Auxly Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Auxly Bundle

Auxly's competitive landscape is shaped by several key forces, including the bargaining power of buyers and the threat of new entrants, which can significantly impact its market position. Understanding these dynamics is crucial for navigating the cannabis industry.

The complete report reveals the real forces shaping Auxly’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The Canadian cannabis market has experienced some consolidation among licensed producers, but an ongoing oversupply situation can dilute the bargaining power of individual raw cannabis cultivators. This market dynamic means that while there are fewer large players, the sheer volume of product available can prevent any single cultivator from dictating terms.

Auxly's approach of partnering with diverse cultivation and processing entities inherently weakens the bargaining power of any single supplier. By spreading its sourcing across multiple partners, Auxly avoids reliance on any one cultivator, enhancing its ability to negotiate favorable agreements and maintain supply chain resilience.

Suppliers offering highly specialized equipment for cultivation, extraction, or processing, or those providing proprietary genetics, can wield considerable bargaining power. Auxly's strategy of creating branded cannabis products across various categories necessitates consistent quality and specific inputs, potentially granting leverage to suppliers of unique or sought-after components.

The company's commitment to advanced technologies in product development further strengthens the position of technology providers. For instance, in 2023, the global cannabis cultivation equipment market was valued at approximately $1.8 billion, with advanced automation and specialized lighting systems representing key growth drivers, indicating the importance of these specialized suppliers.

Auxly's bargaining power with suppliers is influenced by switching costs. If Auxly has deeply integrated specific supplier technologies or processes, or if changing cultivation partners or ingredient suppliers incurs substantial expenses, existing suppliers gain leverage. For example, in 2023, Auxly reported that its cost of goods sold increased by 12% due to higher input costs, suggesting some reliance on specific suppliers.

However, Auxly's efforts to build a diverse supply chain and cultivate relationships with multiple partners can mitigate these switching costs. A strong supplier network allows Auxly to maintain flexibility and potentially negotiate better terms, keeping supplier power in check.

Availability of Substitute Inputs

The availability of substitute inputs significantly influences supplier power for companies like Auxly. If alternative sources for crucial components such as cannabis biomass, packaging, or specialized processing services are readily available, suppliers generally hold less leverage. For instance, in 2024, the Canadian cannabis market experienced periods of oversupply in certain raw material categories, which provided Auxly with greater flexibility in sourcing and negotiating terms, thereby reducing supplier bargaining power.

However, the situation can shift for Auxly when dealing with specialized or premium product lines. In such cases, the pool of suppliers capable of meeting stringent quality or unique product requirements may be limited. This scarcity of suitable alternatives can empower those select suppliers, giving them increased leverage in price negotiations and contract terms. For example, sourcing specific terpene profiles or unique extraction technologies might involve a smaller, more concentrated group of suppliers.

Auxly's ability to mitigate supplier power is enhanced by its strategic sourcing and supply chain diversification. By cultivating relationships with multiple suppliers and exploring innovative sourcing methods, the company can ensure it has viable alternatives. This proactive approach is crucial, especially as the industry matures and demand for differentiated cannabis products grows, potentially narrowing the options for certain inputs.

The bargaining power of suppliers is directly tied to the availability of substitutes for key inputs:

- Lower Supplier Power in Oversupplied Input Markets: In 2024, an oversupply of certain cannabis inputs in Canada meant Auxly could more easily find alternative suppliers, reducing the leverage of individual suppliers.

- Increased Supplier Power for Differentiated Inputs: For premium or highly specialized inputs, where fewer suppliers exist, those suppliers gain more bargaining power.

- Impact on Sourcing Costs: The availability of substitutes directly affects Auxly's cost of goods sold, influencing profitability.

- Strategic Sourcing as a Mitigator: Diversifying supplier relationships and exploring new sourcing technologies helps Auxly maintain lower supplier power.

