Ardent Health Services Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ardent Health Services Bundle

Ardent Health Services operates within a dynamic healthcare landscape, where understanding the competitive forces is paramount. Our initial assessment highlights the significant influence of buyer power from both patients and payers, as well as the constant threat of new entrants eager to capture market share. The complete report reveals the real forces shaping Ardent Health Services’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The healthcare sector, including providers like Ardent Health Services, is grappling with ongoing and intensifying shortages of essential personnel, particularly physicians and nurses. This scarcity directly translates into greater leverage for these specialized workers, driving up labor expenses for healthcare organizations.

Factors such as widespread provider burnout and elevated job stress are compelling many healthcare professionals to exit the industry. This trend further strains the already tight labor market, intensifying the imbalance between the demand for and supply of skilled medical staff.

Suppliers of pharmaceuticals and advanced medical devices hold significant bargaining power. This stems from the proprietary nature of their products, patent protections, and the essential role these items play in patient treatment, making it difficult for hospitals like Ardent Health Services to substitute them easily.

Hospitals are consistently dealing with inflationary pressures and potential disruptions in the global supply chain for these critical medical goods. In 2024, non-labor expenses, which encompass medical supplies, experienced an approximate 10% rise for hospitals, directly increasing Ardent's operational expenditures.

The bargaining power of healthcare technology providers is substantial, driven by the growing dependence on advanced systems like Electronic Health Records (EHR) and Artificial Intelligence (AI). Ardent Health Services' commitment to integrating Epic's EHR and adopting AI tools highlights this reliance. With a significant majority of health executives, around 77% in 2024, focusing on AI investments, these specialized vendors are in a strong position to dictate terms and pricing.

Specialized Services and Consulting

Healthcare providers like Ardent Health Services are increasingly reliant on specialized IT services and consulting firms, particularly in areas like data analytics and cybersecurity. These firms possess niche expertise that is difficult for hospitals to replicate internally, granting them significant bargaining power. For instance, the global healthcare analytics market was projected to reach $60 billion by 2024, indicating substantial investment and demand for these specialized services.

The growing complexity of healthcare regulations and the push for digital transformation further amplify the influence of these external consultants. Their ability to offer tailored solutions for performance improvement and digital strategy makes them indispensable partners. In 2023, healthcare organizations reported spending an average of 15% of their IT budget on external consulting services to address these evolving needs.

- High Demand for Niche Expertise: Specialized firms offering advanced data analytics and cybersecurity solutions command strong leverage due to the scarcity of in-house talent.

- Digital Transformation Imperative: The ongoing digital transformation in healthcare necessitates external expertise for optimizing operations and implementing new technologies.

- Regulatory Compliance Needs: Navigating complex healthcare regulations requires specialized knowledge, increasing the reliance on and power of consulting services.

- Significant Market Growth: The robust growth of the healthcare analytics market underscores the increasing dependence and bargaining power of service providers in this sector.

Construction and Facility Management Services

Ardent Health Services' expansion plans, including acquisitions and new facility construction, bolster the bargaining power of suppliers in the construction and facility management sectors. The company's significant capital expenditure plans for ambulatory build-out and new centers in 2025, estimated to be in the hundreds of millions, amplify this leverage. Specialized providers of construction and ongoing maintenance services can command higher prices due to this concentrated demand.

- Increased Demand: Ardent's planned capital expenditures for 2025, focusing on new facilities and ambulatory centers, directly increase demand for construction services.

- Specialized Expertise: The need for specialized construction and facility management expertise for healthcare facilities, which often have unique requirements, limits the pool of qualified suppliers.

- Supplier Leverage: This combination of high demand and specialized needs grants these suppliers greater power to negotiate terms and pricing with Ardent Health.

Suppliers of pharmaceuticals and advanced medical devices hold significant bargaining power due to proprietary products and patent protections, making them essential for patient care. In 2024, non-labor expenses, including medical supplies, saw an approximate 10% rise for hospitals, directly impacting Ardent's costs.

