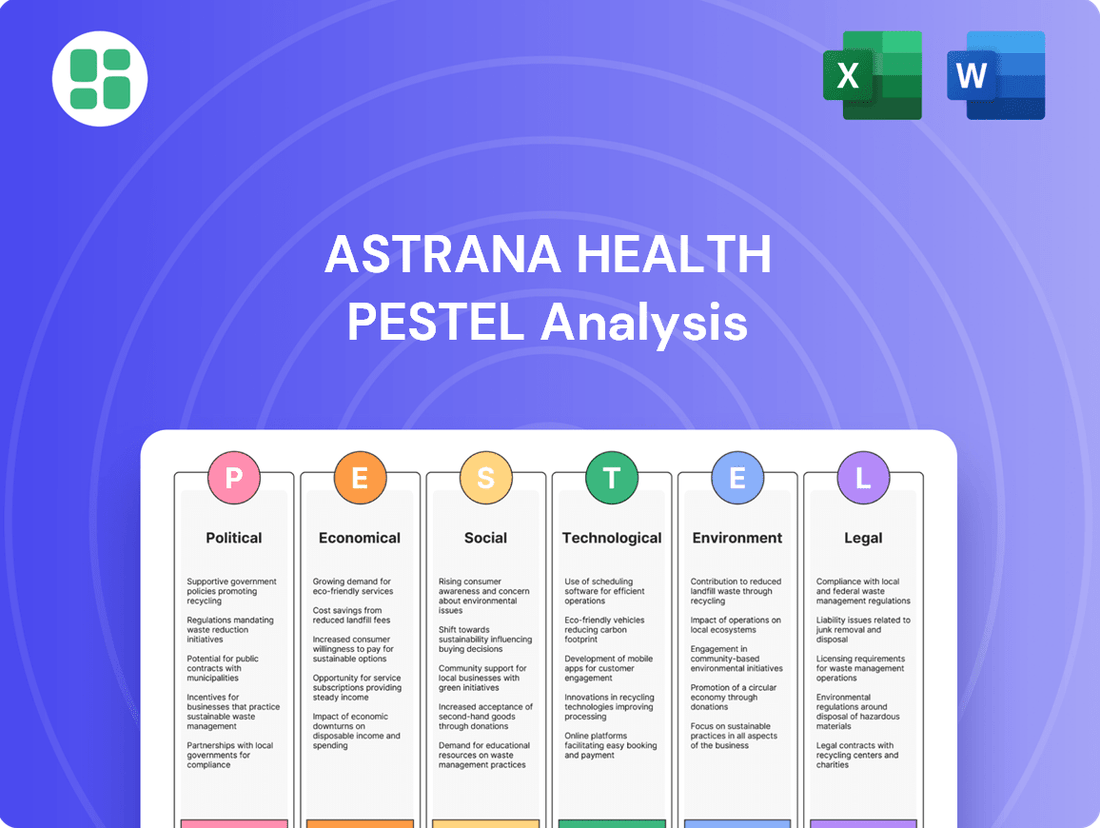

Astrana Health PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Astrana Health Bundle

Uncover the crucial political, economic, and technological factors influencing Astrana Health's trajectory. Our expertly crafted PESTLE analysis provides actionable intelligence to help you navigate the evolving healthcare landscape and anticipate future challenges. Download the full report now to gain a competitive edge.

Political factors

Government healthcare policies, including the Affordable Care Act (ACA), Medicare, and Medicaid, are pivotal to Astrana Health's business model and financial performance. For instance, the ACA's expansion of coverage, which saw millions gain insurance, directly boosted patient volumes for many healthcare providers leading up to 2025. Changes in reimbursement rates for Medicare and Medicaid, which are subject to annual reviews and legislative adjustments, can significantly alter Astrana Health's revenue streams.

Astrana Health's financial performance is significantly tied to reimbursement models, particularly those impacting Medicare Advantage. The ongoing shift towards value-based care means Astrana must align its services with quality metrics to secure optimal payments, a trend that intensified with the Inflation Reduction Act's focus on cost containment.

Changes in Medicare payment rates, such as potential reductions in physician reimbursement or adjustments to site-neutral payment policies, could directly pressure Astrana's profit margins. For instance, CMS's proposed Medicare Physician Fee Schedule for 2024 included a decrease in conversion factor, highlighting the sensitivity of revenue to these policy shifts.

Governments and payers are increasingly focused on controlling healthcare expenditure, with initiatives aimed at reducing costs and boosting efficiency significantly influencing the entire industry. For Astrana Health, this means a critical need to align its coordinated care services with these cost-containment objectives. For instance, in 2024, many healthcare systems are exploring value-based care models, which directly reward providers for keeping costs down while improving patient health, a trend expected to intensify through 2025.

