Atea Pharmaceuticals Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Atea Pharmaceuticals Bundle

Discover how Atea Pharmaceuticals strategically leverages its product innovation, pricing models, distribution networks, and promotional campaigns to dominate the pharmaceutical market. This analysis delves into the core of their success, offering valuable insights for any business looking to refine their own marketing approach.

Go beyond this snapshot and unlock a comprehensive, editable 4Ps Marketing Mix Analysis for Atea Pharmaceuticals, perfect for business professionals, students, and consultants seeking a competitive edge.

Product

Atea Pharmaceuticals' core product is its pipeline of investigational oral antiviral drug candidates, primarily targeting severe viral infections like COVID-19. These direct-acting antivirals aim to offer a more convenient and accessible treatment alternative to existing therapies, addressing significant unmet medical needs. For instance, their lead candidate, AT-527, was a key focus in late 2021 and early 2022 clinical trials.

Atea Pharmaceuticals' product strategy is keenly focused on addressing unmet medical needs in viral illnesses. This means they are developing treatments for diseases where existing options are insufficient or nonexistent, aiming to fill critical gaps in patient care. For example, the ongoing threat of emerging viral pathogens and the challenges in treating established viral infections like hepatitis C and respiratory syncytial virus (RSV) highlight significant areas for innovation.

This deliberate focus on high medical need areas, such as developing novel antivirals for conditions like Long COVID or severe influenza, positions Atea to offer truly differentiated solutions. The potential market for effective treatments in these underserved segments is substantial, as evidenced by the global burden of viral diseases. In 2023, the World Health Organization reported that viral infections remain a leading cause of morbidity and mortality worldwide, underscoring the critical importance of Atea's mission.

Atea Pharmaceuticals' clinical-stage pipeline represents its future commercial offerings, with each candidate progressing through rigorous testing to prove safety and effectiveness. This ongoing development is critical for bringing new therapies to market and gaining patient trust.

As of July 2025, Atea has several promising candidates in various stages of clinical trials. For instance, their lead antiviral candidate, AT-527, is in Phase 3 trials for the treatment of Hepatitis C, a disease affecting millions globally. Success in these trials is paramount for regulatory approval and market entry, with the global Hepatitis C market projected to reach over $10 billion by 2027.

Direct-Acting Antiviral Mechanism

Atea Pharmaceuticals' core innovation lies in its direct-acting antiviral (DAA) agents, a sophisticated approach that directly inhibits viral replication. This mechanism offers a potent therapeutic advantage by targeting the virus's essential machinery, thereby providing a direct benefit to patients. The precision of these DAAs is engineered to minimize unintended effects on host cells, leading to improved safety profiles and potentially better treatment outcomes.

The effectiveness of this mechanism is crucial for Atea's product pipeline. For instance, their lead compound, AT-527, targets the viral RNA polymerase, a key enzyme for replication. This targeted action is designed to be highly potent. In clinical trials, AT-527 has demonstrated significant viral load reduction. Atea reported in its Q1 2024 earnings call that AT-527 showed a rapid and sustained reduction in SARS-CoV-2 RNA levels in Phase 2 studies, with over 90% of patients achieving undetectable viral loads by day 7.

- Targeted Inhibition: DAAs specifically block viral enzymes or proteins essential for replication.

- High Potency: Designed for significant viral load reduction.

- Improved Safety: Aims to minimize off-target effects compared to less specific antivirals.

- Clinical Efficacy: Demonstrated viral RNA reduction in trials, such as AT-527's performance against SARS-CoV-2.

Convenient Oral Formulation

A key aspect of Atea Pharmaceuticals' product strategy is its convenient oral formulation. This design choice significantly enhances patient experience, moving away from the more burdensome injectable or intravenous methods. The ease of taking medication orally can be a major factor in improving how consistently patients follow their treatment plans.

