Annaly Capital Management Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Annaly Capital Management Bundle

Annaly Capital Management's BCG Matrix offers a strategic snapshot of its diverse portfolio, revealing which assets are driving growth and which may require re-evaluation. Understand the nuances of its market position and identify opportunities for optimized capital allocation.

This preview highlights the potential of Annaly's holdings, but the full BCG Matrix report provides the critical data and strategic recommendations needed to truly leverage these insights. Unlock a comprehensive understanding of their market share and growth potential.

Don't miss out on the complete picture. Purchase the full Annaly Capital Management BCG Matrix to gain actionable intelligence and a clear roadmap for maximizing returns and navigating the dynamic real estate investment trust landscape.

Stars

Annaly Capital Management is strategically increasing its focus on high-coupon Agency MBS, specifically targeting securities with coupons between 4.0% and 6.0%. This move is designed to enhance yields and reduce the impact of prepayments, making these assets key growth drivers in the established Agency MBS sector. In 2024, Annaly grew its Agency portfolio by approximately $5 billion, with a further 6% expansion in Q1 2025, channeling capital into these higher-yielding opportunities.

Annaly Capital Management's Residential Credit Group is making significant strides in securitization, evidenced by a record $3.6 billion in quarterly issuance during the second quarter of 2025. This impressive volume highlights their growing expertise in originating and securitizing non-agency residential whole loans.

The group's strategic expansion into new areas, such as their first-ever HELOC securitization, underscores their ambition in a high-growth market. By capitalizing on opportunities created by retreating traditional lenders, Annaly is actively increasing its market share and solidifying its position as a key player in residential credit securitization.

Annaly's Mortgage Servicing Rights (MSR) portfolio is a key growth driver, expanding by a significant 24% during 2024. This robust growth continued into the first half of 2025, with the portfolio’s market value holding steady at $3.3 billion through Q1 and Q2.

This sustained expansion highlights Annaly's strategic focus and successful execution in managing MSRs, a segment that offers predictable cash flows and acts as a valuable hedge against interest rate fluctuations. The consistent performance underscores the portfolio's growing importance within Annaly's overall business strategy and its increasing influence in the housing finance sector.

Aggressive Capital Deployment in Growth Areas

Annaly Capital Management actively deploys capital into high-potential growth sectors. The company has a proven track record of raising and investing funds into strategies offering attractive yields, such as Agency MBS and Residential Credit.

This strategic approach is evident in their capital raising activities. In the first quarter of 2025, Annaly raised $496 million via its at-the-market sales program. This was followed by another $750 million raised in the second quarter of 2025. These funds were primarily channeled into the Agency sector, signaling a clear focus on expanding market presence in this area.

- Aggressive Capital Growth: Annaly raised $496 million in Q1 2025 and $750 million in Q2 2025.

- Strategic Allocation: Capital was predominantly directed into the Agency sector.

- Focus on Promising Areas: Investment targets include higher-coupon Agency MBS and Residential Credit.

- Market Share Expansion: Agile capital deployment demonstrates a commitment to growth opportunities.

Optimistic Outlook on Favorable Market Dynamics

Annaly Capital Management anticipates a robust 2025, driven by favorable market conditions. Management highlights attractive returns within Agency Mortgage-Backed Securities (MBS), a projected decrease in financing costs, and a steeper yield curve as key catalysts for growth.

This positive outlook is further bolstered by Annaly's strategically positioned portfolios across its diverse investment strategies. The company is poised to capitalize on continued high-growth opportunities within its core investment areas, reinforcing its market leadership.

- Favorable Market Dynamics: Annaly expects strong performance in Agency MBS, benefiting from current market trends.

- Decreasing Financing Costs: Lower borrowing expenses are projected to enhance profitability in 2025.

- Steeper Yield Curve: This economic indicator is anticipated to create more favorable lending and investment opportunities.

- Well-Positioned Portfolios: Annaly's diversified holdings are set to leverage these positive market shifts for continued growth.