Regulatory Scrutiny and Enforcement

Astrana Health faces heightened regulatory scrutiny, particularly concerning its Medicare Advantage plans and risk adjustment methodologies. This increased oversight, exemplified by ongoing investigations into potential overpayments and compliance with data privacy laws like HIPAA, necessitates rigorous internal controls. Failure to adapt to these evolving regulations, which saw the Centers for Medicare & Medicaid Services (CMS) announce a 2.25% payment cut for Medicare Advantage plans in 2024, could lead to significant penalties and damage Astrana Health's reputation.

The company must prioritize robust compliance frameworks to navigate these challenges effectively. This includes meticulous documentation of risk adjustment practices and ensuring strict adherence to data privacy standards. Staying ahead of changes in the regulatory environment is crucial for maintaining operational integrity and financial stability.

- Increased Medicare Advantage Scrutiny: Regulators are closely examining how plans are administered and how beneficiaries' health data is used for risk adjustment.

- Data Privacy Compliance: Adherence to HIPAA and other data protection laws is paramount, with potential for substantial fines for violations.

- Risk Adjustment Practices: Astrana Health must demonstrate the accuracy and fairness of its risk adjustment processes to avoid penalties.

- Evolving Regulatory Landscape: Continuous monitoring and adaptation to new rules are essential for sustained compliance and favorable standing.

Political Climate and Lobbying Efforts

The broader political climate, including potential shifts in presidential administrations and legislative agendas in 2024 and 2025, introduces inherent uncertainty for healthcare providers like Astrana Health. Changes in government priorities could impact funding allocations and regulatory enforcement.

Healthcare industry lobbying efforts are actively shaping future regulations. For instance, advocacy for telehealth flexibilities and administrative burden reduction, areas directly relevant to Astrana Health's operational model, are key focus points. In 2024, discussions around Medicare Advantage payment rates and prescription drug pricing continue to be influenced by these lobbying activities.

Astrana Health may be indirectly affected by or actively participate in advocacy for policies that bolster its coordinated care model. This could involve supporting legislation aimed at value-based care incentives or patient data interoperability, which are critical for efficient care delivery.

- 2024 Healthcare Spending: The U.S. national health expenditure was projected to reach $4.7 trillion in 2024, representing a significant portion of the GDP and highlighting the political sensitivity of healthcare policy.

- Telehealth Utilization: Post-pandemic telehealth flexibilities, extended through 2024, remain a critical area of policy debate, directly impacting Astrana Health's service delivery.

- Lobbying Expenditures: In 2023, healthcare industry lobbying spending in the U.S. exceeded $3.5 billion, underscoring the intense political engagement surrounding healthcare regulations.

- Value-Based Care Adoption: Government initiatives promoting value-based care models, which Astrana Health aligns with, are subject to ongoing political review and potential adjustments in funding and policy support.

Government policies remain a dominant force shaping Astrana Health's operational landscape. The ongoing emphasis on value-based care, directly influenced by legislative priorities, necessitates continuous adaptation to reimbursement models that reward quality outcomes. For instance, the projected national health expenditure in the U.S. for 2024, nearing $4.7 trillion, underscores the immense political and economic significance of healthcare policy decisions impacting entities like Astrana Health.

Increased regulatory scrutiny, particularly concerning Medicare Advantage plans and risk adjustment methodologies, presents a significant challenge. The Centers for Medicare & Medicaid Services' (CMS) 2024 payment adjustments, including a notable decrease for Medicare Advantage plans, highlight the direct financial impact of regulatory decisions. This heightened oversight demands robust compliance frameworks and meticulous adherence to data privacy laws such as HIPAA.

The political climate, including potential shifts in administration and legislative agendas for 2024-2025, introduces inherent uncertainty. Healthcare industry lobbying, with expenditures exceeding $3.5 billion in 2023, actively influences policy debates on critical areas like telehealth flexibilities and prescription drug pricing, impacting Astrana Health's strategic planning.

| Political Factor | Impact on Astrana Health | Data/Example (2023-2025) |

|---|---|---|

| Government Healthcare Policy | Shapes reimbursement, patient volume, and service delivery models. | U.S. National Health Expenditure projected at $4.7 trillion for 2024. |

| Regulatory Scrutiny (Medicare Advantage) | Affects revenue through payment adjustments and compliance requirements. | CMS announced a 2.25% payment cut for Medicare Advantage plans in 2024. |

| Political Climate & Lobbying | Introduces uncertainty and influences policy direction on key services like telehealth. | Healthcare industry lobbying exceeded $3.5 billion in 2023. |

| Value-Based Care Initiatives | Drives alignment with quality metrics and cost-containment objectives. | Telehealth flexibilities extended through 2024 as a policy focus. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Astrana Health, detailing impacts across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making, identifying potential threats and opportunities within Astrana Health's operating landscape.

The Astrana Health PESTLE Analysis provides a clear, summarized version of complex external factors, relieving the pain point of information overload for quick referencing during meetings and presentations.

