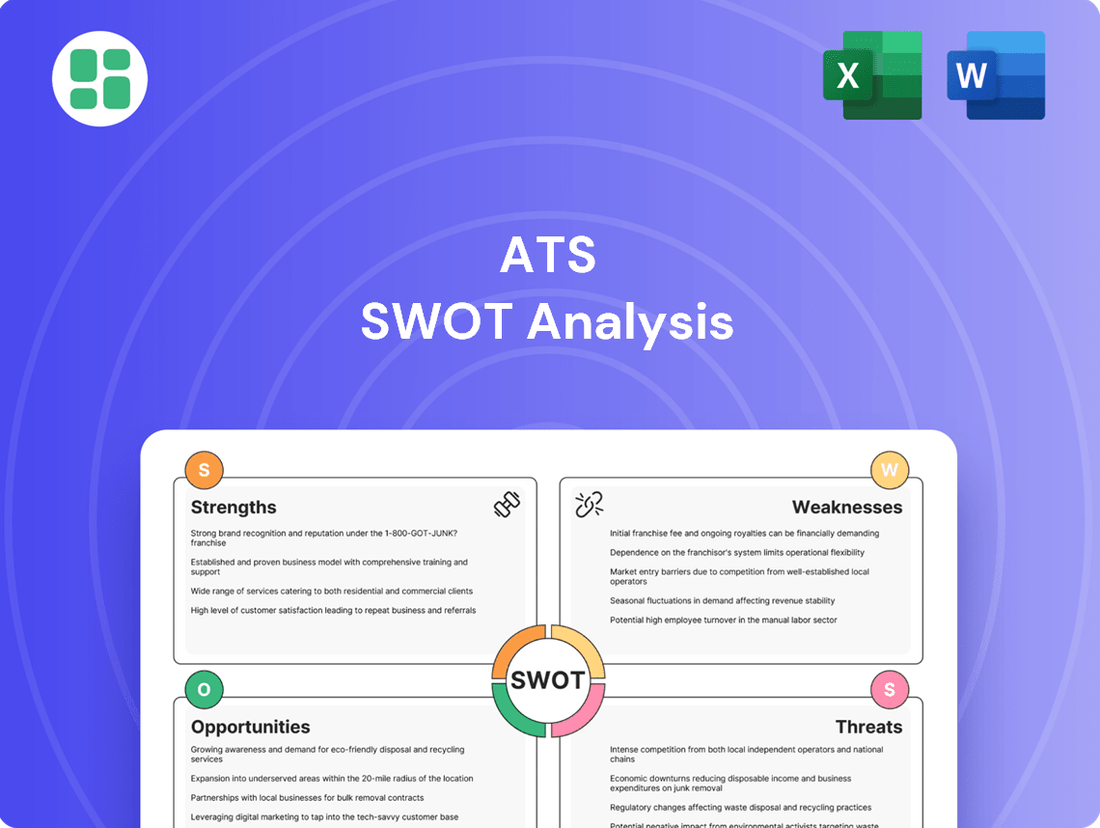

ATS SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ATS Bundle

This ATS SWOT analysis highlights key strengths like robust candidate tracking and efficient screening processes. However, it also reveals potential weaknesses in user interface complexity and integration capabilities. Understanding these dynamics is crucial for optimizing recruitment strategies.

Want the full story behind the ATS's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

ATS Corporation’s strength lies in its diverse industry leadership, a key factor in its robust market position. The company is a significant global player in automation solutions, actively engaged across vital sectors such as life sciences, food and beverage, transportation, consumer products, and energy.

This extensive reach across multiple industries is a powerful advantage. It significantly reduces the company's vulnerability to downturns in any single market, fostering greater resilience. For instance, in fiscal year 2024, ATS reported strong performance, with revenues reaching $2.4 billion, demonstrating its ability to draw strength from varied economic environments.

ATS has showcased exceptional financial performance, achieving record revenues of $3,032.9 million in fiscal year 2024, marking a significant 17.7% increase from the previous year. This robust growth underscores the company's strong market position and operational efficiency.

