Aussie Broadband PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aussie Broadband Bundle

Navigate the evolving telecommunications landscape with our comprehensive PESTLE analysis of Aussie Broadband. Understand the political shifts, economic fluctuations, and technological advancements impacting their operations. This expertly crafted report provides the strategic intelligence you need to anticipate challenges and capitalize on opportunities. Download the full version now to gain a critical edge.

Political factors

Government policies surrounding the National Broadband Network (NBN) are a cornerstone for Aussie Broadband's operations. For instance, the Australian government's ongoing commitment to upgrading NBN fixed wireless and satellite services, with a significant investment of $480 million announced in the 2023-24 budget for enhancements, directly influences the quality and availability of services Aussie Broadband can offer in regional areas.

Changes to NBN Co's wholesale pricing structures, a key component of the government's telecommunications policy, can materially impact Aussie Broadband's profit margins. In 2024, NBN Co implemented revised pricing, including a new wholesale discount for higher speed tiers, which aims to encourage uptake of faster services, potentially benefiting providers like Aussie Broadband.

Furthermore, any shifts in government priorities regarding digital inclusion and infrastructure investment, such as initiatives to close the digital divide, will necessitate strategic adjustments from Aussie Broadband. The government's focus on ensuring equitable broadband access across Australia remains a critical factor shaping the competitive landscape and future growth avenues for the company.

The stability of Australia's telecommunications regulatory landscape is paramount for Aussie Broadband's strategic planning. For instance, the ACCC's ongoing oversight of wholesale service agreements and pricing, as seen in its reviews of the National Broadband Network (NBN) pricing structures, directly impacts Aussie Broadband's operational costs and competitive positioning.

Frequent shifts in regulations concerning data privacy, network security, or consumer complaint handling can introduce significant operational and compliance challenges. A predictable regulatory framework, such as the established framework for spectrum allocation and licensing, allows Aussie Broadband to make substantial, long-term capital investments in its fibre network with greater confidence.

The Australian Competition and Consumer Commission (ACCC) actively monitors the telecommunications market. In 2024, the ACCC continued its focus on wholesale service competition, particularly concerning the National Broadband Network (NBN). Policies aimed at ensuring fair access and preventing monopolistic behaviour by dominant players directly shape the environment in which Aussie Broadband operates, potentially impacting wholesale costs and retail pricing strategies.

Government interventions, such as potential spectrum allocation decisions or regulatory reviews of wholesale access arrangements, can create both headwinds and tailwinds. For instance, a move to foster greater competition among wholesale providers could reduce input costs for Aussie Broadband. Conversely, new regulations could impose additional compliance burdens or limit certain business models, requiring strategic adaptation.

Digital Economy and Connectivity Initiatives

The Australian government's commitment to a strong digital economy and enhanced national connectivity, as seen in initiatives like the Regional Connectivity Program, directly benefits telecommunications companies. These programs often include funding and policy support for expanding broadband infrastructure, particularly in underserved areas. Aussie Broadband can strategically align with these national digital agendas to secure potential subsidies and participate in infrastructure development projects, thereby expanding its reach and service offerings.

Political emphasis on digital transformation and improved internet access creates a favourable environment for companies like Aussie Broadband. For instance, the federal government's 2023-24 budget allocated significant funding towards digital infrastructure and skills development, signalling a clear political priority. This focus can translate into tangible opportunities for Aussie Broadband to grow its customer base and upgrade its network capabilities through government partnerships or grants.

- Government Investment: The Australian government continues to invest in digital infrastructure, with a stated goal of achieving 99% high-speed broadband coverage by 2026.

- Regional Development Focus: Political initiatives often target regional and rural areas, aligning with Aussie Broadband's expansion strategies into these markets.

- Policy Support: Favourable regulatory environments and policies that encourage competition and investment in telecommunications infrastructure are crucial political factors.

International Trade Agreements and Data Sovereignty

While Aussie Broadband is primarily focused on the Australian market, international trade agreements and evolving data sovereignty policies can still have an indirect influence. These agreements, such as those governing the import of telecommunications equipment, could affect the cost and availability of network infrastructure components. For instance, changes in trade tariffs or import regulations stemming from agreements like the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) could impact procurement strategies.

Furthermore, data sovereignty concerns, which are gaining traction globally, might necessitate adjustments in how data is stored and processed, even for a domestic ISP. While direct cross-border data flows for core services might be limited, the underlying hardware and software often have global supply chains. Staying abreast of these broader political trends is crucial for maintaining compliance and ensuring the strategic resilience of Aussie Broadband's operations.

- Trade Tariffs: Potential changes in tariffs on network equipment could impact capital expenditure.

- Data Localization: Evolving data sovereignty laws may influence data storage and processing requirements.

- Supply Chain Resilience: International agreements can affect the stability and cost of sourcing critical network components.