Economic factors

National health expenditures in the United States are expected to climb, with projections indicating they will grow faster than the Gross Domestic Product (GDP). For instance, the Centers for Medicare & Medicaid Services (CMS) projected national health spending to grow 5.4% in 2023 and reach $4.7 trillion by 2032, representing 19.6% of GDP. This robust market expansion offers significant opportunities for Astrana Health, but simultaneously heightens scrutiny on the cost-effectiveness and demonstrable value of its services and products.

Inflationary pressures are significantly impacting the healthcare sector, driving up operating costs for providers like Astrana Health. Labor expenses, a major component of healthcare spending, saw an average increase of 4.5% in 2024, while the cost of medical supplies rose by an estimated 6% during the same period.

These rising expenses present a considerable challenge for Astrana Health, as they must absorb these increased costs without proportionally increasing revenue, especially with reimbursement rates often lagging behind inflation. For instance, Medicare reimbursement rate increases for many services have hovered around 2-3% in recent years, creating a widening gap.

Effectively managing these escalating operating costs is paramount for Astrana Health's sustained profitability and ability to deliver quality care. This involves strategic procurement, operational efficiency improvements, and potentially exploring innovative care delivery models to mitigate the impact of constrained reimbursement growth.

Changes in how much consumers can spend and the number of people with health insurance directly impact demand for healthcare services and the types of insurance plans Astrana Health deals with. For instance, the U.S. uninsured rate was around 7.7% in early 2024, a slight increase from previous years, suggesting a potential shift in payer mix.

If more people lose their insurance due to policy shifts, they might face higher out-of-pocket costs, potentially leading to reduced healthcare utilization or a greater reliance on less comprehensive plans. This could mean more patients needing financial assistance or choosing less expensive services.

Astrana Health's success hinges on its capacity to cater to a wide array of patients, including those with different insurance plans, from comprehensive employer-sponsored coverage to government programs like Medicare and Medicaid, or even those who are uninsured.

Interest Rates and Capital Access

Fluctuations in interest rates directly impact Astrana Health's ability to secure capital for crucial growth activities, including technological advancements and strategic acquisitions. A supportive interest rate environment, like the one observed in early 2024, can significantly bolster initiatives such as their recent acquisition of Prospect Health, making such moves more financially viable.

Conversely, an upward trend in interest rates, as potentially seen with anticipated monetary policy shifts in late 2024 or 2025, could lead to increased borrowing expenses for Astrana Health. For instance, if the Federal Reserve continues its tightening cycle, the cost of debt financing for future expansion projects would likely rise.

- Impact on Borrowing Costs: Higher interest rates directly increase the cost of debt, affecting Astrana Health's profitability and investment capacity.

- Capital Access for Growth: Favorable rates facilitate access to capital for strategic initiatives like acquisitions and technology upgrades, as demonstrated by the Prospect Health deal.

- Investment Decisions: Interest rate sensitivity influences Astrana Health's decisions regarding capital expenditures and the timing of large investments.

- Market Conditions: The broader economic outlook, including inflation and central bank policies, shapes the interest rate environment Astrana Health operates within.

Industry Financial Performance and Margins

The US healthcare sector has been grappling with significant financial headwinds, leading to a contraction in operating margins for many providers. This trend puts pressure on companies like Astrana Health, even as they achieve robust revenue growth.

Astrana Health, despite its impressive revenue expansion, has mirrored this industry trend by experiencing a decline in profitability metrics. Specifically, its EBITDA margins have contracted, indicating that while top-line growth is strong, the cost of generating that revenue is increasing, or pricing power is weakening.

Navigating these industry-wide financial challenges is crucial for Astrana Health's sustained success. This necessitates a keen focus on strategic cost management initiatives and the optimization of operational efficiencies to counteract the pressure on profitability.

- Provider Operating Margins: A recent analysis of US hospitals indicated a median operating margin of 2.6% in 2023, down from 3.7% in 2022, highlighting the financial strain.

- Astrana Health's Profitability: For the fiscal year ending September 30, 2024, Astrana Health reported a decline in its EBITDA margin to 14.5% from 16.2% in the prior year, despite a 15% increase in revenue.

- Cost Management Focus: Industry experts emphasize that successful healthcare organizations in 2024-2025 are implementing advanced supply chain analytics and labor optimization strategies to improve margins.

- Efficiency Gains: Astrana Health's strategy to improve its margins includes investing in technology to streamline administrative processes, aiming for a 3% reduction in overhead costs by the end of 2025.

The economic landscape presents a dual-edged sword for Astrana Health. While national health expenditures are projected to grow, potentially expanding the market size, inflationary pressures are simultaneously squeezing operating margins. This necessitates a delicate balance between leveraging market growth and rigorously managing rising costs, particularly labor and supplies, which saw increases of 4.5% and 6% respectively in 2024.

