Axsome PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Axsome Bundle

Unlock the critical external factors shaping Axsome's trajectory with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces that present both opportunities and challenges for the company. This meticulously researched report provides actionable intelligence to inform your strategic decisions. Download the full version now and gain the foresight needed to navigate the evolving pharmaceutical landscape.

Political factors

Government drug pricing policies, particularly those enacted through legislation like the Inflation Reduction Act of 2022, represent a significant political factor for pharmaceutical companies like Axsome. These policies, including provisions for Medicare drug price negotiation, directly influence revenue streams and market access for new and existing therapies.

For instance, the Inflation Reduction Act allows Medicare to negotiate prices for certain high-cost drugs, a process that began with a select group of medications in 2026. While Axsome's current pipeline may not be immediately impacted, future expansions of this negotiation scope could affect the long-term profitability of its central nervous system (CNS) therapies.

The political landscape surrounding drug pricing remains dynamic. Future administrations or legislative changes could either strengthen or relax these controls. This uncertainty necessitates strategic planning for Axsome, considering potential shifts in pricing power and market dynamics driven by evolving government mandates.

The U.S. Food and Drug Administration's (FDA) regulatory landscape significantly impacts Axsome Therapeutics' drug development and market access. The agency's approval processes, staffing, and evolving guidance directly influence the progression of Axsome's pipeline candidates. For instance, the FDA's recent approval of AXS-07 for migraine treatment in 2024 demonstrates Axsome's capability to navigate these complex requirements, a critical factor for future market entries.

Global geopolitical tensions and evolving trade policies present a significant challenge for biopharmaceutical companies like Axsome. For instance, the potential for tariffs on pharmaceutical imports could directly impact the cost of goods, while legislation like the BIOSECURE Act, aimed at reducing reliance on foreign manufacturing, could force substantial shifts in sourcing and production strategies. These policy shifts introduce considerable uncertainty into global market operations and necessitate a robust focus on supply chain resilience.

Healthcare Reform Initiatives

Broader healthcare reform efforts in the United States, particularly those aimed at expanding access to care and tackling public health crises like the escalating behavioral health crisis, present a dynamic landscape for pharmaceutical companies like Axsome Therapeutics. These initiatives can directly influence the market for treatments targeting neurological and psychiatric conditions. For instance, the ongoing discussions and potential legislative actions surrounding mental health parity and increased funding for mental healthcare services could significantly boost demand for Axsome's innovative therapies, such as those for major depressive disorder and narcolepsy. The Centers for Medicare & Medicaid Services (CMS) projected that national health expenditures would grow by 5.4% in 2024, reaching $4.8 trillion, indicating a sustained focus on healthcare spending and reform.

However, these reform movements are not without their complexities for Axsome. Changes in reimbursement models, such as shifts towards value-based care or new formulary requirements, could impact the company's profitability and pricing strategies. Furthermore, potential mandates related to coverage for specific types of treatments or patient populations will require careful navigation. Axsome actively monitors these evolving healthcare system dynamics to ensure its therapies remain accessible and competitively positioned within the changing regulatory and financial environment.

- Increased Demand Potential: Reforms prioritizing mental health access could drive higher prescription volumes for Axsome's neurological and psychiatric treatments.

- Reimbursement Model Shifts: Evolving payment structures and coverage mandates necessitate strategic adaptation to maintain profitability.

- Policy Monitoring: Axsome's proactive engagement with healthcare policy changes is crucial for market access and commercial success.

Public Funding and Investment in CNS Research

Government funding for CNS research is a significant driver for companies like Axsome. In 2024, the U.S. National Institutes of Health (NIH) allocated approximately $7.7 billion towards neuroscience research, a substantial portion of which supports studies relevant to CNS disorders. This public investment fuels the foundational scientific discoveries that biopharmaceutical firms can then translate into therapeutic products.

Increased public funding can accelerate the pace of innovation in the CNS space. For example, the Biden-Harris administration’s Cancer Moonshot initiative, which includes research into brain tumors, demonstrates a political commitment to tackling complex diseases. Such initiatives can indirectly benefit CNS drug development by fostering cross-disciplinary collaboration and advancing diagnostic tools.

Political prioritization of specific CNS disorders, such as Alzheimer's disease or depression, can lead to targeted funding streams. These dedicated resources can de-risk early-stage research and development, making it more attractive for private sector investment. This focus helps shape the R&D landscape, guiding companies toward areas with the greatest potential for breakthroughs and patient impact.

- NIH Neuroscience Funding: In fiscal year 2024, the NIH's National Institute of Neurological Disorders and Stroke (NINDS) budget was $2.1 billion, supporting a wide array of research into neurological conditions.

