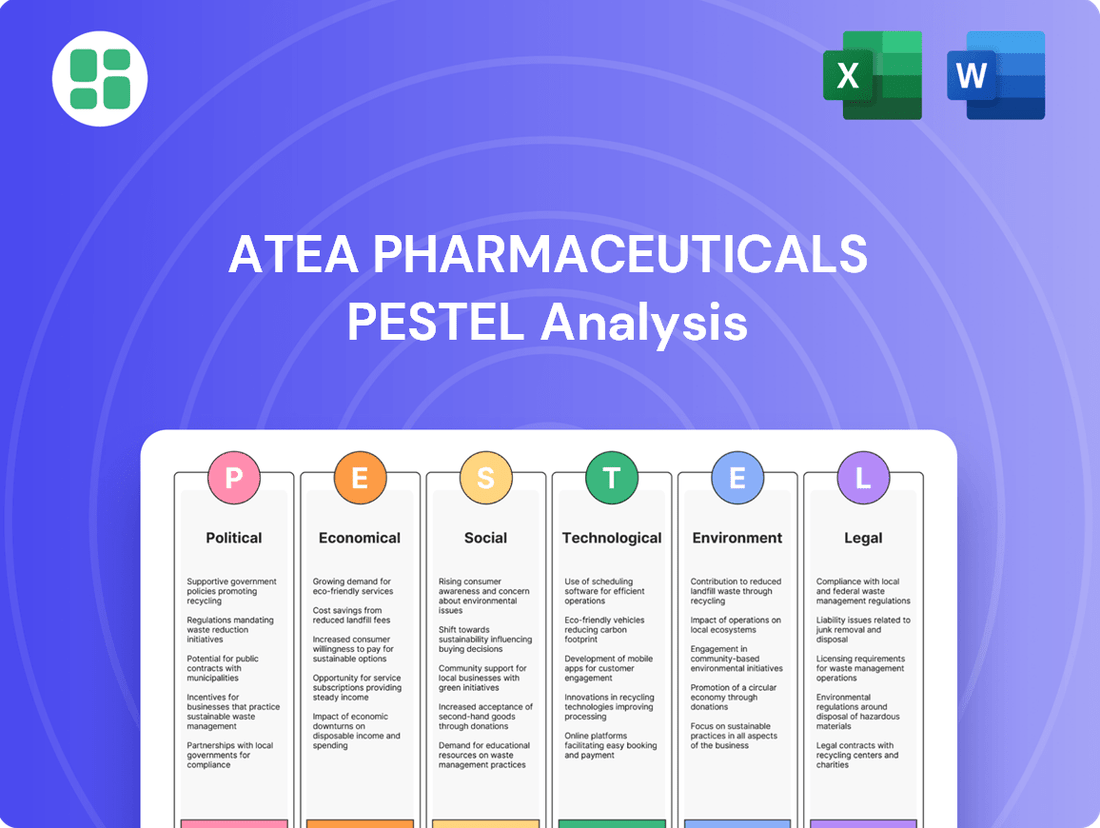

Atea Pharmaceuticals PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Atea Pharmaceuticals Bundle

Navigate the complex external landscape impacting Atea Pharmaceuticals with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are shaping their strategic direction. This analysis is your key to unlocking actionable intelligence and anticipating future market dynamics. Download the full version now to gain a critical competitive advantage.

Political factors

Government policies are a major driver for Atea Pharmaceuticals. Regulations around drug pricing, how easily new treatments can reach patients, and what insurance will pay for directly affect Atea's antiviral therapies. For instance, shifts in laws concerning drug price negotiations or expanded coverage for diseases like Hepatitis C could significantly alter Atea's earning potential and ability to gain market share.

Furthermore, government initiatives aimed at public health, such as building up national stockpiles of antiviral medications in preparation for future outbreaks, can create substantial demand for Atea's products. The US government's actions, like the Biomedical Advanced Research and Development Authority (BARDA) funding for pandemic preparedness, highlight this potential. In 2024, BARDA continued to invest heavily in countermeasures for emerging infectious diseases, offering opportunities for companies like Atea.

Regulatory bodies like the FDA are pivotal in approving new drugs, impacting Atea's oral antiviral candidates. The pace and thoroughness of these reviews, alongside shifting guidelines for trials and efficacy, directly influence Atea's market entry timeline. For instance, Atea's recent successful End-of-Phase 2 meeting with the FDA for its HCV program signals positive progress toward Phase 3 trials, demonstrating regulatory engagement.

Global health initiatives, like the Coalition for Epidemic Preparedness Innovations (CEPI), which aims to accelerate the development of vaccines against emerging infectious diseases, directly impact companies like Atea. Government funding for antiviral research, such as the U.S. National Institutes of Health (NIH) investments, can significantly boost Atea's drug development pipeline, as seen in the increased focus on novel therapeutics following the COVID-19 pandemic.

