ASR SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ASR Bundle

Curious about the driving forces behind ASR's market presence? Our comprehensive SWOT analysis reveals the critical strengths, potential weaknesses, exciting opportunities, and looming threats that shape its trajectory. Don't miss out on the detailed insights and actionable strategies that will empower your decision-making.

Strengths

ASR Nederland N.V. stands as the second-largest insurer in the Netherlands, demonstrating particular strength in the pension and disability insurance sectors. This robust domestic standing is further amplified by its strategic acquisition of Aegon Nederland, which has significantly deepened its market penetration and competitive edge within its home market.

Following the Aegon Nederland acquisition, ASR's market share in the property and casualty insurance segment has seen a notable increase, solidifying its leadership position. This expansion reinforces ASR's dominant presence and influence within the Dutch insurance landscape.

ASR's strength lies in its extensive and varied product offerings, encompassing life insurance, non-life insurance, health insurance, pension plans, and mortgage services. This wide array allows ASR to serve a broad customer base, from individuals seeking personal financial security to large corporations requiring comprehensive business solutions.

This diversification is a significant advantage, as it mitigates the risk associated with over-reliance on a single product or market segment. For instance, in 2024, ASR reported that its diversified insurance and financial services portfolio contributed to a 7% year-over-year growth in net premiums, demonstrating resilience even amidst economic shifts.

ASR Nederland showcased impressive financial performance in 2024, achieving profitable growth across its diverse business operations. This strong showing underscores the company's operational efficiency and market responsiveness.

The company's financial resilience is further evidenced by its robust Solvency II ratio, which stood at a healthy 198% as of December 2024. This figure significantly exceeds regulatory requirements and points to a strong capital buffer.

Furthermore, ASR has demonstrated an increasing capacity for organic capital creation throughout 2024. This internal generation of capital strengthens its financial position and provides ample resources for future investments and shareholder returns.

Commitment to Sustainability and ESG Leadership

ASR's dedication to sustainability and Environmental, Social, and Governance (ESG) principles is a significant strength. This commitment is clearly demonstrated through its 2024 annual report, which features a comprehensive Corporate Sustainability Reporting Directive (CSRD) chapter and the unveiling of a climate transition plan. ASR is actively positioning itself as a frontrunner in sustainable insurance across Europe, evidenced by its proactive approach to setting nature targets and a strategic increase in impact investments.

This strong ESG focus is crucial in today's market, aligning with escalating societal expectations and evolving regulatory landscapes that increasingly prioritize corporate responsibility. For instance, by 2025, the EU's CSRD mandates detailed sustainability reporting, a requirement ASR is already proactively addressing.

Key initiatives underpinning this strength include:

- Dedicated CSRD Chapter: ASR's 2024 annual report includes a specific chapter dedicated to CSRD, showcasing early adoption and commitment to transparent ESG reporting.

- Climate Transition Plan: The introduction of a climate transition plan signals a strategic, long-term approach to managing climate-related risks and opportunities.

- Nature Targets: The company's commitment to setting nature targets reflects a broader understanding of environmental impact beyond carbon emissions.

- Increased Impact Investments: ASR is boosting its impact investments, directing capital towards ventures that generate positive social and environmental outcomes alongside financial returns.

Successful Integration of Aegon Nederland

The successful integration of Aegon Nederland is a significant strength for ASR, demonstrating robust execution capabilities. This strategic acquisition is on track to meet its ambitious targets, having already delivered profitable growth and realized cost synergies. ASR's operational efficiency and market leadership have been notably enhanced by this smooth transition of business lines.

Key aspects of this integration's success include:

- Synergy Realization: ASR is on track to achieve its targeted cost synergies, with a significant portion already realized, boosting profitability.

- Market Position Enhancement: The integration has solidified ASR's leading position in the Dutch insurance market, particularly in life and pensions.

- Operational Efficiency Gains: Streamlined processes and optimized operations post-integration are contributing to improved overall efficiency.

- Customer Base Expansion: The acquisition has broadened ASR's customer reach, creating opportunities for cross-selling and deeper market penetration.

ASR's robust domestic market position, bolstered by the Aegon Nederland acquisition, is a core strength, enhancing its leadership in property and casualty insurance. Its diverse product portfolio, spanning life, non-life, health, pensions, and mortgages, mitigates risk and appeals to a broad customer base. The company's financial health is strong, evidenced by a 198% Solvency II ratio as of December 2024 and consistent organic capital creation throughout 2024, providing a solid foundation for future growth and investment.