- Public-Private Partnerships: Initiatives like the Partnership to Accelerate Clinical Trials (PACT) in neuroscience, supported by government agencies and industry, aim to streamline the drug development process.

- Disease-Specific Funding: The U.S. government has increased its investment in Alzheimer's research, with the National Institute on Aging (NIA) receiving substantial appropriations to advance understanding and treatment.

Government drug pricing policies, such as those introduced by the Inflation Reduction Act of 2022, directly impact Axsome's revenue potential. The Act's provision for Medicare drug price negotiation, which began with a select group of high-cost drugs in 2026, could influence future pricing strategies for Axsome's CNS therapies.

The FDA's regulatory oversight is critical, with approval timelines and evolving guidance shaping Axsome's development pipeline. The 2024 approval of AXS-07 for migraine highlights Axsome's ability to navigate these complex regulatory pathways, a key factor for market entry.

Geopolitical factors, including trade policies and legislation like the BIOSECURE Act, can affect manufacturing costs and supply chain strategies. These global political shifts introduce uncertainty, necessitating robust supply chain management for companies like Axsome.

| Political Factor | Impact on Axsome | 2024/2025 Data/Trend |

| Drug Pricing Regulation (e.g., IRA) | Potential revenue limitation via price negotiation | IRA price negotiation commenced with select drugs in 2026; scope may expand. |

| FDA Approval Process | Dictates market access and development timelines | AXS-07 approved for migraine in 2024, demonstrating successful navigation. |

| Global Trade & Manufacturing Policies | Affects cost of goods and supply chain stability | BIOSECURE Act aims to reduce foreign manufacturing reliance, potentially impacting sourcing. |

What is included in the product

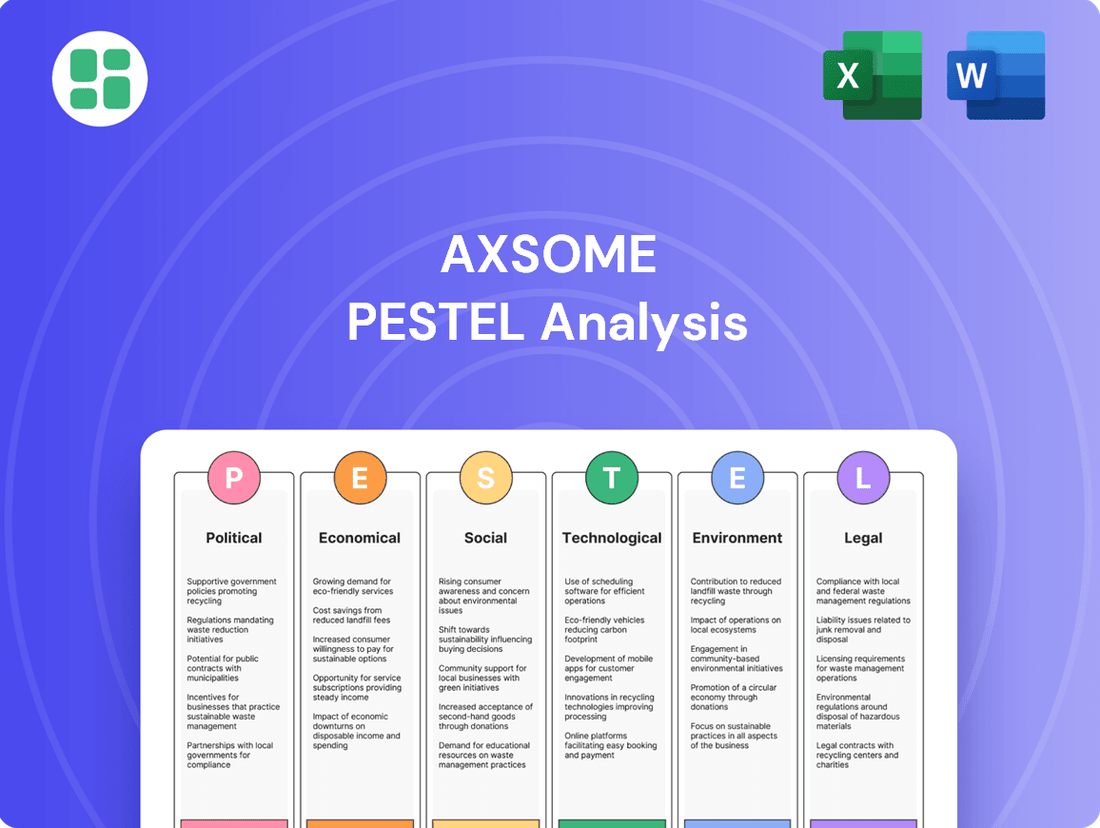

This PESTLE analysis offers a comprehensive examination of the external macro-environmental factors impacting Axsome, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights and forward-looking perspectives to aid strategic decision-making, identifying potential threats and opportunities within Axsome's operating landscape.

