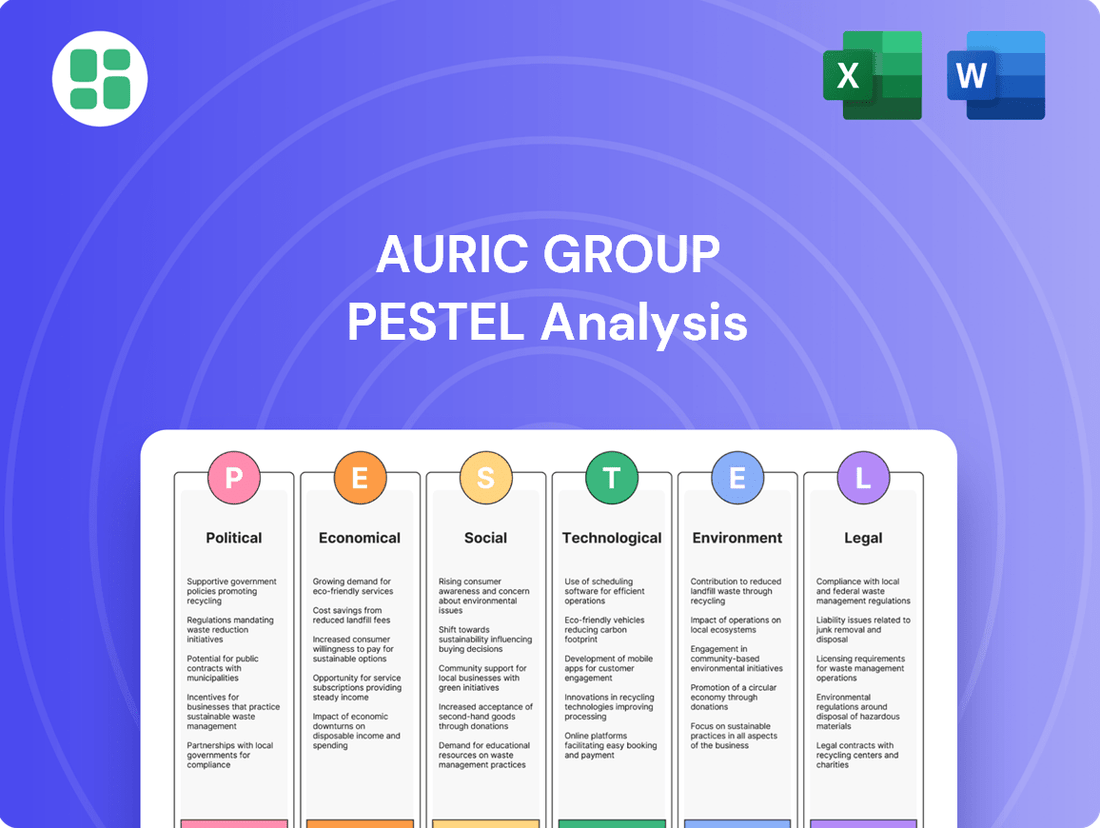

Auric Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Auric Group Bundle

Uncover the critical external factors shaping Auric Group's trajectory. Our PESTLE analysis delves into the political, economic, social, technological, legal, and environmental forces impacting their operations and market position. Equip yourself with this essential intelligence to anticipate challenges and seize opportunities. Download the full PESTLE analysis now for actionable insights that will refine your strategic planning.

Political factors

Evolving government regulations on food safety and labeling present a dynamic landscape for Auric Group's diverse consumer goods portfolio. For instance, the updated 'healthy' food labeling definitions, effective April 28, 2025, will necessitate careful review and potential reformulation of product claims, impacting marketing strategies across various brands.

Furthermore, new rules under the Food Safety Modernization Act (FSMA) are intensifying scrutiny on traceability and sanitary transportation practices. Non-compliance could lead to significant penalties, with FSMA enforcement actions in 2024 already showing an upward trend in recalls for mislabeled or contaminated products, underscoring the critical need for robust supply chain management and adherence to these updated standards to maintain consumer trust and market access.

Changes in international trade policies, particularly the potential for new tariffs under different political administrations, can directly affect Auric Group's cost structure. For instance, the U.S. imposed tariffs on certain goods from China in recent years, impacting supply chains globally. If Auric Group relies on imported materials or components, shifts in these policies could increase expenses, potentially by several percentage points on affected goods, requiring careful management of sourcing and pricing.

