Badger Infrastructure Solutions Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Badger Infrastructure Solutions Bundle

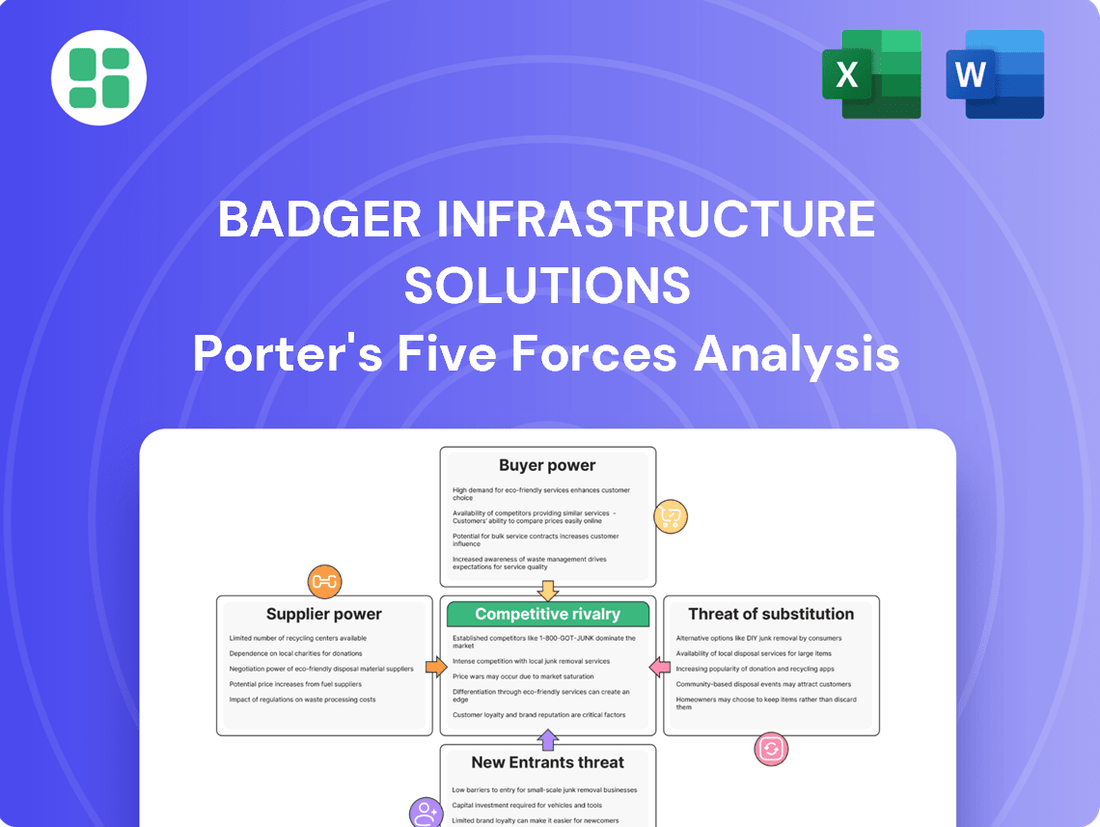

Badger Infrastructure Solutions navigates a competitive landscape shaped by moderate buyer power and the threat of new entrants, while supplier power presents a significant factor. Understanding these dynamics is crucial for any stakeholder.

The complete report reveals the real forces shaping Badger Infrastructure Solutions’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Badger Infrastructure Solutions' manufacturing of its proprietary Badger Hydrovac™ units significantly curtails its reliance on external hydrovac truck manufacturers. This vertical integration offers a distinct advantage, granting the company enhanced control over the design, quality, and supply chain of its essential equipment, a crucial element in navigating supplier power.

Despite this internal manufacturing capability, Badger maintains a dependence on third-party suppliers for critical inputs such as raw materials, vehicle chassis, and specialized components integrated into their hydrovac units. This continued reliance means that the bargaining power of these upstream suppliers remains a factor influencing Badger's operational costs and efficiency.

