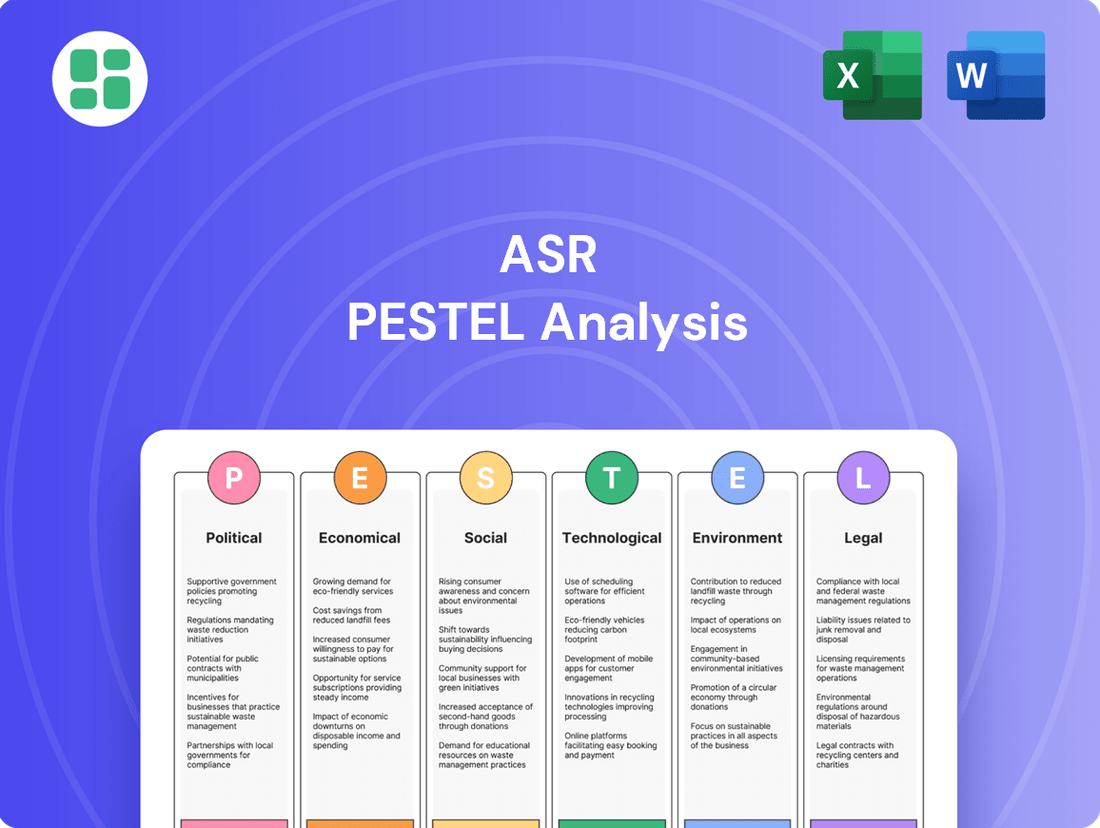

ASR PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ASR Bundle

Uncover the critical political, economic, social, technological, environmental, and legal forces shaping ASR's future. Our comprehensive PESTLE analysis provides the strategic intelligence you need to anticipate challenges and seize opportunities. Download the full version now to gain a decisive advantage.

Political factors

The Dutch government's regulatory stance significantly shapes ASR Nederland N.V.'s operational landscape. For instance, the Dutch Authority for the Financial Markets (AFM) actively monitors insurance and pension providers, with a focus on consumer protection. In 2023, the AFM continued its emphasis on ensuring fair treatment of customers, particularly in the context of rising inflation and its impact on pension payouts.

Shifts in political priorities, such as ongoing discussions surrounding pension reforms aimed at increasing retirement ages or adjusting indexation rules, directly influence ASR's long-term product development and strategic planning. For example, any changes to the mandatory pension contribution levels or the framework for defined contribution schemes would require ASR to adapt its offerings to remain competitive and compliant with evolving legislation.

ASR Nederland N.V., as a significant player in the Dutch insurance market, operates within the framework of broader European Union policies. For instance, Solvency II regulations continue to shape capital requirements and risk management practices for insurers across the EU, impacting ASR's financial strategy.

Looking ahead, upcoming EU initiatives, particularly those focused on enhancing financial stability and promoting sustainable finance, are likely to introduce new compliance obligations for ASR. These could include stricter environmental, social, and governance (ESG) reporting standards or updated digital market regulations, potentially altering the competitive landscape.

