Badger Infrastructure Solutions SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Badger Infrastructure Solutions Bundle

Badger Infrastructure Solutions boasts strong operational capabilities and a growing market presence, but faces potential challenges from increasing competition and evolving regulatory landscapes. Understanding these dynamics is crucial for anyone looking to invest or partner with the company.

Want the full story behind Badger Infrastructure Solutions' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Badger Infrastructure Solutions' proprietary hydrovac technology is a key strength, differentiating it in the non-destructive excavation market. This advanced system allows for more efficient and precise operations compared to traditional methods.

The company's vertical integration is a significant competitive edge. As the sole national provider of non-destructive excavation services with a unified fleet, Badger maintains superior control over equipment quality, maintenance, and availability, ensuring consistent service delivery across its operations.

Badger's commitment to technological advancement is evident in its investment in enterprise and resource planning tools. Furthermore, the company is actively exploring AI and machine learning to optimize its operational efficiency and service capabilities, positioning it for future growth and market leadership.

Badger Infrastructure Solutions stands as North America's largest provider of non-destructive excavation services, a testament to its leading market position. This strong leadership is built upon a broad operational footprint spanning the continent, bolstered by enduring customer relationships and a robust national sales infrastructure.

The company's extensive network and significant market presence are key differentiators, allowing Badger to capitalize on opportunities and effectively compete against smaller, regional players. For instance, as of early 2024, Badger operated over 1,000 hydrovac trucks, a fleet size unmatched by most competitors, underscoring its scale and reach.

Badger Infrastructure Solutions excels in safety and precision, primarily through its hydrovac excavation method. This technique uses high-pressure water and a powerful vacuum to carefully expose underground utilities, drastically reducing the chance of accidental damage. This non-destructive approach is a significant advantage, preventing expensive service interruptions and boosting safety, especially crucial for clients in sectors with sensitive infrastructure.

The company's commitment to operational excellence is reflected in its consistent achievement of industry-leading safety records. For example, Badger reported a Total Recordable Incident Rate (TRIR) significantly below the industry average in recent years, underscoring its robust safety protocols and training programs. This focus on minimizing risk not only protects personnel and assets but also builds strong client trust.

Strong Financial Performance and Fleet Growth

Badger Infrastructure Solutions has showcased impressive financial strength, with revenue climbing to $172.6 million in the first quarter of 2025 and reaching $208.2 million in the second quarter. This growth is underpinned by expanding gross profit and adjusted EBITDA margins, signaling efficient operations and strong market positioning.

The company's strategic outlook includes a planned 4% to 7% expansion of its hydrovac fleet throughout 2025. This aggressive fleet growth demonstrates Badger's confidence in sustained organic expansion and robust demand for its services in the infrastructure sector.

- Robust Revenue Growth: Q1 2025 revenue reached $172.6 million, with Q2 2025 revenue hitting $208.2 million.

- Improved Profitability: Badger experienced enhanced gross profit and adjusted EBITDA margins in early 2025.

- Fleet Expansion: A 4% to 7% increase in the hydrovac fleet is planned for 2025, reflecting positive market outlook.

Diverse and Resilient End Markets

Badger Infrastructure Solutions benefits from serving a diverse array of end markets, including essential sectors like utilities, transportation, and industrial. This broad customer base naturally diversifies revenue, lessening the impact of downturns in any single industry. For instance, the utility sector's consistent need for maintenance and upgrades, coupled with ongoing transportation infrastructure projects, ensures a steady demand for Badger's services.

This resilience is further underscored by the essential nature of infrastructure maintenance and development, which tends to be less cyclical than other industries. In 2024, continued government spending on infrastructure projects, such as those funded by the Bipartisan Infrastructure Law in the United States, directly supports demand for Badger's services. This broad market exposure provides a stable financial foundation, even when specific economic conditions fluctuate.

Key end markets contributing to Badger's revenue stability include:

- Utility Sector: Ongoing investments in grid modernization and maintenance.

