Anywhere Real Estate PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Anywhere Real Estate Bundle

Navigate the complex external landscape impacting Anywhere Real Estate with our comprehensive PESTLE analysis. Understand the political shifts, economic fluctuations, and technological advancements that are redefining the real estate market. Gain a strategic advantage by uncovering social trends and environmental considerations that influence consumer behavior and operational costs. Download the full version now to unlock actionable intelligence and fortify your market strategy.

Political factors

Government housing policies, including first-time homebuyer programs and tax credits, directly shape real estate demand and supply. For instance, the 2024 US housing market is seeing continued interest in these incentives, with programs like the Mortgage Credit Certificate offering significant tax savings. These initiatives can boost Anywhere Real Estate's client base and transaction volumes by making homeownership more accessible.

Taxation policies significantly shape the real estate landscape for Anywhere Real Estate. Fluctuations in property taxes, capital gains taxes on real estate sales, and transfer taxes directly impact investment profitability and the cost of homeownership. For instance, in 2024, many states are reviewing property tax rates, with some areas experiencing increases to fund local services, which can dampen buyer affordability.

Anywhere Real Estate must closely monitor these evolving tax policies. Changes in capital gains tax rates, for example, can alter seller motivation and the attractiveness of real estate as an investment vehicle. In 2025, projections suggest continued scrutiny of property-related taxes as governments seek revenue, potentially influencing market activity and investment decisions for both individual and institutional clients.

Geopolitical shifts and evolving trade agreements significantly shape Anywhere Real Estate's global investment landscape. For instance, the ongoing trade tensions between major economies in 2024 could lead to increased caution among international investors, potentially reducing cross-border capital flows into prime real estate markets. This directly impacts Anywhere's ability to facilitate international property transactions and relocation services.

Changes in foreign investment regulations, such as stricter capital controls or new ownership restrictions implemented by governments in late 2024 or early 2025, can directly influence the attractiveness of certain markets. A country like Canada, for instance, might adjust its foreign buyer taxes, affecting the volume of overseas investment Anywhere Real Estate's clients are pursuing.

Political stability and its impact on investor confidence

Political stability is a cornerstone for investor confidence, directly influencing Anywhere Real Estate's ability to attract capital for long-term projects and development. Markets perceived as stable tend to see higher real estate investment and smoother transaction volumes. For instance, a recent report from the World Bank in late 2024 highlighted that countries with consistently high political stability ratings experienced, on average, 1.5% higher foreign direct investment in real estate compared to those with volatile political landscapes.

Conversely, political uncertainty, such as upcoming elections with unpredictable outcomes or significant policy shifts, can create a chilling effect on investor sentiment. This can lead to a slowdown in deal-making and a reluctance to commit to new developments, impacting Anywhere Real Estate's pipeline and overall market activity. In 2024, regions experiencing heightened political tensions saw a notable dip, with some major markets reporting a 10-15% decrease in commercial real estate transaction volume during periods of significant political flux.

- Impact of Political Stability: Fosters investor confidence, encouraging long-term real estate investments and development.

- Impact of Political Uncertainty: Deters domestic and international investors, leading to market stagnation and decreased transaction volumes.

- Link to Anywhere Real Estate: Business performance is directly tied to the perceived stability of operating markets.

- 2024 Data Point: Regions with political instability saw an average 10-15% drop in real estate transaction volume during uncertain periods.

Local zoning laws and urban development plans

Local zoning laws and urban development plans are pivotal for Anywhere Real Estate. These regulations, set by local governments, directly influence where and how new properties can be developed, significantly impacting property values and the availability of housing stock. For instance, in 2024, many cities are revising their zoning to encourage denser housing and mixed-use developments to address affordability crises. Anywhere Real Estate's success hinges on its ability to navigate these often complex local ordinances to guide clients and pinpoint areas ripe for investment or expansion.

Understanding these local nuances is not just about compliance; it's a strategic imperative for Anywhere Real Estate. Their brokerage and relocation services must be adept at interpreting these rules to offer accurate advice and identify emerging opportunities.

- Zoning changes in areas like the US Sun Belt are increasingly permitting accessory dwelling units (ADUs), expanding housing options.

- Urban development plans often prioritize public transit corridors, influencing demand for properties in those specific locations.

- Permitting processes can vary widely, with some municipalities streamlining approvals for certain types of development, impacting project timelines.