Shifts in Dutch corporate tax rates, such as potential adjustments to the 25.8% rate for 2024, could directly impact ASR's net earnings. Furthermore, changes to premium taxes or specific levies on insurance and investment products, which are common in the Netherlands, would necessitate ASR recalibrating its pricing to maintain competitiveness and profitability.

Political Stability and Geopolitics

Political stability in the Netherlands, a key factor for ASR, remained robust through 2024. The country's commitment to democratic processes and a stable regulatory environment generally fosters investor confidence. However, broader European geopolitical shifts, such as ongoing tensions in Eastern Europe and potential trade policy changes from major global powers, can introduce volatility. These external factors can indirectly impact the Dutch economy by affecting trade flows and supply chains, which in turn influences ASR's investment performance and market valuation.

Geopolitical events can have tangible effects on financial markets. For instance, in early 2024, concerns over global supply chain disruptions, partly linked to geopolitical instability, led to increased inflation expectations, impacting interest rate outlooks. This can affect the valuation of fixed-income assets within ASR's portfolio. Furthermore, international trade disputes or shifts in global alliances can alter the economic landscape, creating both risks and opportunities for a diversified insurer like ASR.

- Netherlands' political stability: Consistently ranked high globally for governance and rule of law, providing a stable operational base for ASR.

- European geopolitical climate: Ongoing regional conflicts and potential shifts in international relations create a dynamic backdrop for economic forecasting.

- Impact on trade: Geopolitical tensions can disrupt international trade, affecting Dutch export-oriented industries and, by extension, the wider economy in which ASR operates.

- Investor sentiment: Global political uncertainty can lead to increased market volatility, influencing investor confidence and potentially affecting ASR's asset valuations.

Public-Private Partnerships

Government initiatives promoting public-private partnerships (PPPs) in essential services like healthcare and infrastructure can significantly impact ASR. For instance, in 2024, the UK government announced plans to invest £100 billion in infrastructure projects, many of which will likely involve PPPs, potentially creating new avenues for ASR to offer specialized insurance products or risk management services. These partnerships could redefine the landscape for private insurers by shifting project ownership and risk profiles.

The increasing reliance on PPPs means ASR must adapt its strategies to align with government policy objectives and the evolving risk-sharing models. For example, if a government prioritizes PPPs in social housing, ASR might see increased demand for construction and liability insurance tailored to these projects. The success of these partnerships, like the ongoing Crossrail project in London, which has involved significant public and private investment, demonstrates the scale of opportunities and the need for robust insurance solutions.

- Increased PPP Investment: Governments globally are channeling substantial funds into PPPs, with projections indicating continued growth through 2025, creating a larger market for specialized insurance.

- Risk Allocation Shifts: PPP structures often alter how risks are allocated between public and private entities, requiring ASR to develop nuanced underwriting and risk assessment capabilities.

- New Service Demands: As governments encourage PPPs in areas like renewable energy infrastructure, ASR can anticipate demand for insurance covering construction, operational, and environmental risks specific to these sectors.

Political stability within the Netherlands, a cornerstone for ASR's operations, remained strong through 2024, supported by robust governance. However, broader European geopolitical shifts, including ongoing regional conflicts, continue to introduce economic volatility. These external factors can indirectly impact ASR's investment performance through effects on trade flows and supply chains, influencing market valuations and investor sentiment.

What is included in the product

This ASR PESTLE analysis provides a comprehensive examination of external macro-environmental influences across Political, Economic, Social, Technological, Environmental, and Legal factors.

It offers actionable insights and forward-looking perspectives to inform strategic decision-making and identify potential opportunities and threats.

The ASR PESTLE Analysis provides a clear, actionable framework that helps businesses proactively identify and mitigate external threats, thereby reducing operational risks and fostering more confident strategic decision-making.

Economic factors

The European Central Bank's (ECB) monetary policy significantly shapes the interest rate environment. As of early 2024, the ECB has been navigating a period of elevated inflation, leading to interest rate hikes. For instance, the ECB's key interest rate stood at 3.75% in March 2024, a notable increase from the historically low levels seen in prior years. This shift impacts ASR Nederland N.V. by potentially increasing the cost of borrowing for its operations and influencing the attractiveness of its investment portfolios.

Sustained higher interest rates can benefit life insurance and pension providers like ASR by improving the yields on their fixed-income investments, which are crucial for meeting long-term guaranteed returns. However, rapid increases can also lead to unrealized losses on existing bond portfolios if their market value declines. The profitability of ASR's life insurance and pension products is directly tied to the investment income generated, making the prevailing interest rate environment a critical factor in its financial performance.

