Badger Meter Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Badger Meter Bundle

Curious about Badger Meter's product portfolio performance? Our BCG Matrix preview highlights key areas, but the full report unlocks the complete picture. Understand which products are driving growth and which require strategic attention.

Don't just guess where Badger Meter's future lies; know it. Purchase the full BCG Matrix to gain detailed quadrant analysis, actionable insights into Stars, Cash Cows, Dogs, and Question Marks, and a clear path for optimizing your investment strategy.

This isn't just a chart; it's your strategic blueprint. Get the complete Badger Meter BCG Matrix to understand market share and growth rates, enabling you to make informed decisions that propel your business forward.

Stars

Badger Meter's smart water metering solutions, featuring ORION Cellular AMI and E-Series Ultrasonic meters, are undeniably Stars in the BCG Matrix. These innovative technologies are seeing significant uptake and impressive sales increases. This growth is fueled by the escalating need for better water efficiency and proactive leak detection across utilities.

The market for smart water management is expanding at a rapid pace. Badger Meter is a prominent player, poised to capitalize on the burgeoning adoption of IoT-enabled water meters and the integration of AI for predictive water analytics. For instance, in 2023, Badger Meter reported a 13% increase in revenue, with their smart water segment showing particularly strong performance, underscoring their Star status.

BEACON® Software as a Service (SaaS) is a prime example of a Star within Badger Meter's portfolio. This comprehensive platform integrates user-friendly software with robust cellular network services, offering clients real-time insights and analytics for effective water management.

The company has experienced significant year-over-year growth in its software division, a clear indicator of a rapidly expanding market segment where Badger Meter has established a strong competitive advantage. For instance, in the first quarter of 2024, Badger Meter reported a 14% increase in organic revenue, with their SaaS offerings being a key driver of this expansion.

The BlueEdge™ Suite of Solutions, a comprehensive offering from Badger Meter, is positioned as a Star in the BCG Matrix. This integrated platform combines smart measurement hardware, robust communications, advanced data visualization, and analytics software, all supported by dedicated customer service. It's designed to streamline water management for utilities and industrial clients.

Badger Meter's strategic focus on digital water solutions is evident in the BlueEdge™ suite's growth. In 2023, Badger Meter reported revenue of $639.6 million, a 10% increase over 2022, with their digital offerings playing a significant role in this expansion. The company continues to invest in these high-value digital solutions, aiming to capture a larger share of the evolving smart water market.

Water Quality Monitoring Solutions (s::can, Analytical Technology)

Badger Meter's strategic acquisitions of s::can and Analytical Technology have significantly bolstered its presence in the high-growth water quality monitoring market. These integrated solutions offer advanced real-time contaminant detection through sophisticated optical and electrochemical sensing. This capability is crucial for ensuring water safety and enabling proactive management strategies across various sectors.

The demand for such advanced monitoring is escalating, driven by increasingly stringent environmental regulations and a growing emphasis on public health. For instance, the global water quality monitoring market was valued at approximately $4.8 billion in 2023 and is projected to reach over $8.5 billion by 2030, demonstrating a compound annual growth rate of around 8.5%.

- Market Growth: The water quality monitoring sector, enhanced by s::can and Analytical Technology, is a key growth driver for Badger Meter.

- Technological Advancement: These solutions utilize cutting-edge optical and electrochemical sensors for precise, real-time data.

- Regulatory Compliance: They provide essential tools for industries and municipalities to meet evolving water safety standards.

- Proactive Management: The technology enables early detection of issues, facilitating preventative maintenance and resource optimization.

Wastewater & Collection System Monitoring (SmartCover Acquisition)

The acquisition of SmartCover Systems in early 2025 is a strategic move by Badger Meter to bolster its presence in the rapidly expanding wastewater and collection system monitoring sector. This integration brings advanced real-time monitoring capabilities for sewer lines and lift stations directly into Badger Meter's BlueEdge platform.

This acquisition directly addresses the critical issue of aging infrastructure, a significant challenge for municipalities worldwide. By offering smart monitoring solutions, Badger Meter is tapping into a market segment with currently low digital penetration but immense potential for future growth and technological adoption.

- Market Expansion: SmartCover's technology opens new avenues for Badger Meter in the essential wastewater management sector.

