Avon Technologies Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Avon Technologies Bundle

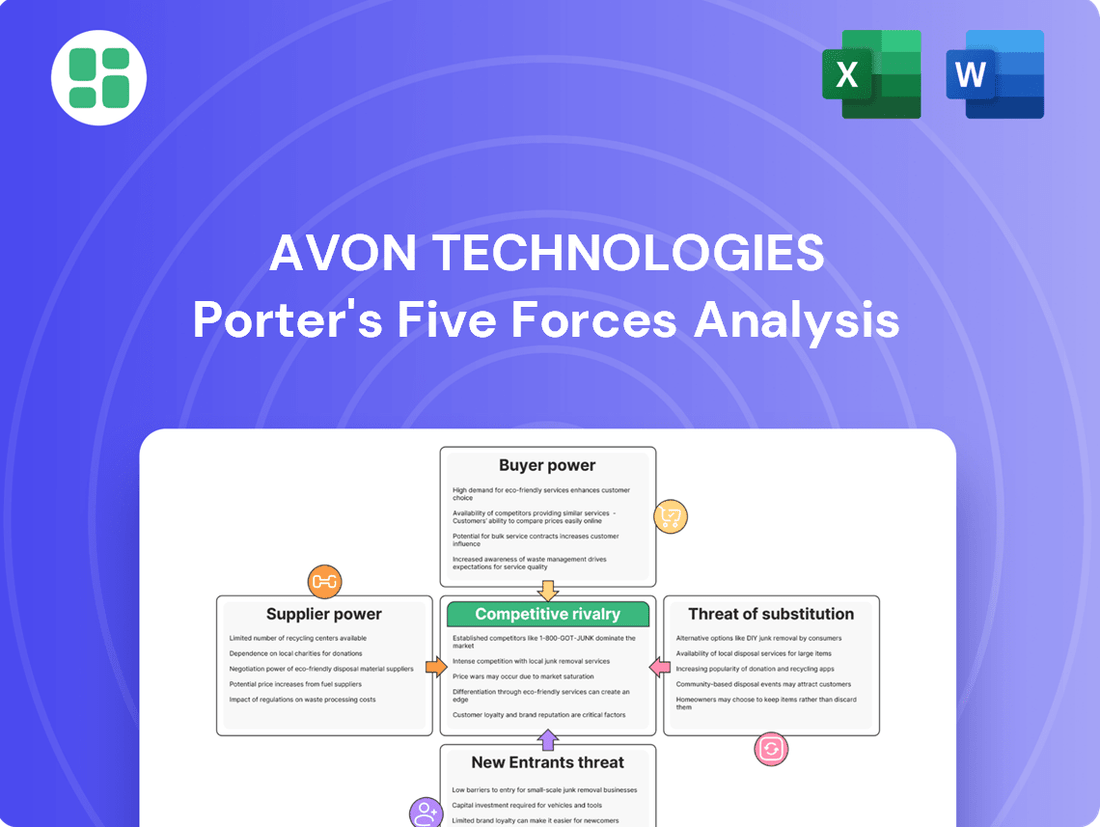

Avon Technologies operates within a dynamic landscape shaped by intense rivalry and the ever-present threat of new entrants. Understanding the power of buyers and the influence of suppliers is crucial for navigating this market.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Avon Technologies’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Avon Protection's reliance on suppliers for highly specialized components, such as advanced filter media and sensor technologies, grants these suppliers considerable bargaining power. The proprietary nature of these materials, coupled with limited alternative sources, means Avon faces significant challenges if these suppliers decide to increase prices or alter terms. For instance, in 2024, the global supply chain disruptions continued to highlight the vulnerability of companies dependent on niche component manufacturers.

In the defense and first responder industries, the rigorous quality and regulatory demands for protective gear mean that only a select few suppliers can consistently meet these exacting standards. This scarcity of qualified vendors for essential components can significantly amplify their negotiation power when dealing with Avon Protection, especially for components that are sole-sourced or possess high-level certifications.

The performance and reliability of Avon Protection's life-saving equipment are directly tied to the quality of its supplied components. For instance, in 2023, Avon reported that a significant portion of its cost of goods sold was attributed to raw materials and components, highlighting the critical nature of supplier input.

Any compromise on material quality or delivery could severely impact Avon's reputation and product effectiveness. In 2024, the defense sector has seen increased scrutiny on supply chain integrity, meaning a failure in a component could lead to costly product recalls and damage customer trust.

