Anker Innovations Technology Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Anker Innovations Technology Bundle

Anker Innovations Technology navigates a dynamic landscape shaped by intense competition and evolving consumer demands. Understanding the interplay of buyer power, supplier leverage, and the threat of substitutes is crucial for sustained success. This brief overview hints at the complexities Anker faces.

The complete report reveals the real forces shaping Anker Innovations Technology’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Anker Innovations, operating in the dynamic consumer electronics market, faces potential supplier concentration risks. The company's reliance on specialized components like semiconductors and advanced battery technologies means a few dominant suppliers could wield significant power. For instance, the global semiconductor market, critical for Anker's products, saw major players like TSMC continue to dominate in 2024, with their advanced node capacity being a key bottleneck.

This concentration can translate into higher input costs or supply disruptions if these key suppliers prioritize other customers. Anker's strategic imperative is to build a resilient supply chain by diversifying its sourcing for critical components. This diversification strategy helps mitigate the bargaining power of any single supplier, ensuring more stable production and pricing for Anker's diverse product portfolio.

The cost and complexity Anker Innovations faces when switching suppliers significantly impact supplier power. If Anker utilizes highly customized components or relies on proprietary technology, the expenses related to retooling manufacturing lines, redesigning products, and requalifying new vendors can be considerable. This increases the leverage suppliers hold over Anker.

Anker's commitment to supplier lifecycle management, as highlighted in their sustainability reports, suggests established processes. However, for components deeply integrated into their product ecosystem, the practical challenges and costs of transitioning to alternative suppliers remain a key consideration, bolstering supplier bargaining power.

The uniqueness of components significantly impacts supplier bargaining power for Anker Innovations. When suppliers offer patented or highly differentiated inputs crucial for Anker's product performance, their leverage increases. For example, Anker's use of advanced Gallium Nitride (GaN) technology in its power adapters, sourced from a select group of specialized manufacturers, grants these suppliers considerable influence due to the limited availability of such cutting-edge materials.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into Anker's market, meaning they start producing consumer electronics themselves, could significantly boost their bargaining power. This would allow them to capture more of the value chain.

While component suppliers might not typically compete across Anker's entire product range, some could potentially launch their own branded finished goods in specific, high-demand niches. For instance, a supplier of advanced battery technology might explore offering their own power banks.

However, Anker's established brand strength and extensive global distribution channels act as a substantial deterrent to such forward integration. In 2024, Anker reported a robust revenue of over $1.9 billion, showcasing their significant market presence.

- Forward Integration Threat: Suppliers entering Anker's consumer electronics market would increase their bargaining power.

- Niche Market Entry: Component suppliers might launch branded finished goods in specific product areas.

- Anker's Mitigation: Strong brand recognition and a global distribution network reduce this supplier threat.

Importance of Anker to Suppliers

The significance of Anker Innovations Technology to its suppliers plays a crucial role in determining bargaining power. Anker's substantial order volumes can make it a key client, especially for smaller, specialized component manufacturers. For instance, if a supplier's revenue is heavily reliant on Anker, they have less room to dictate terms.

Conversely, for larger, more diversified suppliers, Anker's business might represent a smaller fraction of their overall sales. This can shift the power balance, giving those larger suppliers more leverage in negotiations. Anker's impressive scale, with revenues in the billions, means it is likely a highly sought-after customer for many in its supply chain.

- Anker's order size relative to a supplier's total revenue is a key factor.

- For specialized suppliers, Anker can represent a significant portion of their business, increasing Anker's leverage.

- For large, diversified suppliers, Anker's contribution might be smaller, reducing Anker's influence.

- Anker's substantial revenue base makes it an important client for many suppliers.

The bargaining power of suppliers for Anker Innovations is influenced by the concentration of suppliers for critical components. In 2024, the semiconductor industry, vital for Anker's products, remained dominated by a few key players, such as TSMC, limiting Anker's options and potentially increasing supplier leverage.

High switching costs for Anker, particularly when using customized or proprietary components, further empower suppliers. The expense of redesigning products and requalifying new vendors means Anker may be locked into existing supplier relationships, giving those suppliers more influence over pricing and terms.

