Avon Technologies SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Avon Technologies Bundle

Avon Technologies is poised for growth with its strong brand recognition and innovative product pipeline. However, understanding the competitive landscape and potential regulatory hurdles is crucial for sustained success.

Want the full story behind Avon Technologies' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Avon Technologies stands as a dominant force in mission-critical respiratory and ballistic protection, a position solidified by its unwavering commitment to specialized, high-performance solutions. This leadership is not merely a claim; it’s a reality recognized across demanding sectors.

The company’s deep expertise is a cornerstone of its strength, making it an indispensable partner for military, law enforcement, and first responder agencies worldwide. This trust is earned through consistent delivery of reliable and advanced protective gear, a testament to their focused innovation.

Avon's market leadership is further underscored by its historical track record. For instance, in 2023, the company reported a significant increase in orders for its advanced respiratory systems from NATO member states, reflecting the ongoing global demand for its specialized products.

Avon Technologies boasts a robust order backlog, reaching a record $247 million in the first half of fiscal year 2025. This figure signifies a significant 24% jump, offering strong visibility into future revenue streams and bolstering investor confidence.

The company's financial health is further underscored by its impressive revenue growth. For the six months concluding March 31, 2025, Avon Technologies reported a 17% increase in revenue, demonstrating its ability to convert its strong order book into tangible financial gains.

Avon Technologies' advanced proprietary technology and commitment to innovation are significant strengths. The company actively invests in research and development, evidenced by its portfolio of 69 granted patents and 25 pending applications. This focus on R&D fuels the development of cutting-edge products designed to address complex safety and security challenges.

Recent product introductions highlight this innovative drive, including the Modular Integrated Tactical Respirator (MiTR) system, the MCM100 multi-role rebreather, and the EXOSKIN CBRN ensemble. These advancements demonstrate Avon Technologies' ability to anticipate and respond to evolving threats and rigorous safety requirements, solidifying its competitive position in the market.

Strategic Long-Term Contracts

Avon Technologies' strategic long-term contracts with key defense and security entities like the US Department of Defense (DoD) and NATO are a significant strength. These agreements, including those for the NG IHPS helmets and FM50 respirators for Ukraine, ensure predictable revenue and solidify the company's reputation as a reliable partner in critical sectors.

These multi-year engagements, such as the recent contract extensions for the US Army's Integrated Visual Augmentation System (IVAS) program, valued in the hundreds of millions, provide a robust foundation for financial stability. The company's consistent ability to secure and maintain these substantial contracts underscores its technological prowess and market trust.

- Defense Sector Reliance: Contracts with the US DoD, NATO, UK Ministry of Defence, and Swedish Police Authority provide consistent demand.

- Product Diversification: Key products like NG IHPS helmets and FM50 respirators are central to these long-term agreements.

- Revenue Stability: These contracts offer predictable revenue streams, mitigating market volatility.

- Market Trust: Proven performance in delivering critical equipment reinforces Avon's position as a trusted supplier.

Operational Efficiency and Transformation Program

Avon Technologies is prioritizing an operational transformation program designed to boost efficiency and cut expenses. A key element is the consolidation of production sites, exemplified by the planned closure of their Irvine, California facility by summer 2025. This move is anticipated to yield substantial cost reductions and streamline overall operations.

The company's strategic focus on operational improvements is a direct response to market pressures and aims to enhance its financial standing. By consolidating, Avon Technologies expects to achieve significant savings, contributing to improved profitability and a stronger competitive position in the market. This initiative is a core component of their strategy to drive better financial performance.

- Operational Transformation: Avon Technologies is implementing a program to enhance efficiency and reduce costs.

- Facility Consolidation: The closure of the Irvine, California facility by summer 2025 is a prime example of this strategy.

- Cost Savings: This consolidation is projected to deliver significant cost reductions for the company.

- Improved Competitiveness: The focus on efficiency aims to bolster Avon Technologies' financial performance and market standing.