The healthcare technology sector, particularly providers of Electronic Health Records (EHR) and Artificial Intelligence (AI) systems, wield substantial influence. Ardent's reliance on systems like Epic, coupled with 77% of health executives prioritizing AI investments in 2024, strengthens these vendors' negotiating positions.

Specialized IT service and consulting firms also possess considerable bargaining power, driven by the demand for niche expertise in areas like data analytics and cybersecurity. The global healthcare analytics market's projected $60 billion valuation by 2024 highlights this dependency.

Ardent Health Services' expansion plans, including significant capital expenditures for new facilities in 2025, enhance the bargaining power of construction and facility management suppliers. This increased demand for specialized services allows these suppliers to negotiate higher prices.

| Supplier Type | Reason for Bargaining Power | Impact on Ardent Health Services | Relevant Data Point (2024/2025) |

|---|---|---|---|

| Pharmaceuticals & Medical Devices | Proprietary products, patents, essential for treatment | Increased cost of goods, limited substitution options | 10% rise in non-labor expenses (medical supplies) |

| Healthcare Technology (EHR, AI) | High dependence on advanced systems, niche expertise | Potential for higher software/licensing fees, integration costs | 77% of health executives focusing on AI investments |

| IT Services & Consulting (Analytics, Cybersecurity) | Scarcity of in-house talent, regulatory complexity | Elevated costs for specialized support and implementation | Global healthcare analytics market projected at $60 billion |

| Construction & Facility Management | Increased demand from expansion plans, specialized needs | Higher project costs for new facilities and build-outs | Hundreds of millions in capital expenditure for ambulatory build-out and new centers |

What is included in the product

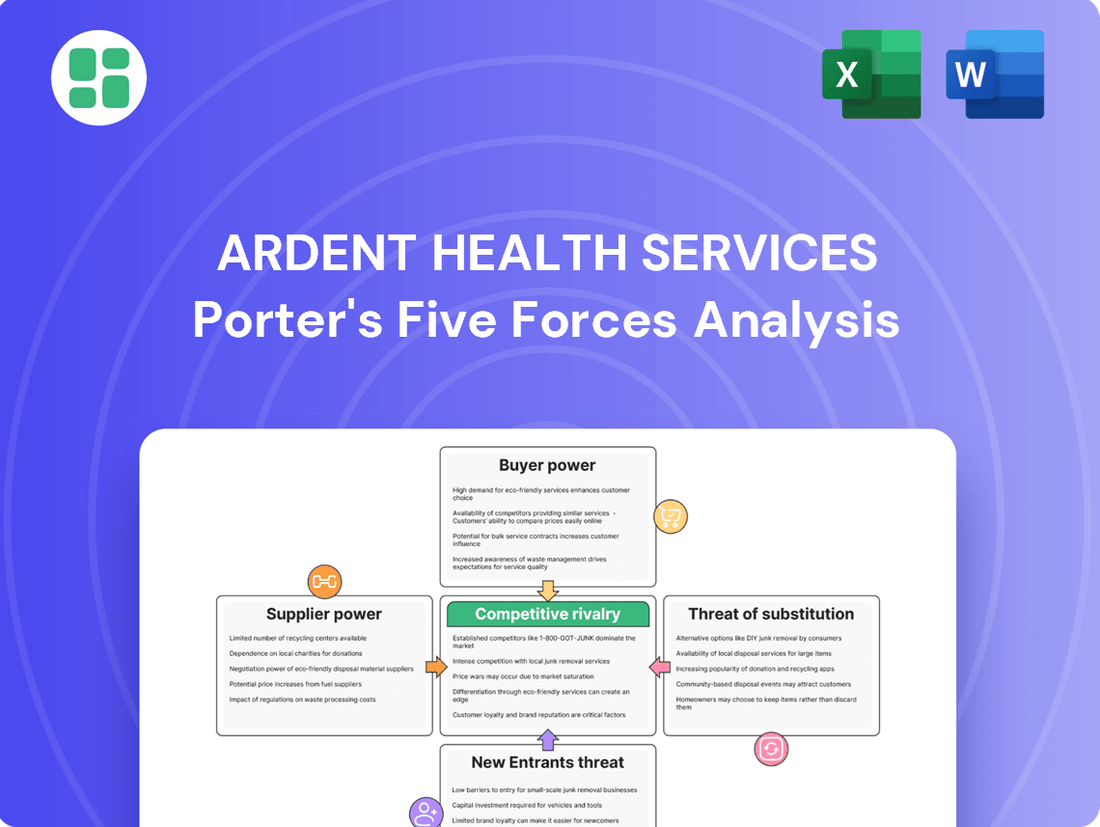

This Porter's Five Forces analysis for Ardent Health Services examines the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitutes within the healthcare industry.

