Anywhere Real Estate Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Anywhere Real Estate Bundle

Anywhere Real Estate navigates a complex landscape shaped by intense rivalry and the constant threat of new entrants. Understanding the bargaining power of buyers and suppliers is crucial for their strategic positioning. The availability of substitutes also presents a significant challenge.

The complete report reveals the real forces shaping Anywhere Real Estate’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The residential real estate sector, including companies like Anywhere Real Estate Inc., depends on various suppliers such as technology firms offering CRM and listing services, marketing specialists, and legal professionals. When a small number of these suppliers dominate the market for critical services, they gain considerable leverage. This concentration allows them to potentially dictate terms, impacting costs and availability for real estate giants.

Anywhere Real Estate Inc. faces potential bargaining power from its suppliers, particularly concerning technology platforms and data providers. The costs associated with switching these critical systems, such as migrating data or retraining staff, can be substantial. For instance, if Anywhere Real Estate relies heavily on a proprietary CRM system or a specific real estate data analytics platform, the expense and disruption of moving to a new provider could be significant, thereby strengthening the supplier's position.

The uniqueness of inputs significantly shapes supplier bargaining power. For Anywhere Real Estate, this can manifest through proprietary real estate data platforms, specialized marketing technologies, or access to highly sought-after, skilled agents. If these inputs are difficult for competitors to replicate, suppliers offering them gain leverage.

Anywhere Real Estate's business model relies heavily on a broad network of independent real estate agents. These agents, by their nature, have the freedom to affiliate with various brokerages. This autonomy grants them a degree of bargaining power, particularly the top-performing agents who are in high demand across the industry.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into the real estate brokerage market could significantly enhance their bargaining power against companies like Anywhere Real Estate. If a key technology provider or service vendor were to launch its own brokerage services, it would directly compete, potentially driving down commission rates and increasing costs for existing players.

While less common for traditional suppliers due to substantial capital investment and complex regulatory hurdles in real estate, the potential exists. For example, a proptech firm with a robust platform and existing client base might explore offering direct brokerage services. In 2024, the real estate technology sector saw continued investment, with companies focusing on streamlining transactions and improving agent efficiency, laying groundwork for potential service expansion.

- Supplier Forward Integration Threat: Suppliers entering the brokerage market directly increases their leverage.

- Example: A proptech firm offering brokerage services would be a direct competitor.

- Barriers: High capital and regulatory requirements often deter traditional suppliers.

- Market Trend: Continued proptech investment in 2024 suggests potential for new service offerings.

Importance of Supplier's Input to Anywhere Real Estate's Business

The bargaining power of suppliers is a critical factor for Anywhere Real Estate, primarily stemming from its reliance on its network of real estate agents. These agents are the lifeblood of the company's residential brokerage and franchise operations, directly impacting service delivery and revenue generation.

Anywhere Real Estate's success hinges on its capacity to attract and retain these agents, highlighting their significant influence. The company's strategic efforts to bolster its agent base, as demonstrated by the addition of approximately 650 producing agents in Q1 2025, underscore the vital nature of a compelling agent value proposition.

- Agent Network as Core Input: Anywhere Real Estate's primary input is its vast network of real estate agents, essential for its residential brokerage and franchise models.

- Agent Retention is Key: The company's ability to attract and keep agents directly affects its operational strength and market reach.

- Q1 2025 Growth: Anywhere Real Estate added around 650 producing agents in the first quarter of 2025, indicating a focus on expanding this crucial resource.

- Value Proposition Matters: A strong value proposition is necessary to maintain the loyalty and productivity of these agents, thereby mitigating their bargaining power.

