Aussie Broadband Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aussie Broadband Bundle

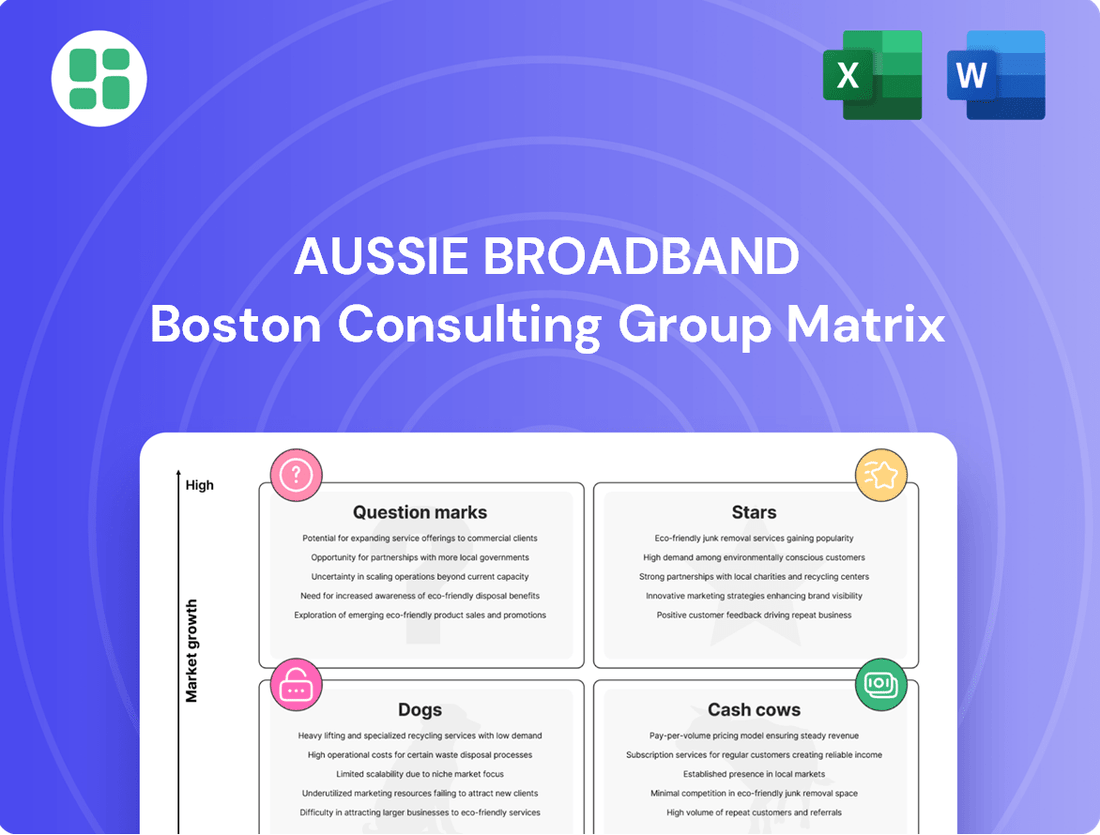

Curious about Aussie Broadband's strategic product positioning? This glimpse into their BCG Matrix reveals how their offerings are performing in the market. Understand which services are driving growth and which might need a closer look.

Dive deeper into Aussie Broadband's BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Aussie Broadband is experiencing a notable shift towards higher-speed NBN plans. As of the first half of fiscal year 2025, more than 54% of their NBN customer base has upgraded to plans offering 100Mbps or faster speeds.

This trend highlights a robust consumer appetite for enhanced internet performance and demonstrates Aussie Broadband's effectiveness in attracting and retaining customers seeking premium service tiers. Their commitment to network quality is clearly resonating with this increasingly important customer segment.

The Enterprise & Government (E&G) segment is a star performer for Aussie Broadband, demonstrating impressive momentum. In the first half of fiscal year 2025, this sector saw its revenue climb by a substantial 13.2%. This growth is fueled by the acquisition of significant new strategic deals, highlighting the company's increasing appeal to larger clients.