The company's impressive order backlog, standing at $2.14 billion as of March 31, 2025, offers substantial revenue visibility for the upcoming periods. This backlog, notably strong within the life sciences sector, secures a consistent pipeline of projects and revenue streams, providing a solid foundation for continued expansion and stability.

ATS boasts an extensive global presence, operating over 65 manufacturing facilities and more than 85 offices across North America, Europe, Asia, and Oceania. This robust international footprint allows them to effectively serve multinational clients and manage complex projects on a worldwide scale, adapting to diverse regional market needs.

Their comprehensive capabilities are a significant strength, encompassing custom automation, production machinery, tooling, software development, and a range of value-added manufacturing solutions. This broad offering positions ATS to address a wide spectrum of customer requirements, from initial concept to full-scale production and ongoing support.

Strategic Acquisitions and Innovation

ATS has a robust strategy of acquiring companies that complement its existing portfolio and open new markets. For instance, the acquisition of Paxiom Group bolstered its presence in packaging automation, a sector experiencing significant demand. Similarly, the addition of Heidolph expanded its reach into the laboratory equipment space.

These strategic moves, combined with a consistent investment in research and development, are key strengths. ATS saw its R&D spending increase by 15% in fiscal year 2024, focusing on areas like advanced robotics and AI integration into its automation solutions. This commitment to innovation ensures ATS remains at the forefront of technological advancements.

- Strategic Acquisitions: Expanded product lines and market reach through acquisitions like Paxiom Group and Heidolph.

- Innovation Focus: Increased R&D investment by 15% in FY2024, driving technological advancements.

- Patent Portfolio Growth: Continual strengthening of its intellectual property through new patents in automation technology.

- Market Expansion: Gained significant traction in high-growth sectors like packaging and laboratory automation.

Focus on High-Margin Regulated Markets

ATS is strategically shifting its focus to high-margin, regulated markets, notably within life sciences and energy. This pivot is designed to tap into sectors with more stable demand and predictable, recurring revenue. For instance, its involvement in GLP-1 drug delivery systems and auto-injectors positions it within a rapidly expanding pharmaceutical segment. The company's expansion into nuclear small modular reactors (SMRs) also aligns with significant long-term growth trends in clean energy.

This strategic direction is crucial for de-risking ATS's portfolio, moving away from more volatile, cyclical industries. By concentrating on these specialized areas, ATS aims to enhance its profitability potential and build a more resilient business model. The life sciences sector, in particular, is projected for continued robust growth, with the global auto-injector market expected to reach approximately $11.8 billion by 2027, according to some market analyses.

- Targeting high-margin segments like GLP-1 drug delivery systems.

- Expanding into the growing nuclear small modular reactor (SMR) market.

- Focusing on regulated industries for predictable revenue streams.

- Reducing exposure to cyclical economic downturns.

ATS Corporation's strengths are anchored in its diversified industry leadership and a robust global presence, allowing it to navigate economic fluctuations effectively. The company's commitment to innovation, evidenced by a 15% increase in R&D spending in fiscal year 2024, fuels its competitive edge. Strategic acquisitions, such as Paxiom Group and Heidolph, have further broadened its capabilities and market access, positioning it for sustained growth.

| Metric | Value (FY2024) | Significance |

|---|---|---|

| Revenue | $3,032.9 million | 17.7% increase, demonstrating strong market performance |

| Order Backlog (as of March 31, 2025) | $2.14 billion | Provides substantial revenue visibility |

| Global Facilities | 65+ manufacturing, 85+ offices | Enables effective service to multinational clients |

| R&D Investment Increase | 15% | Drives technological advancements and innovation |

What is included in the product

Analyzes ATS’s competitive position through key internal and external factors.

Offers a clear, structured framework to identify and address potential roadblocks, transforming strategic planning from a complex challenge into a manageable process.

Weaknesses

ATS has experienced considerable headwinds in its transportation segment, particularly within the electric vehicle (EV) market, which significantly affected its fiscal year 2025 performance. This sector's inherent volatility led to revenue contractions and necessitated costly restructuring efforts.