The bargaining power of suppliers for Anywhere Real Estate is significantly influenced by the concentration of key service providers and the uniqueness of the inputs they offer. When few suppliers control critical technologies or data, they can command higher prices, impacting Anywhere Real Estate's operational costs. For instance, reliance on specialized real estate data analytics platforms or proprietary CRM systems can make switching providers prohibitively expensive and disruptive, thereby increasing supplier leverage.

| Supplier Type | Leverage Factors | Impact on Anywhere Real Estate |

|---|---|---|

| Technology Platforms (CRM, Listing Services) | High switching costs, proprietary systems | Increased operational expenses, potential service disruption |

| Real Estate Data Providers | Data uniqueness, concentration of providers | Higher data acquisition costs, reliance on specific vendors |

| Marketing Specialists | Niche expertise, brand recognition | Potential for higher marketing service fees |

| Legal Professionals | Specialized knowledge in real estate transactions | Variable legal service costs depending on market demand |

What is included in the product

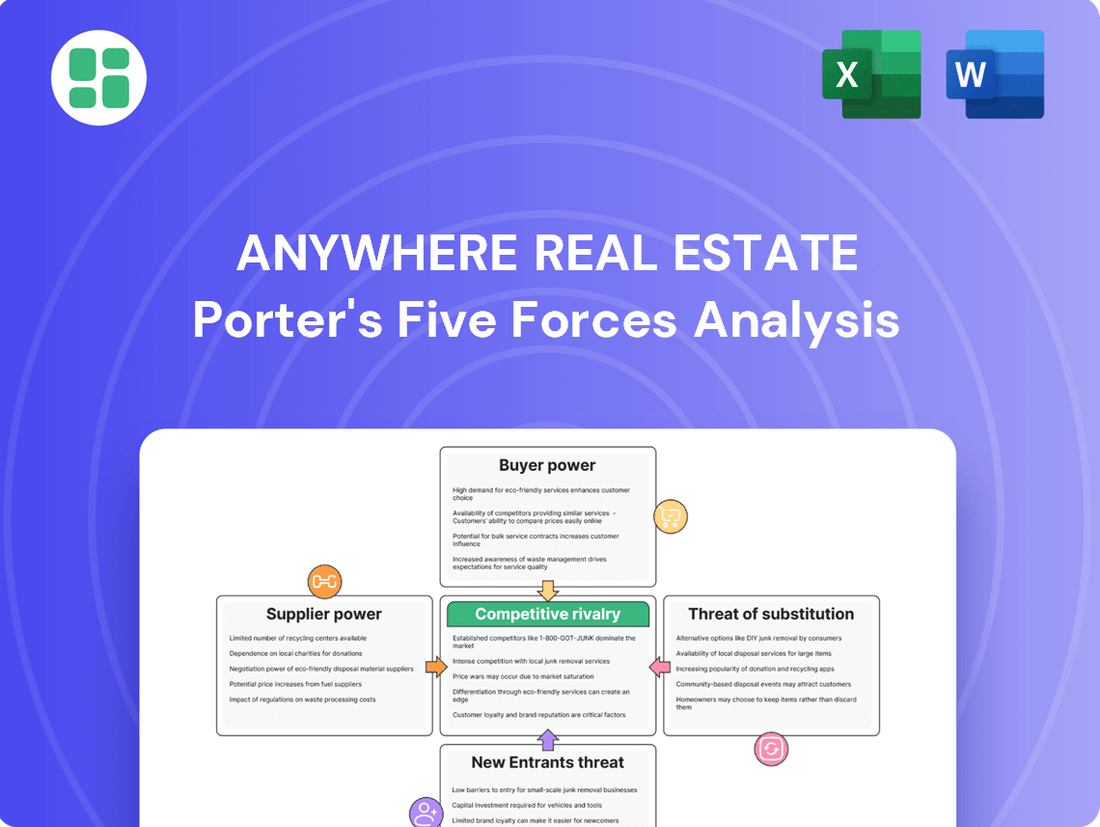

This Porter's Five Forces analysis for Anywhere Real Estate dissects the competitive intensity within the real estate brokerage industry, examining threats from new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the rivalry among existing firms.

Instantly identify and address competitive threats by visualizing the intensity of each of Porter's Five Forces, allowing for targeted strategic adjustments.

Customers Bargaining Power

Homebuyers and sellers, the core customers for Anywhere Real Estate, typically exhibit strong price sensitivity. This is largely due to the substantial financial commitments involved in buying or selling a property, making even small percentage changes impactful.