- Addressing Infrastructure Needs: The solutions provided are crucial for maintaining and upgrading aging municipal sewer systems.

- Growth Potential: The low digital adoption in this market signifies a substantial opportunity for market share capture and revenue generation.

- Enhanced Offering: Integration into the BlueEdge suite provides customers with a more comprehensive and connected utility management solution.

Badger Meter's smart water metering solutions, including ORION Cellular AMI and E-Series Ultrasonic meters, are clear Stars. These technologies are experiencing strong demand due to the growing need for water efficiency and leak detection. In 2023, Badger Meter saw a 13% revenue increase, with their smart water segment leading the charge.

The BEACON® Software as a Service (SaaS) platform is another Star, offering real-time water management analytics. The company's software division showed significant year-over-year growth, with Q1 2024 organic revenue up 14%, driven by these SaaS offerings.

The BlueEdge™ Suite, integrating hardware, communication, and analytics, is a Star. Badger Meter's 2023 revenue reached $639.6 million, a 10% rise from 2022, with digital solutions like BlueEdge being key contributors.

Acquisitions like s::can and Analytical Technology have positioned Badger Meter strongly in the water quality monitoring market, a sector projected to grow from $4.8 billion in 2023 to over $8.5 billion by 2030.

The planned acquisition of SmartCover Systems in early 2025 will further solidify Badger Meter's Star status by expanding its reach into the under-penetrated wastewater monitoring market.

| Product/Service | BCG Category | Key Growth Drivers | 2023 Performance Indicator | Future Outlook |

| ORION Cellular AMI & E-Series Ultrasonic | Star | Water efficiency, leak detection, IoT adoption | 13% revenue increase in smart water segment | Continued strong demand from utilities |

| BEACON® SaaS | Star | Data analytics, real-time insights, utility digital transformation | 14% organic revenue growth in Q1 2024 (SaaS driven) | Expansion of digital service offerings |

| BlueEdge™ Suite | Star | Integrated digital solutions, customer service | Significant contribution to 10% overall revenue growth in 2023 | Strategic focus on high-value digital solutions |

| Water Quality Monitoring (s::can & Analytical Technology) | Star | Regulatory compliance, public health, advanced sensing | Part of a market valued at $4.8 billion in 2023 | Projected market growth to $8.5 billion by 2030 |

| Wastewater Monitoring (SmartCover Systems acquisition) | Star | Aging infrastructure, low digital penetration, essential services | Acquisition planned for early 2025 | Significant growth potential in a new segment |