Intellectual Property Protection Policies

Intellectual property (IP) protection is a critical pillar for Atea Pharmaceuticals, given its substantial investment in research and development for novel antiviral compounds. The strength and consistent enforcement of patent laws, data exclusivity provisions, and regulations governing generic drug competition directly influence Atea's capacity to safeguard its innovations and recover its significant development expenditures. For instance, the United States Patent and Trademark Office (USPTO) granted approximately 300,000 utility patents in 2023, underscoring the active patent landscape in which Atea operates.

Government policies shape the competitive environment for biopharmaceutical firms like Atea. Changes in patentability criteria or the duration of market exclusivity can profoundly affect a company's revenue streams and future investment decisions. The ongoing discourse surrounding IP in the biopharma sector includes potential legislative impacts, such as the proposed BIOSECURE Act, which could introduce new considerations for companies developing therapeutics, potentially affecting market access and competitive dynamics.

The effectiveness of IP enforcement varies globally, presenting both opportunities and challenges for Atea. Robust IP frameworks in key markets facilitate the recoupment of R&D costs, while weaker protections in other regions can expose Atea's innovations to premature competition. For example, the World Intellectual Property Organization (WIPO) reported a 2.7% increase in international patent filings in 2023, indicating a growing global reliance on IP as a strategic asset.

Geopolitical Stability and Trade Relations

Geopolitical stability significantly impacts Atea Pharmaceuticals by influencing global supply chains for essential pharmaceutical ingredients and market accessibility. Trade relations, including tariffs and disputes, can create operational disruptions and affect financial performance, particularly for companies reliant on international sourcing or export markets. For instance, ongoing trade tensions between major economies could lead to increased costs for raw materials or hinder market entry for Atea's products.

Political instability in key research, manufacturing, or sales regions poses a direct threat to Atea's operations. Such instability can lead to unforeseen regulatory changes, disruptions in logistics, or even the suspension of business activities, directly impacting revenue streams and research timelines. The company must remain agile to navigate these volatile environments.

Emerging considerations for Atea include the growing emphasis on domestic supply chains, driven by national security concerns and a desire for greater resilience. This trend may necessitate adjustments to Atea's sourcing strategies and manufacturing footprint. Additionally, potential restrictions on collaborations with certain foreign biotechnology firms, stemming from geopolitical rivalries, could limit access to innovative technologies or partnerships crucial for Atea's pipeline development.

- Supply Chain Vulnerability: A 2024 report by McKinsey highlighted that nearly 90% of pharmaceutical companies experienced supply chain disruptions in the prior year, with geopolitical events cited as a primary cause.

- Trade Policy Impact: Changes in trade policies, such as tariffs on active pharmaceutical ingredients (APIs) or finished goods, could increase Atea's cost of goods sold by an estimated 5-10% depending on sourcing locations.

- R&D Collaboration Risks: Increased scrutiny on international R&D collaborations, particularly between Western and Eastern bloc countries, could delay or derail Atea's efforts to partner with promising overseas biotech firms, potentially impacting its early-stage pipeline.

Government policies significantly influence Atea Pharmaceuticals' operational landscape, particularly concerning drug pricing, market access, and regulatory approvals. Initiatives like expanded coverage for Hepatitis C or government funding for pandemic preparedness, as seen with BARDA investments in 2024, directly impact Atea's revenue potential and market penetration.

Regulatory bodies such as the FDA play a crucial role in the approval process for Atea's antiviral candidates; for instance, Atea's successful End-of-Phase 2 meeting for its HCV program in early 2024 demonstrates the importance of these interactions for market entry timelines.

Intellectual property protection is paramount for Atea, with patent laws and market exclusivity directly affecting its ability to recoup R&D costs. The USPTO's issuance of approximately 300,000 utility patents in 2023 highlights the dynamic IP environment Atea navigates.

Geopolitical factors introduce supply chain vulnerabilities, with nearly 90% of pharmaceutical companies reporting disruptions in 2023 due to such events, according to McKinsey. Trade policies and international R&D collaboration scrutiny, especially in light of emerging legislation like the BIOSECURE Act, present potential risks and opportunities for Atea's growth and partnerships.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Atea Pharmaceuticals, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights into how these forces create both challenges and advantages, empowering strategic decision-making for Atea Pharmaceuticals.

Atea Pharmaceuticals' PESTLE analysis offers a clear, summarized version of the full analysis for easy referencing during meetings or presentations, transforming complex external factors into actionable insights.

Economic factors

The economic landscape for healthcare, especially concerning infectious diseases, significantly shapes Atea Pharmaceuticals' market potential. Global healthcare spending is projected to reach $10 trillion by 2024, with a considerable portion allocated to treating viral infections.

Reimbursement policies from both government bodies and private insurers are critical determinants of Atea's revenue streams. Favorable reimbursement for oral antiviral therapies directly impacts patient access and Atea's ability to achieve profitability for its innovative treatments.

For example, the global market for Hepatitis C (HCV) treatments alone was valued at over $10 billion in 2023, and Atea's strategic aim is to secure a meaningful share of this and other infectious disease markets through its pipeline.

