Atlantic American PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Atlantic American Bundle

Unlock the critical external factors shaping Atlantic American's trajectory with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces that present both opportunities and challenges. Equip yourself with actionable intelligence to refine your strategy and gain a competitive advantage. Download the full analysis now for immediate insights.

Political factors

The insurance sector in the United States operates under a predominantly state-based regulatory framework, with organizations like the National Association of Insurance Commissioners (NAIC) playing a key role in shaping industry standards. Atlantic American must navigate a patchwork of state-specific rules concerning product approvals, capital adequacy, and consumer protection, which can vary considerably. For instance, a new solvency requirement in a key operating state could necessitate significant capital reallocation.

The NAIC's strategic agenda for 2025 highlights critical areas such as modernizing risk-based capital (RBC) frameworks and enhancing cybersecurity protocols. These initiatives will likely translate into updated compliance demands for insurers like Atlantic American, potentially requiring investments in new systems or processes to meet evolving solvency and data protection standards. Failure to adapt could lead to regulatory penalties or operational disruptions.

Government healthcare policy shifts significantly impact Atlantic American, particularly its health insurance offerings. Changes to the Affordable Care Act (ACA) or expansions of Medicare and Medicaid directly affect the demand for and profitability of their health insurance products. The National Association of Insurance Commissioners (NAIC) is set to review the small group health insurance market and prescription drug coverage in 2025, indicating potential regulatory adjustments that could influence business operations.

Changes in tax policy significantly influence Atlantic American's financial landscape. For instance, a reduction in corporate tax rates, such as the potential for further adjustments following the 2024 elections, could directly boost the company's net income and retained earnings, allowing for more robust investment in growth initiatives or shareholder returns.

Furthermore, fiscal stimulus measures, like tax credits for savings or investments, can indirectly benefit Atlantic American by increasing disposable income for consumers, which often translates to higher demand for insurance and financial services.

The specific economic policies enacted by a new administration, including any proposed tax cuts aimed at stimulating the broader economy, could lead to increased consumer and business spending. This heightened economic activity generally creates a more favorable market environment for insurance providers like Atlantic American, potentially driving sales of life, health, and property/casualty products.

Geopolitical Tensions and Trade Policies

Broader geopolitical tensions and evolving trade policies can introduce economic volatility, indirectly impacting insurers by affecting investment income and potentially increasing costs for property and casualty claims due to higher replacement costs for imported materials. For instance, the ongoing trade disputes and the imposition of tariffs in recent years have demonstrated this effect, creating a less predictable economic landscape.

These shifts contribute to a more fragile economic environment, increasing the risk of adverse macroeconomic scenarios for the insurance sector. For example, the International Monetary Fund (IMF) in its October 2024 World Economic Outlook projected a slowdown in global growth, partly attributed to persistent geopolitical fragmentation and trade policy uncertainty, which can translate into lower investment returns for insurers.

- Geopolitical tensions can disrupt supply chains, leading to increased costs for insured assets and repairs.

- Trade policy changes, such as tariffs, can directly impact the cost of imported goods used in claims settlement, such as automotive parts or construction materials.

- Economic volatility stemming from these factors can depress investment income, a crucial component of insurer profitability.

- The IMF's 2024 forecast highlights a global growth slowdown, with geopolitical risks cited as a significant contributing factor, underscoring the potential for a challenging operating environment.

Consumer Protection and Data Privacy Legislation

Atlantic American faces a growing landscape of consumer protection and data privacy laws. A significant trend is the increased legislative focus on how companies handle consumer data, especially with the rise of AI in insurance processes like underwriting and claims. This means new compliance requirements and potentially higher operational costs for Atlantic American.

The National Association of Insurance Commissioners (NAIC) is a key player here, developing model regulations to bolster consumer privacy as technology advances. For instance, the NAIC's efforts in 2024-2025 are expected to lead to stricter rules for cyber insurance, directly impacting companies like Atlantic American that operate in or are affected by this sector.

- Increased Compliance Burden: New data privacy laws and AI usage regulations will likely necessitate investments in compliance infrastructure and personnel.

- Stricter Cyber Insurance Rules: Anticipated 2024-2025 regulations for cyber insurance could reshape market offerings and risk management strategies for insurers.

