American Public Education Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

American Public Education Bundle

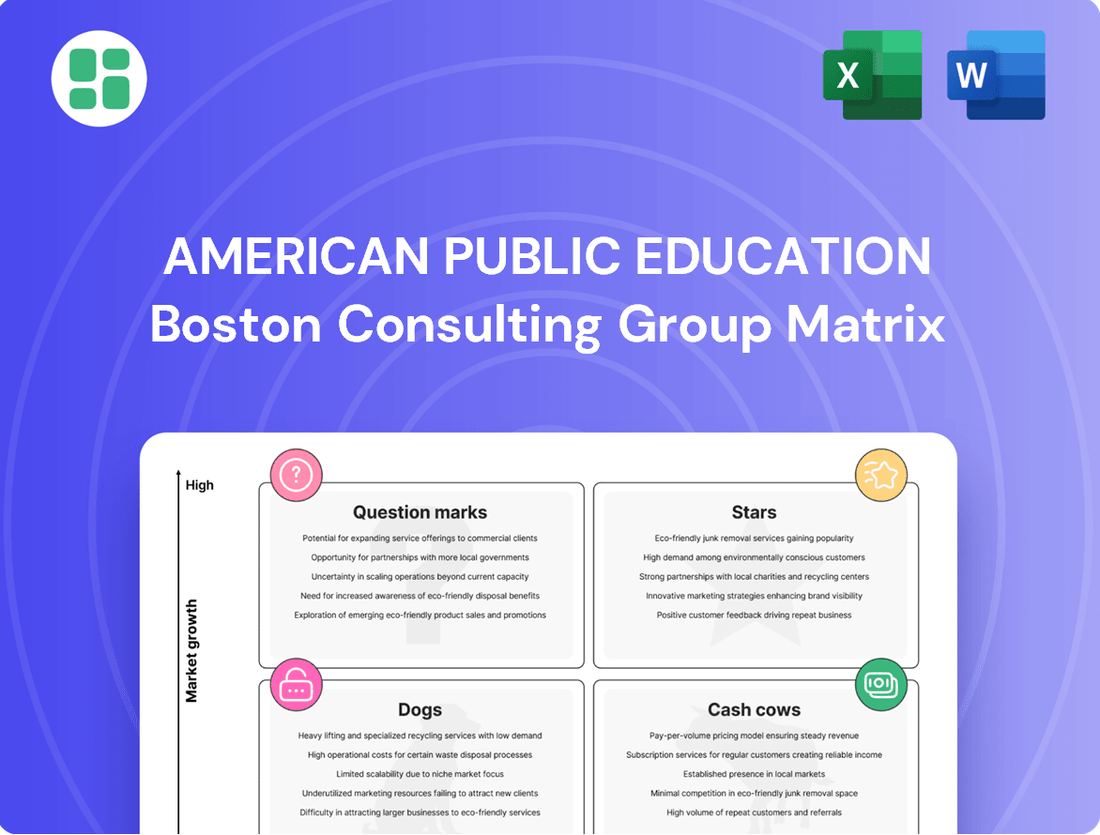

Uncover the strategic positioning of American public education with our comprehensive BCG Matrix analysis. See which educational programs are thriving "Stars," which are consistently generating resources as "Cash Cows," which are underperforming "Dogs," and which hold untapped potential as "Question Marks."

This preview offers a glimpse into the dynamic landscape of public education funding and outcomes. For a complete, actionable understanding of where to invest resources and which initiatives to prioritize for future growth, purchase the full BCG Matrix report.

Gain a clear roadmap to optimizing educational strategies and resource allocation. The full report provides detailed quadrant placements and data-backed recommendations, empowering you to make informed decisions for a stronger public education system.

Stars

Rasmussen University, a key component of American Public Education (APEI), is demonstrating robust performance, particularly within its nursing and allied health programs. In Q1 2025, the university experienced strong enrollment increases, a clear indicator of its Star status within APEI's portfolio.