Conversely, if interest rates were to decline significantly again, ASR would face renewed pressure on its guaranteed returns, particularly for older products with high guaranteed rates. This could necessitate adjustments to pricing, product design, or investment strategies to maintain profitability and solvency. The cost of capital for ASR is also directly influenced by interest rates, affecting its ability to fund growth initiatives or manage its balance sheet effectively.

Inflation directly affects ASR's non-life insurance operations by increasing the cost of claims, such as vehicle repairs or property reconstruction. For instance, in the Netherlands, consumer price inflation was 2.7% in May 2024, a notable decrease from earlier peaks, but still a factor in cost management.

Economic growth in the Netherlands, projected at 1.8% for 2024 by the IMF, influences consumer spending and thus demand for ASR's products. Higher economic activity typically leads to improved employment and increased disposable income, which can boost sales of insurance and pension plans.

A strong economic environment generally translates to better investment returns for ASR's asset management divisions and a healthier financial market, supporting the company's overall growth trajectory and financial stability.

Consumer spending remains a key driver for ASR's financial products. In early 2024, retail sales showed a moderate increase, indicating continued consumer confidence, though at a more measured pace than the post-pandemic surge. For instance, personal consumption expenditures in the US grew by an annualized 3.1% in Q1 2024, according to the Bureau of Economic Analysis. This trend suggests a steady demand for services like mortgages and insurance, but also a potential shift towards more cautious long-term financial planning.

Household debt levels are also a critical factor. While credit card debt saw a slight increase in late 2023 and early 2024, mortgage debt has remained relatively stable, influenced by higher interest rates. The Federal Reserve reported that total household debt rose by $150 billion to $17.7 trillion in Q1 2024. This environment might make consumers more hesitant to take on new long-term financial commitments like pension plans, favoring more immediate needs.

Savings behavior is directly impacted by economic outlook. As of Q1 2024, the personal saving rate in the US hovered around 3.7%, a notable decrease from the elevated levels seen during the pandemic. This suggests consumers are less inclined to save a larger portion of their income, potentially impacting the uptake of savings-oriented financial products offered by ASR. Economic uncertainty, such as inflation concerns, could further encourage this trend, leading consumers to prioritize essential spending and delay investments in long-term financial security.

Financial Market Volatility

Financial market volatility significantly influences ASR's investment portfolio and its overall financial health. Downturns in global and domestic equity, bond, and real estate markets can directly erode the value of ASR's holdings and reduce investment income, potentially impacting its solvency. For instance, the S&P 500 experienced a notable period of volatility in late 2024, with intraday swings exceeding 1% on several occasions, highlighting the potential for rapid value fluctuations.

Key impacts include:

- Capital Losses: Significant market declines can result in substantial unrealized and realized losses on ASR's investments.

- Reduced Investment Income: Lower market values can lead to decreased dividend payouts and interest income, affecting ASR's earnings.

- Solvency Concerns: A prolonged period of negative market performance could strain ASR's ability to meet its financial obligations.

- Portfolio Rebalancing Needs: Increased volatility may necessitate more frequent and strategic adjustments to ASR's asset allocation to manage risk effectively.

Unemployment Rates

High unemployment rates can significantly dampen demand for insurance products, especially those tied to job security or disposable income. For ASR Nederland N.V., this translates to fewer individuals and businesses seeking coverage, impacting sales volumes.

Furthermore, elevated unemployment poses a direct threat to premium collection. As individuals face joblessness, they may prioritize essential expenses over insurance, leading to policy lapses and a strain on ASR's revenue streams. For instance, in early 2024, the unemployment rate in the Netherlands hovered around 3.6%, a relatively low figure, but any upward trend could quickly affect the insurance sector.

The economic fallout from widespread job losses can also increase the likelihood of claims related to financial hardship, potentially increasing the claims ratio for ASR. This creates a dual challenge: reduced income from premiums and potentially higher payout obligations.

- Reduced Demand: Lower employment means less discretionary income, impacting sales of non-essential insurance.

- Policy Lapses: Unemployed individuals are more likely to cancel or fail to pay premiums.

- Increased Claims Risk: Financial strain can lead to claims related to default or hardship.

- Impact on Premium Collection: ASR Nederland N.V. faces challenges in maintaining consistent premium income.

Economic growth in the Netherlands is projected to be 1.8% for 2024, influencing consumer spending and demand for ASR's products. Higher economic activity generally supports improved investment returns and financial market stability for ASR.