- Transportation Sector: Road, bridge, and transit infrastructure development and repair.

- Industrial Sector: Maintenance and upgrades for manufacturing facilities and energy infrastructure.

Badger Infrastructure Solutions' financial performance in early 2025 demonstrates significant strength, with Q1 revenue reaching $172.6 million and Q2 revenue climbing to $208.2 million. This robust growth is complemented by expanding gross profit and adjusted EBITDA margins, indicating efficient operations and strong market positioning. The company's planned 4% to 7% expansion of its hydrovac fleet throughout 2025 further highlights its confidence in sustained organic expansion and the robust demand for its services within the infrastructure sector.

| Financial Metric | Q1 2025 | Q2 2025 |

|---|---|---|

| Revenue | $172.6 million | $208.2 million |

| Gross Profit Margin | Improving | Improving |

| Adjusted EBITDA Margin | Improving | Improving |

| Planned Fleet Expansion (2025) | 4% - 7% | |

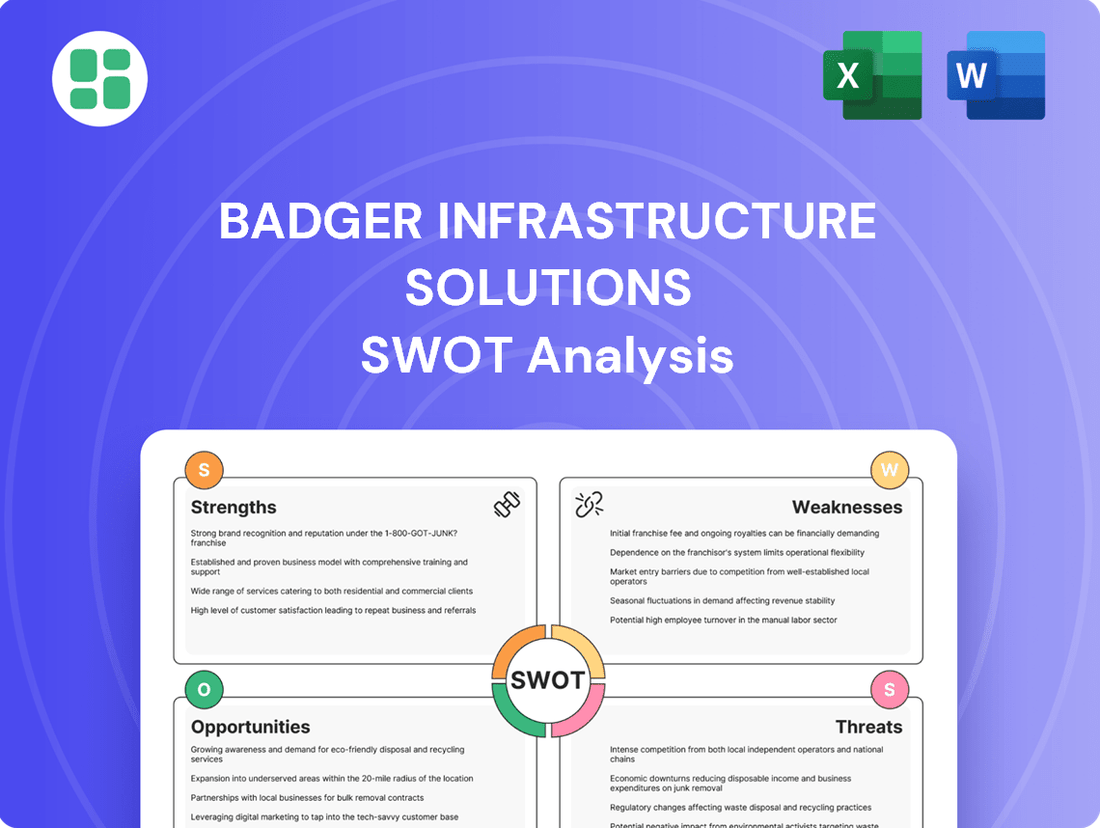

What is included in the product

This SWOT analysis provides a comprehensive look at Badger Infrastructure Solutions's internal strengths and weaknesses, alongside external opportunities and threats, to inform strategic decision-making.