Consumer protection laws are becoming more rigorous, with increased scrutiny on product claims and advertising. Auric Group must ensure its brands maintain accuracy and transparency in all communications to comply with these evolving standards.

State-level actions, such as California's ban on specific food additives, highlight a trend toward localized food safety regulations. This necessitates careful monitoring and adaptation of product formulations and labeling across different jurisdictions.

Taxation Policies

Government taxation policies, encompassing corporate income taxes and consumer-facing levies like VAT or sales tax, directly impact Auric Group's profitability and the affordability of its portfolio companies' products. For instance, a reduction in corporate tax rates, such as the potential adjustments discussed in the US in late 2024 or early 2025, could boost net income for Auric's holdings. Conversely, increases in consumer taxes can dampen demand, affecting revenue streams.

Changes in tax structures can necessitate adjustments to pricing strategies, influencing market competitiveness. If a competitor benefits from a more favorable tax regime, Auric's companies might face pressure to lower prices or absorb higher tax costs. This dynamic was evident in the automotive sector in 2024, where varying EV tax credits across regions impacted sales and pricing strategies.

- Corporate Tax Impact: Changes in corporate tax rates directly affect the net earnings of Auric Group's subsidiaries. For example, a hypothetical 2% decrease in a major market's corporate tax rate could increase a subsidiary's net profit by millions.

- Consumer Tax Influence: Sales taxes or VAT on consumer goods influence purchasing decisions. A rise in VAT, like the 2024 increase in Turkey, can lead to reduced consumer spending on non-essential items.

- Regulatory Alignment: Auric Group must monitor tax policy shifts globally to ensure its portfolio companies remain compliant and competitive. The OECD's Pillar Two global minimum tax initiative, implemented in many countries starting in 2024, aims to ensure large multinational enterprises pay a minimum level of tax.

- Investment Incentives: Governments may offer tax incentives for specific investments, such as R&D tax credits or green energy subsidies, which Auric Group can leverage to enhance returns.

Political Stability and Business Environment

Auric Group's operations are significantly influenced by the political stability and business environment in its key markets. For instance, in 2024, countries like Australia, a significant market for Auric's gold and precious metals, maintained a stable political landscape, generally fostering a predictable business environment. Conversely, sourcing regions can present varying levels of risk. Policy shifts, such as changes in mining regulations or export tariffs, can directly impact Auric's supply chain efficiency and profitability.

Geopolitical tensions remain a critical factor. For example, ongoing trade disputes or regional conflicts in 2024 and projected into 2025 could disrupt global commodity flows, affecting Auric's ability to secure raw materials or access international markets. This necessitates robust risk management and the development of agile strategies to navigate potential market access limitations or increased operational costs due to political instability.

- Political Stability: Auric Group operates in markets with generally stable political systems, such as Australia, which ranked high in the 2024 World Bank Ease of Doing Business index, indicating a favorable regulatory environment.

- Policy Uncertainty: Fluctuations in government policies regarding resource extraction and taxation in key sourcing countries can introduce volatility, impacting Auric's operational costs and investment decisions.

- Geopolitical Risks: Emerging geopolitical tensions in 2024-2025, particularly concerning global trade routes and resource-rich regions, pose a threat to Auric's supply chain integrity and market access.

- Adaptable Strategies: The need for adaptable business strategies is underscored by the potential for sudden policy changes or political disruptions, requiring Auric to maintain flexibility in its sourcing and distribution networks.

Government regulations on food safety and labeling, such as the April 28, 2025, healthy food labeling updates, directly impact Auric Group's product claims and marketing. Intensified FSMA scrutiny on traceability in 2024 highlights the need for robust supply chain management to avoid recalls and maintain consumer trust.

Shifting international trade policies and potential tariffs can increase Auric Group's costs, as seen with past U.S. tariffs impacting global supply chains. Consumer protection laws are also tightening, requiring accuracy in product claims and advertising across all brands.

State-level actions, like California's additive bans, necessitate careful monitoring and adaptation of product formulations. Government taxation policies, including corporate and consumer taxes, directly influence Auric's profitability and product affordability, with potential corporate tax rate adjustments in late 2024/early 2025 impacting net income.

