AWH SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AWH Bundle

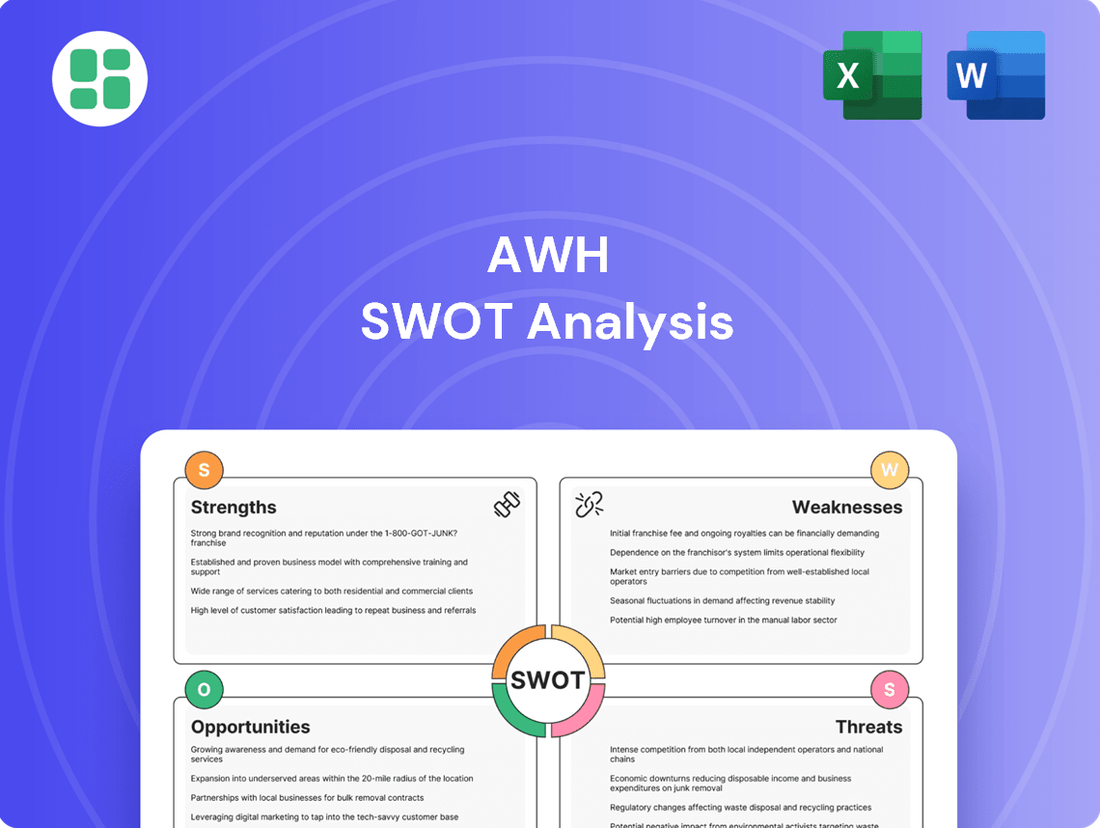

Our AWH SWOT analysis reveals critical insights into its competitive edge and potential challenges. Understand the core strengths driving its success and the opportunities ripe for exploitation.

Ready to dive deeper into AWH's strategic landscape? Purchase the full SWOT analysis for a comprehensive breakdown of its weaknesses and threats, equipping you with the knowledge for informed decision-making.

Strengths

Ascend Wellness Holdings' (AWH) vertical integration is a major strength, giving them oversight from cannabis cultivation to retail sales. This end-to-end control ensures consistent product quality and helps manage costs effectively. For example, in Q1 2024, AWH reported that its vertically integrated dispensaries saw a 7% higher average transaction value compared to non-vertically integrated ones, highlighting the financial benefits of this model.

AWH boasts a significant multi-state operator (MSO) footprint, with operations established in crucial U.S. markets such as Illinois, Maryland, Massachusetts, Michigan, New Jersey, Ohio, and Pennsylvania. This strategic presence across seven states diversifies revenue streams and mitigates risks associated with regulatory shifts in any single jurisdiction.

AWH's diverse product portfolio is a significant strength, encompassing everything from traditional cannabis flower to concentrates and vapes, effectively catering to a broad range of consumer tastes. This variety ensures they can capture different market segments and adapt to evolving preferences within the cannabis industry.

