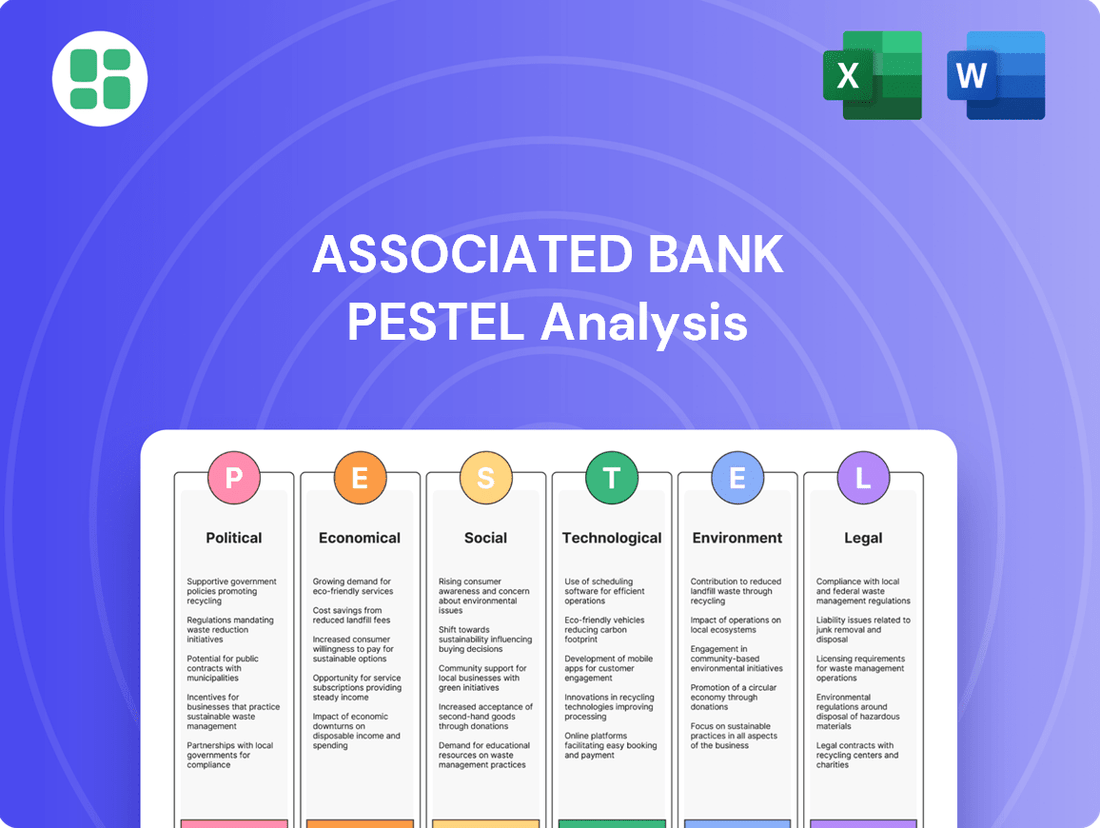

Associated Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Associated Bank Bundle

Navigate the complex external forces shaping Associated Bank's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors impacting their operations and strategy. This in-depth report is your key to unlocking actionable insights and making informed decisions. Download the full version now to gain a competitive edge.

Political factors

Associated Banc-Corp, like all financial institutions, operates within a stringent regulatory landscape shaped by federal and state authorities. These regulations, covering areas from capital adequacy to consumer protection, significantly influence the bank's operational strategies and compliance expenditures.

Anticipated changes in regulatory frameworks, such as the ongoing implementation of Basel III revisions, will continue to be a key factor in 2025. For example, proposed revisions to US Basel III Capital Rules, impacting large banking organizations, were released in July 2023, setting the stage for evolving compliance demands and capital management strategies for institutions like Associated Banc-Corp.

The Federal Reserve's monetary policy, especially its decisions on interest rates, directly impacts Associated Bank's profitability. Higher rates generally widen the net interest margin, but also can dampen loan demand. As of July 2025, the federal funds rate target remains between 4.25% and 4.5%.

Looking ahead, the market anticipates a potential series of gradual rate reductions by the Fed towards the end of 2025 and into 2026. These anticipated shifts will influence borrowing costs for consumers and businesses, affecting loan origination volumes and the cost of funding for Associated Banc-Corp.

The political climate in the United States, particularly the upcoming 2024 elections, presents a key factor for Associated Bank. Shifts in administration and congressional control could alter regulatory approaches, impacting areas like capital requirements, consumer protection, and environmental, social, and governance (ESG) mandates. For instance, a more deregulatory stance could ease merger and acquisition activity, while increased focus on consumer protection might necessitate greater compliance investments.