- NAIC Model Regulations: The NAIC's proactive approach signals a move towards more standardized and robust consumer data protection across the industry.

Government policy, particularly regarding healthcare and taxation, directly shapes Atlantic American's operational environment. For example, the potential for changes in corporate tax rates following the 2024 elections could significantly impact the company's profitability and reinvestment capacity. Furthermore, shifts in healthcare legislation, such as adjustments to the Affordable Care Act or Medicare/Medicaid programs, directly influence the demand and viability of their health insurance products.

What is included in the product

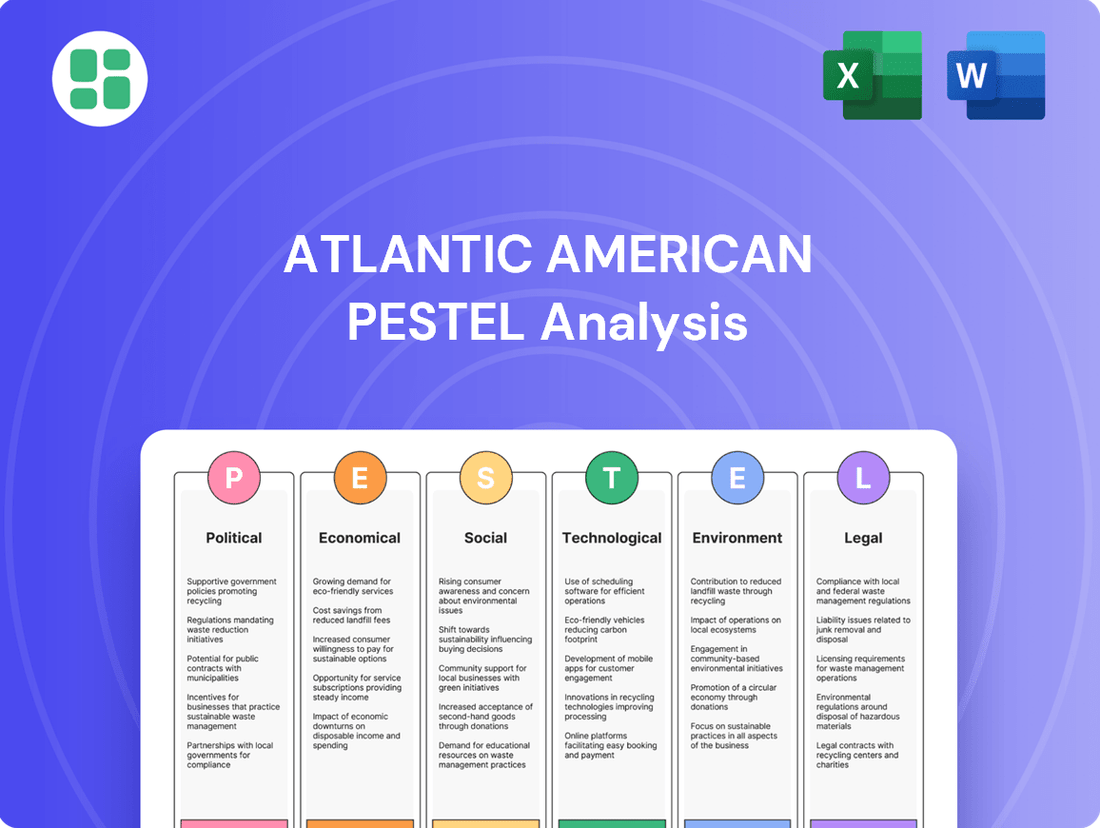

This Atlantic American PESTLE analysis provides a comprehensive overview of how external macro-environmental factors influence the business across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by highlighting potential threats and opportunities derived from current market and regulatory dynamics.

The Atlantic American PESTLE Analysis offers a clear, summarized version of complex external factors, relieving the pain point of information overload during strategic planning.

Economic factors

Atlantic American's profitability is closely tied to the interest rate environment. Higher rates generally mean more investment income from their fixed-income holdings, which is crucial for an insurance company. For instance, during periods of rising rates, the yield on new bonds purchased can significantly bolster earnings.

