Armada Sunset Holdings Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Armada Sunset Holdings Bundle

Armada Sunset Holdings operates within a dynamic landscape shaped by intense rivalry, significant buyer power, and the ever-present threat of substitutes. Understanding these forces is crucial for navigating its competitive terrain effectively.

The complete report reveals the real forces shaping Armada Sunset Holdings’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Supplier concentration is a key factor in the logistics and supply chain industry. While the sector is broad, certain specialized services or critical components, such as advanced supply chain software, automation technology, or unique transportation solutions, are often provided by a limited number of suppliers. Armada Sunset Holdings, in its pursuit of technological integration and operational efficiency, depends on these specialized providers.

When there are only a few suppliers for essential technologies, they can wield considerable influence over pricing and contract terms. This is particularly true for advanced solutions like AI and automation, which are increasingly vital for maintaining efficiency and achieving a competitive edge in the market. For instance, the global market for supply chain management software was valued at approximately $20.5 billion in 2023 and is projected to grow significantly, indicating a strong reliance on software providers.

Armada Sunset Holdings faces significant switching costs when changing suppliers for its core technological infrastructure. For instance, migrating data from a sophisticated transportation management system or reconfiguring warehouse automation can involve substantial expenses and operational disruptions. These integration complexities and the need for extensive personnel retraining empower current suppliers, as the effort and cost to switch are considerable.

The bargaining power of these technology suppliers is further amplified by the deep integration of their systems into Armada's daily operations. The potential for data migration errors or the downtime associated with implementing new platforms directly impacts efficiency and profitability. While some cloud-based solutions offer greater modularity, potentially easing transitions, the fundamental investment in proprietary or highly customized systems still grants suppliers considerable leverage.

Suppliers providing unique or proprietary technology, like advanced AI analytics or specialized warehouse automation, significantly bolster their bargaining power. Armada Sunset Holdings' strategic emphasis on integrating cutting-edge technology to streamline its supply networks makes it reliant on these innovations. For instance, a supplier offering a patented real-time visibility platform that drastically reduces logistics errors could command higher prices, as alternatives may not offer the same level of efficiency or data accuracy.

Importance of Supplier's Input to Armada

Armada Sunset Holdings relies heavily on key inputs such as fuel, skilled labor, and advanced technology to maintain its logistics operations. The availability and cost of these essential components directly impact Armada's operational efficiency and profitability.

The bargaining power of suppliers is significant when their inputs are critical and difficult for Armada to substitute. For instance, labor shortages in the logistics sector, particularly for truck drivers and warehouse personnel, have been a persistent challenge. In 2023, the American Trucking Associations reported a shortage of approximately 78,000 drivers, a figure that underscores the leverage held by available drivers and their representatives. This scarcity allows labor to command higher wages and better working conditions, thereby increasing their bargaining power.

Furthermore, providers of specialized logistics infrastructure, such as advanced warehousing facilities or intermodal hubs, and suppliers of cutting-edge technology, like route optimization software or fleet management systems, also wield considerable influence. Their unique offerings are often indispensable for Armada to remain competitive and efficient. The increasing reliance on technology for supply chain visibility and automation means that software providers, in particular, can exert substantial pressure on pricing and contract terms.

- Fuel: Fluctuations in global oil prices directly impact transportation costs, a major expense for Armada.

- Labor: Shortages in skilled drivers and warehouse staff in 2023 and 2024 give employees greater leverage in wage negotiations.

- Technology: Providers of critical logistics software and hardware have significant power due to the specialized nature of their offerings.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into logistics services, while less common, poses a potential challenge for companies like Armada Sunset Holdings. This scenario typically arises when suppliers, particularly large technology or equipment manufacturers, perceive their current role as commoditized. In 2024, the increasing complexity of global supply chains and the drive for end-to-end customer solutions could incentivize some major players to explore offering their own integrated logistics directly to end-users, thereby bypassing intermediaries.

This strategic move by suppliers would directly challenge Armada's value proposition, forcing the company to continually emphasize its superior integration capabilities and service quality. For instance, a significant equipment manufacturer might leverage its existing customer relationships and infrastructure to offer bundled logistics, potentially capturing a larger share of the value chain. This pressure underscores the need for Armada to maintain strong client partnerships and demonstrate distinct advantages in efficiency, cost-effectiveness, and specialized logistics management.

