ASMedia PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ASMedia Bundle

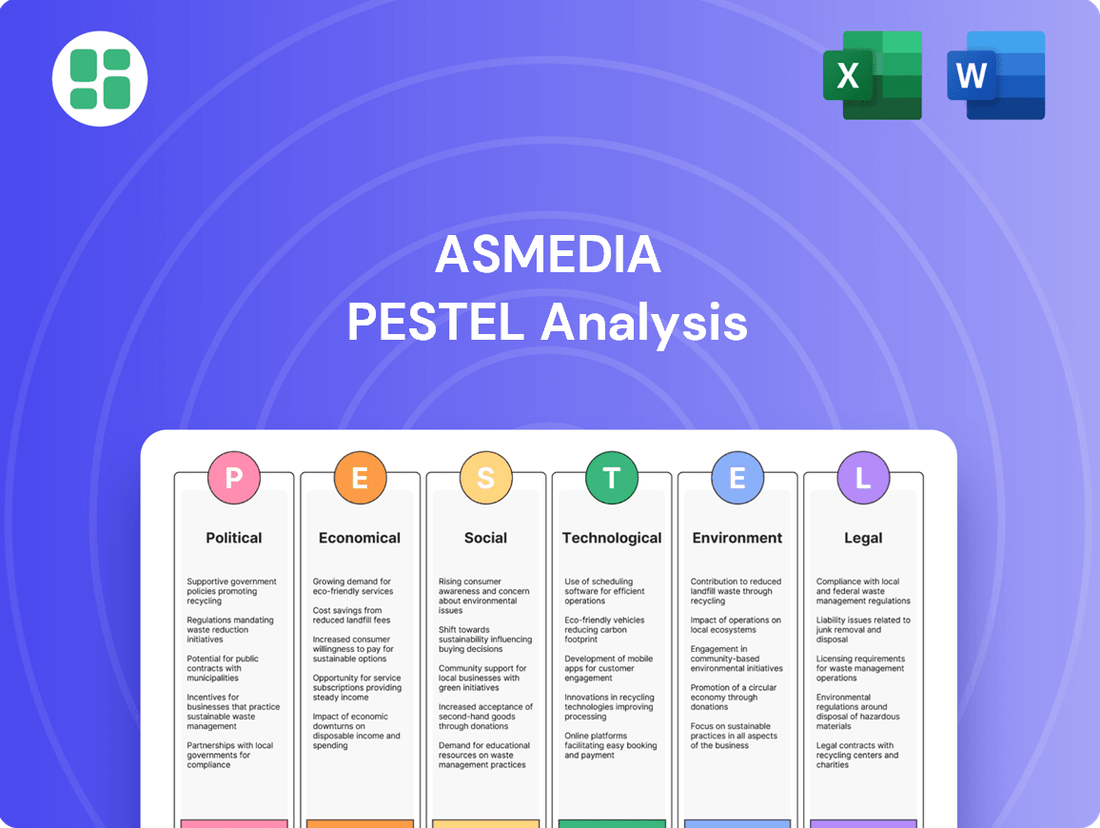

Uncover the intricate web of external forces shaping ASMedia's trajectory with our comprehensive PESTLE analysis. From evolving political landscapes to technological advancements, understand the critical factors influencing their market position. Equip yourself with actionable intelligence to anticipate challenges and seize opportunities. Purchase the full analysis now for a strategic advantage.

Political factors

Geopolitical tensions, especially between the United States and China, continue to reshape the global semiconductor landscape. ASMedia, as a Taiwanese entity, navigates this environment where export controls and national industrial policies are increasingly prominent. These measures directly affect market access and can influence the cost of raw materials and overall operational expenses.

Taiwan's government is a significant enabler for its booming semiconductor sector, including companies like ASMedia. Through initiatives like the 'Taiwan Chip-based Industrial Innovation Program,' substantial funding is directed towards research and development, aiming to integrate advanced chip technology into areas such as artificial intelligence. This strategic backing, which saw the Ministry of Economic Affairs earmarking NT$10 billion (approximately US$310 million) for semiconductor R&D in 2023, cultivates a fertile ground for ASMedia's continued innovation and growth.

International trade agreements and evolving regulations, like the EU Chips Act and the US CHIPS and Science Act, are actively shaping the semiconductor industry. These policies, enacted to bolster regional chip production, could mean more opportunities for domestic manufacturing but also introduce complex compliance hurdles and potential limitations for companies operating globally.

ASMedia, with its international operations, must carefully monitor and adapt to these varying regulatory environments. For instance, the US CHIPS and Science Act allocated $52.7 billion for semiconductor manufacturing and research, aiming to onshore production. Navigating such initiatives requires ASMedia to understand how these incentives and restrictions might impact its supply chain and market access across different regions.