The uniqueness of components, like advanced Gallium Nitride (GaN) technology used in Anker's power adapters, grants significant power to the limited number of specialized manufacturers providing them. This exclusivity makes it harder for Anker to negotiate favorable terms.

Anker's substantial revenue, exceeding $1.9 billion in 2024, makes it a valuable customer for many suppliers. However, for highly diversified suppliers, Anker's business may represent a smaller portion of their total sales, potentially reducing Anker's leverage in negotiations.

| Factor | Impact on Supplier Bargaining Power | Anker's Situation (2024) |

|---|---|---|

| Supplier Concentration | High concentration increases power | Significant for semiconductors |

| Switching Costs | High costs increase power | High for customized components |

| Component Uniqueness | Unique components increase power | Notable for advanced technologies like GaN |

| Anker's Importance to Supplier | Less important supplier = more Anker leverage | Mixed; significant for some, less for diversified |

What is included in the product

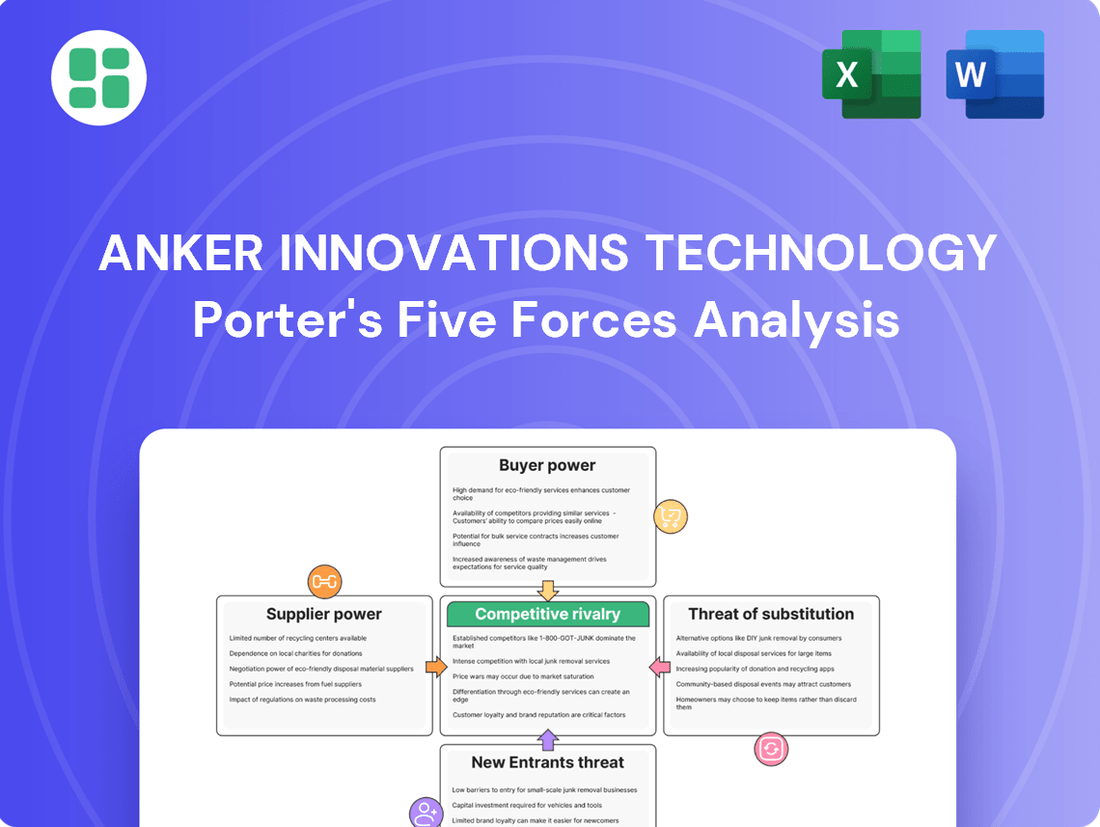

This analysis of Anker Innovations Technology examines the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and its implications for Anker's strategic positioning and profitability.

