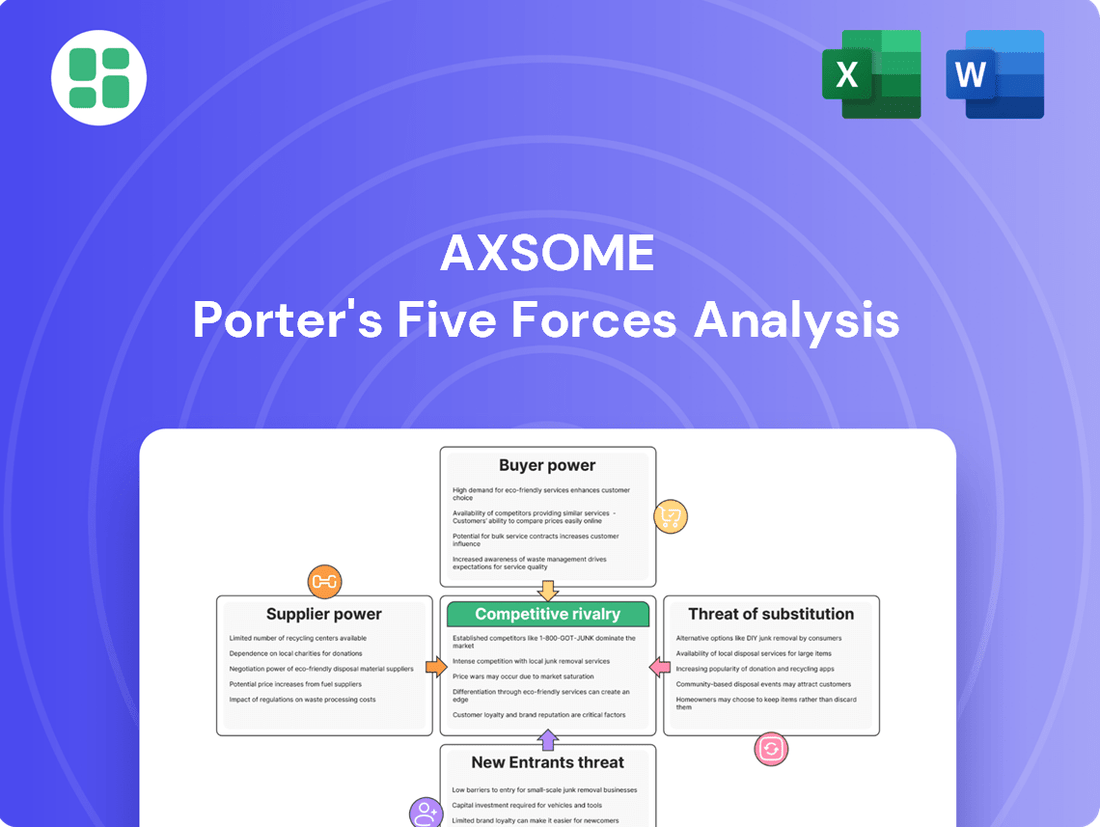

Axsome Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Axsome Bundle

Axsome's competitive landscape is shaped by intense rivalry, the looming threat of substitutes, and significant buyer power within the pharmaceutical sector. Understanding these forces is crucial for navigating this dynamic market.

The complete report reveals the real forces shaping Axsome’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Axsome, a biopharmaceutical firm focused on central nervous system disorders, depends on highly specialized raw materials and Active Pharmaceutical Ingredients (APIs) for its innovative treatments. The intricate chemical compositions and complex production methods for these vital components often mean only a select few suppliers can meet the stringent quality and regulatory demands.

This limited pool of qualified suppliers grants them significant leverage. For instance, if only two or three companies globally can produce a specific API required for Axsome's flagship product, those suppliers can dictate terms, potentially leading to increased costs for Axsome. This scarcity can also impact Axsome's ability to scale production if a key supplier faces disruptions.

The pharmaceutical industry frequently relies on Contract Manufacturing Organizations (CMOs) for specialized production, a necessity for companies like Axsome. This reliance can grant CMOs significant bargaining power, especially when a limited number of CMOs possess advanced manufacturing capabilities.

