Auric Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Auric Group Bundle

Our Porter's Five Forces analysis of Auric Group reveals a dynamic competitive landscape, highlighting the significant influence of buyer power and the moderate threat of substitutes. Understanding these forces is crucial for navigating Auric Group's market. Unlock the full Porter's Five Forces Analysis to explore Auric Group’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The bargaining power of suppliers for Auric Group's portfolio companies is significantly shaped by how concentrated the supplier base is and how unique the inputs are. When few suppliers offer specialized ingredients or proprietary components, especially in the food and beverage, wellness, or lifestyle sectors, their leverage grows. For instance, a premium brand relying on a specific, sustainably sourced cocoa bean variety from a limited number of farms would face suppliers with higher bargaining power.

High switching costs for Auric's portfolio companies significantly bolster supplier bargaining power. For instance, if a portfolio company relies on a supplier's proprietary software or highly specialized components, the expense and disruption of finding and integrating an alternative can be prohibitive, effectively locking them in. This leverage allows suppliers to potentially command higher prices or less favorable terms.

Suppliers can wield considerable power if they possess a believable threat of moving into the consumer brand market themselves. For instance, if a vital supplier of a distinctive ingredient for Auric's products could realistically begin manufacturing and marketing their own end-user goods, this gives them significant leverage over Auric's various brands. This potential for forward integration by suppliers incentivizes Auric to foster strong supplier relationships and potentially offer more favorable contract terms to mitigate this risk.

Importance of Volume to Suppliers

The volume of business a company like Auric Group provides to its suppliers significantly influences supplier bargaining power. If Auric's brands constitute a substantial percentage of a supplier's overall sales, that supplier is likely more amenable to negotiating favorable pricing, delivery schedules, or enhanced service levels. For instance, if Auric represents 15% of a key component supplier's annual revenue, that supplier has a vested interest in maintaining a strong relationship and offering competitive terms.

Conversely, when Auric's purchasing volume is relatively minor for a supplier, the supplier's motivation to offer concessions diminishes. This is because the supplier's overall business health is not heavily reliant on Auric's orders. In such scenarios, suppliers are less likely to bend on pricing or prioritize Auric's needs over larger clients, effectively increasing their bargaining power within the relationship.

Consider the impact on Auric's cost structure. If Auric sources critical raw materials from a few specialized suppliers, and its order volume is only 5% of their total output, those suppliers hold considerable sway. This can translate into higher input costs for Auric, potentially impacting its profit margins. In 2024, for example, companies with lower order volumes often faced price increases averaging 3-5% for essential goods, compared to larger volume buyers who secured discounts.

Key considerations regarding volume and supplier bargaining power for Auric Group include:

- Supplier Dependency: The degree to which suppliers depend on Auric's volume directly correlates to Auric's negotiating leverage.

- Market Concentration: If Auric sources from a concentrated supplier market, even high volume might not fully offset the supplier's power.

- Contractual Agreements: Long-term contracts with volume commitments can mitigate supplier power, ensuring more stable terms.

- Alternative Suppliers: The availability of alternative suppliers with comparable quality and capacity can significantly reduce the bargaining power of existing suppliers, regardless of volume.

Impact of Supply Chain Disruptions and Trends

Recent global events, such as the semiconductor shortages impacting the automotive industry in 2021-2022, have significantly amplified the bargaining power of suppliers who can guarantee consistent and stable deliveries. Companies are now more willing to accept higher prices for the assurance of supply continuity.

The growing demand for ethically sourced and sustainable materials, a trend gaining significant traction in 2023 and projected to intensify, further empowers suppliers who can demonstrate robust environmental, social, and governance (ESG) credentials. For instance, a 2024 survey by Deloitte found that 73% of consumers are willing to change their purchasing habits to reduce environmental impact, directly influencing brand sourcing decisions.

- Supply Chain Resilience: Suppliers offering reliable and stable supply chains command greater leverage.

- Sustainability Demand: Suppliers meeting ESG criteria benefit from increased demand and premium pricing potential.

