices that might bypass conventional metering, impacting market share. For example, the global flow meter market was valued at approximately $7.7 billion in 2023 and is projected to reach over $10 billion by 2028, indicating significant growth and the presence of various competing technologies.

Evolution of Water Management Practices

The water utility sector is increasingly moving beyond basic metering to embrace sophisticated, integrated water management solutions. This evolution presents a significant threat of substitution for standalone meter providers.

Companies offering comprehensive platforms that combine hardware, communication networks, and advanced analytics are gaining traction. For instance, Badger Meter's BlueEdge platform exemplifies this shift, integrating meter technology with data management and communication capabilities. This approach directly counters the threat from less integrated, simpler meter offerings.

- Broadening Scope: The trend is towards holistic water management, encompassing leak detection, pressure management, and customer engagement, not just measurement.

- Technological Integration: Software-driven analytics and remote monitoring are becoming standard, making basic meters less competitive.

- Platform Advantage: Integrated solutions like Badger Meter's BlueEdge offer a more complete value proposition, reducing the appeal of fragmented systems.

- Market Response: Utilities are prioritizing vendors that can deliver end-to-end solutions, impacting the market share of single-product suppliers.

Regulatory and Environmental Drivers

Increasingly stringent environmental regulations and smart city initiatives globally are a significant threat to less advanced water management solutions. These regulations, such as those aimed at reducing water loss and improving water quality, directly push for the adoption of more accurate and efficient technologies. For instance, in 2024, many municipalities are investing heavily in smart water metering infrastructure to comply with mandates for leak detection and conservation.

This regulatory push makes traditional, less precise methods of water management less appealing and viable. As governments worldwide tighten standards for water usage and reporting, the demand for sophisticated solutions like those offered by Badger Meter grows. This trend is further amplified by smart city projects, which prioritize data-driven efficiency and sustainability in urban infrastructure, directly impacting the market for water technology.

The threat of substitutes is therefore elevated by these external drivers, pushing customers towards advanced metering and monitoring systems. Consider the growing emphasis on water scarcity; by 2025, projections indicate that over two-thirds of the world's population could face water shortages, a reality that intensifies the need for precise water management. This context makes older, less accurate technologies a poor substitute for modern, regulated solutions.

- Regulatory Mandates: Stricter environmental laws worldwide compel utilities to adopt advanced water management technologies, making older, less efficient methods obsolete.

- Smart City Integration: The global push for smart cities prioritizes data-driven infrastructure, increasing demand for sophisticated water monitoring and control systems.

- Water Scarcity Concerns: Growing awareness of water scarcity issues in 2024 and beyond drives investment in technologies that ensure accurate measurement and conservation.

The threat of substitutes for Badger Meter's products is multifaceted, encompassing both lower-tech alternatives and more integrated solutions. While traditional mechanical meters offer a lower upfront cost, their lack of advanced features makes them less appealing as environmental regulations and water scarcity concerns intensify. For instance, in 2024, cities facing water stress saw smart meter adoption rise by over 15%, highlighting a clear shift driven by efficiency needs.

Furthermore, the market is seeing a rise in comprehensive water management platforms that go beyond simple measurement. These integrated systems, like Badger Meter's own BlueEdge, combine hardware with advanced analytics and communication, offering a more complete value proposition. This trend pressures standalone meter providers and makes fragmented solutions a less attractive substitute.

The global flow meter market, valued at approximately $7.7 billion in 2023, showcases the diverse technological landscape, with ultrasonic and electromagnetic meters also serving as potential substitutes in specific applications. However, the increasing regulatory push for conservation and smart city initiatives, coupled with growing water scarcity projections for 2025, significantly elevates the demand for sophisticated, data-driven water management solutions, thereby diminishing the viability of less advanced substitutes.

| Substitute Type | Key Differentiator | Threat Level (2024) | Example/Driver |

|---|---|---|---|

| Traditional Mechanical Meters | Lower upfront cost | Moderate to High (in budget-constrained markets) | Limited adoption in regions with less stringent water management regulations. |

| Alternative Flow Technologies (Ultrasonic, Electromagnetic) | Specific performance advantages (e.g., non-contact measurement) | Moderate | Competition in demanding industrial or specialized utility applications. |

| Integrated Water Management Platforms | Comprehensive data analytics, communication, and management capabilities | High | Shift towards end-to-end solutions driven by smart city initiatives and efficiency mandates. |

Entrants Threaten

Entering the flow measurement and control sector, particularly in smart water metering and advanced instrumentation, demands substantial capital. Companies need significant investment for research and development, state-of-the-art manufacturing facilities, and robust distribution networks. This high barrier effectively deters many potential new competitors.