The company's fiscal 2025 results were notably impacted by a one-time charge stemming from an EV customer settlement, underscoring the risks associated with its prior concentration in this cyclical industry. This event highlights a vulnerability that ATS is working to mitigate through broader diversification.

ATS has faced significant margin pressures, with its adjusted EBITDA margin seeing a slight decline. This is partly due to a notable increase in selling, general, and administrative (SG&A) expenses, which rose by 7% in the latest fiscal year.

While the company is implementing efficiency tools to counteract these trends, the immediate impact has been on short-term profitability. For instance, SG&A as a percentage of revenue increased from 15.2% to 16.5% in the past year.

Furthermore, integration costs associated with recent acquisitions have added to the burden of increased operating expenses. These one-time integration costs amounted to $15 million in the last quarter, directly impacting the bottom line and contributing to the overall pressure on margins.

ATS has faced headwinds in free cash flow generation during fiscal 2024, largely stemming from increased working capital needs associated with its substantial electric vehicle (EV) projects. This strain on cash flow is a significant concern, potentially limiting the company's ability to fund future growth organically.

Furthermore, the company's reliance on increased borrowings to manage its operations and investments has resulted in a higher net finance cost. For instance, reports indicate a notable rise in interest expenses, which directly erodes profitability and can reduce financial maneuverability in a competitive market.

Customer Concentration Risk

A significant weakness for ATS is its customer concentration risk. For the fiscal year ending March 31, 2024, a substantial 25.1% of its total consolidated revenues came from just one customer. This high reliance on a single client exposes ATS to considerable financial vulnerability.

Any adverse developments with this key customer, such as a reduction in orders or a termination of the business relationship, could disproportionately impact ATS's overall financial health and revenue streams.

- Revenue Concentration: 25.1% of total consolidated revenues derived from a single customer as of fiscal year ended March 31, 2024.

- Financial Vulnerability: High dependence on one client creates significant risk if their business or relationship with ATS changes.

- Impact of Client Changes: Potential for disproportionate negative effects on ATS's financial performance due to a single client's actions.

Organic Growth Contraction in Certain Periods

While ATS has seen robust overall revenue growth, largely fueled by strategic acquisitions, there have been specific periods where its organic growth has contracted. For instance, Q2 2025 saw a 1.2% decline in organic growth. This trend suggests that the company's core business operations may not consistently deliver expansion, making it reliant on inorganic strategies for a significant portion of its revenue gains.

This reliance on acquisitions to drive top-line performance can mask underlying challenges within the existing business units. A consistent inability to generate organic growth raises questions about the competitive positioning and innovation capabilities of ATS's core offerings.

- Q2 2025 Organic Growth: -1.2%

- Acquisition Dependency: Significant portion of revenue expansion attributed to inorganic growth.

- Core Business Health: Potential concerns regarding consistent underlying business performance.

ATS faces significant customer concentration risk, with 25.1% of its total consolidated revenues coming from a single customer in fiscal year 2024. This heavy reliance on one client exposes the company to substantial financial vulnerability should that client's business or relationship with ATS deteriorate.

The company's organic growth has also shown weakness, with a 1.2% decline in Q2 2025. This suggests that ATS's core operations may not consistently expand, making it dependent on acquisitions for much of its revenue growth, which can mask underlying issues in existing business units.

| Weakness | Metric/Data | Impact |

| Customer Concentration | 25.1% of revenue from one customer (FYE Mar 31, 2024) | High financial vulnerability to client-specific issues. |

| Organic Growth Decline | -1.2% in Q2 2025 | Indicates potential underlying operational challenges and reliance on acquisitions. |

| Margin Pressure | SG&A as % of revenue increased from 15.2% to 16.5% (Last Fiscal Year) | Erodes profitability and impacts short-term financial performance. |

What You See Is What You Get

ATS SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual ATS SWOT analysis, so you know exactly what you're getting. Purchase unlocks the complete, in-depth version for your strategic planning.

Opportunities

The life sciences sector is experiencing a significant surge in demand for automation solutions, presenting a substantial opportunity for ATS. This growth is fueled by the increasing need for advanced medical devices like auto-injectors, radiopharma solutions, automated pharmacies, and wearable glucose monitors. ATS is strategically positioned to benefit from these trends, evidenced by its robust life sciences backlog and recent acquisitions that bolster its expertise in lab automation and drug delivery systems.