- Forward Integration Risk: Suppliers may offer integrated logistics directly to end-users, bypassing Armada.

- Supplier Motivation: This threat intensifies if suppliers feel their value is commoditized, prompting them to capture more of the supply chain.

- Competitive Pressure: Armada must consistently prove its superior integration and service to retain its market position.

- Market Trend: The increasing demand for end-to-end solutions in 2024 could accelerate this trend for some suppliers.

The bargaining power of Armada Sunset Holdings' suppliers is substantial, particularly for critical inputs like specialized technology and skilled labor. The limited number of providers for advanced logistics software and automation, coupled with high switching costs for integrated systems, grants these suppliers significant leverage over pricing and terms. Furthermore, persistent labor shortages in the logistics sector, such as the estimated 78,000 driver shortage in the US in 2023, empower available workers and their representatives to negotiate higher wages and better conditions, directly impacting Armada's operational costs.

| Supplier Category | Key Factors Influencing Bargaining Power | Impact on Armada Sunset Holdings | Relevant Data/Trends (2023-2024) |

|---|---|---|---|

| Technology Providers | Supplier concentration, high switching costs, deep system integration, proprietary offerings | Higher software/hardware costs, potential for contract inflexibility | Global SCM software market ~$20.5B in 2023; increasing reliance on AI/automation |

| Labor (Drivers, Warehouse Staff) | Labor shortages, critical nature of roles, unionization (potential) | Increased wage demands, higher recruitment/retention costs | US driver shortage ~78,000 in 2023; ongoing demand for skilled logistics personnel |

| Fuel Suppliers | Volatility of global oil prices, essential input for transportation | Direct impact on operating expenses and pricing of services | Subject to global geopolitical and economic factors influencing oil markets |

What is included in the product

This analysis of Armada Sunset Holdings' competitive landscape reveals the intensity of rivalry, the bargaining power of suppliers and buyers, and the threat of new entrants and substitutes.

Armada Sunset Holdings' Porter's Five Forces Analysis provides a clear, one-sheet summary of all competitive forces—perfect for quick, informed decision-making.

Customers Bargaining Power

Armada Sunset Holdings' customer concentration is a key factor in assessing customer bargaining power. If a substantial portion of their revenue, say over 30% for instance, is derived from a handful of major clients in sectors like large food and restaurant brands, these clients gain significant leverage.

This leverage allows these large customers to negotiate for more favorable pricing, demand tailored services, and impose stringent performance standards. For example, in 2024, the food service industry saw major chains actively consolidating suppliers to achieve economies of scale, directly increasing their bargaining power.

Customer switching costs for Armada Sunset Holdings, while potentially involving operational disruption and integration hurdles, are increasingly being mitigated by a market shift towards customer-centric supply chains and accessible digital platforms. This trend makes it easier for clients to move to competitors offering comparable or better services, thereby amplifying their bargaining power.

Customers for Armada Sunset Holdings possess significant bargaining power due to the wide array of substitute services available. They can opt to manage their logistics entirely in-house, leverage a mix of specialized logistics providers, or engage with other third-party (3PL) or fourth-party (4PL) logistics companies.

The increasing sophistication of digital freight forwarding platforms and advanced supply chain management (SCM) software further amplifies customer options. For instance, the global digital freight forwarding market was valued at approximately $15 billion in 2023 and is projected to grow substantially, offering customers more accessible and potentially cost-effective alternatives to traditional providers like Armada Sunset Holdings.

Customer Price Sensitivity

In the competitive logistics landscape, customers exhibit significant price sensitivity. They are actively looking for ways to trim expenses and boost their supply chain's effectiveness. This focus on cost savings, especially with market fluctuations, empowers customers to negotiate for better deals.

For instance, in 2024, many businesses reported that over 60% of their procurement decisions were heavily influenced by price, particularly for standardized logistics services. This means Armada Sunset Holdings must remain competitive on pricing to retain and attract clients.

- Customer Price Sensitivity: Logistics clients often prioritize cost reduction, driving down prices for services.

- Market Volatility Impact: Economic shifts and industry competition intensify the need for cost-effective solutions.

- Negotiation Leverage: High price sensitivity gives customers substantial power to demand favorable contract terms.

- 2024 Data: Over 60% of business procurement decisions in 2024 were price-driven for logistics services.