Offers a clear visualization of Badger Infrastructure Solutions' competitive advantages and areas for improvement, alleviating the pain of strategic uncertainty.

Weaknesses

Badger Infrastructure Solutions faces a significant hurdle with its capital-intensive operations. Acquiring and maintaining specialized hydrovac equipment demands substantial upfront investment, with individual trucks often costing upwards of $450,000.

This high cost of specialized machinery means that expanding or upgrading the fleet requires considerable financial commitment. While Badger manages its capital program diligently, the sheer expense of this equipment can strain profitability and cash flow, particularly when the market experiences slower growth phases.

Badger Infrastructure Solutions' revenue is significantly influenced by the ebb and flow of public and private infrastructure spending. This makes the company vulnerable to economic downturns or unexpected changes in government funding priorities.

While the current infrastructure investment landscape appears robust, a future deceleration in construction or utility projects could directly dampen demand for Badger's specialized hydrovac services.

This inherent dependency introduces a notable degree of cyclicality into Badger's revenue streams and its overall project pipeline, necessitating careful financial planning and risk management.

Badger Infrastructure Solutions heavily relies on operators skilled in hydrovac equipment, a specialized niche. The scarcity of these trained professionals presents a notable weakness, potentially hindering operational capacity and project execution.

The construction sector, in general, is grappling with persistent labor shortages. This industry-wide challenge directly impacts Badger's ability to scale its operations and ensure efficient project completion, especially as its fleet expands.

Attracting and keeping qualified hydrovac operators is becoming increasingly competitive, likely driving up labor costs. This escalation in expenses, coupled with retention difficulties, poses a significant operational hurdle for the company.

Limited Awareness in Certain Markets

Despite the effectiveness of hydrovac excavation, Badger Infrastructure Solutions faces a challenge with limited awareness among some contractors, especially in certain U.S. regions where adoption lags behind Canada. This gap in understanding necessitates continued investment in educational initiatives to drive market penetration.

The company's growth strategy must address this by actively promoting the advantages of their services. For instance, while hydrovac usage in Canada is widespread, its penetration in specific U.S. states might still be below 30% for certain project types, requiring targeted marketing campaigns.

- Regional Awareness Gaps: Hydrovac excavation adoption rates vary significantly across the United States, with some regions showing considerably lower utilization compared to established markets like Canada.

- Contractor Education Needs: A portion of the contractor base remains less familiar with the benefits and applications of hydrovac technology, impacting Badger's potential market reach.

- Market Penetration Hurdles: Overcoming this limited awareness is a key challenge for Badger, requiring sustained outreach and demonstration of value to encourage broader adoption.

Operational and Logistical Complexities

Managing Badger Infrastructure Solutions' extensive, geographically scattered fleet of specialized equipment is a significant hurdle. Without sophisticated, integrated systems, challenges arise in maintaining seamless communication and optimizing scheduling, potentially leading to underutilization and increased costs. For instance, in 2024, companies in the heavy equipment sector reported an average of 15% downtime due to logistical inefficiencies.

Furthermore, Badger faces difficulties stemming from the variability of soil conditions across different project sites, which can impact the efficiency of their operations. The need for robust and effective field management systems is paramount to address these on-the-ground realities, ensuring productivity and safeguarding profitability. Research from 2023 indicated that companies implementing advanced field management software saw a 10% improvement in project completion times.

- Geographical Dispersion: Managing assets across multiple, distant locations strains communication and coordination.

- Communication Gaps: Disconnected systems hinder real-time updates and decision-making for field teams.

- Scheduling Inefficiencies: Lack of advanced planning tools can lead to suboptimal resource allocation and increased idle time.

- Varied Site Conditions: Adapting operations to diverse soil types requires flexible planning and specialized equipment deployment.