Ardent Health Services' Porter's Five Forces analysis provides a simplified, one-sheet summary of strategic pressures, perfect for quick decision-making and understanding competitive forces in the healthcare market.

Customers Bargaining Power

Individual patients are increasingly wielding more influence over healthcare providers like Ardent Health Services. This is largely because patients now have better access to information, allowing them to compare services and costs more easily. For instance, the proliferation of online health portals and patient review sites empowers them to make more informed decisions about where to seek care.

The growing availability of alternative care settings also amplifies patient bargaining power. Urgent care centers, telehealth platforms, and specialized outpatient clinics offer convenient and often more affordable options compared to traditional hospitals. This wider range of choices means patients are less reliant on a single provider, forcing companies like Ardent to compete more aggressively on price, quality, and patient experience.

Ardent Health Services recognizes this trend and is actively working to enhance its consumer-centric approach. By expanding its network of accessible care points, including outpatient facilities and virtual care options, Ardent aims to meet patients where they are and cater to their evolving preferences. This strategy directly addresses the rising power of individual patients in the healthcare market.

Major insurance payers, including commercial giants and government programs like Medicare and Medicaid, wield significant influence over Ardent Health Services. These entities represent vast patient populations, enabling them to dictate reimbursement rates and shape operational policies, directly impacting Ardent's revenue streams.

The growing enrollment in government programs, such as Medicare and Medicaid, coupled with state-specific payment initiatives like New Mexico's Directed Payment Program (DPP), exerts considerable pressure on Ardent's financial performance. In 2023, government payers accounted for a substantial portion of healthcare spending, with Medicare and Medicaid reimbursement rates often lagging behind the actual cost of care, creating a persistent challenge for providers.

Ardent, like many healthcare providers, faces continuous pressure to manage reimbursement growth effectively and adapt to evolving payment models. The shift towards value-based care, where providers are reimbursed based on patient outcomes rather than volume of services, requires significant investment in infrastructure and data analytics, further complicating financial planning.

Large employer groups, especially those that self-insure, are growing weary of escalating healthcare expenses. This dissatisfaction fuels their search for payment arrangements that prioritize value and shared risk, giving them more leverage when negotiating with healthcare providers like Ardent Health Services.

In 2023, employer-sponsored health insurance premiums saw an average increase of 6.5%, according to the Kaiser Family Foundation. This persistent rise in costs pushes self-insured employers to demand greater transparency and value from their healthcare partners.

To retain these crucial customer segments, Ardent Health Services must effectively showcase its cost-efficiency and superior patient outcomes. Demonstrating tangible value is paramount in securing and maintaining contracts with these powerful negotiating entities.

Availability of Alternative Care Sites

The increasing availability of alternative care sites significantly bolsters customer bargaining power. Patients now have readily accessible and often more affordable options like ambulatory surgery centers (ASCs), urgent care clinics, and freestanding diagnostic centers. These alternatives directly challenge the traditional dominance of hospitals for many procedures and diagnostic needs.

For instance, the U.S. saw a substantial growth in ASCs, with the number of Medicare-certified ASCs reaching over 5,800 by the end of 2023, demonstrating a clear shift towards outpatient care. This proliferation means patients can bypass higher hospital costs and enjoy greater convenience, directly impacting Ardent Health Services' ability to dictate terms.

Ardent Health Services' strategic acquisition of urgent care centers is a direct acknowledgment of this trend. By integrating these facilities, Ardent aims to capture patients earlier in their care journey, offering a continuum of services that can retain them within its network and mitigate the risk of losing them to independent, lower-cost providers.

