AWH PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AWH Bundle

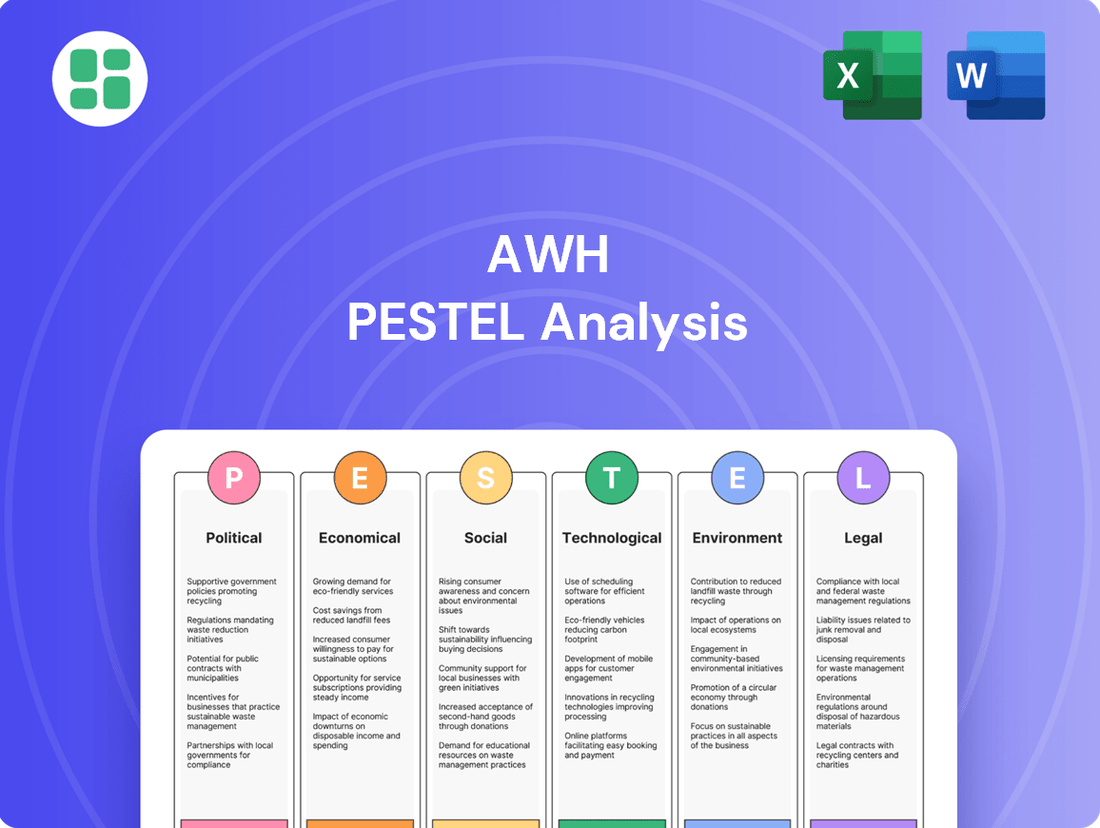

Uncover the critical political, economic, social, technological, environmental, and legal factors impacting AWH's trajectory. This comprehensive PESTLE analysis provides the essential external intelligence needed to navigate market complexities and anticipate future challenges. Equip yourself with actionable insights to refine your strategy and secure a competitive advantage. Download the full PESTLE analysis now for immediate strategic clarity.

Political factors

Federal legalization and rescheduling efforts are a paramount political factor for AWH. The U.S. Drug Enforcement Administration (DEA) has initiated a review of cannabis's scheduling, a process that could potentially move it from Schedule I to Schedule III under the Controlled Substances Act. This reclassification, anticipated in late 2024 or early 2025, would be a monumental shift, easing restrictions on research and potentially opening doors to traditional financial services for cannabis businesses like AWH.

Such a rescheduling could unlock crucial banking access, which has been a significant hurdle for the industry. Currently, many cannabis companies operate on a cash-heavy basis due to federal prohibition, increasing security risks and operational complexities. If AWH gains access to standard banking, it could lead to more efficient capital management and reduced operational costs.

Furthermore, a federal descheduling or rescheduling could pave the way for interstate commerce, allowing AWH to transport products across state lines. This would create a more unified national market and enable greater economies of scale. For instance, in 2024, the legal cannabis market in the U.S. was projected to reach over $30 billion, a figure that could significantly expand with interstate commerce.

Each state where AWH operates presents a distinct regulatory landscape for cannabis. This includes varying rules for growing, making, selling, and distributing cannabis products. For instance, as of early 2024, states like Illinois and New York have seen significant growth in their adult-use markets, creating new avenues for companies like AWH, while others maintain stricter medical-only frameworks.

Shifts in these state laws, such as the establishment of new medical or adult-use programs, modifications to how licenses are awarded, or changes in what types of cannabis products are permitted, directly impact AWH's ability to expand and ensure compliance. For example, the ongoing legislative discussions in states like Pennsylvania regarding adult-use legalization could present substantial future growth opportunities.