This leverage is further strengthened by the substantial costs and time involved in switching CMOs, creating high switching costs for Axsome. For instance, the global CMO market was valued at approximately $130 billion in 2023 and is projected to grow, indicating a robust and consolidated sector.

Clinical Research Organizations (CROs) hold significant bargaining power in their relationships with pharmaceutical companies like Axsome. The specialized expertise and extensive infrastructure required for conducting clinical trials, from patient recruitment to data analysis, are not easily replicated. Leading CROs often possess global networks and deep regulatory understanding, making them indispensable partners.

The lengthy timelines and high stakes involved in clinical development mean that disruptions are extremely costly. Axsome's reliance on CROs for critical trial execution and data integrity creates a strong incentive to maintain stable partnerships. The expense and time involved in onboarding a new CRO for ongoing trials further solidify the bargaining power of existing, trusted partners, especially given the increasing complexity and global nature of studies in 2024.

Intellectual Property and Proprietary Technologies

Suppliers possessing proprietary technologies or critical intellectual property can wield considerable influence over Axsome. If a supplier holds patents or trade secrets vital for Axsome's drug development or manufacturing, their bargaining power escalates significantly. This can translate into increased licensing costs or stricter contract terms, potentially affecting Axsome's profit margins and the pace of its research and development.

For instance, a supplier of a unique active pharmaceutical ingredient (API) with patented synthesis methods could command higher prices. In 2024, the pharmaceutical contract manufacturing market saw increased demand for specialized API production, with some niche providers leveraging their intellectual property to secure favorable terms. This situation could force Axsome to either accept higher costs or invest heavily in developing its own alternative technologies, which is a time-consuming and resource-intensive endeavor.

- Proprietary Technology: Suppliers with patented manufacturing processes or unique chemical compounds essential for Axsome's drug formulations.

- Intellectual Property: Key patents or trade secrets held by suppliers that are difficult or impossible for Axsome to replicate independently.

- Impact on Axsome: Potential for increased costs, restrictive licensing agreements, and potential delays in drug development or market entry if supplier IP is critical.

Regulatory Compliance and Quality Control

Suppliers in the pharmaceutical industry, including those providing components and services to companies like Axsome, face extensive regulatory hurdles. Compliance with agencies such as the U.S. Food and Drug Administration (FDA) is non-negotiable, adding significant costs and complexity to their operations. This stringent oversight means that suppliers who consistently meet these high standards possess a distinct advantage, as Axsome depends on their ability to navigate these requirements without disruption. Any lapse in quality control or regulatory adherence by a supplier could result in costly delays or even halt production, thereby increasing the bargaining power of reliable, compliant partners.

For instance, the FDA's Good Manufacturing Practices (GMP) are critical for pharmaceutical ingredient suppliers. In 2024, the FDA continued to emphasize rigorous inspections and enforcement actions, underscoring the importance of supplier compliance. Axsome's need for suppliers to maintain these certifications means that a disruption in the supply chain due to a supplier's non-compliance can have severe financial implications, potentially costing millions in lost revenue and remediation efforts. This reliance on supplier integrity directly translates to enhanced supplier leverage.

The bargaining power of these specialized suppliers is further amplified by the niche nature of many pharmaceutical components and the high barriers to entry for new, compliant manufacturers. Axsome, like many biopharmaceutical firms, often relies on a limited number of qualified suppliers for critical raw materials and manufacturing services. This limited supplier pool, coupled with the extensive validation processes required for any change in supplier, strengthens the negotiating position of existing, trusted partners.

- Regulatory Burden: Pharmaceutical suppliers must meet stringent FDA regulations, increasing operational costs and complexity.

- Quality Assurance: Axsome relies on suppliers for consistent quality control, making compliance a key factor.

- Supply Chain Risk: Non-compliance by a supplier can lead to significant production delays and financial losses for Axsome.

- Supplier Dependence: The need for specialized, validated components limits Axsome's supplier options, enhancing supplier power.