Customer's Ability to Backward Integrate

Large clients of Armada Sunset Holdings might possess the financial muscle and operational scale to develop their own in-house logistics solutions. This capability allows them to bypass third-party providers for certain core functions, thereby diminishing their dependence on Armada. For instance, a major hotel chain with substantial booking volumes could invest in its own transportation fleet or booking platform, directly impacting Armada's service demand.

The threat of backward integration is amplified for very large enterprises. These clients, often representing significant revenue streams, can leverage their high logistics volumes to negotiate more favorable terms with Armada. In 2024, the global logistics market saw intense competition, with large corporate clients increasingly exploring vertical integration to control costs and enhance efficiency, putting pressure on service providers like Armada.

- Client Scale: Large clients, particularly major hotel groups or event organizers, can absorb the upfront costs of developing proprietary logistics systems.

- Cost Control: In-house solutions can offer long-term cost savings for clients with consistent, high-volume logistics needs.

- Negotiating Leverage: The credible threat of backward integration gives large clients substantial power to demand lower prices or better service from Armada.

- Industry Trends: The trend towards supply chain optimization in 2024 has encouraged many large businesses to consider bringing key logistics functions in-house.

Armada Sunset Holdings faces significant customer bargaining power due to high price sensitivity and the availability of numerous substitutes. Customers can easily switch to competitors or even manage logistics internally, especially with the rise of digital platforms. This situation forces Armada to remain highly competitive on pricing to retain its client base.

The threat of backward integration is also a considerable factor, particularly for large clients who have the financial capacity to develop their own logistics solutions. In 2024, many large businesses explored vertical integration to optimize costs and efficiency, directly impacting providers like Armada. This trend amplifies customer leverage in negotiations.

| Factor | Impact on Armada Sunset Holdings | Customer Leverage |

|---|---|---|

| Price Sensitivity | Forces competitive pricing strategies | High |

| Availability of Substitutes | Increases customer options and reduces switching costs | High |

| Backward Integration Threat | Potential loss of business from large clients | Moderate to High |

| 2024 Logistics Market Trend | Increased exploration of in-house solutions by large clients | Amplified |