The real estate market in 2024 and extending into 2025 is characterized by fluctuating interest rates and home prices. This volatility amplifies customer price sensitivity as affordability becomes an even more critical factor in their decision-making process.

Customers considering real estate services have a wide array of alternatives, significantly boosting their bargaining power. These options range from other major national brokerage firms to smaller, local independent agents who may offer more personalized service. In 2024, the online real estate market continued its expansion, with platforms facilitating 'For Sale By Owner' (FSBO) listings and offering reduced commission structures, presenting a direct challenge to traditional brokerages.

The internet has dramatically boosted information transparency for real estate buyers and sellers. Customers can now effortlessly compare property listings, agent performance, and commission rates, shifting power dynamics. This ease of access means clients are better informed and can negotiate terms with greater confidence, diminishing the traditional leverage held by brokerages.

Switching Costs for Customers

For individual homebuyers and sellers, the costs associated with switching real estate agents or brokerages are generally quite low. These costs primarily manifest as time and effort spent researching, interviewing, and onboarding a new agent, rather than significant financial penalties or fees.

This low barrier to switching directly enhances customer bargaining power, allowing them to readily compare offerings and select the agent or brokerage that provides the most favorable terms, services, and perceived value. In 2024, the ease of finding agent reviews and market data online further reduces these switching costs.

- Low Financial Penalties: Customers typically face no substantial fees for changing agents mid-transaction, unlike some other industries.

- Time and Effort as Primary Cost: The main investment is the time required to find and vet new professionals.

- Information Accessibility: Online platforms provide ample data on agent performance and market conditions, facilitating easier comparison and switching.

Concentration of Customers and Their Volume

While the typical individual homebuyer or seller represents a fragmented customer base, Anywhere Real Estate (ARE) does encounter more concentrated customer segments, particularly within its relocation services division. Large corporate clients seeking to move their employees, or substantial franchisee partners, can wield significant bargaining power due to the sheer volume of business they generate. For instance, a major corporation relocating hundreds of employees annually can negotiate more favorable terms than a single family moving across town.

- Concentrated Customer Segments: Large corporate clients for relocation and significant franchisees represent concentrated customer groups for Anywhere Real Estate.

- Volume-Driven Power: The substantial volume of business these larger clients provide grants them increased leverage in negotiations.

- Negotiating Advantage: This concentrated volume allows these clients to potentially secure more favorable pricing and service agreements compared to individual customers.

Customers in the real estate market, particularly individual homebuyers and sellers, possess significant bargaining power due to a high degree of price sensitivity and readily available alternatives. In 2024, the ongoing digital transformation of the real estate sector, exemplified by the growth of online listing platforms and reduced commission models, further empowers consumers by increasing transparency and lowering switching costs. This dynamic environment necessitates that Anywhere Real Estate carefully considers its pricing and service offerings to remain competitive.

| Factor | Impact on Customer Bargaining Power | 2024/2025 Trend/Data |

|---|---|---|

| Price Sensitivity | High | Amplified by fluctuating interest rates and home prices, making affordability a key driver. |

| Availability of Alternatives | High | Expansion of online FSBO platforms and discount brokerages offering lower commission rates. |

| Switching Costs | Low | Primarily time and effort to find new agents; online reviews further reduce this barrier. |

| Information Transparency | High | Easy access to property listings, agent performance, and commission rate comparisons online. |

What You See Is What You Get

Anywhere Real Estate Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis of Anywhere Real Estate, detailing the competitive landscape, including threats of new entrants, bargaining power of buyers and suppliers, and the intensity of rivalry. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy. You can be confident that the insights and structure you see are precisely what will be delivered, offering a thorough understanding of Anywhere Real Estate's strategic position.

Rivalry Among Competitors

The residential real estate arena is incredibly fragmented, featuring a vast array of players. This includes major global and national brands like Compass and eXp Realty, alongside numerous regional companies and smaller, independent brokerages.