Badger Meter, like many established players in the water meter industry, benefits significantly from economies of scale. This means their larger production volumes allow for lower per-unit costs in manufacturing, purchasing raw materials, and even in research and development. For instance, in 2023, Badger Meter reported a gross profit margin of 44.5%, indicating efficient cost management that newer, smaller competitors would find difficult to replicate.

New entrants face a substantial hurdle in matching these cost efficiencies. Without the same production volume, they cannot negotiate bulk discounts on materials or spread their fixed overheads across as many units. This cost disadvantage makes it challenging for new companies to compete on price with established giants like Badger Meter, thereby acting as a significant barrier to entry.

Badger Meter's proprietary technology, particularly its cellular Advanced Metering Infrastructure (AMI) solutions and software platforms such as BEACON, presents a significant hurdle for potential new entrants. These patented innovations require substantial upfront investment in research and development for any competitor aiming to replicate or surpass Badger Meter's technological capabilities in flow measurement. For instance, in 2023, Badger Meter reported a 13% increase in revenue from its smart metering technologies, underscoring the market's demand and the technological moat these solutions provide.

Access to Distribution Channels

Established relationships with water utilities, commercial sectors, and original equipment manufacturers (OEMs) are paramount for Badger Meter to access key markets. These deep-seated connections are not easily replicated.

New entrants would find it incredibly difficult to establish comparable distribution networks. Building trust with these established customers typically involves lengthy sales cycles and stringent qualification procedures, creating a significant barrier.

- Established Relationships: Badger Meter benefits from long-standing partnerships with a broad base of water utilities and commercial clients.

- Distribution Network Strength: The company's extensive and proven distribution channels provide a significant competitive advantage.

- Customer Trust and Qualification: Gaining entry into the water infrastructure sector requires overcoming rigorous qualification processes and building substantial customer trust, which new players lack.

Regulatory Hurdles and Standards

The water utility sector presents significant regulatory hurdles that act as a barrier to entry. Companies must adhere to stringent standards, such as those set by the American Water Works Association (AWWA), which are crucial for ensuring public health and safety. For instance, AWWA standards cover everything from water quality testing to operational procedures, requiring substantial investment in compliance and expertise. Navigating this complex regulatory landscape can be a daunting and costly undertaking for new entrants, often favoring established companies with existing infrastructure and experience.

These regulatory requirements translate into tangible costs and operational complexities. New companies entering the market may face lengthy approval processes and significant capital expenditures to meet mandated standards for water treatment, distribution, and monitoring. In 2024, the ongoing focus on infrastructure upgrades and cybersecurity within water utilities further intensifies these compliance demands. For example, the U.S. Environmental Protection Agency (EPA) continues to enforce regulations like the Lead and Copper Rule, requiring substantial investment in lead service line replacements, a cost that can be prohibitive for startups.

- Regulatory Complexity: Compliance with AWWA and EPA standards requires specialized knowledge and resources.

- Capital Investment: Meeting water quality and infrastructure mandates necessitates significant upfront capital.

- Operational Burden: Ongoing monitoring, reporting, and adherence to evolving regulations add to operational costs.

- Incumbent Advantage: Established players have existing systems and expertise to manage these regulatory demands more efficiently.

The threat of new entrants in the flow measurement and control sector, particularly for smart water metering, is relatively low for Badger Meter. High capital requirements for R&D and manufacturing, coupled with significant economies of scale enjoyed by incumbents, create substantial barriers. Furthermore, established customer relationships, proprietary technology, and navigating complex regulatory landscapes all discourage new competition.

For instance, Badger Meter's investment in its BEACON platform and AMI solutions in 2023 highlights the technological moat. New entrants would need comparable R&D budgets to compete effectively. The company's 2023 gross profit margin of 44.5% demonstrates an efficiency that is difficult for newcomers to match without similar scale.

The regulatory environment, including stringent AWWA and EPA standards, adds another layer of difficulty. Meeting these requirements, especially with the ongoing focus on infrastructure upgrades and cybersecurity in 2024, demands considerable expertise and capital, favoring established players with proven compliance records.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Badger Meter leverages data from their annual reports, SEC filings, and investor presentations to understand their competitive landscape.