Armada Sunset Holdings PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Armada Sunset Holdings Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Armada Sunset Holdings's trajectory. Our comprehensive PESTLE analysis provides actionable intelligence to navigate these external forces. Download the full version to gain a strategic advantage and make informed decisions.

Political factors

Ongoing geopolitical tensions, particularly between major economic blocs, continue to disrupt global trade. For Armada Sunset Holdings, this translates into the need for more resilient supply chains. For instance, the ongoing trade friction between the US and China has seen tariffs impacting various goods, forcing companies to re-evaluate their sourcing strategies.

These political shifts directly affect logistics costs and operational feasibility. Increased tariffs and export controls, as seen in sectors like semiconductors in 2024, can significantly raise the price of imported components or restrict market access, necessitating adaptive business models and robust risk management.

Governments globally are increasingly implementing new trade policies, sanctions, and export restrictions, often with little advance warning. This creates a challenging environment for companies like Armada Sunset Holdings, which operates within global trade. For instance, the US Department of Commerce's Bureau of Industry and Security (BIS) frequently updates its Entity List, impacting companies' ability to export certain technologies. In 2024 alone, several additions and modifications to this list have been observed, requiring diligent review.

Armada Sunset Holdings must actively manage these evolving regulations, particularly concerning emerging technologies and stricter due diligence requirements. Failure to comply can lead to severe financial penalties and operational disruptions. For example, violations of export control regulations can result in fines reaching millions of dollars, as seen in past enforcement actions. Continuous monitoring and agile adaptation to these policy shifts are therefore critical for maintaining smooth operations and avoiding significant repercussions.

Governments worldwide are increasingly prioritizing supply chain resilience, a trend amplified by recent global events. For instance, the US CHIPS and Science Act of 2022, with its $52 billion in subsidies, aims to bolster domestic semiconductor manufacturing, a clear example of this political push. This focus translates into mandates and incentives encouraging companies like Armada Sunset Holdings to invest in localized production and diversify their supplier networks to mitigate risks from geopolitical instability or natural disasters.

Labor and Employment Policies

Changes in labor laws, such as minimum wage adjustments and regulations on working hours, directly affect Armada Sunset Holdings' operational costs and staffing strategies. For instance, the US federal minimum wage remains at $7.25 per hour, but many states and cities have enacted higher rates, impacting the cost of labor in key logistics hubs.

Immigration policies influence the availability of skilled and unskilled labor crucial for warehousing and transportation roles. Restrictions or expansions in immigration can alter the labor pool, potentially affecting recruitment and retention efforts for Armada Sunset Holdings, especially in regions with a high reliance on foreign-born workers.

Industrial relations, including unionization trends and collective bargaining agreements, can shape employment conditions and operational flexibility. In 2024, reports indicate ongoing discussions and potential shifts in labor-management relations across various sectors, necessitating careful navigation by companies like Armada Sunset Holdings to maintain smooth operations and employee satisfaction.

- Minimum Wage Impact: States like California have minimum wages exceeding $16 per hour, significantly higher than the federal rate, increasing labor expenses for Armada Sunset Holdings in those areas.

- Skilled Labor Shortage: The American Trucking Associations reported a shortage of over 78,000 drivers in 2023, highlighting the challenge of securing qualified personnel for transportation roles.

- Cross-Border Labor: Changes in immigration policies in Canada and Mexico can impact the availability of cross-border truck drivers and warehouse staff, a critical factor for Armada Sunset Holdings' international logistics.

International Cooperation and Trade Agreements

International cooperation and trade agreements are pivotal for Armada Sunset Holdings. For instance, the United States-Mexico-Canada Agreement (USMCA), which replaced NAFTA, aims to modernize North American trade. In 2023, trade between the US and Canada reached approximately $794 billion, showcasing the impact of such agreements on cross-border logistics and market access. New or revised pacts can significantly reduce tariffs and streamline customs, directly benefiting companies like Armada Sunset Holdings by lowering operational costs and expanding their reach into new markets.

Conversely, the breakdown of existing trade relationships or the imposition of new trade barriers can create substantial challenges. For example, trade disputes and tariffs implemented in recent years have demonstrated how quickly global trade flows can be disrupted, increasing the cost of imported goods and complicating supply chains. Armada Sunset Holdings must therefore maintain agile global trade strategies to navigate these evolving international landscapes, ensuring resilience against protectionist policies or the dissolution of key trade blocs.

Key considerations for Armada Sunset Holdings regarding international cooperation and trade agreements include:

- Impact of USMCA: Continued analysis of the USMCA's effects on North American trade flows and potential for market expansion.

- Emerging Trade Blocs: Monitoring the formation and influence of new regional trade agreements, such as those in the Indo-Pacific, for potential new market opportunities.

- Geopolitical Risk: Assessing the influence of geopolitical tensions on existing trade agreements and the potential for trade diversion or disruption.

