ASMedia Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ASMedia Bundle

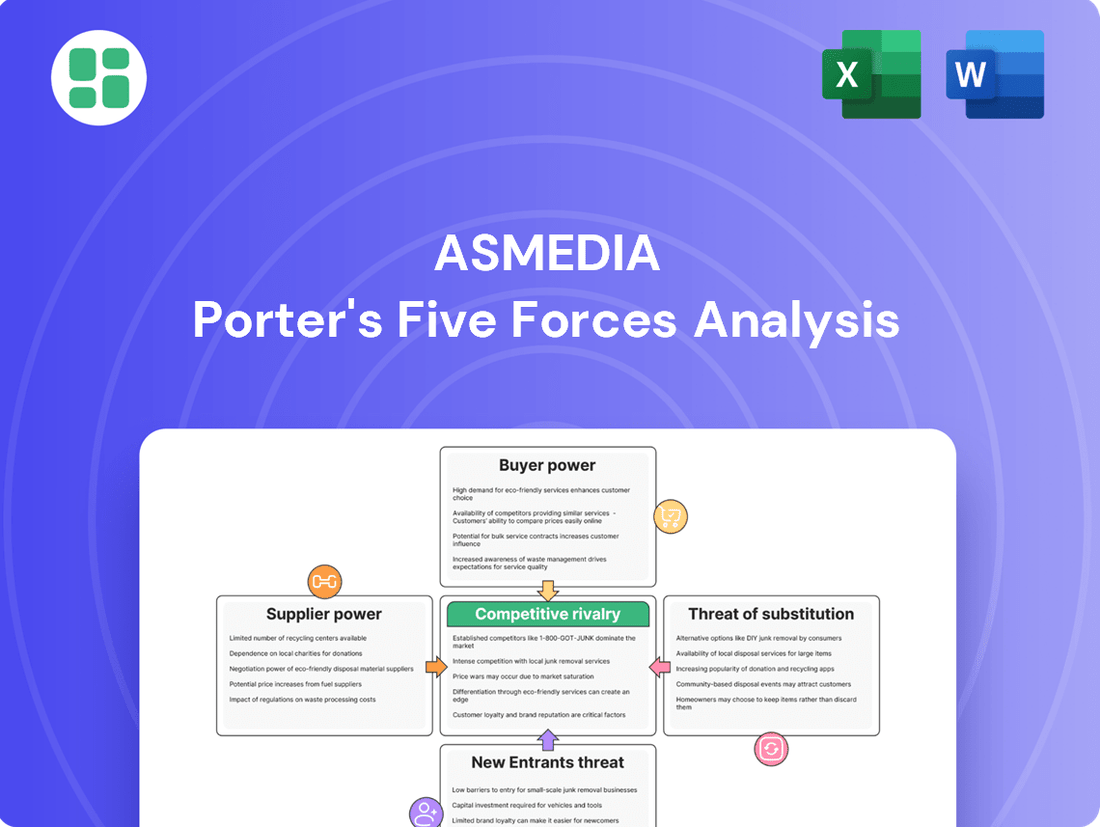

ASMedia's competitive landscape is shaped by the interplay of five key forces, revealing significant pressures from rivals and potential new entrants. Understanding the bargaining power of both suppliers and buyers is crucial for navigating this dynamic market. The threat of substitute products also presents a considerable challenge to ASMedia's market position.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore ASMedia’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The bargaining power of suppliers for ASMedia is significantly influenced by the concentration and uniqueness of its component sources. For critical elements like wafer fabrication, ASMedia relies on a limited number of foundries, such as TSMC, which commands substantial market share and pricing power. The specialized nature of advanced semiconductor manufacturing means few alternatives exist for cutting-edge process nodes, directly increasing the leverage of these key fabrication partners.