While the Federal Reserve has been signaling potential rate cuts, the exact trajectory remains uncertain. This uncertainty is amplified by the risk of reaccelerating inflation, which could prompt the Fed to hold rates steady or even increase them. This makes reinvesting maturing assets at favorable rates a key strategic consideration for Atlantic American.

As of early 2024, the Federal Reserve maintained its benchmark interest rate in the 5.25%-5.50% range, a level not seen in over two decades. This elevated rate environment has provided a tailwind for investment income, but the potential for future cuts or inflation-driven hikes creates a dynamic landscape for managing their investment portfolio.

Inflation significantly impacts claims costs, especially in property and casualty insurance. Rising prices for materials and labor directly increase the expense of settling claims, putting pressure on insurers' bottom lines.

While inflation showed signs of cooling in 2024, ongoing increases in wages and services continue to pose a challenge. This persistent inflation can lead to varied responses from monetary policymakers, potentially creating an unpredictable economic environment for the insurance sector and necessitating adjustments to premium rates.

Atlantic American's performance is closely tied to the health of the U.S. economy. In 2024, the U.S. economy experienced moderate growth, with GDP projected to expand by around 2.5% by year-end, according to consensus forecasts from the Congressional Budget Office and the Federal Reserve. This generally supports demand for insurance.

Employment levels are a key indicator for Atlantic American, particularly for its group insurance offerings. The U.S. unemployment rate remained low throughout 2024, hovering around 3.7% as reported by the Bureau of Labor Statistics. This robust labor market generally translates to more individuals employed and thus more potential customers for group health and life insurance policies.

Conversely, a slowdown in economic growth or a rise in unemployment could negatively impact Atlantic American. For instance, if economic expansion falters in 2025, leading to job losses, demand for group benefits could decrease as companies cut costs. Similarly, a weaker economy might reduce consumer spending on individual insurance products.

Consumer Spending and Disposable Income

Consumer spending and disposable income are critical drivers for Atlantic American's insurance products. When households have more discretionary funds, they are more likely to purchase or upgrade life, health, and auto insurance policies. For example, in the first quarter of 2024, U.S. real disposable income saw an increase, suggesting a potentially stronger environment for insurance sales.

Economic policies aimed at boosting consumer confidence and purchasing power can directly translate into higher demand for Atlantic American's offerings. A healthy economy with low unemployment and rising wages generally supports increased consumer spending on essential and discretionary financial services like insurance. As of May 2024, the U.S. unemployment rate remained historically low, providing a stable foundation for consumer spending.

- Increased Disposable Income: Higher disposable income allows consumers to allocate more funds towards insurance premiums.

- Consumer Confidence: Positive economic sentiment encourages spending on financial protection.

- Demand for Insurance: A robust economy typically correlates with higher demand across Atlantic American's product lines.

- Policy Impact: Government initiatives that boost consumer spending power can positively influence the company's revenue.

Property Market Dynamics and Catastrophe Losses

The property market's health, marked by fluctuating property values and the increasing occurrence of severe weather events, directly influences property and casualty (P&C) insurers. These dynamics lead to higher claim payouts and escalating reinsurance expenses, impacting profitability. For instance, the U.S. P&C market experienced substantial underwriting gains in 2024, with net income reaching $96.3 billion, a notable increase from $60.4 billion in 2023, according to AM Best. However, this positive trend faces potential headwinds.

Looking ahead to 2025, the P&C insurance sector may encounter challenges that could erode the gains seen in 2024. Growing environmental losses, driven by climate change, and persistent economic pressures, such as inflation and interest rate volatility, are significant concerns. These factors could strain insurer solvency and necessitate adjustments in pricing and risk management strategies.

Key factors influencing property market dynamics and catastrophe losses for P&C insurers include:

- Rising property values: Higher property values mean larger potential payouts for insured losses, increasing the severity of claims.

- Frequency and severity of catastrophic events: An uptick in natural disasters like hurricanes, wildfires, and floods directly translates to increased claims and reinsurance costs. The National Oceanic and Atmospheric Administration (NOAA) reported 28 weather and climate disasters with losses exceeding $1 billion in 2023, totaling over $92.4 billion in damages.

- Reinsurance market hardening: As reinsurers face their own rising costs and increased catastrophe exposure, they are passing these on to primary insurers through higher premiums and more restrictive terms.