Political stability and government regulations significantly shape the operational landscape for Armada Sunset Holdings. Shifting trade policies, such as tariffs and sanctions, directly impact global supply chains and logistics costs, as seen with ongoing US-China trade tensions affecting component prices. Government incentives, like the US CHIPS Act's $52 billion for semiconductor manufacturing, encourage localized production and supply chain diversification, a trend Armada Sunset Holdings must monitor.

What is included in the product

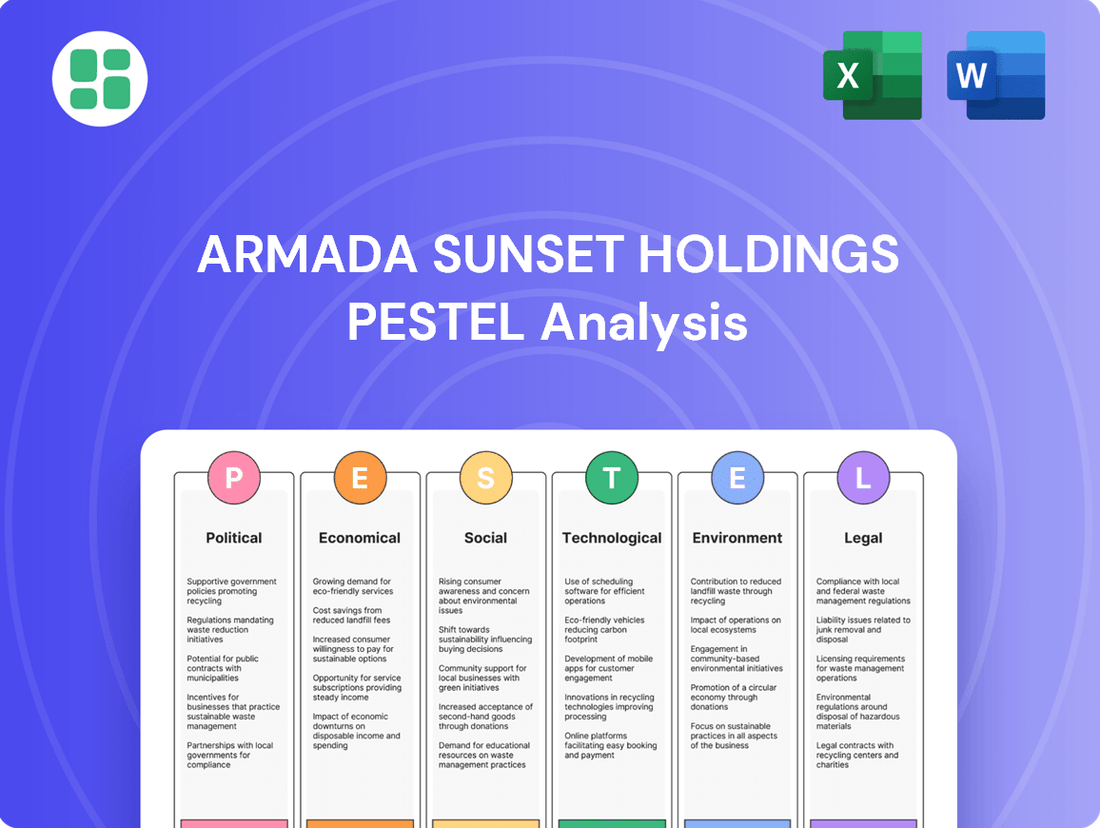

This PESTLE analysis meticulously examines the external macro-environmental forces—Political, Economic, Social, Technological, Environmental, and Legal—that impact Armada Sunset Holdings, providing a comprehensive overview of its operating landscape.

It offers actionable insights by detailing how these factors present both challenges and strategic advantages for Armada Sunset Holdings, enabling informed decision-making and proactive planning.

Provides a concise version of the Armada Sunset Holdings PESTLE Analysis that can be dropped into PowerPoints or used in group planning sessions, offering a readily digestible overview of external factors impacting the business.

Helps support discussions on external risk and market positioning during planning sessions by clearly outlining the political, economic, social, technological, environmental, and legal factors relevant to Armada Sunset Holdings.

Economic factors

The global economic outlook for 2024 and 2025 presents a mixed picture, with varying growth forecasts across major regions. While some economies are expected to see moderate expansion, the International Monetary Fund (IMF) projected global growth at 3.2% for 2024, a slight uptick from 2023, but acknowledged persistent risks. This overall health directly influences demand for logistics services, as reduced consumer spending and business investment during economic slowdowns can significantly dampen freight volumes.

Recessionary fears, particularly in key markets, pose a direct threat to Armada Sunset Holdings. A contraction in economic activity typically translates to lower shipping demand and increased price sensitivity from clients, potentially squeezing profit margins. For instance, if major trading partners experience a downturn, it could lead to a substantial decrease in the number of goods needing transportation, impacting Armada Sunset Holdings' core business.