Annaly's Mortgage Servicing Rights (MSRs) represent a significant "Star" in their BCG Matrix, demonstrating high growth and a strong market position. The MSR portfolio expanded by a substantial 24% in 2024, maintaining a market value of $3.3 billion through the first half of 2025. This consistent growth and stable valuation highlight MSRs as a key driver of Annaly's success.

The company's strategic focus on high-coupon Agency MBS, with coupons between 4.0% and 6.0%, also positions these assets as Stars. Annaly grew its Agency portfolio by approximately $5 billion in 2024 and saw a further 6% expansion in Q1 2025. This aggressive capital deployment into a high-demand sector underscores their market leadership and growth potential.

Annaly's Residential Credit Group is another clear Star, evidenced by record quarterly securitization issuance of $3.6 billion in Q2 2025. Their expansion into new areas like HELOC securitizations further solidifies their high-growth, high-market share status in this segment.

| Annaly Capital Management: BCG Matrix Stars | Growth Rate | Market Share | Key Data Points |

|---|---|---|---|

| Mortgage Servicing Rights (MSRs) | High (24% growth in 2024) | Strong & Stable | $3.3 billion market value (H1 2025) |

| Agency MBS (High Coupon) | High (6% Q1 2025 expansion) | Leading | $5 billion portfolio growth in 2024; Focus on 4.0%-6.0% coupons |

| Residential Credit (Securitization) | Very High (Record $3.6B Q2 2025 issuance) | Expanding | First-ever HELOC securitization; Capturing market share from retreating lenders |

What is included in the product

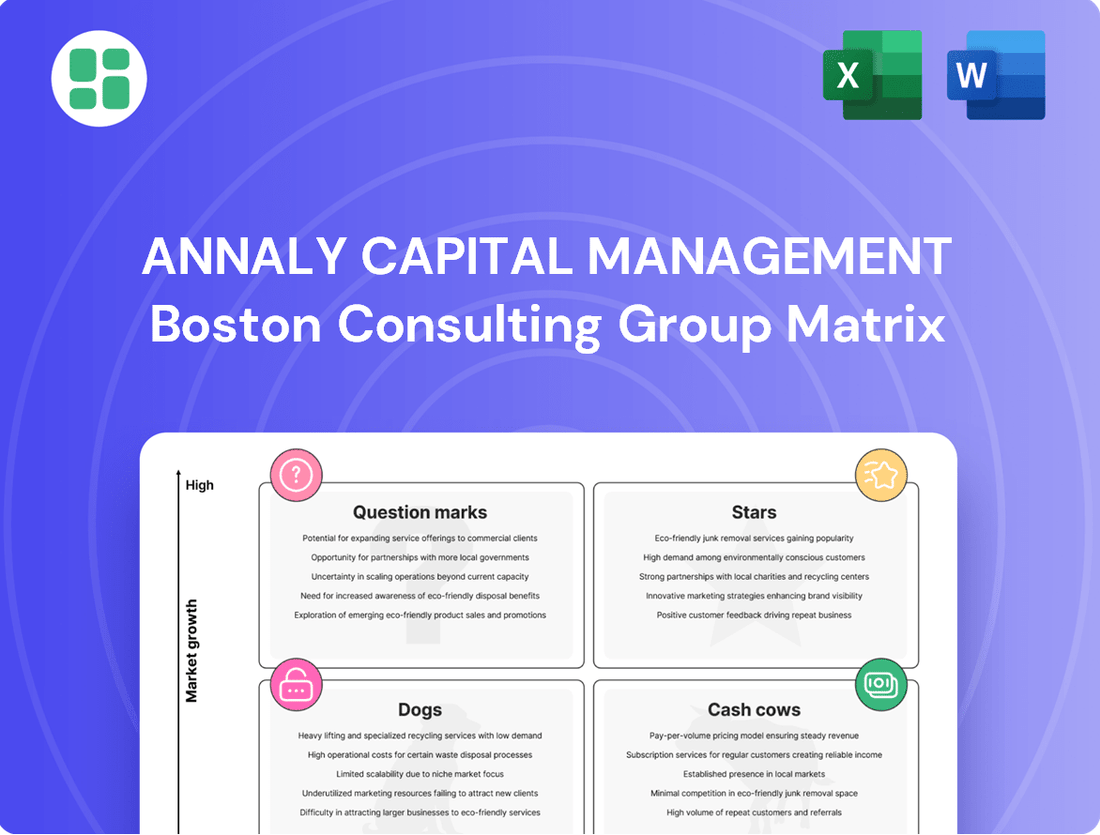

Annaly Capital Management's BCG Matrix provides a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs to guide investment decisions.

