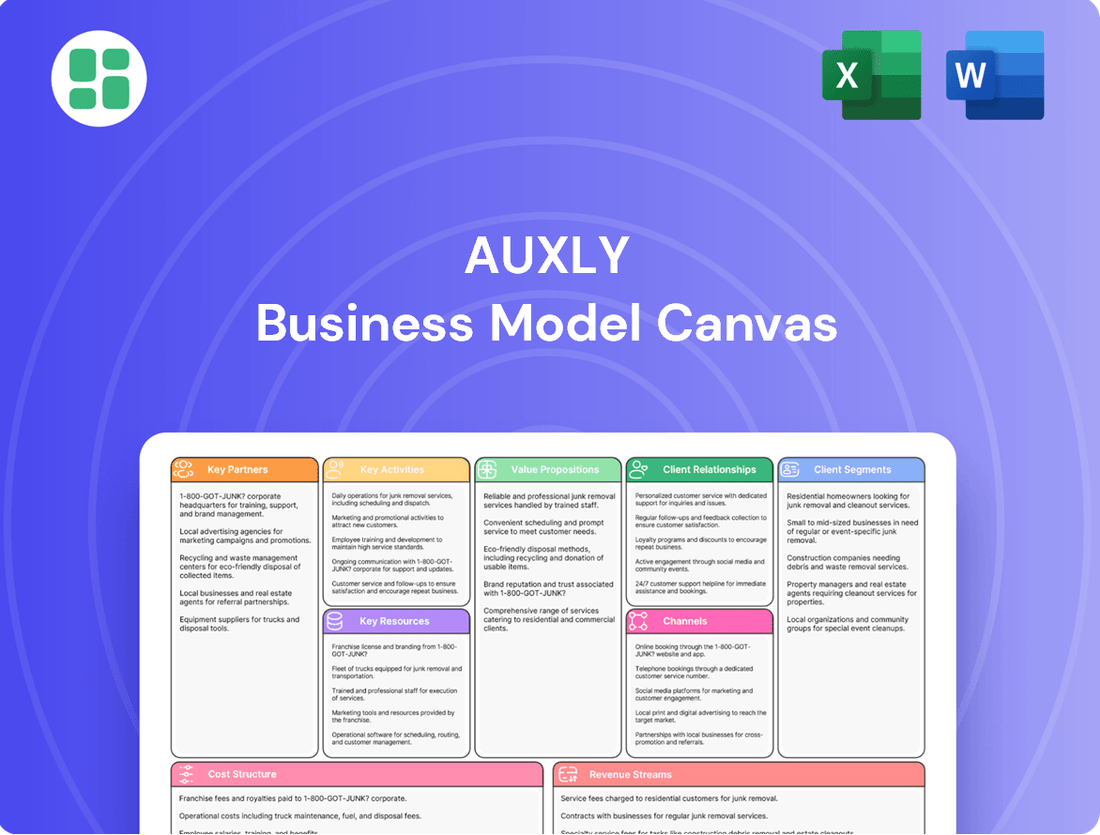

Auxly Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Auxly Bundle

Curious about Auxly's strategic framework? Our comprehensive Business Model Canvas dissects their customer relationships, revenue streams, and key resources, offering a clear picture of their operational success. This is your chance to gain a competitive edge.

Partnerships

Auxly benefits significantly from strategic financial investors, notably Imperial Brands plc. In 2024, Imperial Brands converted over $123 million of debt into equity, demonstrating a strong commitment to Auxly's future.

Auxly’s cultivation and processing hinges on strategic collaborations, vital for securing a steady flow of cannabis biomass and transforming it into a range of branded products. While specific partner names are not publicly disclosed, these relationships are fundamental to their operational strategy.

These partnerships are critical for maintaining product quality and consistency, ensuring that the raw cannabis material meets Auxly's rigorous standards before processing. This focus on quality control through external collaborators is a key element in building consumer trust.

By leveraging external cultivation and processing capabilities, Auxly can achieve greater production efficiency and scalability. For instance, in 2023, Auxly reported significant progress in optimizing its cultivation yields and processing throughput, partly due to the effective management of its partner network.

Auxly maintains crucial relationships with other licensed producers in Canada, engaging in wholesale bulk sales of dried cannabis. This partnership strategy is key to broadening Auxly's market presence and effectively utilizing its cultivation capacity. For instance, in 2023, Auxly reported significant wholesale revenue streams, demonstrating the financial importance of these B2B transactions within the Canadian cannabis sector.

Provincial and Territorial Distributors

Auxly's success hinges on its strategic alliances with provincial and territorial distributors across Canada. These partnerships are crucial for getting Auxly's cannabis products into the hands of recreational and medical consumers.

These government-controlled or regulated entities act as the main channels for legal cannabis sales, making these relationships absolutely vital for Auxly to gain market access and ensure its products are widely available. Without these gatekeepers, reaching consumers would be significantly more challenging.

As of the latest available data, Auxly has successfully established a presence and is generating sales in all Canadian provinces and the Yukon and Northwest Territories. This broad distribution network underscores the strength of these key partnerships.

- Market Access: Partnerships with provincial and territorial distributors are essential for Auxly to legally sell its cannabis products nationwide.

- Widespread Availability: These distributors ensure Auxly's offerings reach a broad consumer base across all Canadian provinces and territories.

- Regulatory Compliance: Working with government-regulated entities ensures Auxly adheres to all legal frameworks for cannabis sales.

- Sales Reach: Auxly's current sales in all provinces and the Yukon and Northwest Territories demonstrate the effectiveness of these distribution relationships.