Government policies, particularly those concerning the National Broadband Network (NBN), significantly shape Aussie Broadband's operational landscape. The Australian government's commitment to enhancing regional connectivity, with substantial investments like the $480 million for fixed wireless and satellite upgrades announced in the 2023-24 budget, directly impacts service quality in underserved areas.

Changes in NBN Co's wholesale pricing, a key policy lever, directly affect Aussie Broadband's profitability. For instance, the 2024 pricing adjustments, including new wholesale discounts for higher speed tiers, aim to boost faster service adoption, potentially benefiting providers like Aussie Broadband.

Government initiatives promoting digital inclusion and aiming to close the digital divide necessitate strategic adaptation from Aussie Broadband, as equitable broadband access remains a critical policy objective influencing the competitive environment.

The Australian Competition and Consumer Commission (ACCC) actively monitors the telecommunications market, with its 2024 focus on NBN wholesale service competition directly impacting Aussie Broadband's operating costs and pricing strategies by ensuring fair access and preventing anti-competitive practices.

What is included in the product

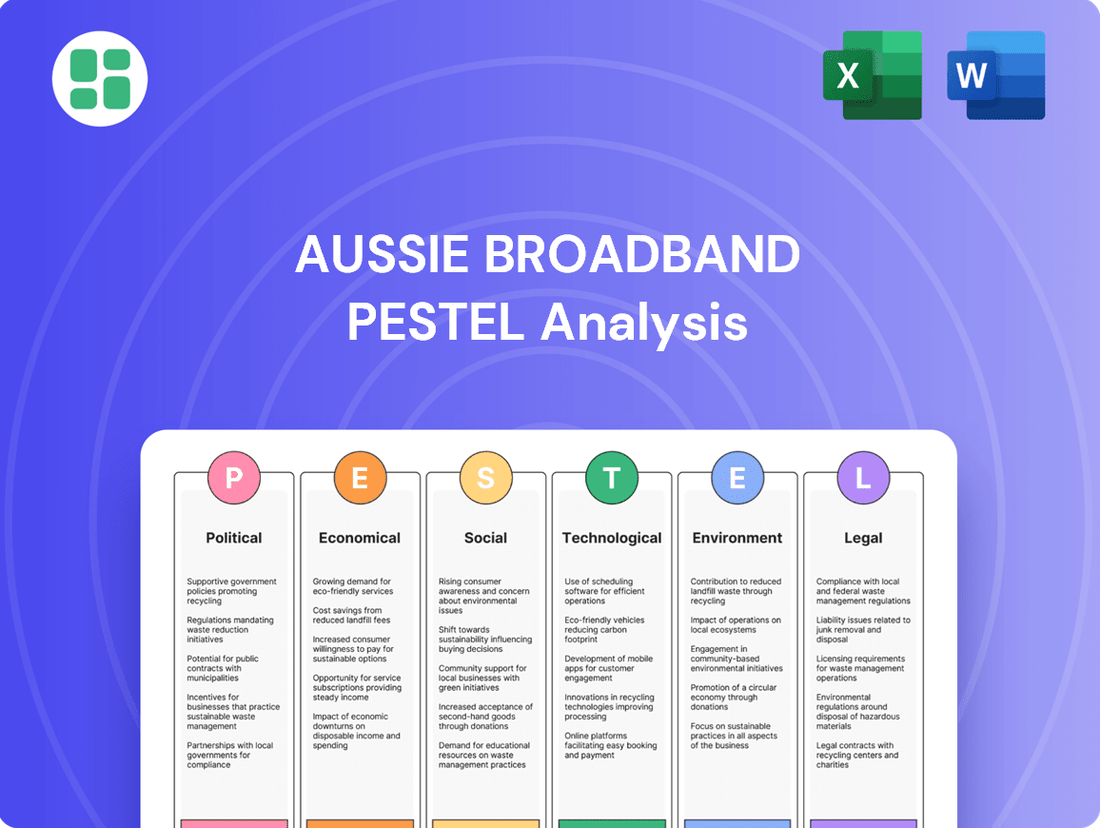

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Aussie Broadband, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers forward-looking insights to support strategic decision-making and identify both threats and opportunities within the Australian telecommunications market.

Aussie Broadband's PESTLE analysis offers a clear, summarized version of external factors, acting as a pain point reliever by simplifying complex market dynamics for easier referencing during strategic planning.

Economic factors

Consumer disposable income is a critical driver for Aussie Broadband, directly impacting demand for its internet and phone services. As of the March quarter of 2024, Australian households saw their disposable income grow by 1.1%, reaching $287.5 billion. This increase suggests a potentially stronger capacity for consumers to invest in higher-tier NBN plans or additional services, benefiting providers like Aussie Broadband.

However, the landscape is nuanced. While disposable income has seen growth, persistent inflation and rising interest rates throughout 2023 and into early 2024 have put pressure on household budgets. This cost-of-living squeeze means that even with nominal income increases, consumers might remain price-sensitive, potentially opting for more basic plans or delaying upgrades, which could temper revenue growth for telecommunication companies.