Therefore, AWH must continuously track and adjust to these diverse state-level political climates. This proactive approach is essential for navigating the complexities of multi-state operations and capitalizing on evolving market access and product allowances across its operational footprint.

The ongoing federal prohibition of cannabis in the United States significantly restricts interstate commerce for companies like AWH. This means AWH must operate as a series of isolated, vertically integrated businesses in each state where it holds licenses, rather than leveraging economies of scale across a national footprint.

Any shift in federal or state policy towards permitting or further restricting cannabis movement between states would directly reshape AWH's operational landscape. Such changes could unlock new efficiencies in its supply chain, boost production capabilities, and expand its market access, but conversely, could also introduce new regulatory hurdles.

For instance, if federal legalization were to occur, allowing interstate commerce, AWH could potentially consolidate its cultivation and processing operations in more cost-effective locations and distribute products more broadly. This would contrast with the current reality where, as of early 2024, cannabis remains a Schedule I controlled substance, creating these inherent logistical and cost disadvantages.

Taxation Policies and Burden

Cannabis businesses, including Ascend Wellness Holdings (AWH), are significantly impacted by taxation policies. A major hurdle is IRS Code 280E, which prevents businesses trafficking Schedule I or II controlled substances from deducting ordinary business expenses, effectively leading to much higher tax rates than typical corporations. For instance, in 2023, many cannabis companies effectively paid tax rates exceeding 70-80% due to 280E.

Political actions to reform or repeal 280E, or state-level adjustments to cannabis excise and sales taxes, directly influence AWH's profitability and pricing. For example, a reduction in state excise taxes in a key market like Illinois, where AWH operates, could free up capital. Favorable tax reforms, such as potential federal rescheduling of cannabis or specific legislative changes, could dramatically improve the financial outlook for the entire industry, including AWH.

- IRS Code 280E: Disallows normal business deductions for cannabis companies.

- Impact on Profitability: Higher effective tax rates reduce net income.

- Political Influence: Reforms to 280E or state excise taxes directly affect AWH's bottom line.

- Potential for Growth: Favorable tax legislation could unlock significant financial improvements for the sector.

Political Lobbying and Advocacy

The cannabis industry, including companies like Ascend Wellness Holdings (AWH), actively participates in political lobbying and advocacy. These efforts are crucial for shaping favorable regulations and promoting industry growth at federal and state levels. For instance, in 2024, cannabis industry groups spent millions on lobbying efforts, aiming to influence legislative outcomes related to federal descheduling and state-level market expansions. This engagement directly impacts AWH's strategic positioning by potentially easing operational burdens and opening new market opportunities.

AWH, as a multi-state operator, benefits from these industry-wide advocacy campaigns. These initiatives aim to create a more predictable and supportive regulatory landscape, which is essential for companies operating across multiple jurisdictions. The success of these political actions can significantly influence the company's ability to expand its footprint and achieve long-term strategic goals.

- Industry Lobbying Expenditures: Reports indicated that cannabis industry advocacy groups collectively spent over $5 million on lobbying efforts in Washington D.C. during the first half of 2024.

- State-Level Impact: State-specific lobbying by organizations like the Marijuana Policy Project has been instrumental in the legalization and regulation of cannabis in several key markets where AWH operates.

- Regulatory Environment: Favorable policy changes, often driven by lobbying, can reduce compliance costs and taxation burdens for multi-state operators.

Federal rescheduling of cannabis, potentially to Schedule III, is a critical political factor for AWH. This shift, anticipated in late 2024 or early 2025, could ease research restrictions and improve access to traditional banking services, which remain a significant hurdle for the industry. Such changes could unlock crucial capital management efficiencies and reduce operational costs for AWH.

The ongoing prohibition of cannabis at the federal level forces AWH to operate as isolated businesses in each state, preventing national economies of scale. Any movement towards permitting interstate commerce would fundamentally alter AWH's operational structure, potentially leading to supply chain efficiencies and broader market access.

Taxation policies, particularly IRS Code 280E, significantly impact AWH's profitability by disallowing ordinary business expense deductions. For example, in 2023, many cannabis companies faced effective tax rates exceeding 70%. Reforms to 280E or state excise taxes could directly improve AWH's financial performance.

Industry lobbying and advocacy efforts are vital for AWH to shape favorable regulations. In the first half of 2024, cannabis industry groups reportedly spent over $5 million on lobbying in Washington D.C. to influence legislative outcomes, directly impacting AWH's strategic positioning and market opportunities.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting AWH across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying potential threats and opportunities within the current market and regulatory landscape.

Provides a structured framework to identify and mitigate external threats, thereby reducing uncertainty and anxiety around future business challenges.