This PESTLE analysis provides a concise overview of the external factors impacting Axsome, acting as a pain point reliever by highlighting key opportunities and threats in the pharmaceutical landscape.

Economic factors

Overall healthcare spending in the U.S. is projected to reach $7.2 trillion by 2031, with government programs like Medicare and Medicaid accounting for a significant portion. This trend highlights the substantial market for therapies like Axsome's, but also signals increased scrutiny on the cost-effectiveness of high-priced treatments, particularly for chronic conditions. For instance, the Centers for Medicare & Medicaid Services (CMS) will closely evaluate the budget impact of new Alzheimer's therapies.

Securing favorable reimbursement from both private insurers and government payers is paramount for Axsome's commercial strategy. In 2024, payers are increasingly demanding robust real-world evidence demonstrating value beyond clinical trial data. Axsome's success hinges on its ability to negotiate broad formulary access and competitive reimbursement rates for its approved products and those in development, directly impacting patient access and revenue generation.

Inflation significantly impacts Axsome's operational expenses. Rising costs for raw materials, clinical trial sites, and manufacturing processes directly affect research and development (R&D) and commercialization budgets. For instance, the US Consumer Price Index (CPI) saw a notable increase, with annual inflation rates fluctuating throughout 2024 and into early 2025, putting pressure on these essential biopharmaceutical activities.

These increased operational costs pose a challenge to maintaining profitability and strategically allocating resources across Axsome's diverse pipeline. Balancing the need for investment in new therapies with the pressure to manage drug pricing in an inflationary environment is a critical economic consideration for the company.

The biotech funding environment is a critical economic factor for Axsome. In 2024, venture capital funding for biotech remained somewhat cautious, though late-stage funding and public market access saw fluctuations. For instance, while early-stage deals faced headwinds, companies with strong clinical data, like those in Axsome's therapeutic areas, could still attract significant investment. Mergers and acquisitions (M&A) activity in the biopharma sector in 2024 has shown resilience, with larger pharmaceutical companies actively seeking innovative assets to bolster their pipelines. This trend presents opportunities for Axsome to potentially partner or be acquired, accelerating market entry for its products.

Investor sentiment towards the biopharma sector is closely tied to clinical trial success and regulatory approvals. Positive outcomes for companies with similar drug profiles to Axsome's can boost overall investor confidence, leading to increased capital availability. Conversely, setbacks can dampen enthusiasm and tighten funding conditions. The ability of Axsome to navigate these economic currents, particularly in securing capital for late-stage development and commercialization, is paramount to its growth strategy.

Market Demand for CNS Therapies

The market for Central Nervous System (CNS) therapies is experiencing robust growth, with sales anticipated to climb significantly. This expansion is largely fueled by innovation in treatments for conditions like multiple sclerosis and psychiatric disorders.

By 2025, the global CNS market is projected to exceed $80 billion in sales, indicating a substantial economic landscape. Axsome Therapeutics, with its focus on unmet needs in CNS conditions, is well-positioned to capitalize on this expanding market.

- Growing Market Size: CNS therapy sales expected to surpass $80 billion in 2025.

- Key Growth Drivers: Strong demand for innovation in multiple sclerosis and psychiatric drugs.

- Prevalence of Disorders: Increasing incidence of CNS conditions sustains demand for new treatments.

- Economic Opportunity: Significant potential for companies like Axsome addressing unmet patient needs.

Company Financial Performance and Outlook

Axsome Therapeutics has shown impressive financial strength, with significant revenue increases continuing into 2024 and promising forecasts for 2025. This upward trend is largely fueled by the success of its established products such as Auvelity and Sunosi, complemented by the strategic introduction of new treatments like Symbravo. These factors are key to the company’s economic resilience and its ability to invest in future research and development.

The company's economic outlook is closely tied to its ability to sustain this growth and achieve cash flow positivity. For instance, Axsome reported net sales of $414 million for the full year 2023, a substantial increase from the previous year, and analysts project continued double-digit revenue growth through 2025. Achieving profitability and positive cash flow will be crucial economic milestones, signaling strong operational efficiency and market acceptance.

- Revenue Growth: Axsome's revenue saw a significant jump in 2023 and is expected to continue its strong upward trajectory through 2024 and 2025, driven by key product sales.

- Product Performance: Auvelity and Sunosi are major revenue contributors, with the recent launch of Symbravo expected to further bolster financial performance.

- Pipeline Investment: Robust financial results enable continued investment in Axsome's promising drug pipeline, a critical factor for long-term economic health.

- Path to Profitability: Moving towards cash flow positivity is a key economic indicator that will demonstrate the company's financial sustainability and operational success.