- Transparency: Brands seeking transparent supply chains empower suppliers who provide this visibility.

- Geopolitical Factors: Global instability can shift power towards suppliers in politically stable regions.

When suppliers are few, inputs are unique, or switching costs are high, their bargaining power increases significantly for Auric Group's portfolio companies. Suppliers can also leverage their power through the credible threat of entering the end-consumer market themselves. Auric's own purchasing volume plays a crucial role; if Auric represents a large portion of a supplier's business, Auric gains more negotiating leverage.

In 2024, for example, companies with smaller order volumes often experienced price increases of 3-5% for essential goods, highlighting the supplier's advantage in such scenarios. Conversely, suppliers who can guarantee supply chain resilience or meet growing ESG demands, as evidenced by a 2024 Deloitte survey showing 73% of consumers willing to alter habits for environmental impact, are increasingly empowered.

| Factor | Impact on Supplier Bargaining Power | Example for Auric Group |

|---|---|---|

| Supplier Concentration | High | Few suppliers of proprietary ingredients for a premium wellness brand. |

| Switching Costs | High | Reliance on a supplier's specialized software for a food processing plant. |

| Threat of Forward Integration | High | A key ingredient supplier considering launching its own branded product line. |

| Auric's Order Volume | Low | Auric representing only 5% of a critical component supplier's annual revenue. |

| Supplier Dependency on Auric | Low | Auric's orders are a small fraction of a supplier's total sales. |

What is included in the product

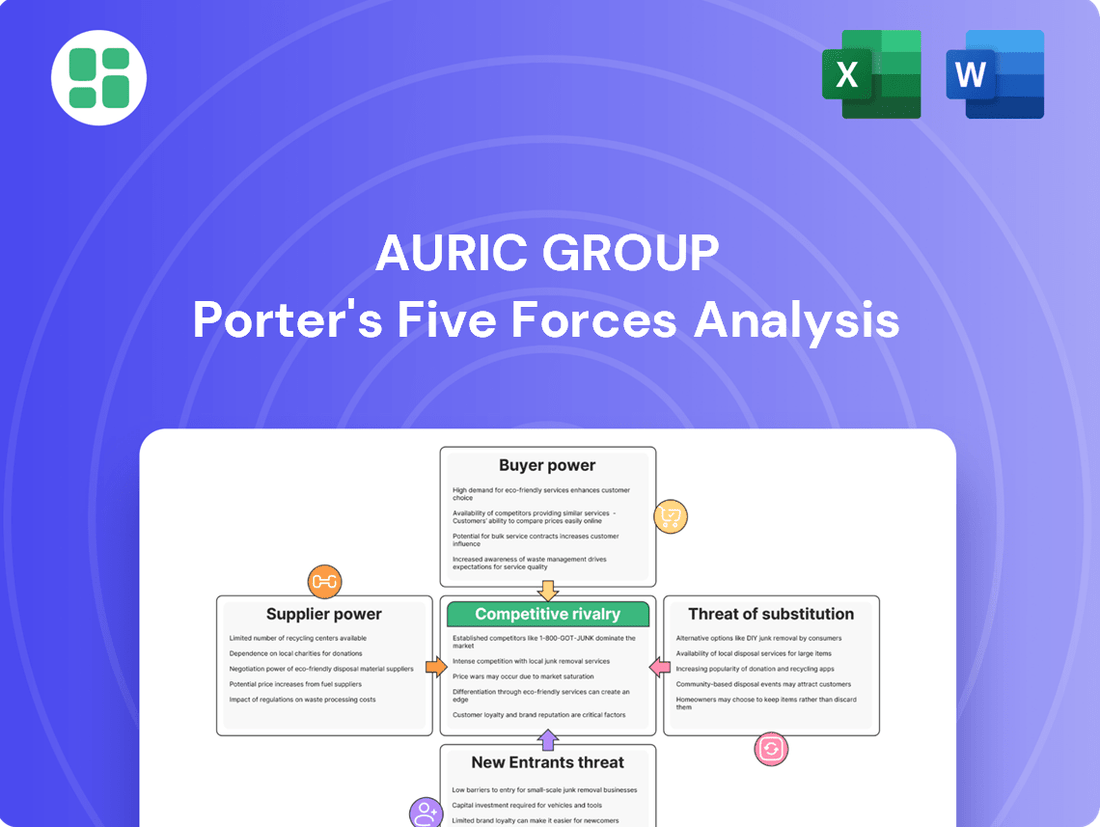

Auric Group's Porter's Five Forces analysis provides a comprehensive understanding of its competitive environment, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes.

