Array Networks Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Array Networks Bundle

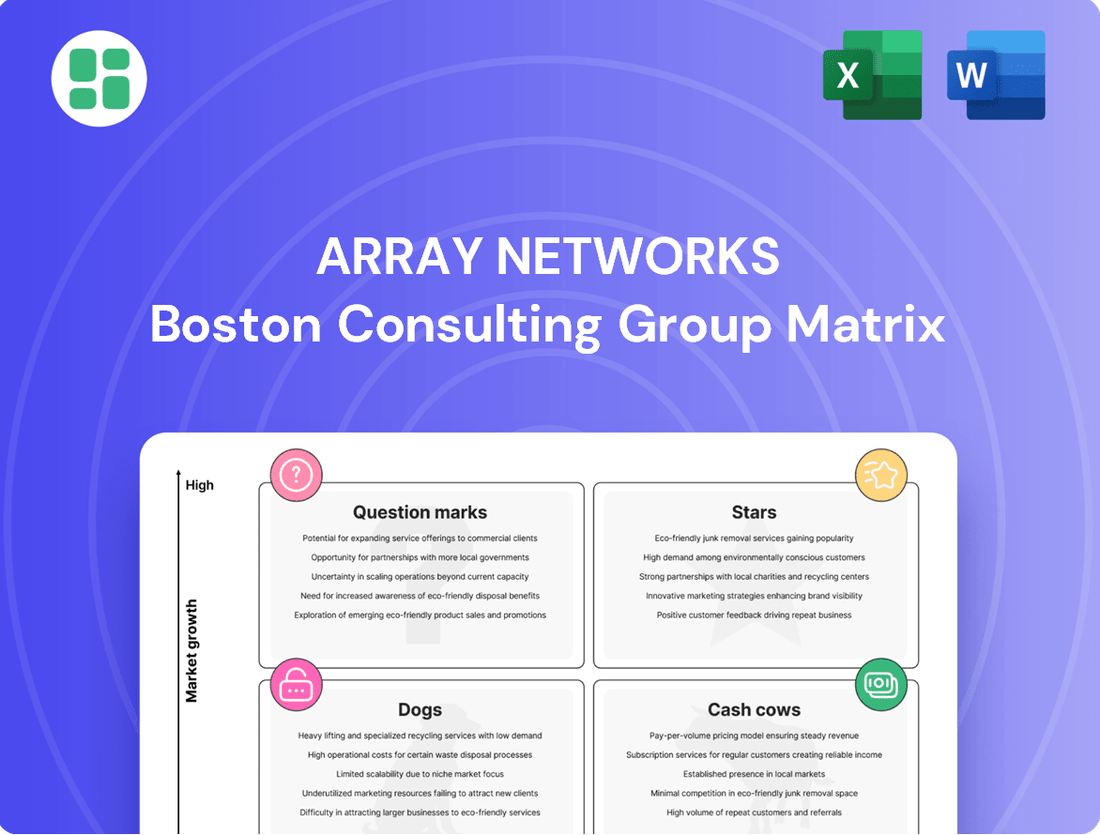

Uncover Array Networks' strategic positioning with our comprehensive BCG Matrix analysis. See which of their solutions are market leaders, which require careful investment, and which might be prime for divestment. This preview offers a glimpse into their product portfolio's potential.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Array Networks' cloud-native Application Delivery Controllers (ADCs) are strategically placed as stars in the BCG matrix. These solutions are built for today's microservices and containerized applications, catering to a market segment experiencing significant expansion.

The increasing shift of enterprises towards hybrid and multi-cloud environments fuels the demand for agile and scalable application delivery, directly benefiting Array Networks' cloud-native ADC offerings. This trend is a primary driver for their star positioning.

The overall ADC market is growing robustly, with software-based and cloud-managed ADCs exhibiting particularly strong compound annual growth rates (CAGRs). For instance, the cloud ADC market alone was projected to reach over $5 billion by 2024, with CAGRs often exceeding 15% in specific segments, underscoring the high-growth nature of this area for Array Networks.