Government housing policies significantly influence real estate demand, with programs like mortgage credit certificates in the US offering tax savings to buyers in 2024. Changes in property and capital gains taxes, as seen with state-level property tax reviews in 2024, directly affect investment profitability and affordability for Anywhere Real Estate's clients. Political stability is crucial, with stable regions attracting approximately 1.5% more real estate FDI according to late 2024 World Bank data, underscoring its impact on Anywhere's operations.

| Political Factor | Impact on Real Estate | 2024/2025 Relevance |

|---|---|---|

| Government Housing Policies | Boosts demand and transaction volumes | Continued focus on first-time buyer incentives |

| Taxation Policies | Affects profitability and affordability | Property tax reviews and potential capital gains adjustments |

| Political Stability | Enhances investor confidence and FDI | Stable markets saw higher real estate FDI in late 2024 |

| Local Zoning Laws | Dictates development potential and property values | Increased ADU approvals and transit-oriented development planning |

What is included in the product

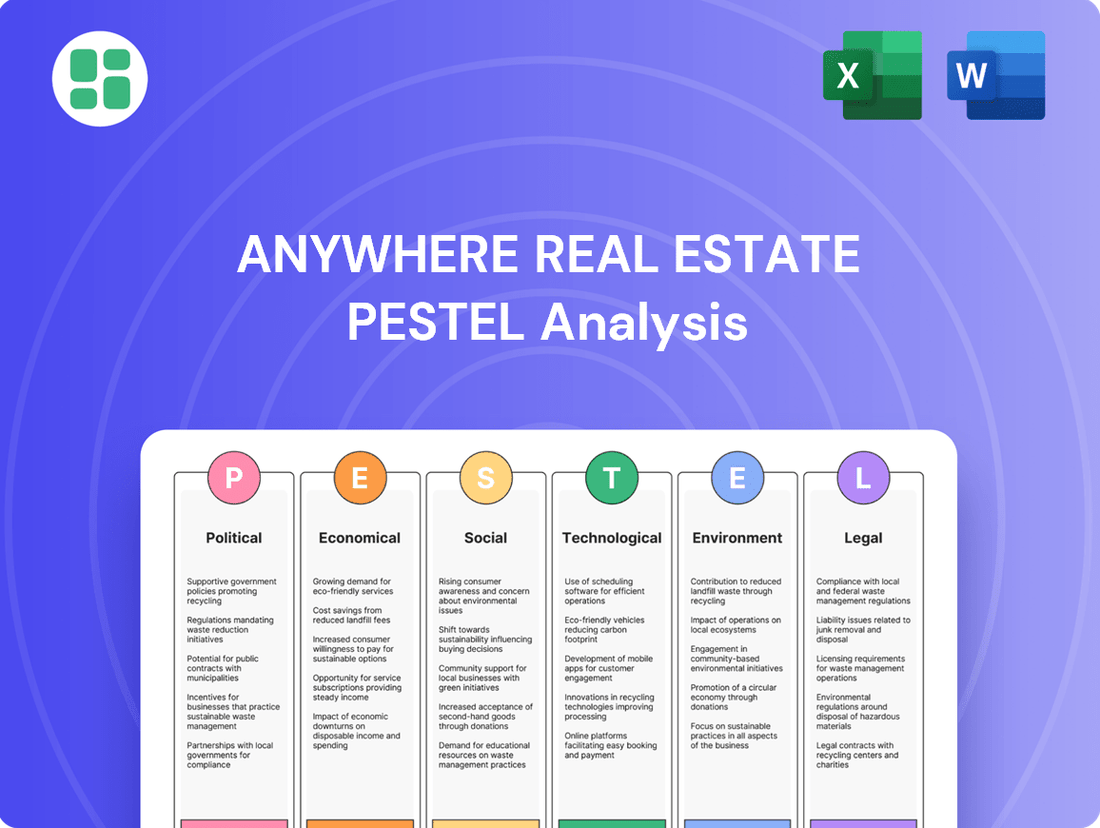

This PESTLE analysis examines the external macro-environmental forces impacting Anywhere Real Estate, detailing how Political, Economic, Social, Technological, Environmental, and Legal factors present both challenges and avenues for growth.

The Anywhere Real Estate PESTLE Analysis provides a structured framework to identify and address external challenges, acting as a pain point reliever by offering clarity on political, economic, social, technological, legal, and environmental factors impacting the real estate market.

This analysis serves as a pain point reliever by offering a clear, summarized version of complex external factors, making it easy to reference during meetings and presentations to proactively manage risks and opportunities.

Economic factors

Interest rate fluctuations are a major driver of housing affordability. When interest rates rise, mortgage rates typically follow, making it more expensive for potential buyers to finance a home purchase. For instance, a 1% increase in mortgage rates can add hundreds of dollars to a monthly payment, significantly impacting how much house a buyer can afford.