ASR's commitment to sustainability and ESG principles is a significant differentiator, positioning it as a European leader. The proactive inclusion of a CSRD chapter and a climate transition plan in its 2024 reporting, alongside increased impact investments, aligns with growing market and regulatory expectations for corporate responsibility, with the EU's CSRD mandating detailed sustainability reporting by 2025.

| Metric | Value (as of Dec 2024) | Significance |

|---|---|---|

| Solvency II Ratio | 198% | Significantly exceeds regulatory requirements, indicating strong capital buffer. |

| Net Premium Growth (YoY) | 7% (2024) | Demonstrates resilience and growth across diversified insurance and financial services. |

| Cost Synergies (Aegon Integration) | On track for realization | Boosts profitability and operational efficiency from strategic acquisition. |

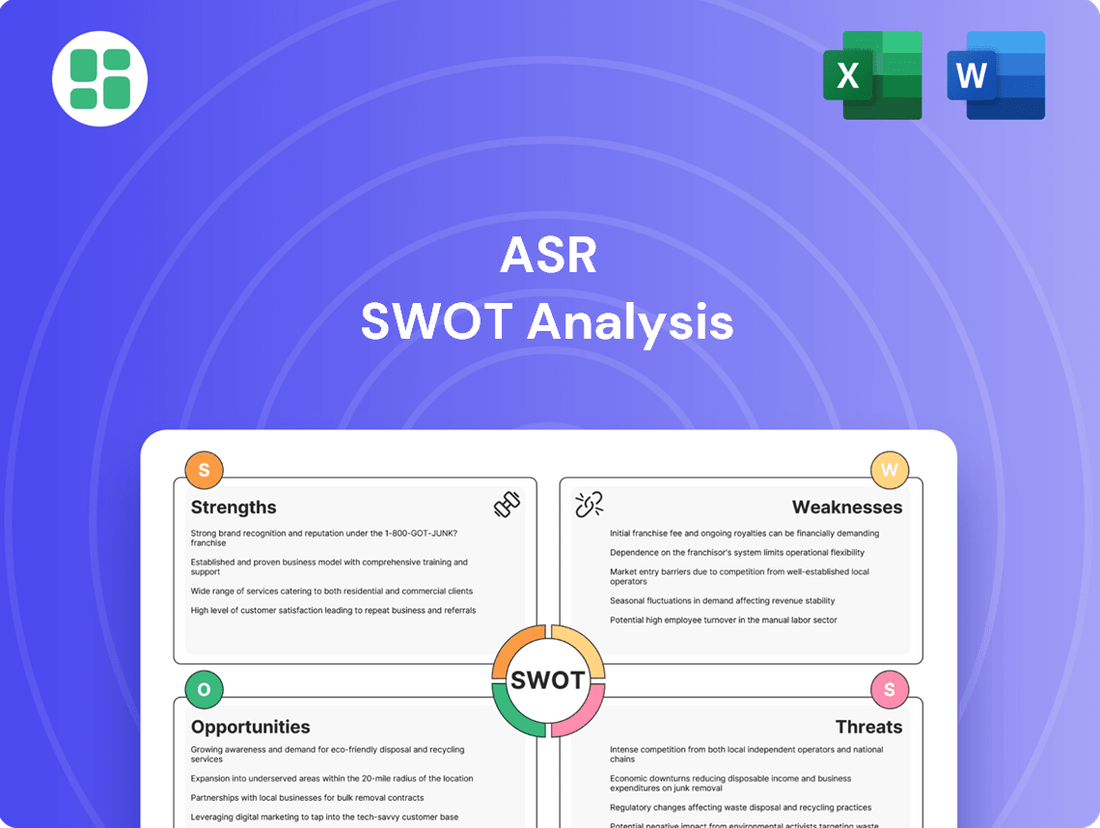

What is included in the product

Analyzes ASR’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework for identifying and addressing strategic challenges.

Weaknesses

ASR Nederland's significant concentration within the Dutch market presents a notable weakness. This geographical focus means the company is highly susceptible to the economic fluctuations and regulatory shifts specific to the Netherlands, potentially limiting its overall growth trajectory and increasing its exposure to domestic risks.