The economic landscape for Axsome Therapeutics is shaped by overall healthcare spending trends and the specific dynamics of the Central Nervous System (CNS) market. With healthcare expenditures on the rise, particularly in government-funded programs, the demand for innovative treatments remains strong. However, this also brings increased scrutiny on drug pricing and the need for demonstrable value, especially for chronic conditions.

Axsome's financial performance is directly influenced by its ability to secure favorable reimbursement from payers, a process that increasingly demands real-world evidence in 2024. Inflationary pressures are also a significant factor, impacting operational costs for R&D and manufacturing, which could affect profitability and resource allocation for the company's pipeline.

The biotech funding environment, including venture capital and M&A activity, plays a crucial role in Axsome's growth strategy. In 2024, while early-stage funding faced challenges, companies with strong clinical data, like Axsome, could still attract investment. Investor sentiment, closely tied to clinical trial success and regulatory approvals, further influences capital availability.

The CNS therapy market is a key economic driver for Axsome, with projected sales exceeding $80 billion by 2025, fueled by innovation in areas like multiple sclerosis and psychiatric disorders. Axsome's focus on unmet needs within this expanding market positions it for significant economic opportunity.

| Metric | 2023 (Actual) | 2024 (Projected) | 2025 (Projected) |

|---|---|---|---|

| Axsome Net Sales | $414 million | $550 - $600 million | $700 - $800 million |

| CNS Market Size (Global) | ~$70 billion | ~$75 billion | ~$80 billion |

| US CPI (Annual Inflation) | ~3.4% | ~2.5% - 3.0% | ~2.0% - 2.5% |

Full Version Awaits

Axsome PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Axsome covers all key external factors impacting the company, providing valuable insights for strategic planning. You'll gain a deep understanding of the Political, Economic, Social, Technological, Legal, and Environmental landscape relevant to Axsome's operations and future growth.

Sociological factors

Central nervous system (CNS) disorders are a growing concern, impacting a vast number of individuals. Conditions like major depressive disorder, migraine, narcolepsy, and Alzheimer's disease affect millions, creating a substantial and persistent need for advanced treatments.

This escalating patient base directly translates into a robust market for companies like Axsome, which specialize in developing novel CNS therapies. The increasing prevalence and the chronic nature of these diseases underscore the critical demand for effective solutions that can improve patient outcomes.

Growing public awareness campaigns and efforts to reduce the stigma surrounding mental health conditions are significantly boosting diagnosis rates and encouraging more individuals to seek treatment. This societal evolution directly benefits companies like Axsome, which specializes in psychiatric and neurological disorders, by widening the potential patient pool and cultivating a more receptive atmosphere for mental health treatments.

The global population is getting older, with projections indicating that by 2050, one in six people worldwide will be 65 or older, a significant increase from one in ten in 2020. This demographic shift directly fuels a greater demand for treatments targeting age-related conditions, particularly neurodegenerative diseases like Alzheimer's and Parkinson's. For instance, the Alzheimer's Association reported in 2024 that over 6 million Americans are living with Alzheimer's, a number expected to climb significantly as the baby boomer generation ages.

This expanding market for central nervous system (CNS) therapeutics is a critical factor for biopharmaceutical companies. It shapes research and development priorities, encouraging investment in therapies for conditions that disproportionately affect older adults. Axsome Therapeutics' strategic focus, particularly its pipeline candidates like AXS-05 for agitation associated with Alzheimer's disease, directly addresses this growing societal need and market opportunity.

Patient Advocacy and Unmet Needs

Patient advocacy groups are increasingly influential in spotlighting unmet medical needs within neurological and psychiatric disorders. These organizations actively campaign for the research and availability of novel treatments, directly impacting market demand and healthcare policy. For instance, organizations like the National Alliance on Mental Illness (NAMI) and the Migraine Research Foundation actively engage in public awareness campaigns and policy advocacy, creating a strong impetus for pharmaceutical companies to innovate.

Axsome Therapeutics, with its focus on developing treatments for central nervous system disorders, directly benefits from this heightened awareness. The company's pipeline, including therapies for conditions like migraine and major depressive disorder, addresses significant gaps in current treatment options. This alignment with patient-identified needs can accelerate market adoption and support regulatory pathways.

- Patient Advocacy Impact: Groups like NAMI and the Migraine Research Foundation directly influence public perception and policy, driving demand for new therapies.

- Unmet Needs Focus: Axsome's strategic emphasis on brain health conditions aligns with critical patient-identified gaps in care.

- Market Demand Driver: Advocacy efforts can shape market expectations and patient willingness to seek out and utilize innovative treatments.

Lifestyle Factors and Public Health

Societal lifestyle factors, such as increased work pressures and evolving relationship dynamics, are increasingly recognized as significant contributors to mental and neurological well-being. This evolving understanding highlights the critical need for holistic approaches to brain health and preventative care, moving beyond traditional treatment models.