- Increased Patient Choice: Patients can choose between traditional hospitals, ASCs, urgent care clinics, and diagnostic centers based on cost, convenience, and service.

- Cost Sensitivity: Alternative sites often offer lower prices, making them attractive to cost-conscious consumers and insurers.

- Outpatient Care Growth: The U.S. outpatient care market is expanding, with ASCs performing an increasing volume of procedures previously done in hospitals.

- Ardent's Strategy: Ardent's acquisitions of urgent care centers are designed to capture market share and offer integrated care pathways, responding to customer demand for accessible and affordable options.

Information Transparency and Digital Access

The increasing availability of healthcare data, including costs, quality ratings, and patient outcomes, significantly boosts customer bargaining power. This transparency, amplified by digital tools, allows patients to compare Ardent Health Services against competitors more effectively. For instance, by mid-2024, platforms like Healthgrades and Vitals provided millions of patient reviews and quality metrics, enabling consumers to make more informed choices about where to seek care.

Ardent Health Services' strategic investments in digital platforms directly address this trend. By offering online scheduling, simplified bill payment, and virtual care options, Ardent enhances customer convenience and access to information. This digital engagement fosters greater customer loyalty but also equips patients with the data needed to negotiate or seek better value, thereby increasing their leverage in the healthcare market.

- Increased Information Access: Patients can now readily access data on pricing and quality from various healthcare providers.

- Digital Platform Engagement: Ardent's online tools enhance transparency and ease of use for consumers.

- Enhanced Comparison: Greater information availability empowers patients to compare Ardent with competitors, strengthening their negotiating position.

The bargaining power of customers, encompassing both individual patients and large payer groups, presents a significant force for Ardent Health Services. Increased patient access to information and a growing array of alternative care providers empower individuals to demand better value and more convenient services. This shift forces providers like Ardent to compete not just on clinical quality but also on price and overall patient experience, directly influencing Ardent's market strategy.

Major payers, including commercial insurers and government programs, wield substantial influence due to their large patient volumes. They dictate reimbursement rates and can shape operational policies, directly impacting Ardent's revenue. For example, in 2023, government payers like Medicare and Medicaid represented a significant portion of healthcare spending, with reimbursement rates often not fully covering the cost of care, creating ongoing financial pressure.

The rise of self-insured employers further amplifies customer bargaining power. Dissatisfied with escalating healthcare costs, these groups actively seek payment arrangements prioritizing value and shared risk. With employer-sponsored health insurance premiums rising, such as a 6.5% average increase in 2023, these entities demand greater transparency and demonstrable cost-efficiency from providers like Ardent to secure favorable contracts.

The proliferation of alternative care sites, such as ambulatory surgery centers (ASCs) and urgent care clinics, significantly enhances customer choice and bargaining power. By the end of 2023, over 5,800 Medicare-certified ASCs were operating in the U.S., offering more affordable and convenient options for procedures previously performed in hospitals. Ardent's strategic acquisitions of urgent care centers are a direct response to this trend, aiming to capture patients seeking accessible and cost-effective care.

Same Document Delivered

Ardent Health Services Porter's Five Forces Analysis

This preview showcases the comprehensive Ardent Health Services Porter's Five Forces analysis you will receive immediately after purchase. You are looking at the actual, fully formatted document, which details the competitive landscape for Ardent Health Services, including insights into buyer power, supplier power, threat of new entrants, threat of substitute products, and industry rivalry. This is the complete, ready-to-use analysis file; what you're previewing is precisely what you get, allowing for immediate strategic application.

Rivalry Among Competitors

The healthcare arena Ardent Health Services navigates is quite varied, featuring large, all-encompassing health systems alongside smaller, independent hospitals. You also have specialized clinics focusing on specific treatments and newer digital health companies entering the fray. This mix means Ardent faces competition from many different types of organizations, each with its own strengths and strategies.

Ardent specifically operates in growing mid-sized urban markets. In these areas, they're up against both long-standing healthcare providers who have deep roots and established reputations, as well as innovative new approaches to delivering care. This dynamic creates a challenging environment where staying ahead requires constant adaptation.