Effortlessly identify and mitigate competitive threats with a dynamic, visual representation of all five forces.

Customers Bargaining Power

Customers in the food and beverage, wellness, and lifestyle sectors are showing a growing price sensitivity. This trend is amplified by economic uncertainties and ongoing inflation, pushing consumers to actively seek out discounts, coupons, and more affordable options, including private label brands. This behavior directly strengthens their bargaining power.

For instance, in 2024, inflation rates in many developed economies continued to impact household budgets, leading to a noticeable shift in consumer spending patterns. Studies indicated that a significant percentage of consumers reported cutting back on non-essential purchases and actively comparing prices across different retailers and brands, a clear indicator of increased price sensitivity.

The consumer brand market in 2024 is a crowded space, with consumers easily finding alternatives. This means Auric Group faces significant customer power due to the sheer volume of choices available. For example, the global e-commerce market, a key channel for many consumer brands, is projected to reach over $7 trillion in 2024, highlighting the vastness of the retail landscape.

Switching between brands is often effortless for consumers, especially with the rise of online platforms and subscription services. Low switching costs empower customers to demand better pricing, superior quality, or a more engaging experience. A 2024 survey indicated that over 60% of consumers would switch brands for a discount of 10% or more, underscoring this sensitivity.

Modern consumers, especially younger demographics, increasingly seek personalized products and customized shopping journeys. Brands that excel in offering tailored solutions, smooth omnichannel experiences, and AI-powered suggestions are better positioned to attract and keep customers. This heightened expectation, however, also strengthens consumers' ability to select brands that cater precisely to their individual needs.

Influence of Digital Information and Social Commerce

The digital age has dramatically reshaped customer power, particularly through the influence of readily available online information and the rise of social commerce. Customers are now incredibly well-informed, able to access product reviews, price comparisons, and expert opinions with just a few clicks. This transparency directly amplifies their ability to negotiate and demand better value, as they can easily identify alternatives and understand market pricing.

Social commerce and influencer marketing further empower consumers by shaping purchasing decisions and highlighting competitive offerings. For instance, a significant portion of consumers rely on social media for product discovery and validation. In 2023, studies indicated that over 50% of consumers used social media to research products before buying, a trend that has only intensified. This collective awareness means customers can easily coordinate preferences and exert pressure on brands for better quality, pricing, or service, thereby increasing their bargaining power.

- Informed Consumers: Access to online reviews and comparison sites means customers are highly knowledgeable about product features and pricing.

- Social Commerce Impact: Social media platforms and influencers significantly guide purchasing decisions, increasing consumer awareness of alternatives.

- Amplified Bargaining Power: Well-informed customers can easily compare options, leading to greater demands for value and better terms from businesses.

- Data-Driven Decisions: In 2024, an estimated 60% of online shoppers consulted at least three different sources of information before making a purchase.

Shifting Values Towards Health, Wellness, and Sustainability

Consumers are increasingly prioritizing health, wellness, and sustainability, directly impacting their purchasing decisions and brand loyalty. This shift empowers them to demand more from companies.

Brands that actively embrace eco-friendly practices, ensure transparent supply chains, and offer products with tangible health benefits are gaining favor. For example, in 2024, the global market for sustainable goods saw significant growth, with consumers willing to pay a premium for ethically produced items.

This conscious consumerism allows customers to exert considerable bargaining power by actively selecting and supporting businesses that align with their personal values and lifestyle choices, effectively dictating market trends.