Inflationary pressures directly affect Aussie Broadband's operational expenses. Wholesale NBN access fees, a significant cost component, are subject to these pressures. For instance, the Australian Bureau of Statistics reported a 5.4% increase in the Consumer Price Index (CPI) for the year ending March 2024, indicating a broad rise in costs across the economy.

Energy costs, crucial for powering network infrastructure, also contribute to the inflationary impact. As of early 2024, wholesale electricity prices in Australia have seen volatility, with some reports indicating significant year-on-year increases. Similarly, wage growth, while beneficial for employees, adds to the company's overheads as it seeks to retain skilled staff in a competitive market.

Aussie Broadband faces the challenge of balancing these escalating operational costs with the need to maintain competitive pricing. The company must strategically decide how much of these increased expenses can be absorbed versus passed on to consumers, a delicate act to avoid customer attrition in a price-sensitive market.

Interest rates directly influence Aussie Broadband's ability to fund significant capital expenditures like network expansion. For instance, if the Reserve Bank of Australia (RBA) maintains its cash rate at 4.35% as of May 2024, borrowing costs for large-scale infrastructure projects become more predictable, but any upward adjustment would increase financing expenses.

Higher interest rates can make it more costly for Aussie Broadband to secure loans for building out its fibre network or upgrading its technology. This increased cost of capital might lead the company to re-evaluate or delay certain expansion plans, impacting its growth pace in a competitive market.

Aussie Broadband's financial strategy hinges on securing competitive financing. The company's ability to negotiate favorable loan terms, especially as interest rates fluctuate, is paramount to managing its debt and funding future investments efficiently, thereby supporting its long-term growth objectives.

Economic Growth and Business Investment

Australia's economic growth directly fuels demand for business telecommunications. As the economy expands, businesses are more inclined to invest in robust internet, voice, and data solutions, which is a core offering for Aussie Broadband. For instance, Australia's GDP grew by an estimated 1.5% in 2023, indicating a generally supportive environment for business investment in essential services like connectivity.

A healthy business climate encourages companies to upgrade their infrastructure, including seeking reliable, high-speed internet. This trend benefits Aussie Broadband's business customer segment, as companies prioritize connectivity for operational efficiency and growth. The ongoing digital transformation across industries further amplifies this need.

- Economic Growth Impact: Positive GDP growth in Australia typically translates to increased business spending on technology and communication services.

- Investment in Connectivity: Thriving businesses are more likely to invest in high-speed, reliable internet to support operations, cloud services, and remote workforces.

- Recessionary Effects: Conversely, economic downturns can lead to reduced capital expenditure by businesses, potentially impacting demand for new or upgraded telecommunication services.

- Digital Transformation Driver: The broader trend of digital transformation across Australian industries necessitates advanced connectivity solutions, benefiting providers like Aussie Broadband.

Exchange Rate Fluctuations

While Aussie Broadband primarily serves the Australian market, it can still be impacted by exchange rate movements. This exposure arises if the company sources essential equipment, software, or services from overseas suppliers.

A weakening Australian dollar, for instance, directly translates to higher costs for these imported goods. In 2024, the AUD experienced volatility against major currencies, potentially increasing capital expenditure for network upgrades or operational costs for software licenses. For example, a 5% depreciation of the AUD against the USD could add millions to the cost of imported network hardware.

- Increased Import Costs: A weaker AUD makes foreign-sourced equipment and software more expensive.

- Impact on CAPEX and OPEX: Higher costs for imported components can affect capital expenditure budgets and ongoing operational expenses.

- Mitigation Strategies: Companies may consider currency hedging or diversifying their supplier base to manage these risks.

- 2024 AUD Performance: The Australian dollar saw fluctuations against key trading partners throughout 2024, highlighting the relevance of this factor.

Consumer spending habits are heavily influenced by economic conditions. As of the March quarter of 2024, Australian households saw a 1.1% increase in disposable income, reaching $287.5 billion, suggesting potential for increased spending on services like those offered by Aussie Broadband. However, persistent inflation, with the CPI rising 5.4% year-on-year to March 2024, and elevated interest rates (RBA cash rate at 4.35% as of May 2024) continue to squeeze household budgets, potentially leading to price sensitivity and a preference for more basic plans.

Rising operational costs are a significant concern for Aussie Broadband. Inflation impacts wholesale NBN access fees, energy costs for network infrastructure, and wages, all contributing to higher overheads. For instance, the 5.4% CPI increase reflects broad cost pressures across the economy, which the company must manage against competitive pricing pressures.

Economic growth directly impacts business demand for telecommunications. Australia's GDP grew by an estimated 1.5% in 2023, a positive indicator for business investment in essential services like connectivity. Digital transformation trends further amplify the need for robust internet solutions, benefiting Aussie Broadband's business segment.

