Atlantic American Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Atlantic American Bundle

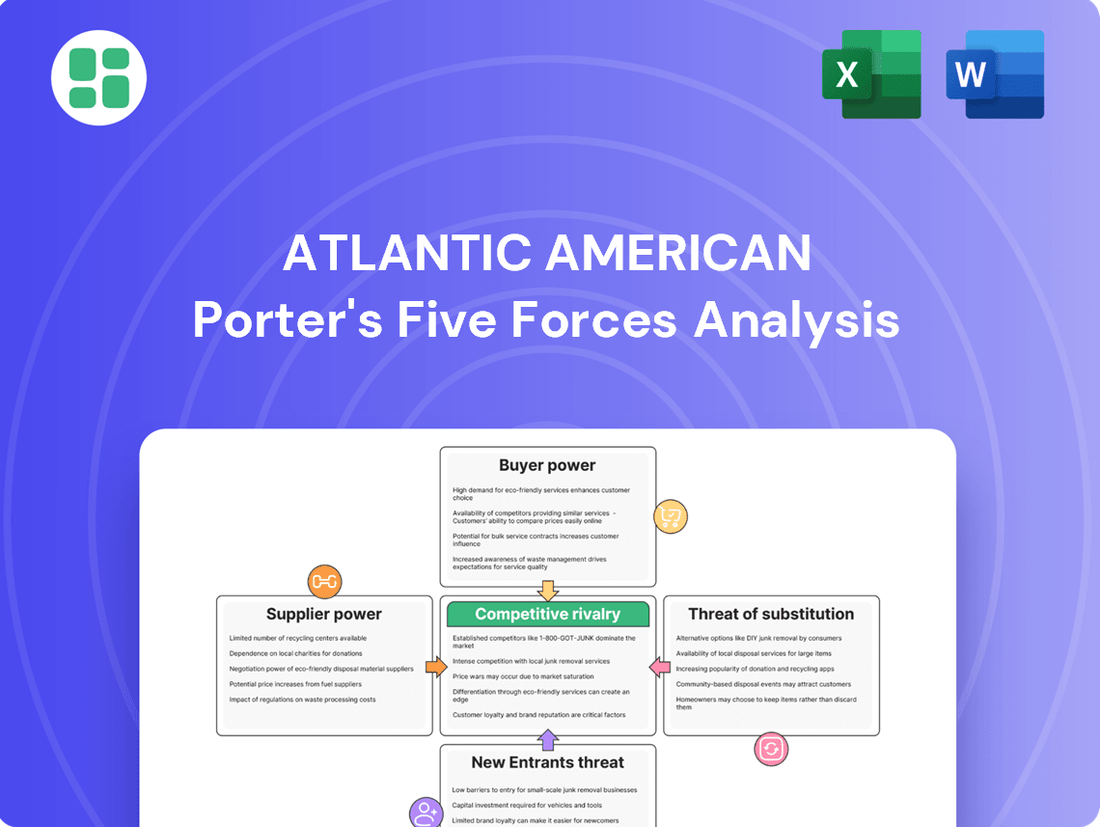

Atlantic American Porter's Five Forces analysis reveals a complex competitive landscape, highlighting significant buyer power and moderate threat of substitutes. Understanding these pressures is crucial for strategic planning.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Atlantic American’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The bargaining power of suppliers in the reinsurance market is a critical factor for Atlantic American. When the reinsurance market tightens, meaning there are fewer reinsurers willing to offer coverage or prices increase significantly, Atlantic American's ability to secure necessary protection for its underwritten risks is directly affected. This scarcity can lead to higher costs for reinsurance, impacting Atlantic American's profitability and its capacity to take on larger insurance policies.

In 2024, the global reinsurance market continued to experience a hardening cycle, with reinsurers demonstrating strong pricing power due to ongoing concerns about climate-related catastrophes and increased claims volatility. This environment means that companies like Atlantic American face higher premiums and potentially more restrictive terms when seeking reinsurance coverage, thereby increasing the influence of these suppliers.

Atlantic American's reliance on technology and software providers for critical functions like claims processing and policy administration means these suppliers can wield significant influence. The uniqueness of their software, the expense and effort involved in switching to a new system, and the availability of comparable alternatives all factor into their bargaining power. For instance, a specialized claims management system with deep integration into Atlantic American's operations would have more leverage than a generic CRM solution with many competitors.