National Security and Supply Chain Resilience

National security concerns are increasingly elevating semiconductors to a critical infrastructure status, prompting governments worldwide to bolster supply chain resilience. This heightened focus translates into tangible policy actions, such as the CHIPS and Science Act in the United States, which allocated $52.7 billion in subsidies and incentives for domestic semiconductor manufacturing and research. Similarly, the European Union's Chips Act aims to double its market share in global semiconductor production by 2030.

These governmental initiatives directly impact companies like ASMedia. The drive to onshore manufacturing or diversify supply chains away from geopolitical hotspots can steer ASMedia's strategic partnerships and investment decisions. For instance, securing government grants or aligning with national strategic goals could become a prerequisite for certain expansions or research collaborations. The overarching objective is to mitigate risks associated with over-reliance on any single geographic region for essential chip components, thereby safeguarding national interests and economic stability.

- Government Incentives: The US CHIPS Act and EU Chips Act are prime examples of policies designed to foster domestic semiconductor production, potentially offering ASMedia opportunities for funding and strategic alignment.

- Supply Chain Diversification: A global push to reduce dependence on specific regions for critical chip components may lead ASMedia to explore new manufacturing locations or partnerships.

- National Security Nexus: Semiconductors are now viewed as vital for national defense, meaning ASMedia's operations and strategic choices could be influenced by national security imperatives.

Intellectual Property Protection Policies

Government policies concerning intellectual property (IP) protection are paramount for fabless semiconductor firms like ASMedia. Their core assets are their innovative chip designs and advanced high-speed interface technologies, making strong IP laws essential for maintaining a competitive advantage.

Effective enforcement of IP rights across various global markets shields ASMedia's innovations from unauthorized replication and ensures they can capitalize on their research and development investments. The semiconductor IP market is projected for significant expansion, underscoring the critical role of these protective measures.

- Global IP Protection Landscape: ASMedia operates in a global market where IP protection varies significantly by country. For instance, while the US and EU generally offer strong IP protections, enforcement can be more challenging in other regions.

- Semiconductor IP Market Growth: The semiconductor IP market is anticipated to see continued growth. Projections suggest the market could reach over $10 billion by 2028, driven by increasing demand for specialized chip designs and the complexity of modern semiconductor development.

- ASMedia's IP Strategy: ASMedia's business model is intrinsically linked to its ability to protect its proprietary designs. This includes patents for its unique interface technologies and trade secrets related to its manufacturing processes.

Governmental support for semiconductor industries is a significant political factor. Initiatives like the US CHIPS and Science Act, with its $52.7 billion allocation, and the EU Chips Act aim to bolster domestic production and research, directly influencing ASMedia's operational landscape and potential for strategic partnerships.

These policies reflect a global trend of governments prioritizing semiconductor supply chain resilience and national security. ASMedia must navigate varying national industrial policies and export controls, particularly given geopolitical tensions, which can impact market access and operational costs.

Intellectual property protection is also a key political consideration. Strong IP laws are crucial for ASMedia, a fabless semiconductor company, to safeguard its innovative designs and maintain a competitive edge in a market where IP is a primary asset.

| Policy/Initiative | Country/Region | Allocated Funding (approx.) | Year of Enactment/Focus |

|---|---|---|---|

| CHIPS and Science Act | United States | $52.7 billion | 2022 |

| Chips Act | European Union | €43 billion (public funding) | 2023 |

| Taiwan Chip-based Industrial Innovation Program | Taiwan | NT$10 billion (approx. $310 million) | 2023 |

What is included in the product

This ASMedia PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and forward-looking perspectives to aid in strategic decision-making and identify potential threats and opportunities within ASMedia's operating landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, making complex external factors digestible for strategic discussions.

Economic factors

The global semiconductor market is on a significant upward trajectory, with forecasts indicating sales will reach record levels in both 2024 and 2025. This surge is largely fueled by the escalating demand for technologies like artificial intelligence (AI), high-performance computing (HPC), and expanded data center infrastructure.

This robust market expansion presents a favorable landscape for ASMedia, whose high-speed interface integrated circuits are essential components for these growth areas. The industry's long-term outlook is equally promising, with projections suggesting the market could surpass one trillion dollars in sales by 2030, underscoring sustained and widespread demand for semiconductor solutions.

Persistent inflation and rising interest rates present a significant challenge for ASMedia. For instance, the US Consumer Price Index (CPI) saw a notable increase, reaching 3.4% year-over-year in April 2024, impacting the cost of raw materials and energy. This upward pressure on operational expenses can squeeze profit margins.

Higher interest rates, exemplified by the Federal Reserve's benchmark rate holding steady in the 5.25%-5.50% range through mid-2024, directly increase financing costs for ASMedia's research and development initiatives and potential expansion projects. This can slow down innovation and growth.

Consumer spending on electronics, a key market for ASMedia's components, is also sensitive to these economic conditions. As inflation erodes purchasing power and higher interest rates make financing more expensive, consumers may delay or reduce purchases of new devices, thereby dampening demand for ASMedia's products.

