Ardent Health Services Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ardent Health Services Bundle

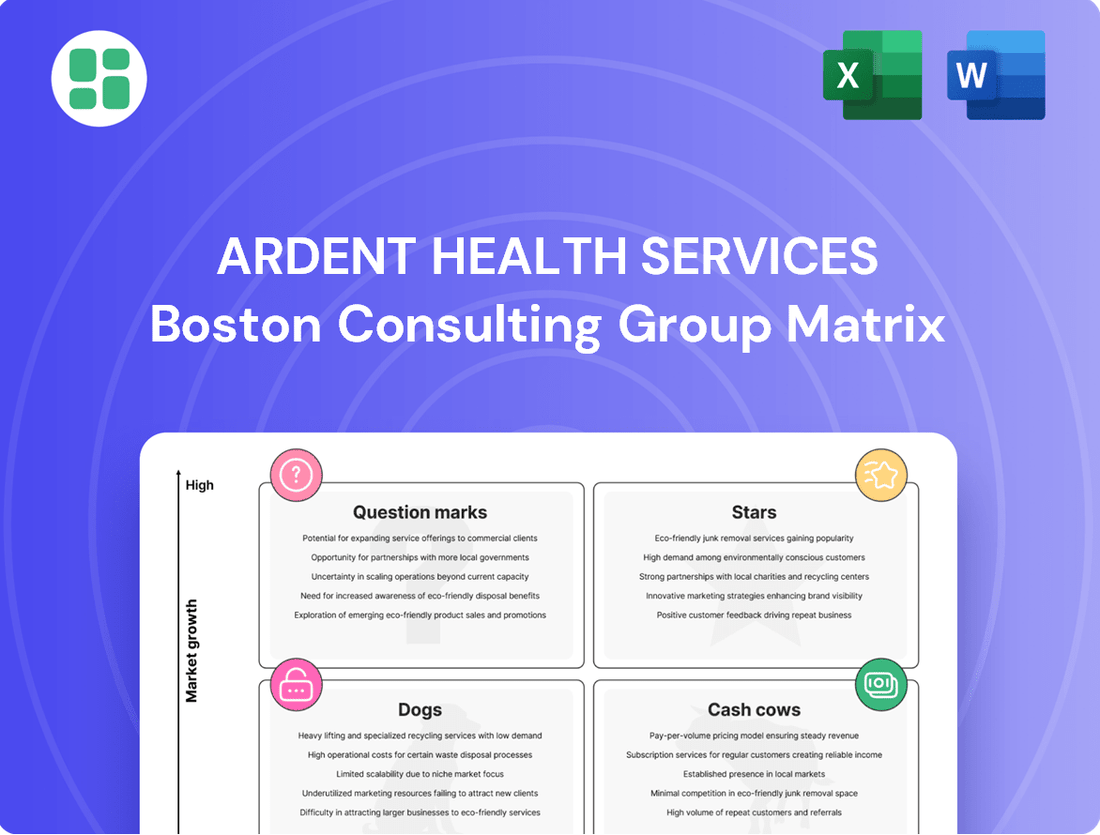

Curious about Ardent Health Services' strategic positioning? This preview offers a glimpse into their product portfolio's performance, hinting at their Stars, Cash Cows, Dogs, and Question Marks.

To truly understand how Ardent Health Services navigates the competitive healthcare landscape and to unlock actionable strategies for growth and resource allocation, you need the full picture. Purchase the complete BCG Matrix for a detailed quadrant breakdown and data-driven insights that will empower your decision-making.

Don't miss out on the opportunity to gain a competitive edge. Get the full BCG Matrix report today and transform your understanding of Ardent Health Services' market dynamics.

Stars

Ardent Health Services is making a significant push into ambulatory care, acquiring 18 urgent care clinics across New Mexico and Oklahoma in early 2025. This follows their acquisition of nine similar clinics in Texas and Kansas during 2024. This expansion aims to broaden Ardent's market reach and direct patients into their larger healthcare network.

The impact of this ambulatory care expansion is already evident. Some of the recently acquired urgent care centers are successfully attracting approximately 45% new patients who had not previously utilized Ardent's services.

Inpatient surgeries at Ardent Health Services have experienced a significant upswing, with a 9.2% year-over-year increase in Q2 2025. This growth is attributed to a surge in demand and more efficient transfer center operations.

The expansion in higher-acuity inpatient services is crucial for Ardent, as it helps offset any fluctuations in outpatient volumes, ultimately boosting overall profit margins.