Furthermore, the healthcare industry is seeing a lot of mergers and acquisitions. Mid-sized systems, much like Ardent, are actively looking to expand their reach and services. This ongoing consolidation intensifies the competition, as players strive to gain market share and offer more comprehensive solutions to patients.

Despite ongoing cost pressures, the healthcare sector is seeing robust demand for both inpatient and outpatient services. This surge is largely fueled by an aging demographic and a growing need for more complex medical treatments. Such market expansion can temper the intensity of competition by creating room for various healthcare providers to grow their operations.

Ardent Health Services, for instance, demonstrated this trend by reporting substantial revenue growth and a rise in adjusted admissions throughout 2024 and into 2025. These figures suggest Ardent is successfully capturing a larger piece of this expanding market, reflecting the overall positive trajectory of the industry.

Ardent Health Services differentiates itself through its unique joint venture model, partnering with prominent nonprofit and academic medical centers. This strategy allows Ardent to leverage the strengths of established healthcare institutions, enhancing its market position and service offerings.

Investments in advanced technology, such as the Epic Electronic Health Record (EHR) system and artificial intelligence (AI), are crucial to Ardent's differentiation. These technological advancements aim to streamline operations, improve patient care coordination, and ultimately enhance patient outcomes, setting them apart from competitors.

A comprehensive network of care sites, encompassing hospitals, physician practices, and urgent care centers, further solidifies Ardent's differentiation. This integrated approach ensures greater patient access and convenience, fostering loyalty and providing a seamless healthcare experience.

High Fixed Costs and Exit Barriers

The healthcare industry, especially acute care hospitals, is characterized by significant fixed costs. These include investments in buildings, sophisticated medical technology, and specialized staff, creating a substantial barrier to entry and exit. For instance, the average cost to build a new hospital in the US can range from $300 million to over $1 billion, depending on size and location.

These high fixed costs mean that hospitals must operate at a certain capacity to cover their expenses. This economic pressure encourages existing players to stay in the market and compete fiercely for patients, even when profitability is low. This persistent competition intensifies the rivalry among healthcare providers.

- High Infrastructure Investment: Hospitals require massive capital outlays for facilities and advanced medical equipment.

- Specialized Personnel Costs: Maintaining a highly trained medical and support staff represents a significant ongoing expense.

- Operational Imperative: The need to cover high fixed costs drives a constant pursuit of patient volume, fueling competitive intensity.

- Limited Exit Options: The specialized nature of hospital assets makes it difficult and costly to divest or repurpose them, keeping competitors engaged.

Aggressive Growth and Acquisition Strategies

Ardent Health Services is demonstrating a clear commitment to aggressive growth, notably through its acquisition of urgent care clinics and expansion into ambulatory services. This strategy is a direct response to a highly competitive landscape where consolidation is a primary tool for gaining market share and influence.

In 2024, the healthcare sector continued to see significant M&A activity, with many health systems prioritizing outpatient and urgent care facilities to expand their reach. For instance, the urgent care market alone was projected to reach over $30 billion in the US by 2027, indicating a lucrative but fiercely contested space. Ardent's moves are indicative of a broader industry trend where competitors are also likely pursuing similar acquisition-driven growth to maintain or enhance their competitive standing.

- Aggressive Acquisition Focus: Ardent Health is actively acquiring urgent care clinics and expanding its ambulatory service offerings.

- Market Share Expansion: This strategy aims to increase Ardent's footprint and market share within its key operating regions.

- Industry Consolidation Trend: The healthcare industry is experiencing a wave of consolidation, with many organizations employing similar growth tactics.

- Competitive Response: Competitors are expected to engage in comparable strategies to protect or improve their market positions.

Competitive rivalry within the healthcare sector, particularly for entities like Ardent Health Services, is intense due to a diverse range of competitors. These include large health systems, specialized clinics, and emerging digital health providers, all vying for patient volume and market share.