A visual representation of Anker's competitive landscape—instantly highlighting threats and opportunities to inform strategic adjustments.

Customers Bargaining Power

Anker's diverse customer base, from individual buyers to large distributors, faces a consumer electronics landscape where price is a major driver. The sheer volume of readily available alternatives, many at lower price points, amplifies this sensitivity. For instance, in 2024, the global market for portable power banks, a key Anker segment, saw intense competition with numerous brands offering products under $20, directly impacting Anker's pricing strategy.

The availability of substitute products significantly empowers Anker's customers. With numerous brands offering comparable portable chargers, audio gear, and smart home devices, consumers have ample choices. This abundance means customers can easily switch to a competitor if Anker’s pricing or product features are not to their liking.

For instance, brands like Selore&S-Global directly challenge Anker by providing more budget-friendly power banks, a core Anker product category. This competitive pressure intensifies customer leverage, as they can readily find alternatives that meet their needs at a lower cost. In 2024, the consumer electronics market continues to see a proliferation of new entrants, further broadening the substitute landscape.

While individual consumers of Anker Innovations' products typically buy in small quantities, the company's reliance on major online retail platforms like Amazon and a vast global distribution network significantly amplifies the bargaining power of these larger buyers. These key channels, by aggregating demand, can negotiate more favorable pricing, demand specific product features, and exert pressure on Anker for promotional support, impacting Anker's margins.

Customer Switching Costs

Customer switching costs for Anker Innovations' core consumer electronics, such as charging cables and power banks, are generally low. For instance, a consumer can readily switch to a rival brand if a better price or enhanced features are available, especially with widespread compatibility standards like USB-C. This ease of transition limits the bargaining power of these customers.

However, the landscape shifts for more integrated product lines, like Anker's smart home ecosystem. In these cases, customers may incur higher switching costs. This can be due to factors such as the need to repurchase multiple compatible devices or the loss of accumulated data and personalized settings within a specific ecosystem, thereby reducing their bargaining power.

- Low Switching Costs for Basic Accessories: For products like USB-C cables or portable chargers, consumers can easily switch brands, impacting Anker's pricing power.

- Emerging Higher Costs in Smart Home: As Anker expands its smart home offerings, the potential for increased switching costs for consumers increases, potentially mitigating customer bargaining power.

- Industry Standards Impact: Universal standards like USB-C reduce differentiation and make it easier for customers to switch, a factor Anker must continually address through innovation and brand loyalty.

Information Availability to Customers

Customers in the consumer electronics sector, including those considering Anker Innovations products, benefit immensely from readily available information. Online platforms, review sites, and price comparison tools offer a wealth of data, allowing consumers to thoroughly research and evaluate options. This transparency is a significant factor in their ability to negotiate and choose the best value.

The ease with which consumers can access product specifications, user reviews, and detailed price comparisons directly impacts their bargaining power. For instance, in 2024, online marketplaces saw continued growth in user-generated content, with millions of product reviews posted across major platforms. This readily available feedback empowers buyers to make informed decisions, directly comparing Anker's offerings against those of its competitors.

- Information Accessibility: Consumers can easily find product details, user feedback, and pricing across numerous online channels.

- Informed Decision-Making: This transparency allows customers to compare Anker's products against a wide array of alternatives.

- Increased Bargaining Power: Well-informed customers are better positioned to demand better prices or features.

- Competitive Landscape: The widespread availability of information intensifies competition, as consumers can quickly identify superior or more cost-effective options.

Anker's customers possess significant bargaining power due to the highly competitive nature of the consumer electronics market and the availability of numerous substitutes. For instance, in 2024, the global market for portable power banks, a key Anker segment, saw intense competition with numerous brands offering products under $20, directly impacting Anker's pricing strategy.

The ease of switching between brands for basic accessories like charging cables and power banks is a major factor. Customers can readily find comparable products from competitors, limiting Anker's ability to dictate terms or prices. This is further amplified by universal standards like USB-C, which reduce product differentiation.