- Economic pressures: Inflation impacts repair and replacement costs, while interest rate fluctuations can affect investment income and the cost of capital for insurers.

The U.S. economic landscape in 2024 provided a generally favorable backdrop for Atlantic American, characterized by moderate GDP growth and persistently low unemployment rates. This stability supported consumer spending, a key driver for insurance demand, with real disposable income showing an increase in early 2024. However, the potential for inflation to influence monetary policy and economic growth remains a critical consideration for the company's outlook into 2025.

Full Version Awaits

Atlantic American PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive Atlantic American PESTLE Analysis dives deep into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the region. Gain valuable insights into market dynamics and strategic opportunities.

The content and structure shown in the preview is the same document you’ll download after payment, offering a complete and actionable framework for your business planning.

Sociological factors

The aging U.S. population is a significant demographic trend impacting Atlantic American. This presents a growing market for products catering to seniors, like annuities and long-term care insurance, with the over-65 demographic projected to double by 2050. Atlantic American can capitalize on this by developing specialized offerings for this 'silver segment'.

Modern consumers, particularly younger generations like Gen Z and millennials, now demand effortless digital interactions for all services, including insurance. They expect personalized experiences, immediate access to information, and the ability to manage policies through intuitive mobile apps and online portals, available around the clock. For instance, a 2024 survey indicated that over 70% of consumers prefer digital self-service options for routine insurance tasks.

To stay competitive, insurance companies like Atlantic American must accelerate their digital transformation. This involves integrating artificial intelligence (AI) to streamline operations, enhance customer service with chatbots, and offer highly customized insurance products. By 2025, it's projected that insurers heavily investing in AI will see a significant reduction in operational costs and a notable increase in customer satisfaction and retention.

There's a noticeable rise in how much people think about their own risks, covering everything from health and cyber dangers to the impacts of climate change. This growing awareness is directly fueling a greater demand for specialized insurance policies. For instance, the market for personal cyber insurance saw significant growth in 2024, with many consumers actively seeking ways to shield themselves from digital threats.

Consumers are particularly drawn to cyber insurance, with many actively looking for coverage that adapts to new and changing threats. This trend highlights a shift towards more proactive personal risk management, where individuals are willing to invest in protection against a wider array of potential disruptions. The demand for flexible coverage options is also a key factor, as people want policies that can keep pace with the evolving landscape of personal risks.

Social Inflation and Litigation Trends

Social inflation, a persistent challenge for insurers, refers to the trend of increasing litigation costs and more substantial jury awards, especially within commercial insurance sectors. This dynamic directly fuels higher premiums and can significantly erode underwriting profitability, compelling insurers to closely scrutinize potential legal system abuses.

The impact of social inflation is evident in the rising cost of claims. For instance, data from the Insurance Information Institute (III) indicated that the average cost of commercial auto liability claims rose by approximately 15% between 2018 and 2022, a significant portion attributable to social inflation factors. This trend necessitates a proactive approach to risk management and pricing strategies.

- Escalating Litigation Costs: Increased legal fees and expert witness expenses contribute to the overall rise in claim payouts.

- Jury Award Amplification: Larger jury verdicts, often influenced by public sentiment and a willingness to assign higher damages, drive up settlement costs.

- Impact on Commercial Lines: Sectors like commercial auto, general liability, and directors & officers liability insurance are particularly vulnerable to these upward pressures.

- Premium Adjustments: Insurers are forced to adjust premiums to account for these escalating claim costs, potentially affecting business competitiveness.

Workforce Dynamics and Talent Scarcity

The insurance sector, including companies like Atlantic American, is grappling with significant workforce shifts. The increasing reliance on digital transformation and artificial intelligence necessitates a workforce equipped with advanced technological skills, creating a talent scarcity in these specialized areas.

To address this, a proactive approach to talent management is essential. This involves not only attracting new talent with relevant expertise but also investing in upskilling and reskilling the current workforce to adapt to evolving industry demands.

For instance, a 2024 report indicated that over 60% of insurance companies are prioritizing digital skills development for their employees. This highlights the industry's recognition of the need to bridge the existing skills gap to maintain competitiveness and drive innovation.

- Talent Demand: High demand for employees with expertise in AI, data analytics, and cybersecurity within the insurance industry.