ASMedia's bargaining power with its suppliers is significantly influenced by switching costs. If ASMedia were to change a key supplier, for instance, a wafer foundry or an IP provider, the associated expenses and complexities would be substantial. These could include redesigning its chip architectures, undergoing rigorous re-qualification processes for new suppliers, and negotiating entirely new supply agreements. For example, the semiconductor industry often sees lengthy qualification cycles for new foundries, which can extend product development timelines by months, directly impacting ASMedia's time-to-market and thus increasing the cost of switching.

The threat of forward integration by ASMedia's suppliers, particularly major foundries like TSMC or significant IP providers, could substantially shift the power dynamic. If these suppliers were to leverage their manufacturing or intellectual property expertise to design and market their own high-speed interface ICs, they would directly enter ASMedia's core business. This would transform them from critical partners into formidable competitors, thereby increasing their bargaining power.

Importance of Supplier Inputs to ASMedia's Products

The performance and quality of ASMedia's high-speed interconnect solutions, like their USB controllers and PCIe switches, are directly tied to the specialized semiconductor components sourced from a limited number of key suppliers. These inputs are not mere commodities; they are critical for achieving the advanced functionality and reliability that define ASMedia's products.

If ASMedia's core value proposition, such as delivering industry-leading data transfer speeds, is heavily dependent on the unique technological capabilities of these specific suppliers, these suppliers naturally wield significant bargaining power. This power can translate into higher input costs or more stringent supply terms for ASMedia.

For instance, the advanced PHY technology required for ASMedia's latest PCIe Gen 5 controllers often originates from a select group of foundries and IP providers. ASMedia's reliance on these specialized capabilities means that any disruption or price increase from these suppliers can have a substantial impact on ASMedia's cost structure and product availability.

- Critical Input Reliance: ASMedia's advanced integrated circuits depend on specialized semiconductor components, impacting performance and functionality.

- Supplier Power Leverage: High reliance on unique supplier technologies for core product features grants suppliers leverage over pricing and terms.

- Industry Examples: Advanced PHY technology for PCIe Gen 5 controllers often comes from a limited pool of foundries and IP providers, increasing supplier influence.

Supplier's Ability to Differentiate Offerings

In the semiconductor industry, suppliers' ability to differentiate their offerings significantly impacts their bargaining power. Companies like ASMedia, which rely on specialized components, face suppliers who can command higher prices if their technology is truly unique or of superior quality. For example, a supplier with proprietary manufacturing processes or advanced chip designs can create a competitive advantage that ASMedia might find difficult to replicate, thus strengthening the supplier's position.

The semiconductor sector is characterized by rapid technological advancement and high research and development costs. Suppliers who consistently invest in innovation and can offer cutting-edge solutions, such as advanced lithography techniques or novel materials, gain substantial leverage. This differentiation can translate into higher margins for the supplier and potentially increased costs or supply chain risks for buyers like ASMedia if they become overly reliant on a single, highly specialized source. In 2024, the demand for high-performance chips for AI and advanced computing has intensified, making suppliers with specialized, high-yield manufacturing capabilities particularly powerful.

- Technological Superiority: Suppliers offering patented chip architectures or advanced packaging solutions possess a distinct advantage.

- Proprietary Processes: Exclusive manufacturing techniques that yield higher performance or lower defect rates enhance supplier leverage.

- Specialized Expertise: Deep knowledge in niche areas like quantum computing components or advanced sensor technology can create strong dependencies.

- Quality and Reliability: Consistent delivery of high-quality, defect-free components is crucial in semiconductors, giving reliable suppliers more pricing power.

The bargaining power of ASMedia's suppliers is considerable due to the industry's high concentration and the specialized nature of semiconductor manufacturing. Key foundries like TSMC, which ASMedia relies on for advanced nodes, hold significant market power. This reliance is amplified by the substantial switching costs involved in changing fabrication partners, which can include lengthy re-qualification periods and redesign efforts, potentially delaying product launches by months.