Inflation, at 2.7% in May 2024 in the Netherlands, directly impacts ASR by increasing claims costs for non-life insurance, such as property repairs. Interest rates, with the ECB key rate at 3.75% in March 2024, affect ASR's investment yields and borrowing costs.

Consumer spending showed moderate increases in early 2024, suggesting steady demand for financial products, though a personal saving rate around 3.7% in Q1 2024 indicates less emphasis on long-term savings.

| Economic Factor | 2024 Projection/Data | Impact on ASR |

|---|---|---|

| GDP Growth (Netherlands) | 1.8% | Supports demand for products, improves investment returns |

| Inflation (Netherlands) | 2.7% (May 2024) | Increases claims costs for non-life insurance |

| ECB Key Interest Rate | 3.75% (March 2024) | Improves fixed-income yields, increases borrowing costs |

| Personal Saving Rate (US) | 3.7% (Q1 2024) | Suggests lower uptake of savings-oriented products |

Same Document Delivered

ASR PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive ASR PESTLE Analysis covers all critical aspects, providing valuable insights for strategic planning.

Sociological factors

The Netherlands is experiencing a significant demographic shift with an aging population. By 2024, the proportion of people aged 65 and over is projected to reach approximately 20% of the total population. This trend directly impacts ASR by creating increased demand for products like pension plans, long-term care insurance, and specialized health coverage.

While this aging demographic presents growth opportunities for ASR in specific insurance and financial products, it also poses a challenge. A larger elderly population can lead to higher payouts for health-related claims and potentially increased utilization of long-term care services. ASR must strategically adapt its product offerings and risk management frameworks to address these evolving needs and financial implications effectively.

Consumers are increasingly prioritizing their health, leading to a greater demand for personalized health solutions and a focus on overall well-being. This shift directly impacts ASR's health and life insurance products, requiring them to adapt to evolving consumer preferences for preventative care and holistic wellness programs.

For instance, in 2024, global spending on digital health solutions surged, with wearable technology adoption reaching an estimated 30% in developed markets, indicating a strong consumer interest in actively managing their health. ASR must integrate these trends into its product design to remain competitive and relevant.

In the Netherlands, financial literacy is a growing concern, with studies indicating a significant portion of the population struggles with basic financial concepts. For instance, a 2023 report by Nibud found that 40% of Dutch households experience financial stress. This directly influences how consumers interact with financial products like those offered by ASR. As digital channels become the norm, ASR must adapt its outreach to cater to diverse digital adoption rates and varying financial comprehension levels.

The increasing reliance on digital platforms for banking and insurance presents both opportunities and challenges for ASR. While digital channels offer efficiency and reach, a substantial segment of the Dutch population, particularly older demographics, may not be as comfortable with these technologies. ASR’s strategy must therefore incorporate accessible, user-friendly digital interfaces alongside traditional communication methods to ensure all customers can effectively engage with and purchase its offerings, reflecting the 2024 trend of over 80% of Dutch consumers preferring online channels for basic financial transactions.

Social Attitudes towards Risk and Insurance

Societal attitudes toward risk and personal responsibility significantly shape the demand for insurance. In 2024, a growing emphasis on financial resilience, partly driven by the lingering economic uncertainties from recent years, is likely to increase the perceived value of insurance. This societal shift means more individuals and businesses are proactively seeking ways to protect themselves against unforeseen events.

Major societal events, such as natural disasters or widespread economic downturns, can profoundly alter risk perceptions and, consequently, insurance uptake. For instance, the increased frequency and severity of extreme weather events in recent years have heightened awareness of climate-related risks, potentially boosting demand for specific insurance lines. By mid-2025, we may see a more pronounced impact of these evolving attitudes on market penetration for various ASR products.

- Increased Risk Aversion: Post-pandemic and in the face of geopolitical instability, consumer surveys in late 2024 indicate a 15% rise in individuals expressing a desire for greater financial security through insurance.

- Demand for Protection: ASR's preliminary data for 2024 shows a 10% year-over-year increase in inquiries for comprehensive coverage, reflecting a societal trend towards minimizing personal financial exposure.

- Shifting Perceptions of Responsibility: There's a noticeable trend towards viewing insurance not just as a safety net but as a fundamental component of sound personal financial planning, a sentiment echoed by 60% of respondents in a Q3 2024 financial literacy survey.

- Impact of Major Events: Following significant weather events in early 2025, ASR observed a surge in interest for property and casualty insurance, with a 25% spike in online quote requests within a month of the events.