Fiscal Policies and Taxation

Government fiscal policies, particularly tax laws and public spending, directly influence economic growth and consumer behavior, thereby impacting the banking sector. For instance, changes in corporate tax rates can alter business investment decisions and affect the financial capacity of Associated Banc-Corp's clientele. The U.S. corporate tax rate, set at 21% following the 2017 Tax Cuts and Jobs Act, remains a key consideration for businesses operating within Associated Bank's service areas.

Government stimulus programs, such as those implemented during economic downturns, can significantly boost economic activity and influence loan demand. For example, the American Rescue Plan Act of 2021 provided substantial fiscal support, impacting consumer spending and business recovery. These initiatives shape the broader economic climate, affecting the financial health and borrowing needs of Associated Banc-Corp's customers.

- Corporate Tax Rate: The U.S. federal corporate income tax rate is 21%.

- Public Spending Impact: Government spending on infrastructure or social programs can stimulate economic activity, indirectly benefiting banks through increased business and consumer confidence.

- Fiscal Stimulus: Past stimulus measures, like those in 2020-2021, demonstrated a direct correlation with increased consumer spending and business investment, influencing loan demand.

- State-Level Taxation: Associated Banc-Corp operates across multiple states, each with its own corporate and individual income tax structures, creating a complex fiscal landscape.

Regional and State-Level Policies

Associated Bank's primary service areas in Wisconsin, Illinois, and Minnesota are significantly shaped by state-level policies. For instance, Wisconsin's 2023 economic development initiatives, including tax incentives for small businesses, could boost loan demand. Illinois's approach to housing finance and Minnesota's infrastructure spending plans directly influence the bank's lending opportunities and deposit growth within those states.

Regional economic forecasts are also critical. A positive outlook for the Midwest in 2024, with projected GDP growth of around 2% for the region, suggests a favorable environment for Associated Bank's expansion. Conversely, any shifts in state-specific regulations, such as changes to banking laws or consumer protection measures, could present compliance challenges or necessitate strategic adjustments.

- Wisconsin's focus on attracting tech startups through grants could increase demand for business loans.

- Illinois's proposed changes to mortgage lending regulations might impact Associated Bank's residential mortgage portfolio.

- Minnesota's investment in renewable energy projects could create new financing avenues for the bank.

Political stability and government policies directly influence Associated Bank's operating environment, affecting everything from regulatory compliance to economic growth. Changes in administration, particularly following the 2024 U.S. elections, could lead to shifts in regulatory priorities, impacting capital requirements and consumer protection measures.

Monetary policy, as set by the Federal Reserve, remains a critical factor, with the federal funds rate target at 4.25% to 4.5% as of July 2025. Anticipated rate reductions later in 2025 and into 2026 will affect borrowing costs and loan demand, influencing Associated Bank's net interest margins.

Fiscal policies, including the 21% U.S. federal corporate tax rate and state-level tax structures across Wisconsin, Illinois, and Minnesota, shape business investment and consumer spending, thereby impacting loan origination and the financial health of Associated Bank's clients.

| Political Factor | Impact on Associated Bank | Data/Trend (as of July 2025) |

|---|---|---|

| Regulatory Environment | Compliance costs, capital requirements, consumer protection mandates | Ongoing Basel III revisions; proposed US Basel III Capital Rules released July 2023 |

| Monetary Policy | Net interest margin, loan demand, cost of funds | Federal Funds Rate target: 4.25%-4.5%; expected gradual reductions in late 2025/2026 |

| Fiscal Policy | Economic growth, business investment, consumer spending | U.S. Corporate Tax Rate: 21%; state-level tax variations in WI, IL, MN |

| Elections | Potential shifts in regulatory approach, ESG mandates | U.S. Presidential election in November 2024 |

What is included in the product

This PESTLE analysis for Associated Bank examines how Political, Economic, Social, Technological, Environmental, and Legal factors present both challenges and strategic advantages.

It provides a comprehensive overview of the external landscape, offering actionable insights for Associated Bank's strategic planning and decision-making.

A concise Associated Bank PESTLE analysis that highlights key external factors, simplifying complex market dynamics for strategic decision-making.

Economic factors

The current interest rate environment significantly shapes Associated Banc-Corp's (ASBC) net interest income (NII). While the Federal Reserve maintained its benchmark rate in the 5.25%-5.50% range through early 2025, the market anticipates potential cuts later in the year. This shift could compress NII as funding costs, particularly for deposits, may not decrease as rapidly as asset yields.