What is included in the product

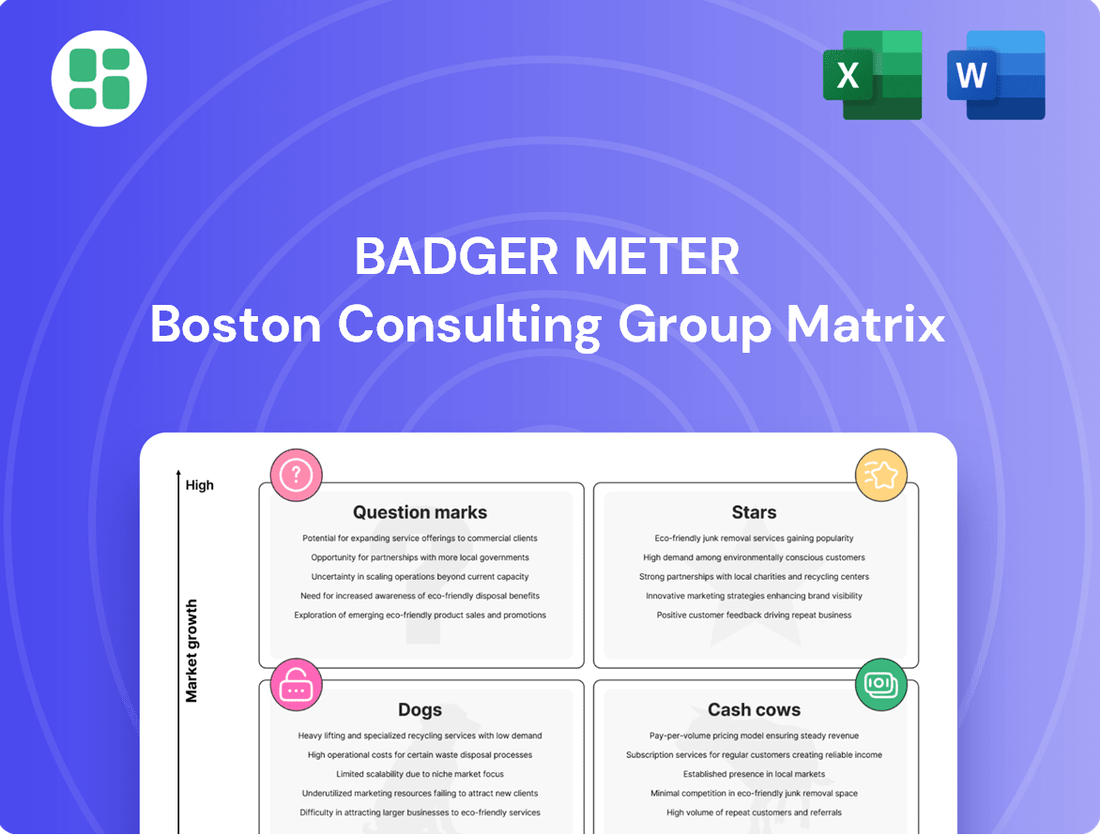

The Badger Meter BCG Matrix categorizes products into Stars, Cash Cows, Question Marks, and Dogs based on market share and growth.

It provides strategic guidance on resource allocation for each product category.

A clear BCG Matrix visual simplifies complex portfolio analysis, reducing the pain of strategic decision-making.

Cash Cows

Badger Meter's traditional mechanical water meters, like the Recordall® Disc Series, are established cash cows. These meters have a dominant market share in mature utility sectors, ensuring steady and predictable revenue. For example, in 2023, Badger Meter reported that its legacy mechanical meter segment continued to be a significant contributor to overall sales, although the company is increasingly focused on smart water solutions.

Badger Meter's established flow instrumentation products represent a classic Cash Cow. Their extensive portfolio serves a wide array of commercial and industrial sectors, with a particular strength in water management applications. This broad market penetration, coupled with a reputation for reliability, generates consistent and substantial cash flow.

While growth in some non-water related segments might be modest, the core water utility and industrial process markets continue to provide a stable demand. This steady revenue stream, characterized by high profit margins due to mature product lines and established manufacturing, underpins the Cash Cow status. For instance, in 2023, Badger Meter reported revenue growth driven by their utility water meter segment, highlighting the continued strength of these established products.

The repair and replacement parts services for Badger Meter's extensive installed base of meters and flow solutions are a clear Cash Cow. This segment thrives on the continuous need for maintenance and spare parts for existing infrastructure, ensuring a steady stream of high-margin revenue. The essential nature of water management and the durable design of Badger Meter products mean that this business requires minimal new investment to maintain its strong returns.

In 2023, Badger Meter reported that its aftermarket services, which include repair and replacement parts, contributed significantly to its overall revenue. While specific figures for just this segment aren't always broken out in detail, the company's consistent growth in this area reflects the robust demand. For instance, the company has highlighted the increasing installed base as a key driver for its service and parts revenue, indicating a stable and predictable income source.

Calibration Services for Flow Meters

Badger Meter's calibration services for flow meters are a prime example of a Cash Cow within their business portfolio. These offerings are vital for ensuring the ongoing accuracy and regulatory adherence of their installed base of flow measurement instruments.

The recurring nature of calibration, driven by the need for consistent performance and compliance, generates a predictable and stable revenue stream. This segment benefits from established operational efficiencies and leverages Badger Meter's existing customer relationships, minimizing incremental marketing and sales costs.

- Steady Revenue: Calibration services provide a consistent income source, as meters require regular checks to maintain accuracy.

- High Profitability: With mature processes and a loyal customer base, calibration services typically exhibit strong profit margins.

- Low Investment: Existing infrastructure and expertise mean minimal new capital expenditure is needed to support this segment.

- Market Dominance: Badger Meter's established reputation in flow measurement supports their position in the calibration market.