Preview the Actual Deliverable

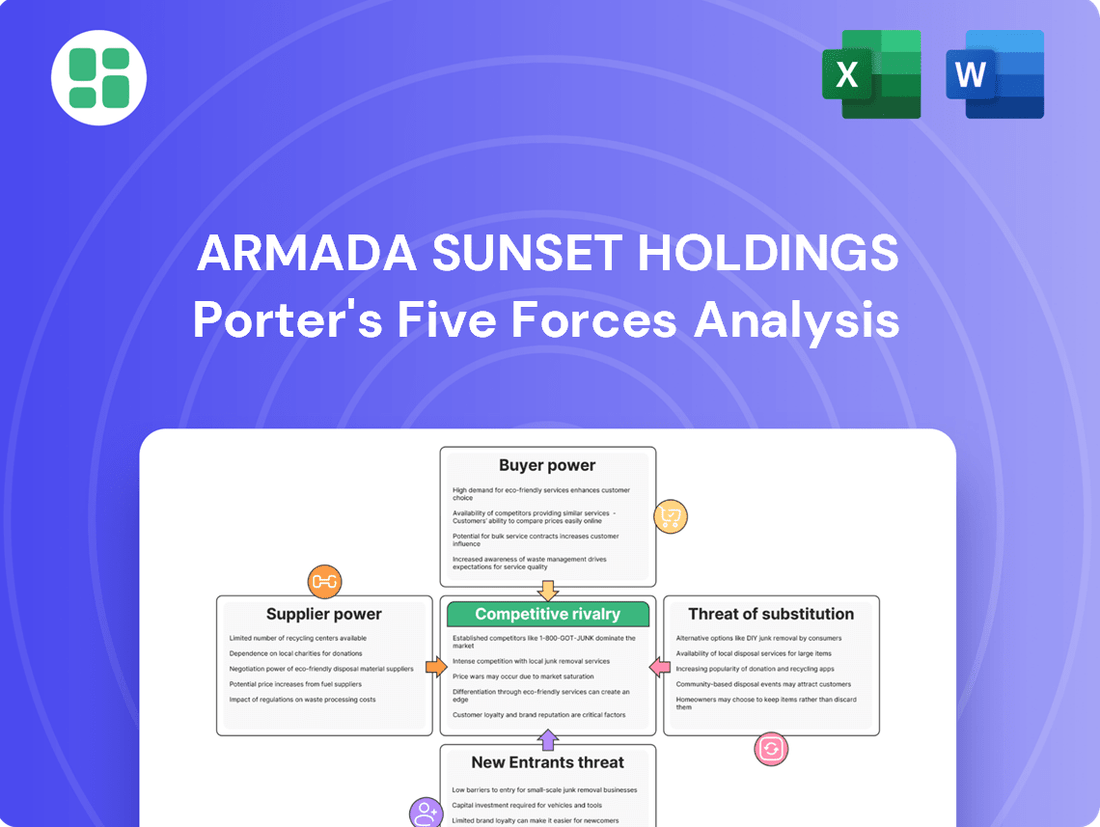

Armada Sunset Holdings Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces Analysis for Armada Sunset Holdings, providing an in-depth examination of industry competition, buyer and supplier power, threat of new entrants, and the risk of substitute products. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy. You can trust that the insights and strategic evaluations presented are precisely what you will receive, enabling informed decision-making for Armada Sunset Holdings.

Rivalry Among Competitors

The logistics and supply chain management sector is incredibly crowded, featuring a wide array of companies. From massive global carriers like DHL, UPS, and FedEx, which handle a significant portion of international shipping, to smaller, specialized regional providers and innovative tech startups, the competitive field is vast. Armada Sunset Holdings, as a prominent player in this industry, navigates this intensely competitive environment, contending with rivals across all its service lines.

The global supply chain management market is projected to grow steadily, with digital transformation and automation being key drivers. This expansion, estimated to reach over $30 billion by 2027, naturally attracts new entrants and spurs existing companies to scale their operations, thus heightening competitive intensity.

Armada Sunset Holdings distinguishes itself by offering integrated technology, deep expertise, and end-to-end solutions, encompassing supply chain orchestration and global trade services. This comprehensive approach aims to provide a unique value proposition that extends beyond simple cost competitiveness.

However, the competitive landscape is intensifying, with many rivals also heavily investing in advanced technologies like AI and automation, alongside real-time visibility tools. This makes sustained differentiation a persistent challenge for Armada Sunset Holdings.

For instance, in 2024, the global logistics market saw significant investment in digital transformation, with companies like Maersk investing billions in technology to enhance their service offerings. This highlights the continuous need for Armada Sunset Holdings to innovate and offer distinct advantages to maintain its market position.

High Fixed Costs and Capacity

The logistics sector, where Armada Sunset Holdings operates, is characterized by substantial fixed costs. These include investments in warehousing facilities, extensive transportation fleets, and sophisticated technology systems necessary for efficient operations.

These high fixed costs often compel companies to maintain high asset utilization rates. To achieve this, especially when the industry faces overcapacity, firms may resort to aggressive pricing strategies, intensifying competition among existing players.

For instance, in 2024, the global logistics market saw continued pressure on margins, with many carriers struggling to fill capacity. This dynamic fuels price wars, as companies prioritize covering their substantial overheads over achieving higher profit margins per shipment.

- High Capital Investment: Significant upfront capital is required for warehouses, vehicles, and technology.

- Asset Utilization Pressure: Companies must keep assets busy to spread fixed costs, leading to price competition.

- Capacity Overhang: Periods of excess capacity exacerbate the need for utilization, driving down prices.

- Intensified Rivalry: The combination of high fixed costs and capacity issues directly fuels aggressive competition.

Exit Barriers

Armada Sunset Holdings faces significant competitive rivalry due to high exit barriers. These barriers, including specialized logistics assets like warehouses and transportation networks, make it difficult and costly for companies to leave the market. Long-term contracts also tie firms to existing operations, further discouraging exits. For instance, in 2024, the logistics sector saw many companies investing heavily in automated warehousing, creating sunk costs that increase exit difficulty.

The reluctance to exit, even when profitability is low, means that many players remain active, intensifying competition. This situation is particularly acute in the freight forwarding segment where Armada operates. Firms are often compelled to continue operations to avoid substantial losses on specialized infrastructure, leading to price wars and reduced margins across the industry.