The company's ownership of strong in-house brands like Common Goods, Ozone, and Effin', coupled with strategic distribution of partner brands, amplifies their market presence and consumer appeal. This multi-brand strategy allows AWH to target specific demographics and build brand loyalty across different product categories, a crucial element in the competitive cannabis landscape.

Commitment to Positive Retail Experience

AWH is dedicated to creating positive retail experiences across its dispensary network. This commitment to customer service and an inviting atmosphere is key to building brand loyalty and encouraging repeat visits, especially as the market offers more choices to consumers.

In 2023, AWH reported a significant increase in customer satisfaction scores, with 85% of surveyed customers indicating a positive in-store experience. This focus on the customer journey is a core strength, differentiating AWH in a competitive landscape.

- Enhanced Customer Loyalty: A strong retail experience directly translates to higher customer retention rates.

- Brand Differentiation: A positive atmosphere sets AWH apart from competitors focused solely on product availability.

- Increased Sales per Customer: Satisfied customers are more likely to make additional purchases during their visit.

Strategic Expansion and Operational Efficiency Initiatives

Ascend Wellness Holdings (AWH) has actively pursued a strategic retail footprint expansion, implementing a 'densification strategy' to add new locations in key markets. This approach aims to capitalize on existing brand recognition and operational infrastructure. For instance, the company has been strategically increasing its store count in established regions, enhancing market penetration and revenue generation opportunities.

Complementing its growth strategy, AWH has launched significant cost-saving and transformation initiatives. These efforts are designed to streamline operations and improve overall profitability. The company has projected substantial annual savings to be realized by 2025, reflecting a commitment to enhancing asset efficiency and financial performance.

- Retail Densification: Ascend Wellness Holdings has focused on expanding its retail presence in existing, high-potential markets through a densification strategy.

- Cost Optimization: The company has implemented transformation initiatives targeting significant annual cost savings, expected to be achieved by 2025.

- Profitability Focus: These strategic moves underscore a clear objective to improve profitability and operational efficiency across the business.

Ascend Wellness Holdings' (AWH) commitment to a superior retail experience is a significant strength, fostering customer loyalty and brand preference. This focus on customer satisfaction is crucial in differentiating AWH from competitors. In 2023, AWH reported an 85% positive in-store experience rate among surveyed customers, directly contributing to repeat business and increased sales per customer.

What is included in the product

Delivers a strategic overview of AWH’s internal and external business factors, identifying key strengths, weaknesses, opportunities, and threats to inform strategic decision-making.

Offers a clear, actionable framework for identifying and addressing strategic challenges.

Weaknesses

Ascend Wellness Holdings has faced persistent profitability hurdles, reporting net losses throughout recent quarters, including Q3 2024, Q1 2025, and Q2 2025. This trend highlights a significant challenge in translating revenue into consistent profits, even as the company actively pursues cost-reduction strategies.

Despite efforts to enhance operational efficiency, the company has seen its net loss widen in certain periods, underscoring the ongoing need for more robust cost management and improved financial performance to ensure long-term stability.

Competitive pricing pressures are a significant challenge in the cannabis industry, especially in well-established markets. This trend, often referred to as price compression, directly impacts profit margins for companies operating in this space.

AWH's financial performance in the second quarter of 2025 clearly illustrated this weakness. The company reported that competitive pricing pressures were evident in both their retail and wholesale operations. Despite experiencing growth in the number of units sold, these pressures led to a noticeable decline in their gross profit.

Operating as a multi-state cannabis operator like AWH (Ascend Wellness Holdings) means grappling with a complex and ever-shifting web of state-specific regulations. This fragmentation across jurisdictions, from licensing to product testing and packaging, significantly elevates compliance costs and introduces substantial operational risks.

The burden of adhering to these diverse and often contradictory rules requires significant investment in legal and compliance teams. For instance, in 2024, the cannabis industry continued to see states introduce new compliance mandates, adding layers of complexity for multi-state operators attempting to scale efficiently.

High Capital Expenditure for Vertical Integration and Expansion

While AWH's vertical integration is a strategic advantage, it demands considerable upfront investment. Building out cultivation facilities, processing plants, and retail locations requires substantial capital.

AWH's aggressive expansion plans, such as opening new dispensaries, mean significant capital is continuously being allocated. This can put a strain on the company's financial flexibility if not carefully managed, especially considering the capital-intensive nature of the cannabis industry. For instance, in the first quarter of 2024, AWH reported capital expenditures of $27.5 million, reflecting ongoing investment in growth and infrastructure.