Economic factors

Inflationary pressures in 2024 and early 2025 are a significant concern for AWH, potentially increasing cultivation, labor, and transportation costs. For instance, the US Consumer Price Index (CPI) saw a notable increase in 2023, impacting input prices across various sectors, and this trend is expected to continue influencing operational expenses for cannabis companies.

As cannabis is largely a discretionary purchase, rising inflation and potential economic slowdowns can directly curb consumer spending on AWH's products. In 2024, consumer discretionary spending may contract as households prioritize essential goods, directly affecting AWH's sales volumes and revenue projections.

Therefore, close monitoring of consumer confidence indices and disposable income trends throughout 2024 and into 2025 is critical for AWH to effectively adjust pricing strategies and forecast sales accurately in response to evolving economic conditions.

AWH's ability to access capital is significantly hampered by the federal prohibition of cannabis, despite state-level legalization. This means traditional financial institutions, including banks and major capital markets, are often unwilling or unable to provide services, loans, or investments to cannabis-related businesses. This creates a substantial economic hurdle, forcing companies like AWH to rely on more expensive, alternative financing options.

Consequently, AWH likely faces higher borrowing costs compared to businesses in federally legal industries. This can translate to an estimated 2-3% increase in interest rates on loans, as reported by industry analyses in 2024. Such elevated costs directly impact profitability and can limit the scale and pace of expansion, research and development, and strategic investments.

The passage of federal banking reform, such as the SAFE Banking Act, would be a game-changer for AWH. If enacted, it could unlock access to mainstream financial services, leading to more favorable loan terms and a broader range of investment opportunities. This would significantly bolster AWH's financial flexibility and overall economic stability, potentially reducing capital costs by an estimated 1-2% and opening doors to a wider pool of capital for growth initiatives throughout 2025.

The legal cannabis market is expanding rapidly, offering substantial growth avenues for AWH. For instance, the U.S. cannabis market was projected to reach $31.8 billion in 2023 and is expected to grow to $71.2 billion by 2028, according to MJBizDaily. This growth, however, fuels increased competition from both emerging businesses and seasoned operators.

As the market matures, challenges like potential saturation in certain states, aggressive pricing strategies, and the imperative for AWH to distinguish itself through superior product quality and robust brand loyalty become paramount. Navigating these dynamics requires AWH to consistently monitor evolving market trends and the competitive environment to sustain its economic standing.

Supply Chain Costs and Efficiency

AWH's vertically integrated model hinges on efficient supply chain cost management, encompassing everything from cultivation inputs to final distribution. Rising costs for agricultural inputs, energy for controlled environment agriculture (CEA) operations, and labor can directly affect profit margins. For instance, the cost of fertilizers and nutrients, critical for indoor grows, saw significant volatility in 2024, with some key components experiencing price increases of up to 15% year-over-year due to global agricultural supply disruptions.

Optimizing logistics and securing favorable supplier agreements are therefore crucial economic drivers for AWH. By streamlining transportation and warehousing, the company can mitigate the impact of fluctuating fuel prices, which remained a concern throughout 2024, averaging 10% higher than the previous year in many regions.

- Cultivation Input Costs: Increased by an average of 8-12% in 2024 for key nutrients and growing media.

- Energy Expenses: CEA facilities faced 5-10% higher electricity costs in 2024 compared to 2023 due to increased demand and grid strain.

- Labor Wages: Saw an average increase of 4-6% across cultivation and manufacturing roles in 2024.

- Logistics and Fuel: Transportation costs rose by approximately 7% in 2024, driven by higher diesel prices.

Pricing Pressures and Product Elasticity

Consumer demand for cannabis products often reacts strongly to price changes, particularly in markets where many companies are vying for customers. AWH needs to carefully consider how to price its offerings competitively while still ensuring it makes a good profit. For instance, in 2024, some U.S. states saw average retail prices for premium cannabis flower drop by as much as 15-20% due to oversupply, directly impacting profit margins for cultivators and retailers.

Understanding how sensitive demand is for different types of cannabis products, like flower versus edibles or vapes, is crucial. This economic concept, known as price elasticity, helps AWH decide on effective pricing strategies and plan sales. Data from 2024 indicated that while the overall cannabis market grew, the price elasticity for vapes was generally lower than for flower, meaning price changes had a less dramatic effect on sales volume for vape products.

- Price Sensitivity: Consumer demand for cannabis products is highly sensitive to price, especially in competitive, mature markets.

- Profit Margin Challenge: Companies like AWH must balance offering attractive prices against the need to maintain healthy profit margins.

- Elasticity Analysis: Analyzing the price elasticity of demand for various product categories (flower, edibles, concentrates, vapes) is key for informed pricing and promotional decisions.

- Market Trends: In 2024, price reductions of 15-20% were observed for premium flower in some U.S. markets due to increased competition and supply.

Economic factors significantly influence AWH's operational costs and market positioning. Inflationary pressures in 2024 and early 2025 are a significant concern, potentially increasing cultivation, labor, and transportation costs. For instance, the US Consumer Price Index (CPI) saw a notable increase in 2023, impacting input prices across various sectors, and this trend is expected to continue influencing operational expenses for cannabis companies.