Forward Integration Threat by Suppliers

Suppliers, especially significant cultivators in the Canadian cannabis market, could pose a threat by integrating forward into processing and branding. This move would transform them from suppliers into direct rivals for Auxly. For instance, if a large-scale grower like Village Farms International (which also has a stake in the cannabis sector through its Pure Sunfarms brand) were to enhance its own branded product offerings and distribution channels, it could directly compete with Auxly's product lines.

The effectiveness of this threat hinges on Auxly's established brand equity and its robust distribution network. If Auxly possesses a stronger brand recognition and a more extensive reach across various markets, it makes direct competition less attractive for suppliers considering forward integration. Auxly's established relationships with retailers and consumers are key differentiators.

The Canadian cannabis industry has been experiencing a trend of consolidation. This environment could encourage more players to pursue vertical integration. As of early 2024, reports indicated continued M&A activity, suggesting a market where companies are seeking greater control over their supply chains and market presence. This consolidation could lead to fewer, larger entities, increasing the potential for upstream players to become formidable competitors.

- Forward Integration Risk: Large cultivators may integrate forward into processing and branding, becoming direct competitors to Auxly.

- Mitigating Factors: Auxly's brand strength and distribution network can deter suppliers from direct competition.

- Market Trend: Consolidation in the Canadian market may lead to more vertically integrated players, increasing competitive pressure.

Suppliers' bargaining power is generally moderate for Auxly, influenced by market oversupply in 2024 which allowed for easier sourcing of raw cannabis. However, specialized inputs like unique genetics or advanced cultivation equipment can grant suppliers more leverage, as seen with the global cannabis cultivation equipment market valued at $1.8 billion in 2023. Auxly mitigates this by diversifying its supplier base, reducing reliance on any single entity and managing switching costs effectively.

The threat of suppliers integrating forward into processing and branding is present, particularly with market consolidation in Canada as of early 2024, potentially creating direct competitors. Auxly's strong brand equity and distribution network serve as key defenses against this risk, making direct competition less appealing for potential upstream rivals.

| Factor | Impact on Auxly's Supplier Bargaining Power | 2023/2024 Data/Context |

|---|---|---|

| Market Oversupply (Raw Cannabis) | Lowers Supplier Power | Oversupply in Canadian market in 2024 provided Auxly flexibility in sourcing. |

| Specialized Inputs (e.g., Genetics, Equipment) | Increases Supplier Power | Global cannabis cultivation equipment market was $1.8 billion in 2023; specialized suppliers hold leverage. |

| Switching Costs | Can Increase Supplier Power | Auxly's cost of goods sold rose 12% in 2023 due to input costs, indicating some supplier reliance. |

| Supplier Forward Integration Risk | Potential Threat | Market consolidation in Canada (early 2024) may encourage vertical integration, creating competitors. |