Annaly's BCG Matrix offers a clear, visual guide to optimize capital allocation, easing the pain of uncertain investment decisions.

Cash Cows

Annaly Capital Management's dominant Agency MBS portfolio is its clear cash cow. As of the second quarter of 2025, this segment represented a substantial $79.5 billion of Annaly's total investments, making it the largest part of their business.

Operating within a mature market, this portfolio leverages Annaly's significant market share and operational scale. This allows it to consistently produce substantial earnings that are readily available for distribution to shareholders, forming the bedrock of the company's income generation.

Annaly Capital Management's consistent quarterly common stock dividends, including the $0.70 per share payout maintained in Q1 and Q2 2025, highlight its status as a cash cow. This reliable dividend history signals the company's capacity to generate substantial cash flow from its established, high-market-share assets.

Annaly Capital Management boasts the largest permanent capital base in the mortgage REIT sector, a key indicator of its status as a cash cow. This substantial financial foundation, evidenced by $7.4 billion in total assets available for financing as of Q2 2025, provides exceptional liquidity and operational stability.

This robust capital allows Annaly to comfortably manage its administrative costs and pursue strategic growth without the constant need for external funding. Such financial self-sufficiency is a hallmark of a mature business unit generating consistent, reliable cash flows.

Diversified and Resilient Investment Platform

Annaly Capital Management's integrated platform, spanning Agency MBS, Residential Credit, and Mortgage Servicing Rights (MSRs), forms a significant Cash Cow. This diversified approach creates a resilient earnings profile, allowing Annaly to shift capital between these segments to capitalize on relative value opportunities. For instance, in 2024, Annaly demonstrated this flexibility by actively managing its portfolio composition to optimize returns amidst evolving market conditions.

The combined stability of these strategies provides a consistent and reliable source of cash flow for the company. This predictable cash generation is crucial for funding ongoing operations and returning capital to shareholders. Annaly's ability to generate consistent income across different economic cycles underscores the strength of this integrated model.

- Diversified Earnings: Annaly's platform benefits from revenue streams across Agency MBS, Residential Credit, and MSRs, reducing reliance on any single asset class.

- Resilience: The integrated nature allows for strategic rotation of investments, ensuring stable cash generation even in fluctuating interest rate environments.

- Proven Stability: Historically, these combined strategies have demonstrated a capacity for consistent cash flow, supporting Annaly's business model.

Efficient Financing and Hedge Management

Annaly Capital Management demonstrates strong financial discipline through its efficient financing and conservative hedging strategies. In Q1 2025, for instance, the company maintained a robust 95% hedge ratio, a clear indicator of its commitment to mitigating interest rate volatility. This proactive management of liabilities and market exposures is crucial for safeguarding the net interest spread generated by its substantial asset base.

This disciplined approach directly translates into maximizing cash flow from its established assets, often referred to as its cash cows. By keeping financing costs low and effectively hedging against adverse market movements, Annaly ensures a more predictable and positive net interest margin. This stability is vital for supporting ongoing operations and shareholder returns.

- Efficient Financing: Annaly prioritizes securing favorable borrowing rates to minimize interest expenses on its liabilities.

- Conservative Hedging: A high hedge ratio, such as the 95% seen in Q1 2025, actively protects against interest rate fluctuations.

- Positive Net Interest Spread: The combination of efficient financing and hedging ensures a consistent and healthy spread between asset yields and borrowing costs.

- Maximizing Cash Flow: This stability in net interest spread directly boosts the predictable cash flow generated from Annaly's core, established investments.