As cannabis is largely a discretionary purchase, rising inflation and potential economic slowdowns can directly curb consumer spending on AWH's products. In 2024, consumer discretionary spending may contract as households prioritize essential goods, directly affecting AWH's sales volumes and revenue projections.

Therefore, close monitoring of consumer confidence indices and disposable income trends throughout 2024 and into 2025 is critical for AWH to effectively adjust pricing strategies and forecast sales accurately in response to evolving economic conditions.

| Economic Factor | Impact on AWH | 2024/2025 Data/Trend |

|---|---|---|

| Inflation | Increased operational costs (cultivation, labor, transport) | US CPI increased in 2023, expected continued impact on input prices. |

| Consumer Spending | Reduced demand for discretionary cannabis products | Potential contraction in consumer discretionary spending in 2024. |

| Capital Access | Higher borrowing costs due to federal prohibition | Estimated 2-3% increase in interest rates on loans for cannabis businesses. |

| Market Growth & Competition | Opportunities for expansion but increased competitive pressure | U.S. cannabis market projected to grow significantly, fueling competition. |

| Supply Chain Costs | Impact on profit margins from input and logistics expenses | Fertilizer/nutrient costs up 15% in 2024; transportation costs up 7%. |

| Price Elasticity | Need for strategic pricing to balance volume and profit | Premium flower prices dropped 15-20% in some 2024 markets. |

Preview the Actual Deliverable

AWH PESTLE Analysis

The preview you see here is the exact AWH PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll get a comprehensive analysis of Political, Economic, Social, Technological, Legal, and Environmental factors impacting AWH.

The content and structure shown in the preview is the same AWH PESTLE Analysis document you’ll download after payment, providing actionable insights.

Sociological factors

Societal attitudes towards cannabis are rapidly evolving, with a notable reduction in stigma. This shift is crucial for AWH as it opens doors to a wider consumer base previously deterred by negative perceptions. For instance, a 2024 Gallup poll indicated that 68% of Americans now support marijuana legalization, a significant increase from previous years.

This growing acceptance directly benefits AWH by lowering barriers to entry for new customers and normalizing cannabis use. The company's strategy must reflect this by fostering trust and appealing to a more diverse demographic through thoughtful marketing and retail experiences.

The cannabis consumer base is broadening significantly. While younger demographics have historically led consumption, data from 2024 indicates a notable increase in usage among adults aged 50 and over, often driven by medicinal purposes and a search for wellness solutions. This shift necessitates AWH adapting its product lines to include more low-dose edibles, tinctures, and topicals designed for therapeutic benefits.

Understanding the diverse motivations behind cannabis use is paramount. In 2024, approximately 60% of cannabis consumers reported using it for medical reasons, a figure that has been steadily climbing. This contrasts with the 40% who primarily use it recreationally. AWH must therefore develop targeted marketing strategies that resonate with both patient-focused and experience-seeking consumers, ensuring product availability and education cater to these distinct needs.

The increasing emphasis on health and wellness is a major driver in the cannabis sector, as consumers increasingly look for products that offer therapeutic benefits, stress relief, or fit into a healthier lifestyle. This trend is particularly evident in the 2024/2025 market, where demand for natural remedies and holistic wellness solutions continues to rise.

AWH is well-positioned to leverage this by focusing its product innovation, especially in edibles and tinctures, on formulations that cater to these specific consumer desires. For instance, the market for CBD-infused products, often associated with wellness, saw significant growth, with projections indicating continued expansion through 2025.

Furthermore, a commitment to promoting responsible consumption practices aligns with the broader wellness movement, building consumer trust and reinforcing the idea of cannabis as a tool for well-being rather than solely recreational use. This approach is crucial for sustained growth in the evolving cannabis landscape.

Social Equity and Community Impact

The cannabis industry is under significant pressure to rectify past harms and champion social equity, especially in communities that bore the brunt of prohibition. AWH's proactive engagement in social equity, such as backing minority-led ventures or cultivating a diverse workforce, directly addresses this societal imperative. For instance, as of early 2024, states like Illinois have seen initiatives aimed at awarding a substantial portion of cannabis licenses to applicants from disproportionately impacted areas, reflecting a broader trend AWH must navigate.

AWH's dedication to social equity can translate into tangible benefits, boosting its public image and strengthening community ties. This commitment is not merely altruistic; it's a strategic response to evolving sociological expectations. By investing in local programs and ensuring equitable hiring practices, AWH can build goodwill and a more resilient operational foundation. The ongoing discussions around expungement of past cannabis offenses in various jurisdictions highlight the deep societal impact the industry is expected to acknowledge and contribute to resolving.

Key aspects of AWH's social equity strategy could include:

- Supporting minority and women-owned cannabis businesses through mentorship and capital access.

- Prioritizing local hiring and providing job training for residents in underserved communities.