Utility Metering Infrastructure (Legacy Fixed Networks)

Utility Metering Infrastructure, specifically legacy fixed networks, operates as a Cash Cow for Badger Meter. These established Automated Metering Infrastructure (AMI) systems, particularly in mature utility markets, provide a consistent and reliable revenue stream. The focus here is on maintaining these existing installations and offering related services, rather than pursuing rapid expansion.

These systems benefit from a large, installed customer base, which translates into predictable income. Investments are primarily directed towards maintenance and operational upkeep, ensuring the continued functionality of these networks. This strategy allows Badger Meter to leverage its existing assets effectively, generating stable cash flow.

- Stable Revenue Generation: Legacy fixed AMI networks contribute consistent income due to their widespread deployment.

- Maintenance Focus: Investments are concentrated on upkeep rather than aggressive growth initiatives.

- Mature Market Dominance: These systems are crucial in established utility sectors, underpinning their Cash Cow status.

Badger Meter's portfolio of traditional mechanical water meters, such as the Recordall® Disc Series, are prime examples of Cash Cows. These products hold a substantial market share in mature utility sectors, consistently generating predictable revenue. For instance, in 2023, Badger Meter highlighted that its legacy mechanical meter segment remained a significant contributor to sales, even as the company shifts focus towards smart water solutions.

The repair and replacement parts services for Badger Meter's extensive installed base of meters and flow solutions also function as a Cash Cow. This segment benefits from the ongoing need for maintenance and spare parts for existing water infrastructure, providing a steady stream of high-margin revenue. The essential nature of water management and the durability of Badger Meter products mean this business requires minimal new investment to maintain its strong returns. In 2023, Badger Meter noted that aftermarket services, including repair and replacement parts, contributed significantly to overall revenue, driven by an increasing installed base.

| Product/Service Segment | BCG Matrix Classification | Key Characteristics | 2023 Financial Insight |

|---|---|---|---|

| Legacy Mechanical Water Meters | Cash Cow | Dominant market share, mature utility sectors, steady revenue. | Significant sales contributor; company focus is shifting. |

| Aftermarket Services (Repair & Parts) | Cash Cow | Recurring revenue from installed base, high margins, low investment. | Significant revenue contributor, driven by growing installed base. |

Full Transparency, Always

Badger Meter BCG Matrix

The Badger Meter BCG Matrix document you are currently previewing is the identical, fully unlocked version you will receive immediately after your purchase. This means the comprehensive analysis, clear visualizations, and strategic insights are exactly as presented, ready for your immediate application without any watermarks or altered content.

Dogs

In the Badger Meter BCG Matrix, de-emphasized non-water related flow instrumentation falls into the Dogs category. These are niche or legacy applications outside of Badger Meter's primary water utility focus, often seeing stagnant or decreasing demand.

The company has acknowledged lower demand in these segments, suggesting they require significant investment for limited returns compared to their core water meter business. For instance, while Badger Meter's overall revenue grew robustly, these non-core areas likely contributed minimally to that growth, potentially even acting as a drag on profitability.

Older, less efficient mechanical metering technologies, if not part of a strategic replacement cycle, might be categorized as Dogs within the Badger Meter BCG Matrix. These products, while still contributing to revenue, are experiencing a shrinking market share as digital and smart metering solutions gain prominence. For instance, in 2024, the demand for advanced metering infrastructure (AMI) continued its upward trajectory, further marginalizing traditional mechanical meters.

Products with limited digital integration within Badger Meter's portfolio, such as older mechanical meter models, would likely fall into the Dogs category of the BCG Matrix. These products, while potentially still generating some revenue, are characterized by low growth and low market share in an increasingly digital water management landscape.

In 2024, the demand for smart water solutions continues to surge. Badger Meter's BlueEdge platform, for instance, aims to provide advanced data analytics and remote monitoring capabilities. Products that cannot seamlessly connect to such platforms risk becoming obsolete, facing declining sales and profitability as customers prioritize more connected and intelligent solutions.

Non-Strategic Niche Product Lines

Non-strategic niche product lines within Badger Meter's portfolio represent areas that do not directly support its primary mission of water measurement and control. These might include legacy products or those acquired without clear synergy, often characterized by limited market share and minimal growth prospects. For instance, in 2023, Badger Meter reported that its smaller, non-core segments contributed a relatively minor portion to overall revenue, underscoring their non-strategic nature.