Suppliers who offer differentiated technologies, such as proprietary manufacturing processes or unique IP for high-speed interfaces like PCIe Gen 5, can command higher prices. The intense demand for advanced chips in 2024 for AI and computing further bolsters the leverage of suppliers with specialized, high-yield capabilities. The threat of forward integration by these suppliers, where they might enter ASMedia's product market, also increases their overall bargaining power.

| Factor | ASMedia Impact | Supplier Leverage |

| Foundry Concentration | High reliance on few advanced foundries | High pricing power |

| Switching Costs | Significant redesign and re-qualification | Low incentive to offer concessions |

| Technological Differentiation | Dependence on unique PHY/IP | Ability to charge premium prices |

| Market Demand (2024) | Increased demand for advanced nodes | Enhanced power for high-capacity suppliers |

What is included in the product

This ASMedia Porter's Five Forces analysis dissects the competitive intensity by examining threats from new entrants, the power of buyers and suppliers, the risk of substitutes, and the rivalry among existing competitors.

Instantly identify and mitigate competitive threats with a dynamic visualization of ASMedia's Porter's Five Forces, enabling proactive strategy adjustments.

Customers Bargaining Power

ASMedia's customer concentration is a key factor in their bargaining power. Major personal computer manufacturers and other large electronics companies represent ASMedia's primary customer base. If a small number of these entities account for a substantial percentage of ASMedia's revenue, their ability to negotiate favorable terms, such as lower prices or extended payment periods, significantly increases.

Customer switching costs for ASMedia's high-speed interface ICs are a significant factor in their bargaining power. If it's easy and inexpensive for customers to switch to a competitor, they have more leverage. This can manifest as demanding lower prices or better contract terms.

The ease of switching depends on several elements. For instance, if ASMedia's ICs use highly standardized interfaces, customers can more readily integrate products from other suppliers. Similarly, if the qualification process for new ICs is straightforward and doesn't require extensive re-engineering, customers face fewer barriers to changing vendors. In 2023, the semiconductor industry saw continued investment in standardization efforts, aiming to reduce such integration friction across various product categories.

Large electronics manufacturers, ASMedia's primary customers, possess the financial muscle and technical expertise to consider in-house development of high-speed interface ICs. This potential for backward integration, where customers produce their own components, directly threatens ASMedia's market position by giving these customers greater leverage in price negotiations and supply chain control.

For instance, major players in the PC and server markets, which are key segments for ASMedia, often have dedicated R&D departments capable of designing complex semiconductor solutions. Should these customers perceive ASMedia's pricing as too high or their supply as unreliable, the incentive to develop proprietary solutions or acquire smaller, specialized IC design firms to achieve backward integration increases significantly.

Customer Price Sensitivity and Product Importance

Customer price sensitivity for ASMedia's integrated circuits (ICs) is influenced by their role in the final product. If ASMedia's chips are a significant cost driver or a commoditized component, customers will likely exert greater pressure on pricing.

The importance of ASMedia's ICs to a customer's product functionality also plays a crucial role. If these components are critical for performance or differentiation, customers may be less sensitive to price and more focused on quality and reliability.

- Price Sensitivity: High if ASMedia's ICs represent a large portion of a customer's bill of materials (BOM).

- Product Importance: Lower price sensitivity if ASMedia's ICs are essential for high-performance or unique product features.

- Market Dynamics: In 2024, the semiconductor industry experienced fluctuating demand, impacting pricing power for suppliers like ASMedia.

Availability of Alternative Suppliers for Customers

The availability of alternative suppliers significantly impacts ASMedia's customers' bargaining power. If numerous companies offer comparable high-speed interface integrated circuits (ICs), such as USB, PCIe, and SATA controllers, customers have more options. This competitive landscape allows buyers to negotiate better prices and terms, as they can easily switch to a different vendor if ASMedia's offerings are not satisfactory.

For ASMedia, a market with many competitors providing similar products means customers can readily compare features, pricing, and support. This forces ASMedia to maintain competitive pricing and product innovation to retain its customer base. For instance, in the highly competitive market for PCIe controllers, ASMedia faces rivals like Broadcom and ASPEED Technology, giving motherboard manufacturers and system integrators considerable leverage.