- Growing Demand for Sustainable Products: The global market for sustainable goods is projected to reach over $150 billion by 2027, indicating a strong consumer preference.

- Health and Wellness Market Expansion: The wellness industry, encompassing everything from organic foods to fitness, continues its upward trajectory, with consumers actively seeking products that promote well-being.

- Transparency as a Key Driver: Studies in 2024 revealed that over 70% of consumers consider product transparency a crucial factor in their purchasing decisions.

- Ethical Sourcing Influence: Consumers are increasingly scrutinizing brand practices, leading to a demand for ethically sourced materials and fair labor conditions.

The bargaining power of customers for Auric Group is substantial, driven by increased price sensitivity and a wide array of available alternatives. In 2024, economic pressures have made consumers more discerning, actively seeking value and readily switching brands for better deals. For instance, over 60% of consumers indicated a willingness to switch brands for a discount of 10% or more, highlighting this trend.

| Factor | Description | 2024 Data/Trend |

|---|---|---|

| Price Sensitivity | Consumers actively seek discounts and promotions due to economic uncertainties. | Inflation influenced spending, with many cutting non-essential purchases. |

| Availability of Alternatives | A crowded market offers numerous choices, reducing reliance on any single brand. | The global e-commerce market exceeded $7 trillion, showcasing vast retail options. |

| Low Switching Costs | Effortless transitions between brands, especially online, empower consumer demands. | Consumers easily find information and compare prices, increasing negotiation leverage. |

| Informed Consumers | Access to reviews and comparisons makes customers highly knowledgeable. | Approximately 60% of online shoppers consulted multiple sources before purchasing in 2024. |

Preview Before You Purchase

Auric Group Porter's Five Forces Analysis

This preview showcases the complete Auric Group Porter's Five Forces Analysis, providing a detailed examination of competitive forces within the industry. You are viewing the exact document you will receive immediately after purchase, ensuring full transparency and no hidden surprises. This professionally formatted analysis is ready for immediate use, offering valuable insights into market dynamics.

Rivalry Among Competitors

The food and beverage, wellness, and lifestyle sectors are incredibly fragmented, featuring a vast array of competitors. This includes everything from nimble local startups to global giants, all vying for consumer attention.

This intense competition means Auric Group faces constant pressure to innovate and differentiate its offerings. For instance, the global food and beverage market was valued at approximately $7.4 trillion in 2023, with numerous players contributing to this figure, highlighting the sheer scale of competition.

Competitive rivalry within Auric Group's sectors is intensifying, driven by a noticeable decline in brand loyalty across many consumer demographics. This shift is particularly evident as customers increasingly prioritize value for money and actively seek novel experiences, making it harder for established brands to retain their customer base.

The landscape is characterized by a relentless stream of new product introductions and innovative concepts from rivals, which directly challenges Auric Group's ability to maintain distinct product differentiation and unique selling propositions. This constant innovation necessitates significant investment in marketing and research and development to stay ahead.

For instance, in the fast-moving consumer goods (FMCG) sector, a key area for many diversified groups, the average product lifecycle has shortened, with many new SKUs failing within their first year. In 2024, reports indicated that over 80% of new product launches in the global FMCG market did not achieve sustained market share, underscoring the difficulty in differentiation.

Competitive rivalry within the sector is intensely fueled by substantial investments in marketing, advertising, and product innovation. Auric Group faces rivals who are consistently boosting their marketing budgets and prioritizing the development of novel products and services. This strategy is employed to capture consumer attention and stimulate sales volume, underscoring a dynamic and highly competitive market environment.

Industry Growth Rates and Market Saturation

While specific areas like wellness and functional foods show robust expansion, the broader consumer goods sector often operates in mature markets with decelerating growth. This maturity can transform competition into a zero-sum dynamic, where gains for one company directly correlate with losses for another, significantly heightening competitive rivalry.

In 2024, the global wellness market was projected to reach approximately $5.6 trillion, demonstrating strong growth in certain segments. However, the overall fast-moving consumer goods (FMCG) market growth in developed economies remained modest, often in the low single digits.