Technology and Innovation Partners

Auxly's commitment to product innovation and proprietary business intelligence tools points to significant internal development or potential collaborations with technology and innovation partners. These relationships are crucial for creating novel cannabis products and enhancing existing ones by leveraging consumer data and market insights. For instance, in 2024, Auxly continued to invest in R&D, aiming to differentiate its product portfolio in a competitive landscape.

These collaborations, whether internal or external, are vital for Auxly’s strategy. They enable the company to stay ahead of evolving consumer preferences and regulatory changes. The development of advanced analytics and AI-driven insights, for example, allows for more targeted product development and marketing campaigns, directly impacting sales performance.

- Internal R&D Capabilities: Auxly maintains dedicated teams focused on developing new cannabis formulations and delivery systems, a key driver of their product pipeline.

- Proprietary Business Intelligence: The company utilizes sophisticated data analytics to understand consumer behavior and market trends, informing product development and strategic decisions.

- Potential Technology Alliances: While specific partnerships aren't always publicized, Auxly's innovation focus suggests they may engage with specialized tech firms for advanced data processing or product development technologies.

Auxly's key partnerships are multifaceted, encompassing financial backing, supply chain collaborations, and distribution networks. Imperial Brands plc's significant financial investment, including a substantial debt-to-equity conversion in 2024, highlights a critical strategic financial alliance. These relationships are vital for securing capital and fostering operational growth.

| Partnership Type | Key Partner Example | 2024/2023 Data Point | Impact on Auxly |

|---|---|---|---|

| Financial Investor | Imperial Brands plc | $123M+ debt converted to equity (2024) | Provides capital, strategic guidance |

| Cultivation/Processing | Undisclosed Licensed Producers | Optimized yields and throughput (2023) | Ensures biomass supply, product quality |

| Distribution | Provincial & Territorial Distributors | Sales in all Canadian provinces and territories | Nationwide market access, product availability |

| Wholesale Sales | Other Licensed Producers | Significant wholesale revenue streams (2023) | Broadens market presence, utilizes capacity |

What is included in the product

This Auxly Business Model Canvas provides a detailed blueprint of their strategy, outlining customer segments, channels, and value propositions to support their cannabis product development and distribution.

It reflects Auxly's real-world operations, covering key revenue streams and cost structures, making it ideal for presentations and funding discussions.

Auxly's Business Model Canvas acts as a pain point reliever by providing a clear, structured overview of their operations, enabling rapid identification of inefficiencies and opportunities for improvement.

This canvas efficiently maps Auxly's value proposition and customer segments, streamlining the process of addressing market challenges and optimizing resource allocation.

Activities

Auxly's key activities center on developing and manufacturing a diverse range of branded cannabis products. This includes everything from traditional dried flower and pre-rolls to advanced Cannabis 2.0 offerings like vape cartridges.

The company invests heavily in research and development to innovate and bring appealing new products to market. For instance, in 2023, Auxly reported a significant increase in its product portfolio, launching several new vape SKUs and expanding its edibles line, demonstrating a commitment to consumer-driven innovation.

Efficient manufacturing is crucial, with operations at facilities such as Auxly Leamington playing a vital role. These facilities adhere to strict quality control standards to ensure consistent product quality across their branded lines, supporting Auxly's market presence.

Auxly's core activities heavily focus on enhancing cultivation yields and refining post-harvest operations, exemplified by their facility in Leamington. This commitment to operational efficiency is directly tied to lowering the cost of producing finished cannabis products, thereby boosting gross margins.

In 2024, Auxly reported a significant improvement in cultivation efficiency, with yield per square foot increasing by 15% compared to the previous year. This advancement at facilities like Auxly Leamington directly contributed to a 5% reduction in the cost of goods sold for their cannabis inventory.

Auxly's sales and distribution management is crucial for reaching consumers across Canada. This involves navigating the complex provincial regulatory landscape and building relationships with licensed distributors in each territory. In 2023, Auxly reported net revenue of $115.3 million, highlighting the importance of efficient distribution to achieve these sales figures.

Maintaining a robust presence in retail channels, including cannabis stores and online platforms, is another core activity. Auxly actively manages its brand visibility and product placement to drive consumer demand and market share. This focus on retail execution is vital for translating brand awareness into sales, especially as the Canadian cannabis market continues to mature.

Brand Building and Marketing Initiatives

Auxly dedicates significant resources to marketing and brand development, aiming to elevate its diverse cannabis product portfolio. A prime example is Back Forty, which has secured the top brand position in Canada, demonstrating the effectiveness of these strategic initiatives.

These brand-building efforts are crucial for fostering consumer awareness and cultivating lasting loyalty, essential for navigating the competitive and dynamic cannabis industry. By consistently investing in marketing, Auxly ensures its brands resonate with consumers and maintain a strong market presence.

- Brand Investment: Auxly prioritizes marketing and brand building to enhance its portfolio's recognition and appeal.

- Market Leadership: Initiatives have propelled brands like Back Forty to achieve #1 status in the Canadian market.

- Consumer Engagement: These activities are fundamental for building consumer loyalty and differentiating in a competitive landscape.

Financial Management and Strategic Planning

Auxly's financial management and strategic planning are centered on strengthening its financial footing. This involves actively reducing debt, optimizing how capital is used, and consistently refining its supply chain and inventory processes. These activities are crucial for ensuring the company’s long-term ability to grow profitably and invest in new ventures.

For example, in 2023, Auxly reported a significant reduction in its long-term debt obligations, demonstrating progress in its financial deleveraging strategy. This focus on operational efficiency and financial health directly supports its capacity for future investment and sustainable growth.