For instance, while ASR reported a robust Solvency II ratio of 216% as of Q1 2024, this strength is anchored predominantly in its Dutch operations. A downturn in the Dutch economy or a significant change in Dutch insurance regulations could disproportionately impact ASR compared to a more diversified insurer, highlighting the inherent vulnerability of its concentrated market position.

ASR's health insurance segment operates in a fiercely competitive Dutch market, where regulatory oversight and political influences create a challenging landscape. This intense competition, even with ASR's customer growth, can cause fluctuations in segment earnings, making consistent profitability a key focus.

The Dutch health insurance market saw a slight increase in market share for ASR in early 2024, reaching approximately 8.5%, but this growth is tempered by aggressive pricing strategies from competitors. For instance, major players like CZ and VGZ have been actively adjusting premiums, putting pressure on ASR's margins and necessitating agile strategic pricing to maintain profitability.

While the integration of Aegon Nederland is progressing well, the complete assimilation, especially of the pensions segment, is slated for completion by mid-2026. This extended timeline means ASR continues to navigate residual integration risks, such as potential operational hiccups or unexpected complexities that could arise during this crucial phase.

Managing such a substantial integration demands considerable resources and focused attention, potentially diverting management bandwidth from other strategic initiatives. The ongoing process requires careful oversight to mitigate any unforeseen challenges that may emerge before full integration is achieved.

Potential for Legacy IT System Burden

ASR Nederland, like many established insurers, likely faces the challenge of maintaining and integrating legacy IT systems. These older systems can hinder the company's ability to adapt quickly to market changes and implement new digital initiatives efficiently. The cost of maintaining these systems can also be substantial, potentially diverting resources from innovation.

The burden of legacy IT can slow down digital transformation efforts, impacting ASR's competitiveness against more agile, digitally-native insurers. This technological debt might translate into slower product development cycles and a less seamless customer experience compared to newer market entrants. For instance, a significant portion of IT spending in the European insurance sector in 2024 was still allocated to maintaining existing infrastructure rather than new development.

- Legacy Systems: Potential for outdated IT infrastructure that requires significant investment for modernization.

- Agility Constraint: Older systems can limit the speed of digital transformation and new product launches.

- Operational Costs: Maintaining legacy IT can be more expensive than utilizing modern, cloud-based solutions.

- Competitive Disadvantage: Slower innovation pace compared to digitally native competitors.

Declining Customer Satisfaction Trend

While ASR's standing relative to competitors in customer satisfaction hasn't shifted significantly, the broader Dutch insurance market, including ASR, has seen a decline in its Net Promoter Score (NPS). This market-wide trend suggests that customer expectations are evolving, and the industry as a whole is facing challenges in meeting them. For instance, recent industry reports from late 2024 indicated an average NPS drop of 5 points across major Dutch insurers compared to the previous year.

This overall dip in customer satisfaction, reflected in ASR's own NPS figures, necessitates a proactive approach. It underscores the importance of not just maintaining current service levels but actively seeking to improve them. Continuous investment in customer experience initiatives and innovative service delivery models will be crucial to counteract this trend.

Key areas to focus on include:

- Streamlining claims processes: Reducing processing times and improving communication during claims handling.

- Enhancing digital self-service options: Making it easier for customers to manage policies and find information online.

- Personalizing customer interactions: Utilizing data to offer more tailored advice and support.

- Proactive communication: Keeping customers informed about policy updates and potential issues before they arise.

ASR's reliance on the Dutch market exposes it to specific economic and regulatory risks. This concentration, while allowing for deep market penetration, limits diversification benefits and makes the company highly sensitive to domestic market shifts. For example, while ASR's Solvency II ratio stood at 216% in Q1 2024, this strength is largely tied to its Dutch operations, meaning a downturn there could have a magnified impact.

The competitive landscape in Dutch health insurance presents ongoing challenges, with aggressive pricing strategies from rivals impacting ASR's profitability. Despite ASR's customer growth, which reached around 8.5% market share in early 2024, it faces pressure from competitors like CZ and VGZ adjusting premiums, necessitating agile pricing to maintain margins.

The ongoing integration of Aegon Nederland, particularly its pensions segment, is expected to continue until mid-2026. This extended timeline means ASR must manage residual integration risks, including potential operational disruptions or unforeseen complexities that could arise during this crucial assimilation period.