Furthermore, the semiconductor industry, including memory components, is subject to volatile pricing cycles. Fluctuations in memory chip prices, influenced by supply-demand dynamics and broader economic sentiment, add another layer of unpredictability to ASMedia's revenue streams and financial planning.

The robust demand for consumer electronics, encompassing smartphones, PCs, and smart home devices, is a primary catalyst for the need for high-speed interface integrated circuits. These devices rely heavily on advanced chipsets to deliver seamless connectivity and performance.

The global consumer electronics market is anticipated to experience significant expansion. For instance, IDC projected worldwide shipments of traditional PCs to reach 235.1 million units in 2024, a 3.4% increase from 2023. This growth, driven by innovation and the increasing prevalence of connected devices, directly bolsters ASMedia's product offerings.

Supply Chain Dynamics and Raw Material Costs

Global supply chain disruptions, such as those experienced in 2021-2022 due to pandemic-related issues and geopolitical tensions, continue to pose a risk to ASMedia. These events can lead to extended lead times and increased costs for essential components and manufacturing services, directly affecting ASMedia's ability to meet demand and manage its operating expenses. For instance, semiconductor manufacturing capacity, a critical input for ASMedia, saw significant strain, with lead times for certain advanced nodes extending to over 12 months in late 2022 and early 2023.

Fluctuations in the cost of raw materials, particularly those used in semiconductor fabrication like silicon wafers and specialized chemicals, directly impact the pricing ASMedia faces from its foundry partners. While ASMedia is fabless, these upstream cost pressures can trickle down, potentially squeezing profit margins if not effectively passed on or managed through cost-optimization strategies. The price of polysilicon, a primary material for silicon wafers, saw volatility, with spot prices fluctuating significantly throughout 2023, impacting the overall cost structure of semiconductor production.

To mitigate these risks, ASMedia's strategy of maintaining diversified supplier networks becomes paramount. By not relying on a single foundry or a limited set of material providers, ASMedia can better absorb shocks and secure necessary production capacity and materials. This diversification is crucial for ensuring business continuity and maintaining competitive pricing in a dynamic market environment. For example, having relationships with multiple leading foundries in different geographic regions can provide flexibility in case of localized disruptions.

- Supply Chain Resilience: ASMedia's fabless model necessitates strong relationships with foundries, making it vulnerable to disruptions that extend manufacturing lead times and increase production costs.

- Raw Material Price Volatility: Fluctuations in the cost of silicon wafers and fabrication chemicals directly influence ASMedia's procurement expenses from its manufacturing partners.

- Diversification Strategy: Maintaining multiple foundry partners and supplier relationships is key to ASMedia's ability to navigate supply chain challenges and ensure consistent production.

Investment in AI and High-Performance Computing

Massive investments in AI infrastructure and high-performance computing (HPC) are fueling significant growth in the semiconductor market. By 2024, global spending on AI hardware is projected to reach hundreds of billions of dollars, with a substantial portion directed towards advanced processors and the supporting infrastructure like data centers. This trend directly benefits companies like ASMedia, whose PCIe and USB4 technologies are essential for connecting these powerful computing systems.

The demand for AI-optimized processors and custom ASICs is particularly robust, driving the need for high-speed interconnect solutions. ASMedia's product portfolio is well-positioned to capitalize on this demand, as these advanced chips require efficient data transfer capabilities that their PCIe and USB4 offerings provide. This creates a substantial growth runway for ASMedia as the AI revolution continues to accelerate.

- Global AI hardware spending is expected to exceed $200 billion by the end of 2024.

- The HPC market is projected to grow at a CAGR of over 10% through 2025.

- ASMedia's PCIe 5.0 and USB4 solutions are critical for enabling the high bandwidth required by AI accelerators and data centers.

The economic landscape presents a dual-edged sword for ASMedia. While the burgeoning semiconductor market, driven by AI and HPC, offers substantial growth opportunities, persistent inflation and rising interest rates pose significant challenges. For instance, the US CPI stood at 3.4% year-over-year in April 2024, increasing operational costs. Concurrently, the Federal Reserve maintained its benchmark rate between 5.25%-5.50% through mid-2024, elevating financing expenses for R&D and expansion.

Consumer spending on electronics, a key market for ASMedia, is directly impacted by these economic headwinds. Inflation erodes purchasing power, and higher interest rates make financing more expensive, potentially leading consumers to postpone or reduce purchases of new devices. This dampens demand for ASMedia's products.

The semiconductor industry also faces volatile pricing cycles, particularly for memory components. These price fluctuations, influenced by supply-demand dynamics and broader economic sentiment, introduce unpredictability into ASMedia's revenue streams and financial planning.

The robust demand for consumer electronics, including smartphones and PCs, is a primary driver for ASMedia's high-speed interface integrated circuits. Global PC shipments were projected to reach 235.1 million units in 2024, a 3.4% increase from 2023, indicating sustained demand for components like those ASMedia produces.