Conversely, periods of economic expansion offer significant opportunities. Increased global trade, driven by rising consumer confidence and business investment, fuels demand for efficient supply chain solutions. As economies grow, companies tend to increase production and expand their reach, necessitating more robust and optimized logistics networks, which Armada Sunset Holdings is positioned to serve.

Rising inflation is a significant concern for Armada Sunset Holdings, directly impacting operational costs. For instance, the global average price of bunker fuel, a key expense for shipping, saw fluctuations throughout 2024, with some periods experiencing increases of over 15% year-on-year. This surge in fuel prices, coupled with upward pressure on labor wages and equipment maintenance, forces Armada to absorb higher expenses across its transportation and warehousing operations.

Managing these escalating costs is crucial for Armada Sunset Holdings to remain competitive. In 2024, the logistics sector faced a challenging environment where the Consumer Price Index (CPI) in major economies remained elevated, averaging around 3-4% in many developed nations. This means Armada must implement strategies to offset these cost increases, such as optimizing routes, investing in fuel-efficient technologies, and negotiating favorable terms with suppliers to protect its profit margins in its global trade divisions.

Interest rate fluctuations directly impact Armada Sunset Holdings' cost of capital for crucial investments in technology, infrastructure, and potential acquisitions. For instance, if the Federal Reserve maintains its benchmark interest rate at the current elevated levels seen in early 2024, borrowing becomes more expensive, potentially tempering the pace of expansion or necessary technology upgrades.

Conversely, a stable or declining interest rate environment, such as a projected rate cut by the end of 2024 or into 2025, could significantly encourage strategic investments. This scenario would lower borrowing costs, making it more attractive for Armada Sunset Holdings to pursue long-term growth initiatives and enhance its competitive standing in the market.

Exchange Rate Volatility

Exchange rate volatility presents a significant challenge for Armada Sunset Holdings, a company deeply involved in global trade and logistics. Fluctuations in currency values directly impact the cost of international transactions, the procurement of goods from overseas suppliers, and the revenue earned from foreign clients. For instance, a strengthening of the US dollar against other major currencies could make Armada's services more expensive for international customers, potentially reducing demand.

The unpredictability of exchange rates necessitates robust financial planning and the implementation of sophisticated hedging strategies. Companies like Armada must actively manage currency risks to maintain financial stability and profitability. As of late 2024 and into early 2025, major currency pairs like EUR/USD and USD/JPY have experienced notable swings, underscoring the ongoing need for vigilance.

- Impact on Costs: A stronger foreign currency can increase the cost of imported raw materials or equipment for Armada.

- Revenue Uncertainty: Revenue generated from international markets can be devalued when converted back to the company's home currency if it weakens.

- Hedging Importance: Financial instruments such as forward contracts and currency options are crucial for mitigating these risks.

- 2024/2025 Trends: The US dollar showed resilience through much of 2024, but forecasts for 2025 suggest potential shifts influenced by differing central bank policies, creating an environment of sustained volatility.

E-commerce Growth and Consumer Spending

The relentless expansion of e-commerce, projected to reach $1.7 trillion in the US by 2024, directly fuels the demand for sophisticated logistics. Consumers increasingly prioritize speed and dependability in deliveries, pushing companies like Armada Sunset Holdings to enhance their last-mile delivery and micro-fulfillment capabilities.

This evolving consumer behavior creates substantial avenues for Armada Sunset Holdings to broaden its service offerings. Investing in automation technologies and adapting to the demand for agile supply chains are crucial steps for the company to maintain its competitive edge and capitalize on these market shifts.

- E-commerce Growth: Global e-commerce sales are expected to climb to $8.1 trillion by 2024, underscoring the sustained shift in consumer purchasing habits.

- Delivery Expectations: A significant majority of consumers (over 60% in recent surveys) are willing to pay more for faster delivery options.

- Logistics Investment: Companies are channeling substantial capital into last-mile delivery solutions, with investments in automation and AI-powered route optimization seeing a marked increase.

- Micro-fulfillment Centers: The adoption of micro-fulfillment centers is on the rise, aiming to reduce delivery times and costs by placing inventory closer to end consumers.

The economic landscape for 2024 and 2025 indicates moderate global growth, with the IMF projecting 3.2% for 2024, but persistent risks remain. This directly impacts Armada Sunset Holdings' demand for logistics services, as economic slowdowns can reduce consumer and business spending, thereby lowering freight volumes. Conversely, economic expansion fuels global trade and necessitates more robust logistics networks.

Same Document Delivered

Armada Sunset Holdings PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis for Armada Sunset Holdings delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's strategic landscape.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain a clear understanding of the external forces that could shape Armada Sunset Holdings' future operations and market position.

Sociological factors

The logistics sector, including Armada Sunset Holdings, is grappling with an aging workforce; the average age of a truck driver in the US, for example, is nearing 50, contributing to a significant driver shortage. This demographic trend, coupled with younger generations prioritizing work-life balance and demanding greater technological integration, creates a dual challenge of attracting new talent and retaining experienced workers. Addressing these shifts is crucial for Armada Sunset Holdings to maintain operational efficiency and competitive advantage.