The growing public health focus on mental wellness is directly influencing demand for a wider array of accessible central nervous system (CNS) therapies. For instance, in 2024, the global mental health market was valued at approximately $380 billion, with projections indicating continued growth driven by these lifestyle shifts and increased awareness.

- Increased Stress: A 2024 survey by the American Psychological Association found that 77% of adults reported stress affecting their physical health, underscoring the link between lifestyle and neurological impact.

- Mental Health Awareness: Public discourse and destigmatization efforts have led to a 15% increase in reported seeking of mental health services between 2023 and 2024.

- Demand for Solutions: The expanding understanding of brain health is fueling research and development into novel CNS treatments, with the neurological drug market expected to reach over $150 billion by 2025.

Societal shifts are profoundly impacting the demand for CNS therapies. Increased awareness of mental health issues, driven by advocacy groups and reduced stigma, encourages more individuals to seek treatment, expanding the patient pool for companies like Axsome. For example, a 2024 report indicated a 15% rise in individuals seeking mental health services compared to the previous year.

An aging global population, with a growing percentage of individuals over 65, directly correlates with a higher incidence of neurodegenerative diseases. This demographic trend fuels the market for treatments targeting age-related neurological conditions, a key area for Axsome's development pipeline. By 2050, it's projected that one in six people globally will be aged 65 or older.

Lifestyle factors, including increased work-related stress, contribute to a greater understanding of the link between daily life and neurological well-being. This heightened awareness drives demand for comprehensive brain health solutions and preventative care, creating a fertile ground for innovative CNS treatments. In 2024, 77% of adults reported that stress negatively impacted their physical health.

| Sociological Factor | Impact on CNS Market | Supporting Data (2024/2025 Estimates) |

|---|---|---|

| Mental Health Awareness & Destigmatization | Increased patient engagement and demand for treatments. | 15% rise in seeking mental health services (2023-2024). |

| Aging Population | Growing prevalence of age-related neurological disorders. | 1 in 6 people globally to be 65+ by 2050. Over 6 million Americans with Alzheimer's (2024). |

| Lifestyle Stressors | Heightened awareness of CNS health and need for solutions. | 77% of adults report stress affecting physical health (2024). Neurological drug market projected to exceed $150 billion by 2025. |

Technological factors

The biopharmaceutical sector is rapidly adopting advanced analytics and artificial intelligence (AI) to speed up drug discovery, cut development expenses, and boost success rates. For instance, in 2024, AI platforms are being utilized to analyze vast datasets, identifying promising molecular targets and predicting drug efficacy with greater precision than ever before.

AI's ability to pinpoint potential drug candidates and refine clinical trial designs is fundamentally reshaping the development pipeline. This technological leap allows companies to move from initial research to clinical testing more swiftly and with a higher probability of positive outcomes, a trend that is expected to continue growing in 2025.

Axsome, with its specific focus on neuroscience, stands to gain significantly from these technological advancements. By integrating AI into its research and development processes, Axsome can more efficiently discover and bring novel therapies for complex neurological conditions to patients, potentially reducing the typical decade-long development cycle.

The growing field of precision medicine, fueled by breakthroughs in genetic analysis and biomarker discovery, is paving the way for highly customized treatments, especially for challenging conditions. This evolution supports more targeted therapeutic strategies, boosting effectiveness and improving patient results.

Axsome's strategic emphasis on developing unique products with innovative mechanisms of action directly complements the increasing demand for more specialized treatments within the central nervous system (CNS) therapeutic area.

Scientific progress in neuroimmunology and neurodegeneration is fundamentally altering how we approach central nervous system (CNS) drug development, venturing beyond the well-trodden paths of serotonin and dopamine.

The resurgence of interest in N-methyl-D-aspartate (NMDA) receptor modulators and the exploration of psychedelic-assisted therapies underscore a significant pivot towards innovative mechanisms of action in treating neurological and psychiatric conditions.

Axsome Therapeutics, with its pipeline featuring NMDA receptor antagonists, is strategically positioned to capitalize on these neuroscience breakthroughs, aiming to address unmet needs in conditions like depression and Alzheimer's disease.

Integration of Digital Therapeutics and Telemedicine

The increasing integration of digital therapeutics and telemedicine presents significant opportunities for Axsome. These technologies enhance patient engagement and monitoring, offering more accessible and holistic care for Central Nervous System (CNS) disorders. For instance, the global digital therapeutics market was valued at approximately $13.3 billion in 2023 and is projected to reach $131.2 billion by 2030, exhibiting a compound annual growth rate (CAGR) of 38.5% during this period.