Actuarial and data service providers hold significant bargaining power due to the specialized nature of their expertise and the critical role of accurate data in insurance. These firms often possess proprietary data sets and deep analytical capabilities essential for risk assessment and pricing, which are fundamental to Atlantic American's operations. For instance, the global actuarial services market was valued at approximately $4.5 billion in 2023 and is projected to grow, indicating a strong demand for these specialized skills.

Investment Management Services

Atlantic American, like many insurance companies, manages substantial investment portfolios to support its financial obligations. The entities providing these investment management services, such as asset managers and financial institutions, wield considerable influence. Their power stems from their track record, the fees they charge, and the unique investment strategies they deploy, all of which directly impact Atlantic American's overall investment performance and profitability.

The bargaining power of suppliers in this context is shaped by several factors. Highly reputable asset managers with proven alpha generation capabilities can command higher fees and favorable terms. Conversely, a crowded market with many providers offering similar services can dilute supplier power. For instance, in 2024, the average expense ratio for actively managed equity funds remained around 0.70%, while passively managed funds averaged closer to 0.06%, illustrating a significant difference in cost that Atlantic American must consider when selecting service providers.

- Performance Metrics: The historical returns and risk-adjusted performance of asset managers are key determinants of their bargaining power.

- Fee Structures: Competitive and transparent fee arrangements are crucial; high management fees can significantly erode investment returns.

- Specialized Strategies: Niche or proprietary investment strategies that offer unique market advantages can increase a supplier's leverage.

- Market Concentration: The number of available and qualified investment service providers influences the balance of power; a more concentrated market empowers suppliers.

Regulatory Compliance and Legal Services

The insurance sector, including companies like Atlantic American, operates within a heavily regulated environment. This necessitates reliance on specialized legal and compliance services, creating significant bargaining power for suppliers in this domain. Firms with proven expertise in insurance law and regulatory adherence can leverage their unique skills to command premium fees.

In 2024, the increasing complexity of financial regulations globally, coupled with evolving data privacy laws, further amplifies the demand for these specialized services. For instance, compliance with the National Association of Insurance Commissioners (NAIC) model laws and state-specific regulations requires deep legal understanding.

- Specialized Expertise: Suppliers with niche knowledge in insurance law and regulatory frameworks are in high demand.

- Regulatory Burden: The constant need to adapt to new and changing regulations increases reliance on expert legal counsel.

- High Stakes: Non-compliance can lead to substantial fines and reputational damage, making these services critical.

- Limited Supplier Pool: The number of law firms and consultants with deep, proven insurance regulatory experience is relatively small.

Suppliers in the reinsurance market, particularly those offering specialized technology and actuarial services, hold considerable sway over Atlantic American. This is due to the critical nature of their offerings and the specialized expertise required, often with limited alternatives. For instance, the global actuarial services market's projected growth indicates a strong demand, empowering these providers.

In 2024, the reinsurance market's hardening cycle continued, with reinsurers dictating terms and prices due to catastrophe concerns. This scarcity directly increases supplier power, impacting Atlantic American's costs and risk-taking capacity. Similarly, specialized software providers for claims and policy administration can leverage system integration complexities and switching costs.

Investment management services also present a significant supplier influence for Atlantic American, driven by performance metrics and specialized strategies. Asset managers with proven track records can command higher fees, as seen in the differing expense ratios between active and passive funds in 2024. The regulatory landscape further amplifies the power of legal and compliance service providers due to the high stakes of non-compliance and a limited pool of specialized firms.

| Supplier Type | Key Influence Factors | 2024/2023 Data Point |

|---|---|---|

| Reinsurers | Market hardening, catastrophe concerns, claims volatility | Continued pricing power due to ongoing concerns |

| Technology Providers (Claims/Policy Admin) | Software uniqueness, switching costs, integration depth | High reliance on specialized systems |

| Actuarial & Data Services | Specialized expertise, proprietary data, analytical capabilities | Global actuarial services market valued ~ $4.5 billion (2023) |

| Investment Managers | Performance track record, fee structures, specialized strategies | Active equity fund expense ratios ~0.70% (2024) |

| Legal & Compliance Services | Insurance law expertise, regulatory complexity, limited supplier pool | Increasing demand due to evolving global regulations |

What is included in the product

This analysis reveals the intensity of competition, buyer and supplier power, threat of new entrants, and the availability of substitutes specifically impacting Atlantic American's market position.