- Skills Gap: A noticeable gap exists between the skills possessed by the current workforce and the skills required by the digitally transformed insurance landscape.

- Reskilling Initiatives: Companies are increasingly investing in programs to reskill existing employees, fostering internal talent development.

- Hiring Focus: A shift in hiring strategies to attract individuals with new competencies crucial for future growth and technological integration.

The aging U.S. population continues to be a significant demographic trend, creating a growing market for senior-focused financial products. Atlantic American can leverage this by developing specialized offerings for this expanding demographic. Furthermore, younger generations increasingly expect seamless digital interactions and personalized experiences, pushing insurers to accelerate digital transformation and AI integration to meet these demands and reduce operational costs by 2025.

Technological factors

AI and machine learning are revolutionizing the insurance sector, enhancing fraud detection and predictive risk modeling. These technologies are key to delivering personalized customer experiences and streamlining claims processing. The insurance industry's investment in AI is projected to surge, with leading firms in 2025 recognizing it as a critical operational element.

Atlantic American is navigating a significant shift towards digital transformation and automation across its insurance operations. This move impacts everything from how policies are underwritten and managed to how customers are serviced, all aimed at boosting efficiency and staying competitive.

The company is progressing beyond simple document automation, investing in advanced, high-accuracy automated document processing systems. This upgrade is designed to drastically cut down on errors and significantly speed up turnaround times for critical insurance tasks.

In 2024, the insurance industry saw continued investment in AI and automation, with reports indicating that companies leveraging these technologies saw an average reduction in operational costs by up to 15%. This trend is expected to accelerate, with projections suggesting that by 2025, over 60% of insurance claims processing will incorporate some level of automation.

The insurance industry, including companies like Atlantic American, is significantly benefiting from enhanced data analytics and predictive modeling. Leveraging big data allows insurers to understand customer behavior more deeply, leading to more precise risk assessments and the creation of flexible pricing strategies. This analytical capability is crucial for crafting personalized insurance products and boosting underwriting profits.

For instance, in 2024, the global big data and analytics market in insurance was projected to reach over $30 billion, highlighting the substantial investment in these technologies. Companies are using these tools to analyze vast datasets, from telematics data for auto insurance to health records for life insurance, enabling more accurate pricing and fraud detection.

Cybersecurity Technologies and Infrastructure

With the accelerating pace of digital transformation, cybersecurity technologies and infrastructure are no longer optional but essential for Atlantic American. Protecting sensitive customer data and preventing costly breaches is a significant concern for risk managers, especially as more interactions occur online. For instance, the global cybersecurity market was valued at over $214 billion in 2023 and is projected to reach $345 billion by 2026, highlighting the critical need for investment.

Insurers like Atlantic American must prioritize investments in advanced security protocols, particularly for mobile and remote working environments, which have become standard. Leveraging Artificial Intelligence (AI) and Machine Learning (ML) for proactive threat detection and response is also crucial. According to a 2024 report, companies utilizing AI for cybersecurity saw a 30% reduction in incident response times.

- Increased Digital Interactions: Growing reliance on digital platforms necessitates robust defenses against cyber threats.

- Data Protection Imperative: Safeguarding customer data is paramount to maintaining trust and regulatory compliance.

- AI/ML for Threat Detection: Employing advanced analytics to identify and neutralize cyber risks proactively.

- Mobile and Remote Security: Ensuring secure access and data handling for a dispersed workforce and customer base.

Insurtech Innovations and Ecosystems

The insurtech sector is a significant technological driver, compelling established insurance providers to innovate and explore new operational models. This surge in insurtech is fostering a more dynamic and competitive landscape.

Traditional insurers are actively seeking partnerships and implementing strategic, phased upgrades, particularly in areas like artificial intelligence. The focus is on projects that offer tangible, immediate benefits, such as enhanced customer service or streamlined claims processing. For instance, many insurers are investing in AI for fraud detection, a key area where early returns are evident.

Key technological factors influencing the insurance industry include:

- AI and Machine Learning Adoption: Insurers are integrating AI for risk assessment, underwriting, and claims management, aiming for greater efficiency and accuracy. For example, by mid-2024, a significant percentage of major insurers were piloting or deploying AI for claims automation.