- Mature Market Dynamics: Many established consumer goods categories exhibit slower growth, forcing companies to fight harder for market share.

- Intensified Rivalry: In slower-growth environments, companies often resort to aggressive pricing, increased promotional activity, and innovation to capture market share from competitors.

- Niche Growth Opportunities: While overall growth may be slow, specific niches within consumer goods, such as plant-based alternatives or personalized nutrition, continue to attract significant investment and intense competition.

Strategic Consolidation and M&A Activity

Strategic consolidation and mergers and acquisitions (M&A) are actively reshaping the competitive landscape. Larger companies are acquiring smaller, innovative brands to expand their market share and access new technologies. For instance, in 2024, the global M&A market saw significant activity across various sectors, with technology and healthcare leading the charge.

Private equity firms are also playing a crucial role, injecting capital and driving restructuring within industries. This increased investment activity, particularly evident in the first half of 2024 with a notable uptick in deal volume compared to the same period in 2023, further intensifies competition as consolidated entities leverage greater resources and market power.

- Increased Market Share: Acquisitions allow larger entities to quickly gain a larger slice of the market.

- Access to Innovation: Buying smaller firms provides access to novel technologies and business models.

- Private Equity Influence: PE firms' investments can lead to operational efficiencies and strategic shifts, altering competitive dynamics.

- Reshaping Competitive Dynamics: Consolidation often leads to fewer, but larger, competitors, impacting pricing and innovation strategies.

Auric Group operates in highly fragmented markets with intense competition from both established players and agile startups. This rivalry is amplified by declining brand loyalty and a constant need for innovation, as evidenced by the high failure rate of new product launches in the FMCG sector. The intensified competition is further fueled by significant marketing investments and a trend towards strategic consolidation, with M&A activity reshaping the competitive landscape.

| Metric | 2023 (Approx.) | 2024 (Projected/Reported) | Impact on Auric Group |

|---|---|---|---|

| Global Food & Beverage Market Value | $7.4 Trillion | Continued growth, increasing market size | Larger overall market, but more competition |

| Global Wellness Market Value | $5.6 Trillion | Projected to reach higher figures | Growth opportunities, but also increased focus from competitors |

| FMCG New Product Launch Success Rate | Over 80% failure rate (within first year) | Likely similar or higher failure rate due to innovation pressure | High risk and cost associated with new product introductions |

| FMCG Growth in Developed Economies | Low single digits | Expected to remain modest | Emphasis on market share gains rather than broad market expansion |

SSubstitutes Threaten

The threat of substitutes for Auric Group is considerable, particularly within the food and beverage industry where generic and private label options are abundant. These alternatives frequently provide quality comparable to branded goods but at a more attractive price point, directly challenging Auric’s market share by attracting budget-conscious consumers.

In 2024, the private label share in the UK grocery market reached approximately 20.6%, demonstrating a significant consumer shift towards these lower-cost alternatives. This trend means Auric must continuously innovate and justify its premium pricing to retain customers who are increasingly open to non-branded products offering similar functionality or taste.

Consumers often encounter minimal expenses when shifting from a particular brand to a substitute product. For instance, the global beverage market, valued at over $1.5 trillion in 2024, sees consumers easily switch between soft drinks, juices, or even tap water, impacting brand loyalty.

This low friction in changing choices, whether it's opting for a home-cooked meal over takeout or exploring different fitness routines, directly amplifies the threat of substitutes. The accessibility and affordability of alternatives mean consumers are less tethered to existing offerings.

The threat of substitutes is amplified by ongoing innovation in alternative products. For instance, the plant-based food and beverage sector saw significant growth, with the global market valued at approximately $29.7 billion in 2023 and projected to reach $169.9 billion by 2030, according to Statista. This rapid expansion means consumers have increasingly viable and appealing alternatives to traditional offerings.

New functional wellness solutions also emerge, offering improved performance or health benefits. These innovations can directly challenge established product categories by aligning better with evolving consumer values, such as a growing demand for sustainable and health-conscious options. For example, the global functional foods market was estimated at $177.4 billion in 2023 and is expected to grow substantially, indicating a strong consumer shift towards these alternatives.