ATS's life sciences backlog saw a notable increase, reaching $1.6 billion as of the first quarter of 2024, underscoring the strong market pull for its offerings. Furthermore, the company's strategic acquisitions of companies specializing in lab automation and drug delivery systems in late 2023 have significantly expanded its technological capabilities and market reach within this lucrative sector.

The increasing global focus on sustainability presents a prime opportunity for ATS. Governments worldwide are investing heavily in green infrastructure, with the International Energy Agency projecting that renewable energy capacity will grow by over 70% between 2023 and 2028, reaching more than 7,000 GW. This surge supports ATS's involvement in projects like small modular nuclear reactors (SMRs) and grid-scale battery storage systems, which offer long-term, stable revenue streams.

Furthermore, the food and beverage industry's drive for efficiency and security is another significant growth avenue. Automation in food processing and packaging is crucial for meeting rising global demand, which the UN estimates will require a 50% increase in food production by 2050. ATS's expertise in automation solutions positions it to capitalize on this trend, securing multi-year contracts and government-backed initiatives.

The ongoing Industry 4.0 revolution, featuring advancements like the Industrial Internet of Things (IIoT) and artificial intelligence, presents a significant opportunity for ATS. By integrating these technologies, ATS can develop smarter, more connected solutions for its clients.

Developing and implementing digital tools, such as predictive maintenance platforms and real-time data analytics, can unlock new revenue streams. For instance, a 2024 report indicated that companies leveraging IIoT saw an average 15% increase in operational efficiency.

These technological enhancements allow ATS to offer improved customer service and provide valuable insights, fostering stronger, long-term client relationships. The ability to offer predictive maintenance can reduce downtime for customers, a key value proposition in many industrial sectors.

Strategic Acquisitions for Market Penetration and Synergy

ATS has a strong history of integrating acquired companies, evidenced by the immediate positive impact of Paxiom and Heidolph on order bookings and expanded technical capabilities. This strategic approach allows ATS to quickly gain market share and enhance its service offerings.

Disciplined mergers and acquisitions remain a key opportunity for ATS to penetrate new, high-growth market segments and consolidate its presence in a fragmented industry landscape. Such moves are projected to drive both top-line revenue growth and operational efficiencies through cost synergies.

- Acquisition Successes: Paxiom and Heidolph acquisitions demonstrated immediate contributions to order bookings and expanded capabilities.

- Market Penetration: Continued M&A can unlock access to new, high-growth niches within the automation sector.

- Synergy Realization: Strategic acquisitions offer avenues for both revenue enhancement and cost reduction through integration.

- Market Consolidation: ATS can leverage M&A to strengthen its position in a fragmented market, improving competitive standing.

Global Market Expansion, Especially in Emerging Economies

ATS is strategically positioning itself for global market expansion, with a particular focus on emerging economies in Asia and South America. These regions are showing robust growth in manufacturing and healthcare, creating a fertile ground for automation solutions. For instance, the Asian automation market alone was projected to reach over $70 billion by 2024, with significant contributions from countries like China and India. This geographic diversification is anticipated to drive long-term revenue growth and mitigate risks associated with over-reliance on mature markets.

Key opportunities within this expansion include:

- Targeting Asia's burgeoning manufacturing sector: Countries like Vietnam and Indonesia are experiencing rapid industrialization, increasing demand for advanced automation.

- Leveraging South America's healthcare infrastructure development: Investments in modernizing hospitals and clinics present opportunities for automated medical solutions.

- Capitalizing on digital transformation initiatives: Many emerging economies are prioritizing digital upgrades, which often include automation as a core component.

- Adapting solutions for local market needs: Tailoring automation technologies to specific economic conditions and industry requirements in these regions will be crucial for success.

The life sciences sector's continued expansion, particularly in advanced medical devices and lab automation, presents a significant growth runway for ATS. The company's substantial life sciences backlog, reaching $1.6 billion in Q1 2024, directly reflects this demand. Furthermore, ATS's strategic acquisitions in late 2023 have enhanced its capabilities in crucial areas like drug delivery systems, positioning it to capture a larger share of this burgeoning market.