Preview the Actual Deliverable

ASMedia PESTLE Analysis

What you’re previewing here is the actual file—fully formatted and professionally structured. This comprehensive ASMedia PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You will receive this exact, detailed document immediately after purchase, ready for your strategic planning.

Sociological factors

The world is becoming increasingly digital, with more people working remotely and using smart home devices. This shift fuels a strong demand for faster data transfer and seamless device connectivity. ASMedia's high-speed interface integrated circuits (ICs) are crucial for this trend, as they allow for the smooth operation of these interconnected electronic systems that consumers increasingly expect.

The global digital transformation is accelerating, with projections indicating that the number of connected devices worldwide could reach 29.3 billion by 2030, according to Statista. This massive growth directly translates into a heightened need for the advanced connectivity solutions ASMedia provides. As consumers embrace more sophisticated digital lifestyles, the demand for reliable and high-performance interface ICs will only continue to rise, benefiting companies like ASMedia.

Consumers increasingly expect electronic devices to be faster, more powerful, and packed with new features. This drive for constant technological advancement, seen in everything from smartphones to gaming consoles, directly benefits companies like ASMedia that provide the high-speed interfaces enabling these improvements.

This societal trend is evident in the rapid adoption of new technologies. For instance, the global smartphone market saw shipments of over 287 million units in Q1 2024, with consumers actively seeking devices offering enhanced processing power and connectivity, directly supporting ASMedia's market for advanced USB and PCIe solutions.

The increasing integration of smart technologies and the Internet of Things (IoT) significantly boosts demand for ASMedia's high-performance connectivity solutions. By 2025, the global IoT market is projected to reach over $1.5 trillion, with smart home devices and wearables representing a substantial portion of this growth. ASMedia's specialized integrated circuits are crucial for enabling the seamless data flow and processing needed for these interconnected devices, thereby broadening their market reach.

Changing Work and Lifestyle Habits

The widespread adoption of remote and hybrid work models, accelerated by events in 2020, has fundamentally reshaped how people interact with technology. This shift has led to a significant increase in the use of personal computers, laptops, and essential peripherals like webcams and monitors, directly benefiting companies like ASMedia that provide the underlying chipsets and connectivity solutions. The demand for stable, high-speed internet is now paramount for both professional productivity and personal communication, underscoring the importance of ASMedia's role in enabling these digital experiences.

The ongoing evolution of work-life balance preferences continues to fuel demand for devices that support flexibility. For instance, a significant portion of the workforce, estimated to be over 30% in many developed economies by late 2024, now operates in hybrid or fully remote capacities. This sustained trend directly translates into a consistent need for advanced networking components and efficient data transfer capabilities, areas where ASMedia's technological expertise is crucial.

- Increased PC and Peripheral Sales: Global PC shipments saw a notable surge in 2024, with demand for laptops and components remaining strong due to hybrid work arrangements.

- Demand for High-Speed Internet: Consumer spending on broadband services and upgrades continued to rise, with over 90% of households in many advanced nations having access to high-speed internet by early 2025.

- Growth in Home Office Equipment: The market for home office peripherals, including monitors, keyboards, and webcams, experienced substantial growth, indicating a long-term commitment to flexible work setups.

- ASMedia's Role in Connectivity: ASMedia's high-performance USB controllers and networking chips are integral to the functionality of these devices, facilitating seamless connectivity and data flow.

Societal Expectations for Sustainability in Technology

Societal expectations for sustainability are increasingly shaping the technology sector. Consumers and investors alike are demanding that companies prioritize environmental responsibility, pushing for greener products and ethical manufacturing processes.

While ASMedia, as a fabless semiconductor company, doesn't directly engage in manufacturing, it's deeply embedded within an industry under scrutiny for its environmental footprint. This societal pressure influences ASMedia's corporate social responsibility (CSR) strategies and its selection of manufacturing partners. For instance, the Semiconductor Industry Association (SIA) reported in 2023 that the industry is actively working on reducing greenhouse gas emissions, with many companies setting ambitious targets for renewable energy adoption in their operations and supply chains.

- Growing demand for eco-friendly electronics: Consumers are actively seeking out products with longer lifespans and reduced environmental impact, influencing design and material choices.

- Supply chain transparency: ASMedia faces pressure to ensure its manufacturing partners adhere to strict environmental standards, impacting sourcing decisions and audits.

- Corporate Social Responsibility (CSR) initiatives: Societal expectations drive ASMedia to invest in and report on its sustainability efforts, aiming to build trust and enhance brand reputation.

- Circular economy principles: There's a growing push for technology companies to design products for repairability and recyclability, reducing electronic waste.

Societal shifts towards remote work and digital lifestyles are profoundly impacting the demand for ASMedia's core products. The increasing reliance on high-speed data transfer for everything from video conferencing to smart home automation directly benefits companies providing advanced connectivity solutions. This trend is further amplified by a growing consumer expectation for faster, more powerful, and feature-rich electronic devices, pushing the boundaries of what ASMedia's interface ICs enable.