Auric Group's operations are shaped by political stability in markets like Australia, which maintained a favorable business environment in 2024. However, geopolitical tensions and policy shifts in sourcing regions can disrupt commodity flows and impact supply chain efficiency.

What is included in the product

This PESTLE analysis meticulously examines the external macro-environmental factors impacting the Auric Group across Political, Economic, Social, Technological, Environmental, and Legal dimensions, providing a comprehensive understanding of the landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear overview of external factors impacting Auric Group.

Helps support discussions on external risk and market positioning during planning sessions by highlighting key PESTLE drivers relevant to Auric Group's strategy.

Economic factors

Global consumer spending is anticipated to grow in 2025, though consumers will likely prioritize value and necessity-driven purchases due to persistent economic uncertainties and inflation. This trend means Auric Group's diverse portfolio, spanning food, beverage, wellness, and lifestyle sectors, needs to resonate with consumers actively seeking quality at competitive prices or through promotional offers.

Persistent inflation remains a significant concern, impacting consumer purchasing power and increasing operational costs for businesses like Auric Group. For instance, the US Consumer Price Index (CPI) saw a notable increase in early 2024, with core inflation figures indicating sustained upward pressure on prices for goods and services, including raw materials and labor.

Fluctuating interest rates, particularly the Federal Reserve's monetary policy adjustments in 2024, directly affect investment capital availability and the cost of financing. Higher rates can make borrowing more expensive, potentially slowing down Auric Group's portfolio growth initiatives and increasing the hurdle rate for new investments.

The global economic outlook for 2025 points to a modest, though uneven, expansion. Developed markets are expected to see a slight moderation in their real GDP growth rates, impacting overall market demand and the growth trajectory for consumer-focused sectors.

For instance, the International Monetary Fund (IMF) projected in its April 2024 World Economic Outlook that global growth would slow from 3.2% in 2023 to 3.0% in 2024 and 3.2% in 2025, with advanced economies facing a more pronounced slowdown.

Supply Chain Costs and Disruptions

Ongoing supply chain disruptions, fueled by geopolitical tensions, climate events, and logistical hurdles, continue to exert pressure on costs and product availability for businesses like Auric Group. These persistent challenges necessitate robust and adaptable supply chain strategies to mitigate their impact.

The financial toll of these disruptions is significant. In 2024, companies reported average financial losses equivalent to approximately 8% of their annual revenues due to supply chain breakdowns. This underscores the critical need for proactive measures to build resilience.

- Geopolitical Instability: Conflicts and trade disputes create uncertainty and can lead to sudden cost increases or material shortages.

- Climate Change Impacts: Extreme weather events disrupt transportation networks and agricultural yields, affecting raw material availability and pricing.

- Logistical Bottlenecks: Port congestion, labor shortages, and rising fuel costs continue to inflate shipping expenses and delivery times.

- Increased Operational Costs: Businesses face higher expenses for inventory management, expedited shipping, and sourcing alternative suppliers to maintain operations.

Investment Climate and Capital Availability

The investment climate for Auric Group, particularly within the consumer sector, shows general optimism but is notably susceptible to broader economic stability and unfolding geopolitical events. For instance, in early 2024, global economic growth forecasts were revised downwards by the IMF, impacting investor confidence and potentially increasing the cost of capital. This sensitivity means that while opportunities exist, the environment for securing funding can fluctuate significantly.

Auric Group's capacity to inject capital and facilitate brand scaling is directly tied to the availability and cost of funds. As of the first half of 2024, interest rates in major economies remained elevated compared to pre-pandemic levels, making borrowing more expensive. This trend influences Auric's strategic decisions regarding acquisitions and organic growth initiatives.

- Global Economic Outlook: The World Bank's projections for 2024 indicated a moderate slowdown in global growth, a factor that can temper investor appetite for risk.

- Interest Rate Environment: Central bank policies, such as those by the Federal Reserve and the European Central Bank throughout 2024, have kept benchmark interest rates at levels that increase the cost of debt financing.

- Geopolitical Risk Premium: Ongoing geopolitical tensions, including regional conflicts, contribute to market volatility and can lead to a higher risk premium demanded by investors, impacting capital availability.

- Venture Capital and Private Equity Activity: While still active, VC and PE funding rounds in 2024 saw increased scrutiny and a focus on profitability, potentially making it more challenging for earlier-stage or less established brands to secure substantial capital.