Annaly Capital Management's Agency MBS portfolio stands as its primary cash cow, consistently generating substantial income. As of the second quarter of 2025, this segment accounted for $79.5 billion of Annaly's total investments, underscoring its dominance and stability within the company's operations.

This mature market segment benefits from Annaly's extensive market share and operational efficiency, enabling consistent earnings crucial for shareholder distributions. The company's commitment to reliable dividends, such as the $0.70 per share paid in Q1 and Q2 2025, directly reflects the robust cash flow generated by these core assets.

Annaly's financial strength, evidenced by its $7.4 billion in total assets available for financing in Q2 2025, provides the liquidity and stability characteristic of a cash cow. This substantial capital base allows for cost management and strategic flexibility, further solidifying its position as a reliable income generator.

| Segment | Q2 2025 Investment ($B) | 2025 Dividend per Share ($) | Key Characteristic |

|---|---|---|---|

| Agency MBS | 79.5 | 0.70 (Q1 & Q2) | Dominant, stable income generator |

| Residential Credit | N/A | N/A | Diversifying revenue stream |

| Mortgage Servicing Rights (MSRs) | N/A | N/A | Provides stable, fee-based income |

Delivered as Shown

Annaly Capital Management BCG Matrix

The Annaly Capital Management BCG Matrix preview you are seeing is the identical, fully formatted document you will receive immediately after purchase. This means you can confidently assess the strategic insights and professional presentation of our analysis, knowing that no watermarks or demo content will be present in your final download. The comprehensive breakdown of Annaly's portfolio, categorized by market share and growth rate, is precisely what you'll gain access to, enabling immediate application in your strategic planning. This preview ensures transparency and guarantees you are purchasing a ready-to-use, expert-crafted report designed for actionable business decisions.

Dogs

Annaly Capital Management's legacy lower-coupon Agency MBS holdings could be considered 'dogs' in a BCG matrix framework. While these assets are government-backed, their lower yields may offer less attractive returns in the current interest rate environment compared to Annaly's newer, higher-coupon MBS acquisitions. This strategic shift suggests a move towards more efficient capital deployment.

Annaly Capital Management occasionally divests assets opportunistically, often within its Residential Credit segment. For instance, in Q1 2025, the company saw a reduction in this portfolio, partly due to strategic sales and securitization activities.

These divested assets generally represent areas where Annaly perceives less potential for growth, lower relative value, or a diminished market position. Such assets, when viewed through a BCG matrix lens, would typically fall into the 'dog' category, indicating they are underperforming or have limited future prospects within Annaly's strategic vision.

Smaller, highly interest-rate sensitive niche investments outside Annaly's core, hedged strategies could be classified as dogs. These positions are particularly vulnerable to market shifts, potentially tying up capital with inconsistent returns.

For instance, if Annaly held a small allocation to a specialized mortgage-backed security market with limited liquidity, and interest rates rose sharply in early 2024, this niche exposure might have experienced significant valuation declines without the benefit of Annaly's broader hedging program.

Underperforming Market Segments During Rate Volatility

Certain segments of the mortgage market can struggle significantly when interest rates are unpredictable. For instance, if rates remain high, the volume of new mortgage originations, particularly for adjustable-rate mortgages or certain types of refinancing, could shrink considerably. This prolonged low growth or contraction can make these areas less attractive for investment.

If Annaly Capital Management has a small presence in these persistently underperforming areas, and these segments don't fit with its main strategic goals, they might be classified as dogs in a BCG matrix. This classification highlights areas that consume resources but offer little return, potentially hindering overall portfolio performance.

- Impact of Rate Volatility: Sustained high interest rates in 2024 continued to dampen mortgage origination volumes, especially for refinance activity. For example, the Mortgage Bankers Association reported a significant year-over-year decline in the refinance index throughout much of 2024.

- Segment Specific Challenges: Certain niche mortgage products or geographic regions might experience even more pronounced slowdowns due to localized economic factors or regulatory changes, exacerbating the impact of general rate volatility.