Effortlessly identify and address competitive threats with a visual breakdown of Porter's Five Forces, transforming complex market dynamics into actionable insights.

Customers Bargaining Power

Customers, whether individuals or businesses, have significant power when they can easily compare insurance prices. This is especially true for straightforward products like term life insurance or commercial auto policies. For instance, in 2024, online comparison platforms saw a surge in usage, with many consumers reporting they switched providers based on price alone.

This ease of comparison, facilitated by the internet and insurance brokers, directly impacts Atlantic American. It means customers can quickly identify the most competitive rates available in the market. This transparency forces Atlantic American to keep its pricing sharp, particularly for its more standardized offerings, to avoid losing business to rivals.

For many insurance products, the effort and cost associated with switching providers are relatively low once a policy term ends. This ease of transition empowers customers to seek better terms or service from competitors if they are dissatisfied with Atlantic American, increasing customer leverage.

The insurance market is highly competitive, with many companies offering comparable products. This saturation means customers aren't tied to one insurer, giving them significant leverage. For instance, in 2024, the U.S. property and casualty insurance market saw numerous mergers and acquisitions, further consolidating the landscape and increasing customer options.

Information Asymmetry Reduction

The digital age has significantly leveled the playing field regarding information access. Customers now have unprecedented access to online reviews, independent ratings, and detailed policy comparisons. This readily available data allows them to thoroughly research insurance providers and their offerings, understanding policy intricacies and coverage nuances. For instance, platforms aggregating customer feedback and financial health scores for insurers provide a transparent view, diminishing the historical advantage insurers held due to proprietary information.

This surge in accessible information directly translates to a reduction in information asymmetry. Customers are no longer solely reliant on insurer-provided details; they can cross-reference information and gauge insurer reputations from multiple independent sources. This empowerment enables them to make more informed purchasing decisions, actively seeking out policies that best meet their needs and budgets. By understanding market pricing and competitor offerings, customers are better positioned to negotiate for more favorable terms and demand greater value from their insurance providers.

- Informed Decision-Making: Customers can now easily compare policy features, coverage limits, and premium costs across various insurers, leading to more educated choices.

- Enhanced Negotiation Power: With a clearer understanding of market value, customers can more effectively negotiate terms and pricing with insurance companies.

- Reputation Scrutiny: Online reviews and independent ratings allow customers to assess an insurer's reliability and customer service before committing, holding companies accountable.

- Demand for Transparency: The ease of information access drives a customer expectation for clear, concise, and easily understandable policy details from all providers.

Demand for Tailored Solutions

Commercial clients, especially, often require insurance plans precisely molded to their unique risk exposures. If Atlantic American struggles to deliver the necessary adaptability or specialized offerings, these clients might turn to specialized competitors, significantly boosting their leverage.

This demand for tailored solutions is a key driver of customer bargaining power. For instance, in 2024, the demand for customized cyber insurance policies surged as businesses faced increasingly sophisticated threats, giving clients with unique cybersecurity needs more options and thus more power to negotiate terms.

- Increased Customer Leverage: A business needing a very specific risk coverage can switch providers if Atlantic American doesn't meet its exact requirements.

- Niche Provider Competition: The existence of specialized insurers catering to unique demands empowers customers to seek better deals elsewhere.

- Product Flexibility is Key: Atlantic American's ability to offer adaptable and specialized insurance products directly impacts its ability to retain these high-demand clients.

Customers possess significant bargaining power when they can easily compare insurance prices, especially for standardized products. This ease of comparison, amplified by online platforms, forces Atlantic American to maintain competitive pricing. For example, in 2024, a significant portion of consumers actively used comparison sites to switch providers based on price alone, highlighting this leverage.

The low cost and minimal effort associated with switching insurance providers after a policy term concludes further empower customers. This allows them to readily seek better terms or service from competitors if dissatisfied with Atlantic American, increasing their leverage in the market.