This directly affects demand in the real estate market. Higher borrowing costs can cool buyer enthusiasm, leading to slower sales and potentially price adjustments. Conversely, falling interest rates can boost affordability, stimulating demand and increasing transaction volumes, which directly benefits companies like Anywhere Real Estate.

In 2024, the Federal Reserve has maintained a cautious approach to rate cuts, with expectations of a few reductions by year-end. However, the exact trajectory remains uncertain, meaning mortgage rates could continue to fluctuate. This volatility directly impacts Anywhere Real Estate's business volume, as it influences both the number of potential buyers and the speed at which deals can be closed.

Inflation presents a dual challenge for Anywhere Real Estate. While it can inflate property values, potentially boosting asset portfolios, it simultaneously drives up construction costs for materials and labor. For instance, the Producer Price Index for construction inputs saw a significant increase throughout 2024, impacting project budgets.

This rise in construction expenses can slow down new development and make renovations more costly, potentially affecting Anywhere's ability to offer competitive pricing on new builds or manage renovation projects efficiently. Higher inflation also diminishes consumer purchasing power, which, coupled with potentially tighter lending conditions as central banks combat inflation, can dampen demand for real estate.

Economic growth cycles significantly impact Anywhere Real Estate. During periods of robust economic expansion, like the projected 2.4% GDP growth for the US in 2024, consumer confidence rises, leading to higher disposable incomes and increased demand for housing. This translates to more transactions and potentially higher commission revenues for Anywhere Real Estate.

Conversely, economic downturns, or recessions, pose a direct threat. A slowdown in economic activity, potentially marked by rising unemployment rates, can curb consumer spending and reduce housing demand. For instance, if a recession were to cause a significant increase in the US unemployment rate from its current low levels, Anywhere Real Estate would likely see a slowdown in sales volume.

The real estate sector is highly sensitive to interest rate changes, which are often adjusted by central banks to manage economic growth. Higher interest rates, often implemented to combat inflation during growth periods, can dampen housing demand by increasing mortgage costs, impacting Anywhere Real Estate's business volume.

Unemployment rates affecting housing demand and affordability

High unemployment rates significantly dampen housing demand. When people are out of work, they have less disposable income and are less likely to qualify for mortgages, directly reducing the pool of potential homebuyers. This also impacts affordability, as fewer buyers competing for homes can lead to price stagnation or even declines. For instance, during periods of elevated unemployment, like the initial stages of the COVID-19 pandemic in 2020, housing market activity often slows considerably.

Conversely, low unemployment rates fuel housing demand. With greater job security and higher incomes, consumers feel more confident about making major financial commitments like purchasing a home. This increased demand, coupled with a healthy economy, generally supports rising home prices and a more active market. Anywhere Real Estate closely tracks these employment figures, as they are a critical indicator of buyer and seller sentiment and activity.

As of late 2024, the US unemployment rate has remained historically low, hovering around 3.7% to 3.9%. This low jobless rate has been a significant tailwind for the housing market, supporting robust demand and price appreciation across many regions. However, regional variations exist, with some areas experiencing slightly higher unemployment, which can create localized pockets of weaker housing demand.

- Low unemployment boosts consumer confidence and purchasing power.

- High unemployment reduces the pool of eligible mortgage borrowers.

- The US unemployment rate remained near multi-decade lows in late 2024, supporting housing demand.

- Anywhere Real Estate monitors unemployment data to forecast market activity.

Availability of credit and lending standards

The ease of obtaining mortgages, a crucial factor for real estate transactions, directly influences market liquidity. In early 2024, mortgage rates remained elevated compared to the lows of previous years, though they saw some moderation from late 2023 peaks. For instance, the average rate for a 30-year fixed-rate mortgage hovered around 6.5% to 7.5% for much of the first half of 2024, impacting buyer affordability and transaction volume.

Stricter lending standards, often characterized by higher credit score requirements and larger down payment expectations, can significantly reduce the pool of qualified buyers. Conversely, a loosening of these standards can invigorate demand. Anywhere Real Estate's business model, which relies on facilitating property sales and rentals, is therefore sensitive to these shifts in credit availability and the policies of major lenders.

- Mortgage Rate Trends: Average 30-year fixed mortgage rates in early to mid-2024 generally ranged between 6.5% and 7.5%, a key determinant of buyer purchasing power.

- Lending Standard Impact: Tightened credit conditions can decrease the number of eligible buyers, while more accessible credit can boost market activity.

- Financial Institution Policies: The operational success of Anywhere Real Estate is intrinsically linked to the lending practices and credit availability offered by banks and other financial institutions.