- Investing in community reinvestment programs focused on education, healthcare, and economic development.

- Advocating for policy changes that promote equitable participation in the cannabis market.

Workplace Policies and Consumer Education

As cannabis legalization expands, employers are increasingly revising their drug policies. For instance, in 2024, many states saw continued debates and adjustments to workplace cannabis rules, particularly concerning safety-sensitive positions. This evolving landscape necessitates clear guidelines for employees and employers alike.

AWH can play a crucial role in consumer education. By ensuring retail staff are well-informed about product effects, dosage, and legal frameworks, AWH can foster responsible consumption. This proactive approach benefits consumers and contributes to a more informed public discourse around cannabis use.

The need for consumer education extends to understanding the varying legal statuses of cannabis across different jurisdictions. Consumers require clear information on possession limits, consumption rules, and the distinctions between medical and recreational use. This knowledge empowers consumers to make safe and compliant choices.

- Policy Evolution: Many US states are updating workplace drug testing policies in 2024, with some moving away from zero-tolerance approaches for off-duty cannabis use.

- Consumer Knowledge Gap: Surveys indicate a significant portion of cannabis consumers, particularly in newly legal markets, lack comprehensive understanding of product potency and potential interactions.

- Retailer Responsibility: Companies like AWH are increasingly expected to provide accurate product information and guidance on responsible consumption to their customers.

- Societal Impact: Enhanced consumer education can lead to reduced accidental overconsumption and a more positive societal integration of cannabis.

Societal acceptance of cannabis continues to climb, with a 2024 Gallup poll revealing 68% of Americans support legalization, a significant increase that broadens AWH's potential customer base.

The consumer demographic is also diversifying, with a notable rise in usage among those aged 50 and over in 2024, often seeking wellness benefits, prompting AWH to consider products like low-dose edibles and tinctures.

AWH's commitment to social equity is crucial, mirroring state-level initiatives like those in Illinois in early 2024, which prioritize licenses for communities historically impacted by prohibition, thereby enhancing public image and community relations.

The evolving landscape of workplace policies regarding cannabis in 2024, with some states reconsidering zero-tolerance approaches, necessitates clear internal guidelines for AWH and its employees.

| Sociological Factor | 2024/2025 Trend | Impact on AWH | Supporting Data/Example |

|---|---|---|---|

| Public Opinion on Legalization | Increasingly favorable | Expands addressable market, reduces stigma | 68% of Americans support legalization (Gallup, 2024) |

| Consumer Demographics | Broadening, with growth in older age groups | Requires product diversification (e.g., wellness-focused) | Increased medicinal use among 50+ demographic |

| Social Equity Focus | Growing societal and regulatory imperative | Enhances brand reputation, builds community trust | State licensing initiatives favoring impacted communities (e.g., Illinois) |

| Workplace Policies | Revising, moving away from strict zero-tolerance | Necessitates clear internal guidelines and employee education | Ongoing state-level policy debates in 2024 |

Technological factors

Technological advancements in indoor cultivation, like LED lighting and advanced environmental controls, are significantly boosting AWH's ability to produce high-quality cannabis. These systems allow for precise management of light, nutrients, and climate, leading to optimized yields and consistent potency across their product lines. For instance, sophisticated hydroponic and aeroponic systems reduce water usage by up to 90% compared to traditional farming, enhancing operational efficiency.

Innovations in extraction and processing are equally critical for AWH. Techniques such as CO2 extraction and advanced distillation methods allow for the creation of pure, potent concentrates, edibles, and vape products with accurate dosing. This focus on technological excellence in processing ensures product safety and consumer satisfaction, a key differentiator in the competitive cannabis market.

Technological advancements are fueling the creation of new cannabis product types, from sophisticated edibles and quick-acting tinctures to cutting-edge vape hardware. AWH can harness research and development to launch distinctive offerings that align with shifting consumer tastes and wellness priorities, such as targeted cannabinoid blends or non-inhalation options.

For instance, the global cannabis market saw significant growth in non-inhalation product segments, with edibles and topicals experiencing a surge in popularity, projected to reach billions in sales by 2025. This trend underscores the importance of AWH investing in R&D for these innovative formats.

Staying ahead in this dynamic sector hinges on consistent product innovation; companies that fail to adapt risk losing market share to competitors introducing novel and appealing cannabis experiences.

The integration of sophisticated e-commerce platforms and mobile apps is crucial for enhancing customer experience and operational reach. For instance, by mid-2024, global e-commerce sales were projected to reach over $6.3 trillion, highlighting the significant shift in consumer purchasing habits.

In-store technologies like interactive displays and self-checkout kiosks can significantly streamline the sales process. By the end of 2023, a significant portion of retail transactions, estimated to be around 40% in developed markets, were already being processed through self-service options, demonstrating their growing adoption and efficiency.