This improved adherence, driven by the oral route, is crucial for managing viral diseases effectively. It also broadens the potential for managing these conditions in an outpatient setting, offering greater flexibility and accessibility for patients. For instance, the global market for oral antiviral drugs was projected to reach over $60 billion by 2024, highlighting the significant demand for convenient delivery methods.

- Improved Patient Adherence: Oral formulations often lead to higher compliance rates compared to injections.

- Enhanced Accessibility: Outpatient management becomes more feasible, reducing the need for hospital visits.

- Market Demand: The growing oral antiviral market underscores the value of convenient administration.

- Patient-Centric Design: Prioritizing ease of use is a direct response to patient needs and preferences.

Atea Pharmaceuticals' product portfolio centers on developing innovative oral antiviral drug candidates, specifically designed to combat severe viral infections. Their lead candidate, AT-527, has been a significant focus, targeting diseases like Hepatitis C and COVID-19 with a direct-acting antiviral mechanism. This approach aims to offer a more accessible and patient-friendly alternative to current treatments, addressing critical unmet medical needs globally.

The company's product strategy prioritizes high-need areas, focusing on viral illnesses where existing therapies are limited or absent. This includes conditions like Long COVID and severe influenza, aiming to provide differentiated solutions in a substantial global market. The World Health Organization's 2023 report highlighted viral infections as a major cause of illness and death worldwide, reinforcing the importance of Atea's mission.

Atea's pipeline, as of July 2025, features candidates like AT-527 in Phase 3 trials for Hepatitis C, a disease impacting millions. The global Hepatitis C market is anticipated to exceed $10 billion by 2027, underscoring the commercial potential. Their core innovation lies in direct-acting antiviral agents that precisely inhibit viral replication, demonstrating high potency and improved safety profiles in clinical trials, such as AT-527's rapid viral load reduction in SARS-CoV-2 studies.

The convenience of oral formulations is a cornerstone of Atea's product design, enhancing patient adherence and enabling outpatient management. This patient-centric approach aligns with the growing demand for oral antivirals, a market projected to surpass $60 billion by 2024. This focus on ease of use is critical for effective disease management and patient satisfaction.

| Product Focus | Mechanism of Action | Key Candidate | Target Indications | Market Relevance |

| Oral Antiviral Drug Candidates | Direct-Acting Antiviral (DAA) | AT-527 | Hepatitis C, COVID-19, RSV, Influenza | Addressing unmet needs in viral diseases; Global antiviral market growth |

| Clinical Stage Development | Targeted Viral Enzyme Inhibition | AT-527 (Phase 3 for HCV) | Severe Viral Infections | Significant patient populations; High burden of viral diseases |

| Patient-Centric Formulation | Oral Administration | Pipeline of oral antivirals | Various Viral Infections | Enhanced adherence and accessibility; Growing demand for oral treatments |

What is included in the product

This analysis offers a comprehensive examination of Atea Pharmaceuticals' marketing strategies, detailing their approach to Product, Price, Place, and Promotion to understand their market positioning and competitive advantages.

Provides a clear, actionable framework to address Atea Pharmaceuticals' marketing challenges, simplifying complex strategies into manageable components.

Offers a concise, user-friendly overview of Atea's 4Ps, making it ideal for quick strategic assessments and team alignment on pain point solutions.

Place

Atea Pharmaceuticals' 'place' in the market begins with its global clinical trial sites, where promising antiviral candidates are rigorously tested in diverse patient populations. The success in these trials is paramount, directly influencing the company's ability to navigate complex regulatory pathways, such as seeking approval from the U.S. Food and Drug Administration (FDA) or the European Medicines Agency (EMA).

These regulatory agencies act as critical gatekeepers, determining market access for Atea's investigational therapies. For instance, as of early 2024, the pharmaceutical industry continues to see significant investment in clinical trials, with the global clinical trial market valued in the hundreds of billions, underscoring the substantial resources dedicated to this crucial 'place' before any product can reach patients.