This situation inherently increases the importance of maintaining strong relationships with key suppliers, potentially leading Avon to accept their terms to ensure consistent quality and timely delivery of essential materials.

Potential for Forward Integration by Suppliers

The potential for suppliers to integrate forward into Avon Technologies' markets, such as respiratory or head protection, represents a significant bargaining chip. If a key component supplier were to decide manufacturing finished goods was more profitable, they could directly compete with Avon. This threat, while less likely for highly specialized suppliers, would dramatically shift power dynamics, especially if their proprietary technology gave them a distinct advantage in product creation.

Consider a scenario where a supplier of advanced composite materials, crucial for lightweight yet durable helmets, decides to establish its own helmet production line. This move could disrupt Avon's supply chain and introduce a formidable competitor. For instance, in 2024, the global advanced composites market was valued at approximately $50 billion, highlighting the substantial resources some suppliers might possess for such an expansion.

- Supplier Forward Integration Threat: Suppliers entering Avon's finished product markets (respiratory, head protection) directly increases their power.

- Specialized Component Impact: High dependency on a supplier's unique technology makes this threat more potent.

- Market Value Context: The significant size of related component markets, like advanced composites (valued around $50 billion in 2024), indicates potential supplier capacity for such strategic shifts.

- Competitive Landscape Shift: A supplier's entry would transform a supplier relationship into direct competition.

Switching Costs for Avon

For Avon, the bargaining power of suppliers is significantly amplified by high switching costs. These costs extend beyond mere financial outlays; they encompass rigorous testing protocols, the necessity of re-certification to stringent standards like NIOSH and NATO, and the inherent risk of production disruptions during any transition.

These substantial switching costs inherently limit Avon's operational flexibility, thereby bolstering the leverage held by its existing suppliers. The complexity and potential risks associated with onboarding a new supplier make it a daunting prospect for Avon, solidifying the supplier's advantageous position.

- High Switching Costs: Financial expenses, extensive testing, and re-certification requirements (e.g., NIOSH, NATO) are key factors.

- Production Disruption Risk: Changing suppliers can lead to significant delays and interruptions in manufacturing processes.

- Supplier Leverage: These barriers empower incumbent suppliers, giving them greater influence over pricing and terms.

The bargaining power of Avon's suppliers is substantial due to the specialized nature of components like advanced filter media and sensor technologies. Limited alternative sources and proprietary materials mean Avon faces price increases or altered terms from these suppliers. In 2024, ongoing global supply chain disruptions continue to highlight the vulnerability of companies reliant on niche component manufacturers.

Rigorous quality and regulatory demands in defense and first responder industries restrict the number of qualified suppliers for essential components. This scarcity amplifies negotiation power, particularly for sole-sourced or highly certified parts. Avon's 2023 cost of goods sold, significantly driven by raw materials, underscores the critical reliance on these suppliers.

High switching costs, including extensive testing, re-certification (e.g., NIOSH, NATO), and the risk of production disruptions, significantly limit Avon's flexibility. These barriers empower incumbent suppliers, granting them greater influence over pricing and terms, as seen in the continued scrutiny on supply chain integrity in 2024.

| Factor | Impact on Avon | Example/Data Point |

|---|---|---|

| Specialized Components | High supplier power due to limited alternatives | Proprietary filter media, sensor technologies |

| Industry Regulations | Scarcity of qualified suppliers | Rigorous defense and first responder standards |

| Switching Costs | Increased supplier leverage | Testing, re-certification (NIOSH, NATO), production disruption risk |

| Forward Integration Threat | Potential for direct competition | Supplier entering finished goods markets (e.g., helmets) |

What is included in the product

This analysis dissects the competitive landscape for Avon Technologies, examining the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants, and the impact of substitutes.

Instantly visualize competitive pressures with a dynamic, interactive five forces diagram, simplifying complex market dynamics for strategic clarity.

Customers Bargaining Power

Avon Protection's consolidated customer base, heavily reliant on government and defense entities such as the US Department of Defense and NATO nations, grants these buyers substantial bargaining power. These major clients, by placing large-volume orders, can negotiate favorable terms and pricing, especially within the context of long-term supply agreements.

While customers hold significant power, their ability to switch from Avon Technologies can be constrained by high switching costs. These costs arise from the deep integration of Avon's systems into a customer's existing operational protocols, requiring significant investment in training and logistical frameworks. For instance, in 2024, the average cost for a business to retrain its IT staff on new enterprise software solutions can range from $10,000 to $50,000, a substantial barrier to switching.