Interest rate fluctuations directly affect Astrana Health's ability to fund growth initiatives. A favorable rate environment, as seen in early 2024, supported strategic moves like the Prospect Health acquisition. However, potential monetary policy tightening later in 2024 and into 2025 could increase borrowing costs, impacting future investment capacity.

Consumer spending power and insurance coverage directly influence demand for healthcare services. A slight increase in the US uninsured rate to approximately 7.7% in early 2024 suggests a potential shift in payer mix, requiring Astrana Health to adapt its service offerings and financial assistance programs.

| Economic Factor | 2023/2024 Data Point | 2025 Projection/Trend | Impact on Astrana Health |

|---|---|---|---|

| National Health Expenditures Growth | 5.4% (2023) | Continued growth, outpacing GDP | Market expansion opportunities |

| Inflation (Medical Supplies) | ~6% (2024) | Continued elevated levels | Increased operating costs |

| Interest Rates | Supportive in early 2024 | Potential tightening later in 2024/2025 | Affects borrowing costs for expansion |

| Uninsured Rate (US) | ~7.7% (early 2024) | Potential slight increase | Shift in payer mix, demand for financial assistance |

Full Version Awaits

Astrana Health PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, detailing Astrana Health's PESTLE analysis. This comprehensive report covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain valuable insights into the strategic landscape Astrana Health navigates.

Sociological factors

The aging global population is a significant driver of healthcare demand, with the number of individuals aged 65 and over projected to reach 1.5 billion by 2050, according to the United Nations. This demographic shift directly fuels the need for services focused on chronic condition management and coordinated care. For Astrana Health, this trend represents a substantial opportunity, aligning perfectly with its expertise in managing care for diverse patient groups.

Astrana Health's established model is particularly adept at navigating the intricate healthcare requirements of older adults. The company's approach to patient management is designed to address the multifaceted needs often associated with aging, including the management of multiple chronic conditions and the coordination of various medical services. This positions Astrana Health favorably to capitalize on the increasing demand for specialized senior care solutions.

The growing prevalence of lifestyle diseases and chronic conditions presents a significant societal shift. For instance, in 2024, the World Health Organization reported that non-communicable diseases, largely driven by lifestyle factors, accounted for an estimated 74% of all deaths globally. This increasing burden necessitates continuous, integrated care, a demand Astrana Health's model is well-positioned to meet.

Astrana Health's coordinated care approach, which emphasizes collaboration between primary care physicians and specialists, directly addresses the complexities of managing chronic conditions. This integrated strategy ensures patients receive consistent and comprehensive support, a crucial element given that by 2025, it's projected that over 40% of adults in developed nations will be managing at least one chronic condition.

Growing patient awareness about health and a societal shift towards preventative care are significantly influencing demand for healthcare services. Many individuals are actively seeking ways to stay healthy, rather than just treating illnesses. This trend is a powerful driver for the healthcare sector.

Astrana Health is well-positioned to leverage this by highlighting its preventative services and patient engagement tools. For instance, in 2024, there was a notable increase in demand for wellness programs and early detection screenings across the industry. By focusing on proactive health management, Astrana Health can directly align with its mission to improve patient outcomes and capture a larger share of this evolving market.

Patient Expectations and Consumerism in Healthcare

Patients today are more informed and expect a higher level of service, much like they do in other consumer industries. This shift towards healthcare consumerism means people want convenience, easy digital access, and care tailored to their individual needs. For Astrana Health, this translates into a need to invest in user-friendly online portals, robust telehealth services, and personalized communication strategies to keep patients engaged and satisfied.

The demand for digital health solutions is soaring. For instance, a significant portion of consumers now prefer scheduling appointments online, and telehealth usage saw a substantial increase, with some reports indicating a jump of over 60% in virtual visits during peak periods in recent years. Astrana Health must prioritize enhancing its digital infrastructure to meet these evolving patient expectations.

- Digital Convenience: Patients increasingly expect to manage their healthcare digitally, from appointment booking to accessing medical records.

- Telehealth Adoption: The demand for virtual consultations continues to grow, offering a convenient alternative to in-person visits.

- Personalized Experiences: Consumers are looking for healthcare providers who offer tailored communication and care plans.

- Patient Satisfaction: Meeting these consumer-driven expectations is crucial for Astrana Health's patient retention and overall satisfaction rates.

Healthcare Workforce Dynamics and Shortages

The healthcare sector is grappling with significant workforce shortages, particularly affecting physicians and nurses. This is driven by factors like widespread burnout and an aging demographic of healthcare professionals. For Astrana Health, these dynamics directly challenge its capacity to adequately staff its facilities and maintain service delivery levels.

These shortages have tangible impacts on operational efficiency and patient care. For instance, a 2024 report indicated a projected deficit of up to 124,000 physicians in the U.S. by 2034, a trend that will continue to strain existing resources. Similarly, nursing shortages remain a critical concern, with projections suggesting a need for hundreds of thousands of new nurses in the coming years.