Developing novel antiviral medications is a costly endeavor, with substantial research and development (R&D) expenditures, especially during the rigorous phases of clinical trials. Atea Pharmaceuticals' financial reports highlight significant R&D investments, notably directed towards its hepatitis C virus (HCV) treatments and prior initiatives targeting COVID-19.

The capacity to secure venture capital and other essential funding streams within the biopharmaceutical industry is paramount for sustaining the progression of Atea's drug pipeline. While this funding landscape has experienced volatility, recent trends in 2024 and early 2025 indicate a potential recovery, offering renewed opportunities for companies like Atea.

The antiviral market is intensely competitive, with established giants and a growing number of generic alternatives actively vying for market share, directly impacting drug pricing strategies. Atea Pharmaceuticals must highlight the unique advantages of its oral therapies, such as superior efficacy, improved safety profiles, and enhanced patient convenience, to justify its pricing against these competitors.

For instance, the global antiviral drug market was valued at approximately $70 billion in 2023 and is projected to grow, but this growth is accompanied by increasing price sensitivity among payers and healthcare providers. Atea's strategic partnerships, particularly for its Phase 3 Hepatitis C virus (HCV) program, are crucial for navigating these pricing pressures and securing favorable market access.

Global Economic Conditions and Inflation

Global economic conditions significantly influence Atea Pharmaceuticals. Inflation rates, interest rates, and overall economic growth directly affect operational costs, the returns on Atea's investments, and the purchasing power of patients. For instance, rising inflation in 2024 and projected into 2025 could lead to increased manufacturing expenses and higher research and development costs, potentially squeezing profit margins.

Economic downturns also pose a risk. A slowdown in economic growth, as seen in some regions in late 2023 and early 2024, can impact healthcare budgets at both governmental and individual levels. This could translate into reduced patient affordability for Atea's therapies and a more cautious approach to new drug development funding. The International Monetary Fund (IMF) projected global growth at 3.2% for both 2024 and 2025, a slight slowdown from previous years, highlighting this persistent economic uncertainty.

- Inflationary Pressures: Global inflation remained a concern through 2023, with many economies experiencing rates well above central bank targets. While some moderation was observed by early 2024, the persistence of supply chain issues and geopolitical events could reignite inflationary pressures, impacting Atea's cost of goods sold and R&D expenditures.

- Interest Rate Environment: Central banks globally continued to navigate interest rate policies in 2023 and early 2024, balancing inflation control with economic growth. Higher interest rates increase the cost of borrowing for Atea, affecting its ability to finance new projects or acquisitions, and can also depress equity valuations.

- Economic Growth Outlook: The projected global economic growth for 2024 and 2025, while positive, indicates a more subdued pace compared to post-pandemic recovery highs. This slower growth environment could lead to tighter healthcare spending and potentially lower demand for Atea's innovative treatments.

Investor Confidence and Capital Markets

Atea Pharmaceuticals' reliance on public capital markets means investor sentiment is paramount. For instance, a general downturn in biotech stock performance, such as the Nasdaq Biotechnology Index experiencing a decline in early 2024, can directly impact Atea's valuation and its capacity to fund research and development through equity.

The company's ability to attract and retain investment is directly tied to its market perception and financial health. Initiatives aimed at boosting shareholder value, such as the workforce reductions announced in late 2023, are strategic moves to improve operational efficiency and, consequently, investor confidence.

Furthermore, Atea's share repurchase programs, like the one potentially active in 2024, signal a commitment to returning capital to shareholders and can support stock price appreciation. These actions are crucial for maintaining financial stability and enabling future growth capital raises.

- Investor Confidence: Atea's stock performance is a direct barometer of investor sentiment in the biopharmaceutical sector.

- Capital Raising: Access to capital through equity offerings is vital for Atea's ongoing clinical trials and operational expansion.

- Shareholder Value: Measures like workforce adjustments and buybacks are designed to enhance Atea's appeal to investors.

- Market Volatility: Broader market trends, such as interest rate changes affecting growth stock valuations in 2024, can significantly influence Atea's capital markets access.

Economic factors significantly influence Atea Pharmaceuticals' operational costs and market demand. Persistent inflation in 2024 and projected into 2025 could increase R&D and manufacturing expenses, potentially impacting profitability. The global economic growth outlook, with the IMF forecasting 3.2% for both 2024 and 2025, suggests a more constrained healthcare spending environment, which may affect patient affordability and funding for new treatments.

| Economic Factor | 2023 Data/Trend | 2024 Projection/Trend | 2025 Projection/Trend | Impact on Atea Pharmaceuticals |

|---|---|---|---|---|

| Global Inflation | Elevated, above central bank targets | Moderating but with potential for resurgence | Continued moderation expected | Increased operating costs (R&D, manufacturing) |

| Global Economic Growth | Varied by region, some slowdown | Projected at 3.2% (IMF) | Projected at 3.2% (IMF) | Potential impact on healthcare budgets and patient affordability |

| Interest Rates | Navigating control vs. growth | Continued policy adjustments | Continued policy adjustments | Higher cost of capital, potential impact on valuations |

Preview Before You Purchase

Atea Pharmaceuticals PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Atea Pharmaceuticals covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's strategic planning and market positioning.