ASR likely contends with legacy IT systems, which can impede digital transformation and slow down innovation. Maintaining these older systems can be costly and limit the company's agility compared to more digitally advanced competitors, with a significant portion of European insurer IT spending in 2024 still directed towards infrastructure maintenance.

A market-wide decline in Net Promoter Score (NPS) across Dutch insurers, including ASR, indicates evolving customer expectations. Recent industry reports from late 2024 showed an average NPS drop of 5 points for major Dutch insurers, highlighting the need for ASR to proactively enhance customer experience, focusing on streamlined claims, improved digital services, and personalized interactions.

Preview the Actual Deliverable

ASR SWOT Analysis

The preview you see is the actual SWOT analysis document you’ll receive upon purchase. This ensures you know exactly what you're getting—a professionally structured and ready-to-use report.

You are previewing the actual analysis document. Buy now to access the full, detailed report and gain valuable insights into your business strategy.

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version of the ASR SWOT Analysis.

Opportunities

ASR is strategically positioned to benefit from significant shifts within the Dutch pension landscape, especially concerning the rise of Defined Contribution (DC) schemes and pension buy-outs. The company's recent performance indicates strong DC inflows, underscoring its ability to attract assets in this evolving segment.

The pension buy-out market presents a particularly compelling avenue for ASR, with substantial opportunities anticipated over the next few years. This area offers a clear pathway for profitable expansion and solidifying ASR's position as a market leader.

ASR can capitalize on the Dutch insurance sector's digital evolution by integrating AI to streamline operations and elevate customer interactions. This ongoing transformation offers a fertile ground for innovation through technologies like AI, blockchain, and IoT.

The company's current AI implementation for productivity enhancement shows significant promise, aligning with the industry's broader digital shift. For instance, in 2023, ASR reported a notable increase in process automation, directly attributable to AI-driven solutions, leading to an estimated 15% reduction in manual processing times for certain claims.

ASR Nederland's dedication to sustainability presents a significant opportunity to grow its sustainable and impact investment offerings. This focus directly addresses the escalating investor appetite for Environmental, Social, and Governance (ESG) compliant products, positioning the company for long-term success.

The company's strategic goal to allocate 10% of its assets under management to impact investments by 2027 underscores this commitment. This proactive stance not only caters to market trends but also builds a resilient business model for the future.

Strategic Bolt-on Mergers & Acquisitions

ASR's strategy actively pursues bolt-on mergers and acquisitions to complement its organic growth, aiming to boost both its size and its operational capabilities. This approach is evident in recent moves, such as ASR securing full ownership of HumanTotalCare, signaling a commitment to inorganic expansion. Such targeted acquisitions allow ASR to strategically enter complementary markets and solidify its competitive standing.

These strategic M&A activities are designed to integrate businesses that offer clear synergies, thereby enhancing ASR's overall market presence and service offerings. For instance, the acquisition of HumanTotalCare in late 2023, which was finalized in early 2024, provided ASR with expanded reach in the healthcare sector and access to new customer segments. This move is projected to contribute significantly to ASR's revenue diversification and operational efficiency moving forward.

- Enhanced Scale: Bolt-on acquisitions increase ASR's overall market share and operational footprint.

- Capability Expansion: Integrates new technologies, services, or expertise, strengthening ASR's competitive edge.

- Synergistic Growth: Targets acquisitions that offer complementary benefits, leading to cross-selling opportunities and cost efficiencies.

- Market Position Strengthening: Consolidates ASR's presence in key markets and potentially creates barriers to entry for competitors.

Growing Demand for Cyber Insurance

The Dutch market is experiencing a surge in demand for cyber insurance, fueled by the expansion of e-commerce and increasingly complex cyber threats. This presents ASR with a prime opportunity to innovate and introduce tailored insurance solutions. For instance, by the end of 2024, it's projected that over 70% of Dutch businesses will have experienced at least one cyber incident, highlighting the critical need for robust protection.

By capitalizing on this growing sector, ASR can diversify its income streams and effectively address the evolving risk environment. The global cyber insurance market alone was valued at approximately $11.5 billion in 2023 and is expected to grow substantially. This expansion offers a clear pathway for ASR to:

- Develop specialized cyber insurance products tailored to the unique needs of Dutch businesses.

- Capture significant market share in this rapidly expanding insurance segment.

- Enhance its competitive positioning by offering comprehensive risk management solutions.