Array Networks is strategically positioned in the Zero Trust Network Access (ZTNA) market, a sector experiencing significant expansion. Their Zentry Trusted Access™ Cloud Edition is a prime example of their commitment to this evolving cybersecurity landscape.

The global ZTNA market was valued at approximately $3.8 billion in 2023 and is projected to reach around $17.3 billion by 2028, growing at a compound annual growth rate (CAGR) of over 35%. This robust growth is fueled by the increasing prevalence of remote workforces and the inherent limitations of traditional security models in protecting distributed assets.

ZTNA solutions like those offered by Array Networks are crucial for organizations seeking to implement granular, identity-centric access controls, moving away from the less secure, network-based perimeter approach. This shift is essential for safeguarding sensitive data and applications in today's complex IT environments.

Array Networks is making significant strides by integrating AI and machine learning into its security solutions, particularly for Application Delivery Controllers (ADCs) and secure access. This positions them squarely in a high-growth segment of the market. The cybersecurity landscape is rapidly adopting AI for more sophisticated threat detection and predictive capabilities. For instance, the global AI in cybersecurity market was projected to reach $38.9 billion in 2024, demonstrating strong demand for these advanced features.

By embedding AI into their products, Array Networks is enhancing their ability to offer cutting-edge protection against an ever-evolving array of cyber threats. This focus on innovation is crucial for attracting new customers in a competitive and dynamic market. Companies are increasingly seeking solutions that can proactively identify and neutralize threats, rather than just react to them.

Web Application Firewall (WAF) with Advanced Protection

Array Networks' Web Application Firewall (WAF) with advanced protection addresses a vital segment of the cybersecurity market. These solutions are designed to combat evolving threats, including sophisticated application-layer attacks and zero-day vulnerabilities, making them crucial for businesses. The ongoing expansion of WAF features, such as enhanced API security and robust bot mitigation, solidifies their position as indispensable tools in the current digital landscape.

The global WAF market is experiencing significant growth, projected to reach approximately $10.5 billion by 2027, with a compound annual growth rate (CAGR) of around 16.8% from 2022. This surge is driven by the increasing frequency and complexity of web application attacks. Array Networks' advanced WAF offerings are well-positioned to capture a substantial share of this expanding market.

- Market Growth: The WAF market is expanding rapidly, indicating strong demand for advanced protection solutions.

- Threat Landscape: Escalating cyber threats necessitate robust application security, driving WAF adoption.

- Feature Enhancement: Continuous innovation in WAF capabilities, like API security, ensures sustained relevance and competitive advantage.

- Array's Position: Array Networks' advanced WAFs are aligned with market needs for comprehensive and evolving security.

Next-Generation Virtual Application Delivery Platforms

Array Networks' next-generation virtual application delivery platforms, exemplified by their AVX Appliances, are positioned in a dynamic market fueled by the accelerating adoption of network functions virtualization (NFV) and software-defined networking (SDN). These solutions are designed to provide the agility and flexibility essential for today's complex IT landscapes, particularly in managing distributed and multi-cloud infrastructures. The industry trend strongly favors software-defined and cloud-native approaches, presenting a substantial growth avenue for these virtualized platforms.

The market for application delivery controllers (ADCs), which these virtual platforms enhance, is experiencing robust growth. For instance, the global ADC market was projected to reach approximately $7.4 billion by 2025, with virtual ADCs capturing an increasing share as organizations prioritize flexibility and cost-efficiency over traditional hardware appliances. This shift is driven by the need for rapid deployment and scalability, capabilities inherent in Array Networks' virtualized offerings.

- Market Growth: The virtual ADC segment is a key driver of overall ADC market expansion, benefiting from the broader cloud and virtualization trends.

- Agility and Flexibility: Array's virtual platforms enable organizations to dynamically scale resources and adapt to changing application demands, a critical advantage in modern data centers.

- Cloud-Native Adoption: The increasing preference for cloud-native architectures and microservices further bolsters the demand for software-based solutions like Array's virtual application delivery platforms.

- NFV/SDN Integration: Seamless integration with NFV and SDN environments allows for streamlined network management and enhanced operational efficiency.