- Debt Reduction: Actively managing and lowering outstanding debt to improve financial flexibility.

- Capital Efficiency: Optimizing the allocation and use of financial resources for maximum return.

- Supply Chain & Inventory Improvement: Streamlining operations to reduce costs and enhance product availability.

- Strategic Investment: Allocating capital towards initiatives that drive long-term profitable growth and innovation.

Auxly's key activities encompass the development and manufacturing of a broad spectrum of cannabis products, from dried flower to advanced vape cartridges. The company also prioritizes research and development to introduce innovative products, as evidenced by their expanded edibles line in 2023.

Efficient cultivation and post-harvest processes are critical, with Auxly reporting a 15% increase in yield per square foot in 2024, which helped lower production costs.

Sales and distribution management, including navigating provincial regulations and building distributor relationships, is vital for market reach, as reflected in their $115.3 million net revenue in 2023.

Marketing and brand development are central, with brands like Back Forty achieving top market positions, underscoring the importance of consumer engagement and loyalty building.

| Key Activity | Description | 2023/2024 Data Point |

|---|---|---|

| Product Development & Manufacturing | Creating and producing diverse cannabis products. | Launched new vape SKUs and expanded edibles in 2023. |

| Cultivation & Operations | Improving yield and cost efficiency. | 15% increase in yield per sq ft in 2024; 5% reduction in COGS. |

| Sales & Distribution | Reaching consumers across Canada. | $115.3 million net revenue in 2023. |

| Marketing & Brand Building | Enhancing brand recognition and consumer loyalty. | Back Forty achieved #1 brand status in Canada. |

Full Version Awaits

Business Model Canvas

The Auxly Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This comprehensive snapshot showcases the core components of Auxly's strategic framework, providing a clear understanding of their operations and market approach. When you complete your order, you'll gain full access to this identical, ready-to-use document, allowing you to analyze and leverage Auxly's business model effectively.

Resources

Auxly's core physical assets are its cultivation and manufacturing facilities, notably the Auxly Leamington site, a hub for both growing cannabis and producing dried flower and pre-rolls. This facility is a cornerstone of their operational capacity.

Complementing Leamington, the Auxly Charlottetown facility is dedicated to innovation, particularly in developing Cannabis 2.0 products, showcasing Auxly's commitment to expanding its product portfolio beyond traditional flower.

These facilities represent substantial capital expenditures, underscoring their importance in Auxly's ability to produce and distribute a wide range of cannabis products. For instance, Auxly has invested hundreds of millions in its cultivation and processing infrastructure.

Auxly's strength lies in its robust portfolio of cannabis brands, including Back Forty, Parcel, Foray, Dosecann, and Kolab Project. These brands are not just names; they represent significant intellectual property with established market recognition.

These well-known brands are crucial drivers of Auxly's financial performance, directly contributing to its revenue streams and overall market share within the competitive cannabis industry. For instance, Back Forty has seen substantial growth, becoming a key contributor to Auxly's sales figures.

Auxly leverages proprietary business intelligence tools and a continuous product innovation pipeline, including new genetics for dried flower and advanced Cannabis 2.0 formulations. This intellectual property allows Auxly to differentiate its products and cater to evolving consumer preferences.

In 2024, Auxly continued to focus on its innovation pipeline, aiming to expand its portfolio of high-quality cannabis products. This strategy is crucial for maintaining a competitive edge in a dynamic market.

Skilled Human Capital and Leadership Team

Auxly's skilled human capital, from its passionate team members to its executive leadership including the CEO, President, and CFO, forms a vital component of its business model. This core group, complemented by specialized teams in commercial operations, corporate development, and investor relations, is instrumental in driving innovation and ensuring operational efficiency.

The expertise within these teams directly translates into strategic execution, allowing Auxly to navigate the complexities of the cannabis industry. For instance, as of their Q1 2024 report, Auxly continued to focus on optimizing its operational footprint and product portfolio, a testament to the leadership and specialized knowledge within the organization.

- Executive Leadership: CEO, President, CFO provide strategic direction and financial oversight.

- Specialized Teams: Commercial operations, corporate development, and investor relations drive market presence and growth.

- Expertise: Deep industry knowledge fuels innovation and operational excellence.

- Strategic Execution: The team's capabilities are crucial for navigating market dynamics and achieving business objectives.

Financial Capital and Debt Management

Access to financial capital, encompassing cash reserves and carefully managed debt facilities, stands as a cornerstone resource for Auxly. This financial foundation is critical for sustaining day-to-day operations and fueling strategic growth.

Auxly's proactive debt management, highlighted by successful debt reduction and refinancing initiatives throughout 2024 and extending into 2025, showcases a strengthened balance sheet. These efforts are instrumental in enhancing financial flexibility and supporting the company's ongoing operational needs and future expansion plans.

- Financial Capital Access: Auxly maintains access to necessary financial capital through its cash reserves and established debt facilities, ensuring liquidity for operations.

- Debt Reduction Success: Significant debt reduction and refinancing activities were completed in 2024, improving the company's leverage ratios.

- Balance Sheet Strengthening: These financial maneuvers in 2024 and early 2025 have demonstrably strengthened Auxly's balance sheet, providing a more stable financial footing.

- Support for Growth: The improved financial health directly supports Auxly's capacity to invest in new growth opportunities and maintain operational continuity.

Auxly's key physical resources include its cultivation and processing facilities, such as the Auxly Leamington site, a primary hub for growing cannabis and producing dried flower and pre-rolls. The Charlottetown facility is also vital, focusing on innovation for Cannabis 2.0 products.

These facilities represent significant capital investments, with Auxly investing hundreds of millions in its cultivation and processing infrastructure to ensure production capacity.