Exchange rate volatility, particularly the Australian dollar's performance in 2024, affects the cost of imported network equipment and software. A weaker AUD can increase capital expenditure and operational expenses, necessitating careful financial management and potential mitigation strategies like hedging.

Preview Before You Purchase

Aussie Broadband PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Aussie Broadband delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting their business. It provides a strategic overview to inform decision-making.

Sociological factors

The increasing digital literacy across Australia is a significant tailwind for Aussie Broadband, fueling demand for high-speed internet. As more Australians embrace online activities, from remote work to streaming services, the need for dependable broadband becomes paramount. This societal shift directly translates into a larger potential customer base for providers like Aussie Broadband.

Data from the Australian Bureau of Statistics in 2023 indicated that over 90% of Australian households have internet access, with a substantial portion relying on broadband. This growing comfort with digital platforms means Australians are actively seeking better connectivity solutions to support their everyday lives, education, and entertainment needs, directly benefiting companies like Aussie Broadband.

The shift towards work-from-home and hybrid models has dramatically boosted demand for robust home internet. Australians now depend on their NBN connections for everything from critical business meetings to accessing cloud-based work tools, making reliable, high-speed internet a necessity, not a luxury.

This sustained reliance directly translates into a greater appetite for premium NBN plans. For instance, during 2024, reports indicated a continued rise in the uptake of higher speed tiers as households found themselves needing more bandwidth to support multiple users and demanding applications simultaneously.

Australians are increasingly embracing online entertainment, with a significant portion of households relying on streaming services for their media consumption. In 2024, reports indicated that over 80% of Australian internet users regularly accessed video streaming platforms, a trend that is expected to continue growing through 2025. This societal shift directly fuels the demand for robust internet infrastructure capable of supporting high-definition streaming and interactive online gaming without buffering or lag.

Consumers now expect a seamless digital experience, prioritizing internet plans that offer high download speeds and substantial data allowances to accommodate their online entertainment habits. This expectation is a key driver for the market, pushing providers to invest in network upgrades. Aussie Broadband's strategic emphasis on network performance and customer service, particularly its commitment to the nbn network, positions it favorably to meet these evolving consumer demands for reliable and fast internet access.

Demographic Shifts and Urbanization

Australia's population is projected to reach 30 million by 2032, with significant growth concentrated in urban and peri-urban areas. This demographic shift directly impacts demand for broadband, as more people moving into these regions require reliable internet access. Aussie Broadband must strategically expand its network infrastructure and tailor marketing campaigns to these growing population centers to secure new subscribers.

Urbanization trends are particularly strong in Queensland and Victoria, with Brisbane and Melbourne experiencing notable population increases. Understanding the specific connectivity needs of these expanding urban and suburban communities is paramount for Aussie Broadband to offer targeted and effective broadband solutions. For instance, increased demand for higher-speed tiers is likely in these densely populated areas.

- Population Growth: Australia's population is expected to hit 30 million by 2032, primarily in urban areas.

- Urban Concentration: Queensland and Victoria are seeing significant urban population increases, influencing broadband demand.

- Network Expansion: Aussie Broadband needs to align network build-outs with these demographic movements.

- Targeted Marketing: Understanding regional connectivity needs is key for effective customer acquisition.

Customer Expectations for Service and Support

Societal expectations for excellent customer service and technical support are particularly high in essential services like telecommunications, a trend that continues to strengthen. Consumers increasingly value responsiveness, transparency, and effective problem resolution, making these core differentiators for companies like Aussie Broadband.

A strong reputation for customer satisfaction is paramount for retention and attracting new subscribers in Australia's competitive broadband market. For instance, in 2023, customer satisfaction scores remained a critical metric, with many consumers willing to switch providers for demonstrably better support experiences. Aussie Broadband has consistently aimed to meet these elevated expectations.

- High Demand for Responsive Support: Australian consumers expect quick resolution of technical issues and readily available assistance.

- Transparency is Key: Customers value clear communication regarding service disruptions, billing, and support processes.

- Service as a Differentiator: Superior customer service is a significant factor in customer loyalty and acquisition in the telco sector.

- Reputation Management: Positive word-of-mouth and online reviews, driven by excellent support, directly impact market share.

The increasing digital literacy and adoption of remote work models in Australia are driving a sustained demand for high-speed, reliable broadband services. Australians' growing reliance on online platforms for work, education, and entertainment means that robust internet connectivity is no longer a luxury but a necessity. This societal trend directly benefits providers like Aussie Broadband, as consumers actively seek better internet solutions to support their evolving digital lifestyles.

Consumer expectations for seamless digital experiences are high, with a strong emphasis on fast download speeds and ample data allowances. Reports from 2024 indicate that over 80% of Australian internet users regularly engage with streaming services, a behavior that is projected to continue its upward trajectory through 2025. This fuels a market demand for internet plans that can support high-definition content and multiple users without interruption, a key area where Aussie Broadband focuses its network performance and customer service.