A key advantage for Aussie Broadband in the E&G space is its proprietary fibre network. This infrastructure allows the company to offer services with higher gross margins compared to other segments. This financial benefit, combined with the strong revenue growth, clearly positions E&G as a high-growth area where Aussie Broadband is effectively capturing market share.

To capitalize on this strong performance and further expand its reach, Aussie Broadband is making strategic investments in its E&G capabilities. These efforts are aimed at diversifying the company's revenue streams and securing larger, more profitable contracts within this crucial sector.

Aussie Broadband's wholesale voice services, bolstered by the February 2024 Symbio acquisition, are a strong performer. This move has significantly enhanced their gross margin and is projected to drive substantial EBITDA growth, positioning them as a Tier-1 Voice provider.

Aussie Fibre Network Expansion

Aussie Broadband is significantly investing in its own fibre network, a move that positions it as a strong contender in the telecommunications market. In the fiscal year 2024, the company extended its owned fibre infrastructure by an impressive 288 kilometers. This expansion is crucial for their growth strategy.

The company plans to boost its capital expenditure in fiscal year 2025, focusing on continued fibre network development and enhancing its internal cloud infrastructure. This strategic investment is designed to solidify their competitive edge by delivering superior network performance. This allows them to target and secure high-value business and enterprise clients, thereby increasing their market share in services underpinned by robust infrastructure.

- FY24 Fibre Expansion: 288 km of owned fibre infrastructure added.

- FY25 Investment Focus: Increased capital expenditure for further fibre builds and internal cloud infrastructure.

- Competitive Advantage: Superior network performance driving acquisition of high-value business and enterprise customers.

- Market Share Growth: Expansion in infrastructure-backed services.

Strategic Diversification into New Sectors (e.g., Energy Partnerships)

Aussie Broadband is making bold moves into new territory, notably through its strategic alliance with Red Energy. This partnership allows them to offer bundled broadband and energy products, a significant step into the energy sector. This diversification taps into a high-growth potential market, utilizing their existing customer relationships and strong brand presence to extend their reach beyond core telecommunications. In 2023, Red Energy reported a net profit after tax of $106 million, highlighting the financial viability of the energy market they are entering.

This venture into bundled services positions Aussie Broadband as an early entrant, aiming to capture substantial future market share. By integrating essential services like energy with their internet offerings, they create a more compelling value proposition for consumers. This strategy is particularly relevant as the Australian energy market continues to evolve, with consumers increasingly seeking integrated solutions.

Key aspects of this strategic diversification include:

- Leveraging Brand Equity: Utilizing their established reputation in telecommunications to build trust in the energy sector.

- Customer Cross-Selling: Offering bundled services to their existing broadband customer base, driving incremental revenue.

- Market Expansion: Entering a new, high-growth sector with significant potential for customer acquisition.

- Competitive Advantage: Establishing an early mover advantage in the bundled broadband and energy service market.

Aussie Broadband's Enterprise & Government (E&G) segment is a clear star, showing robust growth with a 13.2% revenue increase in H1 FY25. This expansion is driven by securing major new contracts, underscoring the company's growing attractiveness to large clients. Their proprietary fibre network further bolsters this segment, enabling higher gross margins and a strong competitive position.

The company's strategic investment in expanding its owned fibre network, adding 288 kilometers in FY24, is a significant driver for its star performers. This infrastructure underpins the superior network performance that attracts high-value business and enterprise customers, fueling market share growth in infrastructure-backed services.

The wholesale voice services, significantly strengthened by the February 2024 Symbio acquisition, are also a star. This acquisition is projected to drive substantial EBITDA growth and solidify Aussie Broadband's position as a Tier-1 Voice provider.