Consumers and stakeholders are increasingly vocal about wanting to know where products come from and if they're made ethically. This includes worries about forced labor and the environmental footprint of businesses. For Armada Sunset Holdings, this means a strong focus on making sure their operations, and those of their partners, are squeaky clean ethically.

To keep up with these evolving societal expectations and protect its brand image, Armada Sunset Holdings needs to boost the visibility of its supply chain. For instance, a 2024 survey indicated that over 70% of consumers consider a company's ethical practices when making purchasing decisions, a significant jump from previous years.

Rapid urbanization presents a dual challenge and opportunity for logistics. While increasing congestion in major cities, it simultaneously fuels demand for innovative urban delivery solutions like micro-fulfillment centers. For instance, by 2024, over 60% of the world's population is projected to live in urban areas, a figure expected to climb further by 2025, highlighting the growing need for efficient city-based logistics.

Armada Sunset Holdings must therefore refine its transportation and warehouse strategies to effectively manage operations within these evolving urban landscapes. This adaptation could involve strategic investments in localized distribution hubs and the adoption of environmentally friendly last-mile delivery methods, such as electric vehicles, to mitigate congestion and meet consumer expectations for faster, greener deliveries.

Health and Safety Standards in Logistics

Public and regulatory attention on health and safety within logistics operations, encompassing warehouses and transportation, is intensifying. For instance, in 2023, the Occupational Safety and Health Administration (OSHA) reported over 5,000 worker fatalities in the U.S., with a significant portion occurring in warehousing and logistics sectors, highlighting the critical need for enhanced safety measures.

Armada Sunset Holdings must therefore place a premium on developing and implementing stringent safety protocols. This includes investing in technologies such as automated guided vehicles (AGVs) and advanced warehouse management systems that can reduce manual handling and the associated risks. The global market for warehouse automation is projected to reach $30 billion by 2026, indicating a strong industry trend towards safer, tech-driven operations.

Maintaining high safety standards is not just about employee well-being and avoiding regulatory penalties; it's also vital for Armada Sunset Holdings' reputation. Companies with a strong safety record often experience lower insurance premiums and higher employee retention rates, contributing to overall operational efficiency and a positive brand image.

- Increased Regulatory Scrutiny: Agencies worldwide are tightening safety regulations for logistics workplaces.

- Workforce Risk Mitigation: Investment in automation and safety training is key to reducing accidents.

- Reputational Impact: Strong safety performance enhances public perception and employee loyalty.

- Financial Benefits: Adherence to safety standards can lead to lower insurance costs and improved operational efficiency.

Societal Expectations for Corporate Social Responsibility (CSR)

Societal expectations for Corporate Social Responsibility (CSR) are increasingly influencing business operations. Beyond mere compliance, consumers and stakeholders anticipate companies like Armada Sunset Holdings to actively contribute to social good, engage with their communities, and uphold ethical standards. This growing demand for responsible business conduct is a significant factor shaping corporate strategy.

Armada Sunset Holdings' proactive approach to CSR, evidenced by its recent focus on diversity, equity, and inclusion (DEI) initiatives, directly addresses these societal expectations. Such commitments not only bolster the company's public image but also serve as a magnet for top talent and foster deeper connections with clients and the communities it serves. For instance, a 2024 Deloitte survey found that 70% of consumers are more likely to purchase from a brand that demonstrates a strong commitment to social and environmental causes.

- Growing consumer demand: Studies in 2024 indicate that over 60% of consumers consider a company's social and environmental impact when making purchasing decisions.

- Talent attraction: Companies with robust CSR programs, like Armada Sunset Holdings' DEI efforts, report a higher success rate in attracting and retaining employees, with a 2025 LinkedIn report showing a 25% increase in applications for roles at socially responsible firms.

- Reputation enhancement: Positive CSR activities, such as community investment and ethical sourcing, directly contribute to a stronger brand reputation, which is crucial in today's competitive market.

- Stakeholder engagement: Demonstrating a commitment to CSR builds trust and strengthens relationships with investors, partners, and local communities, leading to more sustainable business growth.

Societal expectations are increasingly pushing companies like Armada Sunset Holdings towards greater transparency and ethical operations. Consumers and stakeholders demand to know the origins of products and the ethical treatment of workers, directly impacting brand reputation and consumer loyalty. A 2024 survey revealed that over 70% of consumers consider ethical practices in their purchasing decisions.

The growing emphasis on Corporate Social Responsibility (CSR) means businesses must actively contribute to social good and community well-being. Armada Sunset Holdings' focus on Diversity, Equity, and Inclusion (DEI) initiatives aligns with this, enhancing its appeal to talent and customers. A 2025 LinkedIn report indicated a 25% increase in applications for roles at socially responsible firms.

Urbanization trends continue to shape logistics demand, with over 60% of the global population projected to reside in urban areas by 2024. This necessitates efficient urban delivery solutions and strategic investments in localized distribution hubs for companies like Armada Sunset Holdings.