Ardent operates in mid-sized urban markets, facing established players with strong reputations and innovative newcomers. This dynamic necessitates continuous adaptation and strategic positioning to remain competitive.

The industry's consolidation trend, with many mid-sized systems pursuing mergers and acquisitions, further escalates rivalry. Ardent's reported revenue growth and increased admissions in 2024 and early 2025 suggest successful navigation of this competitive environment, likely by capturing a larger share of a growing market.

High fixed costs associated with healthcare infrastructure, such as hospitals and advanced medical technology, also contribute to intense rivalry. These costs, often exceeding hundreds of millions of dollars for new facilities, compel providers to maximize patient volume to cover expenses, leading to aggressive competition for patients.

SSubstitutes Threaten

Urgent care centers and retail clinics present a significant threat of substitution for traditional hospital emergency rooms and primary care physicians, particularly for less severe medical needs. These alternatives often provide a more convenient and cost-effective option for patients, directly impacting the patient volume and revenue streams of established healthcare providers.

Ardent Health Services recognizes this trend and is actively expanding its footprint in the urgent care sector through acquisitions and new clinic development. This strategic move aims to capture patients seeking convenient care and then integrate them into Ardent's larger network for more complex or ongoing medical services, mitigating the direct threat of substitution.

The rise of telemedicine and virtual care platforms presents a significant threat of substitution for traditional in-person healthcare services. These platforms offer a convenient alternative for a growing number of patient needs, from routine check-ups to managing chronic conditions and seeking mental health support. In 2024, the telehealth market continued its robust growth, with many healthcare systems reporting substantial increases in virtual visit utilization, often exceeding 30% of total patient encounters for certain specialties.

Patients are increasingly prioritizing accessibility and convenience, making them more inclined to switch to providers offering seamless virtual care options. This shift can impact patient volumes and revenue streams for organizations that are slower to adopt or integrate these digital solutions. Ardent Health Services, recognizing this trend, has been actively expanding its own virtual visit capabilities and remote patient monitoring technologies to retain and attract patients seeking these modern healthcare delivery methods.

Ambulatory Surgical Centers (ASCs) and freestanding diagnostic imaging centers present a significant threat to Ardent Health Services by offering specialized, cost-effective alternatives to traditional hospital-based procedures. These centers, focusing on outpatient care, are gaining traction due to their convenience and often lower prices, directly competing for services that Ardent provides. For instance, the outpatient surgery market is robust, with many procedures migrating from inpatient hospital settings to these more efficient facilities.

The growing preference for outpatient care is a powerful trend that ASCs and diagnostic centers capitalize on. Ardent's own strategic expansion into these areas underscores their recognition of these entities as viable substitutes. In 2024, the outpatient surgical market continued its expansion, with many providers investing in or acquiring ASCs to maintain market share and capture revenue streams that might otherwise be lost to these competing models.

Home Healthcare and Hospital-at-Home Programs

The increasing sophistication of medical technology and evolving care delivery models are making it possible to offer more complex treatments within a patient's residence. This rise of hospital-at-home programs presents a viable alternative to traditional inpatient hospitalizations for specific medical needs, appealing to patients seeking comfort and potentially more affordable care options. For instance, by mid-2024, the U.S. Centers for Medicare & Medicaid Services (CMS) continued to support and expand pathways for these services, recognizing their potential to improve patient outcomes and manage costs. Ardent Health Services is actively investigating and deploying remote patient monitoring and hospital-at-home initiatives to leverage these trends.

These substitute services can exert significant pressure on Ardent Health Services by drawing patients away from traditional hospital settings. The perceived benefits of convenience and cost savings associated with home-based care, especially for chronic condition management or post-acute recovery, can reduce the demand for Ardent's inpatient services. As of early 2024, studies indicated that hospital-at-home models could reduce readmission rates by up to 20% for certain patient populations, underscoring the competitive threat.

- Technological Advancements: Innovations in telehealth, remote monitoring devices, and portable medical equipment enable a wider range of acute care services to be delivered at home.

- Patient Preference: A growing number of patients express a desire for more comfortable, familiar surroundings and greater control over their care, driving demand for home-based options.