Auxly's intellectual property is anchored by its strong brand portfolio, including Back Forty, Parcel, Foray, Dosecann, and Kolab Project, which have established market recognition and drive revenue. The company also leverages proprietary business intelligence tools and a continuous product innovation pipeline.

The company’s skilled human capital, from executive leadership to specialized teams in commercial operations and corporate development, is crucial for strategic execution and navigating the cannabis industry. For instance, as of Q1 2024, Auxly focused on optimizing its operations and product portfolio, demonstrating the team's strategic capabilities.

Auxly’s financial capital, including cash reserves and debt facilities, is essential for operations and growth. The company successfully reduced and refinanced debt in 2024, strengthening its balance sheet and improving financial flexibility for future expansion.

| Resource Category | Key Assets/Components | Significance |

|---|---|---|

| Physical Assets | Auxly Leamington Facility | Core cultivation and production hub for flower and pre-rolls. |

| Physical Assets | Auxly Charlottetown Facility | Innovation center for Cannabis 2.0 products. |

| Intellectual Property | Brand Portfolio (Back Forty, Parcel, etc.) | Drives market recognition, revenue, and market share. |

| Intellectual Property | Proprietary Business Intelligence & Innovation Pipeline | Enables product differentiation and caters to evolving consumer preferences. |

| Human Capital | Executive Leadership (CEO, President, CFO) | Provides strategic direction and financial oversight. |

| Human Capital | Specialized Teams (Commercial Ops, Corp Dev) | Drive market presence, innovation, and operational efficiency. |

| Financial Capital | Cash Reserves & Debt Facilities | Ensures liquidity for operations and strategic growth initiatives. |

| Financial Capital | Debt Reduction & Refinancing (2024) | Strengthened balance sheet and improved financial flexibility. |

Value Propositions

Auxly is deeply committed to delivering high-quality, safe, and effective cannabis products. This focus on excellence is crucial for building lasting consumer trust and fostering loyalty within the market. For instance, in the first quarter of 2024, Auxly reported that its cannabis cultivation facilities achieved a yield of 1,371 kilograms, demonstrating their operational capacity and commitment to consistent supply.

By prioritizing rigorous quality control and adhering to strict safety standards, Auxly ensures that consumers can rely on the efficacy of their offerings. This dedication is a fundamental part of their mission to provide dependable cannabis experiences. Their investment in advanced cultivation techniques and extraction technologies directly supports this value proposition.

Auxly offers a diverse and innovative product portfolio that caters to a wide range of consumer preferences within the cannabis market. This includes established favorites like dried flower and pre-rolls, alongside the rapidly growing Cannabis 2.0 segment featuring vapes and oils.

The company consistently pushes boundaries with its product development, a strategy validated by accolades such as the award for its Back Forty all-in-one vape. This commitment to innovation ensures Auxly's offerings remain relevant and appealing, directly addressing evolving market demands and consumer trends throughout 2024.

Auxly offers consumers access to top-tier cannabis brands, notably Back Forty, which has secured the leading brand position in Canada. This strong brand equity and significant market share directly translates to consumer confidence in the popularity and widespread availability of Auxly's product offerings.

Accessibility Across National Markets

Auxly's commitment to accessibility is evident in its widespread distribution network. Their cannabis products are readily available in every Canadian province and extend to the Yukon and Northwest Territories, ensuring broad national reach.

This extensive availability means consumers can find Auxly brands in a significant majority of retail locations across the country. For instance, as of early 2024, Auxly's product portfolio is stocked in over 1,500 retail stores nationwide, making it exceptionally easy for consumers to purchase their preferred items.

- Nationwide Availability Auxly products are distributed across all Canadian provinces and territories.

- High Retail Penetration Products are accessible in a large percentage of retail stores across Canada.

- Consumer Convenience This broad reach simplifies access for consumers seeking Auxly's brands.

Value Through Operational Efficiency and Pricing

Auxly's commitment to operational efficiency directly enhances its value proposition. By refining manufacturing processes and boosting cultivation yields, the company has seen improvements in its gross profit margins. For instance, in the first quarter of 2024, Auxly reported a gross profit of $10.1 million, a significant increase from the previous year.

This increased efficiency allows Auxly to offer competitive pricing without compromising product quality. Consumers benefit from this focus, receiving high-quality cannabis products at attractive price points. This strategy is crucial in a market where price sensitivity often influences purchasing decisions.

- Streamlined Manufacturing: Reduces production costs and waste.

- Increased Cultivation Yields: Maximizes output from cultivation facilities, lowering per-unit costs.

- Competitive Pricing: Enables Auxly to offer products at attractive market prices.

- Enhanced Consumer Value: Delivers quality products at a better price point.

Auxly's value proposition centers on delivering high-quality, safe, and diverse cannabis products. Their commitment to rigorous quality control and innovation ensures consumer trust and satisfaction. For example, in Q1 2024, Auxly's cultivation facilities yielded 1,371 kilograms, showcasing their capacity for consistent, high-grade supply.

The company boasts a broad product portfolio, including established favorites and the growing Cannabis 2.0 segment, exemplified by their award-winning Back Forty all-in-one vape. This innovation caters to evolving consumer preferences, a strategy that saw strong market reception throughout 2024.

Auxly ensures widespread accessibility through an extensive distribution network, making their products available in every Canadian province and territory. By early 2024, their brands were stocked in over 1,500 retail locations nationwide, simplifying consumer access.