Safety within logistics operations is under heightened scrutiny, with over 5,000 worker fatalities reported in the U.S. in 2023, many in warehousing. Armada Sunset Holdings must prioritize stringent safety protocols, potentially investing in automation technologies like AGVs, as the global warehouse automation market is expected to reach $30 billion by 2026.

| Societal Factor | Impact on Armada Sunset Holdings | Supporting Data (2024/2025) |

|---|---|---|

| Ethical Consumerism | Increased demand for supply chain transparency and ethical sourcing. | 70% of consumers consider ethical practices when buying (2024 survey). |

| Corporate Social Responsibility (CSR) | Need for active community engagement and social contribution. | 25% increase in applications for socially responsible firms (2025 LinkedIn report). |

| Urbanization | Growing demand for efficient urban delivery and localized hubs. | Over 60% of global population in urban areas (projected for 2024). |

| Workplace Safety | Heightened regulatory focus and investment in safety protocols. | Global warehouse automation market to reach $30 billion by 2026. |

Technological factors

AI and machine learning are transforming supply chain management, offering significant advantages in areas like demand forecasting and route optimization. For instance, studies in 2024 indicate that AI-powered demand forecasting can improve accuracy by up to 20%, leading to reduced inventory costs. Armada Sunset Holdings can harness these technologies to streamline its operations, cutting expenses and boosting decision-making quality.

The warehousing sector is rapidly embracing automation and robotics, with technologies like autonomous mobile robots (AMRs) and automated storage and retrieval systems (ASRS) becoming mainstream. This shift is driven by the need for greater efficiency and accuracy in logistics operations.

Armada Supply Chain Solutions is actively integrating these advancements. Their recent facility features Kargo optical reader verification and advanced narrow-aisle layouts, showcasing a strategic investment in technology to boost productivity. For instance, ASRS systems can achieve throughput rates of up to 1,000 cases per hour, significantly outperforming manual processes.

The Internet of Things (IoT) is revolutionizing supply chain management by enabling real-time tracking of goods, assets, and even environmental conditions. This constant stream of data allows companies like Armada Sunset Holdings to see exactly where everything is at any given moment.

By integrating IoT with sophisticated analytics, Armada Sunset Holdings can achieve complete end-to-end visibility across its operations. This means they can anticipate and react to potential disruptions much faster, leading to optimized inventory levels and greater transparency for their clients, a crucial advantage in today's fast-paced market.

Blockchain for Supply Chain Traceability

Blockchain technology is revolutionizing supply chain management by providing unparalleled transparency and security. Its ability to create immutable records of every transaction and movement significantly enhances traceability. This is crucial for industries dealing with high-value or sensitive goods, where provenance and authenticity are paramount.

Armada Sunset Holdings can leverage blockchain to build greater trust within its global operations. By integrating this technology, the company can combat fraud, reduce disputes, and streamline the complex documentation processes inherent in international trade and logistics. For instance, the global blockchain in supply chain market was valued at approximately $1.5 billion in 2023 and is projected to reach over $10 billion by 2028, indicating strong adoption trends.

- Enhanced Transparency: Immutable ledger provides end-to-end visibility of goods.

- Improved Security: Cryptographic hashing protects data integrity and prevents tampering.

- Reduced Fraud: Verifiable transaction history deters counterfeit products and illicit activities.

- Streamlined Operations: Automation of processes like customs clearance and payment settlement.

Digital Transformation and Cloud-Based Platforms

The ongoing digital transformation is fundamentally reshaping logistics. Armada Sunset Holdings is strategically positioned by its adoption of comprehensive digital platforms and cloud-based warehouse management systems (WMS). This technological pivot is essential for maintaining agility and achieving scalability in a rapidly evolving market. For instance, cloud adoption in the logistics sector saw significant growth, with a projected market size of over $20 billion globally by 2025, underscoring the critical nature of this shift.

Armada Sunset Holdings' commitment to integrated technology and data-driven solutions directly addresses this trend. Their focus on seamless data exchange, remote management capabilities, and enhanced collaboration across internal divisions and with external clients provides a competitive edge. This integration allows for real-time visibility into operations, crucial for optimizing inventory and streamlining supply chains. By 2024, companies leveraging advanced analytics and AI in their supply chains reported an average of 10-15% improvement in operational efficiency.

- Cloud Adoption: The global cloud computing market, vital for WMS, was projected to reach over $1 trillion by 2024, highlighting its widespread integration.

- Data-Driven Efficiency: Logistics firms utilizing predictive analytics saw a reduction in stockouts by up to 20% in recent studies.

- Remote Operations: The ability to manage operations remotely is becoming standard, with over 70% of businesses expecting to increase their remote workforce capabilities by 2025.

- Integration Benefits: Integrated systems can reduce order fulfillment times by an average of 15-25%, a key metric for customer satisfaction.