- Cost Efficiency: Hospital-at-home programs can potentially lower overall healthcare costs by reducing overhead associated with traditional hospital infrastructure and length of stay.

- Ardent's Strategy: Ardent Health Services is investing in capabilities to offer these alternative care models, aiming to capture market share and meet evolving patient expectations.

Preventative Care and Wellness Programs

The growing emphasis on preventative care and wellness programs presents a significant threat of substitutes for Ardent Health Services. As individuals increasingly adopt healthier lifestyles and engage in proactive health management, the demand for acute medical services, which form the core of hospital operations, can diminish.

For instance, the Centers for Disease Control and Prevention (CDC) reported in 2024 that 60% of adults in the US have at least one chronic disease, many of which are preventable or manageable through lifestyle changes. This indicates a substantial opportunity for preventative services to reduce the need for hospitalizations.

Moreover, the expansion of telehealth services and remote patient monitoring tools, which facilitate continuous health tracking and early intervention, acts as a substitute for traditional in-person hospital visits. These digital health solutions empower patients to manage their conditions more effectively outside of a hospital setting.

- Growing adoption of preventative health measures: Increased patient engagement in wellness programs and lifestyle interventions can lead to a reduction in the incidence of chronic diseases.

- Impact of telehealth and remote monitoring: Digital health solutions offer alternatives to traditional hospital care for managing chronic conditions and preventing acute exacerbations.

- Reduced demand for acute services: Effective preventative care can lower the long-term need for high-acuity hospital services, impacting revenue streams for providers like Ardent Health Services.

The threat of substitutes for Ardent Health Services is substantial, stemming from the growing accessibility and cost-effectiveness of alternative care models. Urgent care centers, retail clinics, and telehealth platforms are increasingly capturing patients for less severe medical needs, diverting revenue from traditional hospital services. By mid-2024, telehealth utilization continued its upward trajectory, with many health systems reporting over 30% of patient encounters in certain specialties occurring virtually. This shift highlights a clear preference for convenience and accessibility, forcing providers like Ardent to adapt their service offerings to remain competitive.

| Substitute Service | Key Advantages | Impact on Ardent Health Services |

|---|---|---|

| Urgent Care Centers & Retail Clinics | Convenience, lower cost for minor ailments | Reduced patient volume for non-emergency hospital visits, potential loss of primary care referrals |

| Telehealth & Virtual Care | Accessibility, convenience, cost savings | Competition for routine check-ups, chronic disease management, and mental health services; potential erosion of in-person visit revenue |

| Ambulatory Surgical Centers (ASCs) | Specialized focus, lower cost, patient preference for outpatient settings | Loss of surgical and diagnostic procedure revenue to more efficient, lower-cost facilities |

| Hospital-at-Home Programs | Patient comfort, potential cost savings, reduced readmissions | Decreased demand for inpatient bed days, particularly for post-acute care and chronic condition management |

Entrants Threaten

Establishing a comprehensive healthcare system akin to Ardent Health Services, encompassing acute care hospitals, specialized clinics, and an extensive network of care locations, necessitates substantial capital outlay. For instance, the average cost to build a new hospital in the US can range from $300 million to over $1 billion, a figure that excludes the significant ongoing investment in state-of-the-art medical technology and specialized staffing.

The healthcare sector presents formidable barriers to new entrants due to extensive regulatory and licensing requirements. Navigating complex state and federal laws, obtaining certifications, and complying with intricate healthcare policies demands significant time and resources. For instance, in 2024, the average time to obtain Medicare certification, a crucial step for many healthcare providers, can extend for months, if not over a year, depending on the facility type and state.

Established physician networks and strong brand loyalty present a significant barrier for new entrants in the healthcare sector. Ardent Health Services, like many established providers, leverages decades of relationships with physicians and specialists, creating robust referral streams that are difficult for newcomers to replicate. For instance, in 2024, the average physician referral rate within established hospital systems often exceeds 70%, a testament to ingrained trust and convenience.