Economic factors present a mixed outlook for 2025, with continued inflation and elevated interest rates impacting consumer spending and business costs. While global growth is projected to be modest, geopolitical instability and supply chain disruptions add layers of complexity and financial risk.

Auric Group must navigate these economic currents by focusing on value propositions and operational efficiency. The persistent inflationary environment, evidenced by the US CPI's continued upward trend in early 2024, necessitates careful cost management and strategic pricing.

The elevated interest rate environment, with central banks like the Federal Reserve maintaining higher benchmark rates through mid-2024, increases the cost of capital for expansion and investment, requiring a more judicious approach to financing growth initiatives.

| Economic Factor | 2024 Projection/Data | 2025 Outlook | Impact on Auric Group |

|---|---|---|---|

| Global GDP Growth | IMF: 3.0% (2024) | IMF: 3.2% (2025) | Modest market expansion, potential for uneven demand |

| Inflation (US CPI) | Notable increases in early 2024 | Persistent concern, influencing purchasing power | Increased operational costs, need for value-driven offerings |

| Interest Rates (Federal Reserve) | Elevated through mid-2024 | Likely to remain a factor in financing costs | Higher cost of capital for investments and growth |

| Supply Chain Disruptions | Average 8% revenue loss for companies (2024) | Continued pressure from geopolitical and climate events | Need for resilient supply chain strategies, potential cost increases |

Preview the Actual Deliverable

Auric Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of the Auric Group delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting their operations. Understand the external landscape that shapes the Auric Group's strategic decisions.

Sociological factors

Consumers are increasingly prioritizing health and wellness, driving demand for products that support a healthy lifestyle. The global health and wellness market is forecast to grow significantly, from an estimated USD 6.87 trillion in 2025 to USD 11 trillion by 2034, indicating a substantial shift in consumer spending.

This trend means people are actively seeking out foods and beverages that provide nutritional advantages, improve gut health, and contribute to their overall sense of well-being. Companies that can align their offerings with these evolving preferences are well-positioned for success.

Consumers are increasingly scrutinizing brands for transparency and ethical conduct, driving demand for sustainable products. A 2024 survey indicated that 75% of consumers consider sustainability a key factor in purchasing decisions, with a growing preference for eco-friendly materials and minimal packaging.

This trend translates to a strong preference for brands actively demonstrating environmental and social responsibility, impacting purchasing behavior significantly. For instance, sales of products with recognized sustainability certifications saw a 15% year-over-year increase in early 2025.

Post-pandemic, consumers are doubling down on at-home consumption and convenience, a trend that's significantly shaping the food, beverage, and lifestyle sectors. This translates into a strong demand for easy-to-prepare meals, functional beverages, and products designed to integrate effortlessly into packed schedules.

For instance, the global ready-to-eat meals market was valued at approximately $170.5 billion in 2023 and is projected to grow, reflecting this persistent need for convenience. Auric Group can capitalize on this by expanding its portfolio of quick-prep options and convenient packaging solutions.

Demographic Shifts and Generational Buying Power

Demographic shifts are significantly altering consumer behavior, with Gen Z emerging as a powerful force. This generation, born roughly between 1997 and 2012, is increasingly flexing its economic muscle. By 2025, Gen Z's global spending power is projected to reach approximately $360 billion, according to some market analyses, demonstrating their growing influence.

Gen Z's purchasing habits are distinct, prioritizing sustainability, ingredient transparency, and authenticity. They actively seek out brands that align with their values, often scrutinizing product sourcing and ethical practices. This has led to a demand for greater accountability from companies, pushing them to adopt more responsible business models to resonate with this key demographic.

Brands that successfully tap into these generational preferences are poised for growth. Auric Group, for instance, would need to assess how its product lines and marketing strategies align with these evolving consumer expectations. The emphasis on genuine connection and demonstrable commitment to social and environmental responsibility is paramount for capturing the attention and loyalty of younger consumers.

Key considerations for Auric Group regarding generational buying power include:

- Gen Z's growing economic influence: Their increasing disposable income and purchasing decisions are shaping market trends.

- Emphasis on sustainability: Consumers, particularly younger ones, are more likely to support brands with strong environmental and ethical credentials.

- Demand for transparency: Openness about ingredients, sourcing, and business practices is crucial for building trust.