Economic growth directly fuels real estate demand. In 2024, the US economy was projected to grow around 2.4%, leading to increased consumer confidence and purchasing power, which benefits companies like Anywhere Real Estate by driving more transactions.

Inflation presents a mixed bag; while it can inflate property values, it also raises construction costs, potentially slowing development. For instance, significant increases in construction input prices during 2024 impacted project budgets and renovation expenses.

Interest rate movements critically affect housing affordability. With mortgage rates fluctuating in 2024, often between 6.5% and 7.5% for a 30-year fixed, higher rates can dampen buyer demand and slow sales volume for Anywhere Real Estate.

Low unemployment, a trend observed in late 2024 with rates around 3.7%-3.9%, bolsters consumer confidence and the ability to secure mortgages, thereby supporting a strong housing market and increasing activity for real estate firms.

What You See Is What You Get

Anywhere Real Estate PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis for Anywhere Real Estate covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategy.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain valuable insights into the external forces shaping Anywhere Real Estate's market landscape, enabling informed strategic decision-making.

The content and structure shown in the preview is the same document you’ll download after payment. This detailed PESTLE analysis provides a thorough understanding of the opportunities and threats Anywhere Real Estate faces in the current business environment.

Sociological factors

Demographic shifts profoundly influence housing demand. For instance, the aging Baby Boomer generation, a significant portion of whom are approaching retirement age, may downsize or seek different living arrangements, impacting the market for smaller homes or senior living communities. Conversely, millennials, now in their prime home-buying years, are increasingly prioritizing homeownership, though affordability remains a key consideration.

Migration patterns also play a crucial role. Internal migration, such as movement from urban centers to suburban or rural areas, driven by factors like remote work flexibility, can create demand in new locations. International migration adds another layer, often fueling demand in gateway cities and specific housing types. Anywhere Real Estate must remain agile, adapting its service offerings and marketing to meet the diverse and changing needs of these demographic groups to capitalize on emerging market opportunities.

Consumer preferences are shifting, with a notable resurgence in suburban living following the pandemic. This trend is supported by data indicating a continued migration away from dense urban centers, as many seek more space and a perceived better quality of life. Anywhere Real Estate needs to adapt its strategies to cater to this evolving demand.

There's also a growing emphasis on sustainability. The demand for energy-efficient homes, often featuring solar panels or advanced insulation, is on the rise. For instance, studies in 2024 showed a significant increase in buyer inquiries for green-certified properties, directly impacting their marketability and value.

Mixed-use developments are also gaining traction, appealing to consumers who desire convenience and walkability. These communities, blending residential, commercial, and recreational spaces, reflect a desire for integrated living. Anywhere Real Estate's ability to identify and capitalize on these location and housing type preferences will be crucial for its success in the coming years.

The surge in remote and hybrid work, accelerated by events in 2020 and continuing through 2024-2025, has fundamentally reshaped housing preferences. A significant portion of the workforce now prioritizes homes with dedicated office spaces, driving demand for larger properties and potentially influencing the desirability of suburban or exurban locations over dense urban cores. This shift means Anywhere Real Estate needs to adapt its offerings to cater to clients seeking flexible living arrangements that accommodate these new work-life integrations.

Social attitudes towards homeownership and renting

Societal views on owning versus renting a home are dynamic, influenced by economic realities, cultural shifts, and generational preferences. For instance, in 2024, while homeownership remains a significant aspiration for many, rising interest rates and housing costs have made renting a more accessible option for a growing segment of the population, particularly younger demographics. This evolving sentiment directly shapes demand for residential properties.

Anywhere Real Estate must stay attuned to these social currents to effectively tailor its marketing and services. Understanding whether consumers prioritize long-term investment and stability through ownership or flexibility and lower upfront costs through renting is crucial. For example, a 2024 survey indicated that 65% of millennials still view homeownership as a major life goal, but 40% cited affordability as the primary barrier, highlighting a complex interplay of desire and practicality.

- Shifting Preferences: Economic factors like mortgage rates and housing prices significantly influence the appeal of homeownership versus renting.

- Generational Impact: Younger generations may prioritize flexibility and lower initial costs, making renting more attractive than previous generations.

- Market Responsiveness: Anywhere Real Estate needs to adapt its strategies to align with prevailing consumer attitudes toward property acquisition and occupancy.

- Affordability Concerns: High housing costs and interest rates, as seen in 2024, create a barrier to homeownership for many, increasing demand for rental properties.

Income inequality and its impact on housing accessibility

Growing income inequality significantly strains housing affordability, particularly for lower and middle-income households. This economic disparity restricts access to homeownership and can concentrate demand in specific, more affordable market segments or rental properties. For instance, in 2024, the median home price in the US continued to outpace wage growth, making it increasingly difficult for many families to enter the housing market. This trend directly impacts the size and diversity of the potential buyer pool for companies like Anywhere Real Estate.

