Associated Bank Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Associated Bank Bundle

Associated Bank navigates a complex banking landscape, where customer loyalty is challenged by readily available alternatives and the threat of new digital entrants looms large. Understanding the intensity of these forces is crucial for any stakeholder looking to grasp the bank's true competitive standing.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Associated Bank’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The primary suppliers for a bank like Associated Banc-Corp are its depositors, who provide the essential capital for lending and daily operations. The ability of these depositors to negotiate terms, or their bargaining power, can be significant, especially for larger clients or during times when interest rates are climbing. These customers have the flexibility to shift their funds to competitors offering more attractive rates or superior services.

Associated Banc-Corp anticipates core customer deposit growth between 4% and 5% for 2025. This projection highlights the bank's strategic emphasis on both attracting new depositors and retaining its existing customer base, underscoring the critical role these suppliers play in the bank's financial health.

Technology providers are a crucial supplier group for banks, especially as digital transformation picks up pace. Banks are leaning heavily on specialized vendors for software, cloud services, and AI. For instance, the global cloud computing market, a key area for banks, was projected to reach over $1 trillion by 2024.

The increasing reliance on these technologies, particularly AI for customer engagement and loan underwriting, gives specialized tech suppliers significant leverage. If their solutions are unique or deeply embedded in a bank's operations, their bargaining power is amplified. The AI market itself is expected to grow substantially, with some estimates suggesting it could reach hundreds of billions by 2025, highlighting the critical nature of these partnerships.

Human capital, particularly skilled professionals in commercial banking, technology, and risk management, acts as a significant supplier for Associated Banc-Corp. The bank's strategic expansion of its commercial team underscores the vital need to attract and retain experienced relationship managers.

A noticeable scarcity of qualified talent in specialized banking areas, such as wealth management, can amplify the bargaining leverage of these employees. For instance, in 2024, the U.S. banking sector continued to face challenges in filling roles requiring deep expertise in areas like cybersecurity and data analytics, driving up compensation expectations for top candidates.

Supplier Power 4

Associated Bank's reliance on wholesale funding sources like the Federal Home Loan Bank (FHLB) and interbank markets positions these entities as significant suppliers. The cost and accessibility of this liquidity are directly tied to broader macroeconomic trends and central bank actions, demonstrating a degree of supplier influence.

In 2024, Associated Banc-Corp experienced financial setbacks due to the prepayment of FHLB advances. This event underscores the potential for suppliers to impact a bank's profitability and operational flexibility when managing these crucial funding relationships.

- Wholesale Funding Sources: FHLB and interbank markets are key suppliers of liquidity for Associated Bank.

- Macroeconomic Influence: Supplier costs and availability are sensitive to economic conditions and monetary policy.

- 2024 FHLB Prepayment Losses: Associated Banc-Corp incurred losses related to FHLB advance prepayments, illustrating supplier-driven financial impacts.

Supplier Power 5

Regulatory bodies act as powerful, albeit non-traditional, suppliers to Associated Bank by granting the essential license to operate and dictating the industry's rules. The increasing complexity and constant evolution of regulations, covering areas like anti-money laundering (AML), counter-financing of terrorism (CFT), artificial intelligence (AI), and cybersecurity, impose substantial operational and compliance burdens. For instance, in 2024, the Financial Crimes Enforcement Network (FinCEN) continued to emphasize robust AML programs, requiring significant investment in technology and personnel.

These evolving mandates necessitate considerable investment in regulatory technology, often referred to as RegTech, to effectively manage and adhere to these intricate and often unpredictable requirements. Banks are compelled to allocate significant capital to systems that ensure compliance, track transactions, and report suspicious activities, directly impacting their cost structures.

- Regulatory Compliance Costs: Banks face escalating costs associated with meeting new regulations, such as those related to data privacy and cybersecurity.

- RegTech Investment: Significant capital is deployed into technology solutions to manage regulatory adherence, impacting operational budgets.