This growth is directly contributing to APEI's overall revenue expansion. The strategic emphasis on increasing campus-based nursing enrollment is a significant factor, positioning Rasmussen for continued upward momentum in a high-demand sector.

Hondros College of Nursing is a standout performer within American Public Education's portfolio. In 2024, it achieved a robust 20% revenue increase in the fourth quarter, signaling strong demand for its educational offerings. This momentum continued into the first quarter of 2025, with a notable 9.6% rise in enrollment.

The college's strategic emphasis on nursing and healthcare programs places it squarely in a high-growth market. This strategic alignment, coupled with the introduction of new Medical Assisting programs in 2024, positions Hondros College of Nursing as a key growth driver for its parent company.

American Public Education, Inc. (APEI) is strategically adapting its educational portfolio to align with current and future workforce needs. As of April 2025, their focus on skills-based learning and collaborations with employers indicates a strong push towards programs that offer direct career pathways.

This strategic shift positions online certifications in high-demand sectors as key growth drivers for APEI. For example, the cybersecurity sector alone was projected to have a global market size of $270 billion in 2024, highlighting the immense demand for skilled professionals in this area. Similarly, data analytics and digital marketing continue to see robust expansion, with many companies actively seeking certified individuals to fill these critical roles.

AI-Related Educational Projects

American Public Education (APEI) strategically launched new AI-related educational projects and services in 2024, aiming to boost operating revenue. This move aligns with the projected substantial growth of AI in education and the wider market through 2025 and beyond.

These AI-focused programs are positioned as a high-growth area, reflecting APEI's investment strategy to capture increasing market share. The company is actively developing its offerings in this burgeoning field.

- Market Growth: The global AI in education market is anticipated to experience significant expansion, with projections indicating a compound annual growth rate (CAGR) that could reach substantial figures by 2025. For instance, some analyses suggest the market could approach tens of billions of dollars in value.

- APEI's Investment: APEI's 2024 initiatives represent a direct investment in this high-potential sector, aiming to establish a strong foothold.

- Revenue Driver: The company views these AI courses and services as a key driver for future operating revenue growth.

- Competitive Positioning: By focusing on AI, APEI seeks to enhance its competitive standing in an evolving educational landscape.

Military and Veteran Focused Programs (Growth Areas)

While American Public Education, Inc. (APEI) has a long-standing presence in the military and veteran market, certain programs within this segment are showing notable growth potential. These areas are often driven by evolving military needs and government initiatives aimed at supporting service members and veterans.

For example, programs focused on cybersecurity, data analytics, and advanced manufacturing skills are seeing increased demand. These align with the military's modernization efforts and the civilian job market's needs for veterans transitioning out of service. In 2024, the Department of Defense continued to emphasize upskilling initiatives, which directly benefit educational providers like APEI.

- Cybersecurity Programs: Demand for cybersecurity professionals within the military and for transitioning veterans remains exceptionally high.

- Upskilling Initiatives: New government funding and internal military programs are prioritizing advanced technical training.

- Post-Service Career Transitions: Educational pathways that directly translate military experience into civilian credentials are a key growth driver.

- Data Analytics and IT: Fields experiencing rapid technological advancement are attracting significant interest from the military community.

Rasmussen University and Hondros College of Nursing are identified as Stars within American Public Education's (APEI) portfolio due to their exceptional performance and growth. Rasmussen's nursing and allied health programs saw strong enrollment increases in Q1 2025, directly contributing to APEI's revenue. Hondros College of Nursing achieved a 20% revenue increase in Q4 2024 and a 9.6% enrollment rise in Q1 2025, driven by high demand for its healthcare programs and new Medical Assisting offerings. These institutions represent key growth drivers for APEI.

| Institution | Performance Metric | Period | Growth Indicator |

|---|---|---|---|

| Rasmussen University | Enrollment | Q1 2025 | Strong Increase |

| Hondros College of Nursing | Revenue | Q4 2024 | 20% Increase |

| Hondros College of Nursing | Enrollment | Q1 2025 | 9.6% Increase |

What is included in the product

This BCG Matrix overview details American public education's status in each quadrant, guiding investment and divestment strategies.