The highly competitive insurance landscape, with numerous providers offering similar products, means customers are not locked into a single insurer. This saturation of options grants customers considerable leverage, as evidenced by the 2024 U.S. property and casualty market's consolidation, which paradoxically increased customer choice.

The digital age has democratized information, providing customers with easy access to reviews, ratings, and policy comparisons. This transparency diminishes information asymmetry, enabling customers to make informed decisions and negotiate better terms, as seen with platforms offering independent insurer assessments.

Commercial clients, in particular, benefit from the availability of specialized insurers who can tailor policies to unique risk exposures. If Atlantic American cannot offer such customization, these clients have the power to switch, as demonstrated by the 2024 surge in demand for customized cyber insurance, which gave businesses with specific needs more negotiating power.

| Factor | Impact on Atlantic American | 2024 Data/Trend |

|---|---|---|

| Price Sensitivity | High for standardized products | Increased usage of online comparison tools by consumers |

| Switching Costs | Low | Customers readily switch for better terms or service |

| Market Competition | High | Consolidation in P&C market increased customer options |

| Information Availability | High | Customers use online reviews and ratings for informed decisions |

| Customization Needs | Significant for commercial clients | Surge in demand for tailored cyber insurance policies |

Preview Before You Purchase

Atlantic American Porter's Five Forces Analysis

This preview shows the exact Atlantic American Porter's Five Forces Analysis you'll receive immediately after purchase, detailing the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products. Our analysis provides a comprehensive overview of these critical competitive forces, offering actionable insights into Atlantic American's strategic positioning within its industry. You can trust that the document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy, ensuring you have the complete, professionally formatted analysis at your fingertips.

Rivalry Among Competitors

The insurance sector, encompassing life, health, and property/casualty, is notably fragmented. This means Atlantic American operates within a landscape populated by a vast array of local, regional, and national competitors, making it a highly competitive environment.

Atlantic American contends with considerable rivalry from a diverse spectrum of insurance providers. This intense competition often compels companies to adopt aggressive pricing tactics and robust marketing campaigns to capture market share.

For instance, in 2024, the U.S. property and casualty insurance market alone featured over 2,000 distinct companies, illustrating the sheer density of competition Atlantic American navigates. This fragmentation necessitates constant adaptation and strategic differentiation to stand out.

Atlantic American faces significant competitive rivalry, particularly with its more standardized insurance offerings like basic life and auto policies. These products often resemble commodities in the eyes of consumers, making it difficult to stand out. For instance, in 2024, the overall U.S. auto insurance market saw premiums increase by an average of 8.2%, highlighting the pressure on insurers to manage costs and offer competitive pricing amidst rising claims.

The key challenge for Atlantic American is to effectively differentiate these seemingly similar products. This differentiation can be achieved through superior customer service, building a strong and trusted brand reputation, or by incorporating unique policy features that cater to specific customer needs. Failing to differentiate adequately can lead to a fierce, price-driven competition where margins are squeezed.

In mature insurance segments, Atlantic American faces a landscape where overall market growth is modest, often in the low single digits. This limited expansion means companies must fight harder for existing customers. For instance, the US property and casualty insurance market, a key area for many insurers, saw growth rates around 3-4% in recent years, intensifying competition for market share.

High Fixed Costs and Exit Barriers

Insurance companies, like Atlantic American, often operate with substantial fixed costs. These include investments in robust IT systems for policy management and claims processing, ongoing expenses for regulatory compliance, and the development of extensive distribution channels, such as agent networks and online platforms. These infrastructure requirements mean that even with lower sales volumes, a significant portion of costs remains constant.

The presence of high exit barriers further exacerbates competitive rivalry. For instance, Atlantic American, like other insurers, faces long-term policy obligations that make it difficult and costly to simply cease operations. This can trap less profitable companies in the market, leading them to compete aggressively on price or other factors to maintain market share, thus putting pressure on all players.

- Significant Fixed Costs: Insurance sector investments in technology, compliance, and distribution are substantial, creating a high cost base.

- Long-Term Obligations: Policy commitments create a barrier to exiting the market, potentially prolonging the presence of weaker competitors.

- Intensified Competition: Entrenched players, even if underperforming, can drive down prices and margins for all participants.