- Operational Impact: Evolving rules on areas like AI in lending and AML/CFT programs directly influence how banks conduct daily operations and manage risk.

Associated Banc-Corp's suppliers, primarily depositors and wholesale funding providers, exert considerable bargaining power. Depositors can shift funds based on interest rates, while wholesale funding costs are tied to market conditions. The bank's 2024 experience with FHLB advance prepayments highlights how supplier actions can directly impact profitability.

| Supplier Group | Bargaining Power Drivers | Impact on Associated Banc-Corp | 2024/2025 Data Point |

|---|---|---|---|

| Depositors | Interest rate sensitivity, service quality | Cost of funds, deposit retention | Projected 4-5% core customer deposit growth for 2025 |

| Wholesale Funding (FHLB, Interbank) | Market liquidity, central bank policy | Cost and availability of capital | FHLB advance prepayment losses in 2024 |

| Technology Providers | Uniqueness of solutions, integration depth | Operational efficiency, cost of technology | Global cloud computing market projected over $1 trillion by 2024 |

| Skilled Human Capital | Talent scarcity, specialized expertise | Compensation costs, talent acquisition/retention | U.S. banking sector talent shortages in cybersecurity/data analytics in 2024 |

What is included in the product

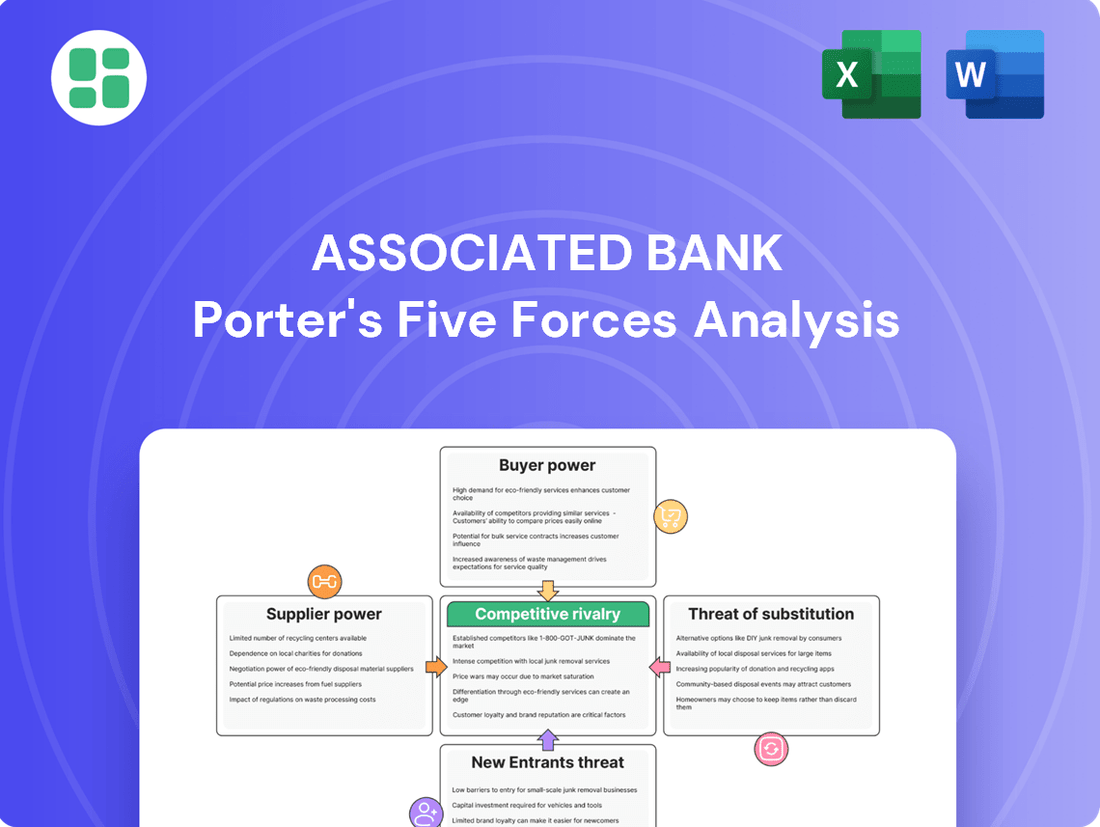

This analysis unpacks the competitive forces impacting Associated Bank, examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the banking sector.