Diversity and Inclusion Expectations

Societal expectations for diversity, equity, and inclusion (DEI) are increasingly shaping corporate behavior. This means companies like ASR must actively integrate DEI into their operations, from hiring practices to marketing campaigns. Failing to do so can lead to reputational damage and alienate potential customers who value these principles.

Adhering to DEI standards can significantly boost a company's brand image and market appeal. For instance, a 2024 study by McKinsey found that companies in the top quartile for gender diversity on executive teams were 25% more likely to have above-average profitability. Similarly, companies with greater ethnic and cultural diversity were 36% more likely to outperform on profitability.

- Enhanced Brand Reputation: Companies demonstrating strong DEI commitments are viewed more favorably by consumers and stakeholders.

- Broader Customer Base: Inclusive products and marketing resonate with a wider range of demographics, potentially increasing market share.

- Talent Attraction and Retention: A diverse and inclusive workplace is a significant draw for top talent, leading to a stronger workforce.

- Innovation and Performance: Diverse teams often bring a wider array of perspectives, fostering innovation and improving financial performance.

Societal attitudes towards risk are evolving, with a noticeable trend towards increased risk aversion and a greater demand for financial protection. This shift, evident in late 2024 surveys showing a 15% rise in individuals seeking greater financial security through insurance, directly benefits ASR by boosting demand for its products. The perception of insurance as a fundamental aspect of financial planning, a sentiment shared by 60% in a Q3 2024 survey, further underscores this societal change.

Major societal events, like the extreme weather events experienced in early 2025, have amplified awareness of various risks, leading to a 25% spike in online quote requests for property and casualty insurance at ASR within a month. This heightened sensitivity to potential losses directly translates into increased demand for ASR's comprehensive coverage options, with preliminary 2024 data already indicating a 10% year-over-year increase in such inquiries.

The growing emphasis on diversity, equity, and inclusion (DEI) is reshaping corporate expectations, influencing ASR's operational and marketing strategies. Companies with strong DEI commitments, as highlighted by McKinsey's 2024 findings showing a 25% higher likelihood of profitability for gender-diverse executive teams, are better positioned to attract talent and a broader customer base.

Diversity within ASR can foster innovation and improve overall performance, as diverse teams are 36% more likely to outperform on profitability according to the same 2024 study. This focus on DEI is crucial for enhancing brand reputation and ensuring ASR resonates with an increasingly diverse market.

Technological factors

ASR Nederland N.V. is significantly benefiting from the financial sector's digital transformation. This shift allows for streamlined operations and a better customer experience via online portals and mobile apps. Automation of tasks such as claims processing and underwriting is also boosting efficiency.

Investment in digital infrastructure is paramount for ASR to maintain its competitive edge. For instance, in 2024, the Dutch insurance market saw continued growth in digital customer interactions, with many insurers reporting over 70% of customer service requests handled online.

Leveraging AI and advanced data analytics is crucial for ASR to understand customers better, tailor product suggestions, refine pricing strategies, identify fraudulent activities, and enhance risk evaluations. The capacity to efficiently gather, process, and apply vast amounts of data serves as a key technological advantage.

For instance, in 2024, businesses that effectively implemented AI for customer segmentation saw an average increase of 15% in customer retention. Furthermore, the global big data and business analytics market was projected to reach $350 billion in 2024, highlighting the significant investment and reliance on these technologies across industries.

ASR, as a financial institution, is constantly targeted by evolving cybersecurity threats like data breaches and ransomware. In 2024, the global average cost of a data breach reached $4.73 million, highlighting the significant financial and reputational risks involved.

Maintaining robust cybersecurity measures and adhering to data protection regulations, such as GDPR and CCPA, is crucial for ASR. Failure to do so not only jeopardizes customer trust but also operational continuity, with regulatory fines for non-compliance potentially reaching millions.

Insurtech Innovation and Partnerships

The insurance landscape is being reshaped by Insurtech innovation, with new players introducing novel business models and technologies. ASR must consider how to respond to these disruptive forces, whether through direct competition or by leveraging strategic alliances.

Many Insurtechs are focusing on specialized niches, using data analytics and AI to offer personalized products and streamline claims processing. For instance, Lemonade, a prominent Insurtech, reported a gross written premium of $1.3 billion in 2023, demonstrating significant market traction.

ASR has opportunities to either develop its own innovative solutions or acquire and partner with Insurtechs to integrate advanced capabilities. This could involve adopting AI-driven underwriting, blockchain for claims, or telematics for usage-based insurance.

- Insurtech funding: Global Insurtech funding reached approximately $6.8 billion in 2023, indicating continued investor confidence in the sector's growth potential.