Axsome's reliance on specialized suppliers for critical raw materials and manufacturing services, often with proprietary technology or intellectual property, significantly enhances supplier bargaining power. The high costs and lengthy validation periods associated with switching suppliers, combined with stringent regulatory compliance requirements, further solidify the leverage of established, compliant partners. This dynamic can lead to increased costs and potential supply chain disruptions for Axsome.

| Factor | Description | Impact on Axsome | 2024 Relevance |

|---|---|---|---|

| Limited Supplier Pool | Few qualified suppliers for specialized APIs and manufacturing. | Higher costs, potential production delays. | Continued demand for niche pharmaceutical manufacturing. |

| Proprietary Technology/IP | Suppliers hold patents on essential manufacturing processes. | Increased licensing fees, restrictive terms. | Increased focus on IP protection in pharma R&D. |

| High Switching Costs | Time and expense to qualify new suppliers. | Reduced flexibility, dependence on existing partners. | Complex validation processes remain a barrier. |

| Regulatory Compliance | Strict FDA GMP requirements for suppliers. | Reliance on supplier integrity, risk of disruption. | FDA enforcement of GMP standards remains high. |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Axsome's position in the pharmaceutical industry.

Effortlessly assess competitive pressures in the pain management market, identifying key threats and opportunities for Axsome's novel therapies.

Customers Bargaining Power

In the biopharmaceutical sector, payers like insurance companies and government programs wield significant power, directly influencing reimbursement and access to medications. For companies such as Axsome, these entities dictate whether drugs like Auvelity and Sunosi are placed on formularies and at what price. This leverage is critical, as demonstrated by the fact that in 2024, payers continue to actively negotiate pricing and manage patient access through prior authorization requirements, impacting commercial viability.

Physicians are central to therapy selection, evaluating factors like effectiveness, safety, and patient needs. Their decisions are heavily shaped by established clinical guidelines, which can steer them towards or away from specific treatments. Axsome’s ability to align its products with these guidelines and demonstrate superior clinical outcomes is crucial for maintaining prescriber loyalty in a competitive landscape.

While individual patients don't directly negotiate drug prices, their collective adherence and demand are crucial for a therapy's success. For conditions like chronic migraines or narcolepsy, patients often seek treatments that are not only effective but also easy to use and well-tolerated, influencing which medications doctors prescribe. Axsome Therapeutics is strategically positioned to capitalize on this by developing therapies aimed at significant unmet medical needs, thereby fostering strong patient demand.

Availability of Alternative Treatments

The availability of alternative treatments significantly bolsters customer bargaining power for companies like Axsome. If patients and their doctors can find comparable or even superior therapies at a lower cost, they have leverage to demand better pricing or switch to competitors. This is particularly relevant in the pharmaceutical industry where patent expirations can lead to the influx of generic alternatives, drastically reducing the pricing power of branded drugs.

For Axsome, this means that the perceived efficacy and cost-effectiveness of its novel treatments, such as those for migraine or Alzheimer's disease, must be demonstrably superior to existing options. For instance, if a competitor launches a new migraine therapy with a comparable efficacy profile but a lower price point, Axsome's pricing flexibility for its own migraine treatments could be constrained. The market for neurological disorders is often crowded with various therapeutic approaches, including established medications and emerging non-pharmacological interventions.

- Customer Bargaining Power: High due to existing treatments.

- Impact of Generics: Generic drug availability erodes pricing power of branded alternatives.

- Competitive Landscape: The presence of numerous pharmaceutical and non-pharmacological options empowers patients and prescribers to seek cost-effective solutions.

- Axsome's Strategy: Continuous innovation and clear differentiation are crucial to counter this power.

Group Purchasing Organizations (GPOs) and Integrated Delivery Networks

Large healthcare systems and Group Purchasing Organizations (GPOs) significantly impact the pharmaceutical industry through their substantial collective bargaining power. By aggregating the purchasing needs of numerous providers, these entities can negotiate highly favorable pricing and contract terms for drugs, including those targeting central nervous system (CNS) conditions. Axsome's success in gaining broad market access hinges on its ability to secure contracts with these powerful buyers, whose negotiating leverage is a key factor in customer power.