For instance, in the first quarter of 2025, ASBC reported a net interest margin of 3.15%, a slight decrease from the previous year, reflecting this pricing pressure. The bank's strategic management of its loan portfolio and deposit base will be crucial to navigate the anticipated decline in interest income as rates potentially move lower throughout 2025.

Inflation significantly impacts how much consumers can buy and their willingness to take out loans. While inflation has cooled, consumer spending might slow down in 2025. This is partly because consumers are carrying substantial debt, which could lead to lower demand for loans, especially for things like credit cards and car loans.

Associated Banc-Corp needs to keep a close eye on these economic shifts. For instance, the U.S. inflation rate was around 3.4% in April 2024, a notable decrease from its peak but still a factor for consumer budgets. Understanding how these trends affect loan demand will be crucial for the bank to adapt its lending strategies and manage its credit risk effectively.

The economic vitality of Wisconsin, Illinois, and Minnesota is a critical determinant for Associated Banc-Corp, directly influencing its loan portfolio performance and the availability of new business prospects. For instance, Wisconsin's GDP grew by an estimated 2.1% in 2023, and Illinois saw a 1.8% increase, providing a solid base for banking operations.

Looking ahead to 2025, projections indicate a slowdown in overall U.S. economic expansion, with similar moderating trends expected within these core regional markets. This anticipated deceleration means banks like Associated Banc-Corp will need to navigate a potentially less dynamic lending environment.

Key indicators such as unemployment rates and the trajectory of business investment within these states will significantly shape the bank's commercial and consumer loan books. In Q1 2024, Minnesota's unemployment rate stood at a low 2.9%, suggesting a healthy consumer base, though business investment trends will be closely watched for future loan demand.

Real Estate Market Trends

The commercial real estate (CRE) sector has seen a notable slowdown, with loan originations falling considerably from their highest points. For Associated Banc-Corp, while commercial real estate lending saw a minor dip in 2024, a persistent downturn in CRE could negatively affect the bank's asset quality and necessitate higher provisions for credit losses in 2025.

Residential real estate, heavily influenced by fluctuating mortgage rates, also plays a crucial role in shaping overall loan demand for financial institutions like Associated Banc-Corp.

- Commercial Real Estate Originations: Down significantly from peak levels, indicating a challenging market environment.

- Associated Banc-Corp CRE Lending: Decreased slightly in 2024, with potential for further impact on asset quality in 2025.

- Residential Real Estate Impact: Mortgage rate volatility directly influences demand for residential loans.

Competitive Landscape and Market Dynamics

The banking sector is a battleground, with established giants and nimble FinTech disruptors vying for market share. For mid-sized players like Associated Banc-Corp, navigating this intensified competition means a constant focus on agility and customer value.

Associated Banc-Corp, like other regional banks, faces pressure to adjust deposit rates and win over new clientele in a dynamic market. This requires a keen understanding of customer needs and the ability to respond swiftly to evolving market conditions.

The ability to offer compelling products and services, while efficiently managing the cost of funds, is paramount for maintaining and growing market share. For instance, as of Q1 2024, net interest margins for many regional banks have been squeezed by rising deposit costs, emphasizing the need for strategic pricing and operational efficiency.

- Intensified Competition: Traditional banks, credit unions, and a growing number of FinTech companies are all competing for customer deposits and loans.

- FinTech Disruption: Digital-first offerings from FinTechs often provide streamlined user experiences and competitive pricing, challenging incumbent banks.

- Deposit Rate Sensitivity: Mid-sized banks must carefully balance offering attractive deposit rates to retain and attract customers against managing their overall cost of funds.

- Product and Service Innovation: Success hinges on the continuous development and delivery of competitive banking products and digital services.

Economic factors significantly influence Associated Banc-Corp's performance, particularly interest rates and inflation. With the Federal Reserve holding rates steady through early 2025, potential cuts later in the year could compress net interest income as funding costs might not fall as quickly as asset yields. Inflation, while cooling, still affects consumer spending and loan demand, with consumers carrying substantial debt potentially limiting borrowing for items like credit cards and auto loans.

The economic health of Wisconsin, Illinois, and Minnesota, Associated Banc-Corp's core markets, is crucial. While these states showed GDP growth in 2023, projections for 2025 suggest a moderation in economic expansion, which could lead to a less dynamic lending environment. Key indicators like unemployment rates, such as Minnesota's low 2.9% in Q1 2024, offer insights into consumer health, but business investment trends will be closely monitored for loan demand.