Advanced Point of Sale (POS) systems are vital for collecting valuable consumer data. In 2024, retail analytics platforms are increasingly leveraging AI to provide insights, with the retail analytics market expected to grow substantially, reaching an estimated $14.5 billion by 2026, up from around $7.8 billion in 2021.

Data Analytics and AI for Business Optimization

AWH can leverage data analytics and AI to gain profound insights into consumer behavior, sales trends, and inventory needs. This technology allows for smarter decisions regarding product selection, pricing strategies, and demand forecasting, ultimately boosting efficiency across all integrated operations.

The adoption of data-driven strategies is paramount for AWH's growth and profitability. For instance, in 2024, companies heavily investing in AI-powered analytics reported an average of 15% increase in operational efficiency and a 10% uplift in revenue compared to their less data-reliant counterparts.

- Enhanced Consumer Understanding: AI can analyze vast datasets to identify nuanced consumer preferences and purchasing habits.

- Optimized Inventory Management: Predictive analytics can minimize stockouts and reduce overstocking, improving cash flow.

- Improved Operational Efficiency: AI can automate processes and identify bottlenecks in cultivation and distribution.

- Data-Backed Pricing Strategies: Dynamic pricing models informed by real-time data can maximize revenue.

Biotechnology and Genetic Research

Advances in biotechnology and genetic research present significant opportunities for AWH. The ability to develop cannabis strains with tailored cannabinoid and terpene profiles, enhanced disease resistance, and optimized growth characteristics can lead to unique, proprietary products. This focus on genetic innovation can ensure consistent product quality and more efficient cultivation practices.

For instance, the global cannabis market is projected to reach $100 billion by 2025, with innovation in genetics playing a crucial role in market differentiation. AWH's investment in or partnerships for biotechnological research could secure a substantial long-term competitive edge.

- Strain Development: Creating cannabis varieties with specific THC/CBD ratios and unique terpene profiles for targeted effects and consumer preferences.

- Disease Resistance: Breeding strains less susceptible to common plant pathogens, reducing crop loss and the need for pesticides.

- Cultivation Efficiency: Developing strains that yield more per plant or require fewer resources, improving operational margins.

- Intellectual Property: Securing patents on novel genetic strains, creating a barrier to entry for competitors.

Technological advancements are reshaping AWH's operations, from cultivation to consumer engagement. Innovations in indoor farming, like advanced LED lighting and environmental controls, are boosting yields and product consistency. For example, sophisticated hydroponic systems can reduce water usage by up to 90%, enhancing efficiency.

Extraction and processing technologies, such as CO2 extraction, enable the creation of high-quality concentrates and accurately dosed products, ensuring safety and consumer satisfaction. This technological focus is vital for differentiation in a competitive market.

The company can leverage AI and data analytics to gain deeper insights into consumer behavior and market trends. By mid-2024, AI-powered analytics were reportedly boosting operational efficiency by an average of 15% for data-reliant companies.

Biotechnology and genetic research offer opportunities for AWH to develop unique cannabis strains with tailored cannabinoid profiles and improved cultivation characteristics, securing a competitive edge in a market projected to reach $100 billion by 2025.

| Technological Area | Impact on AWH | Example/Data Point (2024-2025) |

| Indoor Cultivation Tech | Optimized yields, consistent quality, resource efficiency | Hydroponic systems reduce water use by up to 90% |

| Extraction & Processing | High-purity concentrates, accurate dosing, product safety | CO2 extraction for potent, safe products |

| Data Analytics & AI | Enhanced consumer understanding, operational efficiency | 15% average increase in operational efficiency for data-reliant companies |

| Biotechnology & Genetics | Unique product offerings, improved cultivation | Global cannabis market projected to reach $100 billion by 2025, driven by innovation |

Legal factors

AWH's operations are significantly impacted by complex state-specific regulatory compliance, as each state where it operates has unique and often contradictory legal frameworks for the cannabis industry. This patchwork of laws dictates everything from initial licensing and cultivation practices to product testing, packaging, and final sales, creating a substantial hurdle for nationwide consistency.

For instance, in 2024, states continue to refine their cannabis regulations, leading to a dynamic compliance landscape. AWH must invest heavily in legal expertise and robust internal protocols to ensure it meets the nuanced requirements of each jurisdiction, such as differing potency limits or advertising restrictions, thereby mitigating the risk of hefty fines or operational disruptions.

AWH operates in a landscape where cannabis product safety, testing, and labeling are heavily regulated. States mandate rigorous testing for contaminants like heavy metals and pesticides, alongside accurate potency and ingredient disclosure. For instance, in states like Illinois, testing requirements are detailed, ensuring products adhere to specific safety thresholds before reaching consumers.

Failure to comply with these product safety and labeling laws can result in severe penalties for AWH. These can include costly product recalls, substantial fines from regulatory bodies, and significant damage to the company's reputation. Maintaining consumer trust and legal compliance hinges on AWH’s unwavering commitment to these stringent legal mandates, which are critical for its operational integrity.