- High Number of Competitors: The presence of multiple suppliers for high-speed interface ICs directly amplifies customer bargaining power.

- Price Sensitivity: Customers can leverage competitive pricing from alternative suppliers to negotiate lower costs with ASMedia.

- Product Differentiation: ASMedia must differentiate its products to reduce the perceived substitutability by competitors, thereby mitigating customer bargaining power.

ASMedia's customers, particularly major PC manufacturers, hold significant bargaining power due to several factors. Their ability to switch suppliers is influenced by the standardization of interfaces and the ease of integrating new components, a trend reinforced by industry-wide standardization efforts in 2023. Furthermore, the financial and technical capacity of these large buyers to develop their own ICs, or backward integrate, presents a direct threat, especially if ASMedia's pricing or supply chain reliability falters.

Customer price sensitivity is heightened when ASMedia's ICs constitute a substantial portion of a customer's bill of materials. Conversely, if ASMedia's chips are critical for product performance, customers may exhibit less price sensitivity. The semiconductor market in 2024 saw dynamic demand shifts, impacting the pricing leverage of suppliers.

The competitive landscape for high-speed interface ICs, including USB, PCIe, and SATA controllers, directly empowers ASMedia's customers. With numerous alternative suppliers like Broadcom and ASPEED Technology, buyers can readily negotiate for better terms, forcing ASMedia to maintain competitive pricing and product innovation to retain market share.

| Factor | Impact on ASMedia's Customer Bargaining Power | Supporting Data/Context |

|---|---|---|

| Customer Concentration | High if a few large customers account for a significant revenue share. | Major PC manufacturers are ASMedia's primary customer base. |

| Switching Costs | High if interfaces are standardized and integration is easy. | Industry standardization efforts in 2023 aimed to reduce integration friction. |

| Threat of Backward Integration | High if large customers can develop ICs in-house. | Major PC and server market players have R&D capabilities. |

| Price Sensitivity | High if ASMedia's ICs are a large part of the BOM. | Fluctuating demand in the 2024 semiconductor market influenced pricing. |

| Availability of Alternatives | High due to multiple competitors in high-speed interface ICs. | Competitors include Broadcom and ASPEED Technology for PCIe controllers. |

Same Document Delivered

ASMedia Porter's Five Forces Analysis

This preview showcases the complete ASMedia Porter's Five Forces Analysis, offering a comprehensive examination of competitive forces within the industry. The document you see here is precisely the same professionally formatted analysis you will receive immediately upon purchase, ready for immediate use and strategic decision-making.

Rivalry Among Competitors

ASMedia faces a competitive landscape populated by both seasoned semiconductor giants and nimble newcomers in the high-speed interface IC market. Companies like Realtek, Synaptics, and Parade Technologies are significant players, offering a broad range of similar products. The presence of these established firms, alongside emerging specialists, means ASMedia must constantly innovate to maintain its edge.

The diversity of competitors is also a key factor. While some rivals focus on specific interface technologies, others offer more comprehensive solutions, creating varied competitive pressures. For instance, in the USB controller market, ASMedia competes with companies that have deep roots in consumer electronics connectivity, while in Thunderbolt, the competitive set might include players with strong ties to the premium PC segment.

The high-speed interface IC market segment is experiencing moderate growth. While specific figures for 2024 are still solidifying, historical trends and analyst projections indicate a compound annual growth rate (CAGR) in the mid-single digits. This steady, rather than explosive, expansion means companies are keenly focused on capturing existing market share.

Slower industry growth inherently intensifies competitive rivalry. When the pie isn't growing rapidly, companies like ASMedia must work harder to secure their slice. This often translates to more aggressive pricing strategies, increased investment in product differentiation, and a stronger emphasis on customer retention to maintain and grow their position within the market.