Badger Infrastructure Solutions relies on external suppliers for critical, specialized components such as vacuum pumps and high-pressure water systems for its hydrovac units. The availability and pricing of these high-performance parts directly impact supplier leverage. For instance, if the market for advanced vacuum pumps, essential for efficient hydrovac operations, is dominated by a few manufacturers, those suppliers gain significant bargaining power.

Fuel represents a substantial portion of Badger Infrastructure Solutions' operating expenses, given its large fleet of hydrovac trucks. In 2024, fuel costs for similar heavy-duty vehicle fleets saw fluctuations, with average diesel prices in North America ranging from $4.50 to $5.20 per gallon, impacting Badger's overall cost of service delivery.

Badger's reliance on a wide array of maintenance and repair service providers across North America also influences supplier bargaining power. The concentration of specialized mechanics and parts suppliers in key operational regions can grant these entities leverage, potentially increasing Badger's maintenance expenditures and affecting fleet uptime.

Switching Costs for Inputs

The bargaining power of suppliers for Badger Infrastructure Solutions is influenced by switching costs for its inputs. While general raw materials might have low switching costs, specialized or custom-designed components can present higher costs. These can arise from re-tooling machinery, rigorous testing, and lengthy qualification processes if Badger needs to change suppliers for these critical parts.

Badger's capacity to shift between suppliers for essential inputs without negatively impacting its unique technology or the caliber of its services directly shapes how much leverage suppliers hold. For instance, if a key supplier of custom-fabricated steel beams for Badger's bridge construction projects experiences production issues, the cost and time involved in finding and qualifying a new supplier for those specific, engineered components could be substantial, thereby increasing the original supplier's bargaining power.

- Specialized Component Switching Costs: For custom-engineered components, switching costs can include re-tooling, testing, and supplier qualification, potentially ranging from tens of thousands to hundreds of thousands of dollars depending on the complexity.

- Proprietary Technology Impact: Badger's ability to maintain its technological edge is paramount; switching suppliers for critical, integrated components could disrupt this, giving incumbent suppliers more leverage.

- Service Quality Maintenance: In 2024, Badger's commitment to on-time project delivery, a key service differentiator, means any disruption from a supplier change could have significant reputational and financial consequences, reinforcing the power of reliable suppliers.

Labor Supply and Expertise

The availability of skilled labor, particularly trained hydrovac operators and maintenance technicians, represents a significant form of supplier power for Badger Infrastructure Solutions. A scarcity of these specialized professionals can directly impact operational capacity and drive up labor expenses, potentially squeezing profit margins.

Badger's emphasis on maintaining high operational efficiency and robust fleet management underscores its dependence on a skilled and reliable workforce. For instance, in 2024, the infrastructure sector continued to face challenges in sourcing qualified tradespeople, with some reports indicating a national shortage of skilled equipment operators. This trend suggests that Badger must actively invest in recruitment and retention strategies to mitigate the bargaining power of its labor suppliers.

- Skilled Labor as a Supplier: Trained hydrovac operators and maintenance technicians are critical resources.

- Impact of Shortages: Limited availability can increase labor costs and constrain operations.

- Industry Trends: The infrastructure sector in 2024 experienced ongoing shortages of skilled equipment operators.

- Badger's Reliance: Operational efficiency and fleet management are directly tied to workforce competency.

Badger Infrastructure Solutions faces supplier bargaining power primarily through specialized components and critical inputs like fuel and skilled labor. While vertical integration in manufacturing hydrovac units mitigates some supplier reliance, the company still depends on external sources for essential parts, chassis, and fuel. The availability and cost of these inputs, especially in a fluctuating market, directly influence Badger's operational expenses and profitability.