In 2024, key medical specialties such as general medicine, cardiology, and neurology demonstrated particularly strong performance in terms of patient admissions, underscoring the demand for these inpatient services.

Strategic Joint Ventures are a cornerstone of Ardent Health Services' growth strategy. A substantial 60% of its 30 acute care hospitals, meaning 18 facilities, operate through joint ventures with prominent nonprofit health systems and academic medical centers. This model is a significant differentiator, enabling Ardent to penetrate new markets effectively and leverage established reputations.

Ardent is actively pursuing mergers, acquisitions, and further joint ventures, with a particular focus on partnering with nonprofit entities. This proactive approach underscores their commitment to expanding their footprint and solidifying their market position. For instance, in 2023, Ardent announced plans to acquire several hospitals, signaling continued momentum in executing this strategy.

Technology Adoption and AI Integration

Ardent Health Services is actively embracing technological advancements, notably through its system-wide implementation of Epic's electronic health record. This strategic move ensures consistent data across all facilities, fostering smoother patient care transitions. In 2024 alone, Ardent saw significant gains by integrating machine learning into surgical scheduling, which directly contributed to reduced patient wait times and enhanced operating room utilization.

Furthering its AI integration, Ardent is leveraging this technology to bolster its Chronic Care Management program. The company is also piloting virtual nursing and AI-powered scribe solutions, aiming to elevate both patient outcomes and operational efficiency.

- Epic EHR Implementation: Centralized data for improved patient care coordination.

- AI in Surgical Scheduling (2024): Optimized OR utilization and reduced patient wait times.

- AI for Chronic Care Management: Enhanced support and outcomes for patients with chronic conditions.

- Virtual Nursing & AI Scribes: Initiatives to boost efficiency and patient care quality.

Growth in Mid-Sized Urban Markets

Ardent Health Services has strategically positioned itself in eight growing mid-sized urban markets spread across six states: Texas, Oklahoma, New Mexico, New Jersey, Idaho, and Kansas. These markets are experiencing growth at a rate roughly three times the national average, creating significant opportunities for Ardent to expand its market share. The company's objective is to secure a leading position, either first or second, within these particular geographic segments.

- Strategic Focus: Ardent Health Services concentrates its efforts on eight mid-sized urban markets in six states.

- Growth Trajectory: These markets are growing approximately three times faster than the national average.

- Market Share Ambition: The company aims for a top-two market share position in these chosen segments.

- Geographic Spread: Key states include Texas, Oklahoma, New Mexico, New Jersey, Idaho, and Kansas.

Ardent Health Services' Stars are its high-performing, rapidly growing segments. These likely include its expanding ambulatory care network, which saw 45% new patient acquisition in some locations, and its inpatient services, particularly in key specialties like cardiology and neurology which showed strong patient admission growth in 2024. The company's strategic market focus on rapidly growing mid-sized urban areas, expanding at three times the national average, also positions these markets as potential Stars.

| Segment | Growth Driver | 2024/2025 Data Point |

|---|---|---|

| Ambulatory Care Expansion | Acquisition of urgent care clinics | 18 clinics acquired in early 2025; 9 acquired in 2024. |

| Inpatient Services Growth | Increased demand and operational efficiency | 9.2% year-over-year increase in inpatient surgeries (Q2 2025). |

| Key Medical Specialties | High patient admission demand | General medicine, cardiology, and neurology showed strong performance in 2024. |

| Strategic Market Focus | Expansion in high-growth urban areas | Markets growing ~3x national average, aiming for top-2 position. |

What is included in the product

This BCG Matrix analysis for Ardent Health Services highlights which business units to invest in, hold, or divest based on market share and growth.

A clear BCG Matrix visualizes Ardent's portfolio, easing strategic decisions by highlighting growth opportunities and areas needing attention.

Cash Cows

Ardent Health Services' network of 30 established acute care hospitals represents its primary Cash Cows. These facilities are the bedrock of its operations, consistently delivering a broad spectrum of inpatient services and generating substantial, reliable revenue streams.

The financial performance of these hospitals is robust. For the entirety of 2024, Ardent Health Services achieved a total revenue of $5.97 billion. Looking ahead, projections for 2025 indicate a strong performance, with anticipated revenue between $6.2 billion and $6.45 billion, a growth largely attributable to the sustained success of these core hospital assets.

General inpatient services and emergency room visits are foundational to Ardent Health Services, acting as significant drivers of both patient volume and revenue. These services represent a consistent, high-demand segment within the healthcare industry, particularly in established markets.