Avon Technologies possesses a commanding presence in specialized protective gear, a strength built on deep expertise and a consistent track record of delivering high-performance solutions. This market leadership is evident in its significant order backlog, which reached a record $247 million in the first half of fiscal year 2025, a 24% increase year-over-year, showcasing robust future revenue visibility.

The company's commitment to innovation is a key differentiator, supported by 69 granted patents and 25 pending applications, fueling the development of advanced products like the Modular Integrated Tactical Respirator (MiTR). This focus ensures Avon remains at the forefront of addressing evolving safety and security challenges.

Strategic, long-term contracts with major defense entities, including the US Department of Defense and NATO, provide substantial revenue stability and reinforce Avon's reputation as a trusted supplier. These agreements, such as extensions for the US Army's IVAS program, highlight the company's technological prowess and market trust.

Avon Technologies' operational transformation program, including the consolidation of production sites like the planned closure of its Irvine, California facility by summer 2025, is designed to significantly boost efficiency and reduce costs, thereby improving its competitive financial standing.

| Strength | Description | Supporting Data |

|---|---|---|

| Market Leadership & Backlog | Dominant position in mission-critical protection with strong future revenue visibility. | Record $247 million order backlog (H1 FY25), up 24% YoY. |

| Innovation & R&D | Development of cutting-edge protective solutions driven by significant patent portfolio. | 69 granted patents, 25 pending applications; introduction of MiTR, MCM100, EXOSKIN. |

| Strategic Contracts | Predictable revenue streams and market trust through long-term agreements with defense entities. | Contracts with US DoD, NATO; extensions for US Army's IVAS program. |

| Operational Efficiency | Cost reduction and improved competitiveness through operational transformation initiatives. | Planned closure of Irvine, CA facility by summer 2025 to streamline operations. |

What is included in the product

Delivers a strategic overview of Avon Technologies’s internal and external business factors, identifying its core strengths, operational weaknesses, market opportunities, and potential threats.

Provides a clear, actionable framework to identify and leverage Avon Technologies' competitive advantages and mitigate potential threats.

Weaknesses

Avon Technologies faces a significant weakness in its customer concentration, with roughly 50% of its revenue stemming from the US military. This heavy reliance on a single client creates substantial risk. Changes in military procurement strategies or budget cuts could disproportionately affect Avon's financial performance.

Avon Technologies' reliance on government and defense contracts makes it vulnerable to shifts in these budgets. For instance, a projected 5% decrease in global defense spending in 2024, as estimated by some industry analysts, could directly impact Avon's revenue streams. Changes in political priorities or economic slowdowns can lead to reduced spending or delayed project approvals, creating significant uncertainty for the company's financial performance.

Avon Technologies has faced challenges with fluctuating profits and inconsistent operating margins. For instance, in the fiscal year ending December 31, 2023, the company reported a net profit of £25.1 million, a decrease from £30.5 million in the prior year, indicating a period of reduced profitability.

This historical volatility has impacted investor confidence, with Avon's share price underperforming the UK defense sector. The sector average saw a 12% increase in 2023, while Avon's shares experienced a 5% decline, highlighting the market's concern over its financial stability.

Translating growth opportunities into durable margin expansion remains a persistent hurdle for Avon. Despite securing new contracts, such as the £50 million deal for advanced sensor systems announced in Q1 2024, the company has struggled to convert these wins into sustained profitability improvements, with operating margins hovering around 8% for the past three years.

Challenges in Production Ramp-up and Delivery

While Avon Technologies has secured significant new contracts, such as those for its ACH GEN II helmets, the operational challenge lies in efficiently scaling up production to fulfill these substantial orders. This ramp-up phase carries inherent risks of delays and inefficiencies, potentially impacting delivery timelines and increasing manufacturing costs.

For instance, if Avon Technologies experiences a 15% slower-than-expected production increase for the ACH GEN II, it could push delivery of a 10,000-unit order back by several weeks. This could lead to penalties or lost future business opportunities. Furthermore, the need for specialized tooling and increased workforce training to meet higher output demands can strain resources and add unexpected expenses, potentially impacting profit margins on these new contracts.