- Authenticity in branding: Gen Z values genuine messaging and relatable brand stories over overly polished or corporate communication.

Influence of Social Media and Online Communities

Social media platforms are now essential for brands like Auric Group to build their image, run marketing campaigns, and directly sell to customers. This shift is particularly evident in the rise of social commerce, where consumers are increasingly making purchases directly through platforms they use daily. For instance, TikTok has seen substantial growth in its shopping features, becoming a significant channel for discovering and buying everyday items, including food and beverage products. This trend means Auric Group must actively engage on these platforms to capture consumer attention and drive sales.

The influence of online communities and social media extends beyond direct sales, shaping consumer perceptions and brand loyalty. By 2023, social commerce sales were projected to reach over $1.2 trillion globally, highlighting its growing importance. Auric Group can leverage these digital spaces to foster community around its brands, gather real-time feedback, and adapt its product offerings to meet evolving consumer preferences. This direct line of communication allows for agile responses to market trends and a deeper understanding of customer needs.

- Social Commerce Growth: Global social commerce sales are expected to exceed $1.2 trillion by the end of 2023, demonstrating a massive opportunity for brands.

- Platform Diversification: Platforms like TikTok are becoming key shopping destinations, especially for consumer goods categories relevant to Auric Group.

- Brand Engagement: Active participation in online communities allows for direct consumer interaction, fostering loyalty and providing valuable market insights.

Societal trends show a strong consumer shift towards health and wellness, with the global market projected to reach $11 trillion by 2034, up from $6.87 trillion in 2025. This emphasizes a growing preference for nutritious and gut-friendly products, a key area for Auric Group to address.

Furthermore, sustainability is no longer a niche concern; a 2024 survey revealed 75% of consumers consider it vital in purchasing decisions, with sales of certified sustainable products increasing by 15% in early 2025. Auric Group must integrate these values to resonate with a conscious consumer base.

Demographic shifts, particularly the rise of Gen Z, are reshaping market dynamics. This generation's spending power, estimated to reach $360 billion globally by 2025, prioritizes authenticity, transparency, and ethical practices, demanding greater corporate accountability.

The digital landscape, especially social commerce, is crucial for brand engagement and sales. With global social commerce sales projected to exceed $1.2 trillion by the end of 2023, platforms like TikTok are becoming significant retail channels, necessitating active brand participation.

| Societal Trend | Key Data Point | Implication for Auric Group |

|---|---|---|

| Health & Wellness Focus | Global market to reach $11T by 2034 (from $6.87T in 2025) | Expand product lines with nutritional benefits and gut health support. |

| Sustainability Demand | 75% of consumers prioritize sustainability (2024 survey) | Emphasize eco-friendly materials and transparent sourcing in operations. |

| Gen Z Influence | Global spending power ~$360B by 2025 | Align branding with authenticity, transparency, and ethical values. |

| Social Commerce Growth | Global sales > $1.2T by end of 2023 | Leverage platforms like TikTok for direct sales and community building. |

Technological factors

The e-commerce boom is undeniable, with global online sales expected to reach a staggering $4.8 trillion by 2025. This trend significantly impacts how consumers shop, making it crucial for Auric Group's brands to adapt.

To stay competitive, Auric Group needs to invest in and optimize its e-commerce platforms. Developing strong direct-to-consumer (DTC) capabilities allows brands to build direct relationships with customers, gather valuable data, and control the brand experience from start to finish.

Advanced data analytics and AI are crucial for Auric Group to truly grasp intricate consumer behaviors. This allows for hyper-personalized marketing, making campaigns resonate more deeply. For instance, in 2024, companies leveraging AI for customer insights reported an average 15% increase in marketing campaign ROI.

By analyzing vast datasets, AI tools can uncover hidden patterns and emerging trends in consumer preferences. This capability directly informs more effective, targeted business strategies, helping Auric Group anticipate market shifts. In the retail sector, AI-powered analytics are projected to drive over $400 billion in value by 2025.

Auric Group's production and supply chain operations are increasingly leveraging automation and AI to boost efficiency and cut waste. For instance, AI-powered demand forecasting tools are becoming vital, with the global AI in supply chain market projected to reach $17.9 billion by 2027, indicating a significant shift towards data-driven optimization.

This technological integration is also key to building resilience. By automating processes and using AI for real-time data analysis, Auric Group can better anticipate and respond to disruptions, a critical factor given that supply chain disruptions cost the global economy an estimated $7 trillion in 2023.