While individual consumers have limited power, large online retailers like Amazon, acting as aggregators, can negotiate more favorable terms, influencing Anker's margins and product development. The widespread availability of product information and user reviews in 2024 also empowers consumers to make informed choices, driving competition for better value.

Preview Before You Purchase

Anker Innovations Technology Porter's Five Forces Analysis

This preview shows the exact Anker Innovations Technology Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. You're looking at the actual, comprehensive document detailing Anker's competitive landscape, including the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants, and the threat of substitutes. Once you complete your purchase, you’ll get instant access to this exact, professionally formatted file, ready for your strategic decision-making.

Rivalry Among Competitors

The consumer electronics sector, especially in portable power, audio gear, and smart home tech, is incredibly crowded. Anker faces a wide array of global and local rivals, making the competitive landscape quite intense.

Anker's direct competition includes giants like Apple, Sony, and Bose, but its reach extends to countless smaller brands and even generic manufacturers, particularly across its varied product lines. For instance, in the portable power bank market alone, numerous companies offer similar solutions, often at different price points, intensifying rivalry.

The consumer electronics sector, while generally growing steadily, sees intensified competition in rapidly expanding niches like smart home technology and portable power solutions. This rapid segment growth fuels rivalry as companies aggressively pursue market share.

Anker Innovations demonstrated robust performance through 2024 and into Q1 2025, reporting substantial revenue and profit growth. This financial strength suggests Anker's capability to effectively navigate and capitalize on opportunities within these highly competitive, high-growth areas of the consumer electronics market.

Anker Innovations actively differentiates its offerings through a commitment to innovation and robust quality control across its diverse brand portfolio, which includes Anker, Soundcore, Eufy, and Nebula. This multi-brand approach allows Anker to target various consumer segments and product categories effectively.

While Anker has cultivated significant brand loyalty, especially in the mobile charging market where it commands a substantial market share, the consumer electronics landscape presents a challenge. The rapid pace of technological advancement and the relative ease with which competitors can replicate product features necessitate ongoing investment in research and development to sustain a competitive edge and maintain differentiation.

Exit Barriers

Exit barriers for companies like Anker Innovations in the consumer electronics sector are often moderate. These can include specialized manufacturing equipment, long-term supply agreements, and the significant cost associated with maintaining a positive brand image. The reluctance to abandon these investments can prolong competitive intensity.

Companies may also face challenges exiting due to the potential loss of valuable intellectual property, such as patents and proprietary designs. Furthermore, the substantial research and development (R&D) expenditures incurred to bring products to market can create a strong incentive to remain operational, even in a challenging environment.

- Specialized Assets: High investment in unique manufacturing machinery and tooling.

- Brand Reputation: Significant costs and time required to build and maintain customer trust.

- Intellectual Property: Risk of losing patents and proprietary technology upon exit.

- R&D Investments: Desire to recoup substantial sunk costs in product development.

Strategic Stakes

The consumer electronics arena is a battleground where global tech giants fiercely vie for dominance. This intense rivalry means substantial resources are poured into research and development, marketing campaigns, and expanding distribution networks. Anker Innovations, recognizing these high stakes, has strategically increased its sales expenses, demonstrating a commitment to securing and expanding its market share.

Anker's deliberate refocus on its core charging product lines underscores the critical importance of maintaining a strong position in these key segments. For instance, in 2023, Anker reported significant investments in sales, general, and administrative expenses, a clear indicator of the competitive pressures and the strategic imperative to capture consumer attention and loyalty.

- Aggressive R&D Investment: Leading consumer electronics firms often allocate over 10% of their revenue to R&D to stay ahead of innovation curves.

- Marketing Spend: Companies like Anker invest heavily in marketing to build brand awareness and differentiate in a crowded market.

- Distribution Network Expansion: Establishing a global presence requires significant capital outlay for logistics and retail partnerships.

- Strategic Product Focus: Anker's emphasis on charging products reflects a strategic decision to concentrate resources on areas of proven strength and high demand.