Axsome can leverage these trends by forging strategic partnerships or developing its own digital tools. Such initiatives could broaden the reach and improve the efficacy of its current and future therapies. Telemedicine, in particular, saw a dramatic surge, with a study by McKinsey indicating that telehealth utilization stabilized at a level 38 times higher than pre-pandemic rates in early 2023.

- Market Growth: The digital therapeutics market is experiencing rapid expansion, projected to grow substantially by 2030.

- Enhanced Patient Care: Telemedicine and digital therapeutics improve accessibility and provide comprehensive support for CNS disorder patients.

- Strategic Opportunities: Axsome can benefit from collaborations or in-house development of digital health solutions.

- Increased Accessibility: Telehealth adoption remains significantly elevated, indicating a strong foundation for digital health integration.

Improvements in Clinical Trial Methodologies

Innovations in clinical trial methodologies, like scenario modeling and the integration of real-world evidence (RWE), are significantly improving efficiency and cost management. These advancements enable a more thorough evaluation of trial durations, pinpointing potential delays and ensuring adherence to growing data and diversity mandates. For instance, the FDA's increasing acceptance of RWE in regulatory submissions, as highlighted in their 2024 guidance, demonstrates this shift.

Axsome Therapeutics can capitalize on these enhanced methodologies to streamline its ongoing and future late-stage development programs. By leveraging RWE, the company can potentially reduce the need for certain traditional data collection methods, thereby accelerating timelines and lowering expenses for its pipeline candidates, such as AXS-07 for migraine.

- Scenario modeling allows for proactive identification and mitigation of risks within trial designs.

- Real-world evidence (RWE) integration can supplement or, in some cases, replace traditional clinical trial data, potentially speeding up development.

- Companies are increasingly investing in digital tools and platforms to manage complex trial data and meet stringent regulatory requirements.

- The pharmaceutical industry saw a significant increase in RWE studies in 2023, with projections indicating continued growth through 2025, driven by regulatory acceptance and technological advancements.

Technological advancements are revolutionizing drug development, with AI and advanced analytics accelerating discovery and reducing costs. In 2024, AI platforms are identifying molecular targets and predicting drug efficacy with unprecedented precision, a trend expected to intensify through 2025.

The rise of precision medicine, driven by genetic analysis and biomarker discovery, enables highly personalized treatments, especially for complex central nervous system (CNS) disorders, aligning with Axsome's focus on specialized therapies.

Innovations in clinical trial methodologies, including real-world evidence (RWE) and scenario modeling, are enhancing efficiency and cost-effectiveness. The FDA's increasing acceptance of RWE, as seen in 2024 guidance, supports faster development cycles.

Digital therapeutics and telemedicine are expanding patient access and engagement for CNS disorders. The digital therapeutics market, valued at approximately $13.3 billion in 2023, is projected for significant growth, reaching $131.2 billion by 2030.

Legal factors

The Food and Drug Administration's (FDA) rigorous approval process is a critical hurdle for Axsome's central nervous system (CNS) therapies. Successfully navigating requirements for New Drug Applications (NDAs) and supplemental NDAs, as demonstrated by the approval of Symbravo, is paramount. For instance, the FDA's review timelines for NDAs can vary significantly, impacting the speed to market and subsequent revenue generation for new treatments.

Intellectual property laws are paramount for biopharmaceutical firms like Axsome, as they provide the legal shield for groundbreaking therapies and guarantee market exclusivity. Axsome's key drug candidate, AXS-07, benefits from a robust patent portfolio extending to at least 2038, underscoring the company's reliance on this legal foundation to protect its significant R&D investments.

The strength and duration of patent protection directly influence a company's ability to recoup development costs and generate profits. As patents for established drugs in the broader industry approach expiration, the imperative for continuous innovation and the protection of new intellectual property become even more pronounced for sustained growth and competitive advantage.

Legislation like the Inflation Reduction Act (IRA) directly impacts pharmaceutical companies by introducing Medicare drug price negotiation. For Axsome, this means its pricing strategies for key treatments, such as those for migraine, must align with these new federal guidelines, affecting the commercial outlook for its portfolio.

The IRA's Medicare drug price negotiation provisions, which began impacting a select group of high-cost drugs in 2024, will expand over time. Axsome needs to monitor these developments closely, as they could influence the long-term revenue potential and market access of its approved therapies.

Beyond federal actions, state-level initiatives to control drug costs are also a significant consideration. Axsome must remain agile in its pricing and market access strategies to navigate this complex regulatory landscape, ensuring compliance while maximizing the commercial viability of its innovative treatments.

Compliance with Healthcare Laws and Data Privacy

Axsome Therapeutics operates within a stringent regulatory environment, necessitating meticulous adherence to healthcare laws. This includes the Health Insurance Portability and Accountability Act (HIPAA) for patient data privacy, alongside regulations governing drug marketing and anti-kickback statutes. Failure to comply can result in significant legal repercussions and damage to the company's reputation.