Instantly visualize competitive pressures with a dynamic Porter's Five Forces analysis, allowing Associated Bank to proactively address market threats.

Customers Bargaining Power

The bargaining power of individual retail customers at Associated Bank is a significant factor. With low switching costs and a plethora of banking choices, from established institutions to innovative fintechs, customers hold considerable sway. In 2024, reports indicated that a substantial portion of consumers, often exceeding 40%, consider switching banks for better rates or digital services, underscoring this power.

Customers today expect more than just basic transactions; they seek personalized experiences and user-friendly digital platforms. Associated Banc-Corp’s strategic investments in enhancing its digital offerings and customer service are a direct acknowledgment of this trend. By prioritizing customer satisfaction and digital convenience, the bank aims to mitigate the impact of this customer power.

For Associated Banc-Corp, the bargaining power of customers is particularly strong among small businesses and corporations. These entities, especially those with intricate financial requirements or high transaction volumes, can negotiate terms more effectively due to their need for specialized services like lending, treasury management, and advisory support.

Associated Banc-Corp's strategic focus on commercial and business lending highlights its awareness of this customer segment's significant value and influence. In 2023, Associated Banc-Corp reported total commercial and industrial loans of $20.7 billion, demonstrating a substantial engagement with this powerful customer base.

Customers wield significant power, especially when it comes to basic banking services like savings accounts and loans. Their price sensitivity is often high, meaning they'll readily switch providers if they find better interest rates elsewhere. For instance, in early 2024, the average savings account yield saw considerable fluctuation, prompting many consumers to actively shop for the best returns.

Associated Banc-Corp, as a midsize regional bank, might find it more challenging to dictate deposit rates compared to larger, national institutions with broader funding sources. This competitive landscape, marked by frequent interest rate adjustments, empowers customers to be discerning shoppers, constantly comparing offerings to maximize their earnings and minimize their borrowing costs.

Customer Power 4

The increasing prevalence of digital-first banking and mobile payment solutions has significantly boosted customer power. With over 70% of U.S. banking consumers favoring mobile apps or online banking, customers now expect 24/7 access and instant service, forcing banks like Associated Bank to prioritize digital investments and AI tools to retain them.

This heightened customer control means banks face pressure to offer competitive rates and superior digital experiences. Failure to adapt can lead to customer attrition, as consumers can more easily switch to providers offering greater convenience and better value.

- Digital Dominance: 70% of U.S. banking consumers prefer mobile or online channels.

- Expectation Shift: Customers demand instant, 24/7 access to financial services.

- Competitive Pressure: Banks must invest in digital platforms and AI to meet evolving demands.

- Churn Risk: Inability to meet digital expectations increases customer defection.

Customer Power 5

Customers today have unprecedented access to information, significantly boosting their bargaining power. The internet and burgeoning open banking initiatives allow consumers to easily research and compare financial products and services across numerous institutions. This transparency pressures banks like Associated Bank to offer competitive rates and clear pricing structures. For instance, by mid-2024, comparison sites frequently highlighted average savings account rates, with some online banks offering APYs exceeding 5%, directly influencing customer expectations and choices.

Open banking frameworks are a key driver in this shift, accelerating the secure sharing of financial data. This empowers customers by giving them a clearer view of their financial landscape and the ability to leverage that data to their advantage when negotiating with financial providers. The ease with which customers can switch or threaten to switch providers due to better offers elsewhere intensifies this power.

- Informed Choices: Customers can readily compare fees, interest rates, and service quality from various banks.

- Price Sensitivity: Increased transparency leads to greater price sensitivity among consumers.

- Switching Costs: While historically high, digital platforms and open banking are reducing the perceived cost of switching financial institutions.