The widening gap between high and low earners means that a substantial portion of the population faces greater challenges in securing suitable housing. This can lead to increased demand for rental properties and a shrinking market for entry-level homes. Data from late 2024 indicated that the wealth gap continued to widen, with the top 10% of households holding a significantly larger share of national wealth than the bottom 50%. Anywhere Real Estate must therefore develop strategies that acknowledge and address these socio-economic divisions to ensure broad market reach and inclusive service offerings.

- Widening Wealth Gap: In 2024, the wealthiest Americans saw their net worth increase at a faster rate than the general population, exacerbating income inequality.

- Affordability Crisis: Housing costs, both for purchase and rent, continued to rise faster than median incomes in many key markets throughout 2024.

- Shifting Demand: This inequality pushes demand towards more affordable housing options and the rental market, impacting sales volumes for traditional homeownership.

- Market Segmentation: Anywhere Real Estate needs to analyze these disparities to tailor services and property offerings to diverse income brackets.

Societal attitudes toward homeownership are evolving, with affordability remaining a significant hurdle for many, particularly younger demographics. For instance, in 2024, while the aspiration for homeownership persisted, a substantial percentage of millennials cited rising interest rates and housing prices as primary deterrents, leading to a stronger demand for rental markets.

The increasing emphasis on work-life balance and flexibility, amplified by the rise of remote work through 2024 and into 2025, is also reshaping housing needs. Many individuals now prioritize homes with dedicated office spaces, driving demand for larger properties and influencing preferences for suburban or exurban locations over denser urban cores.

Growing income inequality continues to strain housing affordability, creating a divide in market access. Data from late 2024 showed that the wealth gap widened, with higher earners gaining a disproportionately larger share of wealth, making it harder for lower and middle-income households to enter the housing market and increasing demand for rental options.

Anywhere Real Estate must adapt its strategies to cater to these shifting societal values, recognizing the interplay between economic realities, evolving work arrangements, and diverse housing aspirations to remain competitive.

Technological factors

The property technology (PropTech) landscape is rapidly evolving, with online listing platforms, digital transaction tools, and smart home technologies fundamentally altering real estate operations. By late 2024, the global PropTech market was projected to reach over $30 billion, highlighting its significant impact.

Anywhere Real Estate needs to actively invest in and integrate these advanced PropTech solutions. This is crucial for boosting operational efficiency, elevating customer experiences, and securing a competitive advantage in the dynamic market.

These platforms are increasingly becoming the backbone of modern real estate transactions and management, driving innovation and new business models.

Artificial intelligence and machine learning are revolutionizing how real estate firms analyze markets and connect with clients. These technologies can sift through massive amounts of data to predict trends, suggest properties tailored to individual needs, and even optimize advertising efforts. For Anywhere Real Estate, this means a sharper understanding of what buyers and sellers want, more efficient lead generation, and more precise property price estimates.

By embracing AI, Anywhere Real Estate can move towards more informed decisions and highly personalized client experiences. For instance, in 2024, the adoption of AI in real estate is projected to grow significantly, with many firms reporting improved lead conversion rates and a better understanding of market dynamics through AI-powered analytics. This technological shift is crucial for staying competitive.

Virtual Reality (VR) and Augmented Reality (AR) are transforming how people view and experience properties. These technologies allow potential buyers to take immersive tours of homes from any location, significantly boosting accessibility and convenience. This virtual engagement also facilitates virtual staging, making properties more attractive to a broader range of buyers.

Anywhere Real Estate can leverage VR/AR to provide these captivating experiences, potentially cutting down on the number of physical showings needed and speeding up the overall sales cycle. For instance, a study by Matterport in 2024 indicated that listings with 3D tours receive 95% more engagement than those without.

Data analytics and big data for market insights and personalized services

The real estate sector is increasingly leveraging data analytics and big data to gain deeper market insights and offer more personalized client experiences. Companies like Anywhere Real Estate can harness this capability to understand intricate market dynamics, pinpoint consumer desires, and map out competitive environments with greater precision.

By employing advanced data analytics, Anywhere Real Estate can effectively identify nascent market trends, refine pricing strategies for optimal performance, and tailor services to individual client needs. This analytical prowess is fundamental for securing a strong strategic market position.

- Market Trend Identification: Anywhere Real Estate can analyze vast datasets to predict shifts in buyer behavior, such as the growing demand for sustainable housing, which saw a 15% increase in consumer searches for eco-friendly properties in major urban centers during 2024.