The commercial real estate (CRE) sector is experiencing a notable slowdown, with loan originations down from their peaks. This downturn could negatively impact Associated Banc-Corp's asset quality and necessitate higher provisions for credit losses in 2025, especially given the slight dip in CRE lending observed in 2024. Residential real estate, heavily influenced by mortgage rate volatility, also plays a significant role in overall loan demand.

| Economic Factor | 2024 Data/Trend | 2025 Outlook/Projection | Impact on ASBC |

|---|---|---|---|

| Interest Rates | Fed Funds Rate: 5.25%-5.50% (early 2025) | Anticipated cuts later in 2025 | Potential NII compression; pressure on net interest margin (3.15% in Q1 2025) |

| Inflation | U.S. Inflation: ~3.4% (April 2024) | Cooling, but impacts consumer budgets | Reduced consumer spending, lower loan demand (credit cards, auto loans) |

| Regional GDP Growth | Wisconsin: ~2.1% (2023); Illinois: ~1.8% (2023) | Moderating trends expected | Potentially less dynamic lending environment |

| Unemployment Rate (Minnesota) | 2.9% (Q1 2024) | Expected to remain low | Healthy consumer base, but business investment is key for loan demand |

| Commercial Real Estate (CRE) | Originations down significantly; ASBC CRE lending slightly down (2024) | Persistent downturn; potential asset quality concerns | Higher provisions for credit losses; negative impact on asset quality |

Same Document Delivered

Associated Bank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Associated Bank delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations and strategic decisions. Gain immediate access to this insightful report upon completing your purchase.

Sociological factors

Consumers are increasingly favoring digital channels for their banking needs. In 2023, mobile banking usage continued its upward trend, with a significant portion of daily transactions occurring through apps. This shift means banks must prioritize user-friendly online and mobile platforms to remain competitive.

Associated Banc-Corp recognized this trend early, investing heavily in its digital infrastructure. The launch of their updated digital banking platform in 2022 was a key step, aiming to provide a more intuitive and comprehensive experience for customers managing their accounts, making payments, and accessing financial services remotely.

To keep pace with evolving consumer expectations, Associated Bank must continue to innovate its digital offerings. This includes developing personalized financial tools and ensuring a seamless, integrated experience across all touchpoints, from mobile apps to online portals, to cater to the modern, digitally-savvy customer.

Demographic shifts significantly impact Associated Bank's market. For instance, the aging population in Wisconsin, Illinois, and Minnesota may increase demand for retirement planning and wealth management services. Conversely, a growing Gen Z and millennial population, who often prioritize digital banking and socially responsible investments, necessitates tailored product development.

In 2024, the median age in Wisconsin was around 40.2 years, Illinois 38.7 years, and Minnesota 38.5 years, indicating a substantial segment of the population entering or within their prime earning and saving years. This trend underscores the need for Associated Bank to adapt its service portfolio to meet the diverse financial needs across these age demographics.

Public trust is a cornerstone for financial institutions. Younger consumers, especially, are looking for banks that demonstrate a commitment to sustainability and ethical operations, influencing their banking choices. For Associated Banc-Corp, a strong emphasis on responsible business practices, as detailed in their 2023 sustainability report which noted a 15% reduction in Scope 1 and 2 greenhouse gas emissions, directly bolsters its public image and can foster deeper customer loyalty.

Workforce Trends and Talent Acquisition

The banking industry, including Associated Banc-Corp, is navigating a competitive landscape for talent, especially with a strong labor market. This makes attracting and keeping skilled employees a significant hurdle.

Associated Banc-Corp's strategy acknowledges this by investing in its workforce, exemplified by its plan to grow its commercial middle market team. This expansion aims to build stronger client relationships and spur business development.

To secure top talent, banks must embrace evolving work models and provide compelling benefits packages. For instance, in 2024, the U.S. unemployment rate remained low, hovering around 3.7% for much of the year, underscoring the demand for skilled workers across industries.

- Talent Shortage: Banks face difficulties in recruiting and retaining employees, particularly those with specialized financial skills.

- Strategic Investment: Associated Banc-Corp is focusing on talent acquisition, such as expanding its commercial middle market team to drive growth.

- Competitive Landscape: Adapting to flexible work arrangements and offering attractive compensation and benefits are crucial for attracting skilled professionals in 2024-2025.

- Labor Market Dynamics: A persistently tight labor market, with low unemployment rates, intensifies the competition for qualified banking professionals.

Financial Literacy and Advisory Needs

The increasing complexity of financial products, coupled with ongoing economic uncertainties, is fueling a greater demand for financial literacy and advisory services. This trend presents a significant opportunity for Associated Banc-Corp to enhance customer engagement by offering tailored financial guidance and tools, moving beyond simple transactional relationships. For instance, surveys in late 2024 indicated that over 60% of individuals sought external advice for major financial decisions.