- Data Leverage: Customers can use their financial data to negotiate better terms or seek out more personalized offerings.

The bargaining power of customers for Associated Bank is amplified by the ease of switching and the abundance of choices. In 2024, consumer surveys consistently showed that over 40% of individuals considered changing banks for better rates or digital features. This high degree of price sensitivity means customers can readily demand more competitive offerings, particularly for basic services like savings accounts and loans.

| Customer Segment | Bargaining Power Drivers | Associated Bank's Response | 2024 Data Point |

| Retail Customers | Low switching costs, high price sensitivity, demand for digital services | Investing in digital platforms, competitive rates | 40%+ consider switching banks for better offers |

| Small & Medium Businesses | Need for specialized services (lending, treasury), higher transaction volumes | Focus on commercial lending, tailored financial solutions | C&I loans at $20.7 billion in 2023 |

| All Customers | Increased access to information, open banking initiatives | Emphasis on transparency, competitive pricing | 5%+ APY offered by some online banks on savings |

Preview the Actual Deliverable

Associated Bank Porter's Five Forces Analysis

This preview showcases the complete Associated Bank Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the banking industry. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, providing actionable insights for strategic planning. You're looking at the actual document, ensuring transparency and immediate access to valuable market intelligence upon completion of your transaction.

Rivalry Among Competitors

Associated Banc-Corp faces significant competitive rivalry in its core markets of Wisconsin, Illinois, and Minnesota. This rivalry stems from a broad spectrum of financial institutions, from national giants to smaller, community-focused credit unions, all vying for customer relationships and market share. For instance, as of early 2024, the banking landscape in Wisconsin alone features over 200 distinct banking institutions, creating a densely competitive environment.

The banking sector's competitive rivalry is significantly amplified by the ongoing digital transformation and the increasing integration of artificial intelligence. Associated Bank, like its peers, faces pressure as institutions pour resources into technology to elevate customer interactions, optimize internal processes, and deliver tailored financial products. For instance, by the end of 2023, the U.S. banking sector saw significant investments in fintech, with venture capital funding reaching billions, indicating a strong focus on technological advancement across the industry.

Banks that lag in adopting these advanced digital solutions, including AI-driven analytics and personalized customer platforms, risk falling behind. This technological gap can lead to a loss of market share as more agile competitors capture customer loyalty through superior digital experiences and more efficient service delivery. In 2024, many regional banks are prioritizing AI for fraud detection and customer service chatbots, aiming to improve efficiency and customer satisfaction.

Competitive rivalry within the banking sector intensifies as shrinking net interest margins become a significant factor. This compression, largely due to shifts in the interest rate environment, forces banks like Associated Bank to vie more fiercely for lucrative lending opportunities and dependable deposit bases.

Deloitte's projections for 2025 indicate a notable decline in net interest income across the U.S. banking industry, a trend exacerbated by persistently high deposit costs. This environment directly fuels heightened competition as institutions scramble to maintain profitability.

Competitive Rivalry 4

Associated Banc-Corp's strategic shifts, such as a pronounced focus on higher-margin commercial lending and proactive balance sheet repositioning, are clear attempts to carve out a competitive advantage within specific market segments. This strategic maneuvering underscores the intensely dynamic nature of the banking industry, where institutions continuously pursue differentiated growth opportunities to stand out.

The competitive rivalry within the banking sector remains robust, with players like Associated Banc-Corp actively seeking to enhance their market standing. For instance, in the first quarter of 2024, Associated Banc-Corp reported a net interest margin of 3.10%, a figure that reflects their ongoing efforts to optimize profitability amidst competitive pressures.

- Focus on Commercial Lending: Associated Banc-Corp's strategic emphasis on higher-margin commercial lending aims to capture more profitable business, directly challenging competitors in this lucrative space.

- Balance Sheet Repositioning: Efforts to reposition the balance sheet, potentially by adjusting asset and liability mixes, are designed to improve capital efficiency and offer more competitive pricing, thereby intensifying rivalry.