The competitive rivalry within Anker Innovations' operating segments, particularly portable power and audio, is exceptionally high due to the presence of both global tech giants and numerous smaller, agile players. This intensity is fueled by rapid technological advancements and a relatively low barrier to entry for many product categories, leading to constant price pressures and the need for continuous innovation to maintain market share.

Anker Innovations, despite its strong brand presence, faces direct competition from established players like Apple, Samsung, and Sony, as well as a multitude of emerging brands. The company's strategic investments in R&D and marketing, evidenced by its increased sales expenses in 2023, highlight its commitment to navigating this fiercely competitive landscape and defending its market position.

The consumer electronics market, characterized by its dynamic nature, sees companies like Anker investing heavily to differentiate through quality and innovation. For instance, Anker's multi-brand strategy, encompassing Anker, Soundcore, Eufy, and Nebula, aims to capture diverse market segments and mitigate the impact of intense competition across its product portfolio.

Anker's financial performance through early 2025, showing robust revenue and profit growth, indicates its resilience and ability to thrive amidst fierce competition. This success underscores the effectiveness of its strategies in a market where differentiation and consistent product improvement are paramount for sustained competitive advantage.

SSubstitutes Threaten

Traditional wall outlets and integrated charging ports in vehicles and public spaces represent significant substitutes for Anker's portable power solutions. These established charging methods offer a direct alternative, reducing the reliance on external devices.

The growing prevalence of fixed charging infrastructure, such as the expanding network of electric vehicle charging stations which saw a significant increase in public chargers in 2024, can diminish the perceived need for portable chargers for certain consumer segments. This trend could impact the convenience factor Anker often highlights.

The increasing integration of functionalities into single devices poses a significant threat of substitution for Anker's core products. For instance, smartphones boasting extended battery life, like the Samsung Galaxy S24 Ultra which offers a 5000 mAh battery, directly compete with the need for portable power banks. Similarly, advancements in smart displays, such as the Google Nest Hub Max with its built-in audio capabilities, can diminish the demand for separate smart speakers or audio equipment.

While Anker's primary focus is on consumer electronics, the threat of DIY and non-commercial solutions exists, particularly in areas like smart home devices. Some tech-savvy consumers might explore open-source platforms or build their own smart home ecosystems, bypassing branded products. For instance, platforms like Home Assistant offer extensive customization for those willing to invest the time and technical effort.

However, the barrier to entry for DIY solutions is significantly higher than for Anker's plug-and-play products. The need for technical expertise, ongoing maintenance, and the lack of readily available customer support often deter mainstream consumers. This complexity makes these alternatives less appealing for the average user seeking convenience and reliability, thus limiting their direct impact on Anker's market share.

Evolution of Wired vs. Wireless Solutions

The threat of substitutes for Anker Innovations' wired charging accessories is growing, primarily from advancements in wireless charging. The recent introduction and widespread adoption of Qi2 certification, for instance, offers a more standardized and efficient wireless charging experience, directly competing with traditional wired connections. This evolution could lead consumers to favor the convenience of wireless over the ubiquity of wired solutions for certain applications.

While Anker is actively participating in the wireless charging market, a significant market shift towards seamless, integrated wireless power solutions could still impact the demand for some of its established wired product lines. For example, by the end of 2024, the global wireless charging market was projected to reach approximately $25.5 billion, indicating a substantial and growing consumer preference for these alternatives.

- Qi2 Certification: This new standard enhances magnetic alignment and power delivery for wireless charging, making it a more direct substitute for wired charging convenience.

- Market Shift: Consumer preference is increasingly leaning towards integrated and cable-free charging experiences, potentially reducing reliance on traditional wired accessories.

- Anker's Position: Anker's investment in wireless charging technology helps mitigate this threat, but the overall trend could still affect the market share of their wired product segments.

- Growth in Wireless Market: The projected $25.5 billion global wireless charging market by the end of 2024 underscores the significant competitive pressure from substitute technologies.