ASMedia's competitive rivalry is significantly shaped by product differentiation. The company distinguishes its offerings through proprietary technologies, such as its advanced USB controllers and high-speed switch ICs, which often boast superior performance metrics compared to competitors. For instance, ASMedia's USB4 solutions provide data transfer speeds up to 40 Gbps, a feature that sets them apart in a market where incremental improvements are common.

This focus on unique features and performance can mitigate direct price competition. While the semiconductor industry, particularly in areas like chipsets, can see commoditization, ASMedia's ability to deliver cutting-edge technology, evidenced by its strong patent portfolio and early adoption of new industry standards, allows it to command a premium and reduce the intensity of rivalry based solely on price.

Switching Costs for Customers Among Competitors

Switching costs for customers between ASMedia and its competitors are generally moderate. While ASMedia's advanced chipsets offer performance advantages, the integration into complex systems, particularly in the PC and server markets, involves significant engineering effort and qualification processes. This makes frequent switching costly and time-consuming for system manufacturers.

For instance, a PC manufacturer designing a new motherboard around ASMedia's USB controllers must re-engineer the board layout, re-certify the entire system for compatibility and performance, and potentially update firmware across multiple components. This process can take months and incur substantial R&D expenses, thereby creating a barrier to immediate switching. In 2024, the semiconductor industry continued to see long lead times for new product qualifications, reinforcing these switching costs.

- Moderate Switching Costs: ASMedia's integration into complex systems like PCs and servers involves significant engineering and qualification, making frequent customer switching difficult and expensive.

- R&D and Certification Hurdles: System manufacturers face substantial R&D expenses and lengthy certification processes when adopting new chipsets, acting as a deterrent to immediate competitor switching.

- Industry Trends: In 2024, extended lead times for new product qualifications within the semiconductor sector further solidified these existing switching costs for ASMedia's customers.

Exit Barriers for Competitors

Competitors in the high-speed interface IC market face significant hurdles when considering an exit. High asset specificity, such as specialized manufacturing equipment and dedicated R&D facilities, makes it difficult for companies to redeploy or sell these assets to other industries. For instance, the advanced fabrication processes required for ASMedia's products represent substantial, industry-specific investments.

Furthermore, substantial sunk costs in intellectual property, including patents and proprietary designs for advanced chipsets, create a strong disincentive for exiting. These intangible assets have little value outside the semiconductor industry, meaning companies cannot easily recoup these investments. The strategic importance of maintaining a presence in the high-speed interface market, even if currently facing challenges, also acts as an exit barrier, as firms may fear losing crucial technological expertise and market relationships.

- High Asset Specificity: Specialized manufacturing equipment and R&D centers are difficult to repurpose.

- Sunk Costs in IP: Patents and proprietary designs hold little value outside the semiconductor sector.

- Strategic Importance: Maintaining market presence preserves technological expertise and customer relationships.

ASMedia's competitive rivalry is intense, driven by a market with established players like Realtek and Synaptics, as well as emerging specialists. This dynamic forces ASMedia to continuously innovate and differentiate its high-speed interface ICs, such as its 40 Gbps USB4 solutions, to avoid direct price competition.

The moderate growth of the high-speed interface IC market in 2024, with projected mid-single-digit CAGRs, further amplifies rivalry as companies vie for existing market share. This environment necessitates aggressive strategies in product development and customer retention.

Switching costs for ASMedia's customers are moderately high due to the significant engineering and certification efforts required for integrating new chipsets into complex systems. These integration challenges, coupled with extended product qualification lead times observed in 2024, create a substantial barrier for customers considering a switch to competitors.

Exit barriers for competitors are substantial, stemming from high asset specificity in specialized manufacturing and R&D, as well as significant sunk costs in intellectual property. These factors, combined with the strategic importance of maintaining market presence, discourage companies from leaving the high-speed interface IC sector.