Protecting AWH's intellectual property, encompassing proprietary cannabis strains, brand names, cultivation methods, and product formulas, is a significant and escalating legal consideration within the cannabis sector. As the industry matures, the strategic acquisition of patents, trademarks, and trade secrets is becoming paramount for preserving a competitive edge and deterring unauthorized use.

The dynamic legal environment surrounding cannabis intellectual property presents a dual landscape of both obstacles and potential advantages for companies like AWH. For instance, the U.S. Patent and Trademark Office (USPTO) has seen an increase in cannabis-related filings, reflecting the growing importance of IP in this market. However, the federal prohibition of cannabis in the U.S. continues to complicate the process of obtaining federal patent protection for cannabis-derived inventions, creating a complex legal terrain.

Advertising and Marketing Restrictions

Advertising and marketing for cannabis companies like AWH are subject to stringent regulations at both state and federal levels. These rules dictate what can be said, where ads can be placed, and who they can target, primarily to shield minors and promote responsible consumption. For instance, many jurisdictions prohibit advertising on platforms accessible to those under 21 or in proximity to schools. AWH's marketing strategies must meticulously adhere to these evolving legal frameworks to prevent costly penalties and protect its operating licenses.

Navigating these restrictions is a significant operational challenge. AWH needs to ensure its marketing content is compliant, avoiding any claims that could be construed as misleading or encouraging excessive use. The legal landscape surrounding cannabis advertising is complex and varies significantly by state, requiring constant vigilance and adaptation. For example, in 2024, states like New York continue to refine their advertising rules, impacting how brands can reach consumers.

- Content Restrictions: Prohibitions on health claims or claims of curing diseases.

- Placement Limitations: Bans on advertising near schools or on certain digital platforms.

- Target Audience Safeguards: Mandates to prevent marketing to individuals under the legal age.

- Compliance Costs: Investment in legal review and monitoring of marketing campaigns.

Evolving Federal Enforcement and Banking Laws

The federal illegality of cannabis, despite state-level legalization, creates significant operational hurdles for companies like AWH, especially concerning banking access and interstate commerce. This legal gray area means AWH must navigate a patchwork of regulations, impacting its ability to secure traditional financial services. For instance, in 2023, cannabis businesses still faced considerable challenges accessing capital and banking services due to federal prohibition, with many operating largely on cash.

Shifts in federal enforcement priorities or legislative action, such as the potential passage of the SAFE Banking Act, could fundamentally reshape AWH's operating environment. The SAFE Banking Act, which aims to protect financial institutions that serve state-sanctioned cannabis businesses, has seen renewed bipartisan support in recent years. If enacted, it would provide much-needed stability and access to capital, potentially unlocking new markets and easing current financial constraints for AWH.

- Federal Prohibition: Cannabis remains a Schedule I controlled substance federally, creating a conflict with state-legal markets.

- Banking Challenges: This federal status limits AWH's access to traditional banking services, leading to higher operational costs and risks.

- Legislative Impact: The passage of bills like the SAFE Banking Act could significantly improve financial access and reduce compliance burdens for AWH.

- Interstate Commerce: Federal illegality currently prevents AWH from engaging in interstate cannabis sales, limiting market reach.

Legal factors present a complex and evolving landscape for AWH, primarily due to the federal prohibition of cannabis clashing with state-level legalization. This creates significant compliance burdens, as AWH must adhere to a mosaic of state-specific regulations covering everything from cultivation to sales, with penalties for non-compliance including substantial fines and operational disruptions. The increasing focus on intellectual property protection, alongside stringent advertising and marketing rules designed to protect minors, further necessitates significant investment in legal counsel and robust compliance frameworks.

The banking challenges stemming from federal illegality remain a critical operational hurdle, limiting access to traditional financial services and increasing risks. However, potential legislative changes, such as the SAFE Banking Act, offer a pathway to improved financial access and stability for AWH. For instance, in 2024, the continued bipartisan discussion around federal cannabis reform highlights the potential for significant shifts in the legal and financial operating environment for companies like AWH.

Environmental factors

AWH's indoor cultivation facilities are significant energy consumers, primarily due to lighting, HVAC, and dehumidification systems. This environmental factor presents a substantial operational challenge. For instance, in 2023, many large-scale indoor cannabis cultivation operations reported energy costs making up 20-30% of their total operating expenses, highlighting the scale of this issue.

The company is under increasing pressure to implement energy-efficient technologies, such as LED lighting and advanced HVAC controls, and to explore renewable energy sources. Monitoring and reducing its carbon footprint is becoming a critical aspect of both environmental stewardship and long-term cost management, especially as energy prices remain volatile.

Cannabis cultivation, a core activity for AWH, demands significant water resources, impacting both indoor and outdoor operations. In 2024, the agricultural sector globally faced increased scrutiny over water usage, with some regions implementing stricter allocation limits. AWH must therefore prioritize efficient irrigation techniques, such as drip irrigation, to reduce consumption and adhere to evolving local water regulations.