The Australian population is experiencing steady growth, particularly in urban and peri-urban areas, with projections suggesting a reach of 30 million by 2032. This demographic shift, concentrated in regions like Queensland and Victoria, directly influences the demand for expanded broadband infrastructure. Aussie Broadband must strategically align its network development with these population movements to effectively capture new subscribers in these growing communities.

Societal expectations for exceptional customer service and transparent communication are paramount in the telecommunications sector, a trend that continues to intensify. Consumers prioritize responsiveness and effective problem resolution, making superior support a critical differentiator. In 2023, customer satisfaction remained a key metric, with many Australians willing to switch providers based on their support experiences, highlighting the importance of Aussie Broadband's commitment to meeting these elevated service standards.

| Sociological Factor | Impact on Aussie Broadband | Relevant Data/Trends (2023-2025) |

|---|---|---|

| Digital Literacy & Remote Work | Increased demand for high-speed broadband. | Over 90% of Australian households had internet access in 2023. Continued growth in work-from-home models. |

| Online Entertainment Consumption | Demand for higher bandwidth and faster speeds. | Over 80% of Australian internet users regularly accessed video streaming in 2024. |

| Population Growth & Urbanization | Need for network expansion in growing areas. | Australia's population projected to reach 30 million by 2032, with growth concentrated in urban centers like Brisbane and Melbourne. |

| Customer Service Expectations | Importance of responsive support and transparency for customer loyalty. | Customer satisfaction scores critical; consumers willing to switch for better support (2023 data). |

Technological factors

The NBN network's continuous evolution, particularly the acceleration of its Fibre-to-the-Premises (FTTP) rollout, directly enhances Aussie Broadband's service delivery capabilities. By mid-2024, NBN Co reported that over 10 million premises were ready for service, with a significant portion of these being FTTP, enabling higher speed tiers. This technological advancement allows Aussie Broadband to offer faster and more reliable internet, attracting customers who prioritize performance.

Aussie Broadband's strategy hinges on effectively leveraging these NBN upgrades. For instance, the company actively promotes its gigabit speed plans, which are made possible by the expanding FTTP footprint. Staying informed about NBN Co's technology roadmap, including planned network enhancements and capacity increases, is crucial for Aussie Broadband's service planning and competitive positioning in the market.

Technological advancements in network infrastructure are crucial for Aussie Broadband. Improvements in routing, peering, and data centre technologies allow the company to boost its network performance and capacity. For instance, by upgrading its core network, Aussie Broadband can handle greater traffic volumes and offer faster speeds, which is essential as data consumption continues to rise across Australia.

Investing in cutting-edge infrastructure directly translates to enhanced service reliability and reduced latency for customers. This focus on network quality is a key differentiator. As of late 2024, the demand for high-speed, low-latency internet remains a primary driver for consumer and business choices, making continuous infrastructure upgrades a necessity for maintaining a competitive edge in the Australian telecommunications market.

Cybersecurity threats are escalating, demanding significant investment from Aussie Broadband. In 2023, the Australian Cyber Security Centre (ACSC) reported a 13% increase in cybercrime incidents, with the telecommunications sector being a key target. This necessitates continuous upgrades to protective measures.

Aussie Broadband must deploy sophisticated firewalls, intrusion detection systems, and robust data encryption to defend against increasingly complex cyberattacks. These technologies are vital for safeguarding sensitive customer information and maintaining the integrity of their network infrastructure.

Proactive cybersecurity isn't just about defense; it's a cornerstone for building customer trust and ensuring uninterrupted service delivery. Reliable security directly translates to a stronger brand reputation and customer loyalty in the competitive Australian market.

Emerging Technologies (e.g., 5G, Satellite Broadband)

The rapid rollout of 5G mobile technology presents a dual-edged sword for Aussie Broadband. While it could offer faster wireless alternatives, potentially drawing some customers away from fixed-line services, it also presents opportunities for enhanced fixed-wireless broadband solutions. By mid-2024, 5G coverage in Australia was expanding significantly, with major providers actively increasing their base stations, impacting the competitive landscape for broadband providers.

Advanced satellite broadband, such as Starlink, is another emerging technology that warrants close attention. These services are improving in speed and accessibility, offering viable broadband options in areas where fixed-line infrastructure is less developed. Aussie Broadband must evaluate the potential for these satellite services to either complement its existing network by serving remote areas or to create new competitive pressures in its core markets.

A strategic assessment of these evolving technologies is crucial for Aussie Broadband's long-term planning. Understanding how 5G and satellite broadband adoption rates influence consumer behaviour and market dynamics will inform decisions on network investment and service development. For instance, by Q1 2025, it's projected that 5G-enabled devices will represent a substantial portion of the Australian mobile market, underscoring the need for a proactive response.

- 5G Expansion: Continued investment in 5G infrastructure by major telcos creates potential for fixed-wireless broadband competition.