What is included in the product

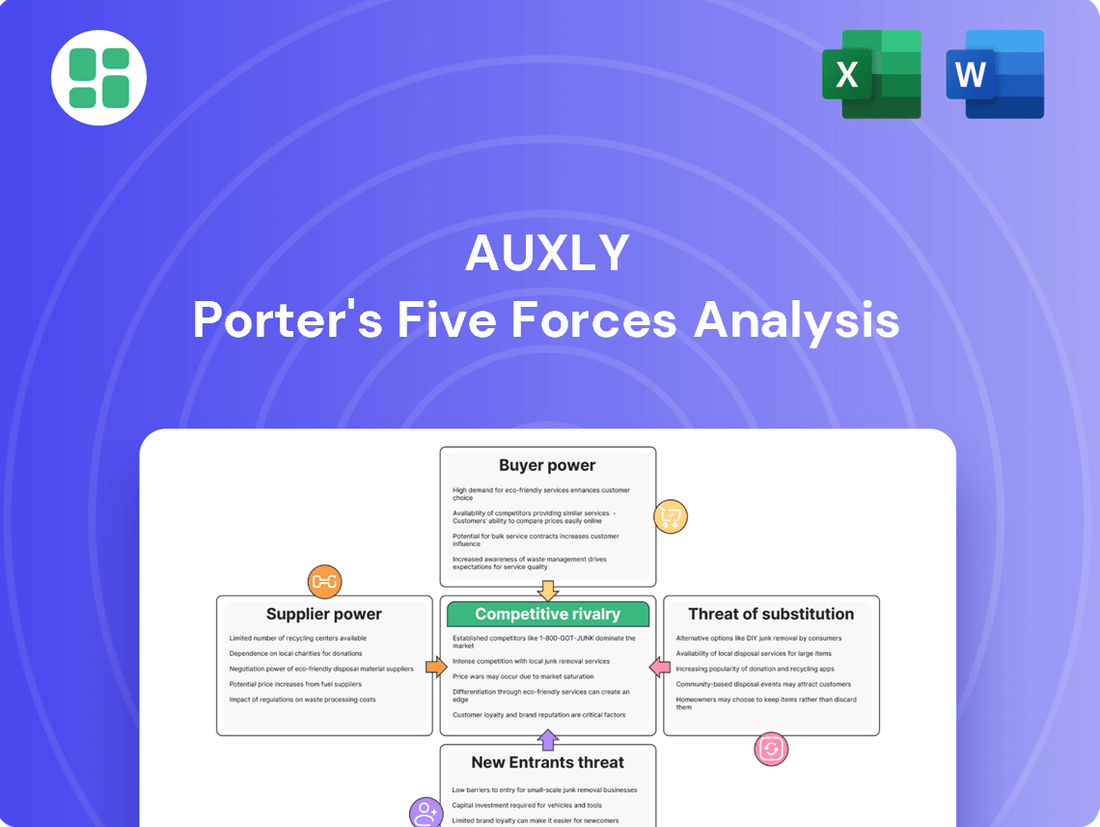

This Porter's Five Forces analysis specifically examines Auxly's competitive environment, detailing the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the impact of substitutes.

Quickly identify and mitigate competitive threats with a visually intuitive breakdown of industry power dynamics.

Customers Bargaining Power

The Canadian legal cannabis market, highly competitive, has seen significant price pressures, making consumers more sensitive to cost. Auxly, operating as a consumer packaged goods company, must carefully balance product quality and brand appeal with competitive pricing to win and keep customers. This heightened price sensitivity significantly empowers the end consumer.

Consumers in the Canadian cannabis market face a vast selection of legal products, from dried flower and vapes to edibles, significantly amplifying their bargaining power. This abundance of choice, coupled with the ongoing presence of the illicit market offering more competitive pricing, puts considerable pressure on companies like Auxly.

For instance, in 2023, Canada's legal cannabis market generated approximately $4.1 billion in sales, yet the illicit market continues to represent a substantial portion of overall consumption. Auxly's success hinges on its capacity to differentiate its offerings, such as its Back Forty brand, to capture and retain customer loyalty amidst this competitive landscape.

The cost for a consumer to switch between cannabis brands or products is typically minimal. This low barrier means customers can easily move to a competitor if they are dissatisfied or find a more appealing option, increasing the bargaining power of customers. For instance, in 2023, the Canadian cannabis market saw significant brand shifts as consumers explored new offerings.

Auxly’s strategy to combat this is by fostering strong brand loyalty. The company’s brand, Back Forty, achieved significant success, ranking among the top brands in key Canadian provinces during 2023, demonstrating that building recognition and preference can mitigate the impact of low switching costs. This highlights the importance of consistent product quality and engaging marketing in retaining customers.

Information Availability to Customers

Customers today have unprecedented access to information about product quality, potency, and pricing, thanks to legal retail channels and a wealth of online resources. This increased transparency directly empowers consumers, enabling them to make more informed purchasing decisions and, consequently, bolstering their bargaining power.

For companies like Auxly, this means that demonstrating a strong commitment to quality and efficacy is no longer just a good practice; it's a critical factor for success in a market where consumers are well-equipped to compare and contrast offerings.