In the first quarter of 2025, Ardent experienced a notable 7.6% rise in admissions. This uptick, influenced by factors such as a more severe flu season, underscores the enduring and predictable demand for these critical healthcare offerings.

Ardent Health Services demonstrated exceptional financial strength in 2024. The company's revenue saw a significant 10.3% increase, while Adjusted EBITDA experienced an impressive 58.4% surge. This robust performance underscores the company's ability to generate substantial profits from its existing, well-established business units.

Looking ahead, Ardent Health has reaffirmed its full-year guidance, projecting continued strong growth in both revenue and Adjusted EBITDA for 2025. This sustained profitability is a clear indicator of the consistent and strong cash flow being generated from its mature and successful operations, classifying them as Cash Cows within the BCG matrix.

Supply Chain Efficiencies and Cost Controls

Ardent Health Services exemplifies strong operational discipline, a key characteristic of its cash cow business segments. In the first quarter of 2025, the company achieved a notable 60 basis point reduction in supply costs relative to revenue, showcasing a direct impact on its bottom line.

These supply chain efficiencies, coupled with moderated growth in professional fees, directly bolster Ardent's profit margins. This cost management prowess is crucial for sustaining the robust cash flow generated by its established, mature service lines.

- Supply Cost Reduction: 60 basis points year-over-year in Q1 2025.

- Profit Margin Enhancement: Driven by efficiency gains and controlled professional fees.

- Cash Flow Generation: Supported by effective cost management in mature services.

New Mexico State Directed Payment Program

The New Mexico State Directed Payment Program is a significant cash cow for Ardent Health Services. Its retroactive approval in late 2024 and renewal for the entirety of 2025 create a predictable and substantial revenue inflow. This program alone generated $94 million in revenue and $65 million in Adjusted EBITDA in the fourth quarter of 2024, highlighting its crucial role in bolstering financial stability and cash flow.

- Program Name: New Mexico State Directed Payment Program

- Impact: Significant and stable revenue stream

- Q4 2024 Contribution: $94 million revenue, $65 million Adjusted EBITDA

- Strategic Value: Bolsters financial stability and cash flow

Ardent Health Services' established acute care hospitals are its prime cash cows, consistently generating significant revenue. In 2024, the company's total revenue reached $5.97 billion, with projections for 2025 between $6.2 billion and $6.45 billion, a testament to the ongoing strength of these core assets.

These mature service lines, like general inpatient and emergency room visits, benefit from predictable demand. The first quarter of 2025 saw a 7.6% increase in admissions, underscoring the enduring need for these services.

Furthermore, operational efficiencies, such as a 60 basis point reduction in supply costs in Q1 2025, directly enhance profit margins and bolster the cash flow from these reliable operations.

The New Mexico State Directed Payment Program is another strong cash cow, contributing $94 million in revenue and $65 million in Adjusted EBITDA in Q4 2024 alone, reinforcing Ardent's financial stability.

| Business Segment | 2024 Revenue | 2025 Projected Revenue | Q1 2025 Admissions Growth | Q4 2024 Adjusted EBITDA Contribution |

|---|---|---|---|---|

| Established Acute Care Hospitals | $5.97 billion (Total Company) | $6.2 - $6.45 billion (Projected) | 7.6% | N/A (Overall Performance) |

| New Mexico State Directed Payment Program | N/A (Retroactive Approval Late 2024) | N/A (Renewed for 2025) | N/A | $65 million |

Delivered as Shown

Ardent Health Services BCG Matrix

The Ardent Health Services BCG Matrix preview you are currently viewing is the identical, fully completed document you will receive immediately upon purchase. This means no watermarks, no placeholder text, and no missing sections – just the comprehensive strategic analysis ready for your immediate use. You can trust that the insights and formatting you see here are precisely what will be delivered, ensuring a seamless transition from preview to practical application in your business planning.

Dogs

Outpatient surgeries at Ardent Health Services have seen a downturn, with a 2.3% decrease in Q1 2025 and a further 3.8% drop in Q2 2025. This segment of Ardent's operations is showing signs of being a low-growth or declining market share area.

While Ardent's management currently considers this a temporary setback, a continued decline in outpatient procedures could point to more significant, long-term challenges for this particular service line.

In May 2024, Ardent Health Services strategically transferred its oncology and infusion services to an academic health system. This action led to a revenue decrease exceeding $10 million in the first quarter of 2025.