Aussie Broadband's foray into bundled broadband and energy products through its alliance with Red Energy represents a strategic move into a high-growth potential market. This diversification leverages their existing customer base and brand, aiming to capture significant future market share in integrated services.

| Segment | Performance Indicator | Data Point | Significance |

|---|---|---|---|

| Enterprise & Government (E&G) | Revenue Growth (H1 FY25) | 13.2% | Strong momentum driven by new strategic deals. |

| Owned Fibre Network | Expansion (FY24) | 288 km | Underpins superior network performance for key segments. |

| Wholesale Voice Services | Acquisition Impact | Symbio (Feb 2024) | Enhances gross margin and drives projected EBITDA growth. |

| Bundled Services (Energy) | Strategic Alliance | Red Energy | Entry into a high-growth market, leveraging brand equity. |

What is included in the product

Aussie Broadband's BCG Matrix analysis would detail its product portfolio's market share and growth, guiding strategic decisions.

Aussie Broadband's BCG Matrix offers a clear, one-page overview, relieving the pain of complex strategic analysis.

Cash Cows

Aussie Broadband's standard residential NBN broadband tiers are their bedrock, bringing in a substantial chunk of their income and attracting a vast number of customers. Even though this market is pretty established and might not be growing as fast as the super-speedy options, these services are reliable money-makers. They benefit from a loyal customer base and the company's smooth operations, making them a consistent cash flow generator. For instance, in the first half of FY24, Aussie Broadband reported a 14% increase in underlying EBITDA to $73.2 million, a testament to the stability of their core offerings.

The Business Broadband segment is a solid performer for Aussie Broadband, boasting a loyal customer base and steady revenue growth. In the first half of fiscal year 2025, this segment saw its revenue climb by an impressive 12.7%.

While it might not be the fastest-growing part of the business, its consistent cash flow generation is undeniable. This stability comes from strong customer relationships and a well-earned reputation for dependable internet speeds, making it a crucial cash cow for the company.

Aussie Broadband's existing mobile virtual network operator (MVNO) services are a solid contributor to their business, acting as a reliable source of income. These services have seen consistent growth, with mobile sales climbing by 17% in the fiscal year 2024, demonstrating their increasing popularity.

While the overall market share for MVNOs might be smaller compared to the big telecommunications companies, Aussie Broadband differentiates itself through exceptional customer service. This focus on customer satisfaction is key to retaining their mobile subscribers, which in turn generates a predictable and steady cash flow for the company.

Furthermore, the recent extension of their agreement for wholesale mobile services with Optus provides a significant layer of security and stability for this segment of their operations, ensuring continued service delivery and revenue generation.

White Label Wholesale Broadband Services

Aussie Broadband's white label wholesale broadband services are a strong cash cow. This segment, which supplies broadband to other telcos, has seen impressive growth, adding 171 managed service providers in FY24.

While margins might be tighter than their retail operations, the sheer volume and existing partnerships create a reliable stream of cash. This business model effectively utilizes Aussie Broadband's network without the heavy costs associated with attracting individual customers.

- Robust Revenue Growth: The wholesale segment contributes significantly to overall revenue.

- Expanding Partner Network: 171 new managed service providers were added in FY24, indicating strong demand.

- Consistent Cash Flow Generation: High volumes and established relationships ensure predictable income.

- Leverages Existing Infrastructure: Utilizes network investments without incurring direct retail acquisition costs.

Legacy Voice Services (Pre-Symbio integration)

Before the Symbio integration, Aussie Broadband's legacy voice services likely functioned as a classic cash cow within their business model. These were established offerings, generating steady income from a loyal customer base, even as the overall market for traditional voice services matured and potentially saw slower growth. For example, in the broader Australian telecommunications market, while fixed-line voice subscriptions have seen a gradual decline, the revenue from these services remained significant for established providers.

These services required minimal new investment to maintain, allowing them to generate substantial free cash flow. This cash could then be reinvested into more promising areas of the business. The strategic shift now involves evolving these legacy assets into more modern, higher-margin services as part of the Symbio integration.

- Mature Market Position: Legacy voice services operated in a well-established, albeit potentially shrinking, market segment.

- Consistent Revenue Generation: These offerings provided a reliable stream of income from existing subscribers.

- Low Investment Requirement: Maintaining these services typically demanded less capital expenditure compared to newer technologies.

- Strategic Evolution: The current focus is on integrating and enhancing these services to align with future growth strategies.