Visualize the American Public Education BCG Matrix for a clear, actionable overview of program performance.

This BCG Matrix analysis offers a pain point reliever by identifying underperforming areas needing strategic attention.

Cash Cows

The American Public University System (APUS) is a cornerstone for American Public Education, Inc. (APEI), catering to a significant demographic of active-duty military, veterans, and working adults. This segment represents a mature, stable market for APEI, characterized by consistent demand and predictable revenue streams, even if growth rates are more modest compared to other areas.

APUS's core undergraduate and graduate degree programs act as reliable cash cows for APEI. The institution benefits from an established brand reputation and a steady flow of course registrations. For instance, APUS experienced a 3.5% growth in enrollments during the first quarter of 2025, underscoring its role as a consistent revenue generator.

American Public Education's (APEI) established nursing and health professions degrees represent a significant cash cow. These programs tap into a perpetually in-demand sector, ensuring consistent student enrollment and revenue streams. For instance, in 2024, healthcare occupations are projected to add 1.8 million new jobs, highlighting the enduring need for skilled professionals and the stability of these APEI offerings.

American Public Education's (APEI) general business and management programs are solid cash cows within its portfolio. Business majors consistently attract a significant portion of students; in Fall 2024, 5.37% of undergraduates at 4-year institutions pursued business-related fields.

APEI's established online offerings in business and management likely benefit from this enduring demand, attracting a large and stable enrollment of working adults. These programs, with their mature operational structures, are positioned to generate consistent revenue streams for the company.

Online Learning Infrastructure and Platform

American Public Education's (APEI) online learning infrastructure and platform function as a significant cash cow within its business model. This mature, scaled infrastructure efficiently supports over 125,000 students, with the company having invested heavily in its development and expansion. The operational efficiency of this platform means that the incremental cost to onboard additional students is relatively low, generating substantial profits that can be reinvested into other areas of the business.

The robustness of APEI's online learning infrastructure is a key driver of its financial performance. In 2023, the company reported total revenue of $776.7 million, with its online segment being the primary contributor. The established nature of this platform allows APEI to maintain a competitive cost structure while serving a large student population, solidifying its position as a reliable source of cash flow.

- Mature Platform: APEI's online learning infrastructure has been developed and scaled over time, representing a significant asset.

- Economies of Scale: The platform efficiently serves over 125,000 students, leading to low incremental costs per student.

- Revenue Generation: This infrastructure underpins APEI's online offerings, which are the main drivers of its substantial revenue, exceeding $776 million in 2023.

- Profitability: The efficient operation of the online platform contributes significantly to APEI's profitability, acting as a consistent cash generator.

Accreditation and Regulatory Compliance Expertise

American Public Education's (APEI) robust accreditation, notably from the Higher Learning Commission, and its adeptness in managing intricate regulatory landscapes are foundational strengths. This ensures ongoing student eligibility for federal financial aid, a critical component for sustained enrollment and revenue generation.

This expertise in compliance acts as a silent but powerful engine, fostering trust and stability. It's a key enabler for their core educational offerings, effectively functioning as a cash cow by safeguarding the business's operational continuity and student access to funding.

- Accreditation Authority: Higher Learning Commission (HLC).

- Regulatory Navigation: Expertise in U.S. Department of Education regulations.

- Financial Aid Eligibility: Crucial for student enrollment and revenue.

- Trust and Stability: Underpins consistent demand for educational programs.