This broad and varied competitive field fuels intense rivalry. Companies are constantly striving to capture market share, making it a dynamic environment where differentiation and service are key.

The U.S. housing market has experienced a period of subdued growth, with sales volume projected for a modest rebound in 2025. This slower growth environment naturally fuels more intense competition among real estate firms, as they vie for a greater slice of existing transactions rather than benefiting from an expanding market.

Anywhere Real Estate leverages its diverse portfolio of recognized brands, such as Coldwell Banker and Sotheby's International Realty, to stand out. This multi-brand strategy appeals to a wider customer base, from luxury markets to more mainstream buyers.

The company’s offering extends beyond simple brokerage to include a full spectrum of real estate services. This integration of relocation assistance and title services provides a seamless customer experience, a significant advantage in a fragmented industry.

In 2023, Anywhere Real Estate reported approximately $19.1 billion in revenue, underscoring the scale of its operations and its ability to capture market share through these differentiated offerings.

Exit Barriers

Anywhere Real Estate faces significant competitive rivalry due to high exit barriers. These include substantial investments in office infrastructure and technology, as seen in their ongoing digital transformation efforts aimed at enhancing agent productivity and client experience. Long-term contractual obligations with their vast network of franchisees and agents also tie the company to the market, even when profitability is low.

The specialized nature of the real estate brokerage business itself acts as another impediment to exiting. Firms are often locked into leases, employee contracts, and brand-building investments that are difficult to recoup. This forces companies like Anywhere Real Estate to persevere through market downturns, intensifying competition among remaining players.

- High fixed asset investments: Anywhere Real Estate's extensive network of company-owned brokerages and technology platforms represent significant capital outlays that are not easily liquidated.

- Long-term contractual commitments: Franchise agreements and agent contracts often have multi-year terms, obligating the company to its operational structure.

- Specialized business nature: The core competencies and infrastructure are specific to real estate services, making diversification or a clean exit challenging.

Strategic Stakes and Aggressiveness of Competitors

The competitive landscape for Anywhere Real Estate is marked by intense rivalry, with key players aggressively investing in technology and innovative agent recruitment models, such as revenue-sharing agreements, to capture market share. Consolidation is also a prevalent strategy, further intensifying the competition for market dominance.

Anywhere Real Estate is actively engaged in its own transformation, channeling significant investments into artificial intelligence and digital innovation. This strategic push is crucial for maintaining its competitive edge in a rapidly evolving market. For instance, in 2024, the real estate technology sector saw substantial venture capital funding, with proptech startups raising billions, underscoring the industry's focus on technological advancement.

- Aggressive Investment in Technology: Competitors are pouring resources into AI-driven platforms and digital tools to enhance agent productivity and client experience.

- Innovative Agent Recruitment: Revenue-sharing models and attractive commission structures are being deployed to lure top-performing agents.

- Consolidation Strategies: Mergers and acquisitions are common as companies seek to scale operations and expand their geographical reach.

- Anywhere's Digital Transformation: The company is prioritizing AI and digital innovation to stay ahead of the curve and improve operational efficiency.

The competitive rivalry within the residential real estate sector is exceptionally high due to market fragmentation and the presence of numerous national, regional, and local players. Anywhere Real Estate, with its portfolio of brands like Coldwell Banker and Sotheby's International Realty, navigates this intense landscape by focusing on a comprehensive service offering and digital innovation.

The company's revenue of approximately $19.1 billion in 2023 highlights its significant market presence, yet it competes fiercely with entities like Compass and eXp Realty, which are also investing heavily in technology and agent recruitment models. This dynamic environment is further shaped by high exit barriers, including substantial investments in infrastructure and long-term contractual obligations, which compel firms to remain competitive even during market slowdowns.