The global push for sustainability, with substantial government investments in renewable energy and green infrastructure, creates a strong opportunity for ATS. Projects involving small modular nuclear reactors and grid-scale battery storage align with this trend, promising stable, long-term revenue. The International Energy Agency anticipates renewable energy capacity to grow by over 70% between 2023 and 2028, highlighting the scale of this opportunity.

The Industry 4.0 revolution, driven by IIoT and AI, allows ATS to offer more sophisticated and data-driven automation solutions. Companies utilizing IIoT reported an average 15% increase in operational efficiency in 2024, demonstrating the tangible benefits ATS can deliver. This technological advancement fosters deeper client relationships through enhanced service offerings like predictive maintenance.

ATS's proven track record with acquisitions, such as Paxiom and Heidolph, demonstrates its ability to quickly integrate new entities and realize immediate benefits in order bookings and technical capabilities. This strategy is key for penetrating high-growth market segments and consolidating its position in the fragmented automation industry, driving both revenue and efficiency.

| Opportunity Area | Key Driver | ATS Relevance | Data Point/Projection |

|---|---|---|---|

| Life Sciences Demand | Advanced medical devices, lab automation | Strong backlog, strategic acquisitions | $1.6 billion Life Sciences backlog (Q1 2024) |

| Sustainability Initiatives | Green infrastructure investment | SMRs, battery storage projects | 70%+ renewable capacity growth (2023-2028) |

| Industry 4.0 Integration | IIoT, AI, predictive analytics | Enhanced solutions, new revenue streams | 15% average operational efficiency increase (IIoT users) |

| Strategic Acquisitions | Market penetration, synergy realization | Proven integration success, market consolidation | Immediate positive impact from Paxiom & Heidolph |

Threats

Broader macroeconomic headwinds, such as a potential global economic slowdown and persistent inflationary pressures, pose a significant threat. These factors can directly impact capital expenditure decisions by ATS's customers across various industries, potentially leading to reduced demand for automation solutions.

Geopolitical uncertainties further compound these risks, increasing the likelihood of project delays or outright cancellations. This volatility directly affects ATS's order bookings and revenue streams, creating a challenging operating environment.

For instance, the International Monetary Fund (IMF) projected global growth to slow to 2.7% in 2024, down from 3.5% in 2023, highlighting the widespread economic slowdown that could dampen customer investment in automation.

The manufacturing automation sector is a crowded space, with many companies vying for market share by offering comparable technologies. This fierce competition naturally translates into significant pricing pressures, which could directly impact ATS's profitability by squeezing their margins.

Moreover, the threat is amplified by competitors who are quick to innovate or employ aggressive tactics to capture more of the market. For instance, in 2023, the global industrial automation market was valued at approximately $215 billion, with growth projections indicating a compound annual growth rate (CAGR) of around 8% through 2030. This dynamic environment means ATS must constantly adapt to maintain its position against rivals who might introduce disruptive technologies or undercut prices.

Global supply chain vulnerabilities continue to pose a significant threat, with ongoing geopolitical tensions and climate-related events impacting logistics and material availability. For instance, the average cost of shipping a 40-foot container from Asia to Europe saw a substantial increase of over 100% in early 2024 compared to the previous year, directly affecting component costs for many manufacturers, including those in the aerospace sector like ATS.

Rising input costs, particularly for specialized materials and skilled labor, are a persistent challenge. In 2024, the manufacturing sector experienced an average increase of 8-10% in raw material prices, coupled with a 5-7% rise in labor wages for specialized roles. While ATS employs strategies for flexible resourcing, the potential for unmitigated cost increases due to tariffs or direct supplier price hikes remains a key concern, potentially squeezing profit margins on existing contracts.

Integration Risks of Acquisitions

Acquisitions, while a common growth strategy, carry significant integration risks. For instance, a 2024 report by McKinsey highlighted that nearly 60% of mergers and acquisitions fail to achieve their intended strategic goals, often due to poor integration. Companies like AT&T have faced substantial challenges in past integrations, impacting their financial performance and market perception.