The bargaining power of suppliers is amplified by the switching costs associated with specialized components, where re-tooling and qualification processes can be substantial. Furthermore, a scarcity of skilled labor, particularly hydrovac operators and technicians, grants significant leverage to these human capital suppliers. In 2024, industry-wide shortages of skilled tradespeople, including equipment operators, continued to impact Badger's ability to manage labor costs and ensure operational continuity.

| Supplier Type | Key Inputs/Services | Factors Influencing Bargaining Power | 2024 Data/Considerations |

|---|---|---|---|

| Component Manufacturers | Vacuum pumps, high-pressure water systems, specialized chassis components | Market concentration, proprietary technology, switching costs (re-tooling, testing) | High-performance pump markets can be dominated by a few key players. |

| Raw Material Suppliers | Steel, other industrial materials | Commodity price volatility, availability, supplier concentration | Fluctuations in steel prices can impact manufacturing costs. |

| Fuel Providers | Diesel fuel | Global oil prices, regional supply/demand, transportation costs | Average North American diesel prices in 2024 ranged from $4.50 to $5.20 per gallon. |

| Maintenance & Repair Services | Specialized mechanics, parts suppliers | Geographic concentration of expertise, availability of specialized parts | Regional shortages of skilled technicians can increase service costs. |

| Skilled Labor | Hydrovac operators, maintenance technicians | Labor market scarcity, training requirements, industry demand | Ongoing national shortages of skilled equipment operators in the infrastructure sector. |

What is included in the product

This analysis uncovers the competitive landscape for Badger Infrastructure Solutions by examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the infrastructure services sector.

Instantly identify and address competitive threats with a dynamic, interactive Porter's Five Forces analysis, empowering Badger Infrastructure Solutions to proactively manage market pressures.

Customers Bargaining Power

Badger Infrastructure Solutions offers a high-value proposition through its non-destructive hydrovac services. These services are essential for clients in critical sectors like utilities and transportation, where preventing damage to buried infrastructure is paramount.

The precision and safety provided by Badger's methods significantly reduce the risk of costly service disruptions, potential fines, and reputational harm for their customers. This inherent value means clients are often willing to accept higher initial costs to avoid the substantial expenses linked to utility strikes, which unfortunately remain a significant issue, with over 160,000 reported in 2022.

Badger Infrastructure Solutions’ diverse customer base significantly dilutes customer bargaining power. The company provides essential services to a wide spectrum of industries, including oil and gas, energy, industrial, construction, telecommunications, transportation, and municipalities throughout North America.

This broad market reach means Badger is not dependent on a handful of major clients, thereby reducing the leverage any single customer can exert. For instance, in 2023, Badger reported serving over 1,000 customers, with its largest customer accounting for only a small percentage of its total revenue, underscoring this diversification.

This wide distribution of clients across different economic sectors and geographic regions strengthens Badger's position. It minimizes the risk of substantial revenue disruption should one or a few clients decide to switch providers or reduce their service needs.

Customers have choices, but moving from a trusted hydrovac service like Badger Infrastructure Solutions to a newer provider involves risks. These include potential damage to utilities, project delays, and safety issues, which can significantly impact project timelines and budgets.

Badger's strong safety record and specialized knowledge act as a deterrent for customers. The peace of mind that comes with a proven performer, especially when dealing with critical infrastructure, represents a significant, albeit intangible, switching cost.

Regulatory and Safety Imperatives

Increasingly stringent safety regulations, like the 'Call Before You Dig' mandate, are a significant factor. These rules compel clients to use non-destructive excavation techniques, which directly benefits companies like Badger Infrastructure Solutions that specialize in hydrovac excavation.

This regulatory landscape significantly boosts Badger's leverage. Hydrovac excavation is frequently the mandated or most compliant method, limiting customers' ability to choose less expensive, potentially riskier alternatives. For instance, in 2023, there were over 20 million locate requests across North America, highlighting the widespread application of 'Call Before You Dig' principles.

- Regulatory Compliance Drives Demand: Mandates for non-destructive excavation, such as 'Call Before You Dig,' make hydrovac services a necessity for many projects.

- Reduced Customer Flexibility: Clients have fewer options to substitute hydrovac services with cheaper, riskier methods due to these safety and regulatory requirements.

- Enhanced Badger's Bargaining Power: The need for compliant services strengthens Badger's position, allowing for more favorable contract terms.

Information Asymmetry and Specialization

Customers often have less insight into the complex technical details and the true long-term cost benefits of sophisticated hydrovac equipment. This knowledge gap is significant.

Badger Infrastructure Solutions leverages its proprietary technology and specialized know-how to create an information imbalance. As the expert provider, Badger is better positioned to communicate the value and essential nature of its services.