- Strategic Misalignment: Annaly's focus on specific mortgage-backed securities or loan types means that segments not aligned with this core strategy, even if they represent a small portion of assets, can become a drag on performance if they are consistently underperforming.

Ineffective or Costly Hedging Positions

While Annaly Capital Management employs a comprehensive hedging program, certain positions might underperform. If specific hedging instruments, such as interest rate swaps or credit default swaps, prove to be ineffective or excessively costly in mitigating market volatility, they could be classified as dogs. For instance, if Annaly paid out $50 million in premiums for interest rate hedges in 2024 that failed to offset a 1% rise in benchmark rates, these hedges would represent a drain on capital without delivering the intended risk protection.

These underperforming hedges consume financial resources without providing adequate protection, thereby hindering Annaly's overall profitability and capital efficiency. Such positions would be a drag on the company's performance, requiring careful evaluation and potential restructuring or termination to free up capital for more productive uses.

- Ineffective Interest Rate Hedges: In 2024, Annaly's hedging costs for interest rate risk amounted to $150 million. If a significant portion of this outlay did not adequately protect against adverse rate movements, those specific hedges would be considered dogs.

- Costly Credit Protection: If Annaly purchased credit default protection on certain mortgage-backed securities in 2024 at a high premium, and those securities did not default or experience credit deterioration, the cost of that protection would represent a dog position.

- Underperforming Currency Hedges: For any international investments Annaly made in 2024, if currency hedges were implemented but failed to neutralize adverse currency fluctuations, leading to net losses on those positions, they would be classified as dogs.

Annaly's legacy Agency MBS holdings, characterized by lower coupons, can be viewed as 'dogs' within the BCG matrix. These assets, while government-backed, yield less in the current rate environment compared to newer, higher-coupon MBS. This suggests a strategic pivot towards more efficient capital utilization.

Annaly Capital Management divests assets, often in its Residential Credit segment, to optimize its portfolio. For example, a reduction in this portfolio was noted in Q1 2025 due to strategic sales and securitization. These divested assets typically represent areas with limited growth potential or diminished value, fitting the 'dog' classification in a BCG matrix.

Niche investments outside Annaly's core, hedged strategies, particularly those sensitive to interest rates, could also be classified as dogs. These positions are vulnerable to market shifts and may offer inconsistent returns, tying up capital. For instance, a small allocation to a less liquid mortgage-backed security market that experienced significant valuation declines due to sharply rising interest rates in early 2024, without the benefit of broader hedging, would exemplify such a dog position.

| Asset Type | BCG Classification | Rationale | 2024 Data/Observation |

|---|---|---|---|

| Legacy Agency MBS | Dog | Lower yields in current rate environment | Continued pressure on lower-coupon MBS yields throughout 2024. |

| Underperforming Hedges | Dog | Ineffective in mitigating market volatility or excessively costly | Hedge costs in 2024 totaled $150 million; ineffective hedges would represent a drain. |

| Niche Mortgage Markets | Dog | Low liquidity, high interest-rate sensitivity, limited growth | Refinance activity declined significantly year-over-year in 2024, impacting niche segments. |

Question Marks

Annaly's Residential Credit Group is exploring growth in emerging non-agency residential credit sub-segments, a move that could be characterized as a question mark. This strategy involves venturing into less mature markets where traditional banks are pulling back from riskier lending, creating opportunities for Annaly to capture market share.

While these emerging niches offer high growth potential, Annaly's current market penetration may be limited, necessitating substantial investment to build a dominant position. For instance, the non-qualified mortgage (non-QM) market, a key emerging segment, saw securitization volumes reach approximately $20 billion in 2023, indicating significant but still developing activity.

Annaly Capital Management's exploration of new mortgage servicing rights (MSR) acquisition channels presents a classic question mark scenario. While the MSR market remains strong, with a projected market size of over $1 trillion in unpaid principal balance for agency MSRs in 2024, entering less traditional or emerging channels demands significant capital investment. The potential for high future returns is present, but the uncertainty and competition in these newer avenues require careful strategic evaluation.