DIY and Home-Based Solutions

Consumers increasingly turn to DIY and home-based solutions for lifestyle and wellness needs, posing a significant threat of substitution for companies like Auric Group. This trend is fueled by a desire for cost savings and perceived authenticity.

For instance, the home cooking market has seen substantial growth. In 2024, the global meal kit delivery service market, a direct competitor to home cooking, was valued at approximately $15 billion, indicating a strong consumer preference for preparing food at home. Similarly, the rise of free online fitness content and community-driven wellness practices offers alternatives to paid gym memberships or wellness programs.

- DIY Meal Preparation: Consumers can save significantly by cooking at home rather than purchasing pre-made meals or dining out.

- Home-Based Fitness: The proliferation of free workout videos and apps provides accessible alternatives to gym memberships.

- Natural and Traditional Remedies: An interest in natural health solutions can lead consumers to use home-brewed remedies instead of commercial wellness products.

- Cost-Effectiveness: DIY options are often perceived as more budget-friendly, especially in the current economic climate, with inflation impacting disposable income.

Changing Consumer Habits and Value Perception

Shifting consumer habits, fueled by growing health consciousness and economic prudence, are a significant driver for substitutes. For instance, in 2024, the global plant-based food market continued its upward trajectory, with sales projected to reach over $70 billion, indicating a clear preference for alternatives to traditional animal products.

Consumers are now scrutinizing products based on their overall value proposition, not just brand recognition. This means that alternatives offering superior functionality, sustainability, or a more authentic experience can easily capture market share. A 2024 survey revealed that 65% of consumers consider a product's environmental impact when making purchasing decisions, highlighting a willingness to switch for perceived ethical benefits.

- Shifting Consumer Habits: Increased health consciousness and economic concerns are leading consumers towards alternative products.

- Value Perception: Consumers prioritize perceived value, including factors like authenticity and sustainability, over brand name alone.

- Market Data (2024): The plant-based food market is expected to exceed $70 billion in sales, demonstrating a strong shift towards substitutes.

- Consumer Priorities (2024): 65% of consumers consider environmental impact, influencing their choice of substitutes.

The threat of substitutes for Auric Group is significant, driven by readily available and often cheaper alternatives across its product categories. Consumers can easily switch to private labels, generic brands, or even entirely different consumption patterns, such as home preparation, due to minimal switching costs. This dynamic is intensified by evolving consumer preferences for health, sustainability, and value, pushing them towards innovative substitutes that may offer comparable or superior benefits at a lower price point.

| Industry Segment | Key Substitutes | 2024 Market Data/Trend |

|---|---|---|

| Food & Beverage | Private Labels, Generic Brands, Home Cooking | UK private label share ~20.6%; Global beverage market > $1.5 trillion |

| Wellness & Health | Plant-based alternatives, DIY remedies, Free online fitness | Plant-based food market projected > $70 billion; Functional foods market ~$177.4 billion |

| Convenience | Home meal kits, DIY solutions | Meal kit delivery market ~$15 billion |

Entrants Threaten

The direct-to-consumer (DTC) model has significantly lowered the capital requirements for new brands entering the consumer goods market. Unlike traditional retail, which demands hefty investments in manufacturing, inventory, and physical distribution networks, DTC brands can leverage online platforms and social media. This shift allows startups to bypass many of the traditional barriers, making it easier to launch and scale.

In 2024, the continued growth of e-commerce and digital marketing tools further democratized market access. For instance, the global e-commerce market was projected to reach over $6.3 trillion in 2024, providing a vast customer base accessible with relatively modest digital marketing budgets. This accessibility amplifies the threat of new entrants, as innovative brands can emerge and gain traction without the massive upfront capital previously needed.

The rapid evolution of consumer preferences, especially towards health-conscious, eco-friendly, and customized offerings, continuously opens doors for new players. These shifts allow nimble startups to focus on specific, underserved segments, bypassing direct competition with larger, more established companies.