This expertise allows Badger to mitigate direct price negotiations from customers. For instance, in 2024, the infrastructure services sector saw continued demand for specialized solutions, where technical understanding often dictates service pricing.

- Information Asymmetry: Customers may not fully grasp the technical nuances of hydrovac operations and their long-term economic advantages.

- Specialized Expertise: Badger's proprietary technology and deep industry knowledge create a knowledge advantage.

- Value Articulation: Badger can effectively explain the benefits and necessity of its advanced services, justifying its pricing.

- Reduced Price Pressure: The information asymmetry limits customers' ability to effectively bargain on price based on a complete understanding of the service's value.

Badger Infrastructure Solutions benefits from relatively low customer bargaining power. This is primarily due to the essential nature of their hydrovac services, the company's broad customer diversification, and the significant switching costs associated with moving to a competitor.

Regulatory requirements, such as 'Call Before You Dig' mandates, further limit customer options, making hydrovac services a necessity rather than a choice for many projects. This regulatory environment, coupled with Badger's specialized expertise and proprietary technology, creates an information asymmetry that strengthens their negotiating position.

The company's commitment to safety and its proven track record also act as deterrents to customers seeking cheaper alternatives, as the risks of utility damage and project delays outweigh potential cost savings.

| Factor | Impact on Customer Bargaining Power | Supporting Data/Reasoning |

|---|---|---|

| Essential Service Nature | Lowers | Hydrovac services are critical for preventing costly utility strikes, which are a significant issue (e.g., over 160,000 reported in 2022). |

| Customer Diversification | Lowers | Serving over 1,000 customers in 2023 with the largest customer representing a small revenue percentage reduces reliance on any single client. |

| Switching Costs | Lowers | Risks of utility damage, project delays, and safety issues deter customers from switching from trusted providers like Badger. |

| Regulatory Environment | Lowers | Mandates like 'Call Before You Dig' increase demand for compliant hydrovac services, limiting alternatives (e.g., over 20 million locate requests in 2023). |

| Information Asymmetry | Lowers | Badger's specialized knowledge and proprietary technology create an information gap, allowing them to better articulate value and justify pricing in 2024. |

Same Document Delivered

Badger Infrastructure Solutions Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces Analysis for Badger Infrastructure Solutions, detailing the competitive landscape, threat of new entrants, bargaining power of buyers and suppliers, and the threat of substitute products. The document you see here is precisely the same professionally written and formatted analysis you'll receive immediately after purchase, ensuring you get the complete, ready-to-use strategic insights without any surprises.

Rivalry Among Competitors

Badger Infrastructure Solutions stands as North America's largest provider of non-destructive hydrovac excavation services, operating within a market that's seeing substantial expansion. This strong market position can somewhat mitigate intense price competition, as demand for these specialized services is on the rise.

The global hydrovac services market is expected to grow considerably, with projections indicating a compound annual growth rate (CAGR) of around 6.5% from 2023 to 2030, reaching an estimated value of $7.8 billion by 2030. This growth is fueled by increased infrastructure projects and stricter safety standards mandating non-destructive digging methods.

Badger Infrastructure Solutions operates in a hydrovac service market that, while seeing Badger as the largest entity, remains quite fragmented, especially within the United States. This means there are numerous regional and national companies vying for business. For instance, competitors such as Hydrodig, Hydro Spy, and Clean Harbors offer comparable services, intensifying the competition for market share.

This competitive structure, characterized by a multitude of players, indicates that despite Badger's leading status, the market is quite dynamic. Companies must constantly adapt and innovate to maintain their edge in this environment. The presence of many competitors means that pricing pressures can be significant, and customer loyalty is hard-won.

Badger Infrastructure Solutions leverages its proprietary Badger Hydrovac™ technology, a key differentiator that the company actively innovates and produces internally. This technological lead, coupled with a strong emphasis on safety and operational efficiency, gives Badger a significant competitive advantage in the market.

Competitors face a substantial hurdle, needing to make considerable investments in developing or acquiring similar technology and expanding their fleets to even approach Badger's established capabilities and market reputation. For instance, in 2024, the specialized hydrovac services market continued to see growth, with companies like Badger demonstrating strong performance due to such technological investments.