By proactively addressing this need, Associated Banc-Corp can foster deeper customer loyalty and trust. This involves equipping customers with the knowledge to navigate their finances effectively, including strategies for debt management and informed investment choices. Financial institutions that prioritize educational resources and personalized advice are better positioned to meet evolving customer expectations in the 2024-2025 period.

- Growing Demand: Over 60% of individuals sought external financial advice for major decisions in late 2024.

- Opportunity for Banks: Associated Banc-Corp can leverage this by offering personalized financial advice and tools.

- Customer Engagement: Building deeper relationships beyond transactional services is key.

- Empowerment: Supporting customers in debt management and informed financial choices is crucial.

Societal expectations are shifting, with a growing emphasis on digital convenience and personalized financial guidance. Consumers, particularly younger demographics, are increasingly seeking institutions that align with their values, prioritizing sustainability and ethical practices. This necessitates that Associated Banc-Corp continues to invest in user-friendly digital platforms and transparent, responsible operations to foster trust and loyalty.

Technological factors

Associated Banc-Corp is making significant strides in its digital banking transformation, pouring resources into enhancing its online and mobile platforms. This focus aims to deliver a superior user experience, a critical factor in today's competitive landscape. For instance, in Q1 2024, Associated Bank reported a 12% increase in digital sales, highlighting customer adoption.

The bank's investment in an omnichannel branch sales platform is designed to bridge the gap between digital convenience and in-person service. This strategy acknowledges that customers expect seamless interactions, whether they are using a mobile app or visiting a physical branch. By Q3 2024, over 60% of new account openings were initiated digitally, underscoring the importance of these channels.

Cybersecurity threats are escalating, with financial institutions like Associated Banc-Corp facing increasingly sophisticated attacks. The cost of data breaches is substantial; for instance, the average cost of a data breach in the financial sector reached $5.90 million in 2023, according to IBM's Cost of a Data Breach Report. Associated Banc-Corp must therefore maintain robust investments in advanced cybersecurity, data protection, and fraud detection to shield customer data and preserve confidence.

A strong cybersecurity framework is evolving into a key competitive advantage. Banks that can demonstrably protect customer information and financial assets are better positioned to attract and retain clients in a digital-first environment. This focus on security is not just a defensive necessity but a proactive strategy for differentiation in the banking sector.

The financial technology (FinTech) sector is rapidly evolving, presenting both challenges and opportunities for established institutions like Associated Banc-Corp. FinTech firms are increasingly offering specialized services, from innovative payment solutions to AI-powered financial advice, directly competing with traditional banking models. For instance, the global FinTech market was valued at approximately $2.4 trillion in 2023 and is projected to reach over $5.5 trillion by 2028, highlighting the significant disruption underway.

Associated Banc-Corp can strategically navigate this landscape by either directly competing with emerging FinTechs or by fostering collaborative partnerships. Engaging with FinTech innovators allows for the integration of cutting-edge solutions, such as real-time payment processing, which saw a 25% increase in adoption in the US during 2023, or AI-driven personalization tools that can enhance customer experience. Such collaborations can not only expand Associated Banc-Corp's service portfolio but also significantly improve operational efficiency.

AI and Automation in Banking Operations

Artificial intelligence (AI) and automation are fundamentally reshaping how banks operate, impacting everything from customer interactions to behind-the-scenes efficiency. Associated Banc-Corp is actively investing in these technologies, with plans to deploy an AI-powered chatbot and investigate AI's potential for advanced fraud detection and the creation of personalized financial management tools. This strategic focus aims to boost operational efficiency, drive down expenses, and elevate the overall customer experience.

The integration of AI and automation offers significant advantages for financial institutions like Associated Bank. These technologies can streamline repetitive tasks, leading to substantial cost savings and allowing human employees to concentrate on more complex, value-added activities. In 2024, the global AI in banking market was valued at approximately $12.5 billion, with projections indicating robust growth. Associated Bank's initiatives align with this trend, seeking to leverage AI for:

- Enhanced Customer Service: AI chatbots can provide instant, 24/7 support for common inquiries, improving response times and customer satisfaction.

- Improved Operational Efficiency: Automation of back-office processes, such as data entry and transaction processing, reduces errors and speeds up workflows.

- Advanced Risk Management: AI algorithms can analyze vast datasets to identify potential fraud patterns and credit risks more effectively than traditional methods.

- Personalized Financial Solutions: AI can help tailor product offerings and financial advice to individual customer needs, fostering deeper engagement.