- In 2024, the global e-commerce market reached an estimated $6.3 trillion, highlighting the vast reach of online information.

- Consumers are increasingly relying on online reviews and product comparisons, with studies showing over 90% of consumers read online reviews before making a purchase.

- Auxly's focus on product consistency and transparent labeling directly addresses this heightened customer awareness.

Influence of Retailers and Provincial Distributors

In Canada's cannabis sector, provincial distributors and licensed retailers are critical gatekeepers for producers like Auxly. These entities wield considerable influence by dictating product availability, shelf placement, and final consumer pricing. Auxly's success hinges on cultivating robust relationships and presenting compelling product offerings to these powerful intermediaries to secure vital market access.

The bargaining power of customers, particularly through these retail channels, is a significant factor for Auxly. For instance, in 2023, the average price per gram of dried cannabis in Canada hovered around $7.00, a figure influenced by the pricing strategies of retailers and distributors who negotiate terms with producers.

- Provincial Control: Each province or territory in Canada has unique regulations and distribution models, meaning Auxly must adapt its strategy for each market, increasing complexity and the power of provincial bodies.

- Retailer Influence: Licensed retailers, especially larger chains, can demand favorable terms, promotional support, and exclusive product listings, directly impacting Auxly's sales volume and profitability.

- Price Sensitivity: Consumers, influenced by retailer pricing, can shift demand towards lower-priced alternatives, forcing producers to compete on cost, thereby amplifying the bargaining power of the end customer through their purchasing choices.

The bargaining power of customers in the Canadian cannabis market is substantial, driven by product abundance, low switching costs, and increased information access. This empowers consumers to demand better quality and pricing. Auxly must navigate this by building strong brand loyalty and offering differentiated products.

| Factor | Impact on Auxly | 2023/2024 Data/Observation |

|---|---|---|

| Product Variety | Increases consumer choice, amplifying bargaining power. | Canada's legal market offers diverse product categories beyond dried flower. |

| Switching Costs | Minimal, allowing easy brand or product changes. | Consumers readily explore new brands, putting pressure on existing market share. |

| Information Access | Enables informed purchasing decisions, demanding transparency. | Over 90% of consumers consult online reviews before buying; global e-commerce reached $6.3 trillion in 2024. |

| Price Sensitivity | Drives demand towards lower-cost alternatives. | Average price per gram of dried cannabis in Canada was around $7.00 in 2023. |

Full Version Awaits

Auxly Porter's Five Forces Analysis

This preview displays the full Auxly Porter's Five Forces Analysis, providing a comprehensive examination of the competitive landscape within the cannabis industry. You are viewing the exact document that will be delivered to you immediately upon purchase, ensuring no discrepancies or missing sections. This detailed analysis covers the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitute products, and the intensity of rivalry among existing competitors, all presented in a ready-to-use format.

Rivalry Among Competitors

The Canadian cannabis market is quite crowded, with a substantial number of licensed producers actively competing. This high number of players, despite some ongoing consolidation, means many companies are fighting to gain and hold onto market share. They achieve this by offering a diverse array of products that cater to various consumer preferences and needs across different cannabis categories.

Auxly, as the fourth-largest Canadian Licensed Producer, finds itself in a competitive landscape populated by both significantly larger entities and smaller, specialized companies. This dynamic forces Auxly to constantly innovate and differentiate its product offerings and market strategies to stand out amidst the intense rivalry.

While the Canadian legal cannabis market saw significant growth, the initial rapid expansion has moderated. This shift, coupled with persistent oversupply issues, has amplified competitive rivalry. Companies are now intensely vying for market share, often resorting to price reductions to attract consumers, which directly impacts profitability.

The oversupply situation has been a defining challenge. For instance, by late 2023, Health Canada data indicated a substantial surplus of dried cannabis, far exceeding domestic demand. This imbalance forces producers to operate at lower margins, making it harder to achieve consistent profitability and increasing the pressure on companies like Auxly to differentiate and optimize operations.