For instance, in 2024, major GPOs often represent billions of dollars in annual pharmaceutical spending, enabling them to demand significant discounts. This concentration of purchasing power means that Axsome, like other pharmaceutical companies, faces considerable pressure to offer competitive pricing to gain formulary acceptance and widespread adoption within these large networks.

- Aggregated Demand: GPOs and integrated delivery networks consolidate purchasing power, representing a significant portion of the market for CNS drugs.

- Negotiating Leverage: These large entities can demand substantial price concessions and favorable contract terms from pharmaceutical manufacturers.

- Market Access Barrier: Axsome's ability to negotiate with these powerful customers is critical for achieving widespread distribution and market penetration for its products.

- Pricing Pressure: The sheer volume of purchases by these groups exerts downward pressure on drug prices, impacting manufacturer profitability.

The bargaining power of customers in the pharmaceutical sector, particularly for companies like Axsome, is considerable. Payers, including insurance companies and government programs, wield significant influence by dictating formulary placement and reimbursement rates. Physicians, as key decision-makers, are swayed by clinical efficacy, safety profiles, and established guidelines, impacting treatment selection. While individual patients have less direct power, their collective adherence and demand for effective, well-tolerated therapies are crucial.

The presence of alternative treatments, including generics and competing novel therapies, further empowers customers by providing options and driving price competition. Large healthcare systems and Group Purchasing Organizations (GPOs) amplify this power through aggregated demand, enabling them to negotiate substantial discounts and favorable contract terms. For Axsome, demonstrating clear clinical advantages and cost-effectiveness is paramount to navigating these powerful customer relationships and securing market access for its products.

| Customer Segment | Influence Factor | Impact on Axsome |

|---|---|---|

| Payers (Insurers, Government) | Reimbursement Rates, Formulary Access | Dictates market access and pricing viability of drugs like Auvelity. |

| Physicians | Prescribing Habits, Clinical Guidelines | Influences adoption based on perceived efficacy and safety compared to alternatives. |

| Patients | Treatment Adherence, Demand | Collective demand for effective therapies drives physician choice and market success. |

| GPOs/Large Healthcare Systems | Purchasing Volume, Contract Negotiation | Leverage significant buying power to demand price concessions. |

Full Version Awaits

Axsome Porter's Five Forces Analysis

This preview showcases the complete Axsome Porter's Five Forces Analysis, providing an in-depth examination of competitive forces within the pharmaceutical industry. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, ensuring you get a comprehensive and ready-to-use strategic tool.

Rivalry Among Competitors

The Central Nervous System (CNS) therapeutic market is a crowded space, with many well-established pharmaceutical and biotech firms vying for market share. Axsome faces formidable competition from giants such as Jazz Pharmaceuticals, Teva Pharmaceutical Industries, and Alkermes, companies that typically boast extensive product lines and significantly larger financial war chests.

This high level of competition underscores the critical need for Axsome to concentrate on developing and marketing truly differentiated therapies. For instance, in 2024, the global CNS drug market was valued at approximately $150 billion, with significant investment poured into research and development by all major players, highlighting the intensity of the battle for innovation and market penetration.

Developing central nervous system (CNS) drugs is a notoriously expensive, intricate, and lengthy undertaking, often plagued by high failure rates during clinical trials. This considerable financial commitment fuels intense competition, as companies strive to recover their research and development outlays through successful market entry. For instance, in 2023, the pharmaceutical industry's R&D spending reached an estimated $240 billion globally, with a significant portion allocated to CNS research, highlighting the sheer scale of investment required.

Competitive rivalry in the pharmaceutical sector, particularly for companies like Axsome, is intensely fueled by the pursuit of novel mechanisms of action and highly differentiated products. This focus is paramount in addressing substantial unmet medical needs within patient populations.

Axsome strategically highlights its innovative approach, exemplified by Auvelity. This drug stands out as the first oral antidepressant in decades to introduce a new mechanism of action, a significant differentiator in a crowded therapeutic landscape. Such unique selling propositions are critical for carving out and expanding market share against established, albeit less innovative, treatments.