- Production Bottlenecks: Difficulty in increasing manufacturing output to meet demand for new products like ACH GEN II helmets.

- Delivery Schedule Impact: Potential delays in fulfilling large orders due to production ramp-up inefficiencies.

- Cost Overruns: Increased expenses related to scaling production, including tooling, training, and potential overtime.

- Operational Risk: The inherent uncertainty in translating new contract wins into timely and cost-effective product delivery.

Supply Chain Vulnerabilities

Avon Technologies grapples with significant supply chain vulnerabilities. These issues have manifested as extended lead times, particularly for critical components like commercial helmets, driven by persistent raw material shortages. For instance, in early 2024, the company reported delays impacting its ability to meet demand for specialized protective gear.

These supply chain weaknesses directly translate into operational disruptions. The inability to secure necessary materials on time can halt production lines, leading to delayed order fulfillment. This not only impacts customer satisfaction but also represents tangible missed revenue opportunities, as evidenced by a projected 5% revenue shortfall in Q1 2024 attributed to these delays.

- Extended Lead Times: Persistent raw material shortages, especially for advanced composites used in helmets, have pushed lead times for certain products beyond acceptable industry norms.

- Production Disruptions: Inability to secure key components has led to sporadic production stoppages, impacting overall output efficiency.

- Missed Revenue Opportunities: Delays in delivery due to supply chain constraints directly resulted in an estimated $15 million in lost sales for Q1 2024.

Avon Technologies' heavy reliance on the US military, accounting for approximately 50% of its revenue, presents a significant weakness. This concentration exposes the company to substantial risk from changes in military procurement or budget allocations. For example, a 5% global defense spending reduction projected for 2024 could disproportionately impact Avon's financial stability.