SSubstitutes Threaten

The threat of substitutes for ASMedia's high-speed interface ICs is a significant consideration. Alternative technologies that offer similar data transfer and connectivity solutions can emerge, potentially impacting ASMedia's market share. For instance, the advancement of integrated platform chipsets that consolidate discrete controller functions could reduce the need for ASMedia's specialized ICs. In 2024, the semiconductor industry saw continued investment in System-on-Chip (SoC) designs, which often integrate high-speed interfaces directly, presenting a direct substitute pathway for some of ASMedia's offerings.

The threat of substitutes for ASMedia's products hinges on how their price and performance stack up against alternative solutions. If competitors offer similar or better functionality at a lower cost, ASMedia faces a significant challenge.

For instance, in the high-performance computing space, ASMedia's interconnect solutions compete with offerings from companies like Broadcom and Marvell. While ASMedia often focuses on specific niches like PCIe switches and controllers, a direct comparison of price per gigabit per second or power consumption per port can reveal shifts in the substitute threat. For example, if a competitor introduces a new generation of PCIe controllers that offer 20% higher bandwidth at a 10% lower price point, the substitute threat for ASMedia's comparable products would rise considerably.

Analyzing recent market reports from 2024, we see intense competition in the data center and AI infrastructure markets. Companies are constantly innovating to provide more efficient and cost-effective solutions. If ASMedia's current product portfolio, say its ASMedia ASM2824 PCIe Gen4 switch, is outpaced in terms of performance-per-dollar by a rival's offering, customers might be more inclined to switch, thereby increasing the threat of substitution.

ASMedia's customers, primarily in the PC and server markets, face a moderate threat from substitutes. The ease of integration for new technologies is a key factor; if a competitor's chip offers comparable or superior performance with minimal changes to existing system designs, adoption rates can accelerate. For instance, the ongoing trend towards more power-efficient chip architectures, like those seen in ARM-based processors for certain computing segments, presents a potential substitute if ASMedia's offerings don't keep pace. Perceived benefits such as lower power consumption or a smaller physical footprint in the final product can significantly sway customer decisions, especially in mobile or space-constrained applications.

Switching Costs to Substitute Products or Services

The threat of substitutes for ASMedia's integrated circuits (ICs) is influenced by the switching costs customers face. If it's easy and inexpensive for a client to move from ASMedia's chips to an alternative, the threat is higher. For example, if a competitor offers a similar performance chip with a simpler integration process or lower upfront design costs, ASMedia could see customers shift.

Consider the complexity involved in redesigning a product to accommodate a new IC. This often includes re-engineering circuit boards, updating firmware, and extensive re-testing, all of which represent significant switching costs. In 2024, the semiconductor industry saw continued pressure on R&D budgets, meaning companies were keenly aware of the cost and time associated with design changes.

Key factors contributing to switching costs for ASMedia's ICs include:

- Technical Integration Effort: The complexity of incorporating a new IC into existing product designs, including hardware and software compatibility.

- Testing and Validation: The time and resources required to thoroughly test and validate a new component to ensure reliability and performance.

- Supply Chain Adjustments: The effort needed to qualify new suppliers and integrate their components into the existing supply chain.

- Learning Curve: The training and familiarization required for engineers and technicians to work with new technologies or development tools.

Technological Advancements in Substitute Areas

Technological advancements in substitute areas pose a significant threat to ASMedia. For instance, the rapid evolution of integrated CPU and chipset solutions by competitors like Intel and AMD could reduce the demand for ASMedia's standalone chipsets. In 2023, the global semiconductor market saw significant investment in R&D, with major players increasing their innovation pipelines, potentially accelerating the development of these integrated alternatives.

Furthermore, the emergence of next-generation wireless connectivity, such as Wi-Fi 7 and advanced 5G integration, could offer integrated solutions that bypass the need for ASMedia's specialized connectivity chips. Companies are heavily investing in these areas; for example, Qualcomm announced significant advancements in Wi-Fi 7 technology in late 2023, aiming for broader integration into mobile and computing platforms.

- Integrated Solutions: Competitors are increasingly embedding networking and I/O functions directly into CPUs, diminishing the need for ASMedia's discrete chipsets.