Aussie Broadband's standard residential NBN broadband tiers are their bedrock, bringing in a substantial chunk of their income and attracting a vast number of customers. Even though this market is pretty established and might not be growing as fast as the super-speedy options, these services are reliable money-makers. They benefit from a loyal customer base and the company's smooth operations, making them a consistent cash flow generator. For instance, in the first half of FY24, Aussie Broadband reported a 14% increase in underlying EBITDA to $73.2 million, a testament to the stability of their core offerings.

The Business Broadband segment is a solid performer for Aussie Broadband, boasting a loyal customer base and steady revenue growth. In the first half of fiscal year 2025, this segment saw its revenue climb by an impressive 12.7%. While it might not be the fastest-growing part of the business, its consistent cash flow generation is undeniable. This stability comes from strong customer relationships and a well-earned reputation for dependable internet speeds, making it a crucial cash cow for the company.

Aussie Broadband's existing mobile virtual network operator (MVNO) services are a solid contributor to their business, acting as a reliable source of income. These services have seen consistent growth, with mobile sales climbing by 17% in the fiscal year 2024, demonstrating their increasing popularity. While the overall market share for MVNOs might be smaller compared to the big telecommunications companies, Aussie Broadband differentiates itself through exceptional customer service. This focus on customer satisfaction is key to retaining their mobile subscribers, which in turn generates a predictable and steady cash flow for the company.

Aussie Broadband's white label wholesale broadband services are a strong cash cow. This segment, which supplies broadband to other telcos, has seen impressive growth, adding 171 managed service providers in FY24. While margins might be tighter than their retail operations, the sheer volume and existing partnerships create a reliable stream of cash. This business model effectively utilizes Aussie Broadband's network without the heavy costs associated with attracting individual customers.

What You See Is What You Get

Aussie Broadband BCG Matrix

The Aussie Broadband BCG Matrix preview you're currently viewing is the exact, fully formatted report you will receive upon purchase. This means no watermarks, no placeholder text, and no hidden surprises—just the comprehensive strategic analysis ready for your immediate use.

Rest assured, the BCG Matrix document you are previewing is the final, polished version that will be delivered to you after completing your purchase. It’s designed for professional application, offering clear insights into Aussie Broadband’s product portfolio without any alterations.

What you see here is the authentic Aussie Broadband BCG Matrix file that you will download immediately after your purchase. This preview accurately represents the professional-grade analysis you’ll receive, making it instantly usable for your strategic planning.

Dogs

Traditional fixed voice-only services in Australia are seeing a steady decline, with customers increasingly opting for Voice over Internet Protocol (VoIP) and mobile alternatives. This shift means these legacy services likely hold a small market share and have very limited growth potential, potentially draining resources without contributing substantially to profits.

For Aussie Broadband, these outdated offerings represent a segment that might require careful management, possibly through phasing out or strategic divestment. In 2023, the Australian Bureau of Statistics reported a continued decrease in fixed-line telephone services, reinforcing the trend away from traditional voice-only plans.

Very low-tier NBN plans, even if they attract a small customer base for Aussie Broadband, represent a 'dog' in the BCG matrix. These plans typically offer minimal profit margins, potentially contributing little to overall profitability or significant market share growth. For instance, if a 12/1 Mbps plan yields only a few dollars profit per month, the volume needed to make a substantial impact is immense, often outweighing the benefits.

Non-recurring project work in Aussie Broadband's Enterprise & Government (E&G) segment, while contributing to revenue in the past, saw a decline in H1 FY24. This suggests these projects are less consistent and likely offer lower margins, making them a less attractive long-term focus for the company.

Such one-off projects, if not strategically designed to generate recurring revenue, can consume significant resources with minimal sustained market share. This characteristic places them in a position that warrants careful consideration within a strategic growth framework like the BCG Matrix.

Discontinued Low-Margin Symbio Product Lines

Following the Symbio acquisition, discontinued low-margin product lines within Symbio in H1 FY25 likely represent Dogs in Aussie Broadband's BCG Matrix. These products, not aligned with the core high-margin voice and unified communications focus, would have been divested or phased out to improve overall gross margin for the Symbio segment. For instance, if these lines contributed less than 5% to Symbio's FY24 revenue and had negative EBITDA, their removal would be a strategic move.