- Satellite Broadband Growth: Advancements in satellite technology offer alternative broadband solutions, particularly in underserved regions.

- Market Disruption vs. Complementarity: Aussie Broadband needs to analyze whether these technologies will disrupt its fixed-line market share or offer opportunities for service integration.

- Strategic Adaptation: Monitoring adoption rates and technological advancements is key to maintaining a competitive edge in the evolving broadband sector.

Automation and AI in Customer Service and Operations

Aussie Broadband's integration of automation and AI is a key technological driver. In 2024, the company is likely focusing on AI-powered chatbots to handle a larger volume of customer inquiries, aiming to reduce response times and free up human agents for more complex issues. This technology can also be applied to network monitoring, using predictive analytics to anticipate and resolve potential outages before they impact customers, thereby improving service reliability.

The financial benefits are substantial. For instance, a successful AI implementation in customer service could potentially lower operational costs by 20-30% in specific functions, as reported by industry benchmarks for similar telecom companies. This efficiency gain is crucial for Aussie Broadband's continued growth and its ability to scale operations without a proportional increase in staffing.

- Enhanced Customer Experience: AI chatbots can provide instant 24/7 support, addressing common queries and improving customer satisfaction scores.

- Operational Cost Reduction: Automating routine tasks in customer service and network management can lead to significant savings.

- Proactive Network Management: Predictive analytics can identify and resolve network issues before they cause disruptions, boosting service uptime.

- Scalability and Innovation: Embracing AI and automation is essential for handling increased demand and fostering future service development.

Aussie Broadband's technological landscape is shaped by the NBN's ongoing fibre rollout, which by mid-2024 had made over 10 million premises ready for service, predominantly FTTP. This allows Aussie Broadband to offer faster speeds, a key differentiator. Furthermore, advancements in network infrastructure, including routing and data centre technologies, are critical for boosting performance and capacity, especially as data consumption rises.

Legal factors

The Telecommunications Act 1997 and its accompanying regulations form the bedrock of Aussie Broadband's operational landscape, dictating everything from licensing requirements to how they provide services and access networks. This framework is overseen by the Australian Communications and Media Authority (ACMA), ensuring all players adhere to the rules.

Staying compliant with these legal mandates is non-negotiable for Aussie Broadband. For instance, the Telecommunications (Consumer Protection and Competition) Act 2010 introduced significant changes to competition rules, directly affecting how telcos operate and interact within the market.

Any shifts or updates to this legislative environment, such as potential future reforms around network resilience or data privacy, will directly reshape Aussie Broadband's legal responsibilities and the very structure of their business operations.

The Australian Consumer Law (ACL) significantly shapes Aussie Broadband's operations, mandating fair trading practices and truthful advertising across all its service offerings. This legal framework ensures consumers receive accurate information about internet speeds, pricing, and contract terms, directly impacting marketing strategies and customer acquisition.

Compliance with the ACL is vital for Aussie Broadband to avoid substantial penalties. For instance, the Australian Competition and Consumer Commission (ACCC) has taken action against telecommunications companies for misleading advertising, with penalties potentially reaching millions of dollars. Upholding ACL standards is therefore essential for maintaining brand reputation and customer loyalty.

Aussie Broadband must navigate Australia's Privacy Act 1988 and its Australian Privacy Principles (APPs). These laws govern the collection, use, storage, and disclosure of customer personal information, a critical aspect for any telecommunications provider. Failure to comply can lead to substantial penalties, impacting customer trust and financial performance.

Furthermore, specific data retention laws require telecommunications companies like Aussie Broadband to store certain data for prescribed periods. This necessitates robust systems for secure data management and adherence to evolving regulatory requirements, ensuring operational integrity and legal standing.

Competition and Consumer Act (ACCC)

The Competition and Consumer Act 2010, overseen by the Australian Competition and Consumer Commission (ACCC), is a critical legal factor for Aussie Broadband. This legislation prohibits anti-competitive practices and the misuse of market power, meaning Aussie Broadband must ensure its wholesale agreements, pricing, and overall market conduct are compliant. The ACCC actively monitors the telecommunications sector to foster fair competition and protect consumers from potentially harmful business practices.

For Aussie Broadband, adherence to the Competition and Consumer Act translates to careful consideration of its market strategies. The ACCC's role in preventing anti-competitive behavior is vital for maintaining a healthy market where smaller players can thrive alongside larger ones. This legal framework ensures that pricing and service offerings are transparent and fair, ultimately benefiting consumers through choice and competitive pricing.

- ACCC Enforcement: The ACCC has the power to investigate and penalize companies for breaches of competition law. For instance, in 2023, the ACCC continued its focus on the telecommunications sector, addressing issues like misleading advertising and wholesale service quality.

- Wholesale Agreements: Aussie Broadband's wholesale agreements with infrastructure providers must not contain clauses that restrict competition or unfairly disadvantage other retailers.