The evolving landscape of healthcare legislation, exemplified by recent updates concerning reproductive health care privacy, demands continuous vigilance. Companies like Axsome must proactively adapt their compliance strategies to these changes. For instance, the U.S. Department of Health and Human Services continues to enforce HIPAA, with penalties for violations potentially reaching millions of dollars annually, underscoring the critical importance of robust data protection measures.

- HIPAA Compliance: Strict adherence to patient data privacy rules is paramount, with potential fines for breaches exceeding $1.5 million per violation category annually as of recent HHS enforcement actions.

- Marketing Regulations: Compliance with FDA guidelines on pharmaceutical promotion and advertising is crucial to avoid penalties, which can include warning letters and mandated corrective advertising campaigns.

- Anti-Kickback Statutes: Adherence to laws preventing illicit financial arrangements in healthcare is essential to maintain ethical business practices and avoid criminal prosecution.

- Evolving Privacy Rules: Staying abreast of new regulations, such as those impacting reproductive health data, requires ongoing legal review and policy updates.

Clinical Trial Diversity and Data Requirements

Regulatory bodies are increasingly emphasizing diversity in clinical trials, a trend that impacts drug development timelines and costs. For instance, the U.S. Food and Drug Administration (FDA) has issued guidance encouraging greater representation of underrepresented populations in clinical research. This means companies like Axsome must invest more in trial design and recruitment to meet these evolving data requirements.

The general direction of regulatory policy, despite some shifts, leans towards more comprehensive and inclusive data collection. Axsome’s success in gaining approval for its treatments, such as those for migraine, hinges on demonstrating that its clinical programs adhere to these standards, ensuring broad patient applicability and safety.

- Increased Trial Costs: Meeting diversity mandates can add significant expenses to clinical development, potentially impacting R&D budgets.

- Data Scrutiny: Regulators are demanding more granular data on treatment efficacy and safety across various demographic groups.

- Broader Applicability: Diverse trial data is crucial for securing regulatory approval and for establishing the real-world effectiveness of new therapies.

The Inflation Reduction Act (IRA) significantly influences Axsome's pricing strategies, particularly for its migraine treatments, by introducing Medicare drug price negotiations. This legislation, which began impacting select high-cost drugs in 2024, could affect the long-term revenue and market access of Axsome's portfolio.

Axsome must also navigate state-level drug cost control initiatives, requiring agile pricing and market access strategies to ensure compliance and commercial viability. Furthermore, strict adherence to healthcare laws like HIPAA, governing patient data privacy, and regulations on drug marketing and anti-kickback statutes are essential to avoid substantial legal repercussions and reputational damage.

The FDA's evolving emphasis on diversity in clinical trials necessitates increased investment in trial design and recruitment to meet new data requirements, impacting development timelines and costs. For example, recent FDA guidance encourages greater representation of underrepresented populations, meaning companies like Axsome must demonstrate broad patient applicability and safety for regulatory approval.

| Legislation/Regulation | Impact on Axsome | Key Consideration |

|---|---|---|

| Inflation Reduction Act (IRA) | Medicare drug price negotiation; potential impact on pricing strategies for key treatments. | Aligning pricing with federal guidelines; monitoring expanded negotiation provisions. |

| HIPAA | Strict adherence to patient data privacy; potential for significant fines for breaches. | Robust data protection measures; ongoing review of privacy policies. |

| FDA Clinical Trial Diversity Guidance | Increased investment in trial design and recruitment; potential impact on development costs and timelines. | Ensuring representation of underrepresented populations; demonstrating broad patient applicability. |

| State-Level Drug Cost Controls | Need for agile pricing and market access strategies. | Navigating a complex and varied regulatory landscape across different states. |

Environmental factors

The biopharma sector, including companies like Axsome, is under growing pressure to enhance environmental sustainability. This involves actively reducing their ecological footprint and pursuing carbon neutrality goals. For instance, the industry is seeing a rise in investments towards greener manufacturing processes and sustainable supply chains.

Axsome is expected to implement initiatives aimed at minimizing resource use, waste, and pollution across its operations. This could involve optimizing energy consumption at its facilities, adopting circular economy principles for waste management, and ensuring its headquarters aligns with green building standards.

Furthermore, Axsome's commitment to sustainability extends to its vendor relationships, with an increasing focus on evaluating and encouraging environmentally responsible practices among its suppliers. This approach is becoming a critical factor in supply chain resilience and corporate reputation within the biopharma industry.