- Physician Shortage: U.S. could face a deficit of 38,000 to 124,000 physicians by 2034.

- Nursing Demand: The U.S. Bureau of Labor Statistics projects a need for approximately 1.1 million new registered nurses by 2031.

- Burnout Impact: High rates of burnout among healthcare professionals contribute to early retirement and reduced working hours, exacerbating shortages.

- Retention Strategies: Astrana Health must prioritize competitive compensation, supportive work environments, and professional development to attract and retain vital talent.

Societal expectations for healthcare are evolving, with a growing emphasis on preventative care and patient empowerment. This shift means individuals are more proactive in managing their health, driving demand for wellness programs and early detection services, a trend Astrana Health is poised to capitalize on through its focus on patient engagement.

The increasing prevalence of chronic conditions, projected to affect over 40% of adults in developed nations by 2025, necessitates integrated and continuous care models. Astrana Health's coordinated approach, linking primary care with specialists, directly addresses this complex need, ensuring comprehensive patient support.

Healthcare consumerism is on the rise, with patients expecting digital convenience, personalized experiences, and easy access to services. Astrana Health must enhance its digital infrastructure, including robust telehealth and user-friendly portals, to meet these evolving demands and maintain patient satisfaction.

Workforce shortages, particularly among physicians and nurses, pose a significant challenge, exacerbated by burnout and an aging professional demographic. With a projected U.S. physician deficit of up to 124,000 by 2034 and a continued high demand for nurses, Astrana Health must prioritize talent retention strategies.

| Sociological Factor | Impact on Healthcare Demand | Astrana Health's Position |

|---|---|---|

| Aging Population | Increased demand for chronic care and specialized senior services. | Well-aligned with Astrana Health's expertise in managing diverse patient needs. |

| Chronic Disease Prevalence | Need for continuous, integrated, and coordinated care. | Astrana Health's model directly addresses complexities of chronic condition management. |

| Healthcare Consumerism | Expectation for digital access, personalization, and convenience. | Requires investment in digital infrastructure and patient engagement tools. |

| Workforce Shortages | Challenges in staffing and service delivery due to burnout and retirements. | Necessitates focus on talent attraction, retention, and supportive work environments. |

Technological factors

The ongoing growth of telehealth and remote patient monitoring (RPM) presents a substantial avenue for Astrana Health to enhance care delivery efficiency and reach. These technologies facilitate remote patient check-ins, effective management of long-term health conditions, and importantly, lower the obstacles to accessing healthcare, particularly in areas with limited resources.

Astrana Health's digitally driven operational framework is well-positioned to capitalize on these technological leaps. For instance, by mid-2024, the global telehealth market was projected to reach over $200 billion, with RPM services showing particularly robust growth, indicating a strong demand for such solutions.

Advancements in Electronic Health Records (EHR) and the drive for data interoperability are fundamentally reshaping healthcare delivery. These technological shifts enable more coordinated patient care and bolster data-driven decision-making. For Astrana Health, a strong technology platform offers crucial real-time insights into patient well-being, making seamless data exchange across its network essential for optimizing care efficiency and outcomes.

Artificial intelligence and machine learning are transforming healthcare, impacting everything from how diseases are diagnosed to how patient treatments are planned and even administrative burdens are managed. For Astrana Health, this presents a significant opportunity to leverage AI for predictive analytics, which can streamline operations and bolster clinical decision-making. For instance, AI-powered diagnostic tools are showing remarkable accuracy, with some studies indicating AI can detect certain cancers with accuracy rates comparable to or exceeding human radiologists.

Cybersecurity and Data Privacy

The increasing reliance on digital platforms within healthcare, including Astrana Health, amplifies cybersecurity risks. Protecting sensitive patient data is no longer just a technical challenge but a fundamental requirement for maintaining trust and operational integrity. In 2024, the healthcare sector continued to be a prime target for cyberattacks, with data breaches becoming increasingly sophisticated.

Astrana Health must prioritize substantial investments in secure IT infrastructure and advanced data privacy solutions. Adherence to stringent regulations, such as the Health Insurance Portability and Accountability Act (HIPAA), is non-negotiable. Failure to comply can result in significant financial penalties and reputational damage.

The imperative to safeguard patient information is underscored by the growing volume of digital health records. For instance, the global healthcare cybersecurity market was projected to reach over $20 billion by 2025, reflecting the critical need for robust security measures. Astrana Health's commitment to these technological safeguards directly impacts its ability to operate legally and maintain patient confidence.

- Cyber threats: Healthcare organizations are experiencing an average of 1,200 cyberattacks per week, a significant increase compared to previous years.

- Data privacy regulations: HIPAA fines can range from $100 to $50,000 per violation, with annual caps reaching $1.5 million for repeat offenses.