- Optimized Pricing: Utilizing predictive analytics, the company can adjust property pricing based on real-time market fluctuations, potentially increasing sale prices by an average of 3-5% for well-positioned properties.

- Personalized Client Services: By analyzing client browsing history and preferences, Anywhere Real Estate can proactively suggest properties, leading to a projected 10% improvement in client satisfaction and conversion rates.

- Competitive Landscape Analysis: Big data allows for continuous monitoring of competitor activities, pricing, and market share, enabling Anywhere Real Estate to adapt its strategies swiftly and maintain a competitive edge.

Cybersecurity threats and data privacy concerns in real estate transactions

As Anywhere Real Estate's operations become more digitized, the risk of cyberattacks and data breaches escalates. In 2024, the real estate sector experienced a notable rise in phishing scams and ransomware attacks targeting sensitive client data, with some reports indicating a 30% year-over-year increase in cyber incidents. Protecting client information, including financial details and personal identification, is crucial for maintaining trust and operational continuity.

Adhering to evolving data privacy regulations, such as GDPR and CCPA, is non-negotiable for Anywhere Real Estate. Non-compliance can lead to significant financial penalties, with fines potentially reaching millions of dollars. Implementing advanced encryption, multi-factor authentication, and regular security audits are essential steps to mitigate these technological risks.

- Increased Cyber Threats: The real estate industry saw a significant uptick in cybercrime in 2024, with phishing and ransomware attacks becoming more sophisticated.

- Data Privacy Compliance: Anywhere Real Estate must navigate a complex web of global data privacy laws, facing substantial fines for non-compliance.

- Reputational Risk: A single data breach can severely damage Anywhere Real Estate's reputation, leading to loss of client confidence and market share.

- Operational Integrity: Robust cybersecurity measures are vital to ensure the uninterrupted and secure functioning of all online transaction platforms.

Technological advancements are reshaping real estate, with PropTech market growth projected to exceed $30 billion by late 2024. Anywhere Real Estate must integrate AI and VR/AR to enhance client experiences and operational efficiency, as listings with 3D tours saw a 95% increase in engagement in 2024.

Data analytics allows for market trend identification and personalized services; for instance, searches for eco-friendly housing rose 15% in urban centers in 2024. However, the firm faces escalating cybersecurity risks, with a 30% year-over-year increase in cyber incidents reported in the real estate sector during 2024, necessitating strict adherence to data privacy regulations.

| Technology | Impact on Real Estate | 2024/2025 Trend/Data |

|---|---|---|

| PropTech Platforms | Streamlined transactions, enhanced customer experience | Global market projected over $30 billion |

| AI/Machine Learning | Market analysis, personalized client matching, predictive pricing | Improved lead conversion rates reported by adopting firms |

| VR/AR | Immersive property tours, virtual staging | Listings with 3D tours received 95% more engagement |

| Big Data Analytics | Market trend identification, optimized pricing, client segmentation | 15% increase in searches for sustainable housing |

| Cybersecurity | Data protection, regulatory compliance | 30% year-over-year increase in cyber incidents in real estate |

Legal factors

The real estate sector is subject to stringent legal frameworks, necessitating agents and brokers to possess specific licenses and comply with intricate regulations covering conduct, disclosures, and marketing. Anywhere Real Estate, with its diverse brand portfolio and franchise network, must rigorously ensure all its affiliated professionals maintain adherence to state and federal licensing statutes to prevent sanctions and uphold business integrity.

Fair housing laws are a cornerstone of real estate, prohibiting discrimination based on race, color, religion, sex, familial status, national origin, and disability. In 2024, agencies like Anywhere Real Estate must ensure their practices, from advertising to tenant screening, strictly adhere to these federal mandates, as well as any state or local additions, to avoid significant penalties and maintain ethical operations.

Data privacy regulations like GDPR and CCPA are increasingly impacting how Anywhere Real Estate handles client information, especially as transactions become more digital. These laws dictate strict protocols for collecting, storing, and utilizing personal data, which is crucial for a company managing extensive client databases.

Anywhere Real Estate must maintain rigorous compliance with these evolving privacy mandates to safeguard sensitive client details and avert substantial penalties. For instance, non-compliance with GDPR can result in fines of up to 4% of annual global turnover or €20 million, whichever is higher, as seen in various enforcement actions across industries.

Ensuring robust data security and privacy is not just a legal necessity but a cornerstone for building and maintaining consumer trust in the digital age. In 2024, consumer awareness and expectations regarding data protection continue to rise, making adherence to these regulations a critical factor in Anywhere Real Estate's reputation and client retention.