Data Analytics for Personalized Services and Risk Management

Associated Bank is increasingly leveraging data analytics to understand customer behavior, enabling the delivery of highly personalized financial products and services. This focus is crucial for enhancing risk management strategies.

By analyzing vast amounts of transaction data, the bank can identify patterns that lead to hyper-personalized offers, such as tailored loan products or investment recommendations. For instance, a customer showing consistent savings behavior might be offered specific high-yield savings accounts or investment vehicles.

This data-driven approach also significantly improves creditworthiness assessments. In 2024, financial institutions like Associated Bank are expected to see a continued rise in the use of alternative data sources for credit scoring, potentially expanding access to credit for a broader customer base while mitigating risk.

Furthermore, predictive analytics and advanced fraud detection systems are becoming cornerstones of a comprehensive financial services suite. These technologies help anticipate potential issues, such as loan defaults or fraudulent transactions, allowing for proactive intervention and safeguarding both the bank and its customers.

- Customer Behavior Analysis: Banks are using data to understand individual spending habits and financial goals.

- Personalized Offers: Data allows for tailored product recommendations, increasing customer engagement.

- Creditworthiness Improvement: Analyzing transaction data enhances the accuracy of credit risk assessments.

- Fraud Detection: Predictive analytics helps identify and prevent fraudulent activities in real-time.

Technological advancements are a primary driver for Associated Bank's strategic direction, with significant investments in digital platforms and AI. The bank's Q1 2024 digital sales saw a 12% increase, demonstrating customer adoption of these enhanced services. By Q3 2024, over 60% of new accounts were initiated digitally, underscoring the shift towards online channels.

Associated Bank is navigating the rapidly evolving FinTech landscape, which saw the global market valued at approximately $2.4 trillion in 2023. Collaborations with FinTechs for solutions like real-time payments, which grew 25% in the US in 2023, are key to expanding service offerings and efficiency.

The bank is also integrating AI and automation to boost efficiency and customer experience, aligning with the global AI in banking market, valued at $12.5 billion in 2024. This includes AI chatbots for enhanced customer service and advanced fraud detection systems.

Data analytics are crucial for Associated Bank to understand customer behavior and deliver personalized services, improving creditworthiness assessments. The use of alternative data sources for credit scoring is expected to rise in 2024, expanding credit access.

Legal factors

Associated Banc-Corp navigates a stringent regulatory environment, including federal mandates like Basel III for capital adequacy and liquidity standards. For instance, as of Q1 2024, Associated Bank reported a Common Equity Tier 1 (CET1) ratio of 11.2%, well above the regulatory minimums, demonstrating its compliance efforts.

Adapting to evolving supervisory priorities is crucial. The banking sector anticipates potential shifts in regulatory focus in 2024-2025, possibly emphasizing cybersecurity resilience and climate-related financial risk, requiring proactive adjustments to compliance and risk management strategies.

Associated Banc-Corp operates under stringent consumer protection laws and fair lending regulations, which are critical for maintaining customer trust and avoiding legal penalties. These regulations, such as the Equal Credit Opportunity Act and the Consumer Financial Protection Bureau's mandates, dictate how banks market financial products and extend credit, ensuring no discriminatory practices occur. For instance, in 2023, the CFPB continued to emphasize fair lending enforcement, with significant actions taken against institutions for discriminatory lending patterns, underscoring the importance of robust compliance for banks like Associated Banc-Corp.

Associated Banc-Corp faces a growing landscape of data privacy and security laws, especially with the rise of digital banking. States like California, with its California Privacy Rights Act (CPRA), have significantly updated consumer data protection requirements, impacting how financial institutions collect, use, and store personal information. Compliance with these evolving regulations is paramount to avoid substantial fines, which can reach millions of dollars, and to safeguard customer trust.

The bank must invest in robust cybersecurity measures to protect sensitive financial data from breaches, a critical concern given the increasing sophistication of cyber threats. In 2023, the financial services sector experienced a significant number of data breaches, highlighting the ongoing risks. Maintaining transparency in data handling practices and demonstrating a commitment to security are essential for Associated Banc-Corp to retain its customers and its reputation in the competitive banking environment.

Anti-Money Laundering (AML) and KYC Compliance

Associated Banc-Corp, like all financial institutions, must adhere to rigorous Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. These rules are designed to thwart the flow of illegal funds and ensure financial system integrity. Failure to comply can result in significant penalties and reputational damage.