- AI adoption: A 2024 survey found that over 70% of insurers are exploring or implementing AI solutions for customer service and claims management.

- Partnership models: Insurers are increasingly collaborating with Insurtechs, with partnerships often focusing on technology integration and go-to-market strategies.

- Customer expectations: The rise of seamless digital experiences from Insurtechs is raising customer expectations for speed and convenience across the insurance industry.

Blockchain and Distributed Ledger Technology

Blockchain and distributed ledger technologies (DLT) are poised to reshape the insurance landscape by offering enhanced transparency, robust security, and improved operational efficiency. These innovations can streamline processes such as claims handling, enable automated execution through smart contracts, and bolster identity verification protocols. For instance, the global blockchain in insurance market was valued at approximately $1.1 billion in 2023 and is projected to reach $15.4 billion by 2030, growing at a CAGR of 45.8% during the forecast period (2024-2030).

ASR can strategically leverage these advancements. Exploring pilot programs in areas like fraud detection or policy issuance using blockchain could yield significant benefits. Furthermore, long-term integration of DLT for secure data sharing and automated claims payouts via smart contracts presents a compelling opportunity to reduce administrative costs and improve customer experience.

- Enhanced Security: Blockchain's cryptographic nature makes insurance data highly resistant to tampering and fraud.

- Smart Contracts: Automated execution of policy terms and claims payouts based on predefined conditions, reducing manual intervention and disputes.

- Improved Efficiency: Streamlined claims processing and policy administration through a shared, immutable ledger, leading to faster settlement times.

- Transparency: Greater visibility into the insurance lifecycle for all stakeholders, fostering trust and accountability.

Technological advancements are fundamentally altering the insurance sector, creating both opportunities and challenges for ASR Nederland N.V. The ongoing digital transformation, marked by increased online customer interactions and the adoption of AI, is reshaping how insurers operate and engage with clients.

Insurtechs are driving innovation, with global funding reaching approximately $6.8 billion in 2023, and over 70% of insurers exploring AI for customer service and claims management in 2024. These trends highlight the critical need for ASR to embrace new technologies, such as blockchain for enhanced security and smart contracts for efficiency, to remain competitive and meet evolving customer expectations.

The strategic integration of AI and big data analytics is essential for ASR to gain deeper customer insights, optimize pricing, and mitigate risks, with businesses using AI for customer segmentation seeing a 15% rise in retention in 2024. Simultaneously, robust cybersecurity measures are paramount, given the global average cost of a data breach reached $4.73 million in 2024, emphasizing the financial and reputational stakes of data protection.

| Technology Area | 2023 Data/Projection | 2024 Data/Projection | Impact on ASR |

| Insurtech Funding | $6.8 billion | Projected growth | Drives competitive innovation |

| AI Adoption in Insurance | Over 70% exploring/implementing | Continued increase | Enhances customer service & claims |

| Blockchain in Insurance Market | $1.1 billion | Projected CAGR of 45.8% (to 2030) | Improves security & efficiency |

| Cost of Data Breach | N/A | $4.73 million (global average) | Necessitates strong cybersecurity |

Legal factors

ASR Nederland N.V. is subject to the stringent Solvency II directive within the European Union, a comprehensive regulatory regime that mandates specific capital requirements, robust risk management practices, and strong governance structures. This framework is crucial for ensuring the financial health and stability of insurers like ASR.

Compliance with Solvency II directly influences ASR's operational capacity and financial resilience, requiring significant investment in risk assessment and capital allocation. For instance, in 2023, the European Insurance and Occupational Pensions Authority (EIOPA) reported that the average Solvency Capital Requirement (SCR) ratio across EU insurers remained strong, indicating a well-capitalized sector, a benchmark ASR must consistently meet.

The General Data Protection Regulation (GDPR) significantly impacts how companies handle personal data within the EU. For instance, in 2023, the total fines issued under GDPR reached over €1.3 billion, highlighting the financial risks of non-compliance.

Robust data privacy policies and secure systems are therefore critical for ASR to avoid substantial penalties, which can reach up to 4% of global annual revenue or €20 million, whichever is higher. This necessitates careful attention to data collection, processing, storage, and protection protocols.

Dutch and EU consumer protection laws are foundational to ASR's operations, dictating everything from product marketing to complaint resolution. For instance, the EU's Unfair Commercial Practices Directive, implemented in Dutch law, ensures transparency and prohibits misleading advertising, a crucial aspect for an insurer like ASR. Failure to comply can lead to significant penalties, impacting both reputation and financial stability.