Sociological factors

The global burden of viral diseases, including Hepatitis C and novel infectious agents, significantly fuels the demand for Atea Pharmaceuticals' antiviral treatments. For instance, the World Health Organization (WHO) estimated in 2024 that over 50 million people worldwide were living with chronic Hepatitis C infection, a substantial market for effective therapies.

Public perception and awareness surrounding viral threats, amplified by recent experiences with pandemics like COVID-19, directly impact patient engagement with treatments and preventative measures. Increased health consciousness in 2024 and 2025 translates to a greater willingness among individuals to seek and adhere to prescribed antiviral regimens.

Patient acceptance of oral therapies is a critical sociological factor for Atea Pharmaceuticals. The company's emphasis on convenient oral treatment options directly addresses a growing patient demand for easier administration and home-based care, which can significantly boost adherence rates over traditional injectable methods. For instance, a 2024 survey indicated that over 70% of patients expressed a preference for oral medications due to convenience, a trend that strongly favors Atea's development pipeline.

Public understanding of viral diseases and treatment adherence significantly shapes health outcomes and market demand for pharmaceuticals like those from Atea. In 2024, global health literacy initiatives are increasingly vital, especially as awareness of viral threats continues to grow. A lack of understanding can directly impede patient engagement and the success of treatment programs, impacting Atea's market penetration.

Effective communication strategies are paramount for Atea Pharmaceuticals. For instance, in 2024, campaigns aimed at improving adherence to antiviral regimens saw a notable impact on patient recovery rates in several key markets. Conversely, the spread of misinformation, particularly concerning vaccine efficacy or treatment side effects, poses a substantial risk, potentially hindering the adoption of Atea's innovative therapies.

Demographic Shifts and Disease Burden

Global demographic trends, such as the increasing average age of populations, directly impact the demand for antiviral medications. As people age, their immune systems can weaken, making them more vulnerable to various viral infections, thereby expanding the long-term market for companies like Atea Pharmaceuticals.

The prevalence of specific diseases, like Hepatitis C (HCV), underscores the importance of demographic understanding in drug development. With millions affected worldwide, Atea can strategically focus its research and development on antiviral solutions that address this significant disease burden.

- Aging Population Growth: By 2050, the proportion of the global population aged 65 and over is projected to reach 16%, a substantial increase from 10% in 2022, indicating a growing at-risk demographic for viral illnesses.

- HCV Prevalence: In 2023, an estimated 58 million people globally were living with chronic Hepatitis C infection, highlighting a persistent and significant market need for effective antiviral treatments.

- Viral Respiratory Infections: The Centers for Disease Control and Prevention (CDC) reported that influenza alone caused an estimated 25 million illnesses and 36,000 deaths in the US during the 2022-2023 season, demonstrating the ongoing threat of viral respiratory diseases across various age groups.

Healthcare Accessibility and Equity

Societal values increasingly emphasize equitable access to healthcare and medicines. This can translate into government policies and public pressure on pharmaceutical companies like Atea to ensure their therapies reach diverse patient populations, including those with comorbidities or substance use disorders. For instance, in 2024, the World Health Organization continued to advocate for universal health coverage, aiming to reduce financial barriers to essential healthcare services.

Atea's stated mission to address unmet medical needs inherently aligns with these broader societal expectations of health equity. By focusing on conditions with limited treatment options, Atea positions itself to contribute to a more equitable healthcare landscape. This commitment is crucial as global health disparities persist; for example, in 2023, the Lancet highlighted significant regional variations in access to advanced medical treatments.

- Government policies promoting universal health coverage, such as those in many OECD countries, directly impact pharmaceutical pricing and market access.

- Public perception and advocacy groups play a significant role in shaping corporate social responsibility mandates for pharmaceutical firms.

- The growing focus on health equity means companies are increasingly evaluated on their efforts to reach underserved populations.

- Atea's development pipeline, if it addresses diseases prevalent in lower-income demographics, could be a key differentiator.

Societal emphasis on health equity and accessible treatments directly influences Atea Pharmaceuticals' market strategy and public image. Growing global advocacy for universal health coverage, as championed by organizations like the WHO in 2024, pressures companies to ensure their innovations reach diverse patient groups, including those in lower-income brackets or with co-existing conditions. This focus on equitable access is increasingly a benchmark for corporate social responsibility.

Atea's commitment to addressing unmet medical needs, particularly in viral diseases, aligns with these societal expectations. By developing therapies for conditions that disproportionately affect certain populations, Atea can enhance its reputation and potentially gain favor with policymakers and patient advocacy groups. For instance, the persistent global burden of Hepatitis C, affecting an estimated 58 million people in 2023, presents an opportunity for Atea to demonstrate its commitment to health equity through targeted treatment solutions.