APEI's established online learning infrastructure is a significant cash cow, efficiently supporting over 125,000 students. This mature platform, a result of substantial investment, allows for low incremental costs per student. The online segment was the primary contributor to APEI's total revenue of $776.7 million in 2023, showcasing its role as a consistent cash generator.

| Category | APEI Offering | BCG Matrix Role | Key Metric | Data Point |

|---|---|---|---|---|

| Core Education | American Public University System (APUS) Degrees | Cash Cow | Enrollment Growth (Q1 2025) | 3.5% |

| In-Demand Fields | Nursing and Health Professions | Cash Cow | Projected Job Growth (2024) | 1.8 million new jobs in healthcare |

| Broad Appeal | General Business and Management | Cash Cow | Undergraduate Business Majors (Fall 2024) | 5.37% at 4-year institutions |

| Operational Backbone | Online Learning Infrastructure | Cash Cow | Total Revenue (2023) | $776.7 million |

What You’re Viewing Is Included

American Public Education BCG Matrix

The American Public Education BCG Matrix preview you are viewing is the identical, fully comprehensive document you will receive upon purchase. This means no watermarks, no sample data, and no missing sections – just the complete, professionally formatted analysis ready for your strategic planning. You can trust that the insights and structure presented here accurately represent the final deliverable, ensuring you gain immediate value for your educational strategy development.

Dogs

Outdated or low-enrollment niche programs within American Public Education's portfolio represent potential "Dogs" in the BCG Matrix. These are academic offerings that, while perhaps historically significant, now struggle to attract students due to a mismatch with current workforce needs or a lack of perceived value. For instance, a program in a rapidly declining manufacturing sector might see enrollment dwindle, making it a poor investment of resources.

In 2024, universities nationwide are grappling with this reality. Data from the National Center for Education Statistics (NCES) indicates a continued shift in student preferences towards fields like technology and healthcare. Programs that haven't evolved to meet these demands, perhaps with outdated curricula or lacking in-demand skills training, are likely to experience consistently low enrollment, impacting the institution's overall cost-efficiency and return on investment.

While American Public Education, Inc. (APEI) heavily leans on its online model, any physical campuses or older facilities that aren't drawing enough students and are costly to maintain present a challenge. These locations can drain resources and divert focus from more profitable ventures. For instance, if a campus has seen enrollment decline by 15% year-over-year and its operational expenses exceed its generated revenue by 20%, it would likely fall into this category.

Legacy IT systems and non-integrated platforms within American Public Education represent significant operational challenges. These systems often demand substantial financial investment for ongoing maintenance, diverting funds that could otherwise be allocated to more innovative educational technologies or direct student support. For instance, in 2024, many school districts continued to grapple with outdated student information systems that struggled to communicate with newer learning management platforms, creating data silos and administrative inefficiencies.

The operational burden of these legacy systems is considerable, consuming valuable IT staff time and financial resources that yield diminishing returns. While essential for basic functions, their inability to seamlessly integrate with modern, efficient platforms limits scalability and hinders the delivery of an enhanced student experience. This lack of integration can lead to increased manual data entry and a slower response to evolving educational needs, impacting overall institutional agility.

Ineffective Marketing or Recruitment Channels

Ineffective marketing or recruitment channels are the Dogs in the American Public Education BCG Matrix. These are strategies that, despite past success, now fail to deliver a positive return on investment. Think of traditional print advertising or partnerships that no longer attract a significant number of new students. Continuing to fund these initiatives is like pouring money into a leaky bucket, diverting crucial resources away from potentially more fruitful endeavors.

For instance, a public school district might find that its long-standing newspaper ad campaigns for open enrollment are generating very few inquiries compared to digital outreach. In 2024, many educational institutions are seeing declining engagement with print media. A study found that only 15% of Gen Z adults regularly consume print newspapers, a stark contrast to older demographics.

- Outdated advertising: Traditional methods like print ads or broadcast commercials may no longer reach the target demographic effectively.

- Underperforming partnerships: Collaborations with organizations that do not align with current student recruitment goals can be a drain.

- Low ROI channels: Any marketing or recruitment avenue that consistently fails to generate a positive return on investment should be re-evaluated.

- Resource misallocation: Continuing investment in these "dog" channels detracts from resources that could be used for more effective growth strategies.

Programs with High Attrition Rates and Low Completion

Educational programs with high attrition and low completion rates, like certain vocational training or foundational academic courses, can be categorized as Dogs in the American Public Education BCG Matrix. These programs often represent a drain on institutional resources, as they require significant investment in faculty, facilities, and support services but yield few successful graduates. For instance, a 2023 report indicated that some online certificate programs in rapidly evolving tech fields saw completion rates as low as 30%, despite substantial marketing efforts.