Geographic Footprint and Network Density

Badger Infrastructure Solutions' competitive rivalry is intensified by its substantial geographic footprint, encompassing over 140 locations across the U.S. and Canada. This extensive network allows for rapid response times and broad service coverage, presenting a significant barrier to entry for smaller, less geographically diverse competitors. The ability to efficiently serve large-scale, multi-location projects and critical emergency responses is a key differentiator.

This wide operational reach and established service infrastructure are not easily replicated, giving Badger a distinct advantage in securing and executing complex contracts. For instance, during 2024, Badger continued to leverage this network to secure contracts for major infrastructure projects, demonstrating the tangible benefit of their geographic density.

- Extensive Network: Over 140 locations across the U.S. and Canada.

- Competitive Advantage: Difficult for smaller rivals to match geographic coverage and response speed.

- Project Suitability: Ideal for large-scale, multi-location projects and emergency services.

- Market Impact: Contributes to Badger's ability to win significant contracts, as seen in 2024 project awards.

Capital Intensive Nature of the Business

The hydrovac industry demands substantial upfront investment in specialized equipment, such as hydrovac trucks, which can cost hundreds of thousands of dollars each. Badger Infrastructure Solutions, like its peers, must maintain a significant fleet to serve diverse project needs. This capital intensity naturally limits the number of new entrants capable of matching the scale and capabilities of established players.

The high cost of acquiring and maintaining this specialized fleet means that existing companies, including Badger, are driven to maximize the utilization of their assets. When demand fluctuates, companies may engage in more aggressive pricing or service offerings to keep their expensive equipment operational, thereby increasing competitive rivalry. For instance, in 2024, the average utilization rate for heavy equipment across various infrastructure sectors saw a notable focus on efficiency due to rising operational costs.

- Significant Capital Outlay: Hydrovac trucks can range from $300,000 to over $700,000, making fleet expansion a major financial undertaking.

- Barrier to Entry: The substantial investment required deters many potential new competitors from entering the market.

- Exit Barriers: Selling specialized, depreciating assets can be challenging, potentially forcing companies to remain competitive even in difficult market conditions.

- Asset Utilization Focus: Companies like Badger must ensure high utilization rates to achieve a return on their capital investment, which can fuel competitive actions.

Despite Badger Infrastructure Solutions' leading position, the hydrovac services market remains highly competitive due to a significant number of regional and national players. Companies like Hydrodig and Hydro Spy actively compete, often engaging in aggressive pricing strategies to capture market share and maximize the utilization of their costly specialized equipment. This dynamic intensifies rivalry, especially during periods of fluctuating demand, as companies strive to maintain operational efficiency for their substantial fleet investments.

The competitive landscape is further shaped by the substantial capital required for specialized hydrovac equipment, with trucks costing upwards of $700,000, acting as a significant barrier to entry. Badger's extensive network of over 140 locations across North America provides a distinct advantage, enabling rapid response and broad service coverage that smaller, less geographically diverse competitors struggle to match. This operational scale and technological differentiation, including Badger's proprietary technology, are crucial in navigating the intense rivalry observed throughout 2024.

SSubstitutes Threaten

Traditional excavation methods like backhoes, excavators, and manual digging represent the primary substitutes for hydrovac services. While these methods may have lower initial costs, they introduce substantial risks of damaging underground utilities. In 2022 alone, the industry experienced over 160,000 utility damage incidents, highlighting the inherent dangers of less precise excavation techniques.

The threat of substitutes for Badger Infrastructure Solutions' services is significantly influenced by the superior safety and precision offered by hydrovac excavation. This method provides a non-destructive and highly accurate alternative to traditional digging, particularly in congested urban environments where underground utilities are densely packed.

This enhanced safety profile directly translates into fewer costly utility strikes and improved worker protection, making hydrovac a compelling choice. In 2024, the increasing regulatory focus on preventing infrastructure damage and ensuring site safety further bolsters the appeal of hydrovac, as it minimizes risks and potential liabilities for clients.