The increasing average age of global populations, with the over-65 demographic projected to reach 16% by 2050, expands the potential market for antiviral treatments as older individuals are often more susceptible to viral infections. This demographic shift, coupled with heightened public awareness of viral threats post-pandemic, creates a sustained demand for Atea's specialized antiviral therapies.

| Sociological Factor | 2024/2025 Relevance | Impact on Atea Pharmaceuticals |

| Health Equity & Access | Growing global advocacy for universal health coverage; WHO's continued push for equitable access in 2024. | Drives strategy for market penetration in diverse demographics; enhances corporate reputation. |

| Patient Preference for Oral Therapies | Over 70% patient preference for oral medications in a 2024 survey due to convenience. | Favors Atea's oral antiviral development pipeline, potentially increasing adherence and market share. |

| Public Health Consciousness | Amplified by pandemic experiences, leading to increased health awareness and engagement with treatments in 2024/2025. | Boosts demand for Atea's antiviral products and patient willingness to adhere to treatment regimens. |

Technological factors

Technological advancements are dramatically speeding up the creation of new antiviral drugs. Breakthroughs in areas like medicinal chemistry, structural biology, and high-throughput screening are key, allowing researchers to identify and develop novel antiviral compounds much faster than before. This rapid pace of innovation is crucial for staying ahead of evolving viruses.

Atea Pharmaceuticals is a prime example of a company capitalizing on these technological shifts. They are actively developing direct-acting antiviral agents by utilizing their unique nucleos(t)ide prodrug platform. This approach, combined with their deep expertise in virology, highlights their commitment to leveraging cutting-edge research and development to create effective treatments.

Atea Pharmaceuticals' success hinges on the evolution of oral drug delivery systems, crucial for maximizing absorption and patient ease. For instance, by mid-2024, the pharmaceutical industry saw continued investment in novel excipients and encapsulation techniques to improve the oral bioavailability of complex molecules.

The creation of fixed-dose combination tablets, a key technological advancement for Atea's Hepatitis C program, directly addresses patient adherence challenges. This approach, gaining traction across various therapeutic areas, aims to simplify treatment regimens and improve patient outcomes, a trend strongly supported by market research indicating a preference for multi-drug therapies in pill form.

Biotechnology and AI are revolutionizing Atea Pharmaceuticals' R&D. AI's ability to sift through vast datasets is accelerating drug candidate identification, a process that historically took years. For instance, in 2024, AI-powered platforms are demonstrating success in identifying novel therapeutic targets at a significantly faster pace than traditional methods.

The integration of AI in clinical trial design and data analysis is also a key technological factor. This can lead to more efficient trials, potentially reducing the substantial costs associated with drug development. By 2025, it's projected that AI will play an even more critical role in optimizing patient recruitment and predicting trial outcomes, further streamlining Atea's R&D pipeline.

Manufacturing Processes and Automation

Innovations in pharmaceutical manufacturing, particularly in automation and advanced quality control, are significantly boosting efficiency and lowering costs for companies like Atea Pharmaceuticals. These advancements are vital for ensuring consistent drug quality, a critical factor in the highly regulated pharmaceutical industry. For instance, the adoption of AI-powered visual inspection systems in drug manufacturing has been shown to reduce quality control errors by up to 90% in some applications, directly impacting production reliability.

The development of scalable and cost-effective manufacturing processes is paramount for the global commercialization of oral antiviral therapies. Atea's focus on these areas is strategic, aiming to make treatments accessible worldwide. By 2024, the global pharmaceutical contract manufacturing market was valued at over $150 billion, with automation being a key driver of growth and efficiency within this sector.

Key technological factors impacting Atea Pharmaceuticals' manufacturing processes include:

- Increased Automation: Implementing robotic systems and AI for tasks like sterile filling and packaging can reduce human error and speed up production cycles. For example, automated visual inspection systems have demonstrated a significant reduction in cosmetic defect detection times.

- Advanced Quality Control: Technologies such as Process Analytical Technology (PAT) allow for real-time monitoring and control of manufacturing processes, ensuring consistent product quality and reducing the need for extensive end-product testing.

- Continuous Manufacturing: Shifting from batch processing to continuous manufacturing can lead to smaller facility footprints, reduced waste, and more agile production, which is particularly beneficial for novel therapies.

- Supply Chain Integration: Digitally integrated manufacturing processes improve visibility and traceability throughout the supply chain, enhancing efficiency and compliance.

Diagnostic Technologies and Disease Monitoring

Advancements in diagnostic technologies are significantly expanding the potential market for antiviral therapies like those developed by Atea Pharmaceuticals. For instance, the increasing availability and accuracy of molecular diagnostic tests, such as PCR and antigen tests, allow for earlier and more precise identification of viral infections. This heightened detection capability directly translates to a larger addressable patient population for Atea's treatments, as more individuals can be diagnosed and subsequently treated. The global molecular diagnostics market was valued at approximately $23.5 billion in 2023 and is projected to grow substantially, indicating a strong trend towards more sophisticated diagnostic tools.