These underperforming programs can negatively impact an institution's financial health and reputation. The cost of enrolling and supporting students who ultimately do not complete their studies can be substantial, diverting funds that could be used for more successful initiatives. Furthermore, a high attrition rate can lead to a perception of poor quality or lack of student support, deterring future enrollments.

- Resource Drain: Programs with high attrition consume instructional and administrative resources without commensurate graduate output.

- Financial Impact: Low completion rates directly affect long-term revenue streams and can increase per-graduate costs.

- Reputational Risk: Persistent low completion rates can damage an institution's standing and ability to attract students.

- Example Data: Some online certificate programs in 2023 reported completion rates below 30%.

Programs with low enrollment and limited future growth potential are the "Dogs" in the American Public Education BCG Matrix. These are offerings that consume resources without generating significant returns. In 2024, institutions are re-evaluating these areas, often driven by shifts in student demand towards fields like STEM and healthcare, leaving older or less relevant programs behind. For example, a university might identify a humanities program with declining majors and limited career prospects as a Dog.

These programs often suffer from outdated curricula or a lack of connection to current job market needs. The financial implication is a drain on institutional budgets, as faculty, facilities, and administrative support are maintained for a small student body. In 2023, the National Student Clearinghouse Research Center reported a continued decline in enrollment for some traditional liberal arts fields, highlighting the need for strategic adjustments.

The challenge lies in reallocating these resources to more promising areas or finding ways to revitalize these underperforming programs. Ignoring these "Dogs" can lead to inefficiency and missed opportunities for growth. For instance, a public school district might find its vocational auto repair program, once popular, now struggling with low enrollment due to the shift towards electric vehicles and a lack of updated training equipment.

Consider the following breakdown of potential "Dog" categories within American Public Education:

| Category | Description | 2024 Trend/Data Point | Financial Implication |

|---|---|---|---|

| Niche Academic Programs | Low-enrollment courses or majors with limited student interest or career relevance. | Continued decline in humanities and some social science majors, with a 5% year-over-year drop reported in some institutions for specific arts programs. | High per-student cost due to fixed faculty and facility expenses. |

| Underutilized Physical Assets | Campus facilities or buildings with consistently low student traffic and high maintenance costs. | Some regional campuses experiencing a 10-15% enrollment decline, leading to underutilized classroom space. | Significant operational overhead without proportional revenue generation. |

| Ineffective Digital Tools | Outdated learning management systems or administrative software requiring costly maintenance and offering limited functionality. | Many K-12 districts still relying on legacy student information systems that are difficult to integrate with modern cloud-based platforms. | Ongoing expenditure on maintenance and support, diverting funds from innovation. |

| Low Completion Rate Programs | Courses or certifications with high attrition and low graduation rates. | Certain online vocational certificates in 2023 reported completion rates below 40%. | Wasted investment in student recruitment and support services. |

Question Marks

Hondros College of Nursing strategically launched new Medical Assisting programs in 2024, positioning them within a high-growth sector driven by increasing demand for healthcare support staff. The Bureau of Labor Statistics projects a 16% growth for medical assistants from 2022 to 2032, much faster than the average for all occupations.

While the market for medical assisting education is expanding rapidly, Hondros College of Nursing's market share in this specific program is still in its nascent stages. This places the new programs in the Question Mark quadrant of the BCG Matrix.

Significant investment in marketing and program quality is crucial for these new offerings. By enhancing their competitive edge and brand recognition, Hondros aims to capture a larger market share and transition these programs from Question Marks to Stars in the future.

American Public Education, Inc. (APEI) is likely considering certifications in areas like blockchain technology and virtual reality development to align with future job market needs. These sectors, while experiencing rapid growth, represent nascent markets where APEI's current market share would be minimal, placing them in the Question Mark category of the BCG Matrix.