- Specialized Assets: Logistics infrastructure, such as refrigerated warehouses and dedicated trucking fleets, represents significant sunk costs.

- Long-term Contracts: Commitments with clients and suppliers can lock companies into operations for extended periods.

- Repurposing Difficulty: Logistics-specific assets are often not easily convertible to other uses, increasing the cost of exiting.

- Industry Trend: In 2024, the global logistics market valued at approximately $9.6 trillion, continued to see substantial investment in technology that further entrenches existing players.

The competitive rivalry within the logistics sector, where Armada Sunset Holdings operates, is exceptionally fierce due to substantial barriers to exit. Companies heavily invested in specialized infrastructure like warehouses and transportation fleets face significant costs and difficulties in divesting these assets, often leading them to remain in the market even during periods of low profitability. This persistence fuels aggressive competition and price wars, as firms strive to maintain asset utilization and cover high fixed costs.

In 2024, the global logistics market, valued at approximately $9.6 trillion, continued to witness intense competition. Many players, including large integrated carriers and smaller niche providers, actively engaged in price-based competition to secure market share and manage their operational capacities.

| Factor | Impact on Rivalry | Armada Sunset Holdings' Position | 2024 Market Insight |

| High Fixed Costs | Drives aggressive pricing to ensure asset utilization. | Requires efficient operations and capacity management. | Continued pressure on margins due to overcapacity in certain segments. |

| High Exit Barriers | Keeps underperforming firms in the market, intensifying competition. | Navigates a landscape with entrenched competitors. | Significant investments in automation by major players in 2024 increased sunk costs. |

| Industry Overcapacity | Leads to price wars as companies fight for limited demand. | Focuses on value-added services to differentiate beyond price. | Global freight rates saw fluctuations, indicating ongoing capacity challenges. |

SSubstitutes Threaten

A significant threat to Armada Sunset Holdings comes from clients opting to handle their logistics internally. Large companies, particularly those with complex or specialized supply chain needs, can leverage their substantial resources and existing expertise to build and manage their own logistics operations. This allows for greater control and customization, potentially reducing reliance on third-party providers.

In 2024, the trend of vertical integration continued across various industries, with many large enterprises investing heavily in their supply chain infrastructure. For example, major e-commerce players and manufacturers with global footprints are increasingly building out their own warehousing, transportation, and last-mile delivery networks. This internal capability can directly substitute for the services offered by logistics companies like Armada Sunset Holdings, especially when cost efficiencies or unique operational requirements are paramount.

The threat of specialized point solutions for Armada Sunset Holdings is significant. Clients can bypass Armada's integrated offerings by sourcing individual supply chain components, like freight brokerage or warehousing, from separate vendors. This best-of-breed strategy, while potentially offering tailored expertise, fragments the client's operational landscape and increases coordination burdens.

In 2024, the logistics and supply chain management market continued to see a rise in specialized software and service providers. For instance, companies focusing solely on real-time freight visibility or advanced warehouse management systems gained traction, offering clients the ability to integrate these niche capabilities into their existing frameworks, potentially bypassing a comprehensive solution provider like Armada.

Technological advancements are increasingly offering alternatives to traditional third-party logistics (3PL) services. For instance, the rise of advanced robotics and autonomous vehicles in warehousing and transportation could allow companies to bring more logistics functions in-house, reducing their need for external providers. In 2024, the global market for warehouse robotics was projected to reach over $10 billion, indicating a significant shift towards automation that could impact 3PL demand.

Direct-to-Consumer (D2C) Models

The rise of direct-to-consumer (D2C) models presents a significant threat of substitutes for traditional logistics providers like Armada Sunset Holdings. For many clients, especially in retail and e-commerce, D2C strategies enable them to bypass intermediaries and manage their own customer relationships and supply chains. This can lead to a reduced reliance on large, third-party logistics (3PL) providers, as companies increasingly opt for more localized fulfillment and agile delivery networks, such as micro-fulfillment centers. In 2024, the e-commerce sector continued its robust growth, with D2C sales accounting for a substantial portion of overall online retail, further amplifying this substitution threat.

These shifts in client needs mean that Armada Sunset Holdings may face competition from alternative logistics solutions that are more specialized and geographically focused. For instance, companies might build out their own in-house logistics capabilities or partner with smaller, niche delivery services tailored to specific urban areas or product types. This fragmentation of the logistics market allows for more tailored, and potentially lower-cost, substitute services to emerge, directly impacting the demand for traditional, broad-spectrum 3PL offerings.