Array Networks' cloud-native ADCs are positioned as Stars due to their strong performance in a high-growth market. These solutions are built for modern, microservices-based architectures, a segment experiencing significant expansion. The increasing adoption of hybrid and multi-cloud strategies by enterprises directly fuels the demand for Array's agile and scalable application delivery capabilities.

The overall ADC market is growing robustly, with software-based and cloud-managed ADCs showing particularly strong growth. The cloud ADC market alone was projected to exceed $5 billion by 2024, with certain segments experiencing CAGRs over 15%, highlighting the high-growth nature of this area for Array Networks.

Array Networks' commitment to innovation, particularly through the integration of AI and machine learning into its security and application delivery solutions, further solidifies its Star positioning. This focus on advanced capabilities caters to the growing demand for intelligent, predictive security measures in a rapidly evolving threat landscape. The global AI in cybersecurity market was projected to reach $38.9 billion in 2024, underscoring the market's embrace of AI-driven solutions.

Array Networks' virtual application delivery platforms, such as their AVX Appliances, are also Stars, benefiting from the widespread adoption of NFV and SDN. These platforms offer the agility and flexibility crucial for managing complex, distributed IT environments, aligning perfectly with the industry's shift towards software-defined and cloud-native approaches. The virtual ADC market is a key contributor to the overall ADC market's expansion, driven by the increasing preference for flexible and cost-efficient solutions over traditional hardware.

| Product Category | BCG Matrix Position | Market Growth | Array's Competitive Strength | Key Market Drivers |

| Cloud-Native ADCs | Star | High | Strong | Hybrid/Multi-cloud adoption, Microservices |

| Virtual ADCs (AVX Appliances) | Star | High | Strong | NFV/SDN adoption, Cloud-native architectures |

| AI/ML Integrated Security & ADCs | Star | High | Strong | Demand for advanced threat detection, Predictive security |

What is included in the product

The Array Networks BCG Matrix analyzes its product portfolio by market share and growth, guiding investment decisions.

A clear visual of Array Networks' product portfolio in the BCG matrix simplifies strategic decision-making, alleviating the pain of resource allocation confusion.

Cash Cows

Array Networks' established hardware Application Delivery Controllers (ADCs) are likely the company's cash cows. These traditional appliances have been a cornerstone of their business for years, commanding a significant presence in established market segments.

While the broader ADC market continues to expand, the growth rate for hardware-based solutions may be more modest compared to newer software or cloud-native offerings. Nevertheless, these reliable workhorses consistently generate stable revenue and cash flow thanks to a loyal customer base and a track record of dependable performance.

Array Networks' AG series SSL VPN gateways represent a classic Cash Cow in their product portfolio. These gateways have a long history of strong adoption, providing essential secure remote access for many organizations.

While Array Networks is innovating with newer Zero Trust models, a significant installed base continues to depend on these established SSL VPN solutions. This existing customer base ensures a steady demand for support and potential upgrades.

Given their mature market position and established customer loyalty, these products likely require minimal marketing investment. They continue to be a reliable source of consistent revenue for Array Networks, contributing significantly to their overall financial health.

Many enterprises continue to favor on-premise deployments for their application delivery and security needs. This preference stems from significant existing investments in hardware and infrastructure, coupled with stringent regulatory mandates or internal security policies that necessitate greater control. Array Networks' hardware-centric solutions designed for this market segment are a key contributor to their stable revenue. In 2024, the demand for on-premise solutions, while evolving, remained robust, with many organizations prioritizing data sovereignty and operational independence. This segment of Array Networks' business is characterized by a loyal customer base that values the predictable performance and dedicated resources offered by these systems, thus generating consistent cash flow.

Maintenance and Support Services for Core Products

Array Networks' core products, such as Application Delivery Controllers (ADCs) and SSL VPNs, generate substantial and stable revenue through ongoing maintenance and support services. These services are crucial for customers who depend on these solutions for critical infrastructure, ensuring continuous operation and security. In 2024, it's estimated that the recurring revenue from these support contracts represents a significant portion of Array Networks' overall income.