- Differentiated Growth Avenues: The pursuit of unique growth strategies highlights a landscape where simply offering standard banking services is insufficient; banks must innovate to attract and retain customers.

- Intensified Competition: These strategic moves signal that Associated Banc-Corp is actively engaged in a competitive battle, pushing rivals to respond with their own strategic adjustments to maintain market share.

Competitive Rivalry 5

Competitive rivalry within the banking sector, particularly for institutions like Associated Bank, remains intense. While market consolidation can sometimes reduce the sheer number of players, the remaining entities often become larger and more powerful, wielding greater resources and market influence. This dynamic means that even with fewer competitors, the intensity of the rivalry doesn't necessarily diminish; it simply shifts to a higher tier of competition.

The banking industry is currently experiencing significant shifts that directly impact competitive rivalry. We're observing a potential reversal of the long-standing trend of branch consolidation, with some banks reconsidering their physical footprints. Furthermore, increased merger and acquisition (M&A) activity is actively reshaping the competitive landscape. For instance, in 2024, the banking sector continued to see strategic M&A deals aimed at expanding market share and capabilities, directly influencing the competitive intensity faced by all participants.

- Market Consolidation Impact: Larger, consolidated banks possess greater financial muscle and broader service offerings, intensifying competition for regional players.

- M&A Activity: Ongoing mergers and acquisitions in 2024 are creating new competitive dynamics and potentially larger, more dominant rivals.

- Branch Strategy Shifts: Re-evaluations of branch consolidation indicate a strategic response to changing market conditions and competitive pressures.

- Resource Disparity: The ability of larger, consolidated banks to invest more heavily in technology and marketing creates a significant resource advantage.

The competitive rivalry for Associated Bank is fierce, driven by a crowded market of national banks, regional players, and credit unions across Wisconsin, Illinois, and Minnesota. For example, in early 2024, Wisconsin alone hosted over 200 banking institutions, creating a highly competitive environment. This rivalry is further intensified by digital transformation, with billions invested in fintech by the end of 2023, pushing banks to adopt AI and advanced digital solutions to retain customers and improve efficiency.

| Metric | Associated Bank (Q1 2024) | Industry Trend (2024) |

|---|---|---|

| Net Interest Margin | 3.10% | Declining due to high deposit costs |

| Digital Investment Focus | AI for fraud detection, chatbots | Billions invested in fintech |

| Number of Competitors (WI) | >200 | High density |

SSubstitutes Threaten

Fintech companies present a substantial threat of substitution for Associated Bank. These firms offer specialized financial services, such as mobile payment apps, peer-to-peer lending platforms, and digital wallets, which directly bypass traditional banking channels. For instance, the global digital payments market was valued at over $2 trillion in 2023 and is projected to grow significantly, indicating a strong shift towards these alternative solutions.

Credit unions pose a significant threat as substitutes for Associated Bank. These member-owned institutions often provide competitive interest rates on loans and deposits, coupled with a personalized, community-centric service model that appeals to a segment of the banking public. For instance, in 2023, credit unions nationally reported an average interest rate of 3.75% on savings accounts, often higher than comparable offerings from larger banks.

The threat of substitutes for Associated Bank is significant, particularly from non-bank lenders and online platforms. These entities offer alternatives for personal, small business, and mortgage loans, often boasting quicker approvals and more adaptable terms than traditional banks.

For instance, in 2024, the online lending market continued its robust growth, with fintech companies capturing an increasing share of loan origination. This trend directly substitutes core banking services, forcing established institutions like Associated Bank to innovate and compete on speed and customer experience.

4

Investment firms and robo-advisors present a significant threat of substitution for traditional banking services, particularly in wealth management and financial advisory. These digital platforms often boast lower fee structures and automated investment advice, making them attractive alternatives for a wide spectrum of investors seeking cost-effective solutions. For instance, the robo-advisor market saw substantial growth, with assets under management projected to reach over $3 trillion globally by 2025, indicating a strong consumer shift towards these alternatives.