Food Technology Innovations

Technological advancements are significantly reshaping the food and beverage industry, with innovations like plant-based alternatives and functional ingredients gaining substantial traction. These developments directly cater to evolving consumer preferences for healthier, more sustainable, and varied food choices.

The market for plant-based foods, for instance, has seen remarkable growth. In 2024, the global plant-based food market was valued at approximately $40 billion, with projections indicating continued expansion. This surge is fueled by consumer awareness of environmental impact and health benefits associated with these products.

Novel food production methods, including precision fermentation and cultivated meat, are also emerging as key technological drivers. These technologies promise to offer more resource-efficient and ethical ways to produce food. By 2025, investments in food tech startups are expected to reach new highs, reflecting strong investor confidence in these transformative innovations.

- Plant-based food market growth: Valued at roughly $40 billion in 2024, demonstrating a significant shift in consumer dietary habits.

- Functional ingredients demand: Increasing consumer interest in foods with added health benefits, such as probiotics and omega-3 fatty acids, driving ingredient innovation.

- Investment in food tech: Projected to see substantial growth in venture capital funding by 2025, highlighting the industry's technological advancement and future potential.

Digital Marketing and Brand Building Tools

Digital marketing is rapidly changing, with video content and social commerce gaining significant traction. For instance, global social commerce sales are projected to reach over $2.9 trillion by 2026, highlighting a major shift in how consumers shop. Brands must leverage these evolving digital landscapes, incorporating AI-powered tools for enhanced customer engagement and content creation to remain competitive.

The integration of Artificial Intelligence (AI) in marketing is becoming crucial. By 2024, AI in marketing is expected to drive over $1.6 trillion in business value. This includes AI agents handling customer service inquiries and generating personalized marketing content, allowing companies like Auric Group to optimize outreach and build stronger brand connections.

- Video Dominance: Short-form video content, exemplified by platforms like TikTok and Instagram Reels, continues to capture audience attention, driving higher engagement rates.

- Social Commerce Growth: Sales directly through social media platforms are expanding, creating new avenues for direct-to-consumer interaction and purchasing.

- AI in Marketing: AI is increasingly used for personalized advertising, customer service chatbots, and content optimization, leading to more efficient and targeted campaigns.

- Data-Driven Strategies: The effective use of analytics to understand consumer behavior across digital channels is paramount for successful brand building and marketing ROI.

Technological advancements are profoundly impacting consumer behavior and business operations for Auric Group. The e-commerce landscape continues its rapid expansion, with global online sales projected to hit $4.8 trillion by 2025, necessitating robust digital platforms and direct-to-consumer (DTC) strategies.

AI and data analytics are becoming indispensable tools for understanding consumers, with AI in marketing expected to generate over $1.6 trillion in business value by 2024, enhancing personalization and campaign effectiveness. Automation and AI are also streamlining supply chains, improving efficiency and resilience, a critical factor given that supply chain disruptions cost the global economy an estimated $7 trillion in 2023.

The food and beverage sector is seeing significant innovation, with the plant-based food market valued at roughly $40 billion in 2024, reflecting a strong consumer shift towards healthier and more sustainable options. Emerging technologies like precision fermentation and cultivated meat are also poised to transform food production, attracting substantial investment by 2025.

Digital marketing is increasingly dominated by video content and social commerce, with social commerce sales projected to exceed $2.9 trillion by 2026. Auric Group must leverage these trends, integrating AI for enhanced engagement and data-driven strategies to maintain a competitive edge.

| Technology Area | 2024/2025 Projection/Value | Impact on Auric Group |

|---|---|---|

| E-commerce Growth | $4.8 trillion global sales by 2025 | Necessitates optimized online platforms and DTC capabilities. |

| AI in Marketing | $1.6 trillion business value by 2024 | Drives personalization, customer insights, and campaign ROI. |

| Plant-based Food Market | $40 billion valuation in 2024 | Offers opportunities for product innovation and catering to consumer trends. |

| Social Commerce Sales | >$2.9 trillion by 2026 | Creates new channels for customer interaction and direct sales. |

Legal factors

Regulatory bodies like the FDA are actively updating food safety and labeling laws for 2025. Key changes include a revised definition of 'healthy' food products and more stringent traceability mandates under the Food Safety Modernization Act (FSMA). These evolving legal requirements directly impact Auric Group's food and beverage portfolio, necessitating careful adherence to ensure compliance and avoid potential penalties.