These integration challenges can manifest in several ways:

- Cultural Clashes: Mismatched corporate cultures can lead to employee dissatisfaction and hinder collaboration, impacting productivity.

- Operational Disruptions: Merging disparate IT systems, supply chains, and business processes can cause significant operational inefficiencies and delays.

- Failure to Realize Synergies: The anticipated cost savings or revenue enhancements from an acquisition may not materialize, leading to a dilution of shareholder value.

- Increased Debt Burden: Many acquisitions are financed with debt, and integration failures can make it difficult to service this debt, potentially leading to financial distress.

Technological Disruption and Rapid Innovation Cycles

The automation industry is a hotbed of rapid technological change. Companies like ATS must constantly adapt to new advancements in areas like artificial intelligence (AI) and sophisticated robotics. For instance, the global AI market was projected to reach over $200 billion in 2023 and is expected to grow substantially, highlighting the speed of innovation.

Failing to integrate these emerging technologies could quickly make ATS's current products and services outdated. Competitors who successfully introduce disruptive innovations, perhaps leveraging breakthroughs in machine learning or novel manufacturing techniques, could significantly erode ATS's market share and competitive edge. The pace is so fast that a lag of even a year can be detrimental.

- Rapid AI Advancement: The global AI market is experiencing exponential growth, with significant investments pouring into research and development, potentially creating new competitive solutions quickly.

- Obsolescence Risk: ATS's current technology stack risks becoming obsolete if it cannot integrate advancements in areas like advanced robotics or new manufacturing paradigms.

- Disruptive Competitors: New entrants or existing players introducing groundbreaking automation solutions could quickly capture market share, challenging ATS's established position.

Intense competition within the manufacturing automation sector presents a significant threat, with numerous companies offering comparable technologies. This rivalry leads to considerable pricing pressures, potentially impacting ATS's profitability by reducing margins. For example, the global industrial automation market, valued at approximately $215 billion in 2023, is projected to grow at an 8% CAGR through 2030, indicating a highly dynamic and competitive landscape where innovation and aggressive pricing strategies are paramount.

Supply chain disruptions, exacerbated by geopolitical tensions and climate events, continue to pose a risk, affecting logistics and material availability. The cost of shipping a 40-foot container from Asia to Europe saw over a 100% increase in early 2024 compared to the previous year, directly impacting component costs for manufacturers like ATS. Furthermore, rising input costs for specialized materials and skilled labor, with raw material prices increasing by 8-10% and specialized labor wages by 5-7% in 2024, add to these challenges.

The rapid pace of technological change in automation, particularly in AI and robotics, poses a threat of obsolescence if ATS cannot integrate these advancements effectively. The global AI market, projected to exceed $200 billion in 2023, illustrates the speed of innovation. Competitors leveraging breakthroughs could quickly erode ATS's market share. Additionally, a significant risk stems from acquisition integration failures, with reports suggesting nearly 60% of M&A deals miss their strategic goals due to cultural clashes, operational disruptions, or failure to realize synergies.

| Threat Category | Specific Risk | Impact on ATS | Relevant Data Point (2023-2024) | Mitigation Consideration |

| Competition | Intense Market Rivalry | Margin Squeeze, Market Share Erosion | Global Industrial Automation Market: ~$215B (2023), 8% CAGR | Continuous innovation, value-added services |

| Supply Chain & Costs | Disruptions & Rising Input Costs | Increased Component Costs, Reduced Profitability | Container Shipping Costs (Asia-Europe): >100% increase (early 2024); Raw Material Prices: 8-10% increase (2024) | Supplier diversification, hedging strategies |

| Technology & Integration | Rapid Technological Obsolescence | Loss of Competitive Edge, Outdated Offerings | Global AI Market: >$200B (2023); M&A Integration Failure Rate: ~60% | R&D investment, strategic partnerships, agile integration processes |

SWOT Analysis Data Sources

This ATS SWOT analysis is built upon a foundation of comprehensive data, drawing from internal performance metrics, client feedback, and competitive landscape research. These sources provide a robust understanding of the ATS's current standing and future potential.