- Pricing Transparency: The Act mandates clear and honest pricing for consumers, preventing deceptive pricing tactics that could mislead customers about the true cost of services.

- Market Power Regulation: The ACCC scrutinizes mergers and acquisitions in the telco space to prevent the undue concentration of market power, which could stifle innovation and competition.

NBN Co Wholesale Broadband Agreement (WBA)

Aussie Broadband's operations are heavily influenced by the NBN Co Wholesale Broadband Agreement (WBA). This legal contract dictates the terms under which Aussie Broadband accesses the National Broadband Network, directly impacting its cost of providing services and its overall profitability. Any amendments or disagreements concerning the WBA can have substantial financial repercussions, making meticulous management of this agreement essential for the company's operational stability.

The WBA governs key aspects of Aussie Broadband's business, including pricing for wholesale services and service level agreements. For instance, in the financial year 2023, NBN Co reported revenue of $5.4 billion, a significant portion of which is paid by retail service providers like Aussie Broadband. Understanding the nuances of this agreement is crucial for forecasting costs and ensuring compliance with regulatory obligations.

- NBN Co Wholesale Broadband Agreement (WBA): This legally binding contract forms the bedrock of Aussie Broadband's relationship with NBN Co, defining the terms for accessing the national network.

- Cost of Goods Sold Impact: Modifications to the WBA or disputes can directly alter Aussie Broadband's wholesale costs, affecting its margins.

- Service Delivery Capabilities: The agreement also outlines service level commitments, influencing Aussie Broadband's ability to reliably deliver broadband services to its customers.

- Regulatory Compliance: Adherence to the WBA is critical for maintaining operational licenses and avoiding penalties.

Aussie Broadband's operations are fundamentally shaped by Australian telecommunications law, including the Telecommunications Act 1997 and the Telecommunications (Consumer Protection and Competition) Act 2010. These acts, enforced by the Australian Communications and Media Authority (ACMA), govern licensing, service provision, and network access, impacting market competition and consumer rights.

The Australian Consumer Law (ACL) is critical, mandating fair trading and accurate advertising, which directly affects how Aussie Broadband markets its services, particularly regarding internet speeds and pricing. The Australian Competition and Consumer Commission (ACCC) actively enforces the Competition and Consumer Act 2010, ensuring fair market practices and preventing anti-competitive behaviour, with significant penalties for non-compliance.

Data privacy is paramount under the Privacy Act 1988 and its Australian Privacy Principles (APPs), requiring strict management of customer information. Furthermore, specific data retention laws impose obligations on telcos like Aussie Broadband to store certain data, necessitating robust security and compliance systems.

The NBN Co Wholesale Broadband Agreement (WBA) is a key legal contract, dictating terms for accessing the National Broadband Network and directly influencing Aussie Broadband's costs and profitability. For instance, NBN Co's FY23 revenue of $5.4 billion highlights the scale of these wholesale relationships.

| Legislation/Agreement | Key Impact on Aussie Broadband | Enforcing Body/Context | Example/Data Point (2023/2024) |

|---|---|---|---|

| Telecommunications Act 1997 | Licensing, service provision, network access | ACMA | Sets operational framework for all telcos. |

| Australian Consumer Law (ACL) | Fair trading, truthful advertising (speeds, pricing) | ACCC | Penalties can reach millions for misleading advertising. |

| Competition and Consumer Act 2010 | Prohibits anti-competitive practices, market power misuse | ACCC | ACCC focus on telco sector in 2023 addressing advertising and wholesale quality. |

| Privacy Act 1988 (APPs) | Customer data collection, use, storage, disclosure | Office of the Australian Information Commissioner (OAIC) | Non-compliance can lead to significant penalties and reputational damage. |

| NBN Co Wholesale Broadband Agreement (WBA) | Access terms to NBN, pricing, service levels | NBN Co / Contractual | NBN Co FY23 revenue was $5.4 billion, reflecting wholesale costs for providers like Aussie Broadband. |

Environmental factors

Aussie Broadband's extensive network infrastructure, data centres, and office spaces are significant energy consumers, directly impacting its carbon footprint. The company's commitment to sustainability means actively seeking ways to mitigate this impact.

In 2023, the Australian telecommunications sector faced growing scrutiny regarding its environmental impact. Aussie Broadband, like its peers, is under increasing pressure from regulators and the public to demonstrate progress in reducing energy consumption and adopting cleaner energy solutions. This focus on corporate responsibility is a defining environmental factor for the company's operational strategy moving forward.

The telecommunications industry, including companies like Aussie Broadband, faces a growing challenge with electronic waste (e-waste) generated from equipment like modems and network hardware. Aussie Broadband must implement strong e-waste management policies, focusing on recycling programs for retired equipment and encouraging customers to adopt sustainable disposal methods.

As of 2024, global e-waste is projected to reach 61.3 million metric tons, highlighting the urgency of responsible disposal. Compliance with environmental regulations concerning waste management is becoming increasingly critical for telecommunications providers to maintain their social license to operate and avoid potential penalties.