Marketing and Commercialization Capabilities

Effective marketing and commercialization are paramount in the highly competitive central nervous system (CNS) market. Companies that possess strong sales forces, well-established physician relationships, and impactful direct-to-consumer marketing strategies are better positioned to capture market share.

Axsome Therapeutics’ strategic focus on building out its commercial capabilities, including plans to expand its sales force for key products like Auvelity, underscores the intense rivalry driven by these factors. For instance, in 2024, pharmaceutical companies are heavily investing in digital marketing and personalized physician outreach to differentiate their offerings.

- Sales Force Expansion: Axsome's commitment to growing its sales team for Auvelity highlights the direct impact of sales force size and effectiveness on product adoption and competitive standing.

- Physician Engagement: Building and maintaining strong relationships with neurologists and psychiatrists is crucial for driving prescription volume, a key battleground in the CNS space.

- Direct-to-Consumer (DTC) Campaigns: Successful DTC advertising can significantly influence patient demand and awareness, creating a pull-through effect that benefits products with strong marketing support.

Patent Protection and Pipeline Strength

Intellectual property, particularly patents, forms a critical barrier in the pharmaceutical industry, granting companies a period of market exclusivity for their novel treatments. This exclusivity allows them to recoup significant research and development investments. Axsome Therapeutics, for instance, relies heavily on its patent portfolio to defend its market position for its approved therapies and pipeline candidates.

The strength and breadth of a company's drug development pipeline are equally important competitive differentiators. A robust pipeline signals future growth potential and a commitment to innovation. Axsome's strategic focus on a diverse range of neurological and psychiatric conditions, with several late-stage assets, positions it to potentially address significant unmet medical needs.

- Patent Exclusivity: Patents provide a limited monopoly, crucial for recouping R&D costs.

- Pipeline Breadth: A strong pipeline indicates future revenue streams and innovation capacity.

- Axsome's Pipeline Focus: Candidates for Alzheimer's agitation, narcolepsy, and fibromyalgia are key to its long-term competitive standing.

Competitive rivalry in the CNS market is fierce, driven by established players with substantial resources and a constant need for innovation. Axsome must differentiate its offerings, as the global CNS drug market, valued at approximately $150 billion in 2024, sees significant R&D investment from all major companies.

The high cost and complexity of CNS drug development, with an estimated $240 billion spent globally on pharmaceutical R&D in 2023, create a high barrier to entry and intensify competition. Companies like Axsome need truly novel therapies, such as Auvelity with its new mechanism of action, to gain traction.

Effective commercialization, including robust sales forces and strong physician relationships, is crucial. Axsome's investment in its sales team for products like Auvelity reflects the importance of direct outreach and marketing support in this competitive landscape.

Intellectual property, particularly patents, and a strong drug development pipeline are key differentiators. Axsome's focus on late-stage assets for conditions like Alzheimer's agitation and narcolepsy aims to secure future market share.

| Factor | Axsome's Position | Competitive Impact |

|---|---|---|

| Established Competitors | Faces giants like Jazz Pharma, Teva, Alkermes | Requires strong differentiation and efficient operations |

| R&D Investment | Significant investment required for CNS therapies | High failure rates and long development cycles increase pressure |

| Product Differentiation | Auvelity offers a new oral antidepressant mechanism | Crucial for market penetration against established treatments |

| Commercialization Strength | Expanding sales force and physician engagement are key | Marketing effectiveness directly impacts prescription volume |

| Intellectual Property & Pipeline | Relies on patents and a pipeline of late-stage assets | Defends market position and signals future growth |

SSubstitutes Threaten

For many central nervous system (CNS) conditions, a variety of established pharmacological treatments are already available. These include older generation antidepressants, stimulants for conditions like ADHD, and various migraine medications. For instance, the global antidepressant market was valued at approximately $13.5 billion in 2023 and is projected to grow, indicating a significant presence of these alternatives.