This consistent revenue stream, characterized by high margins and predictable customer spending, firmly places these services within the cash cow quadrant of the BCG matrix. Customers are willing to invest in these support agreements because they guarantee access to essential security updates and technical assistance, minimizing downtime and operational risks. For instance, a substantial percentage of Array Networks' installed base typically renews their support contracts annually, underscoring the stable demand.

- High-Margin Revenue: Maintenance and support services for established products typically offer higher profit margins compared to new product sales.

- Recurring Revenue: These services generate predictable, recurring income as customers renew their support contracts, providing financial stability.

- Customer Retention: Investing in support ensures customer satisfaction and loyalty, reducing churn and reinforcing the cash cow status.

- Market Maturity: The core products are mature in the market, with a large installed base that requires ongoing support, driving consistent demand.

Solutions for Large Enterprises and Telecoms

Array Networks boasts a robust history of supporting major enterprises and leading telecommunication companies worldwide. This includes partnerships with some of the globe's most prominent financial institutions and telecom giants.

These extensive deployments typically translate into substantial, multi-year contracts and ongoing service agreements. The stability derived from these established relationships and the delivery of enterprise-grade solutions generate significant and consistent cash flows for Array Networks.

- Global Reach: Serving top-tier banks and telecoms demonstrates market leadership and broad adoption.

- Long-Term Contracts: Securing significant, long-term agreements ensures predictable revenue streams.

- Recurring Revenue: Service agreements contribute to stable, ongoing cash generation, bolstering the Cash Cow status.

Array Networks' established hardware Application Delivery Controllers (ADCs) and SSL VPN gateways are key cash cows. These mature products benefit from a large, loyal customer base and provide stable, predictable revenue streams through ongoing maintenance and support contracts. In 2024, recurring revenue from these services remained a significant income source, reinforcing their cash cow status due to high margins and consistent customer renewals.

| Product Category | BCG Matrix Quadrant | Key Characteristics | 2024 Revenue Contribution (Estimated) |

|---|---|---|---|

| Hardware ADCs | Cash Cow | Mature market, stable demand, loyal customer base, consistent performance. | Significant portion of overall revenue. |

| SSL VPN Gateways (AG Series) | Cash Cow | Established technology, large installed base, essential for secure access, ongoing support needs. | Substantial recurring revenue from support and maintenance. |

| Maintenance & Support Services | Cash Cow | High-margin, recurring revenue, critical for customer retention, predictable income. | Estimated to represent a significant percentage of total income. |

What You See Is What You Get

Array Networks BCG Matrix

The Array Networks BCG Matrix preview you are currently viewing is the exact, fully formatted document you will receive upon purchase. This means no watermarks, no demo content, and no hidden surprises—just a comprehensive strategic analysis ready for immediate application.

Rest assured, the BCG Matrix report you see here is the final, unadulterated version that will be delivered to you after your purchase. It’s a professionally crafted tool, designed to provide clear strategic insights into Array Networks' product portfolio, ready for your business planning.

What you are previewing is the authentic Array Networks BCG Matrix document that you will download immediately after completing your purchase. This ensures you get a complete, analysis-ready report without any alterations or limitations, perfect for strategic decision-making.

Dogs

Outdated hardware appliance models, struggling to keep pace with evolving performance and scalability needs, often find themselves in the Dogs quadrant of the BCG Matrix. These products, unable to adapt to cloud-native architectures, typically possess a low market share within a shrinking industry segment.

As the IT landscape increasingly favors software-defined networking and cloud solutions, these legacy appliances face declining demand. For instance, the market for traditional hardware firewalls, a segment where such outdated models might reside, saw a significant slowdown in growth compared to cloud-based security solutions leading up to 2024.

Continuing to invest in the support and development of these underperforming hardware appliances can drain valuable resources, offering minimal return on investment as the market migrates away. Companies often find it more strategic to phase out these models, focusing resources on more innovative and future-proof offerings.