Impact of Digitalization and Insurtech

The increasing digitalization and the emergence of Insurtech firms are significantly intensifying competitive rivalry for Atlantic American. These tech-savvy companies are leveraging digital platforms to streamline operations and offer tailored customer experiences, creating a more dynamic market. For instance, by mid-2024, Insurtechs were projected to capture a larger share of the insurance market, with some estimates suggesting they could account for over 15% of new business premiums in certain segments.

Atlantic American must contend with these agile competitors who often possess lower overheads and can introduce innovative products at a faster pace. This forces traditional insurers to invest heavily in their own digital transformation to remain competitive. By the end of 2023, many established insurers, including those similar to Atlantic American, were allocating substantial portions of their IT budgets, often exceeding 30%, towards digital initiatives and modernization.

The impact on competitive rivalry is multifaceted:

- Enhanced Customer Expectations: Digital-first insurers have raised the bar for customer service, pushing traditional players to offer similar seamless online experiences.

- New Distribution Channels: Insurtechs are adept at utilizing online channels and partnerships, bypassing traditional agent networks and reaching new customer segments.

- Data-Driven Underwriting: Advanced analytics and AI employed by Insurtechs allow for more precise risk assessment and personalized pricing, a challenge for legacy systems.

- Product Innovation: The ability to quickly develop and deploy new, niche insurance products, such as usage-based or on-demand insurance, puts pressure on established offerings.

The competitive rivalry for Atlantic American is intense due to a fragmented market with over 2,000 U.S. property and casualty insurers in 2024. This density forces aggressive pricing and marketing. Mature segments see low single-digit growth, intensifying the fight for existing customers. High fixed costs and exit barriers also contribute to this pressure, as companies with significant obligations must compete to stay afloat.

Digitalization and Insurtechs are further escalating this rivalry. By mid-2024, Insurtechs were projected to capture over 15% of new business premiums in certain segments. These agile competitors, often with lower overheads and advanced data analytics, are raising customer expectations for seamless online experiences and innovative products. This trend is compelling traditional insurers to invest heavily, with many allocating over 30% of IT budgets to digital transformation by the end of 2023.

| Key Competitive Factors | Impact on Atlantic American | Illustrative 2024 Data/Projections |

| Market Fragmentation | High number of competitors necessitates differentiation and competitive pricing. | Over 2,000 P&C insurers in the U.S. |

| Digitalization & Insurtechs | Pressure to adopt digital strategies and improve customer experience. | Insurtechs projected to capture >15% of new business premiums in some segments. |

| Mature Market Growth | Limited market expansion intensifies competition for market share. | Low single-digit growth in mature insurance segments. |

| Cost Structure | High fixed costs require efficient operations to maintain profitability. | Significant IT, compliance, and distribution investments. |

SSubstitutes Threaten

For substantial commercial clients, especially those with predictable risk patterns, self-insuring or establishing captive insurance entities presents a compelling alternative to standard commercial policies. This strategy directly lessens their dependence on external providers like Atlantic American for specific risk management needs.

In 2024, the trend towards self-insurance and captive programs continued to gain traction among large corporations. For instance, industry reports indicate that the global captive insurance market size was valued at approximately $70 billion in 2023, with projections suggesting steady growth through 2024 and beyond. This indicates a significant portion of the market is actively exploring or utilizing these alternatives, posing a direct threat to traditional insurers.

Government-mandated programs like Social Security and Medicare/Medicaid act as significant substitutes for private insurance. These programs offer a baseline level of financial security and healthcare coverage, potentially diminishing the demand for comparable private insurance products. For instance, in 2024, Social Security benefits are projected to provide income for millions of retirees, directly impacting the market for private life insurance and annuities.

The existence of these public safety nets can reduce the perceived urgency and necessity for individuals to purchase extensive private coverage. Medicare, which covered over 66 million Americans in 2023, provides a substantial alternative to private health insurance, particularly for seniors. This can limit the pricing power of private health insurers and reduce their market share for certain demographics.

Investments in robust risk management, safety protocols, and wellness programs by individuals and businesses can reduce the frequency and severity of insurable events. For example, a company implementing advanced cybersecurity measures might reduce its need for cyber insurance, a clear substitute for traditional coverage.