These existing drugs, particularly generic versions, can act as effective substitutes for Axsome's therapies. This is especially true if Axsome's newer treatments are perceived as having a higher cost or a less favorable side effect profile for specific patient populations. The availability of cost-effective generics, which often represent a substantial portion of drug sales, directly pressures the pricing power of newer, branded medications.

Non-pharmacological therapies and lifestyle changes pose a significant threat of substitution for Axsome's drug treatments. For instance, cognitive behavioral therapy (CBT) is a well-established alternative for managing depression, a condition Axsome targets. In 2023, the global mental health apps market, which often incorporates CBT principles, was valued at approximately $5.2 billion and is projected to grow substantially, indicating a strong patient and provider inclination towards these accessible alternatives.

Furthermore, lifestyle modifications like improved diet, regular exercise, and better sleep hygiene are increasingly recognized as effective management strategies for various conditions, including sleep disorders. The growing awareness of holistic health approaches means patients may prioritize or combine these non-drug interventions with or instead of medication. The global wellness market, encompassing these lifestyle aspects, reached an estimated $5.6 trillion in 2023, underscoring the broad appeal and adoption of these substitute solutions.

Physicians might prescribe existing medications for conditions Axsome aims to treat, even if not officially approved for those uses. This off-label prescribing can divert patients, especially if these alternatives are more accessible or cheaper. For instance, in the migraine space, where Axsome has treatments like Aimovig (erenumab-aooe), other established drugs might be used off-label, impacting market share.

Emerging Digital Therapeutics and AI Solutions

The central nervous system (CNS) treatment landscape is undergoing a significant transformation with the emergence of digital therapeutics and AI-powered solutions. These innovations, though still in their early stages, present a potential future threat of substitution for traditional pharmaceutical approaches.

These digital tools can offer novel interventions, such as personalized therapy programs delivered via apps or AI-driven diagnostic support that could refine treatment pathways. While not direct replacements today, their increasing sophistication may lead to a partial substitution or complementary role that impacts demand for conventional drugs over time.

Consider these points regarding the threat of substitutes:

- Digital Therapeutics: Platforms offering behavioral interventions, remote patient monitoring, and personalized treatment plans for conditions like depression or anxiety are gaining traction. For instance, the digital therapeutics market was projected to reach billions by 2024, indicating growing adoption.

- AI in Diagnostics and Treatment: AI algorithms are being developed to identify biomarkers, predict treatment response, and even assist in drug discovery, potentially streamlining or altering the need for certain pharmaceutical interventions.

- Complementary or Substitutive Role: While many digital health solutions are designed to complement existing treatments, their ability to manage symptoms or improve adherence could, in some cases, reduce reliance on certain medications.

Patient-Specific Responses and Treatment Resistance

The inherent complexity and varied nature of central nervous system (CNS) disorders mean that a one-size-fits-all treatment approach is rarely effective. If Axsome's therapies, such as those for depression or migraine, don't demonstrate broad efficacy across diverse patient groups, or if patients develop resistance to these treatments, they will naturally look for alternatives. This dynamic directly impacts the threat of substitutes.

For instance, in the migraine market, while Axsome's DAYVIGO (Dayvigo) offers a new mechanism, the existence of established triptans and CGRP inhibitors means patients have readily available substitutes if DAYVIGO proves less effective for them. In 2024, the migraine market continues to see innovation, with several new entrants and expanded indications for existing drugs, intensifying the competitive landscape where patient-specific responses are paramount. A significant portion of patients experiencing treatment failure with existing therapies actively seek alternative solutions, underscoring the need for Axsome to demonstrate superior or differentiated outcomes.

- Patient Heterogeneity: CNS disorders exhibit significant variability in how patients respond to treatments, creating a constant demand for diverse therapeutic options.

- Treatment Resistance: The development of resistance to Axsome's drugs would prompt patients to seek alternative therapies, increasing the threat of substitution.

- Market Dynamics: In 2024, the pharmaceutical market, particularly for CNS disorders, is characterized by continuous innovation, offering patients a wide array of existing and emerging treatment substitutes.

- Efficacy Threshold: Axsome's success hinges on demonstrating that its therapies provide a meaningful benefit for a substantial patient population, thereby mitigating the appeal of substitutes.