For military and first responder equipment, standardization is high, and reliability is paramount, meaning price isn't the only factor. Customers in these sectors, especially for significant contracts, can still leverage their power by demanding specific features, customization options, and high service levels. This focus on performance over pure cost allows Avon Technologies some leeway, but large-scale procurements still present opportunities for customer negotiation on these critical aspects.

Demand Fluctuation from Government Budgets

Customer demand for Avon Technologies, especially from the military and law enforcement sectors, is sensitive to shifts in government spending. These budgets are often tied to geopolitical events and national defense strategies, meaning changes in these areas directly affect order sizes and the timing of purchases.

For instance, a reduction in defense spending, as seen in some Western nations during periods of perceived stability, can lead to delayed procurements or smaller contract values. This creates leverage for government entities, allowing them to negotiate more favorable terms or push for price reductions, particularly if Avon Technologies has limited alternative markets for its specialized products.

- Government Budget Sensitivity: Defense budgets are dynamic; for example, the U.S. Department of Defense's budget for fiscal year 2024 was set at $886 billion, a slight increase, but future allocations can fluctuate based on evolving threats and political priorities.

- Impact on Negotiations: When government budgets tighten, customers gain bargaining power, potentially leading to price concessions or extended payment terms for suppliers like Avon Technologies.

- Strategic Reviews: Periodic strategic defense reviews can alter procurement needs, impacting demand for specific technologies and influencing contract negotiations.

Availability of Alternative Suppliers for Customers

Customers have a significant bargaining power due to the availability of numerous alternative suppliers in the market. Companies like MSA Safety, 3M, and Honeywell offer comparable respiratory and head protection solutions, directly challenging Avon Technologies.

For less specialized products, this competitive landscape allows customers to easily compare features, quality, and pricing. This comparison capability inherently pressures Avon to maintain competitive pricing and service levels to retain its customer base.

- Global Competitors: Access to global suppliers like MSA Safety, 3M, and Honeywell for respiratory and head protection.

- Product Similarity: Availability of comparable solutions from these competitors, especially for non-specialized items.

- Customer Leverage: Ability for customers to compare offerings and exert pressure on Avon's pricing and service.

Avon Technologies' customers, primarily government and defense entities, wield considerable bargaining power due to the concentrated nature of their purchases and the critical reliance on these protective systems. The sheer volume of orders placed by major players like the US Department of Defense allows them to negotiate favorable pricing and terms, especially within long-term contracts. For instance, the US Department of Defense's FY2024 budget of $886 billion highlights the significant financial clout these buyers possess.

Despite high switching costs associated with system integration and training, customers can still exert influence by demanding specific customizations and high service levels, particularly in critical applications where reliability is paramount. The availability of numerous alternative suppliers, such as MSA Safety, 3M, and Honeywell, further amplifies customer leverage by enabling direct comparisons of features, quality, and pricing, thereby pressuring Avon to maintain competitive offerings.

| Customer Type | Key Negotiating Factors | Example Competitor | Potential Impact on Avon |

|---|---|---|---|

| Government/Defense (e.g., US DoD) | Volume orders, long-term contracts, budget sensitivity | MSA Safety | Price concessions, favorable payment terms |

| First Responders | Standardization, reliability, specific features | 3M | Demand for customization, high service levels |

| Industrial Sector | Price, product comparability, service levels | Honeywell | Pressure on pricing and service to retain business |

Preview Before You Purchase

Avon Technologies Porter's Five Forces Analysis

This preview showcases the complete Avon Technologies Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the industry. The document you see here is precisely the same professionally formatted and ready-to-use analysis you will receive immediately after purchase, ensuring no surprises or missing sections.

Rivalry Among Competitors

The respiratory protection and personal protective equipment (PPE) market, particularly for defense and first responders, is dominated by a handful of large, established companies, with Avon Protection being a key player. This consolidation means intense competition as these major entities vie for lucrative government contracts and overall market leadership. For instance, the global PPE market was valued at approximately $284.7 billion in 2023 and is projected to reach $438.1 billion by 2030, indicating significant stakes for dominant firms.

Competitive rivalry at Avon Technologies is significantly shaped by product differentiation, particularly through advanced technology, comfort, and durability. The company emphasizes specialized features like Chemical, Biological, Radiological, and Nuclear (CBRN) protection and integrated systems, aiming to set its offerings apart. This focus on innovative design and high-performance quality helps Avon mitigate direct price-based competition and build a distinct competitive advantage in the market.