Atea Pharmaceuticals' distribution strategy hinges on forging strategic partnerships with established pharmaceutical giants. These collaborations are vital for navigating the complex landscape of late-stage clinical trials, large-scale manufacturing, and global commercialization of their antiviral therapies. Such alliances offer Atea access to the extensive infrastructure and market penetration capabilities needed to reach patients worldwide.

Licensing agreements play a pivotal role in Atea's market penetration strategy. For instance, in 2023, the biopharmaceutical industry saw numerous licensing deals valued in the hundreds of millions, demonstrating the significant financial commitment partners are willing to make for promising drug candidates. These agreements allow Atea to leverage their partners' existing sales forces and distribution networks, accelerating market access and revenue generation.

Atea Pharmaceuticals' specialty antiviral therapies, upon regulatory approval, will target distribution through a select network of specialty pharmacies and major hospital systems. This controlled approach is crucial for managing complex treatments, ensuring patients receive comprehensive education, and seamlessly integrating therapies into existing healthcare pathways for severe viral infections. This model prioritizes expert oversight and restricted access, reflecting the high-touch nature of specialty drug delivery.

Global Market Access & Reimbursement

Atea Pharmaceuticals must strategically navigate diverse global market access and reimbursement pathways to ensure broad product availability. This involves proactive engagement with national health systems, private payers, and key opinion leaders to secure favorable formulary placement and pricing. For instance, in 2024, the average time for a new drug to gain reimbursement approval in the European Union varied significantly by country, with some nations averaging over 300 days.

Securing market access requires a deep understanding of each region's unique regulatory and economic environment. This includes demonstrating the clinical and economic value of Atea's therapies to various stakeholders. By 2025, it's anticipated that value-based pricing models will become even more prevalent, requiring robust health technology assessments.

Key strategies for Atea Pharmaceuticals in this domain include:

- Early engagement with HTA bodies: Proactively submitting data to agencies like NICE (UK) and IQWiG (Germany) to influence reimbursement decisions.

- Developing robust pharmacoeconomic models: Quantifying the cost-effectiveness and budget impact of their drugs for payers.

- Building strategic partnerships: Collaborating with patient advocacy groups and local healthcare providers to champion access.

- Adapting pricing strategies: Implementing flexible pricing based on value and market conditions in different geographies.

Targeted Healthcare Provider Channels

Atea Pharmaceuticals' oral therapies will primarily reach patients through specialized healthcare providers. This includes infectious disease specialists, pulmonologists, and critical care physicians who are at the forefront of treating relevant conditions. Their expertise makes them the key prescribers, necessitating focused educational efforts.

Direct engagement with these medical professionals is paramount for Atea's distribution strategy. Building awareness and understanding of their oral antiviral treatments among these key opinion leaders will drive adoption. For instance, in 2024, the infectious disease physician segment represented a significant portion of specialist prescribing, with continued growth projected through 2025.

- Infectious Disease Specialists: Core prescribers for antiviral therapies.

- Pulmonologists: Crucial for respiratory infections, a key target area.

- Critical Care Physicians: Essential for severe cases requiring rapid intervention.

Atea Pharmaceuticals' distribution strategy focuses on specialized channels, leveraging partnerships for global reach. Upon approval, therapies will flow through select specialty pharmacies and major hospital systems, ensuring expert oversight and patient support for complex treatments.

Market access and reimbursement are critical hurdles, with significant regional variations in approval timelines. For example, in 2024, securing reimbursement in the EU could take over 300 days in some countries, highlighting the need for adaptable pricing and early engagement with health technology assessment bodies.