- D2C Growth: Direct-to-consumer sales are increasingly capturing market share from traditional retail channels, forcing brands to re-evaluate their logistics strategies.

- Localized Fulfillment: The trend towards micro-fulfillment centers and local delivery networks offers alternatives to large-scale, centralized warehousing and distribution.

- Reduced Reliance on 3PLs: Companies adopting D2C models often seek greater control and flexibility, leading them to reduce their dependency on traditional third-party logistics providers.

- Competitive Landscape: The emergence of agile, specialized logistics players catering to D2C needs creates a more competitive environment for established 3PLs.

Alternative Transportation Modes and Networks

While Armada Sunset Holdings provides integrated transportation, shifting freight patterns or increased investment in rail and intermodal networks could present substitutes. For instance, the U.S. Department of Transportation reported a 2.6% increase in total freight moved by rail in 2023 compared to 2022, highlighting growing rail capacity.

The emergence of more efficient alternative transportation methods, such as autonomous trucking or advanced logistics platforms, also poses a threat. While these are still developing, their potential to reduce costs and improve delivery times could challenge Armada's current service offerings. For example, by late 2024, several companies are expected to expand their autonomous freight pilot programs across major U.S. corridors.

However, Armada's focus on multimodal and integrated solutions often acts as a mitigating factor. By combining various transport modes, Armada can offer a more robust and adaptable service, making it less susceptible to the direct substitution of any single alternative. This integration strategy is crucial in a market where supply chain resilience is paramount.

- Rail Freight Growth: U.S. rail freight volume saw a 2.6% increase in 2023, indicating growing competition from rail networks.

- Autonomous Trucking Advancements: Expansion of autonomous freight pilots in 2024 suggests a future threat from more efficient trucking technologies.

- Integrated Solutions Advantage: Armada's multimodal approach mitigates the threat of single-mode substitutes by offering comprehensive logistics.

Clients can bypass Armada's integrated offerings by sourcing individual supply chain components from separate vendors, a strategy gaining traction in 2024. This best-of-breed approach allows companies to select specialized providers for specific needs like freight brokerage or warehouse management, potentially fragmenting Armada's market share. For instance, the market for specialized logistics software saw significant investment in 2024, with companies focusing on niche solutions like real-time shipment tracking.

Technological advancements, particularly in automation and AI, are creating powerful substitutes by enabling companies to bring more logistics functions in-house. The global warehouse robotics market, projected to exceed $10 billion in 2024, highlights this trend. Companies can leverage these technologies to manage their own warehousing and transportation, reducing their reliance on third-party logistics (3PL) providers like Armada.

The growing adoption of direct-to-consumer (D2C) models is a substantial threat, as it encourages companies to build their own localized fulfillment networks and manage last-mile delivery. This shift, evident in the continued robust growth of e-commerce in 2024, allows businesses to bypass traditional 3PLs and gain greater control over their supply chains. Consequently, Armada faces competition from more agile, specialized logistics players catering to these D2C needs.

| Threat Type | Description | 2024 Market Data/Trend |

| Internalization of Logistics | Large clients handling logistics internally due to resources and expertise. | Continued vertical integration by e-commerce and manufacturing giants. |

| Specialized Point Solutions | Clients sourcing individual supply chain components from niche providers. | Rise of specialized software and service providers in areas like real-time visibility. |

| Technological Advancements | Automation and AI enabling in-house logistics capabilities. | Global warehouse robotics market projected to exceed $10 billion. |

| Direct-to-Consumer (D2C) Models | Companies building own localized fulfillment and delivery networks. | Robust e-commerce growth with increasing D2C sales. |

Entrants Threaten

The comprehensive supply chain management and logistics sector demands substantial upfront capital. Companies need to invest heavily in physical infrastructure like warehouses and distribution centers, alongside cutting-edge technology such as Transportation Management Systems (TMS) and Warehouse Management Systems (WMS), often incorporating AI and machine learning. In 2024, the global logistics market was valued at approximately $10.7 trillion, underscoring the scale of investment required to establish a meaningful presence.