The global digital transformation continues to accelerate, with projections suggesting over 29 billion connected devices by 2030. This expansion directly fuels the need for ASMedia's high-performance USB and PCIe solutions. Furthermore, the sustained adoption of hybrid work models, with over 30% of the workforce in many developed economies operating remotely by late 2024, underscores the ongoing demand for robust networking components and efficient data transfer capabilities.

| Trend | Impact on ASMedia | Supporting Data (2024/2025) |

|---|---|---|

| Digital Transformation & IoT Growth | Increased demand for high-speed interface ICs | Global IoT market projected to exceed $1.5 trillion by 2025. |

| Remote & Hybrid Work | Higher sales of PCs, peripherals, and networking components | Over 30% of workforce in developed economies operating remotely (late 2024). |

| Consumer Demand for Performance | Need for faster, more powerful devices | Smartphone shipments over 287 million units in Q1 2024. |

Technological factors

ASMedia's business is fundamentally tied to the advancement of high-speed interface standards like USB, PCIe, and SATA. For instance, the rollout of USB4 80Gbps and the upcoming 120Gbps specifications, alongside PCIe Gen5 and the emerging Gen6, directly shapes ASMedia's product development cycles and their ability to offer competitive solutions.

The relentless pace of innovation in these interface technologies, with USB4 speeds doubling from 40Gbps to 80Gbps in recent years and PCIe Gen5 offering 32GT/s per lane, necessitates constant R&D investment from ASMedia. Successfully integrating these faster, more efficient standards into their chipsets is paramount for maintaining market leadership and capturing new opportunities in the computing and consumer electronics sectors.

The surge in Artificial Intelligence (AI) and edge computing is creating a substantial demand for advanced data transfer solutions. ASMedia's PCIe offerings are crucial for the high-performance infrastructure powering AI servers, facilitating the rapid movement of massive datasets. This trend is underscored by the projected growth of the AI market, which analysts anticipate will reach hundreds of billions of dollars by 2025.

Furthermore, ASMedia is strategically positioning its USB4 controllers to capitalize on the burgeoning edge AI market. These controllers are being adapted to support external GPU connectivity, a key requirement for accelerating AI processing at the network edge. The expansion of edge AI applications, from autonomous vehicles to smart city infrastructure, directly translates into increased opportunities for ASMedia's high-speed interconnect technologies.

The relentless drive towards miniaturization in consumer electronics, from smartphones to wearables, directly fuels the demand for increasingly compact and integrated semiconductor solutions. ASMedia's success hinges on its ability to design highly integrated circuits (ICs) that pack more functionality into smaller physical footprints.

This trend is underscored by the projected growth in the Internet of Things (IoT) market, which is expected to reach $1.5 trillion by 2025, with billions of connected devices requiring low-power, high-performance chips. ASMedia's innovation in this area is critical for enabling the next generation of portable and embedded technologies.

Research and Development Investment

ASMedia's commitment to research and development is crucial for staying ahead in the dynamic semiconductor market. The company consistently invests in creating novel physical layers and enhancing power efficiency for its high-speed integrated circuits. This focus on innovation also extends to exploring new applications for their advanced chipsets.

For instance, ASMedia allocated approximately NT$2.6 billion (around $85 million USD) to R&D in 2023, a significant portion of its revenue, underscoring its dedication to technological advancement. This investment fuels the development of next-generation connectivity solutions, vital for emerging markets like AI and advanced computing.

- Continuous R&D Investment: ASMedia's ongoing financial commitment to research and development is essential for maintaining its competitive position.

- Focus Areas: Key R&D efforts include developing new physical layers, improving power efficiency, and identifying new applications for high-speed ICs.

- 2023 R&D Spending: The company invested approximately NT$2.6 billion (around $85 million USD) in R&D during 2023, demonstrating a strong focus on innovation.

- Future Growth Drivers: These investments are critical for ASMedia to capitalize on growth opportunities in areas such as AI and high-performance computing.

Competitive Landscape and IP Innovation

The high-speed interface Integrated Circuit (IC) market, where ASMedia operates, is intensely competitive. This necessitates continuous innovation and robust protection of its intellectual property (IP) to maintain a competitive edge. For instance, the global semiconductor IP market was valued at approximately $6.5 billion in 2023 and is projected to grow significantly, highlighting the increasing importance of unique designs and patented technologies.

ASMedia's success hinges on its ability to differentiate its products through proprietary technology. The semiconductor industry's reliance on IP means that companies like ASMedia must invest heavily in research and development to secure patents. These patents are crucial for preventing competitors from replicating their designs and for commanding premium pricing, thereby securing market share in a dynamic environment. For example, in 2024, ASMedia continued to file patents related to its Thunderbolt and USB technologies, reinforcing its IP portfolio.

- Intense Competition: The high-speed interface IC sector demands constant technological advancement.

- IP as a Differentiator: Unique designs and patents are key to market share.