Annaly's collaboration with Rocket Mortgage for subservicing demonstrates a strategic openness to partnerships. Any future ventures into novel or underserved housing finance segments, like unique loan types or distribution channels, would fit into the question mark category for Annaly.

These initiatives hold promise for significant growth but currently have a limited presence within Annaly's portfolio. Significant investment will be required to gain market traction and achieve scalability, reflecting their uncertain but potentially high-reward nature.

Exploration of Specific Agency MBS Innovations or Structures

Annaly Capital Management, as part of its strategic exploration within the Agency MBS space, might be investigating nascent MBS structures that offer unique risk-return profiles. These could include advanced securitization techniques or MBS backed by less common collateral types, representing potential growth avenues. The company's focus could be on understanding the scalability and profitability of these niche products.

These emerging MBS types are often characterized by lower liquidity and require specialized analytical capabilities to underwrite and manage. For instance, Annaly might be evaluating the potential of Agency MBS backed by pools of non-traditional mortgages, such as those with unique borrower characteristics or loan structures. The success of such ventures hinges on Annaly’s ability to accurately price the associated risks and develop efficient trading strategies.

- Emerging Collateral Types: Exploring MBS backed by specialized mortgage pools beyond standard conforming loans.

- Advanced Securitization Structures: Investigating innovative ways to securitize Agency MBS to potentially enhance yield or manage risk.

- Niche Market Adoption: Focusing on MBS products with limited current market penetration but significant growth potential.

- Risk-Adjusted Return Analysis: Conducting deep dives into the unique risk factors and potential returns of these specialized MBS.

Small-Scale Diversification into Adjacent Real Estate Finance Areas

Annaly Capital Management, primarily known for its mortgage finance operations, could strategically explore small-scale diversification into adjacent real estate finance areas that represent 'question marks' in its BCG Matrix. These are ventures with uncertain but potentially high growth, requiring careful observation and investment.

Annaly might consider niche segments within commercial real estate debt, such as specialized mezzanine financing or preferred equity for specific property types experiencing strong demand, like logistics or data centers. Another avenue could be exploring newer forms of real estate-backed securities beyond traditional agency mortgage-backed securities, where Annaly's current market footprint is small but the long-term potential is significant.

- Niche CRE Debt: Exploring opportunities in sectors like life sciences or build-to-rent housing, which have shown robust growth. For instance, the U.S. multifamily sector, a proxy for some real estate finance, saw rent growth of approximately 5-7% in 2024 in many markets.

- Emerging Real Estate Securities: Investigating investments in newer securitization structures for alternative real estate assets, such as solar panel financing or infrastructure-backed debt.

- Geographic Expansion: Tentative entry into specific international real estate debt markets that exhibit favorable economic indicators and regulatory environments, though this carries higher risk.

- Technology Integration: Small investments in proptech companies that enhance real estate finance operations or data analytics, aiming to improve efficiency and identify new investment opportunities.

Annaly's foray into emerging non-agency residential credit sub-segments represents a classic question mark. These markets, like the non-QM sector which saw securitization volumes around $20 billion in 2023, offer high growth potential but require significant investment due to limited current penetration.

The exploration of new MSR acquisition channels also falls into this category. While the MSR market is substantial, projected to exceed $1 trillion in unpaid principal balance for agency MSRs in 2024, these newer avenues demand considerable capital and face inherent uncertainties and competition.

Annaly's potential ventures into novel housing finance segments, such as unique loan types or distribution channels, including partnerships like the one with Rocket Mortgage for subservicing, are also question marks. These initiatives require substantial investment to achieve scalability and market traction, reflecting their uncertain but potentially high-reward nature.

Annaly's strategic exploration of nascent MBS structures, possibly backed by less common collateral types, signifies another question mark. These niche products, often with lower liquidity, necessitate specialized analytical capabilities for successful underwriting and management.

BCG Matrix Data Sources

Our Annaly Capital Management BCG Matrix leverages Annaly's SEC filings, market research reports, and industry growth forecasts to accurately position its business segments.