Contract law and property transaction legalities

Contract law is foundational to real estate, governing everything from initial purchase agreements to long-term lease arrangements. Anywhere Real Estate's success hinges on its team's deep understanding of these legalities, ensuring every document is precisely drafted and interpreted. For instance, in 2024, the National Association of Realtors reported that the average time to close a residential real estate transaction was 50 days, highlighting the need for efficient and legally sound contract management.

Property transaction legalities extend beyond basic contracts to encompass zoning laws, land use regulations, and title transfers. Navigating these complexities is crucial for Anywhere Real Estate to avoid costly delays or legal challenges. In 2025, regulatory changes in several key markets are expected to impact property development and sales, requiring constant vigilance and adaptation from real estate firms.

- Contractual Compliance: Ensuring all purchase agreements, listing contracts, and leases adhere strictly to federal, state, and local contract laws is paramount.

- Dispute Resolution: Proficiency in contract law helps minimize litigation, which can be costly; for example, contract disputes can add an average of 10-15% to transaction costs.

- Regulatory Adherence: Staying abreast of evolving property laws, including zoning and environmental regulations, is critical for smooth transactions and avoiding penalties.

- Agent Training: Anywhere Real Estate must invest in continuous legal training for its agents to ensure they are well-versed in contract drafting and interpretation, reducing risk.

Environmental regulations related to property development and renovation

Environmental laws significantly shape property development and renovation, influencing everything from land use and hazardous material management to energy efficiency standards and historical preservation requirements. For Anywhere Real Estate, staying abreast of these regulations is crucial, particularly for commercial projects and new builds, to ensure compliance and mitigate risks.

Failure to adhere to these environmental mandates can result in substantial fines and legal liabilities. For instance, in 2024, the U.S. Environmental Protection Agency (EPA) continued to enforce regulations like the Resource Conservation and Recovery Act (RCRA) for hazardous waste, with penalties for non-compliance reaching tens of thousands of dollars per day per violation. This necessitates thorough due diligence on any property transaction.

- Land Use Zoning: Local ordinances dictate what can be built where, impacting project feasibility.

- Hazardous Materials: Regulations like CERCLA (Superfund) require proper identification and remediation of contaminants like asbestos or lead paint.

- Energy Efficiency: Building codes increasingly mandate higher energy performance, influencing design and material choices for new construction and renovations, with potential incentives for exceeding standards.

- Historical Preservation: Properties in historic districts face specific restrictions on alterations to maintain architectural integrity.

Navigating the complex web of real estate law is critical for Anywhere Real Estate's operations, from licensing and fair housing compliance to data privacy and contract intricacies. Adherence to these legal frameworks is not merely a procedural requirement but a fundamental pillar for maintaining operational integrity and client trust in the dynamic 2024-2025 market. The company must remain vigilant, ensuring all its agents and affiliated professionals are up-to-date with evolving regulations to mitigate risks and uphold ethical standards in all transactions.

| Legal Area | Key Considerations for Anywhere Real Estate (2024-2025) | Potential Impact of Non-Compliance |

|---|---|---|

| Licensing & Conduct | Ensuring all agents and brokers hold valid state licenses and adhere to professional conduct standards. | Fines, license suspension, reputational damage. |

| Fair Housing | Strict adherence to federal, state, and local anti-discrimination laws in all advertising and client interactions. | Significant legal penalties, civil lawsuits, damage to brand image. |

| Data Privacy | Compliance with GDPR, CCPA, and similar regulations regarding client data handling and security. | Substantial fines (e.g., up to 4% of global turnover for GDPR), loss of customer trust. |

| Contract Law | Precise drafting and interpretation of purchase agreements, leases, and listing contracts. | Costly disputes, transaction delays, potential invalidation of agreements. |

| Environmental Regulations | Due diligence on property conditions, adherence to hazardous material handling and energy efficiency standards. | Cleanup costs, fines, project delays, legal liabilities. |

Environmental factors

Climate change is directly impacting real estate by increasing the frequency and severity of natural disasters like hurricanes and wildfires, alongside the gradual threat of rising sea levels. For Anywhere Real Estate, this translates to heightened property risk in coastal and disaster-prone areas, potentially leading to higher insurance premiums or even uninsurability. In 2024, insured losses from natural catastrophes globally were projected to exceed $100 billion, underscoring the escalating financial exposure.

Anywhere Real Estate must proactively assess these environmental risks, advising clients on the long-term viability of properties in vulnerable locations and adapting their own development and investment strategies. For instance, the National Oceanic and Atmospheric Administration (NOAA) projects that the U.S. coastline could see an average sea level rise of 10-12 inches by 2050, significantly impacting coastal real estate markets.