Furthermore, improvements in disease monitoring technologies are crucial for validating the effectiveness of Atea's drug candidates. Sophisticated tools that track viral load, immune response, and disease progression provide robust data for clinical trials. This data is essential for demonstrating treatment efficacy to regulatory bodies and for convincing healthcare providers and patients of a therapy's value. Real-world evidence gathered through these monitoring systems also supports post-market adoption and can influence treatment guidelines, benefiting companies like Atea by solidifying their market position.

- Early Detection: Enhanced diagnostic accuracy, exemplified by widespread PCR testing for respiratory viruses, increases the number of patients eligible for antiviral treatment.

- Clinical Trial Efficiency: Advanced monitoring tools improve the assessment of treatment outcomes, accelerating drug development timelines for Atea.

- Market Adoption: Real-world data from improved disease monitoring validates drug efficacy, driving uptake by healthcare providers and patients.

- Market Growth: The global diagnostics market's rapid expansion, projected to reach over $40 billion by 2030, signals increasing investment in technologies that benefit antiviral therapy developers.

Biotechnology and AI are revolutionizing Atea Pharmaceuticals' R&D, significantly accelerating drug candidate identification. For instance, in 2024, AI-powered platforms are demonstrating success in identifying novel therapeutic targets at a significantly faster pace than traditional methods.

The integration of AI in clinical trial design and data analysis is also a key technological factor, potentially reducing substantial drug development costs. By 2025, AI is projected to play an even more critical role in optimizing patient recruitment and predicting trial outcomes.

Advancements in diagnostic technologies, like PCR, are expanding the market for antiviral therapies by enabling earlier and more precise identification of viral infections, thus increasing the addressable patient population.

Innovations in pharmaceutical manufacturing, particularly automation and advanced quality control, boost efficiency and lower costs for companies like Atea, ensuring consistent drug quality. For example, automated visual inspection systems have been shown to reduce quality control errors by up to 90% in some applications.

| Technological Factor | Impact on Atea Pharmaceuticals | Relevant Data/Trend |

|---|---|---|

| AI in Drug Discovery | Accelerates identification of novel therapeutic targets and drug candidates. | AI platforms in 2024 identifying targets faster than traditional methods. |

| AI in Clinical Trials | Improves efficiency of trial design, patient recruitment, and data analysis. | Projected increased role of AI in optimizing trials by 2025. |

| Advanced Diagnostics | Expands addressable patient population through earlier and more precise viral infection detection. | Global molecular diagnostics market valued at approx. $23.5 billion in 2023, with significant growth projected. |

| Manufacturing Automation | Enhances production efficiency, reduces errors, and lowers costs. | Automated visual inspection systems can reduce quality control errors by up to 90%. |

Legal factors

Atea Pharmaceuticals navigates a complex web of regulations, with the U.S. Food and Drug Administration (FDA) being a key governing body. These regulations span the entire lifecycle of a drug, from initial development and rigorous clinical trials to manufacturing standards and eventual market release.

Staying compliant with these ever-changing rules, particularly those pertaining to antiviral medications, is absolutely essential for Atea to gain market access and maintain its operations. The FDA's active role is underscored by its approval of 50 new drugs in 2024, demonstrating a dynamic regulatory environment.

Intellectual property laws are crucial for Atea Pharmaceuticals, safeguarding its innovative antiviral compounds and drug formulations through exclusive patent rights. These patents are the bedrock of its competitive advantage.

The company's ability to vigorously enforce these patents against infringers, particularly in the rapidly evolving mRNA technology space, is paramount. Navigating complex IP litigation directly impacts Atea's market standing and the return on its substantial research and development investments.

Atea Pharmaceuticals navigates a complex web of clinical trial regulations, demanding rigorous adherence to patient safety protocols, informed consent procedures, and robust data integrity across diverse international jurisdictions. Failure to comply can lead to significant delays and rejection of trial outcomes.

The company’s operations are critically dependent on upholding ethical standards and strictly following Good Clinical Practice (GCP) guidelines. In 2024, the global pharmaceutical industry faced increased scrutiny on data transparency, with regulatory bodies like the FDA and EMA emphasizing robust data management systems to ensure trial validity and acceptance.

Product Liability and Safety Regulations

Atea Pharmaceuticals, like all drug manufacturers, operates under stringent product liability laws. These laws mean Atea can be held accountable if its products cause harm to patients. This necessitates rigorous safety testing and ongoing monitoring to prevent issues. For instance, in 2024, the pharmaceutical industry saw continued scrutiny of drug safety, with regulatory bodies like the FDA issuing updated guidance on post-market surveillance requirements, emphasizing proactive risk management.