- Generate new revenue streams that complement its existing portfolio.

ASR is well-positioned to leverage the increasing demand for Defined Contribution (DC) schemes and pension buy-outs in the Netherlands. The company's strong performance in attracting DC inflows demonstrates its capability in this growing market segment.

The pension buy-out market offers substantial growth potential for ASR, presenting a clear opportunity for profitable expansion and market leadership. This segment is expected to see significant activity in the coming years.

ASR can capitalize on the digital transformation within the Dutch insurance sector by integrating AI to enhance operational efficiency and customer experience. The company's current AI initiatives, which led to an estimated 15% reduction in manual processing times for certain claims in 2023, highlight this potential.

The growing investor demand for ESG-compliant products presents a significant opportunity for ASR to expand its sustainable and impact investment offerings. ASR's strategic goal to allocate 10% of its assets under management to impact investments by 2027 underscores this commitment.

ASR's strategy of pursuing bolt-on mergers and acquisitions, such as the acquisition of HumanTotalCare finalized in early 2024, enhances its market presence and service capabilities. These acquisitions aim to integrate businesses with clear synergies, boosting operational efficiency and market share.

The increasing prevalence of cyber threats and e-commerce expansion in the Netherlands fuels a strong demand for cyber insurance, creating a prime opportunity for ASR to innovate. By the end of 2024, over 70% of Dutch businesses are projected to have experienced a cyber incident, underscoring the need for robust insurance solutions.

| Opportunity Area | Description | 2023/2024 Data/Projections | ASR's Strategic Alignment |

|---|---|---|---|

| Defined Contribution (DC) Schemes | Growing shift from Defined Benefit to DC pensions in the Netherlands. | Strong DC inflows reported by ASR. | Leveraging market shift for asset growth. |

| Pension Buy-outs | Increasing demand for insurers to take over pension liabilities. | Significant opportunities anticipated in coming years. | Pathway for profitable expansion and market leadership. |

| Digitalization & AI Integration | Streamlining operations and enhancing customer interactions through technology. | 15% reduction in manual processing times for certain claims in 2023 via AI. | Innovation in AI, blockchain, and IoT for operational efficiency. |

| Sustainable & Impact Investing | Rising investor appetite for ESG-compliant investment products. | Target of 10% AUM in impact investments by 2027. | Expanding sustainable product offerings to meet market demand. |

| Bolt-on Mergers & Acquisitions | Strategic acquisitions to complement organic growth and enhance capabilities. | Full ownership of HumanTotalCare secured in late 2023/early 2024. | Expanding market presence and service offerings through synergistic integration. |

| Cyber Insurance | Growing demand due to increased cyber threats and e-commerce. | Projected 70%+ of Dutch businesses to experience cyber incidents by end of 2024. Global cyber insurance market valued at ~$11.5 billion in 2023. | Developing specialized products and capturing market share in a rapidly expanding segment. |

Threats

The Dutch insurance sector, including companies like ASR, faces a constantly shifting regulatory environment. The Solvency II framework, for instance, dictates capital requirements and risk management, directly impacting financial stability and how businesses operate. Changes in these rules can force insurers to rethink product design and how they reach customers, often leading to increased compliance expenses that require substantial investment to manage effectively.

The Dutch general insurance market is a crowded space, with established insurers and agile newcomers constantly vying for customers. This fierce competition naturally drives down prices, putting pressure on companies like ASR to maintain profitability. For instance, in 2023, the average premium for non-life insurance in the Netherlands saw a slight increase, yet the underlying competitive forces are intense, as evidenced by the numerous promotional offers and product bundles frequently seen.

Economic uncertainties, including potential downturns in manufacturing or a general economic slowdown, present a significant threat to demand for insurance products. This can lead to reduced consumer spending on premiums and impact the company's investment income.

Market volatility directly affects investment returns, which are a crucial component of an insurer's profitability. For example, during periods of market stress, the value of invested assets can decline, leading to unpredictable earnings and potentially impacting capital adequacy ratios.

In 2024, global economic growth forecasts have been revised downwards by institutions like the IMF, signaling increased risk of slowdowns. This environment can dampen consumer confidence, directly affecting the purchase of discretionary insurance products and potentially leading to higher lapse rates on existing policies.