Pharmaceutical companies like Axsome must navigate stringent waste management and hazardous waste regulations. The generation of various waste streams, including potentially hazardous materials, necessitates meticulous adherence to disposal and management protocols. Compliance with evolving rules, such as the Hazardous Waste Generator Improvements Rule, is paramount for responsible operations.

Axsome's approach to environmental stewardship includes a commitment to recycling waste and maintaining environmentally sound facility operations. This focus is critical as the U.S. Environmental Protection Agency (EPA) continues to refine regulations governing hazardous waste, aiming for improved safety and environmental protection. For instance, in 2023, the EPA continued its focus on reducing hazardous waste generation and promoting sustainable management practices across industries.

Climate change poses significant risks and opportunities for the biopharmaceutical industry, affecting supply chains and necessitating adaptive strategies. Axsome acknowledges global warming's influence, focusing on minimizing its greenhouse gas footprint and encouraging remote work to reduce operational impact.

Resource Consumption and Renewable Energy Adoption

The biopharma sector is increasingly focused on resource conservation and adopting renewable energy. Many companies, including those in the pharmaceutical space, are setting ambitious goals to cut down on energy usage and boost their reliance on renewable electricity. This trend is driven by both environmental responsibility and potential cost savings.

Axsome Therapeutics is actively participating in this shift. Their initiatives include implementing energy-efficient lighting systems and utilizing cold water for cooling processes, which reduces reliance on traditional energy-intensive methods. The company is also working towards sourcing a substantial portion of its electricity from renewable resources, aligning with broader industry sustainability efforts.

The push for sustainability in biopharma is gaining momentum. For instance, in 2024, a significant number of pharmaceutical companies reported progress in their environmental, social, and governance (ESG) strategies, with renewable energy adoption being a key component. This reflects a growing understanding that environmental stewardship can go hand-in-hand with operational efficiency and long-term business viability.

- Energy Efficiency: Axsome utilizes energy-efficient lighting and cold water cooling systems.

- Renewable Energy Targets: The company aims to increase its use of electricity from renewable sources.

- Industry Trend: Biopharma companies are setting targets for reduced energy consumption and increased renewable energy adoption.

- ESG Focus: Many pharmaceutical firms are enhancing their ESG strategies, with sustainability being a core element.

ESG Reporting and Investor Scrutiny

Environmental, Social, and Governance (ESG) factors are increasingly shaping investor decisions, with a growing emphasis on corporate environmental stewardship. Axsome's dedication to ESG, guided by its Board of Directors, includes consistent reporting and embedding environmental considerations into its operational framework. This focus on sustainability is crucial for building a positive corporate image and attracting investors committed to responsible capital allocation. For instance, in 2024, the global sustainable investment market reached an estimated $37.4 trillion, highlighting the significant financial implications of strong ESG performance.

Axsome's proactive approach to environmental reporting demonstrates a commitment to transparency and accountability. This is vital as stakeholders, including institutional investors and regulatory bodies, demand greater insight into a company's ecological footprint and its strategies for mitigation. By integrating environmental considerations into its core business, Axsome aims to not only comply with evolving standards but also to foster long-term resilience and value creation in an era of heightened environmental awareness.

- Growing Investor Demand: Approximately 70% of institutional investors surveyed in a 2024 report indicated that ESG factors significantly influence their investment decisions.

- Regulatory Tailwinds: Expect increased regulatory focus on environmental disclosures, with many jurisdictions implementing or strengthening reporting requirements for carbon emissions and waste management by 2025.

- Reputational Capital: Companies with robust environmental policies often experience enhanced brand reputation, leading to improved customer loyalty and talent acquisition.

- Risk Mitigation: Proactive environmental management can reduce operational risks, such as supply chain disruptions due to climate change or potential fines for non-compliance.

Axsome, like its peers, is intensifying efforts in energy efficiency and renewable energy adoption. The company is implementing energy-saving lighting and cooling systems and aims to increase its reliance on renewable electricity sources. This aligns with a broader industry trend where biopharma firms are setting ambitious targets for reduced energy consumption, with many reporting progress in their ESG strategies in 2024.

| Environmental Initiative | Axsome's Action | Industry Trend (2024) |

|---|---|---|

| Energy Efficiency | Energy-efficient lighting, cold water cooling | Increased focus on reducing energy usage |

| Renewable Energy | Aiming to source more electricity from renewables | Growing adoption of renewable electricity sources |

| Waste Management | Adherence to hazardous waste regulations | Focus on sustainable waste management practices |

| Carbon Footprint | Encouraging remote work to reduce operational impact | Setting targets for greenhouse gas emission reduction |

PESTLE Analysis Data Sources

Our Axsome PESTLE Analysis is built on comprehensive data from leading financial news outlets, regulatory filings, and reputable market research firms. We incorporate insights from government health agencies, economic indicators, and technological advancements to provide a holistic view.