Legacy Products and Lower-Tech Alternatives

The threat of substitutes for Anker Innovations is present, particularly from legacy products and lower-tech alternatives. For many consumers, simpler, non-smart versions of products can still fulfill basic needs. For example, traditional light switches serve the same core function as smart switches, and basic wired headphones are a viable alternative to Anker's smart earbuds.

Anker needs to consistently highlight the tangible benefits and enhanced performance of its smart devices to justify their higher price points compared to these simpler substitutes. This means clearly communicating the convenience, energy savings, or unique features that its advanced products offer. In 2023, the global market for smart home devices continued its growth, but the demand for more affordable, basic electronics remained robust, indicating a segment of consumers prioritizing cost over advanced functionality.

- Legacy Products: Basic, non-connected versions of Anker's product categories (e.g., standard power banks, simple speakers) remain viable substitutes for consumers not seeking smart features.

- Lower-Tech Alternatives: Traditional headphones, basic lighting solutions, and non-smart charging bricks offer core functionality at a lower cost, directly competing with Anker's more advanced offerings.

- Value Proposition: Anker must continually emphasize the enhanced user experience, integration capabilities, and potential long-term cost savings (e.g., energy efficiency) of its smart products to counter the appeal of cheaper, simpler alternatives.

The threat of substitutes for Anker's power banks comes from integrated solutions and advancements in battery technology. Smartphones with extended battery life, like the Samsung Galaxy S24 Ultra with its 5000 mAh capacity, can reduce the need for external charging. Furthermore, the increasing availability of public charging infrastructure, with a notable rise in public EV chargers in 2024, offers an alternative for consumers on the go.

Wireless charging presents a significant substitute, especially with the growing adoption of Qi2 certification, which enhances convenience and efficiency. The global wireless charging market was projected to reach approximately $25.5 billion by the end of 2024, highlighting a strong consumer shift towards cable-free solutions.

Anker also faces substitutes from simpler, non-smart alternatives. Basic wired headphones or traditional light switches fulfill core functions at a lower cost compared to Anker's smart earbuds or smart switches. The robust demand for affordable, basic electronics in 2023 indicates that a segment of consumers prioritizes cost over advanced features.

| Substitute Type | Example | Anker Product Category | Impact on Anker | Key Differentiator |

|---|---|---|---|---|

| Integrated Charging | Smartphone with large battery (e.g., 5000 mAh) | Portable Power Banks | Reduces reliance on external chargers | Convenience, extended device uptime |

| Public Charging Infrastructure | EV Charging Stations | Portable Power Banks | Diminishes perceived need for portable solutions | Accessibility, reduced need for carrying devices |

| Wireless Charging | Qi2 Certified Chargers | Wired Charging Accessories | Direct competition with wired connections | Cable-free convenience, standardization |

| Legacy/Basic Products | Standard Wired Headphones | Smart Earbuds | Offers core functionality at lower cost | Affordability, simplicity |

Entrants Threaten

Entering the consumer electronics arena, particularly aiming to compete with established players like Anker Innovations, demands substantial upfront capital. This investment is crucial for robust research and development, setting up efficient manufacturing facilities, executing impactful marketing campaigns, and building widespread global distribution channels. These considerable financial outlays create a significant barrier for potential newcomers.

For instance, a company looking to launch a new line of power banks or charging accessories, similar to Anker's core products, would need to allocate millions for advanced battery technology research and automated production lines. Anker itself reported revenues of over $1.5 billion in 2023, indicating the scale of operation and investment required to achieve such market presence.

Anker Innovations has cultivated significant brand loyalty through its diverse portfolio, including Anker, Soundcore, Eufy, and Nebula. This strong brand equity makes it challenging for new competitors to gain traction. For instance, Anker's Soundcore brand saw substantial growth in the audio market, a testament to its ability to build a loyal customer base.

Anker Innovations Technology benefits significantly from its established relationships with major online retailers, particularly Amazon, where it consistently ranks as a top seller in portable power and charging accessories. New competitors struggle to gain similar visibility and favorable placement on these platforms, which are crucial for reaching a broad customer base. Securing shelf space in brick-and-mortar retail also presents a hurdle, as Anker has cultivated strong partnerships with electronics retailers worldwide.