Badger Infrastructure Solutions' capital-intensive nature, with hydrovac trucks costing upwards of $450,000, necessitates significant financial commitment for fleet expansion or upgrades. This high cost can strain profitability and cash flow, particularly during market slowdowns.

The company's reliance on public and private infrastructure spending makes it vulnerable to economic downturns and shifts in government funding priorities, introducing cyclicality into its revenue streams.

A key weakness is the scarcity of skilled hydrovac operators, a challenge amplified by broader construction industry labor shortages. This scarcity can hinder operational capacity, increase labor costs, and impact project execution, especially as the fleet grows.

Limited awareness of hydrovac technology in certain U.S. regions, compared to Canada, requires ongoing investment in educational initiatives to drive market penetration and overcome contractor unfamiliarity with its benefits.

Full Version Awaits

Badger Infrastructure Solutions SWOT Analysis

The preview you see is the actual Badger Infrastructure Solutions SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. This detailed breakdown of strengths, weaknesses, opportunities, and threats is ready for your strategic planning. Unlock the full, comprehensive report to gain actionable insights.

Opportunities

The North American infrastructure sector is booming, with significant public and private investment pouring into upgrades. The U.S. Infrastructure Investment and Jobs Act alone allocated $1.2 trillion, with a substantial portion dedicated to transportation and utilities, directly benefiting companies like Badger. This sustained focus on roads, bridges, and essential services translates into a robust, long-term demand for specialized excavation services.

Governments and regulatory bodies worldwide are placing a growing emphasis on safety and damage prevention, particularly when it comes to excavating near vital infrastructure. This trend is leading to stricter mandates for non-mechanical excavation methods, like hydrovac services, to avoid expensive damage to underground utilities and improve worker safety. For instance, in 2023, the North American utility industry reported billions in damages due to excavation incidents, highlighting the economic imperative for safer practices.

These increasingly stringent safety regulations and environmental compliance standards directly fuel the demand for hydrovac technology. Badger Infrastructure Solutions, with its specialized hydrovac services, is well-positioned to capitalize on this shift. The company's offerings inherently align with these evolving requirements, making its services a preferred choice for projects involving critical utility lines.

This regulatory tailwind acts as a significant growth driver for Badger. As safety and prevention become paramount, the market preference is leaning towards methods that minimize risk, thereby providing a strong impetus for the continued expansion and adoption of Badger's specialized excavation solutions. This focus on safety is expected to remain a key factor influencing market dynamics through 2025 and beyond.

The non-destructive excavation market, especially in the U.S., is still in its early stages of adoption, offering Badger significant growth potential. This suggests a vast untapped market where Badger can expand its reach and services.

Beyond the usual utility and construction work, Badger can leverage its hydrovac technology in emerging sectors like environmental cleanup, mining operations, and niche industrial uses. This diversification opens up new avenues for revenue generation.

By strategically entering these less saturated regions and industries, Badger can tap into previously unexploited markets. For instance, the environmental remediation sector alone is projected to see substantial growth, with global spending expected to reach hundreds of billions in the coming years, providing a fertile ground for Badger's specialized services.

Technological Advancements and Digital Integration

Ongoing technological advancements in hydrovac vehicles present a significant opportunity for Badger Infrastructure Solutions. Innovations like improved trash tank designs and sophisticated water recycling systems can directly boost productivity and lessen environmental impact. For instance, advancements in water recycling technology can reduce water consumption by up to 80% in certain operations, a key selling point for environmentally conscious clients.

Badger's strategic investments in technology, including AI and machine learning, are poised to further enhance operational efficiency. These technologies can optimize routing, predict maintenance needs, and streamline workflow, ultimately strengthening Badger's competitive position in the market. Companies adopting AI in logistics have reported efficiency gains of 15-20% in recent years.

- Enhanced Efficiency: Integration of digital mapping and AI can optimize hydrovac operations, leading to faster project completion times.

- Environmental Benefits: Advanced water recycling systems reduce water usage, aligning with sustainability goals and potentially lowering operational costs.