This divestiture suggests these oncology and infusion services were likely in a low-growth, low-market-share position within Ardent's portfolio. The move aligns with a strategy to focus on core, high-market-share areas, shedding underperforming segments.

Ardent Health Services closed its UT Health East Texas Specialty Hospital, a long-term acute care facility, in April 2024. This 36-licensed-bed hospital's closure suggests it was a low-growth, low-market-share, or low-profitability asset within Ardent's portfolio.

The repurposing of the hospital's inventory and assets signifies a strategic decision to exit this specific business segment, freeing up resources for potentially more promising ventures.

Problematic Exchange Payer Contracts

Ardent Health Services grapples with problematic exchange payer contracts, a significant drag on profitability. These contracts, particularly those with exchange plans, are characterized by substantial payer denial activity, directly impacting reimbursement levels and reducing overall financial performance.

The CEO highlighted that the exchange population, despite its volume, yields lower EBITDA contributions than anticipated. This is primarily due to a high frequency of claim denials and a disproportionate number of emergency room visits within this demographic, which are often more costly to treat.

In response to these persistent financial challenges, Ardent's management is actively evaluating the termination of contracts with specific exchange plans. The decision stems from the inadequate net rates offered by these plans, with a critical review of these arrangements planned for 2025.

- Payer Denial Activity: Ongoing issues with commercial payers, especially exchange plans, result in lower reimbursement.

- EBITDA Impact: Exchange population contributes less to EBITDA due to high denials and disproportionate ER visits.

- Contract Review: Management is considering terminating contracts with specific exchange plans due to inadequate net rates in 2025.

Underperforming Market Segments

Within Ardent Health Services' portfolio, certain market segments might exhibit lower performance. These could be smaller facilities or specific service lines operating in less dynamic areas, even if the overall company targets growing mid-sized urban markets. For instance, a rural clinic acquired by Ardent might struggle to gain traction against established local competitors, leading to a low market share.

Ardent Health Services' strategic approach involves continuous assessment of its service lines. This process naturally includes identifying and addressing areas that are not meeting performance expectations. Such initiatives are crucial for optimizing resource allocation and ensuring the overall health of the organization.

- Low Market Share: Segments with a limited customer base or competitive disadvantage.

- Low Market Growth: Areas where demand for healthcare services is stagnant or declining.

- Minimal Investment: These segments typically require little to no additional capital, focusing instead on efficiency or potential divestment.

- Strategic Review: Subject to ongoing evaluation for potential turnaround or exit strategies.

Ardent Health Services' operations in outpatient surgeries, experiencing a 2.3% dip in Q1 2025 and a further 3.8% in Q2 2025, alongside the strategic divestiture of oncology services in May 2024 and the closure of UT Health East Texas Specialty Hospital in April 2024, all point to segments likely classified as Dogs in a BCG matrix analysis. These areas represent low growth and potentially low market share, prompting strategic decisions to exit or re-evaluate.

The financial performance of certain exchange payer contracts further reinforces this classification, with low EBITDA contributions due to high denial rates and disproportionate ER visits, leading to a planned contract review and potential termination in 2025. These factors collectively indicate a need to shed underperforming assets to focus resources on more promising ventures within Ardent's portfolio.

| Ardent Health Services Segment | Market Growth | Market Share | BCG Classification | Rationale |

|---|---|---|---|---|

| Outpatient Surgeries | Low/Declining | Low/Declining | Dog | Consistent decrease in procedures, indicating market weakness. |

| Oncology & Infusion Services | Low | Low | Dog | Divested in May 2024 due to strategic focus on core areas. |

| Long-Term Acute Care (UT Health East Texas Specialty Hospital) | Low | Low | Dog | Closed in April 2024, signaling an exit from this segment. |

| Exchange Payer Contracts | N/A (Contractual) | Low Impact | Dog | Low EBITDA contribution, high denials, and potential contract termination due to low net rates. |

Question Marks

Ardent Health Services is prioritizing new Ambulatory Surgery Center (ASC) developments over acquiring existing ones, largely because the cost to buy established centers is currently very high. This strategy suggests they are entering a market with significant growth potential, aiming to build their presence from the ground up.

The company anticipates that building out its ASC network will be a gradual process, taking more time to establish. However, they are encouraged by strong interest from physicians and a clear demand from the patient population, signaling a positive outlook for this expansion.

In 2024, the ASC market continued its robust growth trajectory. Industry reports indicated that the global ASC market was projected to reach over $200 billion by 2027, with new builds representing a significant portion of this expansion as providers seek to capture market share in high-demand areas.