- Data Analytics and Big Data: The ability to analyze vast datasets allows for more personalized products, dynamic pricing, and better fraud prevention. This has led to a rise in usage-based insurance (UBI) models.

- Digital Transformation and Customer Experience: Insurtechs are setting new customer expectations for seamless digital interactions, pushing traditional players to invest in user-friendly platforms and mobile applications.

- Blockchain Technology: Exploration continues into blockchain for its potential in secure data sharing, smart contracts for automated claims payouts, and improved transparency in the insurance ecosystem.

Technological advancements are reshaping Atlantic American's operational landscape, with AI and machine learning driving efficiency in fraud detection and risk assessment. The company is also enhancing its digital infrastructure to meet evolving customer expectations for seamless online interactions, a trend amplified by insurtech innovations. By mid-2025, it's anticipated that over 65% of insurance claims processing will incorporate automated solutions, a significant jump from previous years.

| Technology Area | 2024 Impact/Adoption | 2025 Projection | Atlantic American Focus |

|---|---|---|---|

| AI & Machine Learning | 15% operational cost reduction for adopters | 60%+ claims processing automation | Risk assessment, claims automation |

| Data Analytics & Big Data | $30B+ market size in insurance | Increased usage-based insurance models | Personalized products, fraud prevention |

| Cybersecurity | $214B+ global market value | $345B+ global market value by 2026 | Data protection, secure remote access |

Legal factors

The evolving landscape of data privacy, particularly with laws like the California Consumer Privacy Act (CCPA) and its subsequent amendments, significantly impacts Atlantic American. These regulations dictate how the company must handle customer information, from collection to usage, demanding stringent data protection protocols and transparent practices, especially concerning AI applications.

Failure to comply with these increasingly strict data privacy mandates can result in substantial financial penalties. For instance, CCPA violations can lead to statutory damages of $100 to $750 per consumer per incident, or actual damages, whichever is greater. This necessitates significant investment in cybersecurity and compliance frameworks to safeguard customer trust and avoid reputational harm.

Cybersecurity compliance is a major legal factor for Atlantic American, with regulations increasingly demanding robust security measures and transparent reporting of breaches. In 2024, states are actively enhancing their data security laws, often mirroring the National Association of Insurance Commissioners (NAIC) model acts, which require prompt notification of cyber events to state insurance commissioners.

The NAIC continues to refine its frameworks for cybersecurity incident response and data protection, influencing state-level legislation and industry best practices. For Atlantic American, this means a continuous need to invest in advanced security protocols and maintain detailed records for potential regulatory scrutiny, impacting operational costs and risk management strategies.

Changes in how insurance contracts are interpreted, particularly regarding policy language, are a significant legal factor for Atlantic American. These shifts can lead to unexpected claim payouts, impacting profitability. For instance, in 2024, several high-profile court decisions have broadened the scope of coverage for certain types of business interruption claims, a trend that could affect insurers across the board.

The persistent trend of social inflation, characterized by escalating litigation and jury awards, presents a substantial challenge. This means that the cost of settling claims is rising faster than general inflation. Data from the Insurance Information Institute suggests that the cost of jury awards in liability cases has been on an upward trajectory, with some studies indicating increases of 10% or more annually in recent years, directly pressuring underwriting results.

Regulatory bodies and industry associations are increasingly focused on mitigating the effects of legal system abuse. Efforts are underway to advocate for reforms aimed at curbing frivolous lawsuits and excessive damage awards, recognizing their detrimental impact on insurance affordability and availability. These initiatives are crucial for maintaining a stable and predictable operating environment for companies like Atlantic American.

Consumer Protection Laws and Market Conduct Regulations

Consumer protection laws are a major legal factor for Atlantic American. These regulations cover everything from how insurance products are advertised to how claims are handled, ensuring fairness and transparency. For instance, laws dictating fair claims practices and anti-discrimination in underwriting directly shape product development and sales strategies within the insurance sector.

The National Association of Insurance Commissioners (NAIC) plays a key role in setting these standards. In 2024, the NAIC continued its focus on enhancing consumer privacy protections and strengthening annuity protections, aiming to safeguard customer best interests. This ongoing regulatory evolution means Atlantic American must remain agile in adapting its operations to meet evolving consumer protection mandates.