- Next-Gen Connectivity: Advancements in Wi-Fi 7 and 5G integration could render ASMedia's current product lines less competitive if they don't adapt quickly.

- R&D Investment: Significant R&D spending by major semiconductor firms in 2023 indicates a strong push towards developing these disruptive technologies.

The threat of substitutes for ASMedia's high-speed interface ICs is moderate but growing, driven by integrated solutions and technological advancements. If competitors offer similar or better performance at a lower cost, or if switching costs are low, ASMedia faces increased pressure. For example, the trend towards System-on-Chip (SoC) designs, which integrate high-speed interfaces directly, presents a significant substitute pathway.

In 2024, the semiconductor industry continued to see intense R&D investment, particularly in data center and AI infrastructure, where efficiency and cost-effectiveness are paramount. This environment accelerates the development of integrated alternatives that could bypass the need for ASMedia's discrete chipsets. For instance, advancements in Wi-Fi 7 and 5G integration are creating opportunities for streamlined connectivity solutions that may reduce demand for ASMedia's specialized chips.

The ease of integration and perceived benefits like lower power consumption also influence customer decisions, especially in space-constrained applications. As ASMedia's customers, primarily in PC and server markets, evaluate new technologies, the ability of a substitute to offer comparable or superior performance with minimal design changes can accelerate adoption rates.

| Factor | ASMedia's Position | Substitute Threat Level |

| Integrated Solutions (SoCs) | Discrete ICs for specific functions | Moderate to High |

| Price-Performance Ratio | Competitive, but subject to rival innovations | Moderate |

| Switching Costs (Integration Effort) | Can be high due to re-engineering needs | Low to Moderate |

| Technological Advancements (e.g., Wi-Fi 7) | Potential for bypass by integrated next-gen tech | Moderate |

Entrants Threaten

Launching a fabless semiconductor company demands substantial capital. Significant investment is required for cutting-edge research and development to design advanced chips. For instance, securing access to leading-edge foundry services, like TSMC's advanced nodes, can cost hundreds of millions of dollars per wafer run. Furthermore, establishing a global sales and marketing infrastructure to compete effectively adds another layer of considerable expense, creating a high barrier to entry for potential new players.

Intellectual property, including patents and trade secrets, forms a significant barrier to entry in the high-speed interface IC market. ASMedia, for instance, has cultivated a robust IP portfolio, safeguarding its specialized design methodologies and deep technical expertise. This extensive intellectual property makes it challenging for newcomers to establish a competitive foothold without substantial R&D investment or costly IP licensing agreements.

New entrants face a substantial barrier in establishing credible relationships with major PC and electronics manufacturers. Securing crucial 'design wins,' where their integrated circuits (ICs) are incorporated into new product designs, is paramount. For instance, in 2024, the semiconductor industry saw continued consolidation, with established players like Intel and TSMC leveraging decades of partnerships to maintain their market positions.

The challenge for newcomers is amplified by the deep-seated, long-standing relationships that incumbents have cultivated. These existing ties translate into preferential treatment and a trusted supply chain, making it difficult for new IC suppliers to penetrate the market. In 2024, the average lead time for securing a new design win in the consumer electronics sector could extend over 18 months, a significant hurdle for agile startups.

Economies of Scale in Design and Production

ASMedia, like many semiconductor companies, benefits significantly from economies of scale in its design and production processes. Established players can leverage larger, more experienced design teams, leading to more efficient chip architectures and faster development cycles. This scale also allows for greater bargaining power with foundries, securing volume discounts on manufacturing that new entrants simply cannot match. For instance, in 2024, the average cost per wafer for high-volume production runs in advanced process nodes can be substantially lower than for smaller, pilot runs, creating a significant cost barrier.

These cost advantages directly impact the threat of new entrants. A startup would struggle to absorb the immense upfront costs associated with R&D, tape-out, and initial production runs at the same scale as ASMedia.