- Market Growth: The semiconductor IP market's expansion underscores the value of innovation.

- ASMedia's Strategy: Ongoing patent filings in areas like Thunderbolt and USB are vital for differentiation.

ASMedia's technological trajectory is intrinsically linked to the evolution of high-speed interface standards. The company's focus on USB4, PCIe Gen5, and emerging Gen6 specifications directly influences its product roadmap and competitive standing. The rapid doubling of USB speeds to 80Gbps and the increasing bandwidth of PCIe are key drivers for ASMedia's continuous R&D efforts.

The burgeoning AI and edge computing sectors are creating substantial demand for ASMedia's high-performance interconnect solutions. Their PCIe chipsets are vital for AI server infrastructure, facilitating rapid data movement. The global AI market is projected to exceed $1.5 trillion by 2025, highlighting the immense opportunity for ASMedia's technology.

ASMedia's commitment to innovation is evident in its significant R&D investments, with approximately NT$2.6 billion (around $85 million USD) allocated in 2023. This focus on developing advanced physical layers and enhancing power efficiency is crucial for capturing growth in AI and advanced computing markets.

The company's strategic patent filings, particularly in Thunderbolt and USB technologies during 2024, underscore its dedication to intellectual property protection. This is essential for differentiation in the competitive semiconductor IP market, valued at approximately $6.5 billion in 2023.

| Technology Area | Key Standard | ASMedia's Role | Market Relevance | 2023-2025 Outlook |

|---|---|---|---|---|

| High-Speed Interfaces | USB4 (80Gbps, 120Gbps) | Controller ICs | Consumer Electronics, Computing | Continued growth, integration focus |

| High-Speed Interfaces | PCIe Gen5 (32GT/s) / Gen6 | Controller ICs | AI Servers, HPC | High demand, performance critical |

| AI & Edge Computing | External GPU Connectivity | USB4 Controllers | Edge AI Acceleration | Significant growth driver |

| Miniaturization & IoT | Integrated Circuits (ICs) | Low-power, high-performance chips | Wearables, Smart Devices | IoT market projected to reach $1.5T by 2025 |

Legal factors

Intellectual property rights, especially patents, are vital for ASMedia, a fabless semiconductor firm. Protecting its innovative chip designs and high-speed interface technologies is crucial for maintaining its competitive edge and preventing others from copying its work.

The semiconductor industry saw significant growth in patent filings between 2023 and 2024, with companies investing heavily in IP protection. This trend underscores the increasing importance of patents as ASMedia navigates the dynamic market, aiming to secure its technological advancements.

ASMedia navigates a complex web of international trade laws and export controls, particularly critical given its focus on semiconductor technology. These regulations, often shaped by geopolitical tensions, directly influence ASMedia's ability to market its products globally and determine its permissible customer base, thereby impacting its overall market penetration.

For instance, the US Department of Commerce's Bureau of Industry and Security (BIS) Export Administration Regulations (EAR) are a significant factor. In 2023, the BIS continued to implement stringent controls on advanced semiconductor manufacturing equipment and related technologies, impacting companies like ASMedia that operate in this space. These controls aim to prevent the proliferation of sensitive technologies to certain countries, creating compliance challenges and potential market access limitations.

As ASMedia's chipsets facilitate data transfer in numerous electronic devices, increasingly stringent data privacy and security regulations like the EU's GDPR and California's CCPA could indirectly shape product development and customer expectations. While ASMedia doesn't directly manage end-user data, its components are integral to systems that must comply with these evolving legal frameworks.

Antitrust and Competition Laws

Antitrust and competition laws are significant considerations for ASMedia within the semiconductor sector. These regulations, enforced by bodies like the U.S. Federal Trade Commission (FTC) and the European Commission, aim to prevent market monopolization and ensure a level playing field for all players. For instance, in 2023, the FTC continued its scrutiny of major tech companies for alleged anti-competitive practices, demonstrating the active enforcement environment.

ASMedia must meticulously align its business operations, strategic alliances, and market approaches with these global antitrust frameworks. Failure to comply can result in substantial fines, divestitures, and reputational damage, impacting ASMedia's ability to innovate and expand. The ongoing investigations into large semiconductor firms for potential monopolistic behavior underscore the critical need for proactive compliance.

- Global Enforcement: Antitrust authorities worldwide, including the FTC and European Commission, actively monitor the semiconductor industry for anti-competitive practices.

- Compliance Imperative: ASMedia must ensure its business models and partnerships adhere to regulations designed to foster fair competition and prevent monopolies.

- Risk Mitigation: Proactive compliance helps ASMedia avoid significant legal penalties, operational disruptions, and damage to its market standing.

- Market Dynamics: The semiconductor landscape, characterized by consolidation and strategic partnerships, necessitates constant vigilance regarding competition law implications.