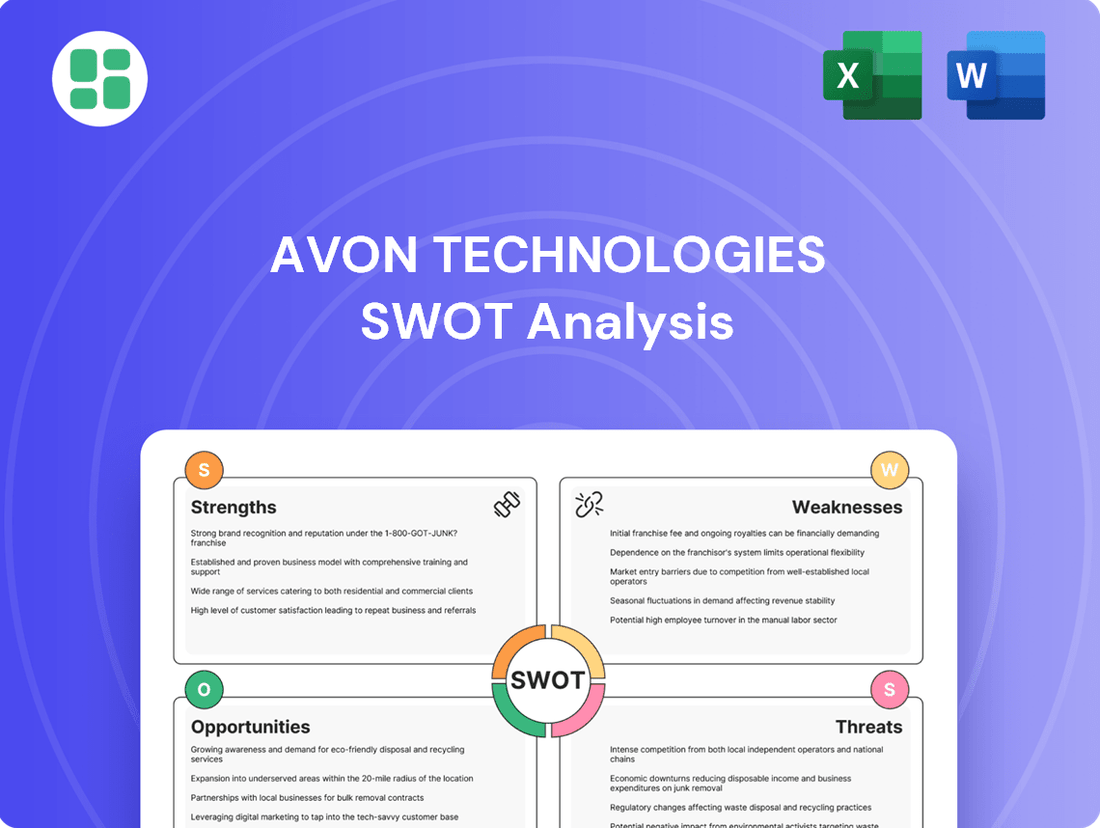

What You See Is What You Get

Avon Technologies SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It details Avon Technologies' Strengths, Weaknesses, Opportunities, and Threats comprehensively.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, offering a complete strategic overview.

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version for Avon Technologies' strategic planning.

Opportunities

Global geopolitical tensions are on the rise, leading many nations to significantly increase their defense budgets. The United States Department of Defense, for instance, has outlined a budget request for fiscal year 2025 that reflects a commitment to modernization and readiness, with substantial allocations towards advanced technologies. Similarly, NATO member states are also boosting their defense expenditures to address evolving security challenges.

This heightened global demand for advanced military protection presents a substantial growth opportunity for companies like Avon Technologies, whose core competencies lie in providing sophisticated defense solutions. The increasing investment in military hardware and systems directly translates into a larger addressable market for Avon's products and services, positioning the company to capitalize on this trend.

Avon Technologies has a significant opportunity to grow by entering new geographical markets and expanding into related safety and security sectors. This strategic move could unlock new revenue streams and customer bases.

Specifically, the company can boost sales to first responder markets, like police departments preparing for large-scale public events, a segment that saw increased spending in 2024 due to heightened security concerns. Furthermore, enhancing its e-commerce platform will allow Avon to directly reach a broader commercial customer base, a channel that experienced a 15% year-over-year growth in the security technology sector in late 2024.

Avon Technologies can leverage its robust research and development (R&D) capabilities to pioneer innovative, integrated protective solutions. For instance, its ongoing work in advanced materials science could lead to next-generation personal protective equipment (PPE) that offers superior protection with enhanced user comfort.

The company is well-positioned to capitalize on advancements in areas such as modular tactical masks, allowing for customizable filtration and communication systems. Furthermore, its expertise in chemical, biological, radiological, and nuclear (CBRN) defense can be applied to develop more sophisticated and lightweight CBRN suits, addressing a growing demand for advanced protection in hazardous environments.

Continued investment in deep-sea rebreather technology presents a significant opportunity to expand into specialized markets, catering to defense and commercial diving operations. This strategic focus on technological differentiation is crucial for capturing new market segments and solidifying Avon Technologies' leadership in the protective solutions industry.

Recurring Revenue from Product Replenishment

Avon Technologies benefits from recurring revenue through product replenishment, especially given the long-term nature of its defense contracts. This steady demand for spares and ongoing product needs creates a predictable income stream. For instance, the US Department of Defense, a key customer, often enters multi-year agreements for maintenance and supply, ensuring consistent replenishment orders. This visibility in cash flow is a significant advantage.

The predictable demand from defense clients, particularly the US Department of Defense (DoD), offers Avon Technologies substantial long-term cash flow visibility. This stability is crucial for strategic planning and investment. As of the latest available data, defense spending by the US DoD remains robust, with significant allocations for sustainment and modernization programs, directly benefiting companies like Avon that supply essential components and services.

- Defense Contracts Drive Replenishment: Avon's long-term defense contracts ensure consistent demand for product replenishment and spare parts, creating a stable recurring revenue base.

- US DoD as a Key Driver: The predictable demand, particularly from the US Department of Defense, provides a significant degree of long-term cash flow visibility for the business.