The appeal of these substitutes lies in their accessibility and efficiency. They can offer personalized investment portfolios with minimal human intervention, catering to individuals who may find traditional advisory services too expensive or complex. This trend is further amplified by the increasing digital literacy of consumers and the demand for convenient, on-demand financial solutions.

Associated Bank, like other traditional financial institutions, faces the challenge of competing with these agile, technology-driven substitutes. The ability of these platforms to rapidly adapt to market changes and offer tailored digital experiences puts pressure on incumbent banks to innovate their own service offerings and pricing models to retain clients.

Key competitive factors from substitute providers include:

- Lower Management Fees: Robo-advisors typically charge annual management fees ranging from 0.25% to 0.50%, significantly less than the 1% or more often charged by human advisors.

- Automated Portfolio Management: Algorithms provide diversified portfolios based on user risk tolerance and financial goals, offering a hands-off investment approach.

- 24/7 Accessibility: Clients can access their accounts, make adjustments, and receive information anytime through online portals and mobile apps.

- Broad Investor Appeal: These services are accessible to individuals with smaller investment amounts, democratizing wealth management beyond high-net-worth individuals.

5

Emerging technologies pose a significant threat of substitution for traditional banking services. For instance, blockchain technology and the development of Central Bank Digital Currencies (CBDCs) are poised to reshape payment systems. These innovations could offer more efficient and transparent alternatives to current financial transaction methods, potentially bypassing established banking channels.

While the full impact is still unfolding, these digital advancements represent a growing long-term substitution threat. For example, by the end of 2023, the global digital payments market was valued at over $2 trillion, with projections indicating continued robust growth, highlighting the increasing adoption of non-traditional payment solutions.

- Blockchain Technology: Offers decentralized and immutable transaction records, potentially reducing reliance on intermediaries for certain financial activities.

- Central Bank Digital Currencies (CBDCs): Could provide a direct digital alternative to physical cash and existing payment rails, potentially impacting deposit bases and transaction volumes for commercial banks.

- Fintech Innovations: Companies are developing specialized financial solutions, from peer-to-peer lending to digital wallets, that directly compete with core banking functions.

- Cross-border Payment Solutions: New platforms are emerging that aim to make international money transfers faster and cheaper than traditional bank wire services, a key revenue stream for many banks.

The threat of substitutes for Associated Bank is multifaceted, encompassing digital payment platforms, credit unions, and non-bank lenders. Fintech innovations, in particular, are rapidly carving out market share by offering specialized, often more convenient, financial services. For example, the global digital payments market exceeded $2 trillion in 2023, demonstrating a clear consumer preference for alternatives to traditional banking for transactions.

Credit unions also present a strong substitute, offering competitive rates and personalized service, which attracted a significant customer base. In 2023, credit unions reported higher average savings account interest rates compared to many traditional banks. Furthermore, online lenders and investment firms, including robo-advisors, provide efficient and cost-effective alternatives for borrowing and wealth management, with robo-advisor assets under management projected to surpass $3 trillion globally by 2025.

| Substitute Type | Key Offerings | Competitive Advantage | 2023/2024 Data Point |

| Fintech Payment Platforms | Mobile payments, digital wallets | Convenience, speed | Global digital payments market > $2 trillion (2023) |

| Credit Unions | Loans, deposits, personalized service | Competitive rates, community focus | Average savings rate ~3.75% (2023) |

| Online Lenders | Personal, business, mortgage loans | Faster approvals, flexible terms | Continued robust growth in online lending market (2024) |

| Robo-Advisors | Automated investment management | Lower fees, accessibility | AUM projected > $3 trillion globally by 2025 |

Entrants Threaten

The threat of new entrants for Associated Bank is considerably low due to the immense regulatory hurdles in the banking sector. Obtaining the necessary licenses, maintaining substantial capital reserves, and adhering to stringent compliance standards like Anti-Money Laundering (AML), Counter-Financing of Terrorism (CFT), and data privacy laws demand significant investment and expertise, effectively deterring most potential new players.