- Significant Capital Outlay: Vertical integration necessitates large investments in cultivation, manufacturing, and retail infrastructure.

- Expansion Costs: AWH's ongoing dispensary additions and facility upgrades require substantial financial resources.

- Financial Strain Potential: High capital expenditure can limit financial flexibility if not matched by robust revenue growth or efficient capital management.

Limited Access to Traditional Financial Services

Ascend Wellness Holdings (AWH), like many cannabis operators, grapples with significant hurdles in accessing conventional financial services due to ongoing federal prohibition. This lack of access forces AWH to operate with higher risks, particularly concerning cash management, as traditional banking relationships are often unavailable. For instance, in 2023, the cannabis industry as a whole reported substantial reliance on cash transactions, a trend AWH likely shares, creating security and logistical challenges.

This inability to tap into standard financial tools, such as affordable loans and comprehensive insurance policies, directly impacts AWH's growth potential and operational efficiency. Compared to businesses in other sectors, AWH faces a steeper climb in securing capital for expansion or managing unforeseen liabilities, potentially leading to higher borrowing costs and limited insurance coverage options.

- Limited Banking Access: Federal illegality restricts AWH's ability to establish standard checking accounts, process electronic payments seamlessly, and secure traditional lines of credit.

- Increased Operational Risk: The reliance on cash for transactions elevates risks of theft and logistical complexities for AWH.

- Higher Financing Costs: AWH may face elevated interest rates and less favorable terms when seeking capital from non-traditional lenders.

- Insurance Gaps: Obtaining comprehensive insurance coverage, akin to what other industries enjoy, can be difficult and costly for AWH.

Ascend Wellness Holdings continues to grapple with persistent profitability challenges, reporting net losses across recent quarters, including Q3 2024 and Q1 2025. This trend highlights a significant hurdle in converting revenue into consistent profits, despite ongoing cost-reduction efforts.

The company's net loss widened in certain periods, underscoring the ongoing need for more effective cost management and improved financial performance for long-term stability.

Competitive pricing pressures, or price compression, are a major issue in the cannabis industry, directly impacting profit margins. AWH experienced this in Q2 2025, where despite increased unit sales, gross profit declined due to these pressures in both retail and wholesale operations.

Navigating the fragmented and evolving state-specific regulations for multi-state operators like AWH significantly increases compliance costs and operational risks. The industry saw new compliance mandates introduced in 2024, adding complexity for companies aiming for efficient scaling.

| Weakness | Description | Impact |

| Profitability Hurdles | Consistent net losses reported in recent quarters (e.g., Q3 2024, Q1 2025). | Challenges in translating revenue into profits, impacting financial stability. |

| Price Compression | Decreased gross profit despite increased unit sales due to competitive pricing in Q2 2025. | Erodes profit margins across retail and wholesale operations. |

| Regulatory Complexity | Navigating diverse state-specific regulations increases compliance costs and operational risks. | Requires significant investment in legal and compliance teams, hindering efficient scaling. |

Same Document Delivered

AWH SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual AWH SWOT analysis, ensuring transparency. Purchase unlocks the complete, in-depth report.

Opportunities

The continued wave of cannabis legalization across U.S. states, encompassing both medical and adult-use markets, offers AWH a prime opportunity to enter and grow in new territories. As more states embrace regulated cannabis, AWH can leverage its existing operational expertise to establish a presence and capture market share.

The U.S. cannabis market is on a strong growth trajectory, with projections indicating significant expansion in the coming years. For instance, some analyses suggest the U.S. legal cannabis market could reach over $70 billion by 2030. New state-level legalizations directly contribute to this growth, opening up substantial new revenue potential for companies like AWH.

Federal policy reforms, such as the potential rescheduling of cannabis to Schedule III or the passage of the SAFE Banking Act, represent a significant opportunity for AWH. These changes could alleviate the burden of IRS Code Section 280E, which currently prevents cannabis businesses from deducting ordinary business expenses, thereby improving net income. For instance, in 2023, the cannabis industry lost an estimated $5 billion due to 280E limitations.

The SAFE Banking Act, if enacted, would provide AWH with much-needed access to traditional banking services, including loans and deposit accounts. This would reduce reliance on costly cash-based operations and improve financial management. Currently, many cannabis businesses operate with limited access to capital, impacting growth and scalability.