Economies of Scale

Anker Innovations Technology, as an established player in the consumer electronics market, benefits significantly from economies of scale. This allows them to achieve lower per-unit costs in manufacturing, raw material procurement, and widespread marketing efforts, making it difficult for newcomers to compete on price. For instance, Anker's substantial production volumes in 2024 likely translated to more favorable supplier agreements compared to a startup attempting to enter the market with much smaller order quantities.

The cost advantage derived from Anker's scale presents a substantial barrier to entry for potential new competitors. A new entrant would find it challenging to replicate the operational efficiencies and bulk purchasing power that Anker commands. This disparity in cost structure means that any new company would likely operate with higher costs, impacting their ability to offer competitive pricing or achieve similar profit margins.

Consider these points regarding economies of scale as a barrier for new entrants targeting Anker's market:

- Manufacturing Efficiency: Anker's high-volume production lines in 2024 likely achieved greater efficiency and lower overhead per unit than a new entrant could initially manage.

- Procurement Power: By sourcing components in massive quantities, Anker secures better pricing, a feat difficult for smaller, less established companies to replicate.

- Marketing Reach: Anker's established brand recognition and marketing budgets, supported by significant 2024 revenue figures, allow for broader and more cost-effective customer acquisition than a new entrant can typically afford.

- Research & Development Investment: The scale of Anker's operations enables substantial R&D investment, leading to product innovation and further solidifying their market position, a level of investment often out of reach for startups.

Intellectual Property and Proprietary Technology

Anker Innovations' significant investment in research and development, evidenced by its extensive patent portfolio, particularly in gallium nitride (GaN) charging technology, acts as a substantial barrier to entry. This intellectual property makes it challenging for new competitors to replicate Anker's advanced features without facing potential patent infringement issues or incurring considerable licensing fees.

For instance, Anker has been a leader in GaN technology, which allows for smaller, more efficient chargers. As of early 2024, the market for GaN chargers continued to grow, with Anker holding a strong position due to its early adoption and patent protection.

- Anker's patent portfolio provides a strong defense against imitation.

- High R&D spending creates a significant upfront cost for potential new entrants.

- Licensing fees for essential technologies can deter smaller competitors.

- The complexity of replicating advanced charging solutions requires specialized expertise and investment.

The threat of new entrants into Anker Innovations' market segment is moderate, primarily due to the substantial capital required for research and development, manufacturing, and marketing. Anker's established brand loyalty and strong distribution channels further deter newcomers. For example, Anker's significant 2023 revenues, exceeding $1.5 billion, highlight the scale of investment needed to achieve comparable market penetration.

Economies of scale significantly reduce Anker's per-unit costs, making it difficult for new entrants to compete on price. Their substantial production volumes in 2024 likely secured better supplier agreements than smaller competitors. Furthermore, Anker's extensive patent portfolio, particularly in GaN technology, creates a formidable barrier, requiring significant investment and expertise to replicate their advanced product offerings.

| Barrier to Entry | Impact on New Entrants | Anker's Advantage (2023-2024 Data) |

|---|---|---|

| Capital Requirements | High upfront investment needed for R&D, manufacturing, and marketing. | Anker's 2023 revenue over $1.5 billion indicates significant operational scale. |

| Economies of Scale | New entrants face higher per-unit costs due to smaller production volumes. | Anker's 2024 production volumes likely led to more favorable procurement and manufacturing costs. |

| Brand Loyalty & Distribution | Challenging to gain visibility and customer trust against established brands. | Anker's diverse brand portfolio and strong online retailer partnerships (e.g., Amazon) provide significant market access. |

| Intellectual Property (Patents) | Replicating advanced technologies like GaN requires significant R&D and may involve licensing fees. | Anker's leadership in GaN technology and extensive patent portfolio protect its market position. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Anker Innovations Technology is built upon a foundation of comprehensive data, including Anker's official annual reports, investor relations disclosures, and relevant industry research from reputable market intelligence firms.