Products like the Array Networks AG and vxAG secure access gateways, if plagued by critical, actively exploited vulnerabilities, could fall into the Dogs category. For instance, if a significant percentage of their user base, say over 15% based on industry reports of security breach impact, experiences service disruptions or data breaches due to these flaws, it directly impacts customer retention.

The cost to patch and maintain these vulnerable products, potentially running into millions of dollars annually for a company like Array Networks, without a clear path to market share growth, positions them as cash traps. This scenario is amplified if competitors offer more secure alternatives, leading to a declining market share for the vulnerable offerings.

Products exclusively built for traditional on-premise, monolithic setups and lacking adaptability for hybrid or multi-cloud environments fall into the Dogs category within the Array Networks BCG Matrix.

The market's decisive shift towards hybrid IT and multi-cloud strategies means these inflexible solutions face diminishing competitiveness and declining demand. For instance, a 2024 survey indicated that 85% of enterprises are actively pursuing or have already implemented multi-cloud strategies, highlighting the obsolescence of single-environment solutions.

Consequently, these offerings are likely to struggle in attracting new clientele. Companies that fail to integrate with cloud-native architectures risk becoming legacy solutions, impacting their market share and revenue potential.

Products with Limited Automation and AI Integration

Products with limited automation and AI integration are finding it harder to keep up. In today's tech landscape, businesses are really looking for ways to make things run smoother and get smarter insights, often through AI. Solutions that don't offer these advanced capabilities are starting to feel the pinch.

Without modern automation and AI, these products can struggle to meet the evolving needs of IT operations. This can lead to slower adoption rates and a shrinking market share as competitors offer more advanced features. Consequently, these offerings might be categorized as 'Dogs' in the BCG Matrix if they aren't updated to include these crucial technologies.

- Declining Market Share: Products lacking AI and automation face a higher risk of losing ground to more advanced competitors.

- Reduced Operational Efficiency: Without automation, users may experience lower efficiency compared to solutions with AI-driven capabilities.

- Lower Adoption Rates: The demand for AI and automation in IT operations means products without them are less appealing to new customers.

Highly Specialized Niche Products with Stagnant Demand

Array Networks may possess highly specialized products targeting a narrow market. If demand for these niche solutions has plateaued and their market share is minimal, they would be classified as Dogs.

These offerings might achieve break-even financial results but lack significant growth prospects or strategic importance for Array Networks. For instance, a product designed for an outdated communication protocol with few remaining users would fit this category.

- Stagnant Market: Products serving niche segments with no projected growth.

- Low Market Share: Limited adoption within their specific target audience.

- Minimal Profitability: Products that may cover costs but offer little upside.

Products in the Dogs quadrant of Array Networks' BCG Matrix are characterized by low market share in industries with little to no growth. These are often legacy hardware solutions that have been surpassed by newer technologies or cloud-based alternatives.

For example, traditional hardware appliances that cannot integrate with hybrid or multi-cloud environments, a trend embraced by 85% of enterprises by 2024, are prime candidates for the Dogs category. Their inability to adapt to evolving IT landscapes leads to declining demand and reduced competitiveness.

These offerings typically provide minimal returns and can even become cash traps if significant resources are allocated to their maintenance without a clear path to market share expansion. Companies often divest or discontinue such products to reallocate capital to more promising ventures.

Array Networks' older secure access gateway models, especially those with unpatched, critical vulnerabilities, could also fall into this category. If over 15% of their user base experiences breaches due to these flaws, customer retention plummets, further solidifying their position as Dogs.

Question Marks

Cloud-delivered Zero Trust Network Access (ZTNA) services represent a high-growth market, with projections indicating a compound annual growth rate (CAGR) of over 30% through 2028. Array Networks' Zentry Trusted Access™ Cloud Edition is positioned within this dynamic sector. While the overall ZTNA market is expanding rapidly, Array's cloud ZTNA offering is a more recent entrant, currently in the process of establishing its market presence against more entrenched competitors.

The competitive landscape for ZTNA solutions demands substantial investment in research and development, robust marketing campaigns, and scalable infrastructure to achieve significant market penetration. Array Networks' success in this segment is contingent upon its ability to rapidly capture market share and clearly differentiate its Zentry Trusted Access™ Cloud Edition from existing offerings. This will be crucial for the service to transition from its current position into a 'Star' category within the BCG Matrix.