The threat of substitutes for Axsome's CNS therapies is substantial, stemming from both established pharmacological treatments and non-drug interventions. Generic versions of older antidepressants and migraine medications offer cost-effective alternatives, directly impacting Axsome's pricing power. For example, the global antidepressant market's value of approximately $13.5 billion in 2023 highlights the scale of existing options.

Non-pharmacological approaches like cognitive behavioral therapy (CBT) and lifestyle changes also present significant substitution threats. The growing mental health apps market, valued at around $5.2 billion in 2023, and the broader wellness market, estimated at $5.6 trillion in 2023, demonstrate patient and provider interest in these alternatives.

Physicians may also prescribe existing drugs off-label, diverting patients from Axsome's newer treatments, especially if cost or accessibility is a factor. Furthermore, emerging digital therapeutics and AI-powered solutions are poised to offer novel interventions, potentially reducing reliance on traditional pharmaceuticals over time.

Patient heterogeneity and potential treatment resistance further amplify the threat of substitutes, as individuals will seek alternatives if Axsome's therapies do not demonstrate broad efficacy. In 2024, the competitive CNS landscape, particularly for migraines, is dynamic, with numerous existing and emerging treatment options available to patients.

| Substitute Category | Examples | Market Context (2023/2024 Data) | Impact on Axsome |

|---|---|---|---|

| Established Pharmacological Treatments | Generic antidepressants, older migraine medications (e.g., triptans) | Global antidepressant market ~$13.5 billion (2023); Migraine market sees continuous innovation. | Pressure on pricing, market share diversion if Axsome's products are costlier or less effective. |

| Non-Pharmacological Therapies | Cognitive Behavioral Therapy (CBT), lifestyle changes (diet, exercise) | Mental health apps market ~$5.2 billion (2023); Global wellness market ~$5.6 trillion (2023). | Reduced demand for medications if these alternatives are preferred or sufficiently effective. |

| Digital Therapeutics & AI Solutions | Behavioral intervention apps, AI-driven diagnostics | Digital therapeutics market projected to reach billions by 2024. | Potential future disruption, offering novel treatment pathways that may complement or substitute drugs. |

Entrants Threaten

The biopharmaceutical sector, particularly in the realm of central nervous system (CNS) drug development, demands massive investments in research and development. It's estimated that bringing a new drug to market can cost upwards of $2.6 billion and often takes more than a decade, creating a significant financial hurdle for any new company attempting to enter this space.

The threat of new entrants in the CNS drug market is significantly mitigated by the lengthy and complex regulatory approval process. Companies must successfully complete multiple phases of clinical trials, a notoriously expensive and time-consuming endeavor, before even seeking FDA approval. For instance, the average cost to develop a new drug is estimated to be over $2 billion, with a success rate for drugs entering Phase 1 clinical trials historically hovering around 10%.

This rigorous scrutiny, particularly from the FDA, presents a formidable barrier. The complexity of central nervous system (CNS) drug development, with its high failure rates and intricate biological pathways, further amplifies the difficulty and risk for any new player attempting to enter the market. These factors collectively make market entry incredibly challenging.

Established pharmaceutical companies, including Axsome Therapeutics, possess substantial patent portfolios that safeguard their approved medications and promising drug candidates. These patents act as a formidable barrier to entry, compelling new competitors to innovate with entirely new compounds or navigate the complex and expensive process of circumventing existing intellectual property rights.

Need for Specialized Expertise and Infrastructure

The development and commercialization of central nervous system (CNS) therapies demand a very specific skill set. This includes deep scientific knowledge, extensive clinical trial experience, navigating complex regulatory pathways, and building specialized commercial teams. For instance, bringing a new drug to market can cost upwards of $2.6 billion, with CNS drugs often facing higher failure rates in development.

New companies entering this space would need to invest heavily in building or acquiring these specialized teams and the necessary infrastructure. This includes not only research and development facilities but also manufacturing capabilities and a dedicated sales force with expertise in the CNS market. The capital expenditure for such an undertaking is significant, creating a substantial barrier to entry.