Technological advancements are fundamentally reshaping the logistics landscape, with AI and automation driving significant efficiency gains. For instance, AI-powered demand forecasting, showing up to a 20% accuracy improvement in 2024 studies, directly benefits Armada Sunset Holdings by reducing inventory costs. The integration of technologies like autonomous mobile robots (AMRs) and automated storage and retrieval systems (ASRS) is also becoming standard practice, with ASRS systems capable of achieving throughput rates of up to 1,000 cases per hour.

The adoption of IoT enables real-time tracking and enhanced end-to-end visibility, allowing companies like Armada Sunset Holdings to proactively manage disruptions and optimize inventory. Blockchain technology is similarly transforming supply chains by offering unparalleled transparency and security, with the global blockchain in supply chain market projected to exceed $10 billion by 2028. Furthermore, the widespread embrace of cloud-based warehouse management systems (WMS) and integrated digital platforms, with cloud adoption in logistics expected to reach over $20 billion globally by 2025, underscores the critical need for digital transformation to maintain agility and scalability.

| Technology | Impact on Logistics | Armada Sunset Holdings Relevance | 2024/2025 Data Point |

|---|---|---|---|

| AI & Machine Learning | Improved demand forecasting, route optimization | Reduced inventory costs, enhanced decision-making | AI forecasting accuracy up to 20% (2024) |

| Automation & Robotics | Increased efficiency and accuracy in warehousing | Higher productivity through AMRs and ASRS | ASRS throughput up to 1,000 cases/hour |

| Internet of Things (IoT) | Real-time asset tracking, end-to-end visibility | Proactive disruption management, inventory optimization | IoT integration for enhanced visibility |

| Blockchain | Enhanced transparency, security, and traceability | Combating fraud, streamlining international trade | Global blockchain in supply chain market to exceed $10B by 2028 |

| Digital Transformation & Cloud | Scalability, agility, remote management capabilities | Competitive edge through integrated platforms and WMS | Logistics cloud market >$20B globally by 2025 |

Legal factors

Armada Sunset Holdings faces significant legal hurdles in managing global trade compliance and sanctions. The ever-changing landscape of tariffs, export controls, and sanctions requires constant vigilance to avoid hefty fines and operational disruptions. For instance, in 2023, the U.S. Treasury Department’s Office of Foreign Assets Control (OFAC) continued to enforce a wide range of sanctions, impacting numerous industries and cross-border transactions.

Ensuring strict adherence to regulations from bodies like OFAC, the Bureau of Industry and Security (BIS), and various European Union agencies is paramount. Failure to comply can lead to severe penalties, including substantial financial penalties and reputational damage, potentially jeopardizing Armada Sunset Holdings' international business activities.

With the growing digital footprint, Armada Sunset Holdings faces significant legal obligations concerning data privacy and cybersecurity. Regulations like the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) mandate strict handling of personal data. Failure to comply can result in substantial fines; for instance, GDPR violations can lead to penalties of up to 4% of global annual revenue or €20 million, whichever is higher.

Armada Sunset Holdings must prioritize robust cybersecurity measures to safeguard sensitive client and operational data from increasingly sophisticated cyber threats. The average cost of a data breach globally reached $4.35 million in 2023 according to IBM's Cost of a Data Breach Report, highlighting the financial imperative for strong defenses. Ensuring technological solutions meet stringent legal requirements for data security is paramount to maintaining trust and avoiding legal repercussions.

New environmental regulations are significantly impacting businesses. For instance, the EU's Corporate Sustainability Due Diligence Directive (CSDDD) and Deforestation Regulation (EUDR) create legally binding requirements for companies to manage environmental risks within their supply chains. Armada Sunset Holdings must embed these sustainability mandates into its operational framework and disclosure practices to ensure adherence and mitigate the risk of penalties.

Labor Laws and Worker Protections

Armada Sunset Holdings must navigate a complex web of labor laws across its operating regions. This includes adhering to varying regulations on minimum wages, overtime pay, and employee benefits, which can significantly impact operational costs. For instance, in 2024, the average minimum wage in the US continued its upward trend, with many states and cities implementing higher rates, directly affecting labor expenses for companies with a significant US presence.

The company also faces increasing scrutiny regarding ethical labor practices and supply chain transparency. Legislation like the Uyghur Forced Labor Prevention Act (UFLPA) in the US, which came into full effect in mid-2022 and continues to influence import regulations in 2024, necessitates robust due diligence to prevent the use of forced labor. Non-compliance can lead to severe penalties, including import detentions and reputational damage.

- Jurisdictional Compliance: Armada Sunset Holdings must ensure adherence to diverse labor laws concerning working hours, wages, and collective bargaining rights across all operating countries.

- Forced Labor Prevention: Diligent oversight of supply chains is critical to comply with regulations like the UFLPA, requiring ethical sourcing and preventing the use of forced labor.

- Worker Protections: Adherence to evolving worker protection standards, including health and safety regulations, is paramount to avoid legal repercussions and maintain workforce morale.