The threat of new entrants for Associated Bank is moderate, primarily due to high capital requirements. Launching a full-service bank necessitates substantial investment in physical branches, advanced technology, regulatory compliance, and skilled personnel. Associated Banc-Corp's substantial asset base of around $44 billion in 2024 underscores the significant financial scale needed to compete effectively in this sector.

The threat of new entrants for Associated Bank is moderate, largely due to the significant barriers to entry in the banking sector. Established institutions like Associated Banc-Corp have cultivated decades of brand loyalty and customer trust, making it challenging for newcomers to attract a substantial customer base. Customers often prioritize security and reliability, which are typically associated with well-established banks.

4

The threat of new entrants for Associated Bank is amplified by the rapid expansion of fintechs and neobanks. While not always traditional banks, these digital-first entities are carving out specific financial service niches. Their ability to scale quickly through technology and a focus on customer experience poses a significant challenge.

These new players often operate with leaner cost structures, allowing them to offer competitive pricing and innovative products. For instance, by mid-2024, several neobanks reported customer growth exceeding 50% year-over-year, demonstrating their rapid market penetration in areas like digital payments and specialized lending.

Associated Bank must contend with the agility of these entrants who can adapt to market changes faster. Consider these points:

- Fintechs often target underserved segments with tailored digital solutions.

- Neobanks can attract customers with user-friendly interfaces and lower fees.

- The regulatory landscape is evolving, sometimes creating opportunities for less burdened new entrants.

- Technological advancements lower barriers to entry in areas like payments and wealth management.

5

The threat of new entrants for Associated Bank is moderate. While the banking sector is heavily regulated, requiring significant capital and compliance hurdles, new digital-first banks and fintech companies can emerge with lower overheads.

However, Associated Bank benefits from established customer loyalty and a broad distribution network. Access to a broad distribution network, including physical branches and extensive ATM networks, acts as a significant barrier. While digital channels are growing, many customers still value physical presence for complex transactions or personalized advice. Associated Banc-Corp serves over 100 communities with nearly 200 banking locations, a substantial physical footprint that new entrants would struggle to replicate quickly.

- Established Physical Presence: Associated Bank operates nearly 200 banking locations across over 100 communities, providing a significant advantage over digital-only competitors.

- Customer Trust and Relationships: Long-standing customer relationships and brand recognition are difficult for new entrants to overcome.

- Regulatory Hurdles: The stringent regulatory environment for banking necessitates substantial capital and compliance expertise, deterring many potential new players.

- Digital Competition: However, agile fintechs and neobanks can enter with lower cost structures and innovative digital offerings, posing a threat.

The threat of new entrants for Associated Bank is moderate. While traditional banking faces high capital and regulatory barriers, fintechs and neobanks can disrupt by offering specialized digital services with lower overheads.

Associated Banc-Corp's substantial physical presence, with nearly 200 locations in over 100 communities as of 2024, provides a significant advantage against digital-only newcomers. This established network, coupled with decades of customer trust, makes it challenging for new players to gain significant market share quickly.

| Factor | Impact on Associated Bank | New Entrant Challenge |

|---|---|---|

| Regulatory Hurdles | High Barrier | Significant Investment & Expertise Required |

| Capital Requirements | Substantial (e.g., $44B assets in 2024) | High Initial Funding Needs |

| Brand Loyalty & Trust | Established Advantage | Difficult to Replicate |

| Physical Distribution Network | Nearly 200 Branches | Costly and Time-Consuming to Build |

| Fintech/Neobank Agility | Potential Disruption | Lower Overheads, Innovative Digital Offerings |

Porter's Five Forces Analysis Data Sources

Our Associated Bank Porter's Five Forces analysis is built upon a foundation of comprehensive data, including publicly available financial statements, industry-specific market research reports, and regulatory filings from banking authorities. This ensures a thorough understanding of the competitive landscape and strategic positioning.