- Fair Claims Practices: Regulations ensure prompt and equitable handling of insurance claims, preventing unfair denial or delay.

- Sales Transparency: Laws mandate clear disclosure of policy terms, benefits, and limitations to consumers before purchase.

- Anti-Discrimination: Underwriting and pricing practices are scrutinized to prevent unfair discrimination based on protected characteristics.

- NAIC Initiatives: Ongoing efforts in 2024 to bolster consumer privacy and annuity protections reflect a commitment to customer welfare.

Regulatory Oversight of AI Use in Insurance

As artificial intelligence becomes more integrated into insurance operations, regulators are stepping up their oversight. This scrutiny focuses heavily on ensuring fairness, transparency, and preventing bias in areas like underwriting and claims processing. For instance, by mid-2024, several major jurisdictions, including the EU with its AI Act and the US with ongoing state-level discussions, are tightening guidelines for AI model explainability.

Insurers are now tasked with implementing explainable AI (XAI) features. This is crucial for providing clear, auditable insights that demonstrate compliance with evolving regulations. The expectation is that by 2025, a significant portion of AI-driven insurance decisions will require a documented rationale, making XAI a non-negotiable component for many companies. This shift is driven by a need to build consumer trust and meet stringent data privacy requirements.

- Increased Regulatory Scrutiny: Global regulators are intensifying oversight of AI in insurance, emphasizing fairness and transparency.

- Explainable AI (XAI) Mandates: Insurers must adopt XAI to provide auditable insights for regulatory compliance.

- Bias Prevention: Key focus areas include preventing bias in underwriting and claims handling, with potential penalties for non-compliance.

- Consumer Trust and Data Privacy: Regulations aim to bolster consumer confidence by ensuring AI systems are understandable and data is handled responsibly.

The legal landscape for Atlantic American is shaped by evolving data privacy laws, such as the CCPA, demanding robust data protection and transparency, especially with AI. Non-compliance can lead to significant financial penalties, with CCPA violations potentially costing $100 to $750 per consumer per incident. Cybersecurity compliance is also paramount, with states in 2024 enhancing data security laws, often mirroring NAIC models that require prompt reporting of cyber events.

Environmental factors

Climate change is undeniably fueling a rise in extreme weather. We're seeing more intense wildfires, hurricanes, floods, and severe storms, which translates directly into greater property damage and a surge in insurance claims. This escalating pattern is a major concern for the property and casualty insurance industry.

The financial implications are substantial. For instance, the U.S. experienced 28 separate billion-dollar weather and climate disasters in 2023 alone, according to NOAA, causing immense economic losses. This trend forces insurers to grapple with higher payouts and, consequently, increased reinsurance costs, impacting their profitability and pricing strategies.

Governments and regulators are pushing insurers like Atlantic American to be more transparent about how climate change impacts their investments and underwriting. This means detailing how they're managing risks associated with things like extreme weather events or shifts to a low-carbon economy.

While there's a growing trend towards disclosure, many insurers still lag in setting clear, measurable goals for climate risk. For instance, a 2024 report by the Net-Zero Insurance Alliance highlighted that only a fraction of members had disclosed specific, science-based emissions reduction targets for their investment portfolios, indicating a persistent gap in actionable metrics.

Atlantic American's property and casualty operations, encompassing commercial lines, face considerable geographical exposure to natural disasters. States where the company operates are often susceptible to events like hurricanes and wildfires, posing a direct threat to its underwriting portfolio.

The insurance industry is seeing a trend where carriers are withdrawing from or repricing coverage in areas deemed high-risk due to climate change and increasing catastrophe frequency. For instance, in 2023, insured losses from natural catastrophes globally were estimated to be around $110 billion, with the US experiencing a significant portion of this due to severe convective storms and wildfires, according to reinsurer Swiss Re.

ESG Principles and Sustainable Underwriting

Environmental, Social, and Governance (ESG) principles are increasingly influencing insurance underwriting and investment decisions. Stakeholders, including investors and regulators, are pushing insurers like Atlantic American to adopt more sustainable practices. This shift is driven by a growing awareness of climate-related risks and the desire for investments that align with environmental and social values.