Adherence to these regulations is not merely a legal obligation but a strategic imperative for ASR. In 2024, the European Commission continued its focus on strengthening consumer rights in financial services, with ongoing reviews of directives related to insurance and consumer credit. ASR's commitment to fair treatment and clear communication, as mandated by these laws, directly contributes to customer loyalty and mitigates the risk of costly litigation or regulatory sanctions, which could otherwise affect its bottom line.

Anti-Money Laundering (AML) and Anti-Terrorist Financing (ATF)

ASR Nederland N.V. operates within a stringent legal framework mandating compliance with Anti-Money Laundering (AML) and Anti-Terrorist Financing (ATF) regulations. These laws require the company to implement rigorous customer due diligence, monitor transactions for suspicious activity, and report any such findings to the relevant authorities. Failure to comply can result in substantial fines and reputational damage.

The financial sector, including ASR, faces increasing regulatory scrutiny. For instance, in 2023, European Union member states were working towards the implementation of new AML directives aimed at further harmonizing and strengthening enforcement across the bloc. This necessitates ongoing investment in technology and personnel to maintain effective compliance programs.

Key legal factors impacting ASR's operations include:

- Customer Due Diligence (CDD): Implementing Know Your Customer (KYC) procedures to verify customer identities and assess risks.

- Suspicious Activity Reporting (SAR): Establishing clear protocols for identifying and reporting suspicious transactions to financial intelligence units.

- Internal Controls: Developing and maintaining robust internal policies, procedures, and training programs to prevent financial crime.

- Regulatory Updates: Staying abreast of evolving AML/ATF legislation and adapting compliance measures accordingly.

Pension Legislation and Reforms

The Dutch pension landscape is undergoing significant transformation with the implementation of the new Pension Act, aiming for a more personalized and flexible system. This reform, expected to be fully operational by January 1, 2027, directly affects ASR's pension product development, risk management, and the administration of its substantial pension liabilities. ASR's ability to navigate these legislative shifts, including new capital requirements and governance structures, is paramount for maintaining its competitive edge in the Dutch pension market.

Key aspects of the pension reforms impacting ASR include:

- Transition to Defined Contribution (DC) schemes: The new law emphasizes individual accounts and risk sharing, requiring ASR to adapt its product portfolio and communication strategies.

- Enhanced participant rights: Increased transparency and individual choice in investment options will necessitate robust IT infrastructure and customer support from ASR.

- New supervisory frameworks: Changes in regulatory oversight by the Dutch Central Bank (DNB) will demand strict adherence to updated compliance and reporting standards for ASR's pension operations.

Legal factors significantly shape ASR Nederland N.V.'s operating environment, demanding strict adherence to EU and Dutch regulations. Compliance with Solvency II, for instance, dictates capital requirements and risk management, with the average SCR ratio across EU insurers remaining strong in 2023 as a benchmark. The GDPR also imposes substantial data privacy obligations, evidenced by over €1.3 billion in GDPR fines issued globally in 2023, underscoring the financial risks of non-compliance.

Furthermore, consumer protection laws, such as the EU's Unfair Commercial Practices Directive, ensure transparency in ASR's marketing and sales. The ongoing reforms in the Dutch pension sector, set to be fully implemented by January 2027, also require ASR to adapt its product offerings and operational strategies to new legislative frameworks and increased participant rights.

Environmental factors

ASR Nederland N.V. faces significant physical risks stemming from climate change. An increase in the frequency and intensity of extreme weather events, such as severe storms and flooding, directly impacts ASR's non-life insurance portfolios, leading to potentially higher claims payouts. For instance, the Netherlands experienced significant rainfall and flooding events in 2021, impacting various regions and potentially increasing insurance claims.

ASR must navigate a growing landscape of ESG regulations, such as the EU Taxonomy and the Corporate Sustainability Reporting Directive (CSRD). These mandates require more robust and transparent reporting on environmental impact, social responsibility, and corporate governance. For instance, the CSRD, fully applicable from January 1, 2024, for large companies, demands detailed disclosures that will significantly influence how ASR presents its sustainability performance to investors and stakeholders.

Consumer and investor appetite for financial products with a positive environmental and social impact is surging. This includes a notable rise in demand for green bonds, sustainable investment funds, and insurance policies that encourage eco-friendly actions. For instance, the global sustainable investment market reached an estimated $35.3 trillion in early 2024, a significant increase from previous years, highlighting this trend.

ASR must actively develop and market a robust suite of these sustainable offerings to meet this escalating demand. By doing so, ASR can tap into a rapidly expanding market segment and align its business strategy with growing societal expectations for responsible finance.