The respiratory protection equipment market is poised for robust expansion, with projections indicating significant growth. This upward trend is largely fueled by increasingly stringent occupational safety regulations worldwide and a surge in demand from the military and aviation sectors, a direct consequence of escalating global geopolitical tensions.

While this market expansion offers a potential buffer against intense rivalry by creating more opportunities, it doesn't eliminate it. Avon Technologies still faces fierce competition, particularly when vying for high-value contracts within these burgeoning sectors.

Long-Term Contracts and Sole-Source Agreements

Avon Protection's competitive rivalry is significantly shaped by long-term contracts, often on a sole-source basis, with major defense organizations. These agreements, like those with the U.S. Department of Defense, create a predictable revenue stream and shield specific product lines from immediate competitive pressures. For instance, Avon's multi-year contract with the U.S. Army for its next-generation mask, valued at hundreds of millions of dollars, exemplifies this advantage.

However, the landscape is not without its competitive intensity. The process of securing new contracts and renewing existing ones remains a fiercely contested arena. Companies must consistently demonstrate technological superiority and cost-effectiveness to win these crucial opportunities. In 2023, Avon faced bids from several established and emerging players for new defense equipment tenders, highlighting the ongoing need for innovation and aggressive pricing strategies.

- Sole-source contracts provide a stable revenue foundation for Avon Protection.

- The U.S. Department of Defense is a key client, securing significant long-term agreements.

- Bidding for new defense contracts remains highly competitive, necessitating continuous innovation.

- Competitive pricing is a critical factor in winning and retaining defense contracts.

Exit Barriers for Competitors

Avon Technologies faces significant competitive rivalry, partly due to high exit barriers for its competitors. Companies operating in this space have made substantial investments in specialized manufacturing facilities, often requiring millions in capital outlay. For instance, advanced semiconductor fabrication plants can cost upwards of $20 billion to build and equip, making it economically unfeasible for many to simply walk away.

Furthermore, the extensive research and development (R&D) necessary to stay competitive, coupled with the rigorous product certifications required by industries like automotive or aerospace, lock in existing players. These certifications can take years and substantial financial resources to obtain, creating a strong disincentive to exit. This commitment means that even when market conditions become difficult, competitors are more likely to remain and battle for market share, intensifying the rivalry.

- High Capital Investment: Competitors have sunk significant capital into specialized manufacturing, making divestment costly.

- R&D and Certification Costs: Extensive R&D and product certification requirements create long-term commitments.

- Intensified Rivalry: These barriers encourage existing players to stay and compete, even during downturns.

Competitive rivalry for Avon Technologies is intense, driven by a market dominated by a few large, established players. While long-term, sole-source contracts with entities like the U.S. Department of Defense offer stability, the bidding process for new and renewed agreements remains a fierce battleground. Companies must consistently demonstrate technological superiority and cost-effectiveness to secure these vital opportunities, as evidenced by the numerous bids Avon faced in 2023 for new defense equipment tenders.

The high capital investment and extensive R&D and certification costs create significant exit barriers for competitors in the personal protective equipment market. These factors encourage existing players to remain and compete aggressively, even in challenging market conditions, thereby intensifying overall rivalry. This commitment to the sector means that innovation and competitive pricing are paramount for Avon to maintain its market position.

| Key Factor | Impact on Rivalry | Avon's Strategy |

|---|---|---|

| Market Consolidation | Intense competition among major players | Focus on product differentiation |

| Long-Term Contracts | Provides revenue stability, shields specific products | Secure and maintain sole-source agreements |

| Bidding Process | Highly contested for new and renewed contracts | Demonstrate technological superiority and cost-effectiveness |

| Exit Barriers | Encourages existing players to stay and compete | Continuous innovation and aggressive pricing |

SSubstitutes Threaten

The threat of substitutes for Avon Technologies' protective gear is significant, stemming from alternative methods and emerging technologies that can achieve similar safety outcomes. For example, advancements in localized ventilation systems can reduce the need for personal respiratory protection in certain industrial settings. In 2024, the global industrial ventilation market was valued at approximately $18 billion, indicating substantial investment in these alternative solutions.

Furthermore, the rise of remote monitoring and sensor technologies offers non-personal protective measures, potentially decreasing reliance on traditional head and body protection. Companies are increasingly adopting integrated safety solutions that combine these technologies, creating a competitive pressure point for standalone protective equipment manufacturers like Avon Technologies.