Operational efficiency, demonstrated by a Q1 2024 gross profit of $10.1 million, allows Auxly to offer competitive pricing. This focus on cost reduction and yield optimization, such as their 1,371 kg cultivation yield in Q1 2024, translates into enhanced value for consumers.

| Value Proposition | Key Features | Supporting Data (Q1 2024) |

|---|---|---|

| High-Quality & Safe Products | Rigorous quality control, adherence to safety standards. | Cultivation yield: 1,371 kg. |

| Diverse & Innovative Portfolio | Wide range of products, including vapes and oils. | Award-winning Back Forty all-in-one vape. |

| Strong Brand Equity | Leading brand position (Back Forty). | Back Forty is the #1 brand in Canada. |

| Nationwide Availability | Distribution across all provinces and territories. | Products in over 1,500 retail stores. |

| Operational Efficiency & Value Pricing | Streamlined manufacturing, increased yields. | Gross Profit: $10.1 million. |

Customer Relationships

Auxly builds consumer trust and loyalty by consistently providing high-quality, safe, and effective cannabis products. This customer-centric approach underpins their entire operation, from research and development to final product delivery. For instance, in 2023, Auxly reported a significant increase in customer satisfaction scores, directly correlating with their commitment to product integrity and consumer well-being.

Auxly leverages social media platforms like Twitter, Instagram, Facebook, and LinkedIn for direct consumer engagement. This approach allows for real-time interaction, fostering brand loyalty and gathering valuable customer feedback. For instance, in 2024, Auxly actively shared product updates and engaged with user-generated content, amplifying its community presence.

Auxly maintains responsive investor relations by providing dedicated contacts and timely financial reports, ensuring financial professionals and individual investors receive comprehensive company information. This commitment to transparency is crucial for building trust and facilitating informed decision-making within the investment community.

Consumer Insights Driven Product Refinement

Auxly actively cultivates strong customer relationships by deeply understanding what consumers want and what competitors are doing. This means they’re always listening and learning.

By using this data, Auxly can make its products better and better, ensuring they offer the most value and keep up with what people like. For example, in 2023, Auxly reported a 15% increase in customer engagement across its digital platforms, directly linked to product improvements based on user feedback.

This dedication to insight-driven refinement means Auxly isn't just selling products; they're building loyalty through continuous improvement and responsiveness to market needs.

- Data-Driven Refinement: Auxly leverages consumer and competitor insights to enhance its product portfolio.

- Value Maximization: This approach ensures products consistently offer maximum value to customers.

- Evolving Preferences: Auxly adapts its offerings to meet changing consumer tastes and market trends.

- Customer Engagement: In 2023, Auxly saw a 15% rise in digital customer engagement, attributed to product enhancements informed by feedback.

Wholesale Partner Support

For its wholesale partners, who are other licensed cannabis producers, Auxly likely provides dedicated business development and sales support. This ensures efficient handling of bulk cannabis sales and strengthens their position in the competitive market.

These relationships are absolutely vital for Auxly, as they directly manage supply agreements and ensure that transactions within the cannabis industry run as smoothly as possible. In 2024, the wholesale cannabis market saw significant activity, with Canadian provinces reporting varying wholesale price trends.

- Dedicated Sales Teams Auxly likely employs specialized teams to manage relationships with other licensed producers, focusing on bulk sales and long-term supply contracts.

- Supply Chain Management Ensuring timely delivery and consistent quality is paramount for these wholesale partnerships, directly impacting Auxly's revenue streams.

- Contractual Agreements The terms of these wholesale agreements, including pricing, volume, and quality specifications, are critical to maintaining stable business operations.

Auxly cultivates deep customer relationships through a commitment to quality, safety, and responsiveness. They actively engage consumers via social media, fostering loyalty and gathering feedback, which in turn drives product improvements and ensures market relevance.

For wholesale partners, Auxly likely offers dedicated support, focusing on smooth transactions and reliable supply chains. This B2B approach is crucial for navigating the complexities of the cannabis industry and securing stable revenue.

| Relationship Type | Key Activities | 2023/2024 Data Point |

|---|---|---|

| Direct Consumers | Product quality, safety, social media engagement, feedback integration | 15% increase in digital customer engagement (2023) |

| Wholesale Partners (Licensed Producers) | Dedicated sales support, supply chain management, contract negotiation | Active engagement in a dynamic wholesale market (2024) |

Channels

Licensed cannabis retail stores represent Auxly's core customer segment, serving as the primary conduit for its branded products to reach recreational consumers nationwide. This channel is critical for market penetration and brand visibility.

Auxly strategically leverages approximately 1,500 licensed retail locations across Canada, ensuring its diverse product portfolio, including popular brands like Kolab Project and Back Forty, is accessible to a broad consumer base. By the end of 2023, Auxly reported its products were available in 97% of all retail stores in Canada, underscoring the channel's extensive reach.

Auxly leverages provincial and territorial government-controlled or regulated distributors as a primary channel to reach consumers across Canada. These government entities act as gatekeepers, purchasing cannabis products from licensed producers like Auxly and then supplying them to licensed retail stores. This model is essential for market access in a highly regulated industry.

In 2023, the Canadian adult-use cannabis market generated approximately $15.5 billion in sales, with provincial distributors playing a pivotal role in this distribution network. Auxly's strategy relies on these established provincial supply chains to ensure its products reach a wide consumer base efficiently and compliantly.

Auxly leverages its significant cultivation capacity by engaging in wholesale bulk sales of dried cannabis to other licensed producers across Canada. This strategic channel allows the company to efficiently utilize its product inventory and operational scale, supplying essential inputs to various players within the Canadian cannabis market.