- Wage and Hour Laws: Staying updated on minimum wage increases and overtime regulations in different markets is essential for accurate payroll and cost management.

Transportation and Logistics Specific Regulations

The transportation and logistics sector is heavily regulated, impacting operations like those of Armada Sunset Holdings. Compliance with rules on vehicle safety, such as those mandated by the National Highway Traffic Safety Administration (NHTSA) in the US, and cargo handling protocols is paramount. For instance, in 2024, the US Department of Transportation continued to emphasize stricter enforcement of hours-of-service regulations for truck drivers to improve road safety.

Navigating licensing requirements and the complexities of cross-border movement, including customs and tariffs, presents ongoing challenges. Armada Sunset Holdings must stay abreast of changes, such as the European Union's ongoing efforts to harmonize digital customs procedures, which aim to streamline trade but require significant IT investment and adaptation from logistics providers. Failure to comply can result in substantial fines and operational disruptions.

- Vehicle Safety Standards: Adherence to NHTSA's Federal Motor Vehicle Safety Standards (FMVSS) is critical for fleet operators.

- Cargo Handling Regulations: Compliance with International Maritime Dangerous Goods (IMDG) code and similar air transport regulations ensures safe and legal shipment of various goods.

- Driver Licensing and Hours of Service: Regulations like the Federal Motor Carrier Safety Administration's (FMCSA) rules dictate driver qualifications and rest periods, impacting scheduling and capacity.

- Cross-Border Movement: Staying updated on trade agreements and customs regulations, such as those evolving under the USMCA, is essential for international logistics.

Armada Sunset Holdings must navigate a complex regulatory environment, including trade compliance and sanctions, which saw continued enforcement by bodies like OFAC in 2023. Adherence to international trade laws and customs regulations is crucial to avoid penalties and operational disruptions. For instance, the EU's ongoing efforts to harmonize digital customs procedures in 2024 necessitate adaptation and investment for seamless cross-border operations.

Data privacy and cybersecurity are significant legal considerations, with regulations like GDPR and CCPA imposing strict data handling requirements. The average cost of a data breach globally reached $4.35 million in 2023, underscoring the financial imperative for robust data protection measures. Armada Sunset Holdings must ensure its technological infrastructure meets these stringent legal standards to maintain trust and avoid legal liabilities.

Environmental regulations, such as the EU's CSDDD and EUDR, are creating legally binding obligations for supply chain due diligence and sustainability management. Failure to comply can lead to penalties, emphasizing the need for Armada Sunset Holdings to integrate these mandates into its operational framework. This proactive approach is vital for mitigating risks and ensuring long-term compliance.

Labor laws across different jurisdictions, including minimum wage and overtime regulations, directly impact operational costs. Many US states and cities increased minimum wages in 2024, affecting labor expenses. Furthermore, legislation like the UFLPA continues to influence import regulations, requiring diligent supply chain oversight to prevent forced labor and avoid severe penalties and reputational damage.

Environmental factors

The logistics sector, a core component of Armada Sunset Holdings' operations, is a substantial source of global carbon emissions. This reality is driving significant pressure for decarbonization efforts worldwide. For instance, the International Energy Agency reported in 2023 that transport accounted for nearly a quarter of direct CO2 emissions globally.

Armada Sunset Holdings must proactively implement strategies to shrink its carbon footprint. This includes optimizing delivery routes to minimize mileage, investing in electric or alternative fuel vehicles for its fleet, and adopting energy-efficient technologies within its warehousing facilities. These actions are crucial for aligning with ambitious global climate targets, such as those outlined in the Paris Agreement.

Increasingly, regulators and stakeholders expect companies to prove their commitment to environmental, social, and governance (ESG) principles across their entire supply chains. Armada Sunset Holdings needs to improve its supply chain transparency to effectively measure and report on ESG indicators.

This includes focusing on areas like minimizing waste, optimizing resource use, and ensuring ethical sourcing practices, a commitment underscored by Armada Sunset Holdings' recent designation as a Green Supply Chain Partner, reflecting a growing trend where supply chain efficiency is directly linked to sustainability performance, with many global companies aiming for 20-30% waste reduction by 2025.

Armada Sunset Holdings faces increasing pressure to minimize waste across its packaging, transportation, and warehousing. A 2024 report indicated that the logistics sector alone accounts for a significant portion of global packaging waste, highlighting the need for immediate action.

Adopting circular economy principles is key for Armada Sunset Holdings. This involves optimizing packaging design to reduce material usage and exploring reusable packaging solutions. For instance, companies in similar sectors have reported up to a 15% reduction in material costs by implementing reusable transit packaging.

Further enhancing sustainability, Armada Sunset Holdings can champion recycling programs within its facilities and seek innovative ways to repurpose materials. This could include reusing pallets or finding secondary markets for discarded materials, aligning with a growing consumer demand for eco-conscious businesses and potentially improving operational efficiency by 2025.