Innovations in material science present a significant threat of substitutes for Avon Technologies' protective gear. For instance, advancements in lightweight, high-strength composites, like those emerging in the aerospace sector, could offer comparable or superior protection at a lower cost or with enhanced user comfort, directly challenging Avon's existing product lines. The rapid pace of discovery means a material developed for an entirely different application could quickly become a viable, and potentially disruptive, alternative in the personal protective equipment market.

For industrial or less critical applications, customers may choose cheaper, generic personal protective equipment (PPE) that provides sufficient, but not top-tier, protection. This can reduce demand for Avon's high-specification products, particularly in segments where cost is a major consideration.

Changes in Safety Protocols or Regulations

A significant threat to Avon Technologies arises from changes in safety protocols or regulations. If industry-wide safety standards were to be relaxed, particularly concerning personal protective equipment (PPE), customers might opt for less advanced and consequently cheaper alternatives. This could erode the demand for Avon's specialized, high-performance safety solutions.

For instance, a hypothetical rollback of stringent requirements for chemical-resistant materials in certain industrial applications could open the door for lower-cost, less effective substitutes. In 2024, the global PPE market, valued at approximately $60 billion, saw significant growth driven by these very regulations. Any weakening of these mandates would directly impact the value proposition of advanced PPE providers like Avon.

- Relaxed PPE Standards: A decrease in the required quality or specifications of personal protective equipment could make lower-cost alternatives more attractive.

- Reduced Perceived Necessity: If safety regulations are loosened, the perceived need for Avon's advanced, high-specification products might diminish.

- Shift to Cheaper Alternatives: Customers may switch to less robust but more budget-friendly safety gear, impacting Avon's market share and pricing power.

Integrated Systems from Competitors

Competitors offering integrated protective systems, which bundle multiple components like masks, suits, and gloves into a single, cohesive solution, pose a threat. These systems can be perceived as a substitute for Avon's individual product lines if Avon lacks a comparable, seamless offering. For instance, a competitor's all-in-one CBRN suit might appeal to customers seeking simplified procurement and deployment over purchasing separate items.

The market for personal protective equipment (PPE) is dynamic, with a growing emphasis on user convenience and interoperability. In 2024, the global PPE market was valued at approximately $65 billion, with significant growth driven by demand for advanced, integrated solutions across various sectors, including defense and emergency response. This trend highlights how a competitor's ability to provide a more unified system can draw customers away from fragmented product offerings.

- Integrated Solutions: Competitors may offer pre-packaged, integrated protective systems that combine masks, suits, and gloves, presenting a more convenient alternative to purchasing individual components.

- User Experience: A competitor's integrated system could offer enhanced user experience through better fit, communication, and mobility compared to assembling separate pieces, potentially impacting Avon's market share if its offerings are less cohesive.

- Market Trends: The increasing demand for simplified procurement and deployment of PPE in sectors like defense and emergency services favors integrated solutions, a trend observed throughout 2024.

The threat of substitutes for Avon Technologies' protective gear is substantial, driven by technological advancements and evolving safety practices. For example, innovations in localized ventilation systems, a market valued at around $18 billion globally in 2024, can reduce the need for respiratory protection. Similarly, advancements in material science, with new composites offering enhanced protection and comfort, directly challenge Avon's existing product lines.

Customers may also opt for cheaper, generic PPE if cost is a primary concern, impacting demand for Avon's high-specification products. A significant factor is the potential for relaxed safety regulations; if standards for PPE are lowered, less advanced and cheaper alternatives become more appealing, directly affecting the value proposition of advanced PPE providers like Avon. The global PPE market, valued at approximately $65 billion in 2024, is heavily influenced by these regulations.

| Substitute Type | Description | Market Context (2024 Data) | Impact on Avon |

|---|---|---|---|

| Ventilation Systems | Localized systems reducing need for respiratory gear | Global industrial ventilation market ~ $18 billion | Decreased demand for respiratory protection |

| Advanced Materials | Lightweight, high-strength composites | Emerging across sectors like aerospace | Potential for lower-cost, superior alternatives |

| Integrated Systems | Bundled protective components (suits, masks, gloves) | Growing demand for simplified solutions | Competition for fragmented product offerings |

| Generic PPE | Lower-cost, less specialized safety gear | Significant portion of the ~ $65 billion global PPE market | Erosion of market share in cost-sensitive segments |

Entrants Threaten

Entering the specialized respiratory and head protection market, especially for military and first responder needs, demands significant upfront capital. Companies need to invest heavily in advanced manufacturing, specialized equipment, and continuous research and development to meet stringent performance standards. For instance, the global military protective equipment market was valued at approximately $25 billion in 2023, with a projected compound annual growth rate (CAGR) of 5.2% through 2030, indicating the scale of investment required to compete effectively.