- Limited Growth Potential: These product lines typically operate in mature or declining markets, offering little opportunity for significant expansion.

- Low Strategic Alignment: They often fall outside Badger Meter's core competencies and strategic focus on smart water solutions.

- Resource Drain: Maintaining these niche products can divert resources and management attention from more promising core business areas.

- Potential for Divestiture: Companies often consider divesting such non-strategic assets to streamline operations and reinvest in core growth initiatives.

Highly Customized, Low-Volume Industrial Flow Solutions

Highly customized, low-volume industrial flow solutions, while serving niche markets, can present challenges within a BCG matrix analysis. These offerings often demand substantial engineering investment for each project, leading to higher production costs and potentially lower profit margins due to their specialized nature.

If these solutions lack scalability or the potential for wider market acceptance, the significant expenditure in development and ongoing support might overshadow the revenue they generate. This can position them as question marks or even dogs in the portfolio if they don't evolve into higher-growth segments.

- High Engineering Costs: Projects requiring extensive custom design and development for a small number of units increase per-unit cost significantly.

- Limited Scalability: The very nature of customization often restricts the ability to achieve economies of scale.

- Potential for Low ROI: If market adoption remains limited, the return on the high engineering investment can be minimal.

- Resource Drain: Significant engineering and support resources allocated to these low-volume products could be better utilized elsewhere if they are not strategically vital.

Products in the Dogs category for Badger Meter are those with low market share and low growth potential, often representing legacy technologies or non-core segments. These might include older mechanical meters that are being phased out by more advanced smart metering solutions. For example, in 2024, the continued growth of advanced metering infrastructure (AMI) further reduced the market relevance of traditional mechanical meters.

These offerings typically require significant investment for minimal returns, diverting resources from more promising areas like Badger Meter's smart water solutions. The company's strategic focus on platforms like BlueEdge highlights the diminishing importance of products that cannot integrate with advanced data analytics and remote monitoring capabilities.

Consequently, these products often have limited strategic alignment with Badger Meter's core mission of water measurement and control. Companies frequently consider divesting such assets to streamline operations and reallocate capital towards growth initiatives, as seen with the relatively minor contribution of non-core segments to revenue in 2023.

The demand for highly customized, low-volume industrial flow solutions can also place them in the Dogs category if they lack scalability and high engineering costs outweigh returns. This was evident in 2024, where the ongoing shift towards standardized, high-volume smart water solutions left niche, custom products with limited growth prospects.

| BCG Category | Badger Meter Product Examples | Market Characteristics | Strategic Implications |

|---|---|---|---|

| Dogs | Legacy mechanical water meters | Low market share, declining demand due to smart meter adoption | Resource drain, potential for divestiture, focus on replacement cycles |

| Dogs | Non-strategic niche instrumentation | Limited growth, outside core water utility focus | Minimal contribution to overall growth, requires significant investment for low returns |

| Dogs | Customized low-volume industrial flow solutions (without scalability) | Low market share, high engineering costs, limited scalability | Potential for low ROI, resource drain if not strategically vital |

Question Marks

Badger Meter is expanding its AI capabilities beyond basic leak detection, venturing into advanced predictive analytics for water systems. This move positions them to offer solutions that optimize network performance and proactively address potential issues, a significant step forward in smart water management.

While these emerging AI-powered predictive analytics hold immense promise for enhancing water infrastructure efficiency and resilience, they are likely in the nascent stages of market adoption. Significant investment is required to develop, implement, and scale these sophisticated solutions, demonstrating their return on investment to a wider customer base.

Badger Meter's expansion of advanced Industrial IoT sensor networks into new verticals, like smart agriculture and advanced logistics, positions them in potential high-growth areas. These ventures require significant investment in market penetration and product customization. For instance, the global IoT in agriculture market was projected to reach $31.7 billion by 2026, indicating substantial opportunity.

Badger Meter's smart water solutions entering new geographic markets with underdeveloped digital infrastructure are considered Stars in the BCG matrix. These markets, such as parts of Southeast Asia and Africa, represent significant growth opportunities, projected to see the smart water market grow at a CAGR of 14.5% through 2030, according to recent industry reports.