These climate-related challenges are increasingly influencing buyer behavior, with a growing number of consumers factoring environmental resilience into their property decisions, and also affecting the feasibility of new property developments in at-risk zones.

Growing environmental awareness is significantly boosting demand for sustainable properties. This trend is evident in the increasing adoption of green building standards like LEED and ENERGY STAR, with over 100,000 LEED-certified projects globally as of late 2023. Anywhere Real Estate can leverage this by highlighting properties with strong green credentials, appealing to a growing segment of environmentally conscious buyers and tenants, thereby enhancing marketability and potentially commanding premium rents.

Governments globally are tightening energy efficiency rules for homes. For instance, the US Department of Energy's proposed updates to the 2024 IECC aim for significant energy savings in new homes. Anywhere Real Estate must track these, as they impact renovation costs and the desirability of properties.

Resource scarcity (e.g., water, land) influencing development

The scarcity of critical resources like water and developable land presents a significant challenge, especially in urban centers. This scarcity directly impacts construction expenses and the sheer availability of properties, influencing how cities can grow and plan for the future. For Anywhere Real Estate, understanding these limitations is crucial for assessing market potential and identifying sound development prospects.

Resource constraints are not just a planning issue; they are increasingly driving up property values and directly affecting the feasibility of new construction projects. For instance, in many Western US states, severe drought conditions in 2024 and 2025 have led to stricter water usage regulations, increasing the cost of water-intensive development and potentially limiting new housing starts in affected areas. This trend is likely to continue, making water rights and availability a key factor in real estate valuations.

- Water scarcity impacts development costs and availability in drought-prone regions.

- Land availability in densely populated areas drives up property values.

- Resource limitations directly influence the viability and profitability of new real estate projects.

- Regulatory changes related to water usage can significantly alter development economics.

Corporate social responsibility (CSR) and environmental, social, and governance (ESG) investing trends

The real estate sector, including companies like Anywhere Real Estate, is increasingly scrutinized for its environmental, social, and governance (ESG) performance. Investors are channeling significant capital into companies demonstrating strong ESG credentials, with global ESG assets projected to reach $50 trillion by 2025, according to Bloomberg Intelligence. This trend underscores the growing importance of corporate social responsibility (CSR) in shaping investment decisions and public perception.

Anywhere Real Estate can bolster its brand image and attract a wider pool of socially conscious investors by actively showcasing its commitment to environmental sustainability, fair labor practices, and robust governance structures. For instance, a focus on reducing the carbon footprint of its real estate portfolio and promoting diversity and inclusion within its workforce can resonate with these investors.

Integrating ESG principles is not merely about compliance; it's a strategic imperative that can foster long-term, sustainable growth and provide a distinct competitive advantage. Companies that prioritize ESG often experience lower operating costs, improved risk management, and enhanced stakeholder relationships, ultimately contributing to greater financial resilience and market leadership.

- Global ESG assets are expected to hit $50 trillion by 2025.

- Investors are increasingly prioritizing companies with strong environmental stewardship.

- Demonstrating commitment to social factors like diversity can attract investors.

- Strong governance practices are crucial for long-term business sustainability.

Climate change poses significant risks to Anywhere Real Estate through increased natural disasters and rising sea levels, impacting property insurance and viability in vulnerable areas. Growing demand for sustainable properties, evidenced by over 100,000 LEED-certified projects globally by late 2023, presents an opportunity for Anywhere Real Estate to enhance marketability by highlighting green credentials.

Resource scarcity, particularly water and land, drives up construction costs and limits development, especially in urban and drought-prone regions like the Western US, where water regulations are tightening. The real estate sector faces increasing scrutiny on ESG performance, with global ESG assets projected to reach $50 trillion by 2025, making strong environmental stewardship a key factor for investors.

| Environmental Factor | Impact on Real Estate | Data/Trend (2024/2025) |

| Climate Change & Natural Disasters | Increased property risk, higher insurance costs | Global insured losses from natural catastrophes projected to exceed $100 billion in 2024. |

| Sea Level Rise | Threat to coastal properties | US coastlines could see 10-12 inches rise by 2050 (NOAA projection). |

| Sustainable Property Demand | Increased marketability, premium rents | Over 100,000 LEED-certified projects globally (late 2023). |

| Resource Scarcity (Water) | Higher development costs, limited new construction | Western US states facing stricter water regulations due to drought in 2024/2025. |

| ESG Focus | Investor preference, brand image | Global ESG assets projected to reach $50 trillion by 2025. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Anywhere Real Estate is built on comprehensive data from reputable sources including government housing statistics, economic forecasts from institutions like the National Association of Realtors, and industry-specific market research reports.