Avon Protection operates in markets where stringent regulatory and certification requirements act as a significant barrier to entry. For instance, their personal protective equipment must adhere to demanding national and international standards, such as those set by NIOSH, NATO, and the US Department of Defense. The process of obtaining these crucial approvals is notoriously time-consuming, costly, and intricate, effectively discouraging many potential competitors from entering these critical sectors.

Avon Protection's deeply entrenched brand reputation, particularly among government and defense sectors, presents a formidable barrier. This reputation, cultivated over decades, signifies a proven track record of reliability and quality, making it exceptionally difficult for new entrants to replicate the trust Avon has earned.

New competitors would face significant hurdles in establishing comparable customer relationships, especially given the high-stakes nature of the protective equipment market where product efficacy directly impacts user safety. For instance, Avon's extensive history with military contracts, a segment demanding rigorous testing and certification, underscores the depth of this established trust.

Proprietary Technology and Intellectual Property

Avon Protection's robust portfolio of patents and proprietary technologies, particularly in mask design, advanced filter systems, and specialized composite materials for protective headgear, presents a significant hurdle for potential new entrants. These intellectual property assets, which are crucial for their high-performance products, make it exceedingly difficult for newcomers to replicate their offerings without substantial investment in research and development or the risk of patent infringement. For instance, as of early 2024, Avon Protection's commitment to innovation is reflected in its ongoing patent filings, securing its technological lead in a competitive market.

The threat of new entrants is therefore considerably weakened by Avon's strong technological moat. Developing comparable filtration efficiency, ergonomic mask fit, and lightweight yet durable helmet construction requires not only significant capital but also deep technical expertise that is difficult and time-consuming to acquire. This intellectual property creates substantial barriers, making it economically unviable for most new companies to challenge Avon's established position in the personal protective equipment market.

- Proprietary Technology: Avon Protection holds numerous patents in mask design and filter technology.

- Intellectual Property Barriers: Existing patents make it challenging for new firms to develop competitive products without infringement.

- R&D Investment: New entrants would need substantial investment to match Avon's technological advancements.

- Market Position: Avon's IP secures its leading position and deters potential competitors.

Economies of Scale and Experience Curve

Existing players like Avon Protection leverage significant economies of scale across their operations. This translates to lower per-unit production costs due to bulk purchasing of raw materials and optimized manufacturing processes. For instance, in 2023, Avon Protection reported revenues of £249.6 million, indicating a substantial operational footprint that new entrants would struggle to match immediately.

The experience curve also presents a formidable barrier. As companies like Avon Protection have refined their manufacturing techniques over years, they've achieved greater efficiency and reduced waste. This accumulated operational knowledge allows them to produce high-quality protective equipment at a more competitive price point than a newcomer could initially attain.

- Economies of Scale: Avon Protection benefits from bulk purchasing and optimized production, lowering per-unit costs.

- Experience Curve: Years of refined manufacturing processes lead to greater efficiency and cost advantages.

- Cost Disadvantage for Entrants: New companies would face higher initial costs until achieving similar scale and experience.

The threat of new entrants into Avon Protection's market is significantly low. High capital requirements for specialized manufacturing and R&D, coupled with stringent regulatory approvals, create substantial barriers. Furthermore, Avon's established brand reputation, extensive customer relationships, and strong intellectual property portfolio make it exceedingly difficult for newcomers to compete effectively.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High investment needed for advanced manufacturing and R&D. | Discourages entry due to significant upfront costs. |

| Regulatory & Certification | Demanding standards (NIOSH, NATO) require lengthy, costly approval processes. | Slows down or prevents market entry for those without compliance. |

| Brand Reputation & Relationships | Decades of trust, especially with defense sectors. | New entrants struggle to build comparable credibility and loyalty. |

| Intellectual Property | Patents on mask design, filters, and materials. | Limits product replication and requires substantial R&D investment. |

| Economies of Scale & Experience | Avon's large operational footprint and refined processes. | New entrants face higher initial costs and lower efficiency. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Avon Technologies leverages a comprehensive dataset including Avon's annual reports, SEC filings, and investor presentations. We also incorporate industry-specific market research reports from firms like Statista and IBISWorld, alongside macroeconomic data to provide a robust competitive assessment.