- Competitive Advantage: Early adoption of AI and machine learning provides a distinct edge in optimizing resource allocation and service delivery.

- Data-Driven Insights: Digital integration allows for better data capture and analysis, informing strategic decisions and service improvements.

Strategic Partnerships and Acquisitions for Market Consolidation

The North American non-destructive digging (NDD) service industry remains notably fragmented, featuring a significant number of smaller and medium-sized enterprises. This fragmentation creates a fertile ground for Badger Infrastructure Solutions to pursue strategic partnerships and acquisitions, aiming for market consolidation. By integrating these smaller entities, Badger can broaden its service portfolio and extend its geographical footprint.

Consolidating the market offers Badger the chance to realize substantial economies of scale, leading to improved operational efficiencies and potentially lower costs. This strategic move is further supported by Badger's robust financial standing and its established reputation within the industry, positioning it as a prime candidate to lead such consolidation efforts.

For instance, the NDD market in North America was estimated to be valued at approximately $2.5 billion in 2023, with projections indicating a compound annual growth rate (CAGR) of around 5.5% through 2028. This growth trajectory underscores the potential for value creation through strategic M&A activities.

- Market Fragmentation: The NDD industry's structure allows for consolidation opportunities.

- Enhanced Offerings: Partnerships and acquisitions can broaden Badger's service capabilities.

- Economies of Scale: Consolidation can drive greater operational efficiency and cost savings.

- Market Leadership: Badger's financial strength positions it to be a key consolidator.

The growing emphasis on safety and environmental regulations in infrastructure projects creates a significant demand for Badger's specialized hydrovac services, as these methods minimize damage and enhance worker safety. Furthermore, the relatively nascent stage of the non-destructive excavation market in the U.S. presents a substantial opportunity for Badger to expand its reach and capture new market share.

Badger can also diversify its revenue streams by applying its hydrovac technology to emerging sectors like environmental cleanup and niche industrial applications, tapping into previously unexploited markets. Technological advancements in hydrovac equipment, such as improved water recycling systems, offer Badger the chance to boost efficiency and appeal to environmentally conscious clients, providing a competitive edge.

The fragmented nature of the North American non-destructive digging (NDD) service industry allows Badger to pursue strategic acquisitions and partnerships, leading to market consolidation and economies of scale. This consolidation, coupled with Badger's financial strength and industry reputation, positions it as a leader in expanding its service portfolio and geographical presence.

| Opportunity Area | Description | Market Data/Potential |

|---|---|---|

| Expanding Niche Markets | Leveraging hydrovac technology in sectors beyond traditional utilities, such as environmental remediation and mining. | Environmental remediation market projected for substantial global growth, potentially reaching hundreds of billions. |

| Technological Advancements | Adopting and integrating innovations like AI for operational efficiency and advanced water recycling systems. | AI adoption in logistics has shown 15-20% efficiency gains; water recycling can reduce consumption by up to 80%. |

| Market Consolidation | Pursuing strategic partnerships and acquisitions within the fragmented NDD industry. | North American NDD market valued at ~$2.5 billion in 2023, with a projected CAGR of ~5.5% through 2028. |

Threats

Economic downturns pose a significant threat to Badger Infrastructure Solutions. A slowdown in construction and infrastructure spending, a key driver of Badger's business, directly impacts project volumes and revenue. For instance, if GDP growth falters, as projected by the IMF to be 2.4% for the US in 2024, this can translate into reduced government and private sector investment in infrastructure projects.

Inflationary pressures are another major concern. Rising costs for essential inputs like fuel, equipment parts, and labor can significantly increase Badger's operating expenses. With inflation in the US hovering around 3.4% in early 2024, these increases directly compress profit margins. Furthermore, high inflation and the subsequent rise in interest rates, which reached a 22-year high for the Fed Funds rate in 2023, can make new project financing more expensive, potentially deterring investment and further impacting Badger's project pipeline.