For instance, the global personalized nutrition market was valued at approximately $11.4 billion in 2023 and is projected to grow significantly, illustrating the potential for new entrants to capture market share by catering to these specialized demands.

Technological advancements, such as AI-driven product development and sophisticated supply chain management tools, significantly lower the barrier to entry for new competitors. For instance, the increasing availability and sophistication of contract manufacturers in 2024 mean that emerging brands don't need massive upfront investment in their own factories. This accessibility allows new entrants to leverage cutting-edge production methods without the capital expenditure, making it easier to launch products and compete with established players.

Brand Building Through Digital Channels

New companies can effectively bypass traditional, high-cost advertising by utilizing digital channels. This allows them to build brand recognition and customer loyalty much faster and more affordably than before.

For instance, in 2024, the global digital advertising spending was projected to reach over $700 billion, showcasing the immense reach and efficiency of these platforms for new entrants seeking market penetration.

- Digital Reach: Online platforms allow for targeted campaigns, reaching specific demographics with lower overhead than traditional media.

- Cost-Effectiveness: Social media marketing and content creation offer a significantly lower barrier to entry for brand building compared to TV or print ads.

- Agility: New entrants can quickly adapt their digital messaging and campaigns based on real-time consumer feedback, a stark contrast to the longer lead times of traditional advertising.

Regulatory Environment and Supply Chain Complexity

While Auric Group operates within a generally manageable regulatory landscape, particularly concerning food safety standards, the increasing complexity of global supply chains presents a significant hurdle for potential new entrants. Navigating intricate logistics, ensuring product integrity across diverse transportation methods, and adhering to varying international compliance requirements demand substantial investment and expertise. For instance, the average lead time for international shipping of food products can range from 30 to 60 days, adding a layer of operational difficulty that smaller, less capitalized competitors may struggle to overcome.

The sheer intricacy of modern food supply chains, from sourcing raw materials to final distribution, acts as a substantial barrier. New entrants must establish robust relationships with suppliers, manage inventory effectively across multiple stages, and implement stringent quality control measures at each touchpoint. Failure to do so can lead to significant financial losses and reputational damage, making the initial investment and operational setup considerably more challenging than in simpler industries. In 2024, disruptions in global shipping, such as port congestion and container shortages, exacerbated these complexities, impacting delivery times and costs for all players in the sector.

- Regulatory Compliance Costs: New entrants face significant upfront costs to understand and implement diverse food safety regulations, which can vary by region and product type.

- Supply Chain Management Expertise: The ability to manage complex, multi-tiered supply chains efficiently is critical, requiring specialized knowledge in logistics, inventory, and quality assurance.

- Investment in Infrastructure: Establishing the necessary infrastructure for sourcing, processing, storage, and distribution, compliant with all regulations, demands considerable capital expenditure.

- Navigating Global Trade: Understanding and adhering to international trade laws, tariffs, and customs procedures adds another layer of complexity and cost for new entrants aiming for broader market reach.

The threat of new entrants for Auric Group remains moderate. While the direct-to-consumer model and digital marketing have lowered initial capital needs, making it easier for startups to emerge, the complexities of food supply chains and regulatory compliance still present significant hurdles. For instance, in 2024, the global digital advertising market's projected $700 billion spend highlights how new players can gain visibility, yet navigating international food safety regulations and intricate logistics, which can take 30-60 days for shipping, requires substantial investment and expertise.

| Factor | Impact on New Entrants | Auric Group's Position |

| Digital Marketing Accessibility | Lowers barrier to entry for brand building. | Leverages digital channels for reach and engagement. |

| Supply Chain Complexity | Requires significant investment and expertise to manage. | Established infrastructure and supplier relationships mitigate this. |

| Regulatory Compliance | High costs and expertise needed for adherence. | Existing compliance framework supports operations. |

Porter's Five Forces Analysis Data Sources

Our Auric Group Porter's Five Forces analysis is built on a foundation of robust data, incorporating financial reports, industry-specific market research, and expert analyst commentary to provide a comprehensive competitive landscape.