Maintaining robust AML/KYC programs requires ongoing investment in technology and personnel. For instance, in 2024, financial institutions globally continued to allocate substantial resources to compliance, with spending on RegTech solutions for AML/KYC expected to grow. Associated Banc-Corp likely invests heavily in transaction monitoring systems and employee training to identify and report suspicious activities effectively.

- Regulatory Scrutiny: Banks face intense oversight from bodies like FinCEN, demanding constant vigilance in AML/KYC processes.

- Technological Investment: The adoption of advanced analytics and AI is crucial for efficient detection of illicit financial patterns.

- Operational Costs: Compliance efforts represent a significant operational expense, impacting profitability but essential for risk mitigation.

- Reputational Risk: Non-compliance can lead to severe reputational damage, eroding customer trust and market standing.

Litigation Risks and Legal Disputes

Associated Banc-Corp, like all financial institutions, navigates a landscape fraught with litigation risks. These can stem from a variety of sources, including disputes over loan agreements, alleged breaches of contract, or even customer dissatisfaction leading to legal action. For instance, in the first quarter of 2024, Associated Banc-Corp reported $1.5 million in legal settlements, highlighting the ongoing nature of these potential costs.

To mitigate these challenges, the bank must maintain strong legal and risk management frameworks. Proactive compliance with evolving banking regulations, such as those related to consumer protection and anti-money laundering, is crucial. A robust internal legal team and external counsel are essential to navigate these complexities and minimize financial and reputational damage from any legal disputes that may arise.

The potential for litigation directly impacts a bank's financial health and operational stability. Unfavorable judgments can result in significant financial penalties and increased compliance costs. For example, a major class-action lawsuit filed in late 2023 against a peer institution resulted in a $50 million settlement, underscoring the stakes involved.

- Contractual Disputes: Associated Banc-Corp must manage potential claims arising from loan covenants, service agreements, and other contractual obligations.

- Regulatory Non-Compliance: Adherence to federal and state banking laws, including fair lending practices and data privacy, is paramount to avoid penalties and lawsuits.

- Customer Complaints: Effective complaint resolution processes are vital to prevent customer grievances from escalating into costly legal battles.

- Litigation Reserves: The bank maintains reserves for potential legal losses, a figure that was $25 million at the end of 2023, reflecting ongoing risk assessment.

Associated Banc-Corp operates within a complex web of legal and regulatory frameworks, necessitating constant adaptation and robust compliance. Key areas include stringent capital adequacy requirements, such as Basel III, which the bank demonstrably meets, reporting a Common Equity Tier 1 ratio of 11.2% as of Q1 2024. Furthermore, evolving regulations around cybersecurity and climate-related financial risks are shaping supervisory priorities for 2024-2025, demanding proactive risk management strategies.

Consumer protection laws, including the Equal Credit Opportunity Act and CFPB mandates, are critical for Associated Banc-Corp to maintain customer trust and avoid legal repercussions, especially as the CFPB intensified fair lending enforcement in 2023. Similarly, data privacy laws like California's CPRA are increasingly impacting how financial institutions handle customer information, with non-compliance carrying substantial financial penalties.

The bank also faces significant legal obligations related to Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations, requiring ongoing investment in technology and personnel to combat illicit financial activities. Global spending on RegTech solutions for AML/KYC was projected to grow in 2024, underscoring the industry's commitment to these essential compliance measures.

Associated Banc-Corp actively manages litigation risks, which can arise from contractual disputes, regulatory non-compliance, or customer complaints, as evidenced by $1.5 million in legal settlements reported in Q1 2024. Maintaining strong legal and risk management frameworks, including adequate litigation reserves, such as the $25 million held at the end of 2023, is crucial for mitigating financial and reputational damage.

Environmental factors

Climate-related risks, like more frequent extreme weather or the shift to a low-carbon economy, can directly affect the value of assets backing loans, such as real estate, and the ability of businesses to repay, particularly in sectors like agriculture and energy. For instance, increased flooding in the Midwest could devalue properties held as collateral for mortgages within Associated Bank's portfolio.

The Federal Reserve is actively engaging with financial institutions to build resilience against these climate-related risks, which will likely shape Associated Banc-Corp's credit risk management frameworks and lending strategies going forward. This focus on climate risk assessment, as highlighted by the Fed's ongoing initiatives, means banks must increasingly integrate these considerations into their underwriting and portfolio management processes.

Investors, customers, and other stakeholders are increasingly demanding that companies showcase robust Environmental, Social, and Governance (ESG) performance. This trend is a significant environmental factor influencing business strategy.

Associated Banc-Corp has responded by intensifying its focus on ESG initiatives, including the appointment of a Director of ESG and Sustainability. This strategic move underscores the growing recognition of ESG's impact on reputation, investor relations, and capital attraction, with ESG assets projected to reach $33.9 trillion globally by 2026, according to Bloomberg Intelligence.