Product Liability and Safety Standards

ASMedia's integrated circuits (ICs) are essential components in numerous electronic devices, meaning the company must navigate a complex web of product liability and safety standards across global markets. Failure to meet these rigorous requirements, such as those set by the Consumer Product Safety Commission (CPSC) in the US or the General Product Safety Regulation (GPSR) in the EU, could lead to costly product recalls, expensive litigation, and significant damage to ASMedia's brand reputation. For instance, in 2024, the global electronics recall market saw a notable increase, with safety concerns driving a significant portion of these actions.

Adherence to these standards is not just about compliance; it's a fundamental aspect of risk management for ASMedia. The company invests heavily in quality control and testing to ensure its ICs meet or exceed international safety benchmarks. This proactive approach helps mitigate the financial and reputational fallout that can arise from product defects, especially as consumer electronics become increasingly integrated into daily life and subject to greater scrutiny.

- Global Compliance: ASMedia must ensure its ICs comply with varying safety regulations in key markets like the US, EU, and Asia.

- Risk Mitigation: Meeting stringent safety standards prevents costly recalls, lawsuits, and reputational harm.

- Quality Assurance: Robust testing and quality control are critical for ASMedia's ICs to meet international safety benchmarks.

- Consumer Trust: Demonstrating a commitment to product safety builds and maintains consumer confidence in ASMedia's components.

ASMedia's operations are heavily influenced by intellectual property laws, particularly patents, which are critical for safeguarding its innovative semiconductor designs. The global semiconductor industry's patent landscape is dynamic, with significant investment in IP protection continuing through 2024 and into early 2025, reflecting its importance for competitive advantage.

Navigating international trade and export control regulations is paramount for ASMedia, especially given the sensitive nature of semiconductor technology. In 2024, geopolitical factors continued to shape these regulations, impacting market access and customer bases for companies in this sector.

Data privacy laws, such as GDPR and CCPA, indirectly affect ASMedia as its components are integrated into devices handling user information. Compliance with these evolving legal frameworks influences product development and customer expectations in 2024 and beyond.

Antitrust and competition laws are a constant consideration, with regulatory bodies actively scrutinizing the semiconductor market. ASMedia must align its strategies with these regulations to avoid penalties, as evidenced by ongoing investigations into major tech firms in 2023 and 2024.

Product liability and safety standards are crucial for ASMedia's ICs, which are used globally. The increasing trend of product recalls due to safety concerns in the electronics market, observed in 2024, highlights the necessity for rigorous compliance and quality control.

Environmental factors

The semiconductor industry, a critical sector for companies like ASMedia, is inherently energy-intensive. Even though ASMedia operates as a fabless entity, its reliance on foundry partners means it's indirectly impacted by the significant power demands of chip fabrication. This energy consumption is a major environmental consideration.

As global demand for advanced semiconductors continues to surge, so does the energy required for their production. For instance, advanced chip manufacturing facilities can consume hundreds of megawatts of power. This escalating demand raises concerns about the industry's carbon footprint, driving a push for greater energy efficiency and the integration of renewable energy sources throughout the semiconductor supply chain.

Semiconductor manufacturing, including operations like those ASMedia relies on, is incredibly water-intensive. For instance, producing a single wafer can consume hundreds of gallons of ultra-pure water. As global water scarcity intensifies, particularly in regions where chip manufacturing is concentrated, expect stricter regulations and greater public scrutiny on water usage in fabrication plants.

This heightened focus means ASMedia and its supply chain partners will face increasing pressure to adopt advanced water recycling and conservation technologies. Companies that demonstrate strong water stewardship will likely gain a competitive advantage, potentially through reduced operational costs and improved brand reputation in the face of growing environmental awareness.

The global e-waste problem is escalating, with projections indicating that by 2027, worldwide e-waste generation could reach 165 million metric tons annually, a significant jump from around 53.6 million metric tons in 2019. This surge is pressuring electronics manufacturers and their suppliers, like ASMedia, to consider the environmental impact throughout a product's lifecycle.

Circular economy principles are gaining traction, encouraging the design of products that are easier to repair, reuse, and recycle. For ASMedia, this could translate into a demand for integrated circuits (ICs) that are manufactured using more sustainable materials or are designed with future disassembly and material recovery in mind, potentially influencing their R&D priorities and supply chain choices.

Hazardous Substance Regulations (RoHS, REACH)

Regulations like RoHS (Restriction of Hazardous Substances) and REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) significantly influence the materials and chemicals ASMedia can utilize in its chip designs and throughout its supply chain. Compliance ensures that ASMedia’s products, and those from its manufacturing partners, meet strict environmental standards, avoiding restricted substances like lead, mercury, and cadmium. For instance, the EU’s REACH regulation, continually updated, impacts over 20,000 chemical substances, requiring rigorous data submission and risk assessment for those manufactured or imported into the EU in quantities exceeding one tonne per year. ASMedia must actively monitor these evolving regulations to maintain market access and product integrity, particularly in major markets like the European Union.