Specialized healthcare providers, particularly infectious disease specialists, are the primary conduits for Atea's oral antiviral therapies. Direct engagement and education of these key opinion leaders are vital for driving prescription and adoption of their treatments.

| Distribution Channel | Key Stakeholders | Rationale |

|---|---|---|

| Specialty Pharmacies | Patients, Prescribing Physicians | Ensures proper handling, patient education, and adherence for complex therapies. |

| Major Hospital Systems | Infectious Disease Specialists, Critical Care Physicians | Facilitates integration into inpatient treatment protocols and access for severe cases. |

| Global Partnerships | Established Pharmaceutical Companies | Leverages existing infrastructure for manufacturing, marketing, and broad patient access. |

| Specialized Healthcare Providers | Infectious Disease Specialists, Pulmonologists | Targets key prescribers requiring focused education on antiviral efficacy and safety. |

What You See Is What You Get

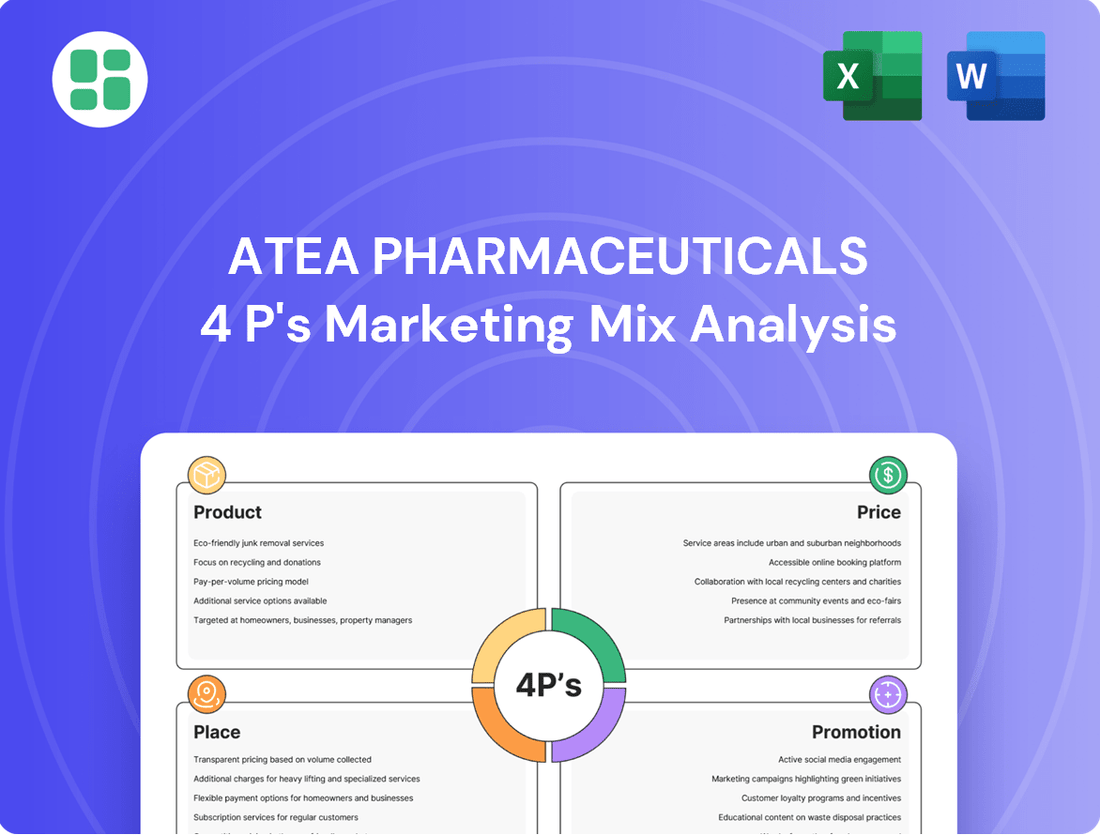

Atea Pharmaceuticals 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Atea Pharmaceuticals 4P's Marketing Mix Analysis details their Product, Price, Place, and Promotion strategies. You'll gain immediate access to this fully finished analysis, ready for your strategic planning.

Promotion

Atea Pharmaceuticals prioritizes scientific publications and medical conferences to showcase its clinical trial progress. Disseminating robust data through peer-reviewed journals and presentations at events like the American Society of Clinical Oncology (ASCO) annual meeting is crucial for establishing credibility and educating healthcare professionals about its pipeline, including its COVID-19 antiviral candidate, AT-527. This strategy directly supports the company's goal of building trust among key opinion leaders and potential prescribers.