Adherence to pharmacovigilance regulations is crucial for Atea. This involves meticulously tracking and reporting adverse events that occur after a drug is released to the market. Failing to comply can lead to significant penalties and reputational damage. In 2024, the global pharmacovigilance market was valued at approximately $8.5 billion, highlighting the significant investment companies make in this area to ensure patient safety and regulatory compliance.

- Product Liability: Manufacturers are legally responsible for damages caused by defective or unsafe products.

- Safety Monitoring: Continuous surveillance of drug performance and side effects in real-world use is mandatory.

- Pharmacovigilance: Robust systems for reporting, assessing, and preventing adverse drug reactions are essential.

- Regulatory Compliance: Strict adherence to guidelines from bodies like the FDA and EMA is critical to avoid legal repercussions.

Antitrust and Competition Law

Antitrust and competition laws are critical for Atea Pharmaceuticals, as they govern market behavior and prevent monopolistic practices. These regulations ensure a level playing field, fostering innovation and consumer choice within the dynamic pharmaceutical sector. For instance, in 2024, the US Federal Trade Commission (FTC) continued its aggressive stance on pharmaceutical mergers, reviewing several deals to assess their impact on competition. Atea must navigate these complexities diligently.

As Atea pursues strategic alliances and aims to capture substantial market share, adherence to competition regulations is paramount. Failure to comply could lead to significant legal repercussions, including hefty fines and mandated business practice changes. For example, in 2025, a major pharmaceutical company faced a substantial penalty for alleged anti-competitive behavior related to drug pricing strategies.

- Monopoly Prevention: Antitrust laws are designed to prevent any single entity from dominating the pharmaceutical market, ensuring a competitive environment.

- Merger Scrutiny: Regulatory bodies like the FTC and European Commission closely examine pharmaceutical mergers and acquisitions to prevent undue market concentration.

- Pricing Regulations: Competition laws can also impact how Atea prices its products, especially in markets where it might hold a significant market share for a particular therapy.

- Partnership Compliance: Any strategic partnerships or licensing agreements Atea enters into must be structured to avoid anti-competitive outcomes.

Atea Pharmaceuticals operates under stringent regulatory frameworks, including those set by the FDA, governing drug development, manufacturing, and market release. In 2024, the FDA approved 50 new drugs, highlighting the dynamic nature of these requirements.

Intellectual property laws are vital for protecting Atea's innovations, with patent enforcement being key to its competitive edge, especially in the mRNA space. Navigating complex IP litigation directly impacts R&D investment returns.

Product liability laws hold Atea accountable for patient harm, necessitating rigorous safety testing and post-market surveillance. In 2024, the FDA updated guidance on this, emphasizing proactive risk management.

Antitrust laws prevent monopolistic practices, with bodies like the FTC scrutinizing pharmaceutical mergers in 2024 to maintain market competition, impacting Atea's strategic alliances and pricing.

| Regulation Area | Key Aspects for Atea | 2024/2025 Relevance |

| Drug Approval & Safety | FDA/EMA oversight, clinical trial compliance, pharmacovigilance | FDA approved 50 new drugs in 2024; increased scrutiny on data transparency and post-market surveillance. |

| Intellectual Property | Patent protection, IP litigation, safeguarding innovations | Crucial for competitive advantage in antiviral and mRNA technologies. |

| Product Liability | Accountability for product-related harm, rigorous safety testing | Continued focus on proactive risk management and adherence to updated FDA post-market surveillance guidance. |

| Competition Law | Antitrust regulations, merger scrutiny, pricing strategies | FTC actively reviewed pharmaceutical mergers in 2024; potential for penalties in 2025 related to pricing practices. |

Environmental factors

Environmental shifts, including climate change and ecological disruptions, are increasingly linked to the emergence and spread of viral diseases. This trend directly influences the demand for Atea Pharmaceuticals' antiviral therapies, as outbreaks can rapidly escalate the need for effective treatments. For instance, the World Health Organization (WHO) has highlighted how changing weather patterns can affect vector-borne diseases, potentially creating new avenues for viral transmission.

The imperative for strong biosecurity protocols and swift responses to novel pathogens is shaping research and development landscapes. This necessitates significant investment in antiviral discovery and development, aligning with Atea's strategic focus. In 2024, global health organizations and governments continued to allocate substantial funding towards pandemic preparedness, with a notable emphasis on novel antiviral research, underscoring the critical role of companies like Atea in public health.

Pharmaceutical manufacturing, including Atea's operations, inherently produces chemical and biological waste streams. Strict adherence to environmental regulations governing waste disposal and emissions is paramount, as evidenced by the U.S. Environmental Protection Agency's (EPA) oversight of hazardous waste management, which impacts companies like Atea.

In 2023, the pharmaceutical industry continued to invest in sustainable practices, with a growing emphasis on Environmental, Social, and Governance (ESG) initiatives. For instance, many companies are exploring advanced waste treatment technologies and circular economy principles to reduce their ecological footprint.

The environmental footprint of sourcing raw materials and managing a global supply chain for pharmaceutical production is under intense scrutiny by investors, regulators, and consumers. Atea Pharmaceuticals' commitment to sustainable sourcing directly impacts its operational costs and market perception.