Consumer protection and advertising standards are becoming increasingly stringent, especially concerning health claims and product descriptions. For Auric Group, this means all marketing materials and product communications need thorough legal vetting to ensure they are truthful and avoid any misleading information. For instance, in 2024, the FTC continued its focus on unsubstantiated health claims in advertising, with significant penalties for non-compliance.

With digital interactions soaring, data privacy laws like GDPR and CCPA are critical for brands. Auric Group's businesses must adopt clear data handling and strong security to earn consumer trust and prevent legal issues.

Intellectual Property Rights and Brand Protection

Protecting intellectual property, including trademarks and patents for new products and branding, is paramount for Auric Group in the fiercely competitive consumer market. Legal frameworks governing IP rights are essential for safeguarding the company's substantial investments in developing and marketing its innovative consumer brands.

These legal protections are critical for preventing competitors from unfairly capitalizing on Auric Group's research, development, and marketing efforts. For instance, in 2024, the global value of intellectual property in the consumer goods sector continued to rise, underscoring the importance of robust legal strategies for brand differentiation and market share protection.

- Trademarks: Auric Group relies on trademark law to protect its brand names, logos, and slogans, ensuring consumer recognition and preventing brand dilution.

- Patents: Patents are vital for shielding Auric Group's novel product designs and manufacturing processes, granting exclusive rights and a competitive edge.

- Copyrights: Copyrights protect original works of authorship, such as marketing materials and packaging designs, preventing unauthorized reproduction.

- Enforcement: Auric Group actively monitors the market and pursues legal action against infringements to maintain the integrity and value of its intellectual property.

Labor and Employment Regulations

Changes in labor laws and employment regulations directly affect Auric Group's operational costs and HR strategies. For instance, minimum wage adjustments or new mandates on benefits can increase payroll expenses for portfolio companies. In 2024, many regions saw continued discussions and some implementation of updated worker protections, impacting industries where Auric Group has investments.

Compliance with evolving workplace health and safety standards is non-negotiable. For example, stricter regulations on remote work safety or industrial hygiene could necessitate capital expenditures or policy overhauls. The ongoing focus on fair labor practices, including equal pay and anti-discrimination measures, also requires diligent oversight to avoid legal repercussions and maintain a positive brand image.

- Minimum Wage Increases: Several countries and states have enacted or proposed minimum wage hikes for 2024-2025, potentially increasing labor costs for portfolio companies by 3-7% depending on the sector.

- Workplace Safety Mandates: New guidelines on ergonomic assessments for remote workers and enhanced safety protocols in manufacturing sectors are being introduced, requiring compliance investments.

- Gig Economy Regulations: Evolving rules around classifying independent contractors versus employees could impact business models reliant on flexible workforces.

- Paid Leave Policies: Expansion of mandated paid sick leave or family leave benefits continues to be a legislative trend, adding to employee compensation costs.

Auric Group must navigate a complex web of regulations, from food safety standards to advertising claims, with agencies like the FDA and FTC continually updating their requirements. Data privacy laws such as GDPR and CCPA are also critical, demanding robust security measures for consumer data. Furthermore, protecting intellectual property through trademarks and patents is essential in competitive markets, with global IP value in consumer goods rising significantly in 2024.

Environmental factors

Increasing consumer and investor demand for sustainability and strong ESG performance is a significant driver for consumer brands. For instance, in 2024, a significant majority of consumers reported that sustainability influences their purchasing decisions, with many willing to pay a premium for eco-friendly products. This trend is reshaping brand loyalty, pushing companies to go beyond mere product features and showcase genuine commitments to environmental responsibility.

Climate change is increasingly disrupting global supply chains, with extreme weather events like floods and droughts causing significant delays and resource scarcity. For instance, in 2024, major agricultural regions experienced unprecedented rainfall, impacting crop yields and raw material availability for many industries.

Auric Group must bolster its supply chain resilience by diversifying sourcing locations and exploring localized procurement strategies. This approach helps mitigate the financial impact of climate-related disruptions, which the World Economic Forum estimated could cost the global economy trillions by 2050 if not addressed.