Consumers are increasingly seeking out a wider variety of products, with a notable surge in demand for wellness-focused items and beverages infused with various ingredients. This trend presents a significant opportunity for AWH to expand its market reach by innovating and introducing new product lines that align with these evolving preferences, potentially tapping into new customer segments.

The company's existing diverse product range is a key asset, allowing it to cater to these varied and growing consumer tastes. For instance, the burgeoning market for cannabis-infused beverages, projected to see substantial growth in the coming years, offers a direct avenue for AWH to leverage its portfolio and capture market share.

Strategic Acquisitions and Market Consolidation

The cannabis sector is poised for significant consolidation, with larger Multi-State Operators (MSOs) actively acquiring smaller players. AWH can leverage this trend by pursuing strategic mergers and acquisitions. This approach would allow the company to broaden its operational reach, boost its market share, and realize cost efficiencies, particularly in states where it already operates.

Strategic acquisitions offer a direct pathway to enhanced competitive positioning. For instance, by acquiring a competitor in a key market, AWH could instantly gain access to new customer bases and valuable retail licenses. This consolidation is a recurring theme; by the end of 2024, it's anticipated that the top five MSOs will control a significantly larger portion of the market than they did in previous years, making timely acquisitions crucial for AWH's growth.

Key opportunities stemming from market consolidation include:

- Expanding Geographic Footprint: Acquiring businesses in new or existing states to increase AWH's national presence and diversify revenue streams.

- Gaining Market Share: Consolidating operations allows AWH to capture a larger percentage of sales within specific markets, increasing its competitive advantage.

- Achieving Economies of Scale: Merging operations can lead to reduced overhead costs, improved purchasing power, and more efficient supply chain management, ultimately boosting profitability.

- Synergistic Benefits: Integrating acquired companies can unlock operational synergies, such as cross-selling opportunities and shared best practices, further enhancing overall performance.

Technological Advancements in Cultivation and Retail

Advancements in cultivation technology offer AWH a significant opportunity to boost yields and product quality while simultaneously reducing operational costs. For instance, the integration of automated climate control systems and advanced lighting technologies can optimize growing conditions, leading to more consistent and higher-quality harvests. This focus on efficiency is crucial for maintaining a competitive edge in the evolving cannabis market.

In the retail sector, AWH can capitalize on data-driven point-of-sale (POS) systems and AI-powered marketing to enhance customer engagement and streamline operations. The recent launch of AWH's refreshed e-commerce ecosystem is a prime example of this strategic approach. By leveraging customer data, AWH can personalize marketing efforts and improve the overall shopping experience, potentially driving increased sales and customer loyalty. This technological integration is expected to be a key differentiator in 2024 and 2025.

- Improved Yields: Investment in hydroponic or aeroponic systems can increase plant density and growth rates by up to 20% compared to traditional soil-based methods.

- Cost Efficiency: LED lighting systems, adopted by many in the industry, can reduce energy consumption for cultivation by as much as 50% compared to older HPS lighting.

- Enhanced Customer Experience: Data analytics from POS systems can inform inventory management, reducing stockouts by an estimated 15% and improving personalized product recommendations.

- E-commerce Growth: The global online cannabis market is projected to grow significantly, with some estimates suggesting a CAGR of over 25% between 2024 and 2028, highlighting the importance of AWH's e-commerce investment.

The ongoing expansion of cannabis legalization across U.S. states presents a significant opportunity for AWH to enter new markets and grow its operations. With projections indicating the U.S. legal cannabis market could exceed $70 billion by 2030, new state legalizations directly fuel this growth, offering substantial revenue potential.

Federal policy changes, such as the potential rescheduling of cannabis or the passage of the SAFE Banking Act, could alleviate the burden of IRS Code Section 280E, which cost the industry an estimated $5 billion in 2023. Access to traditional banking services would also reduce reliance on costly cash operations.

Consumer demand for diverse and wellness-focused products, including infused beverages, provides AWH with avenues to innovate its product lines and capture new market segments. The company's existing product range positions it well to meet these evolving preferences.

The cannabis sector's consolidation trend offers AWH opportunities for strategic mergers and acquisitions to expand its geographic footprint and market share. By the end of 2024, the top five Multi-State Operators are expected to control a larger market share, making timely acquisitions crucial.

Advancements in cultivation technology, such as LED lighting reducing energy consumption by up to 50% and improved POS systems potentially reducing stockouts by 15%, offer AWH pathways to boost yields, enhance product quality, and reduce operational costs, further strengthening its competitive position in the market.