Auxly's reported improvements in profitability for 2024 and projections for 2025 suggest a successful strategy in navigating this competitive landscape. This indicates that the company has managed to control costs, improve product mix, or gain market share effectively, demonstrating resilience amidst industry-wide pricing pressures and oversupply.

Companies in the cannabis sector, including Auxly, actively engage in product differentiation and innovation to stand out. This includes developing new product categories like Cannabis 2.0 (edibles, beverages, topicals) and the emerging Cannabis 3.0. Auxly's experience with its Back Forty brand, which achieved the status of the #1 cannabis brand in Canada, highlights its capability in fostering brand loyalty and carving out a distinct market position amidst intense competition.

Exit Barriers for Competitors

High fixed costs in cultivation, processing, and regulatory compliance, along with specialized assets, present significant exit barriers for competitors in the cannabis industry. For example, the capital expenditure for a licensed cannabis cultivation facility can easily run into millions of dollars, making it difficult for underperforming companies to cease operations without substantial losses.

These elevated exit barriers mean that unprofitable companies may remain in the market longer than they otherwise would. This prolonged presence can exacerbate oversupply issues and intensify pricing pressures, thereby heightening competitive rivalry. While industry consolidation is occurring, some firms might continue to operate at a loss, impacting market dynamics.

- High Capital Investment: Significant upfront costs for cultivation, processing, and licensing create financial hurdles for exiting firms.

- Specialized Assets: Unique equipment and infrastructure required for cannabis operations have limited alternative uses, increasing exit costs.

- Regulatory Entanglement: The complex and evolving regulatory landscape can make winding down operations a lengthy and costly process.

- Lingering Unprofitable Players: The inability to easily exit forces some financially strained companies to continue operating, contributing to market saturation.

Market Concentration and Consolidation

The Canadian cannabis sector is witnessing significant consolidation, as larger entities absorb smaller competitors to bolster their market presence and operational efficiencies. Auxly's strategic debt reduction and profitability initiatives align with this broader industry trend, positioning it to compete more effectively. This wave of mergers and acquisitions is actively reshaping the competitive dynamics within the market.

This consolidation is driven by the pursuit of economies of scale and enhanced market share. For instance, in 2023, the Canadian cannabis market saw several notable M&A deals, reflecting this intensified competitive pressure. Auxly's own financial maneuvers, such as its significant debt repayment in late 2023, are indicative of a strategy to strengthen its balance sheet and emerge as a more formidable player in this consolidating environment.

- Market Consolidation: Larger Canadian cannabis companies are actively acquiring smaller players.

- Economies of Scale: Consolidation aims to reduce costs and improve efficiency through increased size.

- Auxly's Strategy: Auxly is focused on debt reduction and profitability to solidify its market position.

- Competitive Landscape: Ongoing M&A activity is fundamentally altering the competitive structure of the industry.

Competitive rivalry within the Canadian cannabis sector remains intense, characterized by a high number of licensed producers vying for market share. This rivalry is further fueled by persistent oversupply, which has led to price compression and reduced profit margins for many companies. Auxly, as a significant player, must continually innovate and differentiate its offerings to succeed in this challenging environment.

The drive for market share is evident in the aggressive pricing strategies employed by many companies. Auxly's reported improvements in profitability for 2024 and projections for 2025 suggest a successful navigation of these pressures, possibly through cost efficiencies and a strong product mix, such as its leading Back Forty brand.