The threat of substitutes for Badger Infrastructure Solutions is significantly influenced by a growing regulatory push towards non-destructive digging methods. As of 2024, safety and environmental standards are tightening, making traditional excavation methods increasingly unattractive and costly due to potential fines and remediation expenses.

This regulatory landscape directly favors services like hydrovac, which are inherently safer and less disruptive. For instance, many jurisdictions now require hydrovac for any excavation within a certain proximity to underground utilities, effectively sidelining older, more hazardous techniques.

Cost-Benefit Analysis for Customers

While traditional excavation methods may appear cheaper upfront, the cost-benefit analysis often favors hydrovac services for Badger Infrastructure Solutions' customers. For instance, in 2024, the average cost of a utility strike in the U.S. was estimated to be over $100,000, encompassing repair, project delays, and potential fines. Hydrovac's precision significantly reduces this risk.

The avoidance of costly utility strikes, which can derail projects and incur substantial repair expenses, presents a clear advantage. Furthermore, the reduced risk of project delays, a common consequence of accidental damage with traditional methods, translates into greater predictability and efficiency for clients. These factors contribute to a lower total project cost, even if the initial hourly rate for hydrovac is higher.

- Reduced Risk of Utility Strikes: In 2024, the average cost of a utility strike exceeded $100,000, a significant expense avoided by hydrovac.

- Minimized Project Delays: Hydrovac’s precision prevents the delays often caused by accidental damage with traditional excavation.

- Lower Overall Project Costs: Despite potentially higher hourly rates, the long-term savings from avoiding repairs and delays make hydrovac more cost-effective.

- Enhanced Safety and Precision: These benefits further solidify hydrovac's position as a superior alternative, outweighing perceived cost advantages of substitutes.

Limited Effective Substitutes for Specific Applications

For highly specialized tasks like safely exposing underground utilities or operating in tight city spaces, hydrovac technology, Badger's core offering, faces few truly effective substitutes. This limitation significantly reduces the threat of substitution in these critical, high-margin segments of the infrastructure services market.

The precision and safety offered by hydrovac methods are difficult to replicate with alternative technologies in demanding situations. For instance, in 2023, Badger Infrastructure Solutions reported that its hydrovac services were essential for projects where traditional excavation methods posed unacceptable risks to existing infrastructure or personnel.

- Limited alternatives for critical utility exposure: Hydrovac’s ability to precisely locate and expose underground utilities without damage is unmatched by mechanical excavation in many scenarios.

- Safety in congested areas: The controlled nature of hydrovac reduces risks in densely populated urban environments where traditional methods are often impractical or dangerous.

- Niche market strength: Badger leverages this lack of effective substitutes to command premium pricing in its specialized service offerings.

The threat of substitutes for Badger Infrastructure Solutions' hydrovac services is moderate, primarily due to the superior precision and safety offered by this method compared to traditional excavation. While alternatives like backhoes and manual digging exist, they carry a significantly higher risk of utility damage. In 2024, the average cost of a utility strike in the U.S. was over $100,000, a substantial expense that hydrovac helps clients avoid.

The increasing regulatory focus on safety and environmental standards, particularly in 2024, further diminishes the appeal of less precise methods. Many regions now mandate hydrovac for excavations near underground utilities, effectively pushing out older techniques. This trend, coupled with the high cost of utility strikes, makes hydrovac a more cost-effective long-term solution for clients, despite potentially higher initial rates.

| Substitute Method | Key Disadvantages | Estimated Cost of Damage (2024) |

|---|---|---|

| Traditional Excavation (Backhoes, Manual Digging) | High risk of utility strikes, potential for significant project delays, increased liability. | >$100,000 per strike |

| Hydrovac Excavation (Badger's Core Service) | Higher initial hourly rate compared to some traditional methods. | Minimal risk of utility strikes, reduced project delays, enhanced safety. |

Entrants Threaten

Entering the hydrovac excavation market demands significant upfront capital for specialized hydrovac trucks, which carry substantial acquisition and upkeep costs. Badger Infrastructure Solutions, for instance, is projecting fleet growth of 4-7% in 2025, underscoring the continuous and considerable capital expenditure involved in this sector.