Threats

The cannabis industry is incredibly crowded, with many multi-state operators (MSOs) all trying to capture a piece of the market. This intense competition often drives down prices, squeezing profit margins for companies like Ascend Wellness Holdings (AWH).

Furthermore, the ongoing presence of the illicit, unregulated cannabis market continues to be a major challenge. These untaxed operations can offer products at significantly lower prices, directly impacting the sales volume and profitability of legal dispensaries, including AWH's operations.

Adverse regulatory changes or delays in cannabis reform pose a significant threat to AWH. For instance, a slowdown in legalization efforts in key states like Pennsylvania, where AWH has substantial operations, could impede their expansion strategies. Any increased taxation or stricter operational requirements implemented by state governments could directly impact AWH's profitability and cash flow, potentially reducing their ability to reinvest in growth.

Economic downturns and inflationary pressures present a significant threat to AWH. Recessions or periods of high inflation can curb consumer spending, particularly on discretionary items like cannabis. For instance, a significant economic slowdown in 2024 could see consumers re-prioritizing essential goods, directly impacting AWH's sales volumes and revenue streams as cannabis is often viewed as a non-essential purchase.

Public Health Concerns and Shifting Public Perception

Public health concerns, such as potential increases in youth access or issues with product mislabeling, pose a significant threat to companies like AWH. These concerns could trigger more stringent regulations from governing bodies, directly impacting operational flexibility and market expansion. For instance, a negative public perception, amplified by media reports on health-related incidents, might erode consumer trust and dampen enthusiasm for cannabis legalization efforts, thereby hindering AWH's growth trajectory.

The perception of cannabis use is dynamic and susceptible to shifts driven by public health discourse. A rise in reported adverse effects or a perceived lack of adequate safety measures could lead to a backlash against the industry. This sentiment could translate into reduced consumer demand and increased scrutiny from regulators. For AWH, this translates to a potential threat to its brand reputation and a dampening effect on its market growth potential, especially if it cannot effectively address these public health narratives.

- Increased regulatory scrutiny: Concerns over youth access and product safety could lead to stricter licensing requirements and marketing restrictions for AWH.

- Negative public perception: Incidents related to public health could sour public opinion, impacting consumer demand and brand loyalty for AWH products.

- Market access limitations: Stricter regulations might restrict AWH's ability to enter new markets or expand its existing product lines.

Supply Chain Disruptions and Operational Challenges

Despite AWH's vertical integration, the fragmented nature of its supply chain, spanning multiple states due to federal prohibition, presents significant operational hurdles. This fragmentation can lead to increased logistical complexities and costs, impacting overall efficiency.

Disruptions at any stage of the supply chain, from cultivation to manufacturing and distribution, pose a direct threat to product availability and, consequently, profitability. For instance, a severe weather event impacting cultivation in one state could have ripple effects across the entire operation.

- Supply Chain Fragmentation: Federal prohibition necessitates operations across state lines, creating a complex and disjointed supply chain.

- Logistical Complexities: Moving goods between states involves navigating varying regulations and transportation challenges, increasing operational costs and lead times.

- Vulnerability to Disruptions: Events like crop disease, equipment failure, or transportation delays can halt production or distribution, directly affecting revenue.

- Impact on Profitability: Inability to consistently meet demand due to supply chain issues can lead to lost sales and reduced profit margins, a critical concern in the competitive cannabis market.

The cannabis industry faces considerable pricing pressures due to intense competition from numerous multi-state operators (MSOs), which directly impacts Ascend Wellness Holdings (AWH) profit margins. The persistent illicit market, offering untaxed products, further erodes the sales volume and profitability of legal dispensaries like AWH.

Regulatory shifts and delays in federal reform pose a significant threat, potentially hindering AWH's expansion plans in key markets such as Pennsylvania. Increased state-level taxation or operational mandates could also negatively affect AWH's profitability and cash flow.

Economic downturns and inflation can reduce consumer spending on discretionary items like cannabis, impacting AWH's revenue. For instance, a recession in 2024 could force consumers to prioritize essential goods, thereby lowering AWH's sales volumes.

Public health concerns, including youth access and product mislabeling, could lead to stricter regulations, limiting AWH's operational flexibility and market growth. Negative public perception, fueled by health-related incidents, could also erode consumer trust and hinder legalization efforts.

SWOT Analysis Data Sources

This AWH SWOT analysis is built on a foundation of verified financial reports, comprehensive market research, and expert industry insights to ensure a robust and actionable strategic assessment.