Industry consolidation is a key trend, with larger players acquiring smaller ones to achieve economies of scale. Auxly’s strategic debt reduction in late 2023 aligns with this consolidation, aiming to strengthen its position against competitors. This ongoing M&A activity is reshaping the competitive landscape, making it crucial for companies to maintain financial health and market relevance.

| Metric | Q4 2023 (CAD Millions) | Q1 2024 (CAD Millions) | Q2 2024 (CAD Millions) |

|---|---|---|---|

| Auxly Revenue | 19.6 | 21.5 | 23.1 |

| Canadian Cannabis Market Size (Est.) | N/A | N/A | N/A |

| Key Competitor Revenue (Est.) | N/A | N/A | N/A |

SSubstitutes Threaten

The primary substitute for legal cannabis products in Canada is the illicit market. This underground sector thrives by offering significantly lower prices, a direct result of circumventing taxes and the substantial costs associated with regulatory adherence and quality control. For instance, reports from 2023 indicated that the illicit market continued to capture a considerable portion of cannabis sales, even as the legal market expanded, underscoring its persistent threat to legitimate businesses.

Auxly's strategy to combat this threat hinges on its ability to offer competitive pricing and maintain a high standard of product quality. By providing consumers with appealing alternatives that rival or surpass the illicit market's offerings in terms of value and experience, Auxly aims to attract and retain customers, thereby mitigating the impact of this persistent substitute.

Consumers looking for recreational experiences have a wide array of alternatives to cannabis, including alcohol, tobacco, and other psychoactive substances, both legal and illicit. These substitutes, while not identical, satisfy a similar consumer desire for leisure, relaxation, or altered states of consciousness. For instance, in 2024, global alcohol sales were projected to reach over $1.5 trillion, demonstrating the significant market share these established substitutes hold.

Auxly's strategy hinges on differentiating its cannabis products by emphasizing quality, specific cannabinoid profiles, and desired effects, aiming to make cannabis a more appealing and preferred option over these traditional recreational choices. This focus on product innovation and consumer experience is crucial in a market where consumers have numerous avenues for recreational enjoyment and stress relief.

For consumers seeking wellness and health solutions, a variety of substitutes exist for cannabis-based products. Traditional over-the-counter medications and prescription pharmaceuticals remain significant alternatives, offering established efficacy and widespread availability for various ailments. For instance, the global pharmaceutical market was valued at over $1.5 trillion in 2023, demonstrating the scale of these established substitutes.

The increasing consumer interest in CBD and the development of 'Cannabis 3.0' products, such as infused skincare and nutraceuticals, further blur the lines with conventional wellness markets. This trend means that consumers looking for relaxation or specific health benefits might opt for products like essential oils, herbal supplements, or even specialized dietary foods, which are readily available and often perceived as less regulated than cannabis products.

Hemp-Derived Products

The growing market for hemp-derived cannabinoids, like Delta-8 THC, introduces a new wave of substitutes. These products often navigate distinct regulatory pathways, potentially allowing for more competitive pricing compared to traditional cannabis products. This evolving landscape necessitates careful observation by Auxly, as consumer preferences may shift, impacting demand for their existing offerings.

The expansion of hemp-derived products represents a significant threat of substitutes for Auxly. For instance, in 2024, the U.S. hemp market continued its robust growth, with a significant portion of this growth attributed to cannabinoid products beyond CBD. While specific figures for Delta-8 THC's market share are still emerging and vary by state due to differing regulations, industry reports from late 2023 and early 2024 indicated a substantial consumer base exploring these alternatives.

- Market Diversion: Hemp-derived cannabinoids can attract consumers seeking alternative wellness or recreational options, potentially diverting market share from Auxly's core cannabis products.

- Regulatory Arbitrage: Products operating under less stringent regulations than traditional cannabis may offer a cost advantage, making them more appealing to price-sensitive consumers.

- Innovation Pressure: The rapid innovation in hemp-derived products compels Auxly to continually assess its own product development pipeline and market positioning to remain competitive.

- Consumer Education: Auxly must also consider the need for clear consumer education regarding the differences and potential impacts of various cannabinoids, both hemp-derived and those from traditional cannabis sources.

Traditional Pharmaceuticals

For individuals managing conditions like chronic pain, anxiety, or insomnia, traditional pharmaceutical drugs represent a substantial substitute for medical cannabis. The established efficacy and accessibility of these conventional treatments present a significant competitive hurdle for the cannabis sector.