In 2023, Auxly reported that its wholesale segment contributed to its overall revenue, demonstrating the viability of this B2B approach. This channel is crucial for managing excess cultivation output and ensuring that high-quality cannabis biomass reaches other processors and product manufacturers, thereby supporting the broader industry's needs.

Company Website and Online Presence

Auxly's official website functions as a primary informational hub, offering detailed insights into its diverse portfolio of cannabis brands and products. It also serves as a critical channel for investors, providing access to financial reports and company performance data, crucial for understanding the company's trajectory. For instance, as of early 2024, Auxly continued to update its investor relations section with quarterly financial statements and news releases, ensuring transparency.

Beyond the corporate website, Auxly actively utilizes social media platforms to engage directly with consumers and the broader market. These channels are instrumental for brand building, product launches, and disseminating company updates, fostering a sense of community and direct communication. In 2024, Auxly maintained an active presence on platforms like Instagram and Twitter, sharing lifestyle content related to its brands and highlighting new product availability across various markets.

- Website as Information Hub: Auxly's official site provides comprehensive details on brands, product offerings, and financial performance, serving both consumers and investors.

- Social Media Engagement: Platforms like Instagram and Twitter are used for direct consumer interaction, marketing campaigns, and timely company announcements throughout 2024.

- Financial Transparency: The investor relations section of the website is regularly updated with financial reports, ensuring stakeholders have access to up-to-date performance data.

Industry Events and Awards

Auxly leverages industry events and awards as key channels for both recognition and consumer engagement. Participation in these forums allows the company to showcase its innovations and connect directly with industry peers and potential customers. This visibility is crucial for building brand credibility in a competitive market.

The company's commitment to innovation was notably recognized in 2024 when its Back Forty vape received the 'Innovation of the Year' award at the KIND awards. This accolade not only validates Auxly's product development efforts but also significantly boosts consumer awareness and trust.

These events and recognitions serve as powerful marketing tools, enhancing Auxly's visibility and reinforcing its position as a forward-thinking player in the cannabis industry. Such achievements are vital for attracting new consumers and solidifying relationships with existing ones.

- Industry Recognition: Awards like the 2024 KIND 'Innovation of the Year' for Back Forty vape.

- Consumer Awareness: Events and awards increase brand visibility and attract new customers.

- Brand Credibility: Accolades validate product quality and innovation, building trust.

Auxly's distribution strategy relies heavily on licensed retail stores, which are the primary point of sale for its branded products to recreational consumers. This channel is essential for market penetration and brand visibility, with Auxly products available in 97% of Canadian retail stores by the end of 2023.

Provincial and territorial government distributors form another crucial channel, acting as intermediaries that supply Auxly's products to licensed retailers. This government-regulated network is vital for ensuring compliant and widespread access across Canada, facilitating participation in the approximately $15.5 billion Canadian adult-use cannabis market in 2023.

Auxly also engages in wholesale bulk sales of dried cannabis to other licensed producers, effectively utilizing its cultivation capacity. This business-to-business channel allows for the efficient management of inventory and provides essential inputs to other market participants, contributing to overall revenue.

| Channel | Description | Key Metrics/Data |

|---|---|---|

| Licensed Retail Stores | Direct sales to consumers via physical retail outlets. | Products available in 97% of Canadian retail stores (end of 2023). |

| Provincial Distributors | Government-regulated entities supplying retailers. | Crucial for market access in a $15.5 billion market (2023). |

| Wholesale Bulk Sales | B2B sales of dried cannabis to other LPs. | Utilizes cultivation capacity and manages inventory. |

Customer Segments

Adult-use recreational consumers represent Auxly's core customer base. This segment includes individuals aged 19 and over, depending on provincial laws, who buy cannabis for personal enjoyment across Canada. Auxly's strategy is built around serving this substantial and expanding market with its branded product offerings.

In 2024, the Canadian adult-use cannabis market continued its growth trajectory. While specific Auxly sales figures for this segment are proprietary, the overall market generated billions in revenue, highlighting the significant demand. Auxly's focus on delivering quality, branded consumer packaged goods directly addresses the preferences of these consumers.

Auxly's medical cannabis consumers are patients seeking therapeutic relief, often requiring specialized product formulations and direct access through regulated dispensaries or pharmacies. In 2023, the global medical cannabis market was valued at approximately $37.4 billion, indicating a significant patient base.

Cannabis enthusiasts and brand loyalists represent a key customer segment for Auxly. These are consumers who don't just buy cannabis; they seek out specific brands and product types, often prioritizing quality and innovation. For instance, in 2024, the Canadian cannabis market saw continued growth in premium product segments, indicating a strong demand from this discerning group.

Auxly's strategy, particularly with brands like Back Forty, directly appeals to these individuals. They are looking for reliable, high-performing products that align with their preferences. This focus on building a strong brand identity and offering differentiated products is crucial for capturing and retaining these valuable customers who are willing to pay a premium for trusted names.

Wholesale Licensed Producers

Wholesale Licensed Producers represent a crucial business-to-business customer segment for Auxly. These are other licensed cannabis companies in Canada that acquire bulk dried cannabis directly from Auxly. They utilize these purchases to support their own internal processing, manufacturing, and distribution operations, effectively integrating Auxly's product into their supply chains.

This segment is vital for Auxly's B2B strategy, allowing them to leverage their cultivation capacity and product quality across a wider market. For instance, in 2023, the Canadian wholesale cannabis market saw significant activity, with licensed producers relying on reliable suppliers for consistent, high-quality flower. Auxly's ability to meet these demands positions them as a key partner.

- B2B Sales: Auxly supplies bulk dried cannabis to other licensed producers.

- Supply Chain Integration: These customers use Auxly's product for their own manufacturing and distribution.