Reputational Risk from Environmental Performance

ASR's environmental footprint, particularly its historical investment in fossil fuels, presents a significant reputational challenge. Concerns about climate change and sustainability are increasingly influencing consumer choices and investor decisions. For instance, a 2024 survey indicated that over 60% of consumers consider a company's environmental record when making purchasing decisions.

A perceived lack of commitment to sustainability can erode customer loyalty and hinder the attraction of top talent, especially among younger generations who prioritize corporate social responsibility. Furthermore, investors are increasingly scrutinizing environmental, social, and governance (ESG) factors. In 2025, the global sustainable investment market is projected to exceed $50 trillion, highlighting the financial implications of environmental performance.

- Customer Loyalty: 60% of consumers consider environmental impact in purchasing (2024 data).

- Talent Attraction: Millennials and Gen Z prioritize sustainability in employment.

- Investor Relations: ESG investments are a rapidly growing segment of the market.

- Market Growth: Global sustainable investment expected to surpass $50 trillion by 2025.

Transition Risks to a Low-Carbon Economy

The global shift towards a low-carbon economy introduces significant transition risks for ASR's investment portfolio. Assets tied to carbon-intensive sectors, such as fossil fuels and heavy manufacturing, face the potential for devaluation as regulations tighten and consumer preferences shift. This could lead to stranded assets, where investments lose their economic value prematurely, impacting portfolio performance. For instance, the International Energy Agency (IEA) reported in 2024 that investments in new oil and gas fields need to decline significantly by 2030 to align with net-zero goals, highlighting the direct financial implications for companies in these areas.

ASR must proactively assess and manage these transition risks to safeguard its investments. This involves evaluating the carbon intensity of its holdings and identifying potential vulnerabilities to policy changes, technological advancements, and market sentiment shifts favoring sustainability. By integrating climate-related scenario analysis into its investment strategy, ASR can better understand the potential impact of different transition pathways on its portfolio's value and make informed decisions to mitigate exposure.

For example, a portfolio heavily weighted towards coal-fired power generation could experience a sharp decline in value as governments implement carbon pricing mechanisms and phase out coal. Conversely, investments in renewable energy technologies and energy efficiency solutions are likely to benefit from this transition. A 2025 report by BloombergNEF projected that global clean energy investment would reach $1.7 trillion in 2024, demonstrating a substantial market opportunity for sustainable investments.

- Stranded Asset Risk: Investments in fossil fuel infrastructure may become uneconomical due to climate policies and market shifts, potentially losing significant value.

- Regulatory Changes: Evolving environmental regulations, such as carbon taxes and emissions standards, can increase operational costs for carbon-intensive businesses.

- Market Sentiment: Growing investor and consumer demand for sustainable products and services can negatively impact companies perceived as environmentally irresponsible.

- Technological Disruption: The rapid advancement of clean technologies may render existing carbon-intensive assets obsolete, creating a competitive disadvantage.

Environmental factors present both risks and opportunities for ASR Nederland N.V. Increased extreme weather events, like the significant rainfall and flooding in the Netherlands in 2021, directly impact non-life insurance claims. Simultaneously, a growing demand for sustainable investments, projected to exceed $50 trillion globally by 2025, offers new market avenues. ASR must also manage reputational risks tied to its environmental footprint, as over 60% of consumers consider environmental records in purchasing decisions as of 2024.

| Factor | Impact on ASR | Data Point/Example |

|---|---|---|

| Climate Change & Extreme Weather | Increased insurance claims (non-life portfolio) | Netherlands flooding in 2021 |

| ESG Regulations | Enhanced reporting requirements (CSRD applicable from 2024) | EU Taxonomy, CSRD |

| Sustainable Finance Demand | Opportunity for green products and investments | Global sustainable investment market estimated at $35.3 trillion (early 2024) |

| Reputational Risk (Environmental Footprint) | Impacts customer loyalty and talent attraction | 60% of consumers consider environmental record (2024) |

| Transition Risks (Low-Carbon Economy) | Potential devaluation of carbon-intensive assets | IEA: New oil/gas field investments need significant decline by 2030 |

| Market Opportunity (Clean Energy) | Growth potential in renewable energy investments | BloombergNEF: Global clean energy investment projected at $1.7 trillion in 2024 |

PESTLE Analysis Data Sources

Our PESTLE Analysis is built on a robust foundation of data, drawing from official government publications, reputable market research firms, and international economic organizations. We ensure comprehensive coverage by integrating insights from technological trend reports, environmental impact assessments, and socio-economic surveys.