Alternative Risk Transfer (ART) Mechanisms

Beyond traditional insurance, financial instruments like catastrophe bonds, derivatives, and other structured finance solutions offer alternative risk transfer mechanisms. These can be particularly appealing to large corporations seeking to manage significant, potentially catastrophic risks outside the scope of conventional insurance policies.

The market for Alternative Risk Transfer (ART) has seen substantial growth. For instance, the catastrophe bond market issuance reached approximately $15.5 billion in 2023, demonstrating a strong demand for these instruments as a way to offload specific perils.

- Catastrophe Bonds: These instruments allow insurers or corporations to transfer specific risks, like natural disasters, to capital market investors. Investors receive a coupon payment, but can lose principal if a predefined trigger event occurs.

- Derivatives: Financial derivatives, such as futures and options, can be used to hedge against price fluctuations or other market risks, offering a flexible way to manage exposure.

- Structured Finance Solutions: These are complex financial products designed to manage and transfer risk through securitization or other innovative structures.

- Market Growth: The global ART market is projected to continue its expansion, driven by increasing risk awareness and the search for capacity beyond traditional insurance markets.

Emergence of Peer-to-Peer (P2P) Insurance Models

The emergence of peer-to-peer (P2P) insurance models presents a growing threat of substitutes for traditional insurance providers. These platforms enable individuals and businesses to collectively pool funds to cover shared risks, bypassing conventional insurance structures. While the P2P insurance market is still developing, its potential to offer lower premiums and increased transparency could attract a significant customer base away from established players.

For instance, by 2024, several P2P insurance startups had gained traction, particularly in niche markets like ride-sharing or small business liability. These models often leverage technology to reduce administrative overhead, a cost advantage that can be passed on to consumers. The direct community-based approach can also foster greater trust and engagement among policyholders.

- P2P insurance allows risk pooling among individuals or businesses.

- These models can offer lower costs and greater transparency than traditional insurers.

- The market is nascent but growing, with potential to disrupt established players.

The threat of substitutes for Atlantic American is multifaceted, encompassing self-insurance, government programs, alternative risk transfer, and peer-to-peer models. These alternatives directly challenge traditional insurance by offering potentially lower costs, greater flexibility, or specific risk management solutions.

For example, the continued growth of captive insurance, with the global market valued around $70 billion in 2023, signifies a substantial shift for large commercial clients seeking to manage their own risks. Similarly, government programs like Medicare, which covered over 66 million Americans in 2023, provide a baseline of security that can reduce reliance on private health insurance.

The alternative risk transfer market, highlighted by $15.5 billion in catastrophe bond issuance in 2023, offers sophisticated financial instruments for managing large-scale risks outside conventional policies. Furthermore, the emergence of P2P insurance models, gaining traction in niche markets by 2024, presents a community-driven approach that can undercut traditional overheads.

| Substitute Category | Description | 2023/2024 Data Point | Impact on Atlantic American |

|---|---|---|---|

| Self-Insurance/Captives | Companies managing their own risks | Global captive market ~$70 billion (2023) | Reduces demand for commercial policies |

| Government Programs | Public safety nets (e.g., Medicare) | Medicare covered >66 million Americans (2023) | Decreases need for private health/life insurance |

| Alternative Risk Transfer (ART) | Financial instruments for risk transfer | Catastrophe bond issuance ~$15.5 billion (2023) | Offers alternative to traditional reinsurance/coverage |

| Peer-to-Peer (P2P) Insurance | Community-based risk pooling | Gaining traction in niche markets (2024) | Potential for lower costs, disrupting traditional models |

Entrants Threaten

Establishing an insurance company like Atlantic American demands significant capital. For instance, in 2024, new insurance companies often need to demonstrate millions in surplus capital to satisfy state regulatory solvency requirements, a substantial hurdle for many aspiring competitors.

These high initial capital outlays create a formidable barrier to entry. Potential new entrants must secure substantial funding not only for regulatory compliance but also to establish necessary infrastructure, develop product lines, and build a customer base, effectively deterring smaller or less-funded players from entering the market.

The insurance sector is notoriously complex due to extensive regulatory hurdles. New entrants face significant challenges navigating intricate licensing procedures, stringent solvency requirements, and a web of consumer protection and data privacy laws. For instance, in 2024, the National Association of Insurance Commissioners (NAIC) continued to emphasize robust capital and surplus requirements, making it financially demanding for newcomers to establish a secure operational base.