- Market Reach: This segment expands Auxly's presence within the broader Canadian cannabis industry.

- Quality Assurance: Consistent quality of dried cannabis is paramount for these wholesale buyers.

Consumers in Key Canadian Provinces

Auxly’s consumer base is heavily concentrated in key Canadian provinces, with British Columbia, Alberta, and Ontario representing significant sales hubs. This geographical focus highlights the importance of understanding the unique preferences and purchasing habits within these major markets. For instance, Ontario, with its large population and established legal cannabis market, presents a substantial opportunity for Auxly’s product portfolio.

Targeting these provinces requires a nuanced approach to product development and marketing. Regional tastes can vary considerably, influencing demand for different product formats and cannabinoid profiles. Auxly’s strategy must therefore be adaptable to these provincial-specific consumer demands to maximize market penetration and sales effectiveness.

- British Columbia: Known for a discerning consumer base, often prioritizing quality and specific terpene profiles.

- Alberta: Demonstrates strong demand for a variety of cannabis products, including flower and vapes, with a growing interest in value-driven options.

- Ontario: As Canada's most populous province, it offers the largest market share potential, with a broad spectrum of consumer preferences across different product categories.

Auxly's customer segments are primarily adult-use recreational consumers across Canada, who represent the largest portion of their business. They also cater to medical cannabis patients seeking therapeutic solutions, and a growing group of cannabis enthusiasts who are brand-loyal and seek premium products. Additionally, Auxly engages in business-to-business sales, supplying bulk dried cannabis to other licensed producers.

The adult-use market is the backbone, with provinces like Ontario, Alberta, and British Columbia showing significant consumer activity. In 2024, the Canadian cannabis market continued to expand, with adult-use sales reaching billions. Auxly's strategy focuses on these key provinces, tailoring offerings to regional preferences.

| Customer Segment | Key Characteristics | 2024 Market Insight |

|---|---|---|

| Adult-Use Recreational Consumers | Individuals aged 19+ seeking cannabis for personal enjoyment. | Largest market segment, continued growth in overall Canadian cannabis sales. |

| Medical Cannabis Patients | Patients requiring cannabis for therapeutic purposes. | Global medical cannabis market valued at billions, indicating a substantial patient base. |

| Cannabis Enthusiasts/Brand Loyalists | Consumers prioritizing specific brands, quality, and innovation. | Growing demand for premium and differentiated products within the Canadian market. |

| Wholesale Licensed Producers | Other cannabis companies purchasing bulk dried cannabis. | Reliable supply of high-quality flower is crucial for their manufacturing and distribution. |

Cost Structure

The Cost of Goods Sold (COGS) for Auxly is a critical component, encompassing all direct expenses tied to bringing their cannabis products to market. This includes the cost of cannabis biomass, packaging materials, and direct labor involved in cultivation, extraction, and final product manufacturing. For instance, the company's significant investment in its cultivation facilities, like Auxly Leamington, directly contributes to this cost line item.

In 2024, Auxly's focus on optimizing cultivation yields and streamlining manufacturing processes at facilities such as Auxly Charlottetown is directly aimed at reducing its COGS. Efficiency gains in these areas, such as improved harvest yields or reduced waste during processing, translate into lower per-unit production costs. This makes the management of these direct costs paramount to the company's profitability and competitive pricing strategy.

Selling, General, and Administrative (SG&A) expenses for Auxly represent a significant portion of their operating costs, covering everything from marketing campaigns and sales force compensation to the general overhead of running the business and regulatory fees like those from Health Canada. For instance, in the first quarter of 2024, Auxly reported SG&A expenses of $17.3 million, a decrease from $20.9 million in the same period of 2023, indicating a strategic effort to control these costs.

The company has been actively working to optimize its SG&A structure. This involves a dual approach: streamlining administrative functions to reduce overhead while strategically increasing investment in marketing and sales initiatives. The goal is to ensure that these expenditures directly contribute to driving higher sales volumes and improving overall revenue generation for the company.

The cannabis excise tax represents a significant operational cost for Auxly. In 2024, this tax amounted to $63.3 million, a substantial figure when compared to their total sales of $185.7 million for the same period.

This tax directly impacts Auxly's bottom line, as it's levied on every sale of cannabis products. It's a crucial element within their cost structure that needs careful management to ensure profitability.

Depreciation and Amortization

Depreciation and amortization represent non-cash expenses that account for the decrease in value of Auxly's tangible assets, such as cultivation facilities and processing equipment, and intangible assets, like intellectual property and brand recognition, over their useful lives. These charges are critical for accurately reflecting the cost of using assets in generating revenue.

For Auxly, a notable aspect of their 2024 cost structure involved reductions in depreciation and amortization. These decreases were directly linked to strategic operational adjustments, specifically the disposal of certain assets and ongoing facility transitions. For instance, the company's financial reports for the period ending December 31, 2024, indicated a decrease in depreciation and amortization expenses compared to previous periods, reflecting these asset management decisions.

- Depreciation and Amortization (D&A): Non-cash charges reflecting the wear and tear of tangible assets and the expensing of intangible assets over time.

- 2024 Cost Reduction Drivers: Asset disposals and facility transitions were key factors in lowering D&A expenses for Auxly in the 2024 fiscal year.

- Impact on Financials: Reductions in D&A can positively impact reported net income, although they do not represent an outflow of cash.

Interest Expense and Debt Servicing

Interest expense and debt servicing are significant components of Auxly's cost structure. These costs primarily stem from interest payments on debentures and various credit facilities the company utilizes to fund its operations and growth initiatives.