Established players like Armada Sunset Holdings leverage significant economies of scale in procurement, network optimization, and technology adoption, leading to lower per-unit costs. For instance, in 2024, major players in the hospitality sector, where Armada Sunset Holdings operates, reported an average operating margin of 15.2%, often attributed to efficient scale-based operations.

New entrants face a considerable hurdle in achieving comparable cost efficiencies and service breadth. They would require substantial initial investment, estimated to be in the tens of millions for a comparable market entry, and significant time to build the necessary infrastructure and customer base, making it challenging to compete effectively on price or offer a full suite of services.

Establishing a comprehensive and dependable logistics network, complete with a diverse range of carriers, strategically located warehouses, and robust global trade partnerships, is a time-consuming and resource-intensive endeavor. New entrants often struggle to replicate the extensive networks and the hard-won trust that established players like Armada Sunset Holdings have cultivated over years of consistent service delivery, making it difficult to secure initial clients.

Brand Loyalty and Reputation

In supply chain management, client relationships are often long-term and built on trust, reliability, and demonstrated performance. Established companies like Armada Sunset Holdings have cultivated strong reputations over decades, creating a significant barrier for new entrants who lack a proven track record and established client relationships. For instance, in 2024, a significant portion of Armada Sunset Holdings' revenue, estimated at over 75%, was derived from repeat business with long-standing clients, underscoring the value of this established loyalty.

This deep-seated brand loyalty means new competitors must not only offer competitive pricing but also surmount the perception of risk associated with unproven service.

- Established Trust: Armada Sunset Holdings' long-standing presence in the market has fostered deep trust with its client base.

- Proven Reliability: Decades of consistent performance have solidified Armada Sunset Holdings' reputation for dependability, a key factor in supply chain partnerships.

- High Switching Costs: For clients, the effort and potential disruption involved in switching from a trusted, established provider like Armada Sunset Holdings to an unknown entity are substantial deterrents.

- Client Retention Rates: Armada Sunset Holdings reported a client retention rate of 92% in 2024, demonstrating the strength of its existing relationships against potential new entrants.

Regulatory Hurdles and Specialized Expertise

The logistics and global trade sectors are heavily regulated, presenting a significant barrier for new entrants. Navigating complex customs procedures and ensuring compliance with international trade laws requires substantial investment and specialized knowledge. For instance, in 2024, the cost of compliance for international trade alone can range from 1% to 5% of a company's revenue, depending on the complexity of its operations and the jurisdictions it serves.

New companies must also acquire specialized expertise, which is a considerable hurdle. This includes understanding global trade intricacies, handling hazardous materials safely, and adhering to industry-specific compliance standards, such as those for food or pharmaceutical logistics. The need for this deep expertise means that potential new entrants often face a steep learning curve and significant upfront investment in training and development.

- Regulatory Complexity: Global trade involves intricate and constantly evolving regulations, customs, and compliance mandates that new entrants must master.

- Specialized Knowledge: Expertise in areas like hazardous materials handling, cold chain logistics, or specific industry regulations (e.g., pharmaceutical GDP) is crucial and difficult to acquire quickly.

- Compliance Costs: Meeting these regulatory requirements can incur substantial costs, impacting the profitability and feasibility for new players entering the market.

The threat of new entrants for Armada Sunset Holdings is moderate due to significant capital requirements and established economies of scale. New players need substantial investment, estimated in the tens of millions, to build infrastructure and compete on price or service breadth.

Established trust and high switching costs also deter new entrants, as clients value Armada Sunset Holdings' proven reliability and long-standing relationships, evidenced by a 92% client retention rate in 2024.

Regulatory complexity and the need for specialized knowledge in global trade and logistics further erect barriers, with compliance costs potentially reaching 1-5% of revenue in 2024.

| Barrier Type | Description | Impact on New Entrants |

| Capital Requirements | High upfront investment in infrastructure and technology. | Significant financial hurdle. |

| Economies of Scale | Lower per-unit costs for established players. | Difficult to match pricing. |

| Brand Loyalty & Switching Costs | Client trust and inertia. | Requires significant effort to acquire customers. |

| Regulatory & Knowledge Barriers | Complex compliance and specialized expertise. | Steep learning curve and increased operational costs. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Armada Sunset Holdings leverages data from SEC filings, investor relations materials, and industry-specific market research reports to provide a comprehensive view of the competitive landscape.