However, realizing this potential requires navigating complex local regulations and fostering cultural acceptance of advanced metering technologies. For instance, in some emerging markets, the initial investment in smart meter rollout can be a barrier, with governments needing to incentivize adoption. Badger Meter's strategy here involves partnerships with local utilities and demonstrating clear ROI.

Next-Generation Water Quality Sensing Technologies (Beyond Current Portfolio)

Investing in next-generation water quality sensing technologies, those still in early development or market testing, positions Badger Meter in a high-risk, high-reward category, akin to a question mark in the BCG matrix. These innovations, while potentially offering significant advancements, carry substantial research and development expenses and face the inherent uncertainty of market adoption. For instance, advancements in real-time, multi-parameter sensors utilizing AI for predictive analysis are showing promise but require considerable upfront capital.

- High R&D Investment: Significant capital allocation is needed for the research and development of these nascent technologies, potentially diverting funds from more established product lines.

- Market Uncertainty: The commercial viability and widespread acceptance of these next-generation sensors remain unproven, creating a risk of low market penetration despite technological superiority.

- Potential for Disruption: Successful development and market introduction could lead to a substantial competitive advantage and capture of new market segments, fundamentally altering the water quality sensing landscape.

- Strategic Importance: Continued investment is crucial for maintaining long-term relevance and leadership in a rapidly evolving technological environment, ensuring Badger Meter is at the forefront of future water management solutions.

Integrated Solutions for Stormwater Management (Post-SmartCover)

While SmartCover, Badger Meter's innovative stormwater monitoring system, is performing strongly as a Star in the BCG matrix, the expansion of its capabilities into a comprehensive, integrated stormwater management solution presents a Question Mark. This strategic direction taps into a high-growth market, but requires significant investment and development to fully capture the entire stormwater cycle, from collection to treatment and discharge.

The global stormwater management market is projected for substantial growth, with estimates suggesting it could reach over $200 billion by 2028, indicating significant upside for integrated solutions. Badger Meter's existing SmartCover technology, which has seen adoption for sewer and lift station monitoring, can be a foundational element for this expansion. However, achieving full integration across the stormwater lifecycle, including green infrastructure performance, regulatory compliance, and flood prediction, demands further innovation and market penetration.

- Market Expansion Potential: The broader stormwater management sector offers considerable growth opportunities beyond SmartCover's current focus, potentially increasing Badger Meter's market share.

- Strategic Development Needs: Developing and integrating new technologies or acquiring complementary solutions will be crucial to address the full spectrum of stormwater challenges.

- Investment Requirements: Capturing this Question Mark opportunity will necessitate significant R&D investment and strategic marketing efforts to position Badger Meter as a leader in end-to-end stormwater management.

- Competitive Landscape: While SmartCover is a strong performer, the integrated stormwater management space is becoming increasingly competitive, requiring a clear differentiation strategy.

Badger Meter's exploration into advanced water quality sensing, particularly those leveraging AI for predictive analysis, fits the Question Mark category. These technologies require substantial upfront investment in research and development, with their market acceptance and commercial viability still being tested. For instance, the company is investing in innovations that go beyond basic water metering to offer deeper insights into water health.

These next-generation sensors, while holding the potential to disrupt the market, face inherent uncertainty regarding widespread adoption and return on investment. The high cost of development and the need to educate the market on the benefits of such advanced solutions contribute to their Question Mark status. The global advanced water treatment market, which encompasses some of these sensing technologies, was valued at approximately $19.5 billion in 2023 and is projected to grow, indicating a significant opportunity if these technologies gain traction.

The expansion of SmartCover into a comprehensive stormwater management solution also represents a Question Mark. While the underlying technology is performing well, building out a full-cycle solution requires significant investment in new capabilities and market penetration. This strategic move aims to capture a larger share of the growing stormwater management market, which is expected to exceed $200 billion by 2028, but it necessitates overcoming challenges related to integration and competition.

Developing a complete stormwater management system, from collection to discharge, involves integrating diverse technologies and addressing complex regulatory environments. Badger Meter's approach here involves leveraging existing strengths while investing in new areas to create a more holistic offering. The success of this Question Mark hinges on the company's ability to secure the necessary capital and effectively navigate the competitive landscape to establish a leading position.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data from financial disclosures, industry research reports, and market growth forecasts to provide a clear strategic overview.