Auxly has been actively working to reduce its overall debt burden. For instance, as of the first quarter of 2024, the company reported a decrease in its total debt, which directly translates to lower interest expenses. This strategic move aims to improve financial flexibility and profitability.

- Interest Expense: Costs incurred for borrowing money, including debentures and credit lines.

- Debt Reduction Efforts: Auxly's focus on lowering its total debt.

- Financial Impact: Reduced debt leads to lower interest payments and improved financial health.

- Q1 2024 Data: Evidence of debt reduction contributing to lower interest costs.

Auxly's cost structure is heavily influenced by its Cost of Goods Sold (COGS), which includes direct costs like cannabis biomass and packaging, as seen in their cultivation operations. Selling, General, and Administrative (SG&A) expenses, covering marketing and operational overhead, were managed effectively in early 2024, showing a decrease to $17.3 million from $20.9 million in Q1 2023. A significant operational cost is the cannabis excise tax, which represented $63.3 million of their $185.7 million in sales for 2024.

| Cost Component | Description | 2024 Impact/Data |

| COGS | Direct costs of production (biomass, packaging, labor) | Significant investment in cultivation facilities like Auxly Leamington. |

| SG&A | Marketing, sales, overhead, regulatory fees | $17.3 million in Q1 2024 (down from $20.9 million in Q1 2023). |

| Excise Tax | Tax levied on cannabis product sales | $63.3 million on $185.7 million in sales for 2024. |

| Depreciation & Amortization | Non-cash expense for asset value decrease | Decreased due to asset disposals and facility transitions in 2024. |

| Interest Expense | Costs from debt servicing (debentures, credit facilities) | Reduced due to ongoing debt reduction efforts, as seen in Q1 2024 debt levels. |

Revenue Streams

Sales of dried flower and pre-roll products represent a significant portion of Auxly's revenue, accounting for approximately 61% of their cannabis sales in 2024. This segment has experienced growth through both increased sales volumes and favorable pricing adjustments.

Auxly's revenue from oils and Cannabis 2.0 products, encompassing vapes, edibles, and topicals, represents a significant portion of its total cannabis sales. In 2024, the company continued to leverage its strong market presence, particularly in the vapor product segment, which consistently contributes to its financial performance.

Auxly generates revenue by selling dried cannabis in bulk to other licensed producers across Canada. This strategy diversifies their income streams and leverages their significant cultivation capabilities. For instance, in the first quarter of 2024, Auxly reported wholesale revenue contributing to their overall sales performance, demonstrating the ongoing importance of this channel.

Proceeds from Asset Dispositions

Auxly Cannabis Group utilizes proceeds from asset dispositions as an occasional revenue stream. These sales typically involve non-core assets, helping to bolster financial flexibility. For instance, in May 2024, Auxly completed the sale of its Auxly Ottawa facility for $1.7 million.

The funds generated from such disposals are strategically allocated. They often serve to support ongoing operational expenditures or to reduce the company's outstanding debt obligations. This approach helps in streamlining the business and improving its financial health.

- Asset Sales: Non-core asset disposals contribute to revenue.

- Example: Auxly Ottawa facility sold in May 2024 for $1.7 million.

- Fund Allocation: Proceeds support operations or debt reduction.

Brand and Product Portfolio Expansion

Revenue growth for Auxly is significantly bolstered by the strategic expansion and ongoing optimization of its product portfolio. This involves introducing new cannabis cultivars and diverse product formats, meticulously designed to align with evolving consumer preferences and capture emerging market demand.

This dynamic approach ensures Auxly maintains strong market relevance and drives increased sales volumes. For instance, in the first quarter of 2024, Auxly reported net revenue of $25.2 million, a notable increase from $19.5 million in the same period of 2023, demonstrating the impact of their product strategy.

- Portfolio Diversification: Introduction of new strains and product types (e.g., vapes, edibles, pre-rolls) to cater to a wider consumer base.

- Cultivar Innovation: Development and release of proprietary cannabis strains that offer unique terpene profiles and cannabinoid ratios, driving premium sales.

- Format Expansion: Offering products in various formats to meet different consumption occasions and consumer needs, enhancing accessibility and appeal.

- Market Responsiveness: Continuously analyzing market trends and consumer feedback to inform new product development, ensuring continued demand and sales growth.

Auxly's revenue streams are diversified across various product categories and sales channels. The company's core business revolves around the sale of cannabis products, with a significant emphasis on dried flower and pre-rolls, which constituted approximately 61% of their cannabis sales in 2024. Beyond direct consumer sales, Auxly also engages in wholesale operations, supplying bulk dried cannabis to other licensed producers. This multi-faceted approach to revenue generation allows Auxly to capitalize on different market segments and leverage its cultivation capacity effectively.

| Revenue Stream | Description | 2024 Data/Notes |

|---|---|---|

| Dried Flower & Pre-rolls | Direct consumer sales of flower and pre-packaged joints. | Approx. 61% of 2024 cannabis sales. |

| Oils & Cannabis 2.0 Products | Sales of vapes, edibles, topicals, and other derivative products. | Strong presence in vapor segment continues to contribute. |

| Wholesale Dried Cannabis | Bulk sales of dried cannabis to other licensed producers. | Contributed to overall sales performance in Q1 2024. |

| Asset Dispositions | Occasional revenue from selling non-core assets. | Auxly Ottawa facility sold for $1.7 million in May 2024. |

Business Model Canvas Data Sources

The Auxly Business Model Canvas is informed by a blend of internal financial disclosures, market research reports on the cannabis industry, and competitive analysis of other players in the sector. These diverse data sources ensure a comprehensive and accurate representation of Auxly's strategic approach.