- Design Expertise: ASMedia’s established R&D teams possess invaluable accumulated knowledge, reducing design iterations and associated costs.

- Foundry Negotiations: Larger order volumes in 2024 allow ASMedia to negotiate more favorable pricing with leading semiconductor foundries, such as TSMC.

- Operational Efficiency: Mature operational processes and supply chain management further reduce ASMedia’s per-unit production costs compared to a nascent competitor.

- Capital Investment: The sheer capital required to establish a competitive design and manufacturing infrastructure is a formidable hurdle for any new player.

Government Policy and Regulations

Government policies and stringent regulations significantly shape the semiconductor landscape, creating substantial hurdles for new entrants. For instance, compliance with international standards like USB-IF certification or specific national security reviews for advanced chip technologies can be costly and time-consuming. In 2024, the global semiconductor industry continued to navigate complex trade restrictions and export controls, particularly impacting access to advanced manufacturing equipment and intellectual property, thereby raising the barrier to entry.

These regulatory requirements can translate into considerable upfront investment and extended development cycles. New companies must allocate resources not only to product innovation but also to navigating a labyrinth of compliance mandates, certifications, and potential legal challenges. For example, the CHIPS and Science Act in the United States, enacted in 2022 and continuing its implementation through 2024, provides substantial incentives but also imposes conditions on recipients regarding workforce development and supply chain security, adding layers of complexity for potential new players.

Key aspects of government policy impacting new entrants in the semiconductor sector include:

- Intellectual Property Protection: Robust patent laws and enforcement mechanisms are crucial, requiring significant legal expenditure for new firms to protect their innovations and avoid infringement claims.

- Export Controls and Trade Restrictions: Navigating international trade agreements and sanctions, such as those affecting access to advanced lithography equipment, can severely limit market entry and global reach for new semiconductor companies.

- Environmental and Safety Regulations: Compliance with evolving environmental standards for manufacturing processes and product safety certifications adds to operational costs and requires specialized expertise.

- National Security Reviews: Government oversight of foreign investment and technology transfer in critical sectors like semiconductors, as seen with CFIUS reviews in the US, can delay or block market entry for companies with foreign ownership.

The threat of new entrants for ASMedia is considerably low due to immense capital requirements, particularly for accessing advanced foundry services, which can cost hundreds of millions of dollars. Established players like ASMedia benefit from deep-seated relationships with major manufacturers, securing crucial design wins that can take over 18 months to achieve in 2024. Furthermore, ASMedia's robust intellectual property portfolio and significant economies of scale in design and production create substantial cost advantages and technical barriers that are difficult for startups to overcome.

| Barrier to Entry | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Accessing leading-edge foundries (e.g., TSMC's advanced nodes) can cost hundreds of millions of dollars per wafer run. | Extremely high barrier; startups struggle with upfront R&D, tape-out, and initial production costs. |

| Intellectual Property (IP) | ASMedia's extensive IP portfolio safeguards design methodologies and technical expertise. | Challenging for newcomers to compete without significant R&D or costly IP licensing. |

| Customer Relationships & Design Wins | Securing design wins with major manufacturers is paramount; established players have decades of partnerships. | New entrants face difficulty penetrating the market; design win timelines can exceed 18 months in 2024. |

| Economies of Scale | ASMedia leverages larger design teams and higher production volumes for cost efficiencies and foundry discounts. | New entrants cannot match per-unit production costs or bargaining power with foundries. |

| Government Regulations & Trade Policies | Compliance with certifications, export controls, and national security reviews adds cost and time. | Navigating complex trade restrictions and compliance mandates (e.g., CHIPS Act conditions) raises entry barriers. |

Porter's Five Forces Analysis Data Sources

Our ASMedia Porter's Five Forces analysis is built on a foundation of robust data, including company annual reports, industry-specific market research, and financial analyst reports. We also incorporate insights from regulatory filings and macroeconomic data to provide a comprehensive view of the competitive landscape.