For instance, the global blockchain market was projected to reach $11.1 billion in 2023 and is expected to grow significantly. Similarly, the VR development market is also expanding, with projections indicating substantial growth in the coming years. APEI's entry into these areas would reflect a strategic move to capture future demand, albeit with initial low market penetration.

American Public Education (APEI) could consider international expansion for its online education, recognizing the substantial growth potential in the global digital learning market. However, these ventures would likely start with a low initial market share.

APEI would face considerable hurdles in adapting its offerings to diverse local regulations and navigating established competitive environments in new international territories. For instance, the global online education market was projected to reach over $370 billion by 2026, indicating significant opportunity but also intense competition.

Partnerships with New Employer Segments

American Public Education, Inc. (APEI) is actively pursuing partnerships with new employer segments to address evolving workforce needs. This strategy aligns with the company's aim to expand its reach into industries where it hasn't traditionally held a significant market presence.

These new employer partnerships are categorized as potential stars within the BCG matrix. They represent high-growth opportunities, driven by the demand for skilled labor in emerging or underserved sectors. However, their initial market share and demonstrated success are currently low, reflecting the nascent stage of these collaborations.

- Focus on High-Growth Industries: APEI is targeting sectors experiencing rapid expansion and facing talent shortages, aiming to provide tailored educational solutions.

- Strategic Corporate Alliances: The company is forging relationships with large corporations that require specialized training for their employees, creating a new revenue stream.

- Low Initial Market Share, High Potential: While these partnerships are in their early stages with limited current market penetration, they offer substantial upside if APEI can effectively meet the identified workforce demands.

Innovative Learning Models or Pedagogies

Innovative learning models, like personalized adaptive pathways or VR-based courses, represent potential Stars in the American public education BCG matrix.

These approaches could significantly enhance engagement and learning outcomes, potentially capturing new market segments in online education. For example, a 2024 report indicated that adaptive learning platforms can improve student performance by up to 15% in specific subjects. However, their scalability and widespread student adoption remain significant question marks, placing them in a high-risk, high-reward category.

- Personalized Adaptive Learning: Tailors content and pace to individual student needs, potentially boosting engagement and mastery.

- Immersive VR-Based Courses: Offers hands-on, experiential learning in virtual environments, enhancing understanding of complex subjects.

- Market Potential: These models could revolutionize online education and open new revenue streams, but broad adoption is not yet guaranteed.

- Scalability Concerns: The infrastructure and development costs for truly effective, scalable personalized and VR learning remain a challenge for many public education systems.

Question Marks in American Public Education's (APEI) BCG Matrix represent new ventures or programs with low market share in high-growth industries. These initiatives require significant investment to gain traction and potentially become future Stars. For example, APEI's exploration of blockchain and VR development certifications in 2024 falls into this category, targeting rapidly expanding but currently niche markets.

The challenge for APEI is to strategically allocate resources to these Question Marks, fostering growth and increasing market penetration. Success in these areas could lead to substantial returns, but they also carry a higher risk of failure compared to established offerings. The company's focus on new employer partnerships also exemplifies this, aiming for high-growth sectors with initially low penetration.

APEI's investment in innovative learning models, such as personalized adaptive pathways and VR-based courses, also fits the Question Mark profile. While these models show promise for improved student outcomes, their broad scalability and adoption are still uncertain, demanding careful evaluation and investment.

| Initiative | Market Growth | Current Market Share | Strategic Focus |

|---|---|---|---|

| Blockchain Certifications | High | Low | Develop expertise, build partnerships |

| VR Development Courses | High | Low | Invest in curriculum and technology |

| New Employer Partnerships | High (Emerging Sectors) | Low | Tailor programs to specific industry needs |

| Personalized Adaptive Learning | High (Online Education) | Low | Pilot programs, gather data on effectiveness |

| VR-Based Courses | High (Online Education) | Low | Content development, infrastructure investment |

BCG Matrix Data Sources

Our American Public Education BCG Matrix draws from comprehensive data, including government education statistics, enrollment figures, and financial reports from educational institutions to provide a clear strategic overview.