Associated Banc-Corp, like other financial institutions, faces growing pressure to reduce its direct environmental impact. This includes actively managing its operational carbon footprint across its extensive branch network and corporate offices.

Implementing energy efficiency measures, such as upgrading to LED lighting and optimizing HVAC systems, can significantly lower Associated Bank's energy consumption. For instance, many companies in the financial sector are targeting a 20-30% reduction in energy use by 2030, a goal Associated Bank could align with to cut operational costs and demonstrate environmental responsibility.

Sustainable Finance Products and Green Lending

The market for sustainable finance is experiencing robust growth, with a notable surge in demand for green lending products. For instance, the global green bond market, a key indicator of sustainable finance activity, reached an estimated $1 trillion in issuance by early 2024, demonstrating a significant appetite for environmentally focused investments.

Associated Banc-Corp has a strategic opportunity to capitalize on this trend by developing and offering specialized financial solutions. These could include green loans for electric vehicle purchases or financing for renewable energy projects, directly addressing growing customer preferences for sustainability. Such initiatives can not only expand the bank's market reach but also reinforce its brand image as an environmentally conscious institution.

- Growing Demand: Consumer and corporate interest in ESG (Environmental, Social, and Governance) factors is driving increased adoption of sustainable financial products.

- Market Expansion: Offering green lending can attract new customer segments and deepen relationships with existing clients who prioritize sustainability.

- Regulatory Tailwinds: Many governments are implementing policies and incentives to encourage green finance, creating a favorable environment for such products.

- Brand Enhancement: Aligning financial offerings with environmental values can significantly boost a bank's reputation and competitive standing.

Reputational Risk from Environmental Impact

Associated Banc-Corp faces reputational risks if it fails to address environmental concerns or engage in unsustainable practices. Such failures can erode customer trust and lead to significant damage to its public image. For instance, a 2024 survey indicated that 68% of consumers consider a company's environmental policies when making purchasing decisions.

Associated Banc-Corp's commitment to environmental sustainability is therefore vital for maintaining a positive brand perception. This commitment, detailed in their annual reports, helps attract and retain customers who actively seek out businesses demonstrating environmental responsibility. In 2024, the banking sector saw a 15% increase in customer preference for institutions with clear ESG (Environmental, Social, and Governance) initiatives.

- Consumer Preference: 68% of consumers in a 2024 survey factored environmental policies into their buying choices.

- Industry Trend: The banking sector experienced a 15% rise in customer preference for institutions with strong ESG commitments during 2024.

- Reputational Impact: Unsustainable practices can directly lead to a loss of customer trust and a tarnished brand image for Associated Banc-Corp.

Associated Bank must navigate increasing regulatory scrutiny and investor demand for robust Environmental, Social, and Governance (ESG) performance, as demonstrated by the projected $33.9 trillion in global ESG assets by 2026. The bank's commitment to sustainability, including appointing a Director of ESG and Sustainability, is crucial for maintaining a positive brand image, as 68% of consumers consider environmental policies in 2024 purchasing decisions. Furthermore, the growing market for sustainable finance, with the green bond market reaching an estimated $1 trillion by early 2024, presents a significant opportunity for Associated Bank to develop green lending products and attract environmentally conscious customers, reflecting a 15% increase in customer preference for ESG-focused institutions in 2024.

| Environmental Factor | Impact on Associated Bank | Supporting Data (2024/2025) |

|---|---|---|

| Climate Risk | Affects asset values (e.g., real estate) and borrower repayment ability. | Increased flooding in Midwest could devalue mortgage collateral. Fed engaging banks on climate risk resilience. |

| ESG Demand | Drives need for sustainable financial products and impacts reputation. | Global ESG assets projected to reach $33.9 trillion by 2026. 68% of consumers consider environmental policies (2024). |

| Operational Footprint | Requires reduction in energy consumption and carbon emissions. | Financial sector targets 20-30% energy reduction by 2030. LED lighting and HVAC upgrades are key strategies. |

| Sustainable Finance Market | Opportunity for growth through green lending and investment. | Green bond market reached ~$1 trillion issuance by early 2024. 15% increase in customer preference for ESG institutions (2024). |

PESTLE Analysis Data Sources

Our Associated Bank PESTLE Analysis is built on a robust foundation of data from official government publications, reputable financial news outlets, and leading economic research firms. We incorporate insights from regulatory bodies, industry-specific reports, and demographic studies to ensure comprehensive coverage.