The challenge for new entrants is compounded by the deep-rooted community trust and patient loyalty that established players cultivate. Building this level of confidence, which translates into consistent patient volume, requires substantial time and investment. In 2024, healthcare consumer surveys consistently show that over 60% of patients choose providers based on recommendations from their existing doctors or family, highlighting the power of these established networks.

Economies of Scale and Experience Curve

Established healthcare providers like Ardent Health Services benefit from substantial economies of scale. This means they can negotiate better prices for everything from bandages to advanced imaging equipment due to their sheer volume. For instance, in 2024, major hospital networks often secured discounts of 15-20% on bulk medical supplies compared to smaller facilities.

The experience curve also plays a crucial role. Years of operational refinement allow Ardent to optimize patient care pathways, reduce waste, and improve administrative efficiency. This accumulated expertise, often built over decades, is difficult for new entrants to replicate quickly, creating a significant barrier to entry.

- Economies of Scale: Larger healthcare systems leverage bulk purchasing power for supplies and technology, leading to lower per-unit costs.

- Experience Curve: Accumulated operational knowledge in patient management and administrative processes enhances efficiency for established players.

- Cost Advantage: These factors combine to give incumbents like Ardent a cost advantage, making it challenging for new entrants to compete on price.

Difficulty in Securing Payer Contracts

Securing contracts with major insurance companies and government programs like Medicare and Medicaid is fundamental for any healthcare provider's financial viability. These payer relationships are often intricate, built over many years, and challenging for newcomers to establish on advantageous terms.

New entrants face significant hurdles in gaining access to these crucial revenue streams. The lengthy negotiation processes and established networks of existing providers can create substantial barriers to entry, impacting a new organization's ability to operate effectively from the outset.

- Payer Contract Barriers: Obtaining favorable contracts with major insurers and government programs is a significant challenge for new healthcare providers.

- Established Relationships: Existing providers benefit from long-standing relationships with payers, making it difficult for new entrants to negotiate similar terms.

- Revenue Stream Dependence: Access to these contracts is critical for revenue generation, and failure to secure them can severely limit a new entity's operational capacity.

- State-Directed Programs: The success of initiatives like Ardent's New Mexico DPP underscores the importance of well-established payer relationships in navigating complex healthcare payment systems.

The threat of new entrants in the healthcare sector, particularly for a comprehensive provider like Ardent Health Services, is significantly mitigated by substantial capital requirements for establishing facilities and acquiring advanced technology. For instance, the average cost to build a new hospital in the US in 2024 can range from $300 million to over $1 billion, a sum that excludes the ongoing investment in cutting-edge medical equipment and specialized personnel.

Regulatory hurdles and stringent licensing processes also act as powerful deterrents. New entities must navigate complex federal and state laws, secure necessary certifications, and comply with evolving healthcare policies, a process that can be time-consuming and resource-intensive. In 2024, obtaining Medicare certification alone could take many months, sometimes exceeding a year, depending on the facility's specifics and location.

Furthermore, established physician networks and strong patient loyalty, cultivated over years of service, present a formidable challenge. Ardent Health Services benefits from deep-rooted relationships with medical professionals, fostering robust referral streams that are difficult for newcomers to replicate. In 2024, physician referrals within established hospital systems frequently accounted for over 70% of patient admissions, underscoring the value of these ingrained trust networks.

| Barrier | Description | 2024 Data/Example |

| Capital Requirements | High costs for facility construction and technology acquisition. | Hospital construction costs: $300M - $1B+ |

| Regulatory Compliance | Navigating complex licensing and certification processes. | Medicare certification time: Months to 1+ year |

| Physician & Patient Loyalty | Established referral networks and brand trust. | Physician referrals: >70% of admissions in established systems |

| Economies of Scale | Lower per-unit costs due to high volume purchasing. | Bulk medical supply discounts: 15-20% for large networks |

| Payer Contracts | Difficulty securing favorable agreements with insurers. | Established providers have long-standing, advantageous payer relationships. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Ardent Health Services leverages data from industry-specific market research reports, publicly available financial filings (like 10-K and 10-Q), and reputable healthcare trade publications. This comprehensive approach ensures a robust understanding of competitive dynamics.