Resource Scarcity and Water Management

Increasing concerns about resource scarcity, particularly water and essential raw materials, pose a significant risk to Armada Sunset Holdings by potentially disrupting supply chains and increasing operational costs. For instance, the UN projects that by 2025, two-thirds of the world's population may face water shortages, directly impacting industries reliant on water for production or agriculture. This situation necessitates a proactive approach from Armada Sunset Holdings to integrate resource-efficient practices throughout its operations.

To navigate these challenges effectively, Armada Sunset Holdings should focus on implementing water-saving technologies and exploring alternative material sourcing. Encouraging similar resource-efficient practices among its suppliers is also crucial for building a resilient and sustainable supply chain. This dual focus helps mitigate risks associated with scarcity and aligns the company with broader environmental stewardship goals.

- Water Scarcity Impact: By 2025, the UN estimates two-thirds of the global population could face water shortages, directly affecting businesses dependent on water resources.

- Supply Chain Vulnerability: Scarcity of critical raw materials, like rare earth elements essential for electronics, can lead to price volatility and supply disruptions. For example, global demand for critical minerals is projected to surge significantly by 2030, driven by clean energy technologies.

- Operational Costs: Increased competition for dwindling resources can drive up the cost of raw materials and utilities, impacting Armada Sunset Holdings' profitability.

- Sustainable Practices: Implementing water-efficient technologies and exploring circular economy models for material usage can reduce operational expenditures and enhance brand reputation.

Climate Change Adaptation and Resilience

Climate change presents significant physical risks to Armada Sunset Holdings' operations. Extreme weather events, like the intensified hurricane seasons observed in recent years, can directly impact transportation infrastructure, potentially delaying shipments and increasing logistics costs. For instance, the NOAA's 2024 outlook projected an above-normal Atlantic hurricane season, underscoring the need for proactive risk management.

To mitigate these risks, Armada Sunset Holdings must invest in adaptive strategies and bolster the resilience of its supply chains. This includes diversifying transportation routes and exploring alternative warehousing solutions in less vulnerable geographic areas. Building robust contingency plans is crucial for maintaining service continuity and client trust amidst increasing climate volatility.

The company's preparedness will be tested by the growing frequency and severity of climate-related disruptions. For example, a 2024 report indicated that global economic losses from weather and climate disasters reached hundreds of billions, highlighting the financial implications of inaction. Armada Sunset Holdings' ability to adapt will directly influence its operational stability and competitive standing.

- Physical Risk: Increased frequency of extreme weather events (e.g., hurricanes, floods) disrupting transportation and warehousing.

- Adaptation Strategy: Diversification of logistics networks and investment in resilient infrastructure.

- Resilience Building: Developing robust contingency plans and supply chain redundancy to ensure operational continuity.

- Financial Impact: Potential for increased operational costs and service disruptions if adaptation measures are not implemented.

The growing global emphasis on sustainability and environmental protection directly impacts Armada Sunset Holdings. Stricter regulations regarding carbon emissions and waste management are becoming more prevalent, pushing companies to adopt greener practices. For instance, the European Union's Green Deal aims for climate neutrality by 2050, influencing trade and operational standards for businesses operating within or trading with the EU.

Armada Sunset Holdings must prioritize reducing its environmental footprint, particularly within its logistics operations which are a significant contributor to global emissions. Optimizing routes, investing in fuel-efficient fleets, and adopting energy-saving technologies in warehouses are essential steps. The company's commitment to ESG principles is also increasingly scrutinized by investors and consumers alike, making supply chain transparency a critical factor.

| Environmental Factor | Impact on Armada Sunset Holdings | Mitigation Strategies | Relevant Data/Trends (2024-2025) |

|---|---|---|---|

| Carbon Emissions | Increased operational costs due to carbon taxes/penalties; reputational damage from high emissions. | Fleet electrification, route optimization, alternative fuels. | Global transport emissions accounted for 24% of direct CO2 emissions in 2023 (IEA). Many logistics firms targeting 20% fleet electrification by 2027. |

| Waste Management | Higher disposal costs; regulatory fines for non-compliance; consumer preference for sustainable packaging. | Circular economy principles, reusable packaging, enhanced recycling programs. | Logistics sector packaging waste is a significant concern; companies aiming for 15% material cost reduction via reusable packaging by 2025. |

| Resource Scarcity (Water/Materials) | Supply chain disruptions; increased raw material costs; operational halts. | Water-saving technologies, alternative material sourcing, supplier engagement on resource efficiency. | UN projects two-thirds of the world population facing water shortages by 2025. Demand for critical minerals for clean energy to surge by 2030. |

| Climate Change & Extreme Weather | Disruption of transport networks; increased insurance premiums; damage to infrastructure. | Diversification of routes, resilient infrastructure investment, robust contingency planning. | NOAA projected an above-normal Atlantic hurricane season for 2024. Global economic losses from weather disasters reached hundreds of billions in 2024. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Armada Sunset Holdings is meticulously constructed using data from reputable financial news outlets, government regulatory bodies, and leading market research firms. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.