Ardent Health Services is actively integrating cutting-edge technologies like virtual nursing and AI-powered scribes. These advancements aim to streamline clinical workflows and enhance patient care. The healthcare technology sector is experiencing significant growth, making these areas ripe for innovation.

However, Ardent's current market share or immediate financial returns from these specific technology rollouts are likely modest. This positions them as question marks within the BCG matrix, requiring strategic investment to validate their potential and facilitate wider adoption.

Ardent Health Services is actively seeking mergers and acquisitions to enter new geographic territories beyond its current six-state footprint. These new markets are characterized by significant growth potential but represent areas where Ardent currently holds minimal to no market share.

These expansion efforts are classified as question marks within the BCG matrix because they necessitate considerable initial investment to establish a presence and build market share. For instance, entering a new state could involve acquiring an existing hospital system, a process that often requires hundreds of millions in capital, as seen in typical healthcare M&A deals in 2024.

Digital Tools and Patient Outreach Initiatives

Ardent Health Services is actively investing in digital tools and patient outreach programs to expand its reach and make healthcare more accessible. These efforts are vital for attracting new patients and keeping existing ones engaged in today's increasingly digital world.

While these forward-thinking initiatives are crucial for long-term growth, their immediate impact on Ardent's current market share or revenue generation may be modest. For example, in 2024, many healthcare systems saw patient acquisition costs rise, making digital outreach a necessary, albeit initially less directly profitable, strategy.

These areas represent significant growth opportunities that require sustained investment to fully develop their potential. By 2025, it's projected that digital health platforms will play an even larger role in patient decision-making, underscoring the importance of Ardent's current investments.

- Digital Tool Investment: Focus on patient portals, telehealth platforms, and AI-driven appointment scheduling.

- Outreach Strategy: Targeted campaigns for underserved communities and preventative care education.

- Growth Potential: These initiatives aim to capture a larger share of the digitally-native patient demographic.

- 2024 Data Context: Increased digital engagement correlated with higher patient satisfaction scores in many healthcare networks.

Chronic Care Management Program

Ardent Health Services' Chronic Care Management (CCM) program demonstrated significant expansion in 2024, enrolling more than 21,000 patients across its six operating markets. This growth highlights the program's increasing reach and effectiveness in managing long-term health conditions.

Despite this impressive patient acquisition, the CCM program's market share within the broader chronic care sector remains modest. This positions it as a potential star in the BCG matrix, indicating high growth but not yet market leadership.

- 2024 Patient Growth: Over 21,000 patients enrolled across six markets.

- Market Position: High growth potential, but currently small market share in the overall chronic care landscape.

- Strategic Focus: Requires continued investment for scaling and achieving market dominance.

- Value Proposition: Enhances patient engagement and improves health outcomes.

Ardent Health Services' expansion into new geographic territories and investment in digital tools for patient outreach are currently classified as question marks. These initiatives require substantial upfront capital to gain traction and build market share in unfamiliar or nascent markets. For example, entering a new state in 2024 could involve hundreds of millions in acquisition costs, reflecting the significant investment needed to establish a foothold.

These areas represent potential high-growth opportunities that are not yet generating significant returns or market share for Ardent. The success of these ventures hinges on continued strategic investment to validate their potential and drive adoption, much like the projected growth in digital health platforms by 2025, which will influence patient choices.

The company's focus on building new Ambulatory Surgery Centers (ASCs) also falls into the question mark category. While the ASC market is projected to exceed $200 billion by 2027, Ardent's new developments require time and investment to establish themselves and gain market share, despite strong physician interest and patient demand.

| BCG Category | Ardent Health Services Initiative | Rationale | Market Context/Data |

|---|---|---|---|

| Question Marks | New Geographic Market Expansion | Requires significant investment to establish presence and build market share in areas with minimal current penetration. | Healthcare M&A deals in 2024 often involved hundreds of millions for hospital system acquisitions. |

| Question Marks | Digital Tools & Patient Outreach | Investments in patient portals, telehealth, and outreach programs aim for long-term growth, but immediate market share impact is modest. | Patient acquisition costs rose in 2024; digital engagement is crucial for future patient decision-making. |

| Question Marks | New Ambulatory Surgery Center (ASC) Developments | Building new centers requires time and capital to establish market share in a growing sector. | Global ASC market projected to exceed $200 billion by 2027; new builds are key to expansion. |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data from Ardent Health Services' reports, industry research on the healthcare sector, and expert commentary from industry analysts to ensure reliable insights.