In 2024, the real estate technology sector saw billions in venture capital funding, underscoring the industry-wide push for AI and digital advancements. Anywhere Real Estate's commitment to these areas, alongside strategies like multi-brand appeal and integrated services, is crucial for maintaining its edge against competitors employing aggressive recruitment and consolidation tactics.

| Competitor | Approximate 2023 Revenue (USD Billions) | Key Competitive Strategy |

|---|---|---|

| Anywhere Real Estate | 19.1 | Multi-brand portfolio, integrated services, digital transformation |

| Compass | N/A (Private) | Technology platform, agent recruitment |

| eXp Realty | N/A (Private) | Cloud-based model, revenue sharing |

SSubstitutes Threaten

The threat of substitutes for Anywhere Real Estate is significant, particularly from lower-cost alternatives like For Sale By Owner (FSBO) platforms and flat-fee brokerages. These substitutes present a compelling price-performance trade-off for some consumers. For instance, FSBO platforms allow sellers to list properties directly, bypassing traditional agent commissions, which can represent a substantial saving. In 2024, the trend towards DIY solutions in various sectors, including real estate, continued to grow, making these lower-cost options more attractive to budget-conscious sellers.

While FSBO and flat-fee models offer immediate cost advantages, they often come with trade-offs in terms of service breadth and expertise. Consumers opting for these alternatives may need to handle marketing, negotiations, and administrative tasks themselves, which can be time-consuming and complex. Anywhere Real Estate, conversely, leverages its network of agents who provide comprehensive local market knowledge, negotiation skills, and a full suite of services, justifying its higher fee structure for clients prioritizing convenience and expert guidance.

The willingness of homebuyers and sellers to bypass traditional agents is a key factor in the threat of substitutes for Anywhere Real Estate. This willingness is influenced by a buyer's comfort with technology, their perception of the value provided by agents, and prevailing market conditions. For instance, in a tougher market where costs are higher, consumers may be more open to exploring alternative, potentially lower-cost options.

In 2024, the real estate market saw shifts that could impact this propensity. While specific data on agent bypass rates is proprietary, industry trends suggest that digital platforms continued to gain traction. For example, online listing services and iBuying platforms, while facing their own challenges, offer alternatives that some consumers might find appealing, especially if they perceive traditional agent fees as too high relative to the services rendered.

The threat of substitutes for traditional real estate brokerage services is growing significantly due to technological advancements. Proptech companies are introducing innovative models like iBuying, exemplified by firms such as Opendoor and Offerpad, which allow homeowners to sell directly to the company, bypassing agents entirely. These platforms streamline the selling process, offering speed and convenience that directly compete with traditional methods.

Furthermore, sophisticated online listing platforms and AI-driven tools are empowering consumers to conduct their own market analysis and even generate leads independently. This diminishes the perceived necessity of relying on a traditional real estate agent for crucial information and initial property searches. For instance, in 2023, iBuyer transactions represented a notable portion of the overall market, indicating consumer acceptance of these alternative channels.

Indirect Substitutes (e.g., rental market)

A robust rental market can significantly act as an indirect substitute for homeownership, particularly when the economic climate makes purchasing less attractive. For instance, in 2024, persistently high mortgage interest rates coupled with elevated home prices in many regions pushed potential buyers towards renting, thereby dampening demand for residential real estate brokerage and related services. This shift directly impacts companies like Anywhere Real Estate by reducing the overall volume of home sales transactions they can facilitate.

The strength of the rental market as a substitute is often amplified by factors that challenge affordability. When the cost of buying a home, including down payments, mortgage payments, property taxes, and insurance, becomes disproportionately high compared to monthly rental costs, consumers naturally gravitate towards renting. This dynamic can lead to a noticeable slowdown in the traditional home-buying process, a core revenue driver for many real estate service providers.

- Rental Market Strength: High interest rates and home prices in 2024 made renting a more appealing alternative to buying for many consumers.

- Transaction Volume Impact: This preference for renting directly reduces the number of residential property sales, affecting real estate service providers.

- Affordability as a Driver: When the total cost of homeownership significantly exceeds rental expenses, the rental market becomes a more potent substitute.