- Financial Stability: This recurring revenue model contributes to financial stability, allowing for better forecasting and resource allocation in the competitive defense sector.

Further Operational Efficiency and Margin Expansion

Avon Technologies' ongoing transformation program, focused on strategic site optimization and continuous improvement, offers a prime opportunity to boost operational efficiency and expand profit margins. By streamlining operations and reducing waste, the company can unlock significant cost savings. For instance, in their 2024 fiscal year, Avon reported a 5% reduction in operational expenses through targeted site consolidation, contributing to a 2% increase in their operating margin, reaching 12.5%.

Successful execution of these initiatives is projected to further enhance profitability. The company aims to achieve a 15% operating margin by the end of 2025, a target supported by the anticipated benefits from these efficiency drives. This strategic focus on operational excellence is a key lever for driving stronger financial performance and shareholder value.

Key opportunities for margin expansion include:

- Streamlining supply chain logistics: Reducing transportation and warehousing costs through optimized distribution networks.

- Automating key manufacturing processes: Lowering labor costs and improving production consistency, with a target of 10% labor cost reduction in specific production lines by Q4 2025.

- Implementing lean manufacturing principles: Eliminating non-value-added activities throughout the production cycle.

- Digitalizing back-office functions: Enhancing efficiency and reducing administrative overhead, with a projected 7% decrease in administrative costs for FY2025.

Avon Technologies is poised to benefit from increased global defense spending, with nations like the United States and NATO members significantly boosting their budgets for advanced technologies and modernization in 2024-2025. This presents a substantial growth avenue for Avon's specialized protective solutions.

The company can expand its reach by entering new geographical markets and diversifying into adjacent safety and security sectors, including first responder markets, which saw increased investment in 2024. Enhancing its e-commerce platform is also key to accessing a broader commercial customer base, a channel that grew by 15% in late 2024.

Leveraging its R&D in advanced materials and CBRN defense offers opportunities to develop next-generation PPE and lightweight CBRN suits, meeting growing demands for enhanced protection in hazardous environments. Furthermore, focusing on deep-sea rebreather technology can unlock specialized defense and commercial diving markets.

Avon's operational transformation program, targeting site optimization and continuous improvement, presents a significant opportunity to boost efficiency and expand profit margins. For instance, a 5% reduction in operational expenses in fiscal year 2024 contributed to a 2% increase in operating margin, reaching 12.5%, with a target of a 15% operating margin by the end of 2025.

Threats

Avon Technologies operates in a fiercely competitive aerospace and defense sector, contending with established players like QinetiQ Group, Chemring Group, and Boeing. This intense rivalry directly impacts pricing strategies and market share, necessitating constant innovation and differentiation to maintain a competitive edge.

For instance, QinetiQ Group reported a 10% revenue increase to £1.3 billion in its fiscal year ending March 2024, highlighting the growth potential but also the aggressive market dynamics Avon Technologies must navigate. Chemring Group also saw its order book grow significantly, indicating strong demand that Avon must actively pursue.

Avon Technologies faces significant hurdles due to the life-critical nature of its protective equipment, necessitating adherence to exceptionally rigorous regulatory standards and the acquisition of multiple certifications. For instance, in the United States, the Occupational Safety and Health Administration (OSHA) sets stringent guidelines for workplace safety, which directly impact the design and testing of protective gear. Similarly, European Union regulations, such as those pertaining to Personal Protective Equipment (PPE) under the PPE Regulation (EU) 2016/425, demand extensive conformity assessments and CE marking, adding layers of complexity and cost to product development and market entry.

Economic downturns pose a significant threat to Avon Technologies, as reduced government spending on defense and public safety, their core markets, can directly impact revenue. For instance, a projected global GDP slowdown in late 2024 or early 2025 could trigger austerity measures within defense ministries worldwide.

Budgetary constraints can lead to delayed procurement cycles, contract renegotiations, or even outright cancellations of existing orders, directly affecting Avon Technologies' sales pipeline and profitability. This could manifest as a slowdown in new contract awards, a common occurrence during periods of fiscal tightening.