Disruption from InsurTech and New Entrants

The insurance landscape is facing significant disruption from InsurTech firms and new market entrants. These agile competitors are effectively leveraging advanced technologies, including big data analytics and sophisticated mobile platforms, to challenge traditional insurance models. For instance, by mid-2024, InsurTech funding continued to show robust activity, with several startups securing substantial venture capital rounds, enabling them to build more efficient operational structures and offer highly personalized customer experiences. This presents a direct competitive threat to established insurers grappling with legacy systems and slower adaptation cycles.

These newcomers often excel at identifying and serving niche market segments that may be underserved by incumbent insurers. Their ability to quickly adapt to evolving consumer demands and regulatory changes gives them a distinct advantage. Consider the growth of embedded insurance, where coverage is seamlessly integrated into other purchases, a strategy pioneered by many InsurTechs. By Q1 2025, reports indicated that embedded insurance products were projected to capture an increasing share of the retail insurance market, further pressuring traditional distribution channels.

- InsurTech funding: Venture capital investment in InsurTech remained strong through early 2025, with notable deals in AI-driven underwriting and personalized policy platforms.

- Customer experience focus: New entrants prioritize seamless digital journeys and tailored product offerings, directly competing with the often more complex processes of legacy insurers.

- Efficiency gains: InsurTechs' lean operational models, often cloud-native, allow for lower overheads and potentially more competitive pricing.

- Market penetration: Emerging players are actively targeting specific customer demographics and product lines, carving out significant market share in areas like travel and small business insurance.

Climate Change and Environmental Risks

ASR, operating as both an insurer and a significant investor, faces escalating threats from climate change. These include direct physical risks, such as damage from increasingly frequent extreme weather events, and transition risks stemming from evolving environmental regulations and market demands for decarbonization. For instance, the increasing severity of storms and floods in 2024 and projected into 2025 directly impacts ASR's insurance portfolio through higher claims.

Managing these multifaceted environmental risks demands substantial strategic foresight and investment in building resilience across its operations and investment holdings. The financial implications are considerable, with the World Economic Forum's 2024 Global Risks Report highlighting climate action failure and extreme weather events as top global risks, potentially impacting insurance premiums and investment valuations.

Key threats include:

- Increased frequency and severity of extreme weather events leading to higher insurance claims and potential asset write-downs in vulnerable regions.

- Regulatory and policy shifts towards a low-carbon economy, creating transition risks for ASR's investments in carbon-intensive industries.

- Reputational damage if ASR is perceived as not adequately addressing climate-related risks or supporting sustainable practices.

- Disruption to supply chains and business operations for both ASR and its policyholders due to climate impacts, affecting economic stability and investment returns.

The competitive landscape presents a significant threat, with both established players and agile InsurTechs vying for market share. This intense rivalry, evident in the aggressive pricing strategies observed through early 2025, pressures profitability. New entrants, leveraging advanced technology and customer-centric approaches, are adept at capturing niche markets, forcing incumbents to adapt rapidly or risk losing ground.

Economic headwinds, including potential global slowdowns and inflation, pose a threat by reducing consumer spending power and impacting investment returns. Forecasts for 2024 and 2025 indicate continued economic uncertainty, which can dampen demand for insurance products and affect the value of ASR's investment portfolio.

Climate change introduces substantial risks, from increased claims due to extreme weather events to transition risks associated with regulatory shifts towards a low-carbon economy. The financial implications are considerable, with the World Economic Forum's 2024 Global Risks Report underscoring climate action failure as a top global concern, directly impacting insurers.

| Threat Category | Specific Threat | Impact on ASR | 2024/2025 Data/Trend |

|---|---|---|---|

| Competition | InsurTech Disruption | Loss of market share, pressure on pricing | Continued strong InsurTech funding; focus on personalized digital experiences. |

| Economic Conditions | Global Economic Slowdown | Reduced demand for insurance, lower investment income | Revised downward global growth forecasts for 2024/2025 (e.g., IMF). |

| Environmental Factors | Extreme Weather Events | Increased claims, potential asset devaluation | Rising frequency and severity of events observed in 2024, projected for 2025. |

| Regulatory Environment | Evolving Solvency Requirements | Increased compliance costs, potential impact on capital adequacy | Ongoing adjustments to capital and risk management frameworks. |

SWOT Analysis Data Sources

This ASR SWOT analysis is built upon robust data from financial reports, comprehensive market research, and expert industry commentary, ensuring a well-rounded and accurate strategic overview.