Regulatory or Legal Changes Impacting Substitutes

Potential regulatory shifts, such as those affecting traditional agent commission structures, could significantly alter the competitive landscape for Anywhere Real Estate. For instance, if regulations mandate lower commission rates, this could make alternative, lower-cost transaction models more appealing to consumers, thereby increasing the threat of substitutes.

These regulatory changes might directly impact the cost-effectiveness of substitute services, potentially driving consumer behavior towards online platforms or direct-to-consumer sales models. In 2024, discussions around commission reform, particularly in markets like the United States, have intensified, with potential implications for how real estate transactions are priced and facilitated.

- Regulatory Scrutiny: Increased government oversight on commission splits and fee structures could favor disintermediation.

- Impact on Alternatives: Changes could make tech-enabled platforms or flat-fee services more competitive.

- Consumer Behavior Shift: Lower costs associated with substitutes, driven by regulation, may accelerate adoption.

- Market Adjustments: Anywhere Real Estate may need to adapt its service offerings to remain competitive against more cost-efficient alternatives.

The threat of substitutes for Anywhere Real Estate remains a significant concern, particularly from lower-cost alternatives like For Sale By Owner (FSBO) platforms and flat-fee brokerages. These substitutes offer a compelling price-performance trade-off for many consumers, especially in 2024, where budget-consciousness is heightened. For instance, FSBO platforms allow sellers to list properties directly, bypassing traditional agent commissions, which can represent substantial savings. This DIY trend in real estate continued to grow in 2024, making these lower-cost options more attractive.

While FSBO and flat-fee models offer immediate cost advantages, they often come with trade-offs in service breadth and expertise. Consumers opting for these alternatives may need to handle marketing, negotiations, and administrative tasks themselves. Anywhere Real Estate, conversely, leverages its network of agents who provide comprehensive local market knowledge, negotiation skills, and a full suite of services, justifying its higher fee structure for clients prioritizing convenience and expert guidance.

The rental market also acts as a significant indirect substitute for homeownership, especially when economic conditions make purchasing less attractive. In 2024, persistently high mortgage interest rates and elevated home prices in many regions pushed potential buyers towards renting, directly impacting Anywhere Real Estate by reducing the volume of home sales transactions. When the total cost of homeownership significantly exceeds rental expenses, the rental market becomes a more potent substitute.

| Substitute Type | Key Features | Consumer Appeal | Impact on Anywhere Real Estate |

| FSBO Platforms | Direct listing, lower upfront costs | Cost savings, control | Reduced commission revenue, loss of exclusive listings |

| Flat-Fee Brokerages | Limited service package, fixed fee | Predictable costs, basic transaction support | Competition on price, potential for commoditization of services |

| Rental Market | Flexibility, lower initial investment | Affordability, reduced commitment | Lowered demand for home purchases, reduced transaction volume |

| iBuying Services | Speed, convenience, certainty | Quick sale, reduced hassle | Direct competition for sellers, bypassing traditional agent model |

Entrants Threaten

Launching a national or global residential real estate brokerage, akin to Anywhere Real Estate, demands immense capital. Think millions for robust technology platforms, extensive agent networks, and widespread brand recognition, a significant barrier for newcomers.

Existing giants like Anywhere Real Estate leverage economies of scale, reducing per-transaction costs in areas like marketing and operational overhead. This cost advantage makes it incredibly challenging for new entrants to achieve price competitiveness.

In 2023, the U.S. residential real estate market saw over 6 million home sales. New entrants would need to capture a significant share of this vast market to overcome the established players' scale advantages and brand loyalty.

Anywhere Real Estate benefits from deeply ingrained brand loyalty across its diverse portfolio of real estate brands. This loyalty, cultivated over decades, translates into significant consumer trust, making it challenging for new entrants to attract and retain customers.

Newcomers must overcome the hurdle of establishing extensive agent networks and building comparable customer relationships. For instance, in 2023, Anywhere Real Estate's affiliated agents facilitated over 1.1 million transactions, highlighting the scale of existing relationships that new firms must replicate.