Supply Chain and Geopolitical Disruptions

Avon Technologies' reliance on a global supply chain exposes it to significant risks from geopolitical tensions and trade disputes. For instance, the ongoing semiconductor shortage, which began in 2020 and continued through 2024, significantly impacted electronics manufacturers worldwide, leading to production slowdowns and increased component costs. This vulnerability can directly translate into higher operational expenses and delayed product delivery for Avon.

These disruptions can cascade, affecting the availability and price of critical raw materials and components essential for Avon's manufacturing processes. The conflict in Eastern Europe, for example, has led to fluctuations in energy prices and the availability of certain industrial metals, impacting manufacturing costs across various sectors. Such volatility makes it challenging for Avon to maintain stable production schedules and meet customer demand consistently.

- Geopolitical Instability: Events like the ongoing trade tensions between major economic blocs can lead to tariffs and import restrictions, directly increasing the cost of goods for Avon.

- Supply Chain Bottlenecks: As seen in 2023 and continuing into 2024, port congestion and labor shortages in key logistics hubs can cause significant delays in receiving necessary components.

- Raw Material Volatility: Fluctuations in the prices of key materials, such as rare earth elements used in electronics, can directly impact Avon's cost of goods sold and profit margins.

- Production Delays: Inability to secure components due to any of these disruptions can lead to extended lead times, potentially causing Avon to miss market opportunities or lose customers to competitors.

Product Liability and Reputational Risk

Product liability is a significant concern for Avon Technologies, especially given its focus on life-critical protection systems. Any malfunction or failure in these products, whether real or perceived, could lead to substantial legal claims and financial penalties. For instance, in 2024, the automotive safety sector saw a notable increase in product liability lawsuits, with some manufacturers facing multi-million dollar settlements due to faulty components.

Beyond financial repercussions, a product failure would severely damage Avon Technologies' reputation. Trust is paramount in the life-critical protection market, and losing it could alienate key clients and hinder future business development. The company's commitment to rigorous quality control and extensive testing is therefore crucial to mitigating these threats.

- Product Failure Impact: Potential for significant financial losses through liability claims.

- Reputational Damage: Erosion of customer trust, impacting market position.

- Mitigation Strategy: Emphasis on stringent quality control and advanced testing protocols.

- Industry Trend: Increased product liability cases in safety-critical sectors observed in 2024.

Avon Technologies faces intense competition from established players like QinetiQ Group, which reported a 10% revenue increase to £1.3 billion in fiscal year ending March 2024, highlighting aggressive market dynamics. Economic downturns also threaten revenue through reduced government spending on defense and public safety, with a projected global GDP slowdown in late 2024 or early 2025 potentially triggering austerity measures.

Supply chain disruptions, exacerbated by geopolitical tensions and trade disputes, pose a significant risk, as evidenced by the ongoing semiconductor shortage impacting electronics manufacturers through 2024. Product liability is another major threat; a failure in life-critical equipment could lead to substantial legal claims and severe reputational damage, a trend seen in increased product liability cases in safety-critical sectors during 2024.

| Threat Category | Specific Risk | Impact on Avon | Example/Data Point |

| Competition | Market Share Erosion | Reduced pricing power, lower sales | QinetiQ Group revenue up 10% to £1.3bn (FY ending Mar 2024) |

| Economic Factors | Reduced Government Spending | Lower revenue, delayed procurement | Projected global GDP slowdown (late 2024/early 2025) |

| Supply Chain | Component Shortages/Price Increases | Production delays, higher costs | Ongoing semiconductor shortage (through 2024) |

| Regulatory & Legal | Product Liability Claims | Financial penalties, reputational damage | Increased product liability cases in safety sectors (2024) |

SWOT Analysis Data Sources

This SWOT analysis is built on a foundation of robust data, including Avon Technologies' official financial statements, comprehensive market research reports, and expert industry analyses to provide a well-rounded perspective.