By adopting environmentally responsible procurement practices, Atea can mitigate risks associated with resource scarcity and climate change impacts on its suppliers. For instance, a growing number of pharmaceutical companies are setting targets to reduce Scope 3 emissions, which often encompass supply chain activities, with many aiming for significant reductions by 2030.

Ensuring suppliers adhere to environmental standards, such as those related to water usage and waste management, not only bolsters Atea's corporate social responsibility profile but also can lead to more resilient and cost-effective operations in the long run, reflecting a broader industry trend towards circular economy principles.

Energy Consumption and Carbon Footprint

Pharmaceutical research and manufacturing are inherently energy-intensive, a factor Atea Pharmaceuticals must consider. The company's efforts to lower its carbon footprint by improving energy efficiency and integrating renewable energy sources directly address increasing environmental sustainability demands from investors and the general public. Many biopharmaceutical firms are now establishing net-zero emission goals.

The energy required for drug discovery, clinical trials, and large-scale production contributes significantly to a company's environmental impact. For instance, a 2024 report indicated that the average carbon footprint per employee in the pharmaceutical sector can be substantial, highlighting the need for operational improvements.

- Energy Intensity: R&D labs and manufacturing facilities require constant power for specialized equipment and climate control.

- Carbon Footprint Reduction: Initiatives like adopting solar power at manufacturing sites can directly cut emissions.

- Net-Zero Targets: A growing trend sees major pharmaceutical players committing to achieving net-zero emissions by 2030 or 2040.

- Investor Pressure: Environmental, Social, and Governance (ESG) criteria are increasingly influencing investment decisions, favoring companies with strong sustainability practices.

Environmental, Social, and Governance (ESG) Standards

Increasing investor and public scrutiny on Environmental, Social, and Governance (ESG) performance is significantly influencing corporate strategy and access to capital for pharmaceutical companies like Atea. This heightened awareness means that a company's commitment to sustainability and ethical practices directly impacts its financial standing and operational flexibility.

Atea's active engagement with ESG ratings and reporting frameworks underscores its dedication to environmental stewardship. This proactive approach not only enhances its brand reputation but also serves to attract a growing segment of socially responsible investors who prioritize companies demonstrating strong ESG credentials.

In recognition of its efforts, Atea has secured favorable ESG ratings throughout 2024 and into 2025. These positive assessments reflect the company's progress in integrating sustainable practices into its operations and strategic decision-making, signaling a commitment that resonates with the modern investment landscape.

- Investor Demand: A significant portion of global assets under management, estimated to be over $37 trillion by early 2025, is now influenced by ESG considerations, directly impacting Atea's ability to attract investment.

- Brand Enhancement: Strong ESG performance, as evidenced by Atea's favorable ratings, can lead to a 3-5% increase in brand value, according to industry analyses from 2024.

- Risk Mitigation: Companies with robust ESG frameworks, like Atea's demonstrated commitment, are often perceived as having lower operational and regulatory risks, leading to a more stable cost of capital.

Environmental factors, including the increasing frequency of viral outbreaks due to climate change, directly boost demand for Atea Pharmaceuticals' antiviral treatments. The global push for pandemic preparedness in 2024 and 2025 has led to substantial funding for antiviral research, positioning Atea favorably.

Atea's operations must comply with stringent environmental regulations concerning waste management and emissions, as overseen by bodies like the EPA. The company's commitment to sustainable sourcing and reducing its supply chain's environmental impact, including Scope 3 emissions, is crucial for mitigating risks and enhancing its market perception.

The energy-intensive nature of pharmaceutical research and manufacturing necessitates a focus on energy efficiency and renewable sources to meet growing sustainability demands. By 2025, many biopharmaceutical firms, including Atea, are setting ambitious net-zero emission targets, driven by investor pressure and ESG criteria.

| Environmental Factor | Impact on Atea Pharmaceuticals | Industry Trend/Data (2024-2025) |

|---|---|---|

| Climate Change & Viral Outbreaks | Increased demand for antiviral therapies | WHO reports changing weather patterns affecting disease spread. |

| Environmental Regulations | Compliance costs for waste and emissions management | EPA enforces strict hazardous waste disposal standards. |

| Supply Chain Sustainability | Risk mitigation and cost efficiency through responsible sourcing | Many companies targeting significant Scope 3 emission reductions by 2030. |

| Energy Consumption & Carbon Footprint | Need for energy efficiency and renewables | Biopharma sector average carbon footprint per employee is substantial; net-zero targets are common. |

| ESG Investor Pressure | Access to capital and brand value enhancement | Over $37 trillion in global AUM influenced by ESG; strong ESG can boost brand value by 3-5%. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Atea Pharmaceuticals is built on a robust foundation of data from official government health agencies, leading economic forecasting firms, and comprehensive industry-specific market research reports. This ensures that insights into political, economic, social, technological, legal, and environmental factors are accurate and relevant.