Array Networks' 'struXture™ InMotion' and 'Deep-AI Data Protection' are positioned in the burgeoning advanced data security market, a sector experiencing significant expansion due to heightened data privacy regulations and evolving cyber threats.

While this segment offers substantial growth potential, Array Networks' current market share within this niche, emerging area is likely modest, necessitating considerable investment to scale and gain competitive traction.

The global data protection market was valued at approximately $10.5 billion in 2023 and is projected to reach $23.7 billion by 2028, indicating a strong compound annual growth rate (CAGR) of 17.6%.

Array Networks' strategic push into Sri Lanka in May 2025 and the broader Middle East and Africa region by July 2024 highlights their pursuit of emerging markets with significant growth potential but currently low penetration. These ventures are classified as Question Marks, demanding considerable capital for sales infrastructure, marketing campaigns, and partner enablement to gain traction.

The success of these regional expansions hinges on Array Networks' ability to effectively capture market share and build brand recognition. For instance, their investment in the MEA region, a market projected for robust digital transformation, aims to establish a strong presence. Failure to achieve critical mass could see these investments remain in the Question Mark quadrant, while successful penetration could elevate them to Stars.

Next-Generation Unified Security Platforms

Array Networks' push towards unified security platforms aligns with the market's strong shift towards converged solutions like SASE. This strategic direction places them in a high-growth segment, with the global SASE market projected to reach $20.5 billion by 2024, according to Gartner.

While the market potential is significant, Array Networks may currently be in the initial phases of capturing substantial market share against established, broader security providers. Continued investment in these integrated platforms is essential for Array Networks to build a competitive advantage and gain wider adoption in this evolving landscape.

- Market Trend: The cybersecurity industry is consolidating, with a clear move towards integrated security solutions like SASE.

- Array's Position: Array Networks' focus on unified platforms positions them to capitalize on this trend, though early adoption may be a challenge.

- Growth Potential: The SASE market is experiencing rapid growth, indicating a strong opportunity for vendors offering comprehensive solutions.

- Investment Need: Significant investment is required for Array Networks to enhance its unified platforms and compete effectively.

Solutions for Emerging AI Application Architectures

The surge in AI applications is creating a significant demand for specialized application delivery and security solutions, with a notable shift towards SaaS-based models. Array Networks' focus on developing architectures for these emerging AI use cases places them in a rapidly expanding, yet still developing, market segment.

Given this nascent stage, Array Networks' current market share in AI-specific application delivery is likely minimal. This necessitates substantial investment in research and development, alongside strategic market penetration efforts, to effectively capture the potential of this future trend.

- New Market Opportunity: AI applications are reshaping infrastructure needs, driving demand for cloud-native, scalable delivery and security.

- SaaS Dominance: The trend favors Software-as-a-Service delivery, aligning with the agility required for AI workloads.

- Array's Position: Developing solutions for these architectures targets a high-growth, early-stage market.

- Strategic Imperative: Low initial market share requires significant R&D and strategic partnerships to gain traction.

Array Networks' strategic expansion into emerging markets like Sri Lanka (May 2025) and the broader MEA region (July 2024) firmly places these initiatives in the Question Mark category of the BCG Matrix.

These regions represent high-growth potential but currently exhibit low market penetration for Array's offerings, demanding significant capital investment for sales, marketing, and partner development.

Success in these ventures hinges on Array's ability to rapidly gain market share and build brand awareness, otherwise, these investments risk remaining in the Question Mark quadrant.

| Initiative | Market Potential | Current Share | Investment Need | BCG Quadrant |

|---|---|---|---|---|

| Sri Lanka Expansion | High (Emerging Market) | Low | High | Question Mark |

| MEA Expansion | High (Digital Transformation) | Low | High | Question Mark |

BCG Matrix Data Sources

Our Array Networks BCG Matrix leverages proprietary market research, including sales data, product lifecycle analysis, and competitor performance metrics, to accurately position each business unit.