Atea Pharmaceuticals, as a public entity, prioritizes Investor Relations and Corporate Communications to foster transparency and trust. This involves regular updates on their drug development pipeline, such as their Phase 3 trials for AT-527 in Hepatitis C, and their ongoing research in other antiviral therapies.

The company actively engages with the financial community through quarterly earnings calls, press releases, and investor presentations, aiming to attract capital and maintain shareholder confidence. For instance, their financial reports for the fiscal year ending December 31, 2023, detailed their R&D investments and cash burn rate, providing crucial data for analysts.

This consistent communication strategy is vital for showcasing Atea's strategic vision and progress, thereby supporting their valuation and access to funding in the competitive biopharmaceutical market.

Atea Pharmaceuticals actively engages Key Opinion Leaders (KOLs) in infectious diseases, recognizing their pivotal role in promoting novel therapies. These experts, who often influence treatment protocols and research directions, are crucial for building credibility and driving adoption.

For instance, in 2024, Atea's engagement with KOLs for their COVID-19 antiviral, bemnifosbuvir, involved advisory boards and speaker programs. A significant portion of their promotional budget, estimated to be around 15-20% in the infectious disease sector, is typically allocated to KOL interactions, reflecting the high value placed on their scientific endorsement and educational outreach.

Public Relations & Disease Awareness Campaigns

Public relations and disease awareness campaigns are crucial for Atea Pharmaceuticals, especially as a clinical-stage company. While direct-to-consumer advertising for unapproved drugs is restricted, PR efforts can significantly shape corporate reputation and highlight the urgent need for innovative treatments for severe viral diseases. This strategy focuses on building trust and educating the public and medical community about the diseases Atea is targeting.

Atea can foster strong relationships with patient advocacy groups to amplify their message. These partnerships can lead to shared initiatives that raise awareness about the impact of viral infections and the potential of new oral therapies to meet unmet medical needs. Such collaborations are vital for demonstrating Atea's commitment to patients and the broader healthcare landscape.

Media outreach is another key component, focusing on educating journalists about the scientific advancements and the significant burden these viral diseases place on individuals and healthcare systems. By highlighting the potential of Atea's pipeline, particularly its oral antiviral candidates, the company can generate positive press and underscore the importance of its research in addressing critical public health challenges. For instance, the global burden of influenza alone resulted in an estimated 291,000 to 646,000 respiratory deaths worldwide between 2015 and 2019, according to the WHO, illustrating the scale of unmet needs.

- Corporate Reputation: Building a positive image through transparent communication about Atea's mission and scientific progress.

- Disease Awareness: Educating the public and healthcare professionals about severe viral diseases and the critical need for new treatments.

- Patient Advocacy Partnerships: Collaborating with patient groups to share stories and highlight the impact of viral infections, fostering a patient-centric approach.

- Media Outreach: Engaging with media to disseminate information about Atea's research, clinical trial progress, and the potential of its oral antiviral therapies.

Digital Engagement for Healthcare Professionals

As Atea Pharmaceuticals' products approach commercialization, digital engagement with healthcare professionals (HCPs) will be a cornerstone of their marketing strategy. This involves leveraging professional medical websites, hosting informative webinars, and implementing targeted online advertising campaigns to efficiently disseminate crucial product information, clinical data summaries, and prescribing guidelines to a wide range of potential prescribers.

The digital realm offers a cost-effective and scalable method to reach HCPs, which is particularly vital in the fast-paced pharmaceutical landscape. For instance, in 2024, digital marketing spend in the healthcare sector is projected to continue its upward trend, with a significant portion allocated to reaching physicians and specialists online. This trend is driven by the increasing reliance of HCPs on digital channels for medical education and product information.