Climate change poses significant physical risks to Aussie Broadband's network infrastructure. Extreme weather events, like the widespread flooding experienced across Eastern Australia in early 2024, causing billions in damages, and the increasing intensity of bushfires, directly threaten the reliability and resilience of physical assets such as fibre optic cables and data centres.

Aussie Broadband must proactively assess and mitigate these climate-related risks to guarantee uninterrupted service delivery, especially during natural disasters. This includes evaluating vulnerabilities in its network footprint, particularly in areas prone to extreme weather.

Investing in resilient infrastructure, such as undergrounding cables in high-risk zones and reinforcing network nodes, alongside robust disaster recovery planning, is paramount for maintaining service continuity and protecting its customer base from the escalating impacts of climate change.

Sustainable Supply Chain Practices

Aussie Broadband faces growing pressure to ensure its entire supply chain operates sustainably, encompassing everything from component manufacturing to final delivery. This means actively vetting suppliers for their environmental performance and ethical sourcing practices.

By promoting sustainability throughout its network of partners, Aussie Broadband can significantly bolster its corporate reputation and mitigate its broader environmental footprint. For instance, in 2023, the telecommunications industry globally saw a heightened focus on Scope 3 emissions, which largely stem from supply chain activities.

- Supplier Audits: Implementing rigorous environmental audits for key suppliers.

- Ethical Sourcing: Prioritizing suppliers with strong ethical labor and environmental standards.

- Logistics Optimization: Working with logistics partners to reduce transport emissions.

- Circular Economy: Exploring opportunities for recycling and reusing network equipment.

Resource Scarcity and Material Sourcing

The availability and cost of essential raw materials for telecommunications infrastructure, such as copper and rare earth elements, are increasingly subject to global resource scarcity and geopolitical tensions. For instance, the price of copper, a key component in network cabling, saw significant volatility in 2024, influenced by supply chain disruptions and increased demand from the renewable energy sector. Aussie Broadband must navigate these fluctuating costs and secure reliable sourcing channels.

Considering the sustainability of material sourcing is paramount for Aussie Broadband's long-term operational viability. Embracing circular economy principles, like component reuse and recycling in network upgrades, can mitigate environmental impact and potentially reduce reliance on primary resource extraction. This strategic approach aligns with growing investor and consumer demand for environmentally responsible business practices.

The company's commitment to sustainable sourcing is crucial for managing operational risks. For example, disruptions in the supply of critical minerals used in electronic components, often sourced from politically unstable regions, could significantly impact network expansion and maintenance. Proactive strategies to diversify suppliers and explore alternative materials are essential.

Key considerations for Aussie Broadband include:

- Monitoring global commodity prices for key materials like copper and aluminum.

- Assessing the geopolitical stability of regions supplying critical raw materials.

- Developing partnerships for the responsible sourcing and recycling of telecommunications equipment components.

- Investing in research for more sustainable and readily available material alternatives.

Aussie Broadband faces increasing pressure regarding its environmental footprint, particularly concerning energy consumption and electronic waste. The company must actively manage its impact by adopting cleaner energy solutions and robust e-waste recycling programs, aligning with global trends and regulatory expectations.

Climate change presents significant physical risks to Aussie Broadband's infrastructure, necessitating investments in resilient network solutions and disaster preparedness to ensure service continuity amid extreme weather events.

The company's supply chain sustainability and responsible sourcing of raw materials are critical for long-term operational viability and reputation management, especially given global resource scarcity and geopolitical influences on commodity prices.

| Environmental Factor | Impact on Aussie Broadband | 2024/2025 Data/Trend |

|---|---|---|

| Energy Consumption & Carbon Footprint | High energy usage from network infrastructure and data centres. | Increasing scrutiny on Scope 1 and 2 emissions; focus on renewable energy procurement. |

| Electronic Waste (E-waste) | Generation of e-waste from network equipment and customer devices. | Global e-waste projected to reach 61.3 million metric tons in 2024; emphasis on circular economy principles for equipment. |

| Climate Change & Extreme Weather | Physical damage to infrastructure (fibre, data centres) from floods, fires. | Increased frequency and intensity of extreme weather events impacting service reliability. |

| Supply Chain Sustainability | Environmental impact of component manufacturing and logistics. | Growing focus on Scope 3 emissions and supplier environmental performance. |

| Raw Material Sourcing | Volatility in prices and availability of copper, rare earth elements due to scarcity and geopolitics. | Copper price fluctuations in 2024 influenced by supply chain issues and demand from renewable energy sector. |

PESTLE Analysis Data Sources

Our PESTLE analysis for Aussie Broadband is built on a robust foundation of data from Australian government agencies, industry regulators, and reputable market research firms. This ensures that insights into political, economic, social, technological, legal, and environmental factors are current and relevant to the Australian telecommunications landscape.