Consider the regulatory hurdles alone; the FDA's approval process for CNS drugs can be lengthy and demanding, often requiring multiple phases of clinical trials. Axsome Therapeutics, for example, invested years and substantial capital in clinical development and regulatory submissions for its migraine treatments. This high bar for expertise and infrastructure significantly deters potential new entrants.

- High R&D Costs: Developing novel CNS treatments can cost billions, with a high attrition rate in clinical trials.

- Regulatory Complexity: Navigating FDA approvals for CNS drugs is intricate and time-consuming, demanding specialized regulatory affairs teams.

- Specialized Infrastructure: Building or acquiring manufacturing facilities and a targeted sales force for CNS products represents a major capital investment.

- Talent Acquisition: Attracting and retaining top scientific, clinical, and commercial talent in the highly specialized CNS field is a significant challenge.

Brand Recognition and Established Relationships

Brand recognition and established relationships represent a significant barrier for new entrants looking to compete with companies like Axsome. Existing players have cultivated strong ties with healthcare professionals, ensuring their products are considered and prescribed. For instance, in 2024, pharmaceutical companies continue to invest heavily in sales forces and medical education to reinforce these relationships, a strategy new entrants must counter.

Newcomers must also navigate the complex landscape of payer relationships and patient advocacy groups. Gaining market access and securing favorable reimbursement terms requires substantial effort and often relies on pre-existing trust and proven value, which can take years to build. Axsome, by fostering these connections, has created a moat that new pharmaceutical companies will find challenging to breach without considerable investment and strategic outreach.

- Brand Recognition: Established pharmaceutical companies like Axsome benefit from years of marketing and clinical experience, making their brands familiar and trusted by prescribers.

- Established Relationships: Deep-rooted connections with physicians, hospitals, and pharmacy benefit managers (PBMs) are crucial for market access and prescribing habits.

- Payer Influence: Agreements with insurance companies and PBMs, often solidified through long-term partnerships, dictate formulary placement and patient co-pays, a hurdle for new entrants.

- Patient Advocacy: Strong ties with patient advocacy groups can influence treatment decisions and drive demand, providing an advantage to incumbents.

The threat of new entrants in the CNS drug market is relatively low due to substantial barriers. These include the immense capital required for R&D, estimated at over $2.6 billion per drug, and the lengthy, complex regulatory approval processes, often taking over a decade. Furthermore, established companies like Axsome possess strong patent portfolios and deep relationships within the healthcare ecosystem, making it difficult for newcomers to gain traction.

The specialized expertise needed for CNS drug development, encompassing advanced scientific knowledge, clinical trial management, and regulatory navigation, is another significant deterrent. New entrants would need to invest heavily in acquiring or building these capabilities, alongside manufacturing and commercial infrastructure, a substantial undertaking that limits the pool of potential competitors. For instance, the success rate for drugs entering Phase 1 trials is historically around 10%, highlighting the inherent risk and investment needed.

Established brand recognition and existing relationships with healthcare professionals, payers, and patient advocacy groups create a formidable competitive advantage for incumbents. Building this trust and market access typically requires years of consistent performance and strategic engagement, a timeline and investment that can dissuade new market participants. In 2024, continued heavy investment in sales forces and medical education by established firms reinforces these established networks.

| Barrier Type | Description | Estimated Cost/Timeframe |

|---|---|---|

| R&D Investment | Developing novel CNS treatments | $2.6 billion+ per drug |

| Regulatory Approval | FDA approval process for CNS drugs | 10+ years |

| Specialized Talent | Scientific, clinical, and commercial expertise | High acquisition and retention costs |

| Infrastructure | Manufacturing facilities and sales force | Significant capital expenditure |

| Brand & Relationships | Market access and prescriber loyalty | Years of investment and engagement |

Porter's Five Forces Analysis Data Sources

Our Axsome Porter's Five Forces analysis is built upon a robust foundation of data, including Axsome's SEC filings, industry-specific market research reports from firms like EvaluatePharma, and insights from financial news outlets and analyst reports.