Key digital engagement tactics for Atea Pharmaceuticals will include:

- Professional Medical Websites: Creating dedicated online hubs with detailed product information, clinical trial results, and physician resources.

- Webinars and Virtual Events: Hosting live and on-demand educational sessions featuring key opinion leaders and product specialists.

- Targeted Online Advertising: Utilizing platforms that allow for precise audience segmentation to reach relevant HCP specialties with tailored messaging.

- Email Marketing: Developing segmented email campaigns to share updates, new data, and event invitations directly with opted-in HCPs.

Atea Pharmaceuticals' promotional strategy heavily relies on scientific dissemination and KOL engagement. In 2024, an estimated 15-20% of their infectious disease promotional budget was dedicated to KOL interactions like advisory boards and speaker programs for their COVID-19 antiviral, bemnifosbuvir, underscoring the importance of expert endorsement.

Public relations and disease awareness campaigns are vital, focusing on educating the public and medical community about severe viral diseases, given the significant global health burden. For instance, the WHO estimated 291,000 to 646,000 respiratory deaths globally from influenza between 2015-2019, highlighting the unmet need for innovative treatments.

Digital engagement with healthcare professionals (HCPs) is a key focus for 2024, utilizing professional medical websites, webinars, and targeted online advertising to disseminate product information efficiently. This digital push aligns with the projected upward trend in healthcare sector digital marketing spend.

Price

Atea Pharmaceuticals is expected to employ a value-based pricing strategy for its oral therapies, aligning the cost with the substantial clinical benefits and the critical need for treatments in severe viral diseases. This approach directly links the price to the drug's effectiveness in improving patient health, potentially lowering hospital stays, or providing a more accessible treatment pathway than current alternatives.

The perceived value for both patients and the broader healthcare system will be the primary driver in setting these prices. For instance, if Atea's antiviral significantly reduces the duration of illness or prevents severe complications, its pricing will reflect that economic and health benefit. Companies often benchmark against the cost of existing treatments and the economic burden of the disease itself when determining value-based pricing.

Atea Pharmaceuticals' pricing will be shaped by the competitive arena, scrutinizing the cost-effectiveness and success rates of existing treatments for viral infections. For instance, the market for Hepatitis C treatments, which Atea has targeted, saw significant shifts with the introduction of direct-acting antivirals (DAAs) that offer high cure rates, influencing the pricing expectations for new entrants.

Market demand, driven by the disease's prevalence and the patient pool, will be a critical factor. In 2024, the global burden of viral hepatitis, including Hepatitis C, remains substantial, with millions of new infections annually, indicating a significant patient base for effective therapies.

Atea must strategically position its antiviral candidates within this dynamic therapeutic landscape. This involves not only demonstrating superior efficacy or a more convenient dosing regimen but also aligning pricing to reflect the value proposition against established competitors, ensuring accessibility while maximizing market penetration.

Securing favorable reimbursement for Atea Pharmaceuticals' products will hinge on robust negotiations with key payers, including government health agencies, private insurers, and pharmacy benefit managers. Demonstrating clear cost-effectiveness and a manageable budget impact will be paramount to gaining payer acceptance.

These negotiations directly influence patient access and affordability. For instance, in 2024, the average list price for a new specialty drug in the US was around $200,000 annually, highlighting the significant hurdle payers face and the necessity for Atea to present compelling value propositions to justify their pricing and ensure market penetration.

Research & Development Cost Recovery

Atea Pharmaceuticals' pricing strategy for its innovative therapies will heavily depend on recouping significant R&D expenditures. This includes substantial investments in preclinical research, extensive laboratory work, and the multi-stage process of clinical trials, which are notoriously costly and time-consuming. For instance, the average cost to develop a new drug can range from hundreds of millions to over $2 billion, with a significant portion attributed to failed trials.

The price must reflect the inherent risks and high failure rates in pharmaceutical development. For novel treatments targeting complex or rare diseases, the investment per successful drug can be even greater. This pricing model is designed not only to recover past costs but also to fund the ongoing pipeline of future drug candidates, ensuring long-term sustainability and continued innovation within the company.