The medical cannabis market must demonstrate clear advantages in terms of efficacy, safety profiles, and patient accessibility to attract and retain consumers who have established routines with existing pharmaceutical options. For instance, in 2024, the global pharmaceutical market was valued at over $1.6 trillion, highlighting the sheer scale of entrenched competition.

- Established Efficacy: Pharmaceuticals often have decades of clinical research supporting their use for specific conditions.

- Regulatory Approval: Traditional drugs undergo rigorous, lengthy approval processes, building consumer trust.

- Insurance Coverage: Many pharmaceutical treatments are covered by insurance, making them more affordable than out-of-pocket medical cannabis expenses.

The threat of substitutes for legal cannabis is multifaceted, encompassing the illicit market, alternative recreational substances, and conventional wellness products. Auxly's strategy must address these by offering competitive value, superior quality, and distinct product benefits to capture consumer preference and mitigate market diversion.

The illicit market remains a primary substitute due to its lower pricing, a direct consequence of avoiding taxes and regulatory compliance costs. For example, in 2023, the illicit market continued to hold a significant share of cannabis sales in Canada, despite the legal market's growth.

Consumers seeking recreational experiences have numerous alternatives like alcohol and tobacco, which hold substantial market share. Global alcohol sales were projected to exceed $1.5 trillion in 2024, illustrating the entrenched competition from these established substitutes.

For wellness and health needs, traditional pharmaceuticals and even herbal supplements are significant substitutes. The global pharmaceutical market's valuation surpassed $1.5 trillion in 2023, underscoring the scale of these alternatives.

| Substitute Category | Key Characteristics | Competitive Factors for Auxly | Relevant Market Data (2023-2024) |

|---|---|---|---|

| Illicit Market | Lower prices, no regulation | Price competitiveness, quality assurance | Significant market share retention in Canada (2023) |

| Recreational Substances (e.g., Alcohol) | Established consumer habits, widespread availability | Product differentiation, unique consumer experiences | Global alcohol sales projected >$1.5 trillion (2024) |

| Wellness/Health Products (e.g., Pharmaceuticals) | Proven efficacy, insurance coverage | Demonstrating superior medical benefits, safety profiles | Global pharmaceutical market >$1.5 trillion (2023) |

| Hemp-Derived Cannabinoids | Potentially different regulatory pathways, varied pricing | Product innovation, clear consumer education on differences | Robust growth in U.S. hemp market (2024) |

Entrants Threaten

The Canadian cannabis sector faces substantial regulatory hurdles, significantly deterring new entrants. Obtaining the necessary licenses for cultivation, processing, and distribution is a complex and costly undertaking, with Health Canada’s rigorous oversight demanding extensive compliance measures.

These high barriers mean that aspiring companies must navigate intricate application processes and absorb significant operational costs from the outset. For instance, the average cost to obtain a standard cannabis cultivation license in Canada can range from tens of thousands to over a hundred thousand dollars, not including ongoing compliance and security expenses.

The cannabis industry, particularly for a company like Auxly, faces a significant threat from new entrants due to the substantial capital required to establish operations. Building out cultivation facilities, processing plants, and distribution networks demands millions in upfront investment. For instance, in 2024, the average cost to set up a medium-sized cannabis cultivation facility in Canada could range from $5 million to $15 million, depending on scale and technology.

Furthermore, the ongoing federal illegality of cannabis in certain key markets, including the United States at the federal level, limits access to traditional banking and financing. This financial barrier, coupled with stringent regulatory compliance costs, effectively deters many potential new players from entering the space. Auxly's existing, scaled infrastructure and operational experience provide a crucial competitive advantage against these high entry costs.

New entrants in the cannabis market, like Auxly, often struggle with the need for established distribution channels. Building relationships with provincial distributors and securing crucial retail shelf space is a significant hurdle, especially when incumbents already possess strong, existing agreements. This makes it tough for newcomers to reach a broad consumer base.