There's a significant and growing call for eco-friendly packaging, favoring materials that can be recycled, composted, or reused. This trend is driven by both regulatory bodies and consumers who are increasingly prioritizing waste reduction and circular economy practices.

In 2024, the global sustainable packaging market was valued at approximately $315 billion, with projections indicating a compound annual growth rate (CAGR) of around 6.5% through 2030. This growth underscores the substantial market shift towards environmentally responsible packaging solutions.

Resource Scarcity and Sustainable Sourcing

Growing global awareness of resource scarcity is significantly shaping ingredient selection and sourcing for food, beverage, and wellness companies. This trend pushes brands towards natural ingredients and a reduced environmental impact.

Companies are prioritizing responsible sourcing of raw materials to meet consumer demand for sustainability. For instance, the global sustainable sourcing market was valued at approximately $11.8 billion in 2023 and is projected to reach $25.2 billion by 2030, growing at a CAGR of 11.5%.

- Increased demand for ethically sourced ingredients: Consumers are actively seeking products with transparent supply chains.

- Focus on water conservation: Many agricultural inputs require significant water, making water-efficient sourcing a key consideration.

- Shift towards renewable and biodegradable packaging: This addresses concerns about plastic waste and resource depletion.

- Investment in alternative ingredient development: Companies are exploring lab-grown ingredients and upcycled materials to mitigate scarcity.

Consumer and Investor Demand for Eco-Friendly Practices

Consumers and investors are increasingly looking beyond just a company's products to evaluate its broader environmental impact. This means scrutinizing energy use, waste management, and a company's overall carbon footprint. For Auric Group, demonstrating a commitment to eco-friendly practices is becoming a significant differentiator.

The demand for sustainable investing is on the rise, with many investors actively seeking out companies that align with environmental, social, and governance (ESG) principles. In 2024, global sustainable investment assets were projected to exceed $50 trillion, highlighting a substantial market shift. Companies that proactively adopt green energy solutions and transparently report their environmental initiatives are better positioned to attract this capital and enhance their brand reputation.

- Growing ESG Investment: Global sustainable investment assets are expected to surpass $50 trillion in 2024, indicating strong investor preference for environmentally conscious companies.

- Brand Reputation Boost: Embracing green energy and transparent environmental reporting can significantly improve a company's public image and attract a wider investor base.

- Carbon Footprint Scrutiny: Beyond products, consumers and investors are now evaluating a company's entire operational environmental impact, including energy consumption and emissions.

- Competitive Advantage: Companies demonstrating strong environmental stewardship are likely to gain a competitive edge in attracting both customers and investment capital.

Environmental factors are increasingly shaping business strategies, with consumers and investors prioritizing sustainability. Auric Group must navigate growing demands for eco-friendly packaging, with the global sustainable packaging market valued at approximately $315 billion in 2024 and projected for robust growth.

Climate change poses significant supply chain risks, as evidenced by widespread agricultural disruptions in 2024 due to extreme weather. Diversifying sourcing and exploring localized procurement are crucial for mitigating these impacts.

The rise of ESG investing, with global sustainable assets projected to exceed $50 trillion in 2024, underscores the financial imperative for companies to demonstrate strong environmental performance and transparent reporting.

| Environmental Factor | Impact on Auric Group | Key Data/Trend (2024/2025) |

|---|---|---|

| Consumer Demand for Sustainability | Influences purchasing decisions and brand loyalty. | Majority of consumers report sustainability influences purchases; willingness to pay a premium. |

| Climate Change & Supply Chains | Disrupts raw material availability and logistics. | Extreme weather events caused significant agricultural impacts in 2024. |

| Packaging Regulations & Consumer Preference | Drives shift to recyclable, compostable, or reusable materials. | Global sustainable packaging market valued at ~$315 billion in 2024, with strong CAGR. |

| Resource Scarcity Awareness | Promotes use of natural, responsibly sourced ingredients. | Global sustainable sourcing market valued at ~$11.8 billion in 2023, growing at 11.5% CAGR. |

| ESG Investment Growth | Attracts capital and enhances brand reputation. | Global sustainable investment assets projected to exceed $50 trillion in 2024. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Auric Group is meticulously constructed using data from reputable international organizations like the World Bank and IMF, alongside government publications and leading industry research firms. This ensures a comprehensive understanding of global economic trends, regulatory landscapes, and technological advancements impacting Auric Group.