ASMedia’s adherence to these directives is crucial for its global operations and reputation. Failure to comply can lead to product recalls, fines, and significant reputational damage. The semiconductor industry, in particular, relies on complex material compositions, making proactive management of hazardous substances a continuous challenge. For example, the global market for semiconductors reached approximately $600 billion in 2023, underscoring the vast scale of production and the importance of widespread regulatory compliance.

- RoHS Compliance: Ensures products are free from specific hazardous materials, facilitating market entry into regions with such mandates.

- REACH Impact: Requires detailed chemical registration and safety data, affecting material sourcing and product formulation for ASMedia’s supply chain.

- Supply Chain Scrutiny: ASMedia must verify that its foundries and component suppliers also meet these environmental standards.

- Market Access: Non-compliance can restrict sales in key markets, impacting revenue and growth potential for ASMedia’s product portfolio.

Climate Change and Emissions Reduction Targets

Global initiatives aimed at mitigating climate change, such as ambitious net-zero emissions targets, are increasingly influencing the semiconductor sector. These targets necessitate a shift towards more sustainable manufacturing processes and supply chain management.

ASMedia has proactively addressed this by achieving ISO 14064-1 Greenhouse Gas Verification, a significant step in quantifying and managing its environmental impact. This certification underscores the company's dedication to reducing its carbon footprint.

Furthermore, ASMedia's business ecosystem, including its suppliers and partners, is under growing pressure to adopt environmentally responsible practices. This collaborative approach to emissions reduction is becoming a critical factor for operational continuity and market competitiveness.

- ASMedia's ISO 14064-1 Verification: Demonstrates a concrete commitment to measuring and managing greenhouse gas emissions.

- Industry-Wide Sustainability Push: Global net-zero targets are driving demand for greener semiconductor production.

- Supply Chain Responsibility: Partners are expected to align with ASMedia's sustainability goals, impacting sourcing and operations.

The semiconductor industry's considerable energy needs, even for fabless companies like ASMedia relying on foundries, present a significant environmental challenge. The escalating global demand for advanced chips directly correlates with increased power consumption in manufacturing, raising concerns about the sector's carbon footprint and driving innovation in energy efficiency and renewable energy adoption.

Water scarcity is another critical factor, as chip fabrication is highly water-intensive, with hundreds of gallons of ultra-pure water potentially used per wafer. This intensifies scrutiny on water usage in manufacturing hubs, pushing companies like ASMedia and its partners towards advanced water recycling and conservation technologies.

The growing e-waste problem, projected to reach 165 million metric tons annually by 2027, is prompting a shift towards circular economy principles. This could influence ASMedia's design choices and supply chain decisions, favoring products built for repairability, reuse, and material recovery.

Stringent regulations such as RoHS and REACH dictate material usage, requiring ASMedia to ensure its designs and supply chain avoid hazardous substances. The EU's REACH regulation alone impacts over 20,000 chemicals, necessitating rigorous compliance for market access, especially given the semiconductor market's approximate $600 billion valuation in 2023.

Global climate change initiatives and net-zero targets are pressuring the semiconductor sector towards sustainable practices. ASMedia's ISO 14064-1 Greenhouse Gas Verification highlights its commitment to managing its environmental impact, a commitment that extends to its entire supply chain.

| Environmental Factor | Impact on ASMedia | Industry Trend/Data (2024-2025 Focus) | ASMedia's Response/Action |

|---|---|---|---|

| Energy Consumption | Indirectly high due to foundry reliance; significant power demand in chip fabrication. | Advanced chip facilities can consume hundreds of megawatts; push for renewables in manufacturing. | Focus on energy-efficient designs; indirect influence on foundry partners' energy choices. |

| Water Usage | High water consumption in wafer fabrication impacts ASMedia's supply chain. | Hundreds of gallons of ultra-pure water per wafer; increasing water scarcity concerns in manufacturing regions. | Emphasis on supply chain partners adopting advanced water recycling and conservation. |

| E-Waste & Circularity | Need to consider product lifecycle impact; potential demand for sustainable materials and design. | E-waste projected to reach 165 million metric tons annually by 2027; growing adoption of circular economy principles. | Consideration of product design for repairability and recyclability; influence on R&D and sourcing. |

| Chemical Regulations (RoHS, REACH) | Must ensure compliance in chip design and supply chain; restricted substances impact material choices. | REACH impacts over 20,000 chemicals; continuous updates to regulations affecting global markets. | Proactive monitoring of evolving regulations; ensuring supply chain adherence to avoid market restrictions. |

| Climate Change & Emissions | Pressure to reduce carbon footprint across the value chain. | Global net-zero targets driving demand for greener semiconductor production. | ISO 14064-1 Greenhouse Gas Verification; encouraging supply chain partners towards emissions reduction. |

PESTLE Analysis Data Sources

Our ASMedia PESTLE Analysis is built upon a robust foundation of data from official government publications, reputable financial institutions, and leading market research firms. We meticulously gather insights from economic reports, regulatory updates, and technological trend analyses to ensure comprehensive and accurate assessments.