Building effective distribution channels, whether through agents, brokers, or direct-to-consumer platforms, is crucial for reaching customers in the insurance sector. New entrants face the significant challenge of establishing these networks, which can be both time-consuming and expensive to build or acquire.

For instance, a new insurance company might need to invest millions in setting up a national sales force or securing partnerships with established agencies. In 2024, the cost of customer acquisition in the insurance industry remained a substantial barrier, with some channels costing upwards of $500 per policyholder.

Brand Reputation and Customer Trust

The insurance industry fundamentally relies on trust. Atlantic American, like other established insurers, has cultivated brand reputation and customer loyalty over many years. This deep-seated trust is a significant barrier for new entrants who lack a proven history and must invest heavily to build credibility.

New companies entering the insurance market face the daunting task of establishing trust without an existing track record. For instance, in 2024, the average customer acquisition cost for insurance products can be substantial, reflecting the effort required to overcome this trust deficit.

Consider these points regarding brand reputation and customer trust as a barrier:

- Brand Recognition: Established insurers benefit from decades of marketing and customer interaction, creating strong brand recall that new entrants find difficult to match quickly.

- Customer Loyalty: Long-term policyholders often remain with trusted brands due to perceived reliability and established relationships, making it challenging for newcomers to attract this segment.

- Trust as a Differentiator: In an industry where product features can be similar, a strong reputation for integrity and service becomes a key differentiator that new entrants must actively earn.

- Reputational Risk: A single negative incident can severely damage a new entrant's nascent reputation, whereas established firms often have more resilience due to their history.

Economies of Scale and Data Advantages

Existing insurers, like Atlantic American, leverage significant economies of scale. This allows them to spread fixed costs over a larger volume of policies, reducing the per-unit cost of underwriting, claims handling, and administration. For instance, in 2024, the average expense ratio for U.S. property and casualty insurers remained competitive, a testament to the efficiency gains from scale.

Furthermore, established players possess vast historical data sets. This data is invaluable for refining risk assessment models and achieving more accurate pricing, a critical advantage over newcomers who must build their data reserves. In 2024, companies with extensive actuarial data were better positioned to navigate evolving market risks and offer competitive premiums.

- Economies of Scale: Lower per-unit costs in operations due to larger policy volumes.

- Data Advantage: Historical data enables superior risk assessment and pricing accuracy.

- Competitive Barrier: These factors create a significant hurdle for new companies entering the insurance market.

The threat of new entrants for Atlantic American is moderate. High capital requirements, stringent regulations, and the need to build distribution networks and customer trust present significant barriers.

However, technological advancements are lowering some of these barriers, allowing for more agile and digitally-focused entrants. Established players' economies of scale and data advantages remain strong deterrents.

In 2024, the cost to launch a new insurance carrier, even a specialized digital one, often required tens of millions in seed capital, with regulatory compliance being a major driver.

The complexity of insurance regulations, including solvency margins and consumer protection laws, continues to demand substantial legal and compliance resources, making market entry demanding.

| Barrier Type | Description | 2024 Relevance |

|---|---|---|

| Capital Requirements | Significant upfront investment for licensing, operations, and reserves. | New insurers often need millions in surplus capital; e.g., $50M+ for some licenses. |

| Regulatory Hurdles | Navigating complex state and federal insurance laws and compliance. | Ongoing compliance with NAIC standards and evolving data privacy laws. |

| Distribution Channels | Establishing and maintaining agent networks or direct-to-consumer platforms. | Customer acquisition costs can exceed $500 per policyholder in some channels. |

| Brand Reputation & Trust | Building credibility and customer loyalty in a risk-averse industry. | Long-term trust is built over years, a significant challenge for new entrants. |

| Economies of Scale & Data | Leveraging existing infrastructure and historical data for efficiency and pricing. | Established insurers benefit from lower expense ratios and superior risk modeling. |

Porter's Five Forces Analysis Data Sources

Our analysis of the Atlantic American Porter's Five Forces is built upon a foundation of robust data from industry-specific market research reports, financial statements of key players, and publicly available trade association data, ensuring a comprehensive understanding of the competitive landscape.