- Strategic Divestment: Phasing out low-margin Symbio products enhances focus on profitable offerings.

- Margin Improvement: Removing underperforming lines boosts the Symbio segment's gross margin.

- FY25 H1 Impact: Discontinued products in H1 FY25 are classic 'Dog' portfolio components.

- Focus on Core: This aligns with prioritizing high-margin voice and unified communications.

Underperforming Regional Fixed Wireless/Satellite Offerings

Underperforming regional fixed wireless and satellite offerings represent a potential 'Dog' category for Aussie Broadband within the BCG Matrix. These services, often catering to niche areas where fibre or NBN deployment is challenging, may exhibit low market share and high operational expenditures. For instance, while specific figures for these niche services are not publicly broken out by Aussie Broadband, the broader regional telecommunications market often faces higher per-customer costs compared to urban areas.

These offerings might struggle to achieve significant growth or profitability due to limited customer adoption and the inherent costs associated with maintaining infrastructure in dispersed locations. This situation is common in the telecommunications sector, where scaling specialized services can be difficult.

- Low Market Share: Limited uptake in specific regional zones.

- High Operational Costs: Increased expenses for infrastructure maintenance in remote areas.

- Profitability Challenges: Difficulty in achieving economies of scale compared to core NBN/fibre services.

- Strategic Consideration: May require divestment or significant restructuring to improve financial performance.

Aussie Broadband's traditional voice-only services, facing declining demand and customer preference for VoIP and mobile alternatives, are prime examples of 'Dogs' in the BCG matrix. These legacy offerings likely possess a small market share with minimal growth potential, potentially consuming resources without significant profit contribution, as evidenced by the Australian Bureau of Statistics' continued reporting of decreasing fixed-line telephone services.

Very low-tier NBN plans, offering minimal profit margins and requiring immense customer volume for substantial impact, also fall into the 'Dog' category. Non-recurring project work within the Enterprise & Government segment, experiencing a decline in H1 FY24 and offering less consistent revenue, further illustrates this classification. Following the Symbio acquisition, discontinued low-margin product lines within Symbio in H1 FY25, which contributed minimally to revenue and had negative EBITDA, represent classic 'Dog' components, strategically removed to enhance overall gross margin.

Underperforming regional fixed wireless and satellite offerings, characterized by low market share and high operational expenditures in niche areas, also represent potential 'Dogs'. These services may struggle with profitability due to limited adoption and the inherent costs of maintaining dispersed infrastructure, making them a strategic consideration for divestment or restructuring.

| Category | Aussie Broadband Example | Market Share | Growth Potential | Profitability |

|---|---|---|---|---|

| Dogs | Traditional Voice-Only Services | Low | Very Low | Low / Negative |

| Dogs | Very Low-Tier NBN Plans | Low | Low | Minimal |

| Dogs | Discontinued Symbio Product Lines (H1 FY25) | Negligible (Post-Discontinuation) | None | Negative (Pre-Discontinuation) |

| Dogs | Underperforming Regional Fixed Wireless/Satellite | Low | Low | Challenging |

Question Marks

Buddy Telco, launched in July 2024, operates as a digital-first challenger brand within Aussie Broadband's portfolio, specifically targeting value-conscious households. Its strategic objective is to capture 100,000 subscribers by fiscal year 2027, aiming for significant market penetration in a competitive landscape.

By the third quarter of fiscal year 2025, Buddy Telco had secured over 9,695 connections. However, its current growth rate is lagging behind initial projections, placing it in the 'Question Mark' category of the BCG Matrix. This position indicates a need for substantial investment to accelerate subscriber acquisition and achieve its ambitious market share goals.

Aussie Broadband's new enterprise offerings built on its expanding fibre network are positioned as Stars in the BCG Matrix. This segment is experiencing high growth, driven by the company's data-first sales strategy targeting enterprise and government clients. For instance, in the first half of 2024, Aussie Broadband reported a 32% increase in their wholesale broadband revenue, indicating strong demand for their network capabilities.