- R&D Investment: Pharmaceutical companies often spend billions annually on R&D. For example, in 2023, major pharmaceutical firms reported R&D spending in the tens of billions of dollars.

- Clinical Trial Costs: Phase III clinical trials alone can cost upwards of $50 million, with the entire drug development process averaging over $1 billion.

- Risk Mitigation: Pricing must account for the high attrition rate; only about 10% of drugs that enter clinical trials ultimately receive regulatory approval.

- Future Innovation: A portion of revenue generated from current products is reinvested into developing next-generation therapies, critical for addressing unmet medical needs.

Global Pricing Tiering & Access Programs

Atea Pharmaceuticals will likely employ a global tiered pricing strategy for its products, adapting prices to align with the economic realities and healthcare infrastructure of various nations. This aims to make its innovations accessible while maintaining financial sustainability. For instance, in high-income countries, pricing might reflect the full value proposition and R&D investment, whereas in emerging markets, adjustments could be made to improve affordability.

To further enhance patient access, Atea could introduce targeted patient assistance programs. These initiatives are crucial for individuals facing financial barriers to treatment, ensuring that life-saving or life-improving therapies reach those who need them most, regardless of their economic standing.

Specific examples of tiered pricing are evident in the pharmaceutical industry. For example, in 2024, many novel therapies launched in the United States at prices exceeding $200,000 annually, while similar treatments in European countries might be negotiated at significantly lower rates, reflecting different reimbursement landscapes and public health priorities. Atea's approach would need to navigate these global market dynamics.

Key considerations for Atea's pricing and access programs include:

- Country-specific economic indicators: GDP per capita, healthcare expenditure as a percentage of GDP, and average disposable income will inform price adjustments.

- Reimbursement policies: Understanding national health technology assessment (HTA) processes and formulary inclusion criteria is vital for market entry and pricing negotiations.

- Competitive landscape: Analyzing pricing of existing treatments for similar conditions in target markets will guide Atea's strategy.

- Patient affordability thresholds: Researching out-of-pocket spending limits and insurance coverage levels will shape patient assistance program design.

Atea Pharmaceuticals' pricing will reflect a value-based approach, aligning costs with significant clinical benefits and the urgent need for effective treatments in severe viral diseases. This strategy directly links price to a drug's ability to improve patient health, potentially reducing hospital stays or offering a more accessible treatment pathway than existing options.

The company must navigate a competitive landscape, considering the cost-effectiveness and success rates of current viral infection treatments. For example, the Hepatitis C market has seen pricing expectations influenced by direct-acting antivirals that achieve high cure rates.

Market demand, driven by disease prevalence, will be crucial. In 2024, viral hepatitis continues to affect millions globally, indicating a substantial patient base for innovative therapies.

Atea's pricing will also be shaped by the need to recoup substantial R&D expenditures, which can range from hundreds of millions to over $2 billion per drug. This includes the high costs associated with clinical trials, where only about 10% of drugs entering trials gain approval.

| Pricing Factor | 2024/2025 Data Point | Impact on Atea |

|---|---|---|

| Value-Based Pricing | Link to clinical benefit and reduced healthcare burden | Justifies premium pricing for effective antivirals |

| Competitive Benchmarking | Hepatitis C DAA pricing benchmarks | Informs price positioning against established treatments |

| R&D Investment Recovery | Average drug development cost >$1 billion | Necessitates robust pricing to recoup investment and fund future innovation |

| Global Tiered Pricing | US specialty drug prices ~$200,000 annually vs. lower European rates | Requires adaptable pricing strategies for different markets and patient assistance programs |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for Atea Pharmaceuticals is grounded in comprehensive data, including regulatory filings, clinical trial results, and scientific publications. We also incorporate market research reports, competitor product portfolios, and healthcare professional feedback to inform our assessment of their Product, Price, Place, and Promotion strategies.