Integrating ESG factors into underwriting means assessing risks not just on traditional metrics, but also on their environmental impact and social responsibility. For example, insurers might offer preferential rates for businesses with strong sustainability credentials or avoid insuring projects with significant negative environmental externalities. This strategic alignment aims to attract ESG-conscious investors and build a more resilient business model for the future.

- Growing ESG Investment: Global sustainable investment assets reached $37.7 trillion in early 2024, indicating a significant shift in capital allocation towards ESG-aligned companies.

- Climate Risk Focus: Insurers are increasingly factoring in physical climate risks, such as rising sea levels and extreme weather events, into their underwriting models.

- Regulatory Scrutiny: Regulators worldwide are enhancing disclosure requirements for climate-related financial risks, pushing companies to demonstrate their ESG commitment.

- Investor Demand: A significant portion of institutional investors, often exceeding 70%, now incorporate ESG factors into their investment strategies.

Impact on Infrastructure and Commercial Property

Extreme weather events, increasingly linked to climate change, present a growing threat to both infrastructure and commercial properties. This translates directly into higher claims for insurers like Atlantic American, particularly within their commercial auto and other property-related lines. For instance, the National Oceanic and Atmospheric Administration (NOAA) reported 28 separate billion-dollar weather and climate disasters in the U.S. during 2023, a significant increase from previous years, impacting commercial operations and assets.

Consequently, Atlantic American, and the broader insurance industry, must adapt their risk assessment methodologies. Businesses situated in areas prone to flooding, wildfires, or severe storms may face adjusted premiums. This proactive approach is crucial for maintaining solvency and ensuring the availability of coverage in a changing environmental landscape.

The financial implications are substantial. Increased payouts for damages necessitate a re-evaluation of pricing models. This could mean higher insurance costs for businesses in vulnerable coastal regions or those reliant on transportation networks susceptible to weather disruptions. For example, a report by Swiss Re in 2024 highlighted that the economic losses from natural catastrophes globally reached $280 billion in 2023, with insured losses amounting to $108 billion, underscoring the escalating financial burden.

- Increased Claims: Extreme weather events lead to higher payouts for commercial auto and property damage.

- Risk Assessment Adaptation: Insurers must refine their models to account for climate-related risks.

- Premium Adjustments: Businesses in vulnerable locations may see increased insurance premiums.

- Economic Impact: Global natural catastrophe losses are rising, impacting the insurance sector's financial stability.

Atlantic American faces increasing challenges from climate change, leading to more frequent and severe weather events. This directly impacts property and casualty insurance through higher claims and increased reinsurance costs. For example, 2023 saw 28 billion-dollar weather disasters in the U.S., according to NOAA, stressing the industry's financial resilience.

Governments and investors are pushing for greater transparency in how insurers manage climate-related risks, including their investment portfolios. Many insurers, however, still need to set clear, measurable goals for emissions reduction, highlighting a gap in actionable climate strategies.

The trend of insurers withdrawing from or repricing coverage in high-risk areas is accelerating. Global insured losses from natural catastrophes were approximately $110 billion in 2023, with the U.S. bearing a significant portion due to severe storms and wildfires, as reported by Swiss Re.

| Environmental Factor | Impact on Atlantic American | Supporting Data (2023-2024) |

|---|---|---|

| Extreme Weather Events | Increased property damage claims, higher reinsurance costs | 28 U.S. billion-dollar weather disasters (NOAA); $110 billion global insured losses from natural catastrophes (Swiss Re) |

| Climate Risk Disclosure | Pressure for transparency in underwriting and investments | Growing regulatory scrutiny on climate-related financial risks |

| ESG Integration | Demand for sustainable practices and investments | Global sustainable investment assets reached $37.7 trillion (early 2024); Over 70% of institutional investors incorporate ESG |

| Geographical Exposure | Vulnerability in areas prone to hurricanes, wildfires | Companies in coastal or wildfire-prone regions face repricing or withdrawal of coverage |

PESTLE Analysis Data Sources

Our Atlantic American PESTLE Analysis draws from a comprehensive range of sources, including official government publications, international economic databases, and leading industry research firms. We meticulously gather data on political stability, economic indicators, social trends, technological advancements, environmental regulations, and legal frameworks to provide a robust overview.