Aussie Broadband's acquisition of Symbio marks a significant entry into the high-growth Unified Communications as a Service (UCaaS) market. This strategic move positions the company to offer integrated cloud-based voice and messaging solutions, tapping into a rapidly expanding sector of the telecommunications industry.

Within the BCG matrix, Aussie Broadband's UCaaS solutions, bolstered by the Symbio acquisition, would likely be classified as Stars. This classification is due to the high growth potential of the UCaaS market itself, combined with the fact that these new offerings are still developing their market share within Aussie Broadband's established customer base. Continued investment is crucial to solidify their competitive position and capitalize on this promising segment.

Emerging Mobile Services Leveraging Optus Partnership Scale

Aussie Broadband's renewed partnership with Optus for wholesale mobile services is a strategic move to expand its market presence. This collaboration allows Aussie Broadband to leverage Optus's extensive network infrastructure, enabling them to offer a wider range of mobile services and reach a larger customer base. The focus is on developing innovative mobile products that tap into high-growth segments of the market.

Emerging mobile services stemming from this partnership are likely classified as Stars in the BCG Matrix. This is due to the high growth potential within the mobile services sector, driven by increasing data consumption and the demand for 5G connectivity. For instance, the Australian mobile market saw a 4.3% year-on-year growth in mobile subscriptions in the first half of 2024, reaching over 35 million active services.

- High Market Growth Potential: The Australian mobile market is expanding, with 5G services becoming increasingly prevalent.

- Significant Investment Required: Developing and marketing new differentiated mobile products demands substantial investment in technology and customer acquisition.

- Scalability through Optus Network: The partnership allows for rapid scaling of mobile service delivery by utilizing Optus's existing infrastructure.

- Focus on Differentiated Offerings: Aussie Broadband aims to launch unique mobile plans or bundled services to capture market share.

IoT and Smart Solutions for Businesses

The Australian telecommunications sector is experiencing significant growth in Internet of Things (IoT) and smart solutions for businesses. Aussie Broadband's strategy for diversified growth positions them to explore these burgeoning markets. Any current or planned IoT or smart solution offerings would likely be considered a '?' in the BCG matrix, representing a high-growth area with a currently low market share, demanding considerable investment in research and development and market penetration.

This classification highlights the need for strategic investment and careful consideration of market dynamics. For instance, the Australian IoT market was projected to reach AUD 25.3 billion by 2025, indicating substantial future potential. Aussie Broadband's entry into this space would require focused efforts to build brand awareness and establish a competitive edge.

- High Growth Potential: The increasing adoption of connected devices across Australian industries, from agriculture to manufacturing, signifies a rapidly expanding market for IoT solutions.

- Low Market Share: As a relatively new entrant or with nascent offerings, Aussie Broadband would likely hold a small portion of this growing market, necessitating aggressive market development.

- Investment Requirement: Significant capital expenditure will be needed for technology development, infrastructure, and marketing to gain traction against established players.

- Strategic Focus: Success hinges on identifying niche business needs and developing tailored smart solutions that offer clear value propositions to Australian enterprises.

Buddy Telco, Aussie Broadband's challenger brand, is currently in the Question Mark category of the BCG matrix. Despite launching in July 2024 with ambitious subscriber targets, its growth by Q3 FY25, with over 9,695 connections, is slower than anticipated.

This positioning signals a need for increased investment to boost subscriber acquisition and achieve its market penetration goals. The brand represents a high-growth potential area for Aussie Broadband, but its current market share is low, requiring strategic focus to convert potential into performance.

The success of Buddy Telco hinges on effective marketing and service offerings that resonate with value-conscious households in a competitive telecommunications landscape.

| BCG Category | Aussie Broadband Segment | Market Growth | Relative Market Share | Strategic Implication |

|---|---|---|---|---|

| Question Mark | Buddy Telco | High | Low | Requires significant investment to grow market share. |

BCG Matrix Data Sources

Our Aussie Broadband BCG Matrix leverages a blend of internal financial disclosures, Australian telecommunications market research, and customer usage data to accurately position each service.