Gaining widespread market penetration requires substantial investment in sales and marketing efforts. For instance, in 2024, the Canadian cannabis market continued to see consolidation, with established players leveraging their existing distribution networks to maintain market share, making it harder for smaller, newer entrants to gain traction without significant capital outlay.

Brand Building and Customer Loyalty

New entrants face a significant hurdle in building brand recognition and fostering customer loyalty, especially in markets where established players like Auxly have cultivated strong brand equity. For instance, Auxly's Back Forty brand has invested in marketing and product development, creating a loyal customer base. Newcomers must allocate substantial resources to marketing campaigns and product differentiation to even begin to chip away at this loyalty.

The challenge is amplified by the increasing importance of branding in consumer purchasing decisions. Without a compelling brand narrative and consistent quality, new entrants struggle to capture consumer attention amidst a crowded marketplace. This means significant upfront investment is required to establish a brand presence that can rival established competitors.

- Brand Investment: New entrants need to invest heavily in marketing and advertising to build brand awareness, a cost that can be prohibitive.

- Customer Loyalty: Overcoming existing customer loyalty to established brands like Auxly's requires superior product offerings or aggressive pricing strategies.

- Market Saturation: In a market with many similar products, a strong brand is crucial for differentiation and attracting initial customers.

Market Saturation and Consolidation

The Canadian cannabis market is showing signs of significant maturity, leading to increased saturation and a notable wave of consolidation among licensed producers. This trend makes it considerably more challenging for new entrants to establish a presence. With fewer untapped market segments and fierce competition for existing consumer demand, the industry's attractiveness for newcomers is diminishing.

As of early 2024, the landscape reflects this reality. For instance, the number of active retail cannabis stores in Canada continued to grow, but the rate of new store openings has begun to moderate in many provinces as prime locations become occupied. This saturation means that any new player must contend with established brands and a crowded retail environment, requiring substantial differentiation and marketing investment to carve out market share.

- Market Saturation: The Canadian cannabis market has seen a rapid increase in licensed producers and retail outlets, leading to an oversupply of products in certain categories.

- Consolidation: Several mergers and acquisitions have occurred among Canadian cannabis companies, reducing the number of independent players and concentrating market power.

- Intensified Competition: Existing companies are fighting for market share, often through aggressive pricing and promotional strategies, making it difficult for new entrants to compete on cost or brand recognition.

- Limited Niches: Most readily accessible market niches have already been addressed by existing operators, requiring new companies to either innovate significantly or target highly specialized, potentially smaller, customer segments.

The threat of new entrants into the Canadian cannabis market, particularly for companies like Auxly, remains moderate due to significant capital requirements and regulatory complexities. While the market has matured, the upfront investment for cultivation, processing, and distribution, estimated between $5 million to $15 million for a medium-sized facility in 2024, continues to be a substantial deterrent.

Furthermore, the need for established distribution channels and strong brand recognition, which incumbents like Auxly have cultivated, presents a considerable challenge for newcomers. Overcoming existing customer loyalty and market saturation requires substantial marketing investment, making it difficult for new players to gain traction without significant differentiation.

| Factor | Impact on New Entrants | Example/Data Point (2024) |

|---|---|---|

| Capital Investment | High Barrier | Estimated $5M-$15M for medium cultivation facility |

| Regulatory Compliance | High Barrier | Complex licensing and ongoing oversight by Health Canada |

| Distribution Channels | Significant Hurdle | Securing provincial agreements and retail shelf space |

| Brand Recognition/Loyalty | Challenging to Overcome | Established brands like Auxly's Back Forty require substantial marketing |

| Market Saturation | Increasing Challenge | Moderating new store openings, occupied prime locations |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Auxly leverages data from industry-specific market research reports, company financial statements, and regulatory filings. We also incorporate insights from trade publications and analyst reports to provide a comprehensive view of the competitive landscape.