A significant hurdle for new real estate entrants is gaining access to established distribution channels and agent networks. Anywhere Real Estate benefits from a substantial existing network, boasting around 179,200 independent sales agents across the U.S. as of their last reported figures. This extensive reach is a formidable barrier to entry.

New competitors face the daunting task of either poaching agents from established players like Anywhere Real Estate or painstakingly building their own networks from scratch. Both strategies demand considerable time, financial investment, and strategic effort to replicate the deep-rooted relationships and market penetration that incumbents already enjoy.

Regulatory and Licensing Hurdles

The real estate sector faces substantial regulatory and licensing barriers, significantly deterring new entrants. For instance, in 2024, virtually all U.S. states mandate specific licensing for real estate agents and brokers, requiring education, exams, and ongoing continuing education credits. This intricate web of compliance, including adherence to fair housing laws and local zoning ordinances, demands considerable investment in time and resources, acting as a formidable entry hurdle.

These regulatory complexities create a steep learning curve and financial commitment for aspiring businesses. For example, obtaining a broker’s license often involves years of experience as an agent and passing rigorous state-specific examinations. The cost associated with initial licensing, annual renewals, and staying abreast of evolving legal frameworks can easily amount to thousands of dollars, presenting a tangible obstacle for smaller or less capitalized new firms aiming to enter the market.

- Licensing Requirements: Most U.S. states require real estate agents and brokers to hold licenses, involving education and exams.

- Compliance Costs: Adhering to fair housing laws, zoning regulations, and other real estate statutes incurs significant operational expenses.

- Time Investment: Gaining the necessary experience and completing educational requirements for licensing can take several years.

- Market Entry Barriers: These hurdles collectively increase the difficulty and cost for new companies to establish a presence in the real estate industry.

Expected Retaliation from Existing Players

Established players within the real estate sector, such as Anywhere Real Estate Inc., are poised to react strongly to new entrants. This retaliation often manifests as aggressive pricing strategies, amplified marketing campaigns to retain market share, or even strategic acquisitions to neutralize emerging competition. Anywhere Real Estate's commitment to its 'Reimagine 25' initiative, coupled with significant investments in artificial intelligence, underscores its proactive approach to fending off potential market disruptions and maintaining its competitive edge.

The threat of retaliation from existing firms like Anywhere Real Estate is a significant barrier for newcomers. For instance, Anywhere Real Estate reported total revenue of $1.5 billion in the first quarter of 2024, indicating the substantial resources available for defensive maneuvers. Their ongoing 'Reimagine 25' strategy aims to streamline operations and enhance customer experience, making it harder for new, less capitalized entrants to gain traction.

- Aggressive Pricing: Established firms can lower prices to make it unprofitable for new entrants.

- Enhanced Marketing: Increased advertising spend can drown out new competitors' messages.

- Strategic Acquisitions: Companies like Anywhere Real Estate may acquire promising startups to absorb them or gain their technology.

- Investment in Innovation: Anywhere Real Estate's focus on AI can create a technological moat, deterring rivals.

The threat of new entrants into the residential real estate brokerage market, particularly against established players like Anywhere Real Estate, is significantly mitigated by substantial capital requirements. Launching a national brokerage demands millions for technology, agent networks, and brand building, creating a formidable financial barrier.

Economies of scale enjoyed by incumbents like Anywhere Real Estate, which processed over 1.1 million transactions in 2023 through its affiliated agents, translate into lower per-transaction costs. This cost advantage makes it exceedingly difficult for new firms to compete on price against a company with approximately 179,200 independent sales agents in the U.S.

Regulatory and licensing hurdles, such as state-specific agent and broker licensing requirements in 2024, add further complexity and cost. These compliance demands, including adherence to fair housing laws, necessitate significant time and financial investment, acting as a substantial deterrent to market entry.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Anywhere Real Estate is built upon a foundation of publicly available financial reports, including annual and quarterly filings, alongside industry-specific market research from reputable firms like NAR and Zillow Research.

We also incorporate data from economic indicators, government housing statistics, and news articles detailing competitor strategies and market trends to provide a comprehensive view of the competitive landscape.