While Badger Infrastructure Solutions' hydrovac technology offers distinct advantages, traditional excavation methods persist as viable substitutes, posing an ongoing threat. The market also faces the potential emergence of new competitors or innovative, non-destructive excavation alternatives, which could disrupt established market dynamics.

Increased competition is a significant concern, potentially leading to downward pressure on pricing and a subsequent erosion of Badger's market share. For instance, in the broader excavation services market, which saw significant activity in 2024, price sensitivity remains a key factor for many clients.

To counter these threats, Badger must prioritize continuous innovation in its service offerings and focus on differentiating its value proposition. This strategic imperative is crucial for maintaining a competitive edge and securing future growth in a dynamic market landscape.

Badger Infrastructure Solutions faces a significant threat from volatility in input costs, particularly for fuel, water, and specialized equipment parts. These essential operational components are subject to market fluctuations that can directly squeeze profit margins.

For instance, a surge in diesel prices, a critical expense for Badger's extensive fleet, could rapidly escalate operating expenditures. If fuel costs rise by, say, 15% in a given quarter, as seen in some periods of 2024, this directly reduces the profitability of projects unless passed on to clients, which isn't always feasible.

Adverse Regulatory Changes or Compliance Burdens

Adverse regulatory shifts present a significant threat to Badger Infrastructure Solutions. For instance, a tightening of environmental standards could increase the cost of compliance, potentially impacting project margins. The infrastructure sector, particularly in North America, saw increased scrutiny on environmental impact in 2024, with some jurisdictions proposing stricter waste disposal and emissions regulations.

New or more complex compliance requirements could force Badger to invest in new technologies or alter its established operational methods. This could lead to increased capital expenditure and potentially slower project execution. For example, the introduction of more rigorous safety protocols in 2025, as discussed in industry forums, might require additional training and equipment, adding to overheads.

- Increased Compliance Costs: Potential for higher operational expenses due to new environmental or safety mandates.

- Operational Disruptions: Risk of needing to change existing practices, impacting efficiency and timelines.

- Resource Strain: Maintaining adherence to evolving regulations demands significant financial and human resources.

Risk of Technological Obsolescence

The rapid evolution of technology presents a significant threat to Badger Infrastructure Solutions. Even with their proprietary systems, the excavation and construction sectors are constantly seeing new, more efficient methods emerge. This means Badger's current hydrovac technology could become outdated, impacting their competitive edge.

For instance, advancements in automated excavation or alternative non-disruptive digging techniques could offer lower costs or faster project completion times compared to hydrovacing. Badger must therefore commit substantial resources to research and development to stay ahead of these potential disruptions and maintain market relevance.

- Technological Disruption: Emerging technologies could render current hydrovac methods less competitive.

- Investment Needs: Continuous R&D spending is crucial to adapt and innovate.

- Market Share Risk: Failure to keep pace with innovation could lead to a loss of market share to more technologically advanced competitors.

The infrastructure sector is susceptible to economic downturns, which can reduce overall project spending. For example, a projected US GDP growth of 2.4% in 2024, as indicated by the IMF, suggests a potentially slower pace of investment compared to previous years, directly impacting Badger's project pipeline.

Inflationary pressures, with US inflation around 3.4% in early 2024, increase Badger's operational costs for fuel, parts, and labor, potentially squeezing profit margins. Furthermore, higher interest rates, which saw the Fed Funds rate reach a 22-year high in 2023, can make financing new projects more expensive, deterring clients.

Increased competition and the potential emergence of new, disruptive excavation technologies pose a threat to Badger's market share and pricing power. For instance, the broader excavation market in 2024 was characterized by significant activity and price sensitivity among clients.

Badger Infrastructure Solutions faces threats from evolving regulations, such as stricter environmental standards that could increase compliance costs and operational disruptions. The company must also contend with rapid technological advancements in excavation, which could render its current hydrovac technology less competitive if R&D investment lags.

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, drawing from Badger Infrastructure Solutions' official financial reports, comprehensive market research, and expert industry analyses to provide a clear and actionable strategic overview.