Badger Infrastructure Solutions' proprietary Hydrovac™ technology and its vertically integrated manufacturing capabilities create a significant hurdle for potential new entrants. Developing comparable advanced technology is both expensive and time-consuming, while relying on external manufacturers can lead to higher costs and reduced control. This technological edge makes it challenging for newcomers to match Badger's innovation and efficiency.

Badger Infrastructure Solutions benefits from an established brand reputation and deep customer relationships, a significant barrier to new entrants. With over 30 years in the industry, Badger is recognized for its unwavering commitment to safety and reliability. This long-standing track record has fostered strong bonds with major clients across North America, including key players in the utility, transportation, and industrial sectors.

New companies entering the infrastructure solutions market would find it exceptionally challenging to replicate Badger's established trust and secure contracts. Large clients in these critical sectors place a premium on proven expertise and impeccable safety records, making it difficult for newcomers to gain traction without a similar history of successful project delivery and client satisfaction.

Extensive Geographic Footprint and Network

Badger Infrastructure Solutions’ extensive geographic footprint, with over 140 operational locations across the U.S. and Canada, presents a formidable barrier for new entrants. This national reach allows for rapid response and service delivery, capabilities that are incredibly difficult and costly for newcomers to establish quickly.

Replicating Badger's established network requires immense capital investment and years of logistical development. This significant upfront commitment in terms of time, financial resources, and operational expertise deters many potential competitors from entering the market.

- National Reach: Badger operates from over 140 locations across the U.S. and Canada.

- Rapid Response: This extensive network enables swift and efficient service delivery.

- Barrier to Entry: Replicating this scale of operations is capital-intensive and time-consuming for new companies.

Regulatory and Safety Compliance

The hydrovac industry is heavily regulated, particularly concerning safety. New companies entering this space must contend with rigorous compliance requirements, industry certifications, and stringent safety standards. For instance, in 2024, the Occupational Safety and Health Administration (OSHA) continued to enforce detailed safety protocols for excavation and utility work, which directly impact hydrovac operations. Meeting these benchmarks requires significant investment in training, equipment, and ongoing audits, presenting a substantial barrier to entry.

Navigating these complex regulatory landscapes and proving a robust safety culture is a considerable hurdle for aspiring hydrovac businesses. This not only increases the initial capital outlay but also demands specialized knowledge and continuous vigilance to maintain compliance. Failure to adhere to these standards can result in severe penalties, operational shutdowns, and reputational damage, making it a critical factor that deters potential new entrants.

- Stringent Safety Regulations: Hydrovac operations are subject to strict safety standards, often exceeding general construction industry requirements.

- Compliance Costs: New entrants face significant costs associated with obtaining necessary certifications, implementing safety management systems, and ongoing compliance monitoring.

- Demonstrating Safety Culture: Establishing and proving a strong safety culture is paramount and requires dedicated resources for training and risk management.

The threat of new entrants into Badger Infrastructure Solutions' hydrovac excavation market is considerably low due to substantial capital requirements for specialized equipment and the need for regulatory compliance. For example, the cost of a single hydrovac truck can range from $300,000 to over $500,000, and Badger's projected fleet growth of 4-7% in 2025 highlights the ongoing investment needed to compete. Furthermore, stringent safety regulations, like those enforced by OSHA in 2024, demand significant investment in training and operational protocols, adding to the initial cost and complexity for newcomers.

| Factor | Impact on New Entrants | Badger's Advantage |

| Capital Investment | High (Hydrovac trucks $300k-$500k+) | Established fleet, economies of scale |

| Technology & Innovation | Challenging to replicate proprietary tech | Proprietary Hydrovac™ technology |

| Brand Reputation & Relationships | Difficult to build trust and secure contracts | 30+ years of proven safety and reliability |

| Geographic Footprint | Costly and time-consuming to establish | 140+ operational locations |

| Regulatory Compliance | Significant investment in safety and training | Established compliance infrastructure |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Badger Infrastructure Solutions is built upon a foundation of robust data, including Badger's annual reports, industry-specific market research from firms like IBISWorld, and relevant regulatory filings. This blend of internal company data and external industry intelligence ensures a comprehensive understanding of the competitive landscape.