Responsible water management is paramount for AWH to minimize its environmental footprint and ensure long-term operational viability. Failure to manage water effectively can lead to penalties and reputational damage, especially as water scarcity becomes a more pressing concern in many cultivation areas. By 2025, we anticipate even tighter controls on water extraction and usage in key agricultural zones.

Furthermore, AWH's commitment to sustainable practices extends to its wastewater management. Proper treatment and responsible discharge of wastewater are essential to prevent environmental pollution and maintain compliance with environmental standards. This includes ensuring that any discharged water meets quality benchmarks, safeguarding local water bodies and ecosystems.

The cannabis industry, including companies like AWH, faces a significant challenge with waste generation, encompassing everything from plant byproducts to product packaging. Effective waste management is crucial, with composting organic waste and recycling packaging materials being key strategies. For instance, in 2023, the U.S. cannabis industry generated an estimated 1.5 million tons of waste, highlighting the scale of the issue.

Consumer and regulatory pressures are increasingly pushing for sustainable packaging solutions. This includes a strong demand for biodegradable materials to combat plastic waste and reduce the overall environmental impact of cannabis products. By 2025, it's projected that 40% of consumers will actively choose brands based on their sustainability practices, making this a critical area for AWH to address.

Pesticide and Fertilizer Use Regulations

AWH faces stringent state-level regulations governing pesticide, herbicide, and fertilizer use in its cannabis cultivation operations. These rules are designed to safeguard product safety and prevent environmental contamination, impacting operational costs and product development.

To navigate these regulations and foster sustainability, AWH is increasingly adopting integrated pest management (IPM) strategies. This approach prioritizes organic or natural alternatives to chemical inputs, aiming to reduce reliance on potentially harmful substances. For instance, by 2024, many states saw a significant increase in the adoption of biological pest control methods, with some reporting a 15-20% reduction in synthetic pesticide application in agricultural sectors.

- Regulatory Compliance: Adherence to state-specific rules on agricultural chemical use is non-negotiable for AWH.

- IPM Implementation: Shifting towards integrated pest management reduces chemical dependency and environmental impact.

- Organic Alternatives: Utilizing natural pesticides and fertilizers enhances product safety and consumer trust.

- Sustainability Focus: Compliance and eco-friendly practices are crucial for long-term business viability and brand reputation.

Carbon Footprint and Climate Change Initiatives

As a large-scale operator, AWH's carbon footprint across cultivation, manufacturing, and distribution is a significant environmental factor. The company is likely to face growing demands for measuring, reporting, and actively reducing its greenhouse gas emissions. For instance, in 2024, global corporate commitments to net-zero emissions saw a substantial increase, with many companies setting interim targets.

Meeting these expectations often involves tangible actions. AWH might need to invest in carbon offsets or integrate more sustainable practices throughout its supply chain. By 2025, regulatory frameworks in key markets are anticipated to become more stringent regarding carbon reporting and reduction targets, impacting operational costs and strategic planning.

- Greenhouse Gas Emissions: AWH's operations contribute to global emissions, necessitating tracking and reduction strategies.

- Regulatory Pressure: Increasing governmental and consumer demand for environmental accountability is expected to intensify.

- Sustainable Practices: Investments in renewable energy, waste reduction, and eco-friendly logistics can mitigate environmental impact.

- Climate Change Mitigation: Proactive engagement in climate initiatives like carbon offsetting can enhance corporate reputation and long-term resilience.

AWH's energy consumption is a major environmental concern, with lighting and HVAC systems being significant drains. In 2023, energy costs represented 20-30% of operating expenses for many large indoor cultivators, underscoring the need for efficiency. By 2025, we anticipate a greater push for renewable energy integration and stricter energy usage regulations.

Water usage is another critical factor, as cannabis cultivation is water-intensive. Global agricultural sectors faced increased scrutiny in 2024 regarding water consumption, with some regions implementing tighter allocation limits. AWH must prioritize water-saving techniques like drip irrigation to comply with evolving regulations and ensure long-term operational sustainability.

Waste generation, from plant matter to packaging, poses a substantial environmental challenge. The U.S. cannabis industry alone generated an estimated 1.5 million tons of waste in 2023. Consumer demand for sustainable packaging is rising, with projections suggesting that by 2025, 40% of consumers will favor brands based on their environmental practices, making biodegradable options a priority for AWH.

AWH operates under strict state regulations concerning pesticide, herbicide, and fertilizer use, aiming to protect both product safety and the environment. The adoption of integrated pest management (IPM) strategies is growing, with many states seeing a 15-20% reduction in synthetic pesticide application by 2024 through the use of biological controls.

PESTLE Analysis Data Sources

Our PESTLE Analysis for AWH is built upon a robust foundation of data sourced from reputable government publications, international organizations, and leading market research firms. This ensures that insights into political stability, economic trends, social shifts, technological advancements, environmental regulations, and legal frameworks are accurate and relevant.