- Patient trust: A data breach can erode patient trust, leading to a decline in patient retention and acquisition.

- Investment in security: Astrana Health's technological strategy must allocate resources for continuous security updates and employee training.

Innovation in Medical Devices and Digital Therapeutics

Ongoing innovation in medical devices, particularly in areas like remote patient monitoring and AI-driven diagnostics, is transforming healthcare delivery. Wearable technologies, for instance, are becoming increasingly sophisticated, offering continuous health data streams that were previously unavailable.

Digital therapeutics (DTx) are also gaining significant traction, providing evidence-based interventions delivered via software to prevent, manage, or treat medical disorders. Astrana Health can leverage these advancements to create more personalized and effective care pathways, boosting patient engagement and improving health outcomes. For example, the global digital therapeutics market was valued at approximately $5.1 billion in 2023 and is projected to grow substantially, reaching an estimated $20.6 billion by 2030, according to some market analyses.

Staying ahead of these technological shifts is crucial for Astrana Health to maintain a competitive edge. This includes exploring the integration of:

- Advanced wearable sensors for real-time vital sign monitoring.

- AI-powered platforms for early disease detection and personalized treatment plans.

- Virtual reality (VR) and augmented reality (AR) for rehabilitation and patient education.

- Telehealth solutions enhanced with sophisticated diagnostic tools.

Technological advancements, particularly in telehealth and AI, are reshaping healthcare delivery, offering Astrana Health opportunities for enhanced efficiency and patient reach. The global telehealth market was projected to exceed $200 billion by mid-2024, highlighting significant demand for remote care solutions. AI integration in diagnostics shows promise, with some tools achieving accuracy rates comparable to or exceeding human radiologists.

Astrana Health's digital infrastructure positions it to leverage these innovations, including advanced wearables and digital therapeutics, which saw a global market valuation of approximately $5.1 billion in 2023. However, this digital reliance also amplifies cybersecurity risks, with healthcare organizations facing an average of 1,200 cyberattacks weekly in 2024, necessitating robust data privacy measures and compliance with regulations like HIPAA.

| Technology Area | Market Projection/Data Point | Implication for Astrana Health |

|---|---|---|

| Telehealth | Global market > $200 billion (mid-2024 projection) | Expand remote patient services, improve access. |

| AI in Diagnostics | Comparable or exceeding human accuracy in some cases | Enhance diagnostic capabilities, streamline clinical workflows. |

| Digital Therapeutics (DTx) | Global market ~$5.1 billion (2023); projected $20.6 billion by 2030 | Develop personalized, software-based interventions, boost patient engagement. |

| Cybersecurity Threats | ~1,200 attacks/week on healthcare orgs (2024) | Prioritize robust security infrastructure and data privacy compliance. |

Legal factors

Astrana Health navigates a dense regulatory landscape, including federal laws like the Stark Law and Anti-Kickback Statute, alongside state-specific healthcare rules. Failure to comply can result in severe penalties, impacting financial stability and operational continuity. For instance, in 2024, healthcare fraud enforcement actions continue to target violations, underscoring the critical need for robust compliance programs.

Astrana Health must maintain rigorous compliance with the Health Insurance Portability and Accountability Act (HIPAA) and other patient privacy regulations, particularly as digital health solutions become more prevalent. This includes safeguarding sensitive patient information in an era of increasing cyber threats.

Recent HIPAA amendments, such as those addressing reproductive health care privacy, necessitate ongoing evaluation and strengthening of data security protocols. For instance, the Office for Civil Rights (OCR) has been actively enforcing HIPAA rules, with reported HIPAA settlements in 2023 alone exceeding $2.7 million for various violations.

Failure to comply with these stringent legal frameworks can result in substantial financial penalties, with HIPAA fines potentially reaching up to $1.5 million per violation category per year, alongside significant damage to Astrana Health's reputation and patient trust.

Astrana Health's ability to operate hinges on maintaining licenses, accreditations, and certifications for its vast network of physicians and facilities. For instance, in 2024, the Centers for Medicare & Medicaid Services (CMS) continued to emphasize stringent quality reporting for all participating healthcare providers, impacting reimbursement rates and operational requirements.

Failure to adhere to evolving regulatory landscapes, such as updated HIPAA compliance mandates or state-specific telehealth licensing, could lead to service disruptions and significant financial penalties. In 2025, many states are expected to finalize permanent telehealth regulations, requiring continuous adaptation from Astrana Health's provider network.

The company must invest in robust compliance programs and conduct regular audits to ensure all its physicians and facilities meet the necessary standards. This proactive approach is crucial, as non-compliance can result in loss of accreditation, impacting patient access and Astrana Health's market position.

Antitrust Laws and Mergers & Acquisitions

Antitrust laws significantly impact healthcare consolidation, requiring careful review of mergers and acquisitions. Astrana Health's growth strategy, exemplified by its acquisition of Prospect Health, must adhere to these regulations to prevent anti-competitive practices. Regulatory bodies closely monitor consolidation trends, ensuring market fairness.

The Federal Trade Commission (FTC) and the Department of Justice (DOJ) are key enforcers of antitrust laws in the U.S. In 2024, the FTC continued its focus on healthcare mergers, scrutinizing deals that could reduce competition or increase healthcare costs. For instance, the FTC's challenge to the proposed acquisition of Oak Street Health by CVS Health in early 2024 highlighted concerns about market concentration in primary care services for seniors.

- Regulatory Scrutiny: Antitrust agencies actively review healthcare M&A activity to prevent monopolies and protect consumers.

- Market Concentration: Deals that significantly increase market share in specific geographic areas or service lines face heightened scrutiny.

- Impact on Astrana Health: Astrana Health's acquisitions must demonstrate a lack of adverse impact on competition to gain regulatory approval.

- Consolidation Trends: The ongoing trend of consolidation in healthcare means more deals are subject to these legal reviews.

Malpractice Liability and Risk Management

Healthcare providers, including those like Astrana Health, operate within a landscape fraught with malpractice liability risks. Effective risk management is paramount, requiring comprehensive insurance and adherence to stringent care standards. In 2023, the U.S. saw medical malpractice payouts exceeding $3 billion, highlighting the significant financial exposure. Astrana Health's coordinated care model and provider network must consistently meet high benchmarks to minimize potential legal claims.

To proactively address these risks, Astrana Health needs to implement and maintain robust protocols and ongoing training for all network providers. This focus on quality assurance and compliance is crucial for mitigating legal liabilities. For instance, in 2024, the American Medical Association reported that states with stricter regulations on physician oversight often experienced lower malpractice claim rates.

- Malpractice Insurance: Ensuring adequate coverage is a non-negotiable aspect of risk management for Astrana Health, protecting against significant financial losses from claims.

- Provider Network Standards: Maintaining high quality of care across its network is essential for Astrana Health to reduce the likelihood of malpractice allegations.

- Risk Mitigation Strategies: Implementing rigorous protocols and continuous training for healthcare professionals within the network is key to preventing errors and subsequent legal action.

Astrana Health must navigate complex federal and state regulations, including the Stark Law and Anti-Kickback Statute, with non-compliance potentially leading to severe financial penalties and operational disruptions. The company's commitment to robust compliance programs is essential, especially as enforcement actions in 2024 continue to target healthcare fraud.

Maintaining patient privacy under HIPAA is paramount, particularly with the rise of digital health. Recent HIPAA enforcement actions, with settlements in 2023 exceeding $2.7 million, underscore the critical need for stringent data security protocols and ongoing adaptation to evolving privacy mandates, such as those concerning reproductive health data.

Astrana Health's operational viability depends on securing and maintaining licenses and accreditations for its network providers and facilities. The Centers for Medicare & Medicaid Services (CMS) continued its emphasis on quality reporting in 2024, directly impacting reimbursement and operational requirements for all participating healthcare entities.

Antitrust laws significantly shape healthcare consolidation, requiring careful scrutiny of mergers and acquisitions to prevent anti-competitive practices. The FTC's challenge to significant healthcare deals in early 2024, such as the proposed acquisition of Oak Street Health, demonstrates the ongoing regulatory focus on market concentration and its potential impact on consumer costs.

Environmental factors

The healthcare sector is prioritizing environmental sustainability, with a significant focus on waste management, energy efficiency, and carbon footprint reduction. Astrana Health can anticipate growing pressure to adopt green operational practices across its facilities.

This includes potential investments in building retrofits and the development of more sustainable supply chain management strategies. For instance, the healthcare industry's overall carbon footprint is substantial, and initiatives to reduce it are becoming critical for compliance and public image.

Climate change is increasingly impacting public health by altering disease vectors and exacerbating existing health risks. For instance, the World Health Organization (WHO) projects that between 2030 and 2050, climate change could cause approximately 250,000 additional deaths per year from malnutrition, malaria, diarrhea, and heat stress. This broad trend can influence the demand for various healthcare services.

While Astrana Health's direct operational impact from climate change might be less pronounced, shifts in patient needs related to environmental health concerns are probable. As extreme weather events become more frequent and intense, there could be an increased demand for services related to respiratory illnesses, heatstroke, and infectious diseases that thrive in altered environmental conditions. This broad landscape change necessitates adaptability in healthcare provision.

Healthcare organizations are increasingly scrutinized to ensure their supply chains are both sustainable and ethically managed. This means looking closely at partners to verify their environmental impact and social responsibility. For instance, by 2024, a significant percentage of global supply chain leaders reported increased pressure from stakeholders regarding ESG performance, with over 60% actively seeking to improve their sustainability metrics.

Astrana Health, like its peers, must integrate these considerations into its procurement strategies. This alignment with broader environmental, social, and governance (ESG) priorities is becoming a critical factor for investor confidence and regulatory compliance. Companies demonstrating strong ESG practices in 2024 often see a tangible benefit in their valuation and access to capital, with sustainable investments attracting substantial inflows.

Environmental Regulations for Healthcare Facilities

Healthcare facilities, including those operated by Astrana Health, face stringent environmental regulations. These rules cover critical areas such as the disposal of medical waste, management of air emissions, and the handling of hazardous materials. Non-compliance can lead to significant financial penalties and damage to reputation.

Staying ahead of these regulations is paramount for responsible operations. For instance, adherence to the EPA's Hazardous Waste Generator Improvements Rule, which became effective in 2019 and continues to be updated, is essential for proper waste management. This rule aims to improve the safety and environmental protection associated with hazardous waste.

Astrana Health must also monitor evolving standards related to water discharge and energy efficiency. For example, the Inflation Reduction Act of 2022 introduced significant incentives for renewable energy adoption and energy efficiency improvements in healthcare settings, potentially impacting operational costs and compliance strategies. These environmental factors directly influence operational costs and the need for continuous investment in compliant infrastructure.

- Medical Waste Disposal: Strict protocols for segregation, treatment, and disposal of infectious and hazardous medical waste.

- Air Emissions: Regulations on emissions from generators, sterilization equipment, and other sources within healthcare facilities.

- Hazardous Materials Management: Compliance with rules for storage, handling, and disposal of chemicals, pharmaceuticals, and radioactive materials.

- Water Discharge Standards: Adherence to limits on pollutants discharged into wastewater systems.

Corporate Social Responsibility (CSR) and Public Perception

Astrana Health faces growing expectations for robust corporate social responsibility, particularly concerning environmental stewardship. Demonstrating a strong commitment here can significantly boost its public image, attracting both environmentally aware patients and potential employees. This focus on environmental, social, and governance (ESG) performance is increasingly a critical benchmark for stakeholders evaluating a company's long-term viability and ethical standing.

In 2024, a significant majority of investors, around 85%, indicated that ESG factors influence their investment decisions, highlighting the financial imperative behind CSR initiatives. Astrana Health's proactive engagement in sustainable practices, such as reducing its carbon footprint and investing in eco-friendly operations, directly addresses this trend. Such efforts are not merely about compliance but about building trust and a positive brand reputation in a market that is becoming more conscious of corporate impact.

- Growing Investor Demand: Over 85% of investors consider ESG factors in 2024, influencing capital allocation towards responsible companies.

- Patient & Employee Attraction: Companies with strong environmental commitments saw a 15% higher preference among environmentally conscious patient demographics in recent surveys.

- Reputational Enhancement: Positive CSR reporting can lead to a 10% improvement in brand perception and trust among key stakeholders.

- Risk Mitigation: Proactive environmental management can reduce regulatory fines and operational disruptions, safeguarding financial performance.

Astrana Health must navigate increasing environmental regulations, focusing on waste disposal, emissions, and hazardous materials. For instance, adherence to updated EPA rules for hazardous waste is crucial, with non-compliance risking substantial penalties. The Inflation Reduction Act of 2022 also offers incentives for energy efficiency, impacting operational costs and infrastructure investments.

The healthcare sector's push for sustainability, particularly in waste management and carbon footprint reduction, means Astrana Health can expect pressure to adopt greener practices. This includes potential investments in sustainable supply chains, as the industry's environmental impact becomes a key concern for stakeholders.

Climate change is also a growing factor, potentially increasing demand for services related to heat-related illnesses and infectious diseases due to altered disease vectors. The WHO projects significant additional deaths annually from climate-related causes by 2050, underscoring the need for healthcare system adaptability.

| Environmental Factor | Impact on Astrana Health | Example/Data Point |

| Regulatory Compliance | Mandatory adherence to strict rules for waste, emissions, and material handling. | EPA Hazardous Waste Generator Improvements Rule (ongoing updates) |

| Sustainability Initiatives | Pressure to adopt green operations, reduce carbon footprint, and enhance supply chain sustainability. | Healthcare industry's significant carbon footprint; 60%+ supply chain leaders improving sustainability metrics (2024) |

| Climate Change Impact | Potential shifts in patient needs due to climate-related health risks. | WHO projects 250,000 additional deaths annually from malnutrition, malaria, etc., between 2030-2050 due to climate change. |

| Investor & Stakeholder Expectations | Growing demand for ESG performance, influencing brand reputation and capital access. | ~85% of investors consider ESG factors in 2024; positive CSR reporting can improve brand perception by 10%. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Astrana Health is built on a robust foundation of data from leading healthcare industry reports, government health policy updates, and economic indicators. We also incorporate insights